The wound debridement products market will only see moderate growth in between 2025 to 2035 owing to a host of factors including rising prevalence of chronic wounds, rising awareness to novel wound care products, and advance debridement technology. High demand for effective wound debridement products that stimulates the removal of dead tissue and healing is observed for wide spread of diabetes ulcers, pressure ulcers and burns.

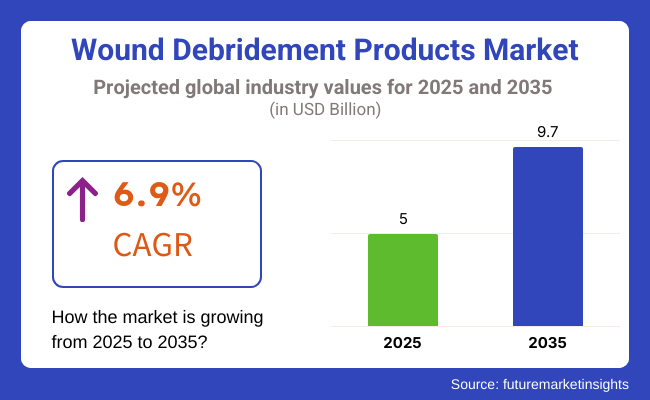

The market size is estimated to increase of USD 5.0 Billion in 2025 and shall observe a constant high growth rate of CAGR 6.9% throughout the forecast period of 2025 to 2035, USD 9.7 Billion by 2035. Increase prevalence of surgical wounds, traumatic, and infected wounds are causing the demand of debridement therapy which involve mechanical, enzymatic, autolytic and surgical debridement therapy. Moreover, bioactive and nanotechnology based therapy for wound care is coming into play, as it offers a less-invasive and more efficacious debridement therapy strategy than the conventional therapies.

The market is primarily driven due to government programs of enhanced wound care management, reimbursement policies, and increased research and development (R&D) expenditure. The demand for advanced debridement wound products has also been owing to the rising incidence of chronic wounds and impaired healing conditions, worldwide geriatric population.

Explore FMI!

Book a free demo

The Wound Debridement Products Market in North America also being driven by the development of advanced healthcare systems and high prevalence of diabetes and chronic wounds along with government initiatives to promote research in wound care. Favourable access of the top manufacturers of the market, growing adoption of the advanced wound care products, and widespread reimbursement practices are also driving the regional market growth.

High Incidence of Chronic Wounds: High incidence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers in this region is creating strong demand for advanced wound debridement products.

Technological Advancements: In the USA and Canadian markets players are investing significantly in enzyme-based and bioactive wound debridement products to make wound care more efficient and less invasive.

The surge in government initiatives and insurance programs promoting the management of wounds coupled with the use of debridement treatments is fostering the market growth.

The North America wound debridement products market is lucrative for suppliers owing to growing geriatric population and increasing number of outpatient facilities solely dedicated at wound care market.

Europe leads the Wound Debridement Products Market in terms of market share, attributed to government-funded healthcare systems, increasing incidence of chronic wounds, and a demand for affordable and advanced wound-care procedures. For enhanced medical research and increase geriatric population, Germany, the UK, and France are some of the countries that can drive market growth.

Increasing Usage of Next-Gen Wound Care: European nations are increasingly focusing on bio-debridement and enzymatic debridement treatment methods as they provide lesser chances of infection and are more effective for wound healing.

Government-Funded Healthcare and R&D - Already, both local governments and the European Union are funding research of this sort for wound care, bringing cutting edge debridement technology within the solvability envelope.

Educating Healthcare Professionals: By providing professional wound care educational programs to clinicians, nurses, and caregivers, education is raising awareness about optimal debridement wound adoption techniques.

Germany and UK are bringing the surgical debridement innovations into the front row, while we see France cantering on the tissue recovering in pace and improved clinical outcomes with enzymatic wound care innovations.

Geographically, the Asia-Pacific is anticipated to grow at the fastest CAGR in the wound debridement products market during the forecast period on account of increasing healthcare expenditure, rising awareness regarding advanced wound care products and high ageing population with higher risk of chronic wounds. China, India, Japan and South Korea have invested in advanced wound care facilities and new medical technologies.

