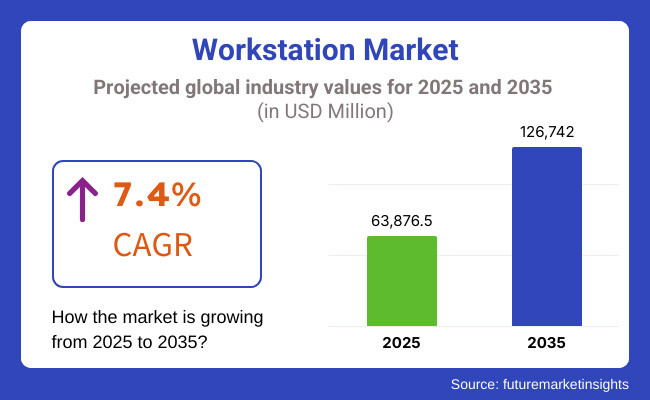

The global Workstation market is projected to grow significantly, from USD 63,876.5 million in 2025 to USD 126,742.0 million by 2035 an it is reflecting a strong CAGR of 7.4%.

As more businesses utilize more vendors and partners for their workstation solutions, vendor management is a major force at work.

From heavy convergence between product developers for best efficiency between products to forming at-scale singer-sign-on partnerships for cloud usage, enterprises look ahead at the aspiration of industry-specific high-performance computing for first up-take through third-party providers. This trend fuels the demand for tailored workstation solutions in various industries.

The increasing demand for high-performance computing solutions across BFSI, healthcare, and IT sectors is driving the growth of the market. Many businesses need high-end workstation configurations with high core count CPUs and high bandwidth GPUs that can handle compute-heavy workloads for AI, data analytics, 3D modeling, etc.

The growing trend of working from home and digital transformation is fueling the adoption of cloud-based workstation solutions. Such solutions come with scalability, remote accessibility, and cost efficiency that empower enterprises to optimize their IT infrastructure without compromising on performance.

They are usually faced with serious security issues since making a mistake may result in heavy losses. With cyber threats and the risk of data breaches on the rise, companies demand workstations that are equipped with strong security features to protect sensitive information and stay compliant.

North America is the leading region in the market due to advancements in technology, high enterprise IT demand, and increasing adoption of AI/ML workloads. China and developing nations in growth corridors, such as India and Australia, are enjoying rapid growth as enterprises continue to invest in digital transformation and HPC solutions to drive their expanding operations.

Explore FMI!

Book a free demo

| Company | Dell Technologies |

|---|---|

| Contract/Development Details | Awarded a contract by a global engineering firm to supply high-performance workstations equipped with advanced graphics capabilities, supporting complex design and simulation tasks in various engineering projects. |

| Date | April 2024 |

| Contract Value (USD Million) | Approximately USD 30 |

| Renewal Period | 3 years |

| Company | HP Inc. |

|---|---|

| Contract/Development Details | Partnered with a leading animation studio to provide customized workstations optimized for rendering and visual effects production, enhancing creative workflows and reducing project turnaround times through improved processing power and reliability. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 25 |

| Renewal Period | 4 years |

Increasing adoption of 3D modeling, digital content creation, and advanced data processing

3D modeling, digital content creation, and advanced data processing have all had an explosive impact on the workstation market. 3D modeling is utilized in multiple industries, including entertainment, architecture, and healthcare, for 3D animation, design visualization, and medical imaging respectively. This transition requires computing workstations that can perform intensive computation and rendering efficiently.

For example, the National Institutes of Health hosted a "Science in 3D" festival to encourage the use of 3D technology in bioscience, which draws attention to the expanding relevance of 3D modeling in research and development.

Likewise, the area of digital content creation has transcended into almost every marketing, education, and entertainment area, necessitating demand for a workstation that can handle complex software applications. Big data analytics and machine learning need power computation and thus push for higher end workstations.

Rising cybersecurity concerns driving demand for secure workstations

The rise in cyber threats is pushing organizations to focus on protecting their digital assets, which is why the demand for secure workstations is rising.

Act (HIPAA)Regular Operation - National StandardsIt helps keep electronic health information safe and secure Electronic health information Privacy and Security of Health InformationAct (HIPAA) Health Insurance Portability and Accountability Act (HIPAA) Regular Operation - National Standards Security Computing Environment to Outreach New Computing Environment.

Public companies are also subject to new rules adopted by the USA Securities and Exchange Commission on enhanced and standardized disclosures by public companies on cybersecurity risk management, strategy, governance, and incidents.

Some industries will find themselves with few compliance requirements, thus leading organizations not to invest in workstations with superior security functionality; however, legislation factors that seek to safeguard sensitive data compel such organizations to be compliant.

This leads to an increasing number of launches in the workstation market that have advanced security protocols, encryption abilities, and secure access control, driven by the growth in the occurrence of cybersecurity threats in every industry.

