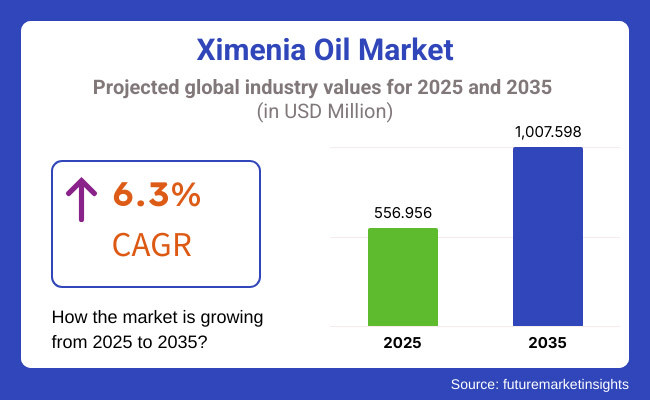

The global ximenia oil market is set to witness USD 556.956 million in 2025. The industry is projected to expand at 6.3% CAGR from 2025 to 2035 and reach USD 1,007.598 million.

Traditionally, ximenia Oil has been a product widely used for its medicinal and cosmetic benefits in Namibia and the Southern Africa region. The roots, bark, and leaves of the Ximenia plant have found their place in traditional remedies for some decades, which have been confirmed by modern scientific studies as effective. The pharmaceutical and cosmetic industries are the ones that have patented the most formulas which consist of the ximenia oil, and this further proves its commercial value. The growing trend of natural and exotic beauty ingredients has also been a success for the increased use of the product in luxury skincare and haircare products.

The companies have shown a clear move away from synthetic oils and are going for plant-based alternatives, especially those that contribute to moisturizing and anti-aging. The ximenia oil business is mostly based on two important elements: it is a sustainable oil, and consumers opt for ingredients that are produced ethically and have the lowest environmental footprint. Transparency in the supply chain has been one of the main differentiators, and companies have stated what they have done to support ethical production methods. This is in line with the clean beauty movement that consumers are into at the moment, where skin-care products with few artificial additives are the focus.

The product’s diverse features are another reason for the rise in demand, while the customers are keen on multipurpose beauty products. It is well-known to hydrate the skin, have anti-inflammatory properties, and counteract UV rays, therefore it is useful for many personal care purposes.

Explore FMI!

Book a free demo

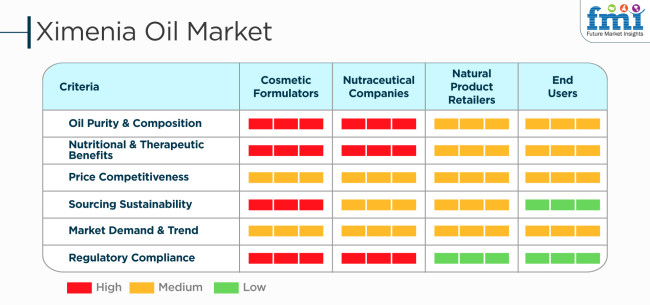

The market for Ximenia oil is dictated by several factors that drive the tastes of cosmetic formulators, nutraceuticals, natural product retailers, and consumers. High value for cosmetic formulators and nutraceuticals is placed on oil purity and composition for controlling product quality and effectiveness.

Nutritional and therapeutic advantages are also a high priority for these industries, while natural product retailers and final consumers give moderate value to these issues. Price competitiveness is a medium priority for all stakeholders since affordability is weighed against quality. Sourcing sustainability is a major priority for cosmetic formulators and nutraceutical firms, which emphasizes the importance of ethical, sustainable production practices. Market trends and demand drive all categories moderately consistent with consumer preference for natural oils. Regulation compliance is extremely critical for formulators and nutraceuticals but less critical for end-users. The market keeps moving forward with additional emphasis on sustainability and transparency.

From 2020 to 2024, the industry grew steadily, driven by increasing demand in cosmetics, personal care, and aromatherapy applications. The oil’s rich moisturizing and anti-aging properties made it popular in skincare and haircare formulations. Rising consumer preference for natural and organic ingredients further fueled industry expansion. However, supply chain limitations and seasonal variations in ximenia fruit availability posed challenges to consistent production and pricing.