The rising prevalence of diabetes in Asia-Pacific region is resulting in an increasing burden of pressure and diabetic foot ulcers, which is one of the key factors that is expected to drive the demand for wound debridement techniques in the region. India and Thailand are emerging medical tourism destinations treating you right: Both emerging as medical tourism destinations at home & away Both India & Thailand have emerged as medical tourism destinations offering high-technology, value-for-money debridement therapy to foreigners.

Governmental Regulations Regarding Wound Management in Regions- Several countries across regions have been working to improve the availability of innovative wound handling technologies and this has also stimulated the demand for enzymatic debridement and bio-debridement products. The growth of investments in R&D in medicines and in the indigenous manufacture of affordable wound debridement products are also contributing to the market.

Challenges

Costly Advanced Wound Debridement Products

The cost of enzymatic and bioactive wound debridement products remains prohibitively high, limiting their use in developing countries.

Healthcare facilities in low-income countries may not have the resources to afford advanced debridement technologies in consequence will opt for conventional and low-cost wound care measures.

Significant variation or comparison issues

The strict regulatory systems governing wound care products slow down the approval of new debridement technologies, preventing new players from entering the market.

The cost of ensuring that products both comply with regulations and are distributed accordingly, including dealing with regulatory variance from one region to another, is high for multinational companies.

Limited Awareness among Healthcare Providers in Rural Settings

In developing countries, clinicians and caregivers typically have no training in advanced wound care techniques, limiting the use of appropriate debridement products.

Awareness of the most modern wound care solutions and how to access them should be bolstered through education programs and continuing education for healthcare professionals.

Opportunities

New Enzymatic and Bioactive Debridement Solutions

Generation Next of debridement technologies are being developed including enzymatic, autolytic, and bioactive debridement products to enhance the rate of wound healing whilst decreasing the chances of infection.

Researchers are creating smart debridement dressings that use nanotechnology and controlled-release drugs to help patients.

Increasing Demand for Non-Surgical and Without Painful Debridement Methods

Minimally invasive, pain-free debridement techniques are gaining acceptance, with diabetic foot ulcer and geriatric patients seeing the most successes with these methods. Ultrasound-assisted debridement devices and artificial intelligence-based wound monitoring systems are redefining wound care devices.

Expanding Access to Wound Care in Developing Nations

Both state and non-state actors are focusing on enhancing access to advanced wound care products in rural health facilities. Public-private partnerships (PPPs) are driving investments in locally made and affordable solutions for wound debridement among poorer communities.

Between 2020 and 2024, the market for wound debridement products grew significantly as healthcare professionals increasingly used advanced wound care solutions to help patients heal as well as reduce infection and promote recovery.

The prevalence of chronic wounds (pressure ulcers, diabetic foot ulcers), burns, and surgical site infections led to a growing demand for wound debridement, while optimal wound bed preparation facilitated tissue regeneration. In addition, factors such as the increasing geriatric population, diabetic foot ulcer patient population, and global burden of non-healing wounds also spurred the need for more sophisticated enzymatic, mechanical, autolytic and surgical wound debridement solutions.

According to USA Food and Drug Administration (FDA), European Medicines Agency (EMA) and the World Health Organization (WHO) Next generation product for Wound debridement seems to have a higher level of safety, effectiveness and biocompatibility. Enzyme-based debridement gels, bioengineered dressings, ultrasonic debridement devices, hydro surgical debridement systems, and other wound therapy technologies designed to optimize wound healing while minimizing patient discomfort entered hospitals, wound care clinics, and home healthcare providers.

The increase in patient population makes it essential to have simple, cost effective and easy to use debridement modes, especially in long-term care facilities, home healthcare and outpatient wound care centres which also reduces the burden of invasive surgical debridement procedures.

Bioengineered technologies for bioengineered wound dressings, AI-powered wound assessment weapons, and nanotechnology-enhanced debridement breakthroughs in the ultimate ability of wound cleaning to aid-in-tissue regeneration symbioses during healing processes. Next, important advancement in wound cleansing consists: collagen-based enzymatic debridement agents, antimicrobial peptide infused cleansers, and smart bioactive dressings promoting wound healing potential with low inflammatory response and bacterial colonization.

Well, as a result of these joint planning’s, AI-based wound imaging solutions have been introduced in this direction to provide real-time assessment of wounds, automated decision making in de-clogging process and personalized treatment recommendations, thus leading to more effective treatment of wounds and a reduction in healing duration.