Growth in compact and mobile workstations for enhanced flexibility

The increasing popularity of compact and mobile workstations is due to the new move and flexibly evolving workforce. Individuals specializing in design, engineering, content creation, etc., need portable but robust computers to get work done from different places.

Manufacturers have responded by creating lightweight workstations that offer uncompromised performance. With mobile devices equipped with powerful processors, sophisticated graphics capabilities, and long-lasting battery life, professionals can remain productive away from the office. Bass Parsons is a leading authority on mobile workstations, which have become increasingly popular in recent years with the rise of remote work and decentralized teams.

Growing Preference for Lightweight, Portable Devices Challenges Traditional Workstation Demand

The evolution towards lighter, more portable devices is changing workstations and becoming a competitor to the desktop and tower class workstations. In fact, now professionals across industries, such as engineering, media, and world-class software development, expect computing solutions that are mobile and perform well.

Powerful processors and top-tier GPUs in laptops, ultrabooks, and mobile workstations are replacing traditional bulky workstations. This change is mainly attributed to the changing landscape of work settings with the rise of remote work and hybrid office arrangements. Employees and freelancers need to work from several locations with mthe ost efficient computing solution.

To compound this, hardware technology has also made it possible for small devices to provide computing capabilities that were once limited to expensive desktop workstations. Longer battery life, enhanced thermal needs, and better processing potentials in portable devices have made them a credible alternative.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Remote work policies and compliance requirements increased demand for secure workstations. |

| Hardware Performance | Workstations adopted high-performance GPUs for AI and simulation tasks. |

| Hybrid Work Environment | Enterprises deployed high-performance remote workstations to accommodate hybrid work. |

| Energy Efficiency & Sustainability | Energy-efficient workstation components reduced power consumption. |

| Market Growth Drivers | Increased demand from AI, engineering, and content creation sectors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven endpoint security compliance becomes mandatory for all enterprise workstations. |

| Hardware Performance | Quantum computing integration accelerates workstation capabilities beyond traditional processors. |

| Hybrid Work Environment | AI-powered virtual desktops dynamically allocate resources based on user behavior. |

| Energy Efficiency & Sustainability | Carbon-neutral workstation designs use AI-driven energy optimization techniques. |

| Market Growth Drivers | Widespread adoption of immersive AR/VR workspaces drives future workstation innovations. |

The global workstation market is segmented into three vendor tiers based on market presence, product portfolio, and reach to customers. Leading vendors in the space with product offerings and global reach are obvious tier 1, such as Dell Technologies, HP Inc., and Lenovo. These companies build high-performance workstations forthe engineering, media, and healthcare industries.

With significant investments in research and development, brand reputation, and enterprise-level offering, they cater to large business needs through their scale and custom internal solutions, thus reigning as the market leader.

Tier 2 vendors have a competitive edge with specialization in regions or industries. While generic x86 and related brands dominate general-purpose markets, niche players like Fujitsu, Apple, and Acer turn out one box at a time to service specific markets - be it creative professionals, high-end industrial applications, or enterprise needs in a particular region.

Apple’s Mac Pro: a staple of media and design, and Fujitsu has focused on CELSIUS workstations in European and Asian markets. Such vendors rely on distinctive capabilities, hardware coupling, and long-standing regional expertise to sustain a steady stream of customers without directly competing with Tier 1 vendors.

Tier 3 vendors consist of newer and niche-targeted companies like BOXX Technologies, MSI, and Origin PC, providing more specialized and tailored workstations. These vendors are drawing customers with unique configurations, high-end graphics capabilities, and customized solutions for various industries - including gaming, animation, and high-performance computing.

Their smaller market reach does not stop them from competing effectively in the sectors most customized for and innovative while bringing diversity and a competitive edge to the workstation market, with great potential for innovation and determination.

The section highlights the CAGRs of countries experiencing growth in the Workstation market, along with the latest advancements contributing to overall market development. Based on current estimates, China, India, and the USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 12.7% |

| China | 11.3% |

| Germany | 7.2% |

| Japan | 8.5% |

| United States | 9.4% |

In China’s manufacturing and engineering sectors, AI-driven workstations are the secret sauce for increased productivity and innovation. They are also excellent at performing a variety of resource-hungry tasks, from complex simulations to real-time analytics and automated design processes, which make them ideal for industries such as automotive, aerospace, and industrial machinery.

And it continues to spread the same philosophy via "Made in China 2025" plans focusing on high-tech manufacturing and smart factories. Over the past few years, initiatives for enterprises to update their hardware infrastructure further promoted the increase in the number of AI-compatible workstations.

In November, an AI-driven workstation system from Sinai Group was integrated with a state-owned manufacturing center for government-funded industrial undertakings, accelerating production lines by an average of 30%.

In addition, companies are replacing their workstations with those equipped with deep-learning capabilities to decrease machine downtimes, owing to the growing penetration of AI-based predictive maintenance. China is anticipated to see substantial growth at a CAGR of 11.3% from 2025 to 2035 in the Workstation market.