Between 2025 and 2035, the industry is expected to see stronger demand for sustainably sourced and ethically harvested oil. Brands emphasizing fair trade, biodiversity conservation, and eco-friendly extraction methods will gain a competitive edge. Expanding research on the oil’s therapeutic benefits may open new applications in pharmaceuticals and nutraceuticals. Additionally, advancements in extraction technologies will improve yield and purity, supporting industry growth. As the natural beauty trend continues to rise, the product is poised to remain a sought-after ingredient in high-end skincare and wellness products.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Niche Market Adoption: The product gained recognition among natural beauty enthusiasts and niche skincare brands, but mainstream adoption remained limited. | Mainstream Beauty Integration: The product will become a staple ingredient in premium and mass-market skincare, haircare, and wellness products due to its powerful hydration and anti-aging benefits. |

| Early Sustainability Awareness: A few ethical brands promoted sustainable sourcing, but large-scale industry adoption was slow. Consumers were just beginning to demand transparency in supply chains. | Sustainability as a Standard: Ethical harvesting, fair trade partnerships, and eco-friendly production will be industry norms, with regulatory bodies ensuring compliance to protect biodiversity and indigenous sourcing communities. |

| Clean Beauty Movement Expansion: Customers began moving toward plant-based, chemical-free beauty products, leading to a higher demand for unique oils such as ximenia. Awareness was still in development. | Clean Beauty as the Norm: Natural, toxin-free formulas will be mainstream, with the product commonly known as an upscale botanical ingredient in organic beauty products and dermatological remedies. |

| Niche Product Availability: Ximenia oil existed mostly in niche-batch skincare product lines with narrow uses in addition to moisturizers and hair oils. | Multiple Product Applications: Wider applications in sunscreens, anti-aging serums, scalp care, and multi-use beauty products will propel greater consumer usage and industry expansion. |

| Emerging Digital Marketing Presence: Brands relied on social media and influencer marketing to introduce the product, but educational content was still developing. | AI-Driven Consumer Engagement: Advanced AI-driven recommendations, personalized skincare solutions, and immersive digital experiences will make the product more accessible and appealing to global consumers. |

| Regional Market Concentration: The demand was mostly in Europe and North America, with sluggish growth in Asia and Latin America. | Global Market Expansion: Growing disposable incomes and expanding awareness of natural beauty will fuel demand in Asia-Pacific, Latin America, and the Middle East, making the product a globally accepted ingredient. |

Manufacturers are witnessing a lack of raw materials, which is hampering product adoption. Ximenia oil is made from the seeds of the Ximenia tree. It grows in semi-arid regions, which makes its trunk considerably threatened by changes in the climate, droughts, and deforestation. The stranded supply and volatile prices are the results of this.

Regulatory compliance is another critical aspect to consider. The product is utilized as a component in cosmetic, skincare, and pharmaceutical products; therefore, it should be in accordance with the quality and safety criteria on an international level, including EU REACH, the USA FDA regulations, and ISO certifications. Losing the battle for compliance with these criteria, a brand can have problems related to entering the industry, products being returned, or being discredited.

Unless a company presents or emphasizes the exclusive benefits of its Ximenia oil product, for example, the product with the highest fatty acid content and skin properties, competing for a share of the industry in the flourishing organic skincare sector would be very tough.

Questions raised about sustainability are also noteworthy. To maintain the industry position, the companies must practice ethical sourcing and fair trade. Nowadays, customers and regulatory authorities are more concerned with the moral and fair employment of workers. Failure to implement ecological harvesting of natural resources, transparency along the supply chain, and obtaining certificates from the fair-trade movement may lead to a company's loss of public trust and earned attention in the form of regulatory scrutiny.

The presence of high amounts of long-chain fatty acids in the product gives it great emollient properties and is, therefore, a natural softener and conditioner. It provides deep moisture and nourishment to both hair and skin, making it more elastic and smoother. It helps prevent trans epidermal water loss and, therefore, improves the texture and hydration of the skin due to a protective barrier created by the oil. That makes it especially good for dry, damaged, or mature skin and brittle hair. This non-greasy but penetrating quality distinguishes it from conventional emollients.

Growing consumer preference for chemical-free and plant-based components in cosmetics and personal care products has resulted in increasing use of the oil in high-end cosmetics formulations. This is driving brands to create products that capitalize on the moisturizing and conditioning properties of the product, appealing to consumers looking for natural, effective personal care products.

