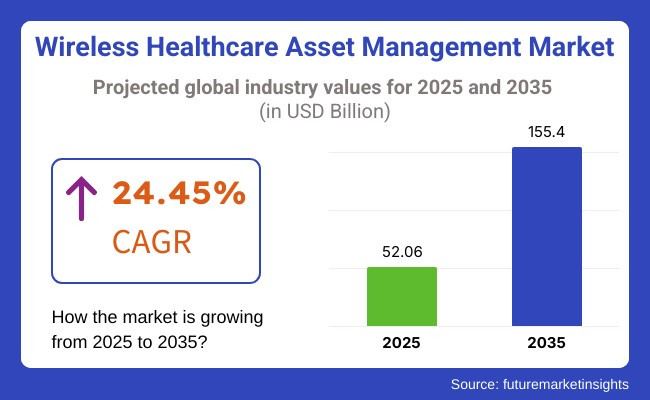

The market will reach USD 52.06 billion in 2025 and expand to USD 155.40 billion by 2035, reflecting a CAGR of 24.45% during the forecast period. Healthcare organizations are increasingly turning to wireless asset management solutions to make operations more effective and safe for patients and minimize the equipment loss. Investment in AI-powered asset tracking, IoT-based real-time location systems (RTLS), and cloud-based inventory will also be key drivers for the market's growth.

Wireless healthcare asset management systems play a critical role in optimizing hospital workflows, regulatory compliance, and decision-making based on the data. The confluence of AI-driven analytics, RFID tracking, and 5G-enabled connectivity will further drive system performance and broaden market applications.

Furthermore, the increasing uptake of predictive maintenance, blockchain inventory security, and automated supply chain management is transforming the healthcare asset management market. With increased focus on real-time monitoring, compliance automation, and cost optimization by hospitals and clinics, sensor-based tracking technology innovation, edge computing, and intelligent healthcare ecosystems will continue to fuel market expansion.

Explore FMI!

Book a free demo

The wireless healthcare asset management market is growing and will continue to grow dramatically due to the escalating need for real-time asset tracking features, enhanced patient safety, and cost-effective inventory management. Hospitals and clinics are ready to improve their operational efficiency by stressing the need for real-time tracking, data security, and seamless IoT integration.

Pharmaceutical companies take a slant on conformity with regulatory standards, visibility of the supply chain, and automation of the logistics process to reduce losses. Medical device manufacturers, on their part, look for mass-producible and economically attractive measures to improve their production and supply chains.

The government and regulatory bodies concentrate on adherence to the law, the security of information, and the simplicity of healthcare operations; in that way, they bring about transparency and efficiency. The market is undergoing a tremendous shift with the implementation of RFID, Bluetooth Low Energy (BLE), and AI-driven analytics for real-time monitoring, predictive maintenance, and automated inventory tracking, which has made wireless asset management one of the critical components in the healthcare structures of the modern era.

| Company | Contract Value (USD Billion) |

|---|---|

| EQT | Approximately 1.0 - 1.2 |

| Yokogawa Electric Corporation | Approximately 200 - 250 |

In February 2025, EQT, a Swedish private equity group, positioned itself to acquire Device Technologies, a medical technology service provider specializing in healthcare robotics and ophthalmology. The auction is expected to exceed USD 1.0 - 1.2 billion, with other interested parties including The Carlyle Group, CV Capital, Bain Capital, and TPG Capital. This acquisition reflects a significant investment in the wireless healthcare asset management sector, aiming to enhance technological capabilities and market presence.

In June 2022, Yokogawa Electric Corporation launched OpreX Asset Health Insights, a cloud-based asset monitoring service designed to enhance operational efficiency in healthcare settings. This service provides real-time data and AI-driven analytics, offering a comprehensive view of asset performance and enabling proactive management of diverse asset types. The estimated contract value for this initiative is USD 200 - 250 million, with a renewal period of 4 - 6 years.

These developments indicate a growing trend toward integrating AI, IoT, and cloud-based solutions in the Wireless Healthcare Asset Management Market. The market is projected to reach USD 52 - 55 billion by 2025, growing at a CAGR of 24.45% to reach USD 150 - 160 billion by 2030. The increasing need for efficient asset tracking, real-time monitoring, and IoT adoption in healthcare settings drives this growth.

