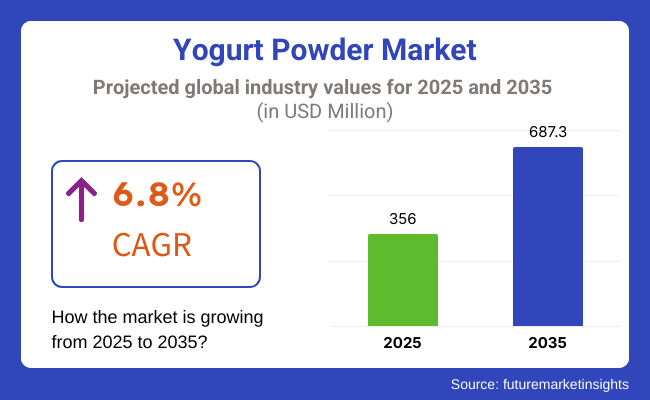

The global Yogurt Powder market is estimated to be worth USD 356.0 million in 2025 and is projected to reach a value of USD 687.3 million by 2035, expanding at a CAGR of 6.8%over the assessment period of 2025 to 2035

Manufacturers are enhancing yogurt powder by adding vitamins, minerals, and probiotics, catering to the growing demand for functional foods. This fortification not only boosts the nutritional profile of yogurt powder but also appeals to health-conscious consumers seeking convenient ways to incorporate essential nutrients into their diets.

By offering products enriched with probiotics for digestive health and vitamins for overall wellness, yogurt powder becomes a versatile option for those looking to improve their nutritional intake without compromising on taste.

As environmental concerns rise, consumers are increasingly prioritizing sustainable products. Yogurt powder's lightweight and compact packaging significantly reduces transportation costs and carbon emissions compared to traditional liquid yogurt.

This eco-friendly approach not only minimizes waste but also aligns with the values of environmentally conscious consumers. By choosing yogurt powder, consumers can enjoy a nutritious product while supporting sustainability efforts, making it an attractive option for those looking to make responsible purchasing decisions that benefit the planet.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global yogurt powder market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.9% (2024 to 2034) |

| H1 | 6.4% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

The above table presents the expected CAGR for the global yogurt powder demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 6.4% in the first half and remain relatively moderate at 7.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Rise of Plant-Based Alternatives

The increasing popularity of plant-based diets is reshaping the yogurt powder market, leading to the emergence of non-dairy yogurt powders made from sources like almond, coconut, and soy. This trend caters to a growing demographic of vegan consumers and those with lactose intolerance, who seek dairy-free options that still provide the nutritional benefits of traditional yogurt.

As awareness of the health benefits associated with plant-based diets rises, manufacturers are innovating to create yogurt powders that not only mimic the taste and texture of dairy yogurt but also offer added nutritional value. This expansion into plant-based alternatives broadens market reach, appealing to a diverse consumer base and driving sales in a competitive landscape focused on health and sustainability.

E-commerce Growth

The rapid expansion of e-commerce platforms has significantly transformed the yogurt powder market, making these products more accessible to consumers globally. Online shopping provides unparalleled convenience, allowing consumers to browse a wide variety of yogurt powder options from the comfort of their homes. This shift has enabled brands to reach a broader audience, including those in remote areas where physical stores may have limited selections.

Additionally, e-commerce platforms often feature customer reviews and detailed product information, empowering consumers to make informed purchasing decisions. The ability to compare prices and explore different brands and formulations online has further fueled interest in yogurt powder, driving sales and encouraging brand loyalty in an increasingly digital marketplace.

Innovative Flavor Profiles

Manufacturers in the yogurt powder market are increasingly experimenting with unique and exotic flavor profiles to capture the attention of adventurous consumers. By introducing flavors such as matcha, turmeric, and superfruit blends, brands are not only enhancing the sensory appeal of yogurt powder but also tapping into current health trends associated with these ingredients.

This innovation encourages consumers to try new products, leading to increased trial and repeat purchases. The incorporation of trendy flavors also allows brands to differentiate themselves in a crowded market, appealing to consumers seeking novel and exciting options. As flavor innovation continues to evolve, it plays a crucial role in driving consumer interest and expanding the overall market for yogurt powder.

Global Yogurt Powder sales increased at a CAGR of 5.2% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on yogurt powder will rise at 6.8% CAGR.

Yogurt powder's versatility makes it a valuable ingredient across various industries, including food, beverages, dietary supplements, and cosmetics. It can be easily incorporated into smoothies, baked goods, sauces, and snacks, allowing manufacturers to create innovative products that cater to diverse consumer preferences.

Additionally, its ability to blend seamlessly with other ingredients enhances its appeal in functional foods and health products. This adaptability not only attracts manufacturers seeking to expand their offerings but also meets the evolving demands of health-conscious consumers.

Flavor innovation is a key driver in the yogurt powder market, as manufacturers experiment with unique and exotic flavors to captivate adventurous consumers. By introducing options like matcha, turmeric, and superfruit blends, brands can differentiate their products and create excitement in a competitive landscape.

This focus on innovative flavors not only enhances the sensory experience of yogurt powder but also encourages consumers to try new products, leading to increased trial and repeat purchases. As flavor trends evolve, they play a crucial role in sustaining consumer interest and driving market growth.

Tier 1 Companies comprise industry leaders with annual revenues exceeding USD 20 million and a market share ranging from 40% to 50%. These companies are recognized for their high production capacities and extensive product portfolios, which include a variety of yogurt powder formulations tailored to meet diverse consumer preferences. Tier 1 players are distinguished by their robust manufacturing capabilities, advanced technology, and a broad geographical reach, supported by a loyal consumer base.