Additionally, robotic-assisted debridement approaches and ultrasound-guided enzymatic debridement procedures that enabled more controlled and precise removal of tissue from the wound bed, enabling an ideal preparation of the wound bed without damaging the surrounding healthy tissue.

Many low-income healthcare settings had either lacked access to or could not afford enzymatic and mechanical debridement technologies, leading most to adhere to manual or traditional processes. Besides, the factors restraining the use of new generation wound debridement products are Infection control issues, regulations, difference in training of clinician.

However, companies offering AI-enabled wound healing platforms and affordable biodegradable debridement dressings & personalized debridement therapies improved the efficiency, scalability and accessibility of wound care management across healthcare facilities.

What percentage of chronic wound medical modalities do they achieve which segment made the deepest audio transmission into the skin How deep does it penetrate the blood What are the remarkable comparison and contrast for treating chronic wounds between self-adaptive debridement and snare techniques.

Driven by emerging technologies, the wound debridement products market is set for revolutionary alterations over the period 2025 to 2035, and trends such as AI-based wound diagnostics, bioengineered tissue regeneration technologies, and self-adaptive debridement materials will help raise the bar for wound care, infection management, and tissue healing efficiency.

Anticipated future state: AI-powered wound analysis platforms will emerge as a go-to toolbox among healthcare providers, utilizing machine learning algorithms and predictive analytics in real time with imaging to assess not just the severity of the wound, but the risks for infection, and optimized debridement techniques. Wound cleaning will be performed using AI-powered automated debridement robots that will conduct non-contact wound cleaning under precision-guidance & none of the manual intervention.

Iris Mucosa Biocompatible wear and tear remote checking PDSP-gather fully fledged solutions for wound cure: Quantum computing driven re-enactments will be directed to improve wound biology-arranged treatment trails to create the best healing for each and every patient, choicest and fastest cure, diminished healing centre readmission.

Bioengineered, self-healing wound dressings and smart debridement gels will become widely used and, as such, will make traditional debridement techniques obsolete by enabling natural tissue regeneration and reducing risks of infection. One will have stem cell-seeded debridement agents which will have biodegradable scaffolds and regenerative growth factors so that the amount of healing of the wound will be permissive not excessive.

Moreover, the gene therapy mediated debridement solutions will provide targeted tissue repair and antimicrobial defines to prevent chronic wound complications & expedite new tissue formation. The nanotechnology-derived debridement foams will also have the benefit of gravity, in that they will treat wound exudate by disrupting bacterial biofilm development and promoting hydration balance, facts which are of utmost importance for a wound-healing environment whether they be chronic or acute in nature.

Big data on wound healing and tracking of biochemical markers within the wound, levels of tissue oxygenation, and specific indications of infection from a smart bandage that can, in real time, adjust the intensity of debridement and topical therapy delivered to the wound on an individual patient-basis for optimum recovery leading to the development of a type of battery-free AI-enabled smart bandage.

This review focuses on the clinical utility of next-generation wireless bioelectric devices for enhanced wound-healing efficiency by integrating electrical stimulation-assisted debridement, cellular repair acceleration, inflammatory suppression, and fibroblast migration promotion.

AI also be the crucial part of healing the wound healing cascade where doing timely, necrotic tissue (debris) removal by the patient specific wound dressing printed in 3D format based on the personalised wound-image and predictive analytics which will determine the healing capability of the tissue, including incorporation of AI and showing the patients are getting heal in a day or post-debridement which will lead into a reduction of any complications and wound healing time.

This way, cost efficient, sustainable and accessible wound-debridement care will find its way to the future. Automation of wound care manufacturing systems will lower treatment costs, while bio fabricated biodegradable dressings and regenerative medicine-based wound therapies will reduce medical waste and improve access to advanced wound care in deprived territories. However, block chain technology scientific article customized wound monitoring protocols international standardisation with patient compliance, a debridement monitoring and increased safety and clinical performance in healing management.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Clinically approved enzyme-based debridement gels, bioengineered wound dressings, and ultrasonic debridement devices. |

| Technological Advancements | Mechanical debridement pads, antimicrobial dressings, and AI-powered wound imaging tools. |

| Industry Applications | Wound debridement performed for diabetic foot ulcer preparation, surgical wound, and pressure ulcer care. |

| Adoption of Smart Equipment | Ultrasonic debridement devices were routine equipment in hospitals and wound care clinics. |