Between 2020 and 2024, the wireless healthcare asset management market grew significantly as hospitals and healthcare facilities adopted real-time location systems (RTLS), RFID, and IoT-based solutions to track medical equipment, optimize workflows, and reduce operational costs. The COVID-19 pandemic heightened the demand for contactless asset tracking and automated inventory management to enhance patient care and infection control.

AI-driven predictive analytics improved asset utilization, minimizing equipment shortages and maintenance disruptions. However, challenges such as cybersecurity risks, integration complexities with legacy systems, and high implementation costs limited widespread adoption.

Between 2025 and 2035, the market will see transformative advancements with AI-driven automation, blockchain-secured asset tracking, and 6G-enabled real-time monitoring. AI-powered predictive maintenance will enhance equipment lifespan, while blockchain will ensure secure, tamper-proof asset management.

The expansion of edge computing and IoT will enable decentralized, low-latency data processing for real-time tracking and decision-making. Sustainability will become a key focus, with energy-efficient sensors and eco-friendly asset management solutions optimizing resource utilization and reducing waste in healthcare operations.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulations (HIPAA, GDPR, FDA, HITECH) required healthcare facilities to implement secure, compliant asset-tracking solutions with encrypted data transmission. | AI-driven, blockchain-secured asset management platforms ensure real-time regulatory compliance, decentralized identity authentication, and tamper-proof audit trails for medical asset tracking. |

| AI-powered asset management solutions optimized equipment utilization, automated predictive maintenance, and improved real-time asset tracking. | AI-native, self-learning asset management platforms enable real-time equipment health diagnostics, AI-driven predictive analytics, and autonomous workflow optimization in healthcare environments. |

| Hospitals adopted IoT-connected sensors, RFID tags, and BLE (Bluetooth Low Energy) beacons for real-time location tracking of medical devices and inventory. | AI-enhanced, edge-native asset management systems provide ultra-fast, AI-driven IoT synchronization, real-time intelligent asset allocation, and predictive maintenance scheduling. |

| 5G-enabled healthcare asset management systems improved data transmission speeds, ensuring real-time tracking of critical medical equipment. | AI-powered, 6G-integrated wireless asset management platforms deliver instant data synchronization, AI-assisted automated alerts, and ultra-low latency connectivity for seamless hospital logistics. |

| Hospitals implemented RTLS to track high-value assets such as ventilators, infusion pumps, and mobile diagnostic devices. | AI-driven RTLS solutions leverage real-time AI-driven spatial mapping, predictive asset allocation, and AI-powered workflow automation for seamless healthcare operations. |

| Rising cyber threats led to AI-enhanced security frameworks with multi-factor authentication and encrypted asset communication. | AI-native, quantum-secure asset management ecosystems autonomously detect cyber threats, enforce tamper-proof encryption, and enable AI-driven anomaly detection in healthcare asset tracking. |

| Healthcare providers optimize asset management systems to reduce energy consumption and improve sustainable operations. | AI-driven, carbon-conscious asset tracking platforms integrate energy-efficient IoT sensors, predictive maintenance for sustainability, and AI-powered waste reduction analytics. |

| Blockchain-based asset tracking improved data integrity, prevented fraud, and ensured the traceability of medical inventory. | AI-integrated, decentralized asset management ecosystems enable real-time smart contract execution, immutable asset history verification, and AI-driven predictive supply chain risk management. |

| Hospitals experimented with automated guided vehicles (AGVs) and robotic systems to optimize asset movement and hospital logistics. | AI-driven, autonomous robotic asset managers leverage real-time AI-driven navigation, predictive workflow scheduling, and self-optimizing logistics solutions for next-gen healthcare facilities. |

| Hospitals began using AI for dynamic patient-centric asset allocation, ensuring timely access to critical equipment. | AI-powered, self-adaptive asset management systems autonomously prioritize patient needs, predict demand surges, and enable real-time AI-driven resource optimization for precision healthcare logistics. |

A risk that the wireless healthcare asset management sector has, is reportedly the data security and privacy issues. Hospitals or other healthcare facilities have to deal with many patients and maintain the corresponding equipment data. This makes them the most favored candidates for cyber-attacks and data breaches. The first step toward trust building and sensitive information safeguarding is ensuring compliance to HIPAA, GDPR, and various other laws and regulations.

Interoperability problems, however, serve to pose one more difficulty. Of all, numerous hospital facilities employ the legacy systems, which might not be compatible with the existing systems. The case that follows here is that the inefficiencies and the exorbitant costs of the integration will force organizations to invest in their custom software and APIs to settle compatibility problems between systems.

