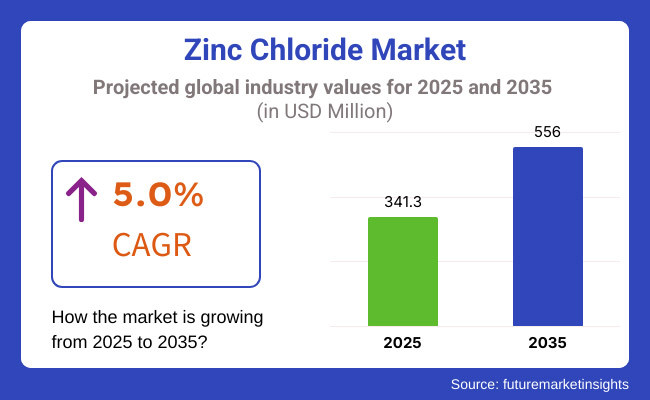

The zinc chloride market is poised for steady growth between 2025 and 2035, driven by increasing demand across diverse industries such as metallurgy, chemical manufacturing, pharmaceuticals, batteries, and water treatment. The market is projected to expand from USD 341.3 million in 2025 to USD 556.0 million by 2035, reflecting a CAGR of 5.0% over the forecast period.

Zinc chloride is among the most widely used compounds on the market because of its corrosive, hygroscopic, and soluble properties. In addition to electroplating, the textile, petroleum, and fluxed for soldering industries are the major consumers of this material.

The rise in consumption of zinc chloride in dry cell batteries, water treatment chemicals, and as a catalyst in the organic synthesis sector continues to be a dynamic market mover. Furthermore, a marked rise in used water treatment and robust environmental directives have set up a scenario where the need for flocculants based on zinc chloride is needed in water purification systems.

The movement towards sustainable and energy-saving technology is also serving to affirm the zinc chloride market positively. The electric vehicle (EVs) penetration and the increased use of battery zinc technologies pattern are what will bring the markets grow in the long run. The new dynamics that come from pharmaceutical applications and chemical synthesis will be pivotal further boosting the market.

The growing demand for high-purity zinc chloride in batteries, healthcare, and chemical processing is driving the market’s expansion. Increasing research into eco-friendly manufacturing methods and the recycling of zinc-based materials is also expected to support future growth.

Explore FMI!

Book a free demo

North America continues to be one of the prominent regions for the zinc chloride market, primarily due to the robust demand from battery manufacturing, pharmaceuticals, and industrial water treatment sectors.

The USA and Canada are predominantly acquiring and using more of the zinc chloride in electric vehicle (EV) batteries, catalyst applications, and chemical synthesis. The need for strict regulations on water treatment and waste disposal is, to a greater extent, increasing the realization for complementing zinc chloride with purification solutions.

The establishment of a fully electric vehicle industry in North America is the core ride for the demand of supplementary zinc chloride in battery pour electrolytes. What is more, government schemes which are focused on eco-friendly water treatment and green chemistry are highly likely the factors promoting the industrial use of zinc chloride.

The European zinc chloride market presents stable growth due to the environmental sustainability, industrial innovation, and battery technology advancements. Germany, France, and the UK are recycling, happily manufacturing sustainably, and generously using high-efficiency water treatment solutions that induce a parallel increase in the industrial and environmental application of zinc chloride.

Zinc chloride is largely used as a catalyst in organic reactions, polymer processing, and specialty coatings due to the continuous demand from the European chemical manufacturers. Moreover, the commitment of the European Union to limit carbon emissions and support energy storage solutions of purity further guides the way for exploration of zinc-based battery technologies, thus supporting the market expansion.

Asia-Pacific stands as the fastest racing region for the zinc chloride market, overshadowing the rest due to the following factors: quick industrial advancement, battery manufacturing companies multiplying, and chemical production investments rising. China and India, in particular, are exhibiting a demand for zinc chloride in the metal processing, water treatment, and electronics manufacturing fields.

China still outstands as the foremost player engaging in the production and consumption of zinc chloride thanks to its well-settled chemicals industry and the increased pull factor from electronics and batteries. The usage of zinc chloride in the galvanizing and textile industries is also a major contributor to the region's growth. The expansion of the pharmaceutical sector and the improved industrial wastewater treatment industry in India are new adventures for zinc chloride suppliers.

Japan and South Korea that are known for their high advancements in both energy storage and electronics manufacturing are the main consumers of high-purity zinc chloride in battery production, semiconductor processing, and chemical synthesis. Southeast Asian countries such as Indonesia, Vietnam, and Thailand are also coming into the peripheral vision of the international market due to the auto-industrial sector's growth and practical need for proper wastewater treatment.

Latin America, the Middle East, and Africa are making a utility of the slowly growing market in the zinc chloride sector through the establishment of chemical manufacturing industries, infrastructure development, and water treatment investments. Several companies in countries including Brazil and Mexico are processing zinc chloride for textile, petroleum, and pharmaceutical industries.

