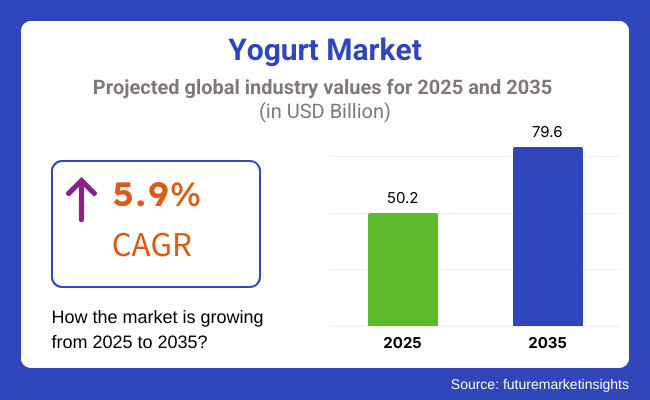

The yogurt business is projected to manifest a steady growth trend through the forecast year 2025 with a valuation of USD 50.2 billion and then it will brighten significantly to USD 79.6 billion eleven years later, in 2035 with a CAGR of 5.9%. This growth is mainly due to the health-conscious consumers preference for functional dairy products, probiotic-rich foods, and clean-label nutrition solutions.

Besides the customers changing lifestyle, probiotic-packed is there among the yogurt products and also there are dairy-free, sugar-free, high-protein variations, these specialty products even cross the line into the functional food category.

The organic dairy sector, plant-based yogurt substitutes, and other health-oriented products have grown rapidly with the alignment of the consumer's health needs. Also, yogurt companies are taking advantage of the technologies that allow them to deliver both consumer needs and health benefits efficiently.

The yogurt brands which have mostly been mentioned in the developments of the focus on the clean-label formulations, the reduced sugar content, and fortified variations with additional vitamins, minerals, and functional probiotics that are attached to the health-oriented consumers have informed new discussions about the incorporating of yogurt into the everyday diet by means of these things

Even though the natural and organic ones are the primary elements that many people rely on, the yogurt trade is not an exception to the wheel of change conducting by such elements since chemical-free and sustainably supplied products are the consumers preferred choice of ingredients. The increasing trend of plant-based and organic dairy products has, in turn, generated the need for yogurt made from unconventional types of milk, primarily almond, coconut, soy, and oats.

The beauty and wellness sectors have as well been beneficiaries of the probiotic yogurt consumption and have brought the product into diet plans that are attentive to wellness. Additionally, the North American and European regulatory bodies are pushing the narrative of clean-label dairy production thus, alternative ingredients, mainly derived from natural sources are being promoted as a result of this trend. The end up being the organic yogurt brands that have built a brand on the ethical sourcing, non-GMO certification, and minimal additives.

Herbal drinks and yogurt varieties are packed with herbs focusing on consumers concerned about the immunity, gut health, and the choice of detoxifying foods stay as a short-time trend. The yogurt-based soda drinks, which use probiotics, and mix of aloe vera and herbs are among the most important functional drinks. In the era of the corruptive elements of artificial food additives, the market is now gravitated to natural sources of hydration, and yogurt, as a healthy, most convenient option has gained popularity.

The primary ingredients that the probiotic-rich yogurt-based skin-caring and dermatological products used are probiotics and natural enzymes, which are the breakthroughs of the healing of the skin and anti-inflammatory effects. The multi-functional nature of yogurt which incorporates nutrition, wellness, and industrial application, thus, the market is expected to grow sustainably due to innovation, sustainability, and consumer preferences transformation.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global Yogurt market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 15.4% (2024 to 2034) |

| H2 | 16.0% (2024 to 2034) |

| H1 | 16.3% (2025 to 2035) |

| H2 | 17.0% (2025 to 2035) |

The above table presents the expected CAGR for the global Yogurt demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 15.4%, followed by a slightly higher growth rate of 16% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 16.3% in the first half and remain relatively moderate at 17% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

The global yogurt market witnessed a growth of 19.0% CAGR during the period of 2020 to 2024 owing to the increase in demand for probiotic-rich and functional dairy products among consumers. The thriving growth momentum of the market was stimulated through the traditional and plant yogurt segments on the health consciousness as well with gut-health interest.