| Environment-Friendly & Economical | Biodegradable wound dressings and AI-driven debridement automation were rapidly adopted. |

| Data Analytics & Prediction Modelling | AI-powered wound tracking models, predictive healing analytics, and infection detection models optimized treatment planning. |

| Timeline of Production & Supply Chain Dynamics | Bioengineered debridement products faced high costs, supply chain issues, and regulatory delays. |

| Market Growth Drivers | Growth driven by increasing chronic wound cases, rising AI-based demand in wound care, and regenerative wound treatment advancements. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered real-time assessment, bioengineered regenerative debridement therapies, and smart bandage adherence frameworks. |

| Technological Advancements | Quantum-enhanced wound healing modeling, AI-driven debridement robots, and regenerative stem cell-based therapies. |

| Industry Applications | AI-assisted wound care for personalized treatment, automated wound debridement using robotics, and bioengineered skin grafts for faster recovery. |

| Adoption of Smart Equipment | Wireless bioelectric wound healing devices, real-time analytics smart bandages, and 3D-printed regenerative wound debridement materials. |

| Environment-Friendly & Economical | AI-optimized wound care production, blockchain-driven wound healing standardization, and regenerative wound healing technologies. |

| Data Analytics & Prediction Modelling | Quantum-assisted wound repair simulations, AI-driven predictive analytics for debridement, and smart biometric-driven wound monitoring. |

| Timeline of Production & Supply Chain Dynamics | AI-based smart wound dressings, decentralized 3D-printed wound debridement devices, and blockchain-secured logistics for wound treatment. |

| Market Growth Drivers | AI-integrated wound debridement robotics, gene-therapy-assisted wound healing, and bioengineered self-adaptive wound closure systems. |

he United States Wound Debridement Products Market is anticipated to increase due to increase in chronic wound cases, increase in diabetes and vascular diseases incidence, and technological development in enzymatic and autolytic debridement. The Centres for Disease Control and Prevention (CDC) estimates that more than 8.2 million Americans suffer from chronic wounds, which leads to high demand for advanced debridement products.

The rising occurrences of diabetic foot ulcers (DFUs) & pressure ulcers in the aging and sedentary population are one of the main market driving forces. This is expected due to the increasing adoption of enzymatic debridement agents and bioactive wound care solutions.

The increasing number of clinics for wound care and home healthcare based debridement services are boosting the demand for debridement products such as collagenase-based enzymatic debrides, hydrogel dressings, and Bio Surgical therapies, as steps are being geared up. Furthermore, top players in the segment, such as Smith & Nephew, 3M, and Mölnlycke are also targeting next-gen wound debridement devices, alongside, early stage investment in next-gen antimicrobial & nanotechnology based dressings, which can help in promoting wound healing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

Over 3.8 million people in the UK have chronic wounds, according to the NHS, adding to demand for effective debridement solutions, including enzymatic, autolytic, and mechanical debridement. This has resulted in the trend of increased penetration of bio surgical debridement (maggot therapy) and enzymatic debrides in the hospitals and community-based healthcare centres to improve wound healing rates.

Digital wound care management platforms and AI-assisted wound assessment tools can help with the early detection and treatment of chronic wounds. Additionally, the increasing government expenditure on various advanced wound care therapies specifically biological wound dressings and growth factor-based therapies is also promoting the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Horizon Europe Program in the EU (4.2 billion available for chronic disease initiatives) is stimulating innovation in advanced wound debridement technics such as enzymatic, bio surgical and autolytic debridement method.

The major European markets are made up of Germany, France and Italy driven by wound care centres for specialist treatment, with innovations in advanced wound care solutions such as bioengineered skin substitutes and growth factor therapy. The use of antimicrobial dressings combined with smart wound monitoring technology is helping to drive infection control and real-time wound assessment, unlike older approaches to infection management that required significant nurse time involvement per patient.

In addition, the increasing patient population in home healthcare is expected to drive the growth in demand for portable wound debridement products accounting for its better wound cleansing accessibility for elderly patients and patients with limited mobility.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

The global Non-Contact Ultrasonic Wound Debridement System market is poised to grow by USD 139.56 million during 2025 to 2035, progressing at a CAGR of 11.9% during the forecast period. In fact, Japan with one of the highest aging populations globally - 28% of citizens aged 65+ is seeing a rise of chronic wounds, pressure ulcers and DFU’s. As a sign of this commitment, the Japanese government has allocated 1.3 billion for advanced wound care research, thereby facilitating further development of enzymatic and bioengineered wound debridement.