The Middle East, moreover states like Saudi Arabia and the UAE, are generating the chemical treatments for water purification projects through the promotion of industrialization. Africa's development of cities and a major shift towards water of good quality to every citizen have added to the increase in zinc chloride in municipal water treatment facilities.

Challenges

Raw Material Prices Volatility & Supply Chain Disruptions

Zinc chloride is a product of the transformation between hydrochloric acid and zinc metal. Both reactants are characterized by the market's volatility and affected by mining output, global traffic, and raw materials availability. Price fluctuations and alternative strategies using other atmospheric and water treatments also affect the situation.

Moreover, logistical bottlenecks, regulatory red tapes, and transport costs are the major factors hindering the smooth global supply zinc chloride Chain. As a Way Out, firms need to engage in local production, solicit different suppliers, and adopt just-in-time inventory systems.

Environmental & Regulatory Concerns

Zinc chloride being a highly corrosive substance if not handled properly is hazardous. It requires proper disposal and manufacturing compliance primarily to mitigate environmental harm. Different countries are making the law stricter on the management of chemical waste and the transportation of hazardous materials which is resultant in high cost of compliance for the manufacturers and users.

As industries continue to put more emphasis on sustainability, companies must harness the potential of manufacturing through greener production technologies, emission reductions, and waste disposal aligned with the global environmental standards.

Opportunities

The Rise in Use of Zinc-Based Batteries

The vast market of electric vehicles (EV), and applications in renewable energy sectors and mandate additionally launches the market for sections like zinc chloride. This cupola construction reveals an essential yet overweight component of zinc-in-water-air batteries. In fact, zinc chloride, as a counterweight, replaces lithium ions not only for specific applications in the batteries being the main component of water which burns the surface of lithium.

Increasing global funding for sustainable energy storage projects, the battery manufacturers are working on improving the formulations of zinc chloride with additives for better performance and stability which in turn will drive the market.

Boost in Water Treatment & Environmental Sector

The need for good wastewater treatment and industrial effluent management is the only source of a continuous rise in demand for systems based on zinc chloride. Due to the stricter laws, industries are using zinc chloride in various treatment processes such as flocculation, coagulation, and pH control in water plants.

Recent innovations in eco-friendly chemistry and clean water sanitation systems are also foreseen to motivate the use of zinc chloride in water treatment and pollution control.

Rise in Use in Pharmaceuticals & Chemical Synthesis

The pharmaceutical and chemical sectors have been incorporating an increased amount of zinc chloride in the processes for example, as a catalyst, dehydrating agent, and reagent in organic synthesis. Its impact in areas like specialty coatings, polymer stabilization, and medical formulations leads to new avenues for market growth.

The upsurge of research on biocompatible and antimicrobial coatings will significantly impact the demand for the high-purity zinc chloride formulations due to the medical device manufacturing and advanced pharmaceutical applications.

The zinc chloride market has registered an upright development from 2020 to 2024, completely thanks to its integration into diverse sectors such as chemical manufacturing, batteries, textiles, and water treatment. The growing industrialization rate and with it the increasing need of zinc chloride in galvanizing, fluxes, and dry cell batteries, was the main driver for this sideways market movement.

The regulatory framework incentivizing the adoption of green manufacturing and waste management practices also affected the market baseline. In the period of 2025 to 2035 the focus of technology on battery improvements, green chemistry growth, and remedial water treatment is envisaged to lead the market.

The principal reasons for the additional increase will be the rise in zinc chloride applications in the production of zero or very low-impact by-products and the development of energy storage products based on new technology.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with chemical safety regulations and waste disposal guidelines. |

| Technological Advancements | Improved synthesis methods for high-purity zinc chloride. |

| Industry-Specific Demand | High usage in batteries, water treatment, and metal processing. |

| Sustainability & Circular Economy | Efforts to reduce hazardous waste and improve efficiency. |

| Market Growth Drivers | Industrial demand, battery production, and metal galvanization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental policies and circular economy initiatives promoting sustainable production. |

| Technological Advancements | Development of eco-friendly production techniques and recycling innovations. |

| Industry-Specific Demand | Expansion into renewable energy storage, advanced chemical catalysis, and pharmaceuticals. |

| Sustainability & Circular Economy | Large-scale adoption of green chemistry, closed-loop recycling, and bio-based alternatives. |

| Market Growth Drivers | Growth in sustainable energy storage, enhanced water purification technologies, and eco-friendly manufacturing. |

The USA zinc chloride market is currently experiencing a stable increase as a result of the increased applications of zinc chloride in battery production, chemical processing, and water treatment sectors. The main contributor to that growth is the development of electronics and energy storage industries that, in their turn, are most influenced by the switch to zinc-carbon and alkaline batteries.