Consumers became more inclined to demand immunity-enhancing health foods, leading to increased sales in fortified yogurts that added probiotics, vitamins, and minerals as a result of the pandemic's additional effect on the demand. Hitherto, the dairy-free allowances mainly almond, soy, and oat-based yogurts gained recognition among lactose-intolerant and vegan sections of the population. However, the inconsistencies caused by raw material price volatility and supply chain disruption jeopardized the irreversible growth of the market.

Between 2025 and 2035, yogurt sales will increase at a CAGR of 17.8% driven by innovation in high-protein, low-sugar, and functional yogurt formats. Growing demand for clean-label, organic, and personalized nutrition products will contribute to market growth. Fermentation technology advancements will bring new flavors and textures, generating consumer enthusiasm and thus driving sustained growth through different global markets.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market continues to expand through the increasing consumer adoption of dairy yogurt supplemented with probiotics. Also, the diversification of product ranges into functional, plant-based, and fortified yogurts feeds the growth vigor of this industry. | People are getting inclined toward plant-based yogurts produced from almond, soy, and coconut. Therefore, innovations in plant-based formulations with better taste and texture and increased protein levels are taking place. |

| Sugar reduction trends lead to the development and launching of low sugar and no added sugar yogurts. | The health benefits of yogurts are being enhanced by the use of natural sweeteners widely, prebiotic fibers, and fermentation techniques. |

| Supermarkets and hypermarkets continue to dominate the distribution channel. | The use of e-commerce and direct consumers model is not standing still; rapid growth into personalized nutrition offerings is desirable. |

| Strong yogurt consumption growth in emerging markets from Asia-Pacific and Latin America. | Penetration deepens into Africa and the Middle East, aided by urbanization and increasing disposable income. |

| Regulators frown at artificial additives and demand full-labelling transparency. | More stringent regulations on clean-label claims and sustainability practices have effects on product development. |

| The sustainability drive is towards green packaging and low-dairy farming emission levels. | The circular economy model: waste reduction, carbon neutral production approach, and regenerative agricultural practices. |

The yogurt market is experiencing transformation as it rewrites itself to fit changing consumer tastes and competitive pressures. For health-conscious consumers looking for a vegan or lactose-free option, dairy-free, plant-based almond, soy, coconut and oat yogurts are increasingly competing for market share with their dairy-based counterparts. This competition pushes traditional dairy brands to innovate by approaching product differentiation - such as launching high-protein Greek yogurts or probiotics-rich formulations.

Furthermore, yogurt production has difficulty with a strong cold chain, requiring constant refrigeration from production to retail, so high storage and transportation costs can arise. Rising costs of energy and logistics add to the complexity in the market whereas increasing consumer awareness regarding sugar content is influencing the demand for lower sugar or no sugar version.

All this has to happen with no compromise on quality and taste against the backdrop of a competitive pricing environment in which private labels and value packs add pressure on margins.

According to the latest research by FMI, yogurt pricing is currently experiencing a mix of premiumization and value offerings, reflecting the consumer landscape. Premium products - whether probiotic-rich or high-protein Greek-style yogurts - fetch premium prices because of their superior nutrition and more complex production methods. These items typically retail for almost twice the price of regular yogurts.

By contrast, store-brand and bulk-pack products are offered at lower prices to target value-oriented consumers. Because there are various forms of pricing strategies, such as volume discounts (buying large quantity, for instance) and promotional pricing (temporary price cuts on certain items or bundles), retailers add all these in the consumers' purchase, creating room for loyalty just to the shoppers.

