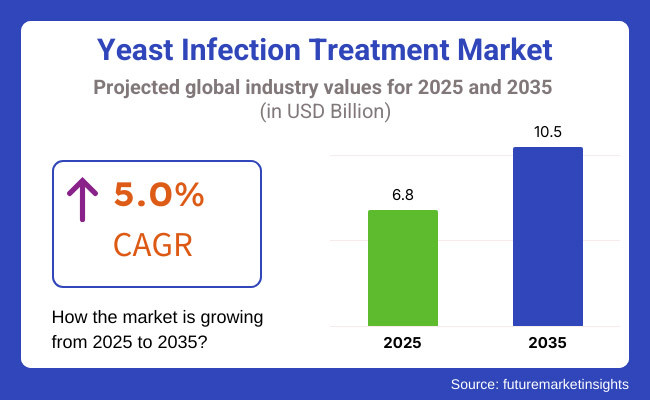

The global yeast infection treatment market is expected to exhibit steady growth throughout the forecast period on account of the rising prevalence of fungal infections and autoimmune disorders, as well as the advances being made in antifungal treatments. By 2025, the market is expected to reach a value of USD 6.8 billion; by 2035, the value will increase to USD 10.5 billion, growing at a 5.0% CAGR.

Technology advances in antifungal treatments, such as the development of new azole and echinocandin drugs, probiotic treatment, and combination therapy, have driven the effective management of yeast infections.

Furthermore, increased availability of OTC antifungal medications and telemedicine services are contributing to the growth of the yeast infection treatment market. Key challenges to the growth of this market are antifungal resistance, prolonged use side effects, and strict regulations.

Explore FMI!

Book a free demo

The most important issue in the yeast infection treatment market is the rising incidence of antifungal drug resistance, which limits the efficacy of treatment and necessitates other active therapeutic approaches. A surplus of antifungal drugs has contributed to drug-resistant Candida strains from clinical and self-medication contexts. So much so that treatment becomes more complex because of these factors.

Even the adverse effects of prolonged antifungal medication like gastrointestinal disturbances, allergic reactions, and hepatic toxicity influence the compliance of the patient. The other bottleneck is the approval of new antifungal drugs because such stringent guidelines and too lengthy clinical trial processes slow down the introduction of novel treatments.

Lack of awareness regarding yeast infections in some regions and cultural stigmas surrounding vaginal and skin infections further limits a patient's likelihood of seeking treatment.

Emerging opportunities for the market are posed by probiotic-based and natural ingredients for yeast infection treatment, one of its strongest drivers. Probiotics restore microbial equilibrium in the body and have been hailed as the latest preventive and therapeutic approach toward recurrent infections.

The proliferation of digital health platforms and telemedicine services improves accessibility to this yeast infection treatment, allowing patients to receive consultation and prescriptions without in-person visits.

In addition, the continued research of next-generation antifungal therapies, such as immunotherapies and microbiome-targeted treatments, promises tremendous innovation in the industry.

This value extends to the rise of personalized medicine, which will certainly be based on an individual's genetic and microbiome profile when designing therapies and therefore presents other openings that could be explored regarding market growth.

E-commerce has progressed with direct-to-consumer (DTC) technologies through the development of access to antifungal treatments as consumers now can buy effective therapy conveniently and discreetly.

Improving Novel Antifungal Drug Development Research: research into new classes, including second-generation azoles and echinocandins, has developed in efficacy and safety from resistance. Combined therapies, which target multiple routes of fungal cell survival, are also improving success rates with therapy.

Increasing Demand for Over the Counter (OTC) Remedies: The rising availability of antifungal creams, suppositories, and oral tablets has been increasing options for self-treatment and expansion of this market, 'to meet the growing needs of fast-acting, long-lasting, easy and effective treatment.

Probiotic-Based Therapy Extension: probiotic supplements and functional foods further emerging alternatives or complementary treatments in recurrent yeast infection management; they would restore balance in the microbial population that would lead to decreased overgrowing fungal organisms and decreased need for pharmacological intervention.

Treatment of Antifungals Personalized: Personalized antifungal treatment will be made possible by advances in genetic testing and microbiome analysis, which will enable therapies tailored to individual patient profiles. These will improve treatment outcomes such as targeted management of recurrences and selection of the most effective antifungal regimen to treat each patient for resistance.

