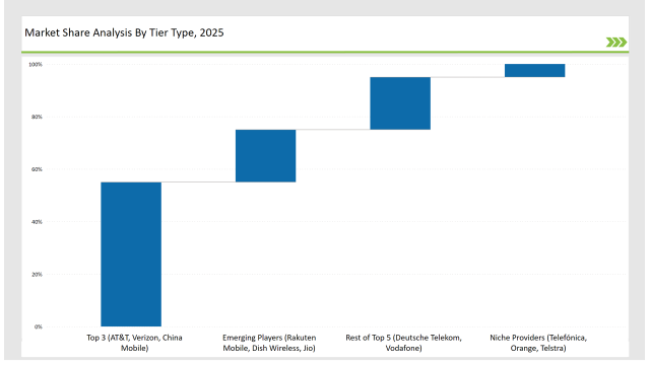

The 5G rollout, IoT adoption and cloud-based network solutions are radically transforming the wireless telecommunication services space. The global market is dominated by a handful of leading vendors are AT&T, Verizon, and China Mobile, which have captured 55% through their large networks, extensive spectrum holdings, and bundled service offerings. With a strong domestic and global presence; they capture 20% of the market, with Deutsche Telekom and Vodafone.

Top-tier small cell service providers (50%), followed by emerging players - Rakuten Mobile, Dish Wireless, Jio (20%) which emphasize cloud-native, affordable mobile data plans and 5G SA technology. Regional and enterprise-specific Niche providers, such as Telefónica, Orange and Telstra, hold onto 5% of the market. A rise in demand for high-speed connectivity and smart network solutions will drive the wireless telecom industry.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (AT&T, Verizon, China Mobile) | 55% |

| Rest of Top 5 (Deutsche Telekom, Vodafone) | 20% |

| Emerging Players (Rakuten Mobile, Dish Wireless, Jio) | 20% |

| Niche Providers (Telefónica, Orange, Telstra) | 5% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

The 5G Network Services segment dominating with 40% market share propelled due to the the expansion of nationwide 5G rollouts and private network solutions. The major giants such as AT&T, Verizon and China Mobile are propelling in this area help for offering high-speed, low-latency connectivity to consumers and enterprises. IoT and M2M Connectivity cater around 30% of the market due to the vendors such as Vodafone, Deutsche Telekom, and Jio, focusing on smart cities, autonomous transport, and industrial automation.

Cloud-Based Network Management makes up 20%, with Rakuten Mobile and Dish Wireless leading in virtualized RAN (vRAN) and Open RAN solutions, enhancing network flexibility and efficiency. The Satellite-Based Wireless Services segment, contributing 10%, is growing with SpaceX's Starlink, Amazon's Kuiper, and OneWeb providing coverage in remote and underserved areas.

The consumer mobile segment is huge: accounting for 50% of the market as 5G adoption continues at a healthy pace. The growth is fuelled by demand for high-speed mobile data and unlimited plans and next-gen smartphone connectivity. Holding a 30% share, the enterprise and industrial vertical is witnessing a growth on account of the increasing demand for IoT-based services and solutions, private 5G networks and industrial automation technologies.

With this dedicated wireless network in hand, companies can also improve security, efficiency, or even execute real-time operations. Public sector and defense industry hold 20%, where governments globally are investing in secure, high-bandwidth wireless networks for national security, emergency response systems and mission-critical communication.

AT&T

AT&T expanded fiber-backed 5G coverage, improving network reliability and latency. The company launched 5G private networks for enterprises, enhancing business connectivity.

Verizon

Verizon introduced multi-access edge computing (MEC) for 5G applications, allowing businesses to process data closer to the source. The company also strengthened its mmWave 5G services for ultra-fast speeds in urban areas.

China Mobile

China Mobile rolled out 5G Standalone (SA) networks, enabling low-latency, high-reliability connections essential for smart cities and autonomous vehicles.

Deutsche Telekom

Deutsche Telekom integrated Open RAN technology, reducing dependence on traditional network vendors and improving network agility.

Rakuten Mobile

Rakuten Mobile expanded its cloud-native telecom infrastructure, reducing operational costs and pioneering fully virtualized 5G networks.

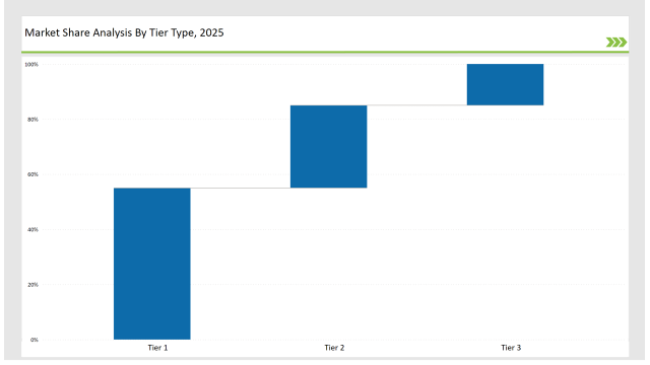

| Tier | Tier 1 |

|---|---|

| Vendors | AT&T, Verizon, China Mobile, Deutsche Telekom, Vodafone |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 3 |

|---|---|

| Vendors | Rakuten Mobile, Dish Wireless, Jio |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 1 |

|---|---|

| Vendors | Telefónica, Orange, Telstra |

| Consolidated Market Share (%) | 15% |

| Vendor | Key Focus |

|---|---|

| AT&T | Nationwide 5G rollout, fiber-backed networks, enterprise private 5G. |

| Verizon | Multi-access edge computing, ultra-fast mmWave 5G. |

| China Mobile | 5G Standalone (SA), smart city infrastructure. |

| Deutsche Telekom | Open RAN adoption, European market expansion. |

| Vodafone | IoT connectivity, cloud-based network services. |

| Rakuten Mobile | Cloud-native 5G, virtualized network deployments. |

| Dish Wireless | Open RAN-based 5G, MVNO expansion. |

| Jio | Affordable 5G plans, AI-driven network automation. |

Wireless telecommunications is a rapidly evolving space, and vendors will need to iterate on existing AI-driven network automation strategies to maximize connected networks as well as augment operational capabilities. Telecom companies will set up partnerships with Cloud providers to improve hybrid network solutions and tap into scalable future-ready cloud-based network functions. The continued growth of fiber infrastructure will be a priority in order to back up high-speed wireless and minimize latency.

Also, satellite-based internet provider investment will allow broadband services to reach the most remote and underserved areas, closing the digital divide. Focus on 6G Research and Development: Telco companies must start investing in building their capacities for the next era in the evolution of the networks. As they embrace innovation, align with changing regulations, and expand their global footprint, wireless telecom vendors will stay competitive and keep pushing toward an ultra-connected, high-speed digital future for the industry.

AT&T, Verizon, and China Mobile collectively hold 55% of the market.

Emerging players such as Rakuten Mobile, Dish Wireless, and Jio hold 20% of the market.

Telefónica, Orange, and Telstra control 5% of the market.

The top five vendors control 75%, reflecting a high market concentration.

The market concentration is categorized as high for the top 10 players controlling the market.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.