Limited-edition or seasonal flavors tend to emerge at a small price premium to capitalize on their freshness, while standard flavors are kept competitively priced to ensure mass-market appeal. If manufacturers balance both strategies, who attracts health-conscious segments and to open price-sensitive shoppers at the other end, so manufacturers will capture the market, maximize industry growth and reach more customers.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 4.5% |

| UK | 3.8% |

| Italy | 2.5% |

| France | 3.2% |

| India | 6.5% |

As per FMI's report, the USA yogurt market will expand by 4.5% CAGR from 2025 to 2035 due to increased health awareness and a shift towards functional foods. The high-protein, probiotic, and plant-based yogurt market keeps expanding, with more than 60% of American consumers actively seeking gut-health-related food products. Market leaders Danone and Chobani have introduced plant-based and high-protein yogurts in response to vegan demand.

| Key Drivers | Details |

|---|---|

| Health Consciousness | Over 60% of consumers focus on gut health boosting demand for probiotic yogurt. |

| Plant-Based Products | Dairy-free yogurt is growing in double digits among vegan and lactose-intolerant consumers. |

| Functional Foods Trend | Consumers are opting for immune-boosting, high-protein, and digestive health yogurts. |

| E-commerce Expansion | Online yogurt sales increased 20% through channels such as Instacart and Amazon Fresh. |

As per FMIs analysis the UK yogurt market will record a 3.8% CAGR growth from 2025 to 2035. demand brands like The Collective Dairy and Yeo Valley focusing on organic, grass-fed, and locally sourced ingredients.

Supermarkets Tesco, Sainsbury’s, and Waitrose have expanded their private-label yogurt ranges, increasing competition in the market.

| Key Drivers | Details |

|---|---|

| Low-Sugar Yogurt Demand | Sugar content in flavored yogurts fell by 17% after government action. |

| Organic & Grass-Fed Yogurt | Ethically and sustainably produced dairy is a key factor for consumers. |

| Private-Label Expansion | Retailers such as Tesco, Waitrose, and Sainsbury’s expanding their yogurt ranges to match top brands. |

| High-Protein Trend | Increasing demand for high-protein Greek yogurt from consumers. |

Italy's yogurt market is expected to grow at a CAGR of 2.5% during 2025 to 2035, with a focus on premium and traditional yogurt production. Italian consumers prefer organic and locally sourced dairy, and brands like Parmalat and Granarolo lead in the premium and traditional categories.

| Key Drivers | Details |

|---|---|

| Artisanal & Organic Dairy | Consumers demand locally made, organic, and high-quality yogurt. |

| Mediterranean Diet Influence | Yogurt is a key part of healthy diets, often consumed with fruits and nuts. |

| Lactose-Free Yogurt Growth | 40% of Italians experience lactose intolerance, increasing demand for lactose-free yogurt. |

| Traditional Yogurt Preferences | Italian consumers prefer traditional and natural types of yogurt from home manufacturers. |

The French yogurt market is projected to grow at a CAGR of 3.2% between 2025 to 2035, driven by its strong dairy industry and rising demand for probiotic yogurts.

| Key Drivers | Details |

|---|---|

| Strong Dairy Tradition | 80% of French consumers purchase yogurt on a regular basis. |

| Probiotic & Functional Yogurt | Major brands spearheading the movement with gut-health-focused yogurt products. |

| Sustainable Dairy Practices | Increased adoption of regenerative and carbon-free dairy farming. |

| Premium & Gourmet Yogurt | Strong demand for high-quality, locally produced yogurt varieties. |

India’s yogurt market is set to grow at the highest rate, with a CAGR of 6.5% from 2025 to 2035, driven by urbanization, rising disposable incomes, and changing dietary habits.

| Key Drivers | Details |

|---|---|

| Urbanization & Income Growth | Increased demand for convenience-based yogurt products. |

| Drinkable & Flavored Yogurts | Growing demand for lassi and probiotic yogurt drinks. |

| Affordable & Wholesome Options | Consumers prefer cost-effective yet nutritious yogurt choices. |

| E-commerce Growth | Online yogurt sales growing at a rate of 30% per year. |

Greek-style yogurt is one of the fastest growing segments in the world yogurt market and accounted for a large market share owing to its protein-rich content, creamy texture as well as a broader range of applications. The demand for Greek-style yogurts has grown because consumers turned to food rich in protein, low in carbohydrates and friendly to the gut, which made Greek-style yogurts a staple in a fitness, weight management and high-protein diet.