Integrating AI into Drug Discovery: AI research became the new direction towards faster discovery of antifungal compounds while rationalizing processes for drug development and resistance issue management. Machine learning models are becoming a standard in the industry when it comes to predicting fungal drug interaction, optimizing trial design, and improving antifungal R&D efficiency.

From 2025 to 2035, continued product innovation in the formulation of antifungal drugs would remain a key influence on the market, alongside increased investment in research into fungus resistant to drugs, and finally an increased demand for personalized solutions. Adoption of AI-facilitated diagnostic and telemedicine platforms would enhance both access to treatment and adherence by patients to treatment plans.

Sustainability issues will prompt innovative development for green packaging and herbal-ingredient based antifungals while regulatory bodies will intensify focus on drug efficacy and safety standards.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased scrutiny on ingredient safety and over-the-counter antifungal treatments. | Stricter global regulations ensuring efficacy, safety, and sustainable ingredient sourcing. |

| Advancements in rapid diagnostic testing and OTC antifungal treatments. | AI-driven diagnostics, personalized medicine, and next-generation antifungal formulations. |

| Growing preference for natural and probiotic-based treatments. | Increased adoption of personalized treatment solutions and telemedicine-driven prescriptions. |

| Rising prevalence of yeast infections, improved hygiene awareness, and growing female health concerns. | Expansion of research into drug-resistant strains, enhanced treatment accessibility, and digital health integration. |

| Limited focus on eco-friendly formulations and packaging. | Greater emphasis on biodegradable packaging, natural antifungal agents, and sustainable sourcing. |

| Reliance on key pharmaceutical suppliers for antifungal ingredients. | Strengthened supply chain diversification and localized production for improved market stability. |

The yeast infection treatment market in the United States is constantly steady, being propelled by the upsurge prevalence of yeast infections and increased awareness on the existence of fungal diseases. The aging population and increased incidences of autoimmune diseases contribute to the need for effective treatment.

In this market, treatment options include over the counter and prescription medications. However, antifungal resistance and expensive treatments are factors that may slow down this market growth.

Market Growth Factors

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.2% |

Germany's yeast infection treatment market is characterized by a robust healthcare system and an equally high standard of medical care. The increasing incidence of yeast infections, especially in the aged population, maintains demand for effective treatments.

The market is further supported by government initiatives for the timely detection and prevention of fungal diseases. Nevertheless, it may face restraints due to strict regulatory requirements and rising prices for antifungal treatments.

Market Growth Drivers

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.9% |

Market Outlook

China's yeast infection treatment market is growing rapidly, owing to the increasing incidence of fungal infections and growing aged population. Further, economic development and advanced healthcare infrastructure would increase overall access to treatments.

This increase will also witness improved adoption of innovative antifungal therapies. However, health access gaps between urban and rural areas and low awareness may negatively affect the market growth.

Market Growth Factors

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.4% |

The yeast infection treatment market in India is expected to grow significantly due to the increasing incidence of fungal infections and an aging population. Associated with this, is expansion of healthcare facilities and increased health spending.

Government initiatives facilitating access to improved preventive care have also aided growth in the market. In addition, the inadequate resource support in rural India and uneven health quality may limit market penetration.

Market Growth Factors

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.8% |

The yeast infections treatment market in Japan is regulated by a strict infrastructure upheld in healthcare delivery and medical standards. This has increasingly driven the incidence of yeast infection treatment, especially among the elderly, thus making treatments demandable.

The government programs are also supporting the market with initiatives for the early detection and prevention of fungal diseases. Stringent regulations are limiting market growth, coupled with high antifungal medication pricing.

Market Growth Driving Forces

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.0% |

The treatment market for yeast infections is projected to experience gradual growth as a result of increasing personal care awareness, high healthcare expenditure, and the growing awareness of fungal infections. The market comprises prescription and over-the-counter antifungal agents, with topical formulation preferred. Economic disparities and regulatory issues will limit equitable access to treatments in different areas.

Growth drivers of the Market

Market Forecast

| Year | CAGR(2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.3% |

The antifungal agents in the market include azoles, polygenes, echinocandins, and other types of antifungal medicines. Azoles are the most widely used treatments because they are generally effective and cheap. Polygenes such as amphotericin B are usually reserved for severe infections because of their powerful fungicidal action.