The right asset-tracking system requires connectivity and reliability features. Wireless infrastructures go wireless with technologies like Wi-Fi, RFID, Bluetooth, and IoT networks that are usually interfered with, are impaired in signal transmission, or are not properly implemented in large hospital areas. The need to deploy backup systems and to relieve the network's physical layer through signal amplifiers becomes crucial when operations have to continue without interruptions.

The materialization of huge initial implementation costs is seen as a threat to the financial security of healthcare providers. The sensor, software, and infrastructure upgrade costs as a whole can put a lot of strain on the smaller hospitals and clinics that are already suffering in this regard. It is wise for businesses to focus their course of action on offering solutions that are compatible with different scales and different pricing options in order to facilitate the dealing of such obstacles.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| UK | 9.9% |

| European Union | 10.1% |

| Japan | 10.0% |

| South Korea | 10.4% |

The USA Wireless Healthcare Asset Management Market is experiencing strong growth as healthcare providers adopt IoT-enabled tracking solutions to improve asset utilization, lower operational costs, and enhance patient safety. Hospitals utilize cutting-edge RFID and real-time location systems (RTLS) to monitor medical devices, track pharmaceutical inventories, and ensure regulatory compliance. The increasing demand for automated asset tracking, cloud-based management, and AI-powered analytics drives market growth.

Wireless asset management solutions have become indispensable in the healthcare, pharmaceutical, and biotechnology sectors as they improve workflow efficiency and reduce losses from lost or underutilized assets. Moreover, stringent regulatory environments drive corporates to adopt scalable and secure solutions for asset tracking, a key adoption accelerator. FMI is of the opinion that the USA market is slated to grow at 10.2% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Rise of IoT and AI in Asset Management | Hospitals and healthcare facilities implement smart tracking systems to manage operations and minimize asset loss. |

| Increasing Demand for Cloud-Based and AI-Driven Solutions | Predictive analytics and automated tracking enhance inventory management and efficiency. |

Hospitals and medical facilities in the United Kingdom are increasingly implementing AI-powered tracking systems to have real-time asset availability, minimizing losses and optimizing patient care. Healthcare providers use wireless tracking solutions to automate inventory management, enhance hospital logistics, and ensure compliance with regulatory standards.

Growing adoption of RFID, Bluetooth Low Energy (BLE), and cloud-based asset management to propel the market growth. Moreover, initiatives for the digital transformation of healthcare facilities drive investment in advanced wireless tracking solutions, enabling real-time monitoring and increased efficiency for hospitals. FMI’s analysis shows that the UK market is expected to witness growth at 9.9% CAGR during the forecast period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Expanding Use of AI-Enabled Asset Tracking | Hospitals are integrating AI-supported systems to improve asset utilization and operational efficiency. |

| Growing Adoption of Cloud-Based Inventory Management Solutions | Healthcare providers leverage cloud platforms to facilitate real-time tracking of medical equipment and pharmaceuticals. |

To enhance operational efficiency and minimize equipment downtime, hospitals and pharmaceutical firms in the European Union are deploying IoT-enabled tracking solutions, resulting in the growth of the Wireless Healthcare Asset Management Market. Leading markets like Germany, France, and Italy have them integrated into smart asset management systems in the healthcare & life sciences sectors.

Data security and healthcare regulations are rigorous in the European Union (EU), which requires businesses to have wireless asset trackers that adhere to the General Data Protection Regulation (GDPR). The development of AI-backed analytics and real-time monitoring pushes adoption. The EU market is estimated to expand at a CAGR of 10.1% during the study period, believes FMI.

Growth Factors In European Union

| Key Drivers | Details |

|---|---|

| Strict Data Security and Compliance Regulations | The healthcare industry adopts GDPR-compliant asset management systems to maintain the safety of patient data. |

| Enhanced AI-Powered Analytics and Real-Time Monitoring | With improved tracking of all assets, including the usage of AI in logistics, these AI-powered solutions are capable of improving asset utilization, predictive maintenance, and efficiency. |

The increasing automation of inventory management, tracking, and cloud-based monitoring solutions is propelling market growth in Japan. Hospitals and health care providers employ asset management technologies to maximize the efficiency of resources, quality patient care awarding, and compliance with the regulation.