Greek yogurt's incredible functional benefits like probiotic support, enhanced digestion, and muscle recovery make it an even more attractive option. Applying it to increasingly elaborate smoothies, breakfast bowls, dips and baked goods, Greek yogurt has become a multifunctional dairy product.

There is also increasing demand for varieties such as organic, lactose-free, and plant-based Greek yogurt alternatives, which cater to consumers with dietary restrictions and consumers who prefer sustainable options. Fortified and sugar-free variants as brands continue to innovate are expected to drive Greeks yogurt to be a high growth product in the global yogurt market.

Yogurt drinks possess functional properties such as help in digestive health, immune system strengthening, and gut microbiome balance, boosting their demand. Probiotic drinks are becoming a part of daily wellness routine, especially in Asia- Pacific, as well as Europe and North America regions.

Innovation in plant-based, organic, and fortified yogurt drinks is also growing in the market, catering to lactose-intolerant as well as health-conscious consumers. Low sugar, high protein, and vitamin-enriched formulations are also growing among brands, giving an additional boost to the market. Yogurt Yoga products The global yogurt industry is projected to be a high demand product as dairy and plant-based alternatives continue to develop.

Hypermarkets have continued to lead the global yogurt market segmented by distribution channel, capturing a large portion of total sales. This is why hypermarkets remain a significant retail hub for yogurt purchases, thanks to their diverse product offerings, competitive pricing, and promotional discounts.

Hypermarkets have dedicated dairy sections that stock a range of yogurt types like flavored, Greek, organic, and drinkable yogurts for diverse consumer needs. The lesser prices of private-label yogurt brands has cemented hypermarkets' growth in the market.

Customer engagement through bulk purchase options, in-store tastings, and promotional campaigns add to it leading to rise in sales of yogurt. Retailers, such as convenience stores, grocery stores, and specialty dairy stores, are key to making yogurt available to a wider swath of consumers. They are the preferred channel to make small, frequent purchases, and are critical for impulse buying as well as the daily dairy basket.

To adapt to changing dietary needs, retailers stock a variety of yogurts, including organic, lactose-free, and probiotic yogurts, as well as capture the ever-growing health-conscious and premium consumers. Yogurt sales have also been bolstered by the availability of local and artisanal brands in specialty retailers, particularly in urban and health-oriented markets.

The rising needs for fresh dairy and dairy products are leading to continuous expansion in shelf space for refrigerated varieties of yogurt (including both sweetened and unsweetened) among retail outlets, thereby increasing the extent of their market reach. Retailers will continue to be an important distribution channel for both dairy.

Tier 1 companies in the Yogurt Market comprise industry leaders with annual revenues exceeding USD 20 million, holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacity, diversified product portfolios, and extensive global distribution networks.

They possess significant expertise in aloe vera cultivation, extraction, and formulation, allowing them to serve a wide range of applications, including cosmetics, pharmaceuticals, functional foods, and nutraceuticals. Their global presence spans multiple continents, with a strong brand reputation and consumer trust driving consistent sales.

Tier 2 companies in the Yogurt Market are mid-sized firms with annual revenues between USD 5 million and USD 20 million, holding a market share of approximately 25% to 35%. These firms focus on regional markets and specialized product segments, including organic, cold-pressed, and pharmaceutical-grade aloe vera extracts.

While they may not have the global scale of Tier 1 companies, they excel in specific niches, catering to premium skincare, dietary supplements, and functional beverage sectors. They often emphasize sustainable sourcing, fair trade practices, and innovative processing techniques to maintain a competitive edge Terry Laboratories, Houssy Globa Real Aloe Inc. These companies are offering premium-grade, ethically sourced aloe vera extracts for skincare and wellness products.

Tier 3 companies in the Yogurt Market consist of small-scale enterprises with annual revenues below USD 5 million, holding a market share of approximately 10% to 20%. These companies operate at a local or community level, often serving specific markets or private-label brands.