Echinocandins such as caspofungin and micafungin are used most often in infections due to resistant yeasts and in invasive candidiasis, especially in immunocompromised individuals. The category "others" pertains to combinations, new antifungal formulations, and more alternatives that are in the works to address growing drug resistance.

The marketing target for this is genital candidiasis, invasive candidiasis, oropharyngeal/esophageal candidiasis (thrush), and other yeast infections. The most common form of candidiasis is caused by yeast, largely affecting a wider patient base, mostly women. Invasive candidiasis is a very serious condition that happens in the bloodstream; therefore, it needs aggressive treatment with IV antifungals.

Most often, oropharyngeal and esophageal candidiasis are seen in immunocompromised individuals. This condition typically needs both a topical and a systemic treatment form. Other illnesses or conditions that increase the market network include those related to the skin and outer parts of the nails where infections happen.

By the end of the market are oral, topical, IV/IM, and others. Although systemic efficacy and ease of use would dominate oral treatments over others, there would be topical treatments such as creams and ointments for localized infections, unable to be reserved by IV and IM treatments for severe or resistant infections, particularly in hospitalized patients.

Other emerging administration methods include transdermal patches and nanoparticle-based drug delivery into the body for improved absorption and patient compliance.

The market would include powders, creams/ointments, tablets/capsules, and others. Tablets and capsules are still the treatments of choice for systemic treatment by convenience. Creams and ointments are common for the treatment of external yeast infections. Powders are for keeping moisture content low so that chances of recurrent infection are reduced. Alternatives, such as sprays, gels, or lozenges, provide more patient-centered alternatives.

The segmented market consists of retail pharmacies, hospital pharmacies, specialty stores, online sales, and other places. Retail pharmacies and drug stores are the primary sources for over-the-counter medications.

Hospital pharmacies dispense the drugs for inpatient use as prescribed due to the severity of the infection. Specialty stores that focus on skincare and personal hygiene might carry a variety of personal care products to prevent yeast infections.

Online sales would explode rapidly with digital healthcare adoption and convenience of shopping. Other distribution, such as hypermarkets and conventional stores, provide general OTC antifungal products available to the general population.

The yeast infections treatment market is undergoing growth as awareness increases about fungal infections, yeast infections continue to strike more individuals, and antifungal drug creation and research proceed.

Market players are now focused on the development of formulations, OTC solutions, and prescription drugs for antifungal treatments to accommodate an ever-increasing patient populace. The market is highly competitive with pharmaceutical giants and emerging biotech firms investing in R&D to come up with better, effective, and fast-acting treatments.

| Company Name | Key Offerings/Activities |

|---|---|

| Bayer AG | Provides leading antifungal treatments such as Canesten for yeast infections. |

| Pfizer Inc. | Develops prescription-based antifungal medications, including fluconazole. |

| Johnson & Johnson | Offers OTC antifungal creams and personal care products targeting yeast infections. |

| Perrigo Company plc | Specializes in generic antifungal treatments and private-label OTC solutions. |

Key Company Insights

Bayer AG (18-22%)

Bayer is a strong retailer in the yeast infection treatment market and has a full range of antifungal treatments from the Canesten brand. Marketing and awareness campaigns also receive funding from Bayer to enhance accessibility to their products.

Pfizer Inc. (15-18%)

Fluconazole, a prescription antifungal drug manufactured by Pfizer, is extensively used for the treatment of yeast infections and is an important contributor to the market. Further research into broad-spectrum antifungal agents is being undertaken by the company.

Johnson & Johnson (12-15%)

Providing an array of OTC yeast infection treatment products in creams and personal care items, the strong retail presence and brand credibility of Johnson & Johnson sustain its preeminent position in the market.

Perrigo Company plc (8-10%)

Perrigo specializes in generic antifungal medications and private-label offerings for price-sensitive consumers. Its customer base is targeted on affordability and accessibility in the antifungal treatment market.

A large number of other pharmaceutical and healthcare firms play an important role in the yeast infection treatment market via innovative drug formulations and extended distribution networks. Some notable entrants are:

The increasing prevalence of fungal infections, rising autoimmune disorders, and the advancement of antifungal drugs are the underlying growth factors.

Azoles are the most common antifungals, polygenes follow, and then echinocandins for more serious infections.

Oral treatments work throughout the system to eliminate infections, while topical creams and ointments act on localized infections.

Retail and hospital pharmacies, specialty stores, and the Internet for an easy buy.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.