Consumers prefer buying specialty oils like ximenia oil online, as these allow greater access to brands, organic status, and more ingredient details. Assorted quality and niche face and skin care brands offering ximenia oil are available in direct-to-consumer websites. Online shops are the most desirable platform to purchase the product because of their convenience food, greater product offering, and access. Customers are able to search through a selection of product offerings from various companies, compare prices, and learn from customer comments before making an order.

Pharmaceuticals and personal care are among the largest end-use industries, driven by their therapeutic and skin-nourishing benefits. The product is rich in monounsaturated fatty acids, antioxidants, and vitamin E, which are highly valuable in wound healing, anti-inflammatory, and skin repair products. The rise in consumer interest in natural and herbal skincare products has driven its application in soothing balms, lotions, and body oils. Its ability to hydrate dry skin, improve elasticity, and protect against environmental stressors makes it a valuable ingredient in sensitive and aging skin personal care products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

| Germany | 6.0% |

| UK | 6.1% |

| India | 4.7% |

| Japan | 12.6% |

The USA industry is driven by a growing demand for organic and natural ingredients for use in skincare and haircare. The clean beauty trend and interest in sustainable, responsibly sourced products have helped its popularity, too. Commonly found in high-end skincare, the product is preferred for providing anti-aging, hydrating, and anti-inflammatory benefits. Its uses in haircare and aromatherapy are on the rise, too.

More and more cosmetic brands are formulating new products with this exotic oil owing to growing R&D investments. Consumer demand for premium wellness solutions is also a key trend driving the industry, with the product projected to play a leading role in the beauty industry’s future. The USA ximenia oil industry is expected to register a 6.0% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Natural and Plant-based preference | Consumer Preference for natural ingredients in well-being, personal care, and home care. |

| Focus On Sustainability | Increasing demand for Ximenia oil in green products and sustainable beauty brands. |

Germany's industry is growing, owing to the country's inclination for natural, organic, and sustainable beauty and personal care products. Plant-based skin care and hair care solutions are appealing to German consumers seeking clean beauty. With its anti-aging, moisturizing, and skin-repairing properties apart, the product is a popular ingredient in both luxury and dermatological skincare.

Eco-friendly brands are also including ethically sourced oils in their formulations. Since Germany is known for being the home to cosmetic innovations as well as green beauty, ongoing R&D investments and product diversification are further contributing to industry growth. The trend fits in with Germany’s stringent sustainability standards and premium wellness emphasis. The German industry will expand at 6.0% CAGR during the study period, according to FMI.

Growth Factors in Germany

| Key Factors | Details |

|---|---|

| Natural & Plant-based Preferences | Preferences Growing consumer preference for products that utilize natural ingredients for personal care, well-being, and home care. |

| Sustainability Focus | Increasing demand for the product in natural and organic beauty and skincare formulations. |

The UK industry is driven by an increasing preference for natural, organic, and sustainable beauty products. The clean beauty movement is increasing the demand for plant-based skincare and haircare, and the product is becoming popular due to its moisturizing, anti-aging, and skin-repairing properties. Consumers are requesting green and cruelty-free formulations more, and brands are challenged to incorporate ethically sourced oils.

The premium wellness and aromatherapy sectors are also incorporating the product for its therapeutic benefits. As R&D investments and subsequent product diversification further promote industry growth, the UK is a frontrunner in green beauty innovation. The UK industry will grow at 6.1% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Natural & Plant-Based Trends | There is a growing demand for natural ingredients for personal care, wellness, and home care. |

| Sustainability Element | Increasing demand for the product in clinical and sustainable cosmetics. |

Demand for natural and ayurvedic beauty products is driving growth in India's industry. With the popularity of sustainability in the beauty space, consumers are now turning to plant-based skincare and haircare, looking for plant ingredients that offer moisturizing, anti-aging, and healing benefits.