AI can enable chronic wounds to be more readily recognized, which will lead to earlier diagnosis, faster treatment, better disease management and improved patients outcomes (complication/hospitalisation) and already, there are AI wound assessments tools being developed to help achieve that. Additionally, Japanese companies specializing in medical devices such as Nitto Denko, Terumo also are making up for next gen hydrocolloid and antimicrobial dressings that will help them take control of the infection and help faster healing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

The South Korea’s Ministry of Health and Welfare allocated 1.2 billion to the wound care and chronic disease related area, which leads to the rapid development and usage of new wound debridement products. Use of enzymatic debridement gels and collagen-based wound dressings increase and there by leads to increase in the chronic wound cleaning & Healing rates. AI-powered digital wound tracking systems are increasingly deployed alongside telemedicine platforms to aid real-time wound monitoring and personalized treatment approaches.

Moreover, South Korea's second stronghold in biotech and medical research is driving bioactive debridement agents and nanotechnology-enriched wound dressing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Hydrosurgical debridement devices and low-frequency ultrasound devices used as wound debridement products contribute a significant share to the market, driven by the rising preference of hospitals, trauma centers, and wound care clinics toward minimal invasive and precision-oriented wound cleansing and preparation techniques, which are anticipated to enhance healing, lower the chances of infections, and prepare the wound bed.

These devices are helpful for the management of chronic ulcers, surgical wounds, traumatic injuries, and burn cases, promoting quicker recovery, better patient outcomes, and lower lengths of hospital stays.

Hydrosurgical debridement devices have become a desired method of choice for minimally invasive with directed wound lavage, allowing effective targeting of devitalized tissue, biofilm and bacterial load with superior preservation of healthy tissue. In contrast to traditional mechanical debridement techniques, hydrosurgical debridement systems employ pressurized saline streams to effectively excise non-viable tissue for improved bench preparation and healing potential.

The increasing incidence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers is driving demand for hydrosurgical wound debridement solutions, as healthcare practitioners look for minimally invasive procedures over surgical excision to minimize patient discomfort, lower infection rates, and promote tissue regeneration.

The increasing use of hydrosurgical debridement in acute wound management, trauma, and burn treatment has further propelled market expansion, as these devices swiftly remove necrotic tissue with moisture balance and reduced bleeding, providing optimal wound healing conditions and enhanced post-debridement management.

AI-driven RASD systems integrate image recognition and real-time intelligence to deliver precise amounts of saline with application of pressure, fine-tune speed, and pressure during delivery, improving the accuracy of debridement with less variability in outcomes and also assisting to limit damage to healthy tissue surrounding the wound, together enhancing the overall effectiveness of wound care.

Moreover, the growth of hydrosurgical debridement usage worldwide in the military and emergency medicine drives the market: combat medics, first responders, and field surgeons depend upon portable hydrosurgical devices to treat battlefield injury, blast wounds, and complex trauma, providing immediate tissue cleansing and infection management in remote or resource-poor settings.

Nevertheless, the relatively high cost of complex equipment, its limited availability in less developed healthcare systems and the necessity for a specially trained operator have prevented the widespread acceptance of hydrosurgical debridement, despite its benefits in targeted wound cleansing.

Advancing technologies of portable hydrosurgical generator devices, disposable wound irrigation solutions, and artificial intelligence (AI) driven technologies for the assessment of wounds are being developed for improved cost competitiveness, access to care and clinical uptake, which will result in ongoing expansion to the hydrosurgical debridement market.

Low-frequency ultrasound debridement devices have been well adopted in the market, especially of chronic and non-healing wounds, infected ulcers, and severe burns, as a gentle, non-invasive method for wound cleansing that leads to the rapid formation of granulation tissue and promotion of epithelialization. Limited to high-frequency sound waves, traditional debridement techniques generally do not use necrotic tissue breakdown offered by the ultrasound-assisted debridement technology which leads to a subsequent biofilm disruption and formation of microcirculation that provide better conditions for wound healing.

