The global woodworking CNC tools market is expanding steadily, driven by increasing automation in the furniture and construction industries. With a projected CAGR of 5.0%, the market is expected to reach USD13.3 billion by 2035, fueled by demand for precision machining and high-speed cutting solutions.

The growing adoption of CNC routers, milling cutters, and drill bits in wood processing is shaping market dynamics, especially in mass production environments.

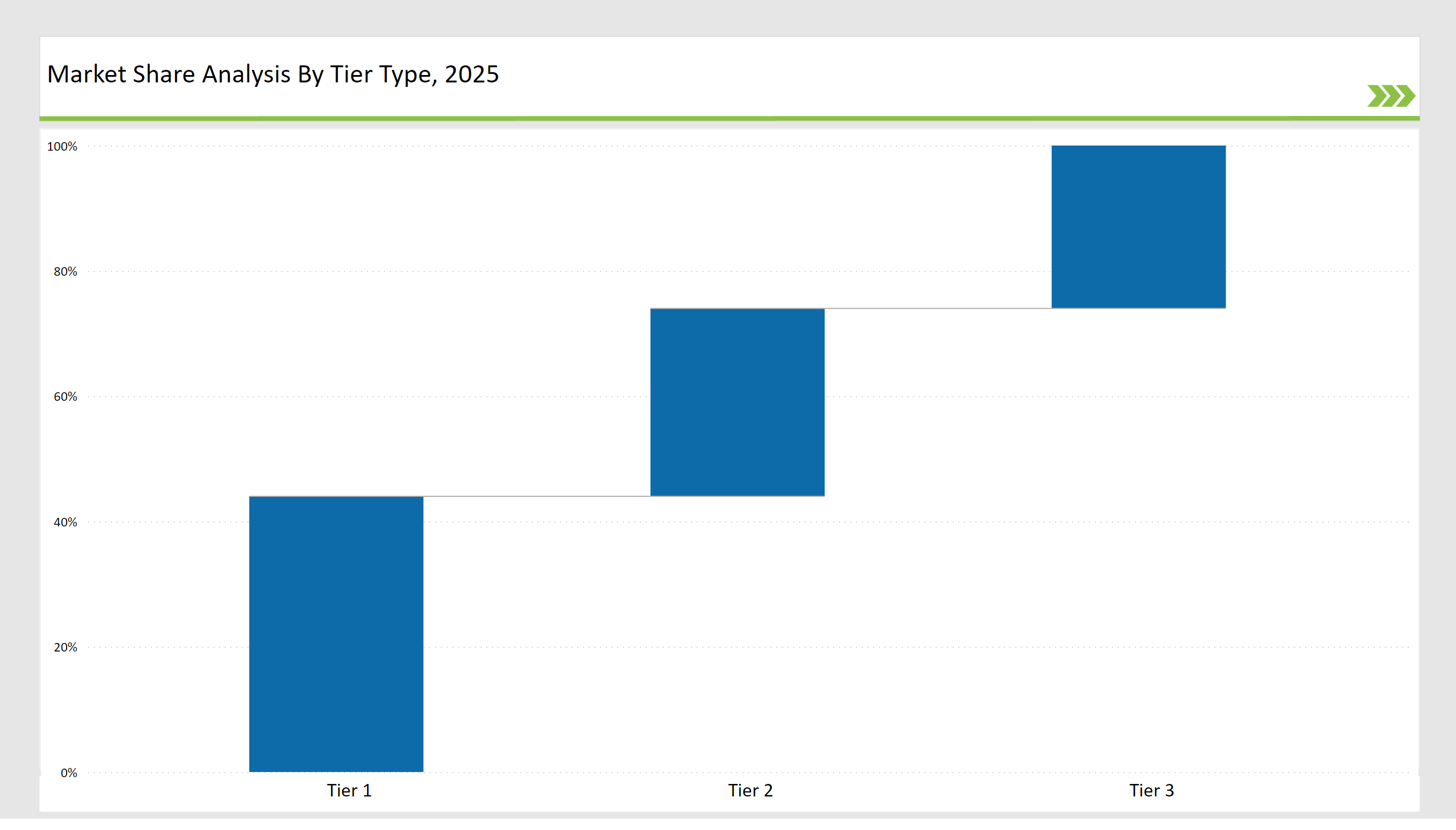

The market structure exhibits a medium level of consolidation, with Tier 1 players such as Vortex Tool Company, Amana Tool, and GDP Industrial Tooling collectively holding 45% of the global market share. These companies maintain dominance through extensive product portfolios, strong distribution networks, and continuous investment in carbide and diamond-coated tools.

Router bits account for 40% of the market share, given their versatility in cabinetry, furniture making, and architectural woodwork. The furniture industry represents the largest end-use sector, commanding 30% of the market, driven by increasing demand for customized and modular furniture.

Competitive strategies emphasize technological innovation and efficiency, with Tier 1 players focusing on advanced coatings, tool longevity, and high-speed cutting capabilities. Meanwhile, Tier 2 players such as Sistemi Klein and Yash Tooling System secure 25% of the market share by offering specialized CNC tools tailored for niche applications and small-scale manufacturers.

Regional manufacturers collectively hold 30% of the market share, leveraging cost-effective solutions and local market expertise. As advancements in CNC automation and tool optimization continue, the market is expected to witness further technological progress and strategic partnerships, reinforcing its steady growth trajectory.

| Attributes | Details |

|---|---|

| Estimated Value (2035) | USD 13.3 Billion |

| Value-based CAGR (2025 to 2035) | 5.0% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players | 38% |

| Next 2 of 5 Players | 32% |

| Rest of the Top 10 | 30% |

The market is semi fragmented, with top players influencing pricing strategies, technological advancements, and key partnerships with industrial sectors. Regional and niche players sustain themselves by offering affordable and application-specific products to localized markets.