This adoption has been further encouraged by the rise of herbal and organic personal care brands. Moreover, product is being blended into the wellness, as well as aromatherapy sectors with the promising aspect of therapeutic benefits. The Indian industry is expected to expand at 4.7% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Natural & Plant Based Preferences | Herbal, ayurvedic, and plant-based personal care products are gaining popularity. |

| Sustainability Focus | Rising interest in sustainable and ethically sourced cosmetic products drives the need for The product. |

The Ximenia oil industry in Japan is growing at a continuous pace with the country's keen interest in the use of advanced skincare, including anti-aging and natural products. Japanese consumers value the performance of the item through plant-based components, and The product is a well-known ingredient in costly skincare and haircare merchandise. Its moisturizing, anti-inflammatory, and elasticity-boosting properties meet Japan’s thirst for innovative and effective beauty formulas.

Additionally, clean beauty, sustainable sourcing and climate-friendly cosmetics and the increasing trend toward the production of eco-friendly cosmetics are expected to spur the growth of the industry. Japan's advanced R&D capability and technology allow it to increasingly blend this oil into high-end beauty and wellness products, which has further boosted its popularity. FMI anticipates Japan's industry to grow at 12.6% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Natural & Plant-Based Principles | Innovation Outbreak of efficacious, botanical cosmetics and haircare. |

| Sustainability Focus | More novel use of Ximenia oil in eco-aware, sustainable, and ethically sourced beauty products |

The key players, such as Kupanda and Aldivia, are ruling the industry by utilizing their expertise in the field of natural oil extraction with sustainable sourcing and their superior quality standards. They now focus on the ethical procurement and environmentally responsible production that are aligned with the consumer preference for green and socially responsible ingredients. Fair-trade practices and ethical sourcing are emerging as differentiators, with firms highlighting sustainable harvesting practices to appeal to green consumers.

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Kupanda | Specializes in sustainable product extraction, supplying the cosmetic and personal care industry. |

| Aldivia | Develops bioactive natural oils, including ximenia oil, for high-performance skincare and haircare formulations. |

| Clover Hill Food Ingredients Ltd | It focuses on providing natural and organic ingredients that cater to the cosmetic and food industries. |

| Cargill, Incorporated | Offers a diversified portfolio of natural oils, including the product, for use in beauty and wellness products. |

| ADM WILD Europe GmbH & Co. KG | Supplies plant-based ingredients, including the product, for personal care and functional applications. |

| Wilmar International Limited | Engages in the sustainable production and distribution of plant-derived oils, including ximenia oil. |

| Buhler AG | It specializes in high-quality oil processing technologies, supporting the extraction and refinement of the product. |

Kupanda

A leader in sustainable ximenia oil production, emphasizing eco-friendly sourcing and high-quality extraction techniques.

Aldivia

Known for innovation in bioactive natural oils, Aldivia integrates the product into advanced personal care formulations.

Clover Hill Food Ingredients Ltd

Supplies premium natural ingredients, including the product, for applications in cosmetics, food, and wellness.

Cargill, Incorporated

A global supplier of plant-based oils, investing in sustainability and research to expand its personal care segment.

ADM WILD Europe GmbH & Co. KG

Offers natural oils and botanical extracts, supporting the clean beauty and functional ingredients market.

Wilmar International Limited

Specializes in refining and distributing high-quality natural oils, catering to the cosmetics, food, and health industries.

Buhler AG

Develops advanced oil processing solutions, enhancing the efficiency and purity of plant-based ingredients.

Other Key Players

The industry is slated to reach USD 556.956 million in 2025.

The market is predicted to reach a size of USD 1,007.598 million by 2035.

Key companies include Kupanda, Aldivia, Clover Hill Food Ingredients Ltd, Cargill, Incorporated, ADM WILD Europe GmbH & Co. KG, Wilmar International Limited, Buhler AG, Nestlé, PURATOS, Shellz Overseas Pvt. Ltd., INFORUM Group, Barry Callebaut, Unigrà S.r.l., Blommer Chocolate Company, CEMOI, and HERZA Schokolade GmbH & Co. KG.

Pharmaceuticals & personal care industry widely uses the product.

Japan, set to witness 12.6% CAGR during the study period, is projected to witness fastest growth.

The segmentation is as softening and conditioning agent and lubricating agent.

The segmentation is as direct sales, indirect sales, supermarket/hypermarket, online stores, and retail stores.

The segmentation is as food industry, pharmaceuticals & personal care, cosmetics, and aromatherapy.

The segmentation is as North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific.

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Flavors Market Trends – Growth & Industry Forecast 2025 to 2035

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.