The growing prevalence of diabetes and related ailments, such as diabetic foot ulcers and other complications, have fueled the demand for low-frequency ultrasound wound debridement, in which selective tissue removal can reduce a wound's bacterial load and decrease discomfort associated with the procedure in patients with neuropathic wounds. Studies show that low-frequency ultrasound increases fibroblast activity, vascular permeability, and growth factors, leading to improved overall wound healing rates.

OUF-based debridement in burn care and surgical wound management for the removal of slough, fibrin deposits and coagulated blood while limiting any tissue trauma thus improving pain management and reducing the risk of hypertrophic scarring has also contributed to the market expansion As a result, the market is growing further as burn treatment require skilful burn injury management which augments the adoption of OUF systems to remove the slough by stimulating the detached epidermal layer.

Advancements such as AI-driven ultrasound wound assessment, automated intensity modulation, and real-time feedback controls have enhanced precision, individualized treatment adjustments, and patient safety measures that maintain consistent debridement results and reduce risks of overtreatment or hypo-debridement.

Portable and point-of-care ultrasound debridement systems have increased the accessibility of market that has allowed the wound care specialists, home healthcare providers, and ambulatory surgical centers to provide advanced debridement therapies beyond hospital settings thereby reducing the burden of travelling and increasing accessibility of the product.

Interestingly, despite its advantages in non-invasive wound management, low-frequency ultrasound debridement is facing adverse aspects such as longer treatment times, variable effectiveness for deep necrotic wounds, and lack of insurance coverage in certain parts of the world. Nevertheless, advances in AI-based ultrasound wound therapy, nanobubble-assisted ultrasound debridement, inexpensive handheld ultrasound devices, increased treatment efficacy, affordability, and clinical acceptance will drive a sustained market growth for low-frequency ultrasound wound debridement solution.

The chronic ulcers and surgical wounds segments are the major market determinants, as healthcare professionals, wound care specialists, and surgeons continue incorporating advanced debridement technologies in standard protocols for wound management to enhance healing, decrease infection risks, and achieve positive long-term outcomes.

The most difficult aspect of managing chronic ulcers remains driving high demand for wound debridement products that enhance tissue viability, prevent the colonization of bacteria and promote the process of re-epithelialization. Unlike acute wounds, chronic ulcers need repeated and continuous wound bed preparation, biofilm removal, and necrotic tissue elimination to support healing-where automated, non-invasive debridement strategies have turned vital for contemporary wound management.

The growing incidence of diabetes and venous insufficiency-related diseases worldwide has caused the increased occurrence of chronic ulcers such as diabetic foot ulcer (DFU), pressure ulcer (PU) and venous leg ulcer (VLU), which has led to the need for new wound debridement methods to lower the amputation rate and achieve better limb salvage rate.

Research has shown that treatments such as hydrosurgical debridement and low-frequency ultrasound are effective in promoting chronic wound healing, activating the production of new blood vessels as well as avoiding secondary infections, providing patients with a secure and effective way to recover.

The merging of AI-fueled wound assessment, intelligent dressing technologies, and predictive analytics for ulcer progression has enabled personalized treatment planning that allows wound care professionals to determine the most-performing debridement methods by integrating real-time wound data, infection risk, and healing potentials.

Moreover, the availability of home-based wound debridement solutions has also driven the market, and telemedicine platforms and remote patient monitoring allow healthcare providers to monitor wound debridement performed by trained caregivers, minimizing hospital visits and providing wound debridement to patients with limited mobility.

Although chronic ulcer wound debridement is of high clinical importance, it faces the challenges of high treatment costs, limitation surgeon’s reimbursement and wound care regimen adherence infiltratory regimen. But increasing innovations in biocompatible debridement agents, steps toward AI-assisted ulcer risk profiling, and bioengineered wound-healing scaffolds will eventually improve cost-effectiveness, accessibility, and patient outcomes, all of which will ensure that chronic ulcer debridement solutions continue to capture market share.

Postoperative wounds are a significant therapy area for wound debridement technologies, with the need to tackle delayed wound healing, surgical infections and increased scarring via targeted soft tissue management contributing to the growth of the overall wound debridement products market. Surgical incisions, in contrast to smaller wounds, necessitate careful wound bed preparation, infection management, and tissue preservation to avert dehiscence, keloid formation, and deep tissue necrosis, thus reinforcing the importance of advanced debridement technologies in post-surgical recovery.