Advanced computing for research, diagnostics, and skill development is becoming more and more commonplace in the education and healthcare industries making way for a new era of PC adoption and influencingthe growth of the Workstation segment.

Universities and technical institutions are putting high-performance workstations to use, offering AI, data science, and engineering simulations, leading to better learning results with and at scale and moving into the cloud. At the same time, hospitals and medical research institutions in India are incorporating workstations for medical imaging, genomic sequencing, and AI-assisted diagnostics.

India, for example, and the Indian government have already launched many initiatives to increase digital infrastructure in education and healthcare, thereby boosting the demand for computing power to higher levels.

This week, the government launched a nationwide plan to supply medical facilities with state-of-the-art AI diagnostic tools, resulting in a 40% increase in demand for healthcare workstations. India's Workstation market is growing at a CAGR of 12.7% during the forecast period.

The transition to remote and hybrid work models in the United States has boosted demand for mobile and compact workstations. More businesses are empowering their workforce with portable, lightweight but strong machines capable of running professional applications, ranging from video editing and CAD modeling to financial analytics.

The US government is among those that have encouraged flexible work environments, with federal agencies adopting policies to facilitate remote work. As a result, we are witnessing an increase in the demand for mobile workstations that can match the processing capabilities of conventional desktops yet are portable.

According to a recent government report, 25% of federal agencies are now investing in secure, high-performance mobile workstations to enable remote operations. Moreover, cybersecurity is a major concern, so businesses are choosing mobile workstations that encompass built-in security features like biometric authentication and AI-powered threat detection.

Demand for compact yet powerful computing solutions has been even more accelerated by the rise of gig economy professionals and freelance digital creators. The USA. is anticipated to see substantial growth in the Workstation market, significantly holding a dominant share of 78.5% in 2025.

The section contains information about the leading segments in the industry. By type, the mobile workstation segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by core, the 6 cores segment holds a dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| Mobile Workstation | 10.0% |

Mobile Workstation segment is expected to grow at a CAGR of 10.0% from the period 2025 to 2035. The increasing adoption of remote and hybrid work models has played an important role in boosting demand for mobile workstations.

Professionals in fields (like digital content creation, engineering, and financial analytics) want power-enabled but portable devices to work from different places without losing computing power. Mobile workstations have powerful processing, dedicated GPUs, and security features similar to desktops, addressing mobile flexibility for professionals.

Moreover, companies are rapidly empowering their employees with mobile workstations to boost productivity while providing secure access to corporate networks.

Governments are also coming to realize they need flexible computing solutions. In the breadth of the problem, this new federal government effort led to increased investment by 35% in mobile workstations for remote employees working in industries such as public administration and defense.

| Core | Value Share (2025) |

|---|---|

| 6 Cores | 29.1% |

The Banks & Financial Institution segment is poised to capture share 29.1% in 2025. Among various workstations, 6-core chips are the best value overall thanks to their power, performance, and price point. These processors are used across various industries where specific workloads can benefit from high frequency and fewer cores, such as digital design, software development, and financial modeling.

A solution that is capable of handling multiple tasks, data processing and medium-intensity workloads seamlessly is why 6-core workstations became the ultimate choice for both SMEs and enterprise experts.

Government-sponsored digital infrastructure initiatives are further driving the demand. A use case in education technology found a 40% increase in the adoption of 6-core workstations across educational institutions focused on training people in AI and data science, reaffirming the importance of such machines in human skill development.

The workstation ecosystem is extremely competitive, with advances in processing power, A.I. integration, and evolving user demand. Companies are focusing on the performance and energy efficiency delivered by their products, and on security capabilities.

Mobile and cloud-based workstations are on the rise, and the competition among vendors who must innovate is increasing. Pricing, customization, and after-sales support - to name a few - are some of the major drivers that determine buyer preferences in this space.

Recent Industry Developments in the Workstation Market

The Global Workstation industry is projected to witness CAGR of 7.4% between 2025 and 2035.

The Global Workstation industry stood at USD 63,876.5 million in 2025.

The Global Workstation industry is anticipated to reach USD 126,742.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.4% in the assessment period.

The key players operating in the Global Workstation Industry Dell Technologies, HP Inc., Lenovo Group Ltd., Apple Inc., Fujitsu Ltd., Microsoft Corporation, Acer Inc., ASUS, MSI (Micro-Star International), Intel Corporation.

In terms of type, the segment is divided into Rack Workstation, Desktop Workstation, Mobile Workstation and Tower Workstation.

In terms of core, the segment is segregated into 6 Cores, 8 Cores, 12 Cores, 18 Cores, 28 Cores, 32 Cores, 56 Cores and Other.

The industry is classified by segment as Healthcare, Education, BFSI, Manufacturing, Media and Entertainment, Engineering & Design and Other Industry.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.