Moreover, the USA chemical industry persistent commitment to zinc-based catalysts in demand of organic synthesis and petroleum refining stands as the major catalyst for this market increment. Additionally, the increased concern about the environment, through effluent technology and protective coatings in building the infrastructure, are two powerful reasons that drive market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK zinc chloride market has been growing consistently with the demand increase from the pharmaceutical, chemical, and metallurgical industries. The use of zinc chloride in battery production and industrial coatings is growing rapidly in turn the market growth.

The focus of the country on sustainability and environmental regulations is fueling the adoption of these clean technologies in metal processing and water treatment. Furthermore, the growth of the pharmaceutical industry in the UK is creating a new demand for zinc chloride used in medicinal and chemical synthesis.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The zinc chloride market in the European Union stands true to the claim that it is witnessing the development in the face of challenges from the environmental regulations and the increased demand from the industrial applications side as well as innovation in the power battery sector. Germany, France, and Italy, which mainly utilize zinc chloride in energy storage, chemical processing, and water treatment, are the biggest consumers of the product in the EU.

The EU's quest for sustainable energy sources and chemical production encourages the use of highly pure zinc chloride in electroplating, metal treatment, and battery applications. Apart from that, funding for the development of the eco-friendly corrosion inhibitors and catalysts also makes a positive contribution to the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

The Japanese zinc chloride market is on the rise owing to its mounting use in high-performance batteries, chemical synthesis, and textile processing. The country's prime concentration on the technological as well as the precision chemical manufacturing sectors is pushing the consumption of ultra-pure zinc chloride in electronic and industrial systems.

As Japan's energy storage and renewables development pace grows, the demand for zinc-based batteries and electrochemical applications rises. Furthermore, the country is a force in the specialty chemicals and pharmaceutical sectors, which is fueling its demand for high-purity-grade zinc chloride in the formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The zinc chloride market in the South Korean region is accelerating due to succinctly put, the increasing electronics industry, and the directive pull of energy storage solutions, and innovations in water treatment technologies. The prominent role played by the country's battery manufacturing and zinc-air and rechargeable types of batteries is the main factor behind the market's progress.

The actions of the South Korean government to stimulate and introduce the use of pep sustainable chemical processing and green energy solutions are also aiding the industrial applications of zinc chloride. In addition, the inventions of the country such as in nano-coatings, semiconductor processing, and anti-corrosion treatments are leading to an increase in the demand for high-purity zinc chloride formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

High Purity Grade Zinc Chloride Gains Traction in Specialty Applications

High purity grade zinc chloride is mainly focused on specialized applications in pharmaceuticals, laboratory research, and electronic component manufacturing.

This product is recognized as a perfect material for the pharmaceutical industry because of its maximum chemical stability and the very small amount of impurities, making it a must in the high-precision industries. The entry of high-purity zinc chloride in the manufacturing of, for instance, high-performance batteries, catalysts, and specialty coatings is the factor responsible for the growth of the market.

Electrochemical technologies are also the subject of attention, as advancements in chemical synthesis and material science are promoting improvement in this grade quality and performance, which in turn, it is enabling it to be used in different applications such as the electronic and medical sectors.

Battery Grade Zinc Chloride Sees Rising Demand in Energy Storage Solutions

Battery grade zinc chloride finds its application mainly in dry cell batteries and energy storage systems on account of its high conductivity and moisture absorption properties. The surge in demand for portable electronics, electric vehicles, and new renewable energy storage options has become a significant driving force behind this market's growth.

Along with the research that aims at the extension of battery lifespan and the increase of their efficiency, manufacturers are forming new zinc-chloride compounds that will be more efficiently used and have a lower impact on the environment. Moreover, the expected environmentally friendly and recyclable battery technologies will certainly contribute to the more extensive use and acceptance of battery-grade zinc chloride in the near future.

Powdered Zinc Chloride Leads Due to Versatile Industrial Applications

Powdered zinc chloride finds use in chemical manufacturing, metal treating, and textile processing due to its ease of handling and great reactivity. This form of zinc chloride is good because it can help the chemical reactions to occur faster, and it is such a good soldered flux, as well as adhesive, and catalyst material.

The industrial coatings, galvanizing agents, and chemical intermediates sectors are the demand drivers for powdered zinc chloride. In addition, its utilization in waste water treatment operations and chemical purification is also a major contributor to market development.

Liquid Zinc Chloride Gains Popularity in Electroplating and Battery Manufacturing

Liquid zinc chloride has become very popular in precise concentration control and easy dispersion oriented industries such as electroplating, battery manufacturing, and pharmaceuticals.