The Top 3 players (Amana Tool, Freud Tools, Vortex Tool Company Inc.) dominate due to their high-performance tool manufacturing, extensive distribution networks, and strong industry presence. Tier 2 players (Dimar Tools, CMT Orange Tools) focus on specialized CNC tool manufacturing for niche woodworking applications. Regional manufacturers cater to cost-sensitive markets, offering customized and affordable CNC tools.

Ridgid

Ridgid has strengthened its position in the woodworking CNC tools market by expanding its product range of high-performance router bits and cutting tools, catering to both professional and industrial applications. The company’s focus on durability and precision has made its tools a preferred choice for large-scale manufacturing and fine woodworking projects.

Recognizing the rising demand for automated woodworking solutions, Ridgid has introduced CNC-compatible cutting tools designed for seamless integration with modern CNC systems. Additionally, the company has enhanced its distribution network in North America and Europe, ensuring faster delivery and improved customer support.

With a growing emphasis on efficiency and reduced waste, Ridgid's tools are optimized for longer lifespan and minimal material wastage, making them a cost-effective choice for woodworking businesses.

DeWalt

DeWalt continues to dominate the woodworking CNC tools market by investing in next-generation carbide-tipped cutting tools and automated precision milling solutions. The company has leveraged its expertise in power tools and accessories to develop high-speed cutting heads and router bits, ensuring superior performance in high-volume production environments.

With a strong focus on innovation, DeWalt has integrated smart tool technology, allowing users to track tool performance and lifespan via IoT-enabled monitoring systems. This has increased adoption among furniture manufacturers and carpentry businesses seeking greater predictability and efficiency in their CNC operations.

Furthermore, DeWalt has expanded its presence in Asia-Pacific markets, capitalizing on the growing demand for automated woodworking solutions in developing economies.

Rockler Companies, Inc.

Rockler Companies, Inc. has reinforced its specialty woodworking tool segment by expanding its customized CNC tool offerings for hobbyists and small-scale businesses. Recognizing the increasing popularity of DIY woodworking and small-scale CNC machining, Rockler has developed affordable, high-precision cutting tools, making CNC technology more accessible to a broader market.