This is due to the increasing number of orthopedic, plastic, and reconstructive surgeries, which creates the need for better post-operative wound hygiene, less bacterial colonization, and better tissue regeneration with hydrosurgical and ultrasound-based debridement systems.

AI (Artificial Intelligence), such as drive healing assessments processed in real time to doctor- daily digital wound application tracking and automation of post-operative wound debridement protocols have improved surgeon decision making, customisation of treatment endpoint and recovery parameters to ensure patient satisfaction and reduction in complications in the long run.

Wound debridement for surgical wounds plays a critical role in surgical care, but faces challenges related to cost, variability in wound healing rates, and limited standardization of debridement techniques. Nonetheless, innovative advances in smart wound dressings, bioengineered tissue grafts, and AI-enabled suture-integrated debridement systems are promoting the accessibility, efficiency, and postoperative recovery timeframe of treatment, facilitating further market development for surgical wound debridement solution.

Growth of the wound debridement products market is stimulated by rise in chronic wound, diabetic ulcer, pressure sore, and surgical site infection prevalence. Some of the major players in the global advanced wound care market include Ethicon, Smith & Nephew Plc and 3M. The commercial landscape comprises both the foremost global players and niche manufacturers specializing in wound care, all of whom have driven technological innovations surrounding mechanical, autolytic, enzymatic, and surgical wound debridement techniques.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smith & Nephew plc | 15-20% |

| Molnlycke Health Care AB | 12-16% |

| ConvaTec Group plc | 10-14% |

| Coloplast A/S | 8-12% |

| Medline Industries, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smith & Nephew plc | Develops Santyl® enzymatic debridement ointments, mechanical debridement pads, and active wound therapy solutions. |

| Molnlycke Health Care AB | Specializes in Mepilex® foam dressings, hydrogels, and antimicrobial wound debridement solutions. |

| ConvaTec Group plc | Manufactures AQUACEL® Ag+ Extra antimicrobial dressings and enzymatic wound debridement therapies for chronic wound care. |

| Coloplast A/S | Provides Biatain® and Comfeel® dressings, optimizing autolytic debridement and advanced wound healing. |

| Medline Industries, Inc. | Offers mechanical debridement wipes, collagenase-based enzymatic debridement, and bioengineered wound therapy solutions. |

Key Company Insights

Smith & Nephew plc (15-20%)

Smith & Nephew is a leading player in the wound debridement market, with, at the operational end, enzymatic debridement ointments (Santyl®), and mechanical wound cleansers, negative pressure wound therapy systems that accelerate healing and help to prevent infections.

Molnlycke Health Care AB (12-16%)

Molnlycke focuses on hydrogel and foam debridement dressings that utilize the Mepilex® antimicrobial technology to promote autolytic wound healing.

ConvaTec Group plc (10-14%)

AQUACEL® Ag+ Extra, as well as dressings impregnated with silver, such as silver ions for biofilm and other permeable and/or dissolvable dressing matrices. ConvaTec specializes in designing enzymatic and biofilm-disruptive wound care treatments for diabetic ulcers and chronic wounds.

Coloplast A/S (8-12%)

Headquartered in Denmark, Coloplast manufactures Biatain® silicone dressings and autolytic debridement devices which can promote moist wound healing, an important goal with wound management to ensure better patient outcomes.

Medline Industries, Inc. (5-9%)

Medline manufactures a complete line of mechanical debridement wipes, enzymatic cleansers, and hydrogel debridement treatments including algae-based, plant-based, and hydro/glycol based, allowing you to prepare the wound bed for optimal tissue regrowth in less time.

Other key players (Combined 40%-50%)

Multiple companies in the space are involved with next-gen wound debridement solutions, biologic wound healing, and AI platforms for wound assessment. These include:

Offering unprecedented Wound Debridement Products Market size was USD 5.0 Billion in 2025.

The Wound Debridement Products Markets USD 9.7 Billion by 2035.

Rising geriatric and diabetic population, chronic wounds prevalence, breakthrough in wound care technologies, and awareness towards effective wound management is driving the need of faster healing products are up surging the demand for wound debridement products in the coming years.

USA, UK, Europe Union, Japan and South Korea are top 5 countries which Black-colored the growth of Wound Debridement Products Market.

Hydrosurgical Debridement Devices and Low-Frequency Ultrasound Devices Drive Market to command significant share over the assessment period.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.