Uniform consistency and high solubility are the features of liquid zinc chloride that makes it an appropriate medium for applications which require accurate formulation. The boom in the market for zinc-based electrochemical and the progress in electrolyte are the two main reasons for the growth in this segment. Also, liquid zinc chloride's position in industrial wastewater treatment and corrosion prevention is predicted to be a strong driving force for its future market.

The zinc chloride market is witnessing steady growth, driven by increasing demand across industries such as metallurgy, pharmaceuticals, chemical processing, and batteries. Zinc chloride is widely used as a catalyst, electrolyte component, and in flux applications, making it an essential chemical compound. The rising adoption of rechargeable batteries, along with the growing need for industrial-grade chemicals, is further fueling market expansion.

Technological advancements in zinc chloride production, including the development of high-purity and eco-friendly formulations, are shaping the competitive landscape. Companies are investing in R&D to enhance efficiency, sustainability, and application diversity. Additionally, stringent environmental regulations regarding waste disposal and chemical safety are prompting manufacturers to develop more sustainable production techniques.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TIB Chemicals AG | 18-22% |

| Zaclon LLC | 15-18% |

| Vijaychem Industries | 10-14% |

| American Elements | 8-12% |

| Flaurea Chemicals | 5-9% |

| Other Companies | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| TIB Chemicals AG | Produces high-purity zinc chloride for chemical processing, galvanizing, and battery applications, focusing on eco-friendly production. |

| Zaclon LLC | Specializes in industrial-grade zinc chloride formulations for metal treatment, electronics, and water treatment applications. |

| Vijaychem Industries | Develops zinc chloride solutions for pharmaceutical, textile, and electroplating industries, emphasizing quality and cost-effectiveness. |

| American Elements | Supplies ultra-high-purity zinc chloride for scientific research, specialty applications, and advanced manufacturing sectors. |

| Flaurea Chemicals | Focuses on sustainable zinc chloride production, catering to environmental, chemical, and metallurgical industries. |

Key Company Insights

TIB Chemicals AG

TIB Chemicals AG is a global leader in the manufacture of zinc chloride and offers high-purity and industrial grade solutions for a wide range of applications. The company emphasizes environmentally-friendly methods and is 100% in compliance with international regulatory standards.

Zinc chloride of TIB Chemicals can be found in many areas like galvanizing, chemical synthesis, and battery manufacturing. Backed up by a strong R&D section, the company is actively working on the development of new formulations with better efficiency and lower environmental impact.

Zaclon LLC

Zaclon LLC is a zinc chloride production industrial company that specializes in the generation of high-performance zinc chloride for applications in metal treatment, water treatment, and chemical processing. The company is now an important player in this business thanks to its reliable, and high-quality formulations meeting industry standards.

In a move to promote sustainability, Zaclon works with the best production techniques and has allied in the quest for eco-friendlier methods of manufacturing zinc chloride in the metal treatment industry, water treatment, and chemical processing sectors.

Vijaychem Industries

Vijaychem Industries is a leading manufacturer of zinc chloride solutions, which are mainly supplied to the pharmaceutical, textile, and electroplating sectors.

The Company focuses on manufacturing methodologies which save the costs but not in the quality of the products. It has a vast distribution network that connects it with both local and foreign markets efficiently. In addition, Vijaychem is also promoting research work to create green alternatives while enlarging its application scope in specialized chemical formulations.

American Elements

American Elements is an ultra-high-purity zinc chloride supplier that provides it for exclusive use in scientific research, electronics manufacturing, and advanced hi-tech sectors. The company is recognized for its quality, innovation, and product customization.

American Elements cooperates with laboratory research institutions and industries in an endeavor to produce next-generation zinc chloride formulations, which comply with cutting-edge technological inventions. It is through a strong global supply chain that American Elements secures its reputation of reliability and a consistent source of products.

Flaurea Chemicals

Flaurea Chemicals is dedicated to sustainable zinc chloride production and includes the environmental responsibility factor as a priority, therefore- it serves industries that also amortize and apply the environmental responsibility principle.

The company has adapted innovative recycling processes so that they can minimize waste and make their production chain more sustainable. Flaurea Chemicals’ zinc chloride is extensively utilized in metallurgical, chemical, and environmental sectors. By aligning its business philosophy with the global agenda for sustainability, the company has set itself a target of being a pioneer in green chemical production.

The global zinc chloride market is projected to reach USD 341.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.0% over the forecast period.

By 2035, the zinc chloride market is expected to reach USD 556.0 million.

The Battery Grade segment is expected to hold a significant share due to its growing application in dry cell batteries and energy storage solutions.

Key players in the zinc chloride market include Eurocontal SA, Airedale Chemical, Weifang Dongfangsheng Chemical Co., Ltd., Lipmes.

The market is segmented into High Purity Grade, Battery Grade, Technical Grade, and Commercial Grade.

The industry is categorized into Powder and Liquid.

The market serves Electronics, Chemical, Agriculture, Pharmaceuticals, and Other industries.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.