The company has also focused on expanding its retail and online distribution, ensuring easy access to its product range. To enhance customer experience, Rockler has launched educational workshops and online tutorials, helping craftsmen and small business owners optimize CNC usage.

By blending affordability, education, and quality craftsmanship, Rockler continues to be a preferred brand for woodworking enthusiasts and small-scale CNC operators.

Robert Bosch

Robert Bosch has cemented its position as a technology-driven leader in woodworking CNC tools by focusing on precision engineering and automation. The company’s advanced solid carbide and diamond-coated cutting tools are designed for high-speed, high-accuracy machining, making them ideal for mass production in furniture and cabinetry manufacturing.

Bosch’s strategic investments in AI-integrated CNC tool optimization have enabled woodworking professionals to reduce tool wear, improve cutting efficiency, and enhance surface finishes. The company has also expanded its global partnerships with industrial CNC machine manufacturers, ensuring seamless compatibility between Bosch tools and leading CNC systems.

Additionally, Bosch’s sustainability initiatives focus on producing energy-efficient, long-lasting cutting tools, aligning with industry trends toward eco-friendly manufacturing processes.

Kreg Tool Company

Kreg Tool Company has emerged as a market leader in precision joinery and drilling solutions tailored for CNC woodworking applications. With an emphasis on ease of use and accuracy, Kreg has introduced innovative pocket hole jigs and precision router systems optimized for CNC users.

The company has focused on enhancing tool adaptability, ensuring its products integrate seamlessly with both entry-level and industrial CNC machines. To cater to the rising demand for custom furniture and cabinetry, Kreg has expanded its range of adjustable cutting and drilling solutions, making it easier for woodworkers to achieve professional-grade finishes.

Additionally, Kreg has strengthened its e-commerce and direct-to-consumer sales channels, allowing woodworking professionals and hobbyists greater accessibility to its premium CNC tool offerings.

With these strategic advancements, these leading players continue to shape the Woodworking CNC Tools Market, driving innovation, efficiency, and automation across the industry.

| Tier | Examples |

|---|---|

| Tier 1 | Amana Tool, Freud Tools, Vortex Tool Company Inc |

| Tier 2 | Dimar Tools, CMT Orange Tools |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| Amana Tool | Developed nano-coated router bits for extended tool life and heat resistance. |

| Freud Tools | Introduced high-speed milling CNC tools optimized for hardwood and engineered panels. |

| Vortex Tool Company Inc. | Launched carbide insert knives with self-sharpening technology for improved cutting efficiency. |

| CMT Orange Tools | Expanded engraving tool offerings to support luxury and artistic woodworking applications. |

| Dimar Tools | Focused on advanced profiling and grooving cutters for architectural wood designs. |

Recommendations for Suppliers

The woodworking CNC tools market will continue evolving, driven by automation, smart technologies, and sustainable innovations. Key future developments include

Leading companies in the woodworking CNC tools market include Ridgid, DeWalt, Rockler Companies, Inc., Robert Bosch, and Kreg Tool Company. These companies dominate the market due to their strong brand reputation, innovation in CNC tool design, and extensive distribution networks across various regions.

The primary product types include CNC router bits, end mills, saw blades, drill bits, and engraving tools. These tools are essential for precision cutting, shaping, and detailing in woodworking applications, offering improved efficiency and accuracy.

The furniture manufacturing, cabinetry, and architectural millwork industries are major drivers of demand for woodworking CNC tools. The increasing adoption of automated CNC solutions in small and large-scale woodworking businesses further contributes to market growth.

The market is expected to grow steadily, fueled by increasing demand for precision woodworking, rising automation in manufacturing, and the growing preference for custom-made furniture. Innovations in tool coatings and materials also enhance durability and cutting efficiency, driving adoption.

Technological advancements, such as high-speed machining, automated tool-changing systems, and AI-integrated CNC software, are improving the precision, efficiency, and lifespan of CNC tools. The adoption of carbide and diamond-coated tools is also enhancing cutting performance and reducing tool wear.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.