Prominent companies in this tier include Danone S.A., Nestlé S.A., and Fonterra Co-operative Group Limited. Their strong market presence and innovative product offerings position them as leaders in the yogurt powder segment.

Tier 2 Companies consist of mid-sized players with revenues between USD 5 million and USD 20 million. These companies have a significant presence in specific regions and play a crucial role in influencing local retail markets. Tier 2 companies are characterized by their strong regional knowledge and consumer insights, which enable them to cater effectively to local tastes and preferences.

While they may not possess the extensive global reach of Tier 1 companies, they often leverage good technology and ensure regulatory compliance. Notable companies in this tier include Arla Foods, Müller Group, and Prolactal GmbH, which are well-positioned to capitalize on regional market opportunities.

Tier 3 Companies represent the majority of small-scale players operating within local markets, with revenues below USD 5 million. These companies primarily focus on niche demand spaces, fulfilling specific local marketplace needs.

Tier 3 players are often characterized by limited geographical reach and a lack of extensive structure compared to their organized counterparts. This segment is recognized as an unorganized field, where small-scale operations thrive by catering to localized consumer demands.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 103.1 million |

| Germany | USD 68.7 million |

| China | USD 55.0 million |

| India | USD 34.4 million |

| Japan | USD 13.7 million |

Increased awareness of probiotics has significantly influenced consumer behavior, leading to a surge in demand for products that promote gut health. As more individuals recognize the role of probiotics in supporting digestion, immunity, and overall wellness, yogurt powder has emerged as a convenient option for incorporating these beneficial bacteria into daily diets.

Marketed as a versatile ingredient, yogurt powder can easily be added to smoothies, baked goods, and snacks, making it accessible for health-conscious consumers. This growing interest in gut health, coupled with the convenience of yogurt powder, positions it as a popular choice among those seeking to enhance their nutritional intake.

The growing popularity of plant-based diets in Germany is significantly influencing the demand for non-dairy yogurt powders derived from sources such as soy, almond, and coconut. As consumers increasingly adopt vegan or lactose-free lifestyles, they seek alternatives that align with their dietary preferences and ethical values. Plant-based yogurt powders not only provide the nutritional benefits associated with traditional yogurt but also cater to those with lactose intolerance or dairy allergies.

This expanding demographic is driving sales, as manufacturers respond by developing a diverse range of flavorful and innovative plant-based yogurt powder options, further enhancing their appeal in the competitive health food market.

The increased focus on nutritional supplements in India is driving demand for yogurt powder, which is recognized for its convenience and health benefits. As consumers become more proactive about their health, they seek products that can enhance their diets and support overall wellness. Yogurt powder serves as an accessible source of probiotics, promoting gut health and aiding digestion, while also providing essential nutrients.

This trend is particularly significant amid rising health concerns, as individuals look for preventive healthcare solutions. The versatility of yogurt powder allows it to be easily incorporated into smoothies, snacks, and meals, making it an attractive option for health-conscious consumers.

| Segment | Value Share (2025) |

|---|---|

| Flavored (Flavor) | 52% |

Flavored yogurt powders are increasingly appealing to younger demographics, particularly millennials and Gen Z, who prioritize taste and variety in their food choices. This age group is more inclined to experiment with new flavors and products, driving the growth of flavored yogurt powder in the market. Additionally, the versatility of flavored yogurt powder enhances its attractiveness, as it can be seamlessly incorporated into a wide range of applications, including smoothies, baked goods, snacks, and desserts.

This multifunctional ingredient allows consumers to enjoy the nutritional benefits of yogurt while satisfying their cravings for delicious and innovative flavors. As younger consumers seek convenient and tasty options, flavored yogurt powder is well-positioned to meet their evolving dietary preferences.

| Segment | Value Share (2025) |

|---|---|

| Cosmetics and Personal Care products (Application) | 12% |

Yogurt powder is increasingly favored in cosmetics due to its rich content of vitamins, minerals, and probiotics, which provide significant skin nourishment. Its moisturizing and soothing properties help hydrate and improve skin texture, making it an attractive ingredient in skincare formulations. Additionally, the lactic acid in yogurt powder serves as a gentle exfoliant, promoting cell turnover and effectively removing dead skin cells. This exfoliation benefit enhances the efficacy of facial scrubs, masks, and other products.

Furthermore, yogurt powder's versatility allows it to be seamlessly incorporated into a wide range of cosmetic formulations, including creams, lotions, and hair care items. This adaptability enables manufacturers to innovate and cater to diverse consumer preferences, driving its popularity in the beauty industry.

Key players are investing in research and development to introduce unique flavors and formulations, including plant-based options, to cater to evolving consumer preferences. Additionally, brands are enhancing their marketing strategies and expanding distribution channels, particularly through e-commerce, to reach a broader audience. Collaborations and partnerships with health and wellness influencers further bolster their competitive edge in this dynamic market.

For instance

The global Yogurt Powder industry is estimated at a value of USD 356.0 million in 2025.

Sales of Yogurt Powder increased at 5.2% CAGR between 2020 and 2024.

Nestlé S.A., Danone S.A., General Mills, Inc., Yakult Honsha Co., Ltd., and FrieslandCampina N.V. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 23% over the forecast period.

North America holds 31% share of the global demand space for Yogurt Powder.

This segment is further categorized into regular, low-fat and non-fat.

This segment is further categorized into plain and flavored.

This segment is further categorized into sachets/pouches, cans/jars, and bulk packaging.

This segment is further categorized into food and beverage industry, nutraceuticals, dietary supplements, and cosmetics and personal care products.

This segment is further categorized into supermarkets and hypermarkets, convenience stores, online retailing, specialty stores, and others.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.