They lack the large-scale production and advanced R&D capabilities of Tier 1 and Tier 2 players but thrive by catering to niche consumer demands, offering artisanal, locally sourced, and customized aloe vera products. Many of these firms supply bulk extracts to private-label cosmetics, herbal medicine manufacturers.

The global yogurt market is moderately competitive, with leading players leveraging large-scale production, vertical integration, and extensive distribution networks. Companies such as NESTLÉ SA, Danone Groupe SA, and General Mills dominate the industry through strong brand presence, innovative product offerings, and strategic acquisitions. Meanwhile, emerging brands are focusing on organic, probiotic-rich, and plant-based yogurt alternatives to cater to shifting consumer preferences.

With increasing demand for functional and clean-label yogurt, companies are investing in research and development, sustainability initiatives, and digital marketing strategies. Mergers, acquisitions, and direct-to-consumer models are shaping the competitive landscape, as brands expand their footprint in high-growth regions like Asia-Pacific and Latin America.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NESTLÉ SA | 14-18% |

| Danone Groupe SA | 12-16% |

| General Mills | 10-14% |

| Yakult Honsha Co. Ltd | 7-11% |

| Chobani Inc. | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| NESTLÉ SA | Offers a diverse range of dairy and plant-based yogurts, focusing on health benefits and clean-label formulations. |

| Danone Groupe SA | Innovating with functional and probiotic-rich yogurts, emphasizing gut health and sustainable sourcing. |

| General Mills | Known for its Yoplait brand, General Mills is expanding its portfolio to include organic and high-protein yogurts. |

| Yakult Honsha Co. Ltd | Specializes in probiotic yogurt drinks, with a strong presence in functional dairy beverages. |

| Chobani Inc. | A market disruptor with high-protein, low-sugar, and non-dairy yogurt alternatives, targeting health-conscious consumers. |

Key Company Insights

NESTLÉ SA (14-18%)

A leader in dairy and plant-based yogurts, Nestlé focuses on innovation and sustainability to meet evolving consumer preferences.

Danone Groupe SA (12-16%)

Pioneering probiotic and gut-health yogurts, Danone maintains a strong global presence with brands like Activia and Oikos.

General Mills (10-14%)

Expanding its Yoplait brand to include organic, Greek-style, and protein-enriched yogurts.

Yakult Honsha Co. Ltd (7-11%)

A dominant force in probiotic dairy beverages, Yakult continues to expand into functional health markets.

Chobani Inc. (6-10%)

A leader in high-protein and plant-based yogurt alternatives, Chobani is driving market growth through innovation.

The market is estimated at a value of USD 50.2 billion in 2025.

The sales of this market will increase at a CAGR of 5.9% between 2025 and 2035

Forever Living Products, Aloe Farms Inc., Herbalife Nutrition Ltd., Lily of the Desert Organic Aloeceuticals, and Aloecorp Inc. are some of the leading manufactureres in this industry.

The Asia-Pacific region is projected to hold a revenue share of 29% over the forecast period, driven by high consumer demand for herbal skincare, functional beverages, and dietary supplements.

North America holds a 33% share of the global demand space for Yogurt, driven by strong sales in clean-label skincare, nutraceuticals, and organic wellness beverages.

By product type, the market is categorized into yogurt drinks, Greek yogurt, set yogurt, and frozen yogurt.

By distribution channel, the market is segmented into hypermarkets, retailers, convenience stores, and specialist retailers.

By region, the market is divided into North America, Latin America, Europe, the Middle East & Africa, East Asia, South Asia, and Oceania.

Food Starch Market Insights - Growth & Demand Analysis 2025 to 2035

Frozen Snacks Market Growth - Convenience & Consumer Trends 2025 to 2035

Gelatin Market Trends - Food, Pharma & Nutritional Growth 2025 to 2035

Functional Milk Replacers Market Growth - Nutrition & Industry Demand 2025 to 2035

Galactose Market Growth – Nutritional & Industrial Applications 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.