With a commitment to healthcare innovation, smart hospitals, and automation, it can be seen that high adoption of wireless asset-tracking solutions is happening in Japan. Next-gen assets always keep spotting potential errors and faults, helping pharma and biotech companies invest in asset monitoring systems that ensure that their operation is not just compliant but more effective. According to FMI, the Japanese market is expected to witness a CAGR of 10.0% over the forecast period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI in Asset Tracking and Management | AI analytics optimize hospital inventory and lower the loss of assets. |

| Evolving Healthcare Innovation & Smart Hospital Infrastructure | Advanced technologies drive wireless tracking systems in Hospitals and research facilities. |

Healthcare providers in South Korea are increasingly adopting wireless healthcare asset management solutions powered by IoT and AI technologies, leading to rapid market growth. Government initiatives actively support digital healthcare transformation, accelerating the adoption of smart asset management technologies in hospitals and research institutions.

Companies integrate real-time location tracking, predictive maintenance analytics, and RFID-enabled asset monitoring to optimize hospital operations. Additionally, advancements in 5G connectivity and blockchain-based asset security further fuel market expansion. FMI’s research shows that the South Korean market is slated to grow at 10.4% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government Support for Digital Health Transformation | Policies drive the use of advanced asset tracking solutions in hospitals and research facilities. |

| Secure Asset Management with 5G and Blockchain Integration | High-speed connectivity and blockchain security enhance real-time asset-tracking capabilities. |

With the help of Asset Tags Segment, hospitals can track critical medical equipment such as ventilators, infusion pumps, and diagnostic equipment in real-time, enabling improved asset management and hospital supply chain operations. They work the same way in keeping their quality, but with these tags, the search time for equipment is reduced, and losses of equipment are minimized , thus, overall, helping improve the efficiency of the hospital.

As per studies, hospitals lose around 10 to 20% of their mobile assets each year due to misplacement or theft. An asset tag can be a valuable tool in every hospital's arsenal to reduce these losses and enjoy cost savings.

Companies like Zebra Technologies, Stanley Healthcare, and GE Healthcare have RFID and barcode-enabled asset tags that mesh well with hospital management systems. With the rapidly growing implementation of IoT-facilitated tracking systems, utilizing assets becomes much easier while remaining compliant and reducing operation inefficiencies.

With patient safety and workflow efficiency remaining key priorities for hospitals and geriatrics services, the demand for the wearable tags segment is growing at a good pace. The applications for patient tracing, staff panic buttons, and infant protection are a common practice as well, to allow for more efficient response time during an emergency and the prevention of a patient's eloping. In neonatal departments, RFID-based wearable tags are also used for virgin infants' abduction prevention systems to ensure security.

Real-time location systems (RTLS) integrated into wearable tags from companies like Centrak, Impinj and Securitas Healthcare enable biometric monitoring and location tracking in real time. Wearable patient identification bands and smart wristbands raise demand by automating the check-in process, contact tracing, and remote patient monitoring, which improves the hospital life cycle and patient experience.

The demand for such solutions is anticipated to rise as healthcare providers are anticipated to invest in advanced tracking capabilities that will help healthcare and life sciences organizations increase asset utilization and improve patient outcomes.

With their low cost, long-range tracking, and high data accuracy, RFID Segment dominates the wireless healthcare asset management market. Many hospitals integrate passive and active RFID tags for automating the management of inventories, asset utilization, and staff tracking, which immensely minimizes the time taken to search for or lose equipment. According to studies, RFID helps companies save approximately 25% on inventory and increases efficiency in workflow.

With the adoption of AI-based RFID systems such as those suggested by companies like Impinj, Alien Technology, and GAO RFID, hospitals can undertake predictive analysis and offer asset lifecycle management for optimized resource allocation. Moreover, the growing demand for pharmacy inventory management and surgical instrument tracking is further facilitating the adoption of RFID, decreasing medical mistakes, and improving patient safety.

This segment is growing quickly as the Wi-Fi technology can connect directly to the existing hospital network for real-time monitoring of all assets without the need of dedicated RFID infrastructure. Hospitals can also track high-value assets and patient records through Wi-Fi-based tracking, keeping an eye on staff movement to increase their operational efficiency.

Stanley Healthcare, Aruba Networks (HPE), and Cisco Systems are leading the way in innovating RTLS-enabled Wi-Fi solutions focused on improving security and hospital asset visibility. As 85% of hospitals have adopted cloud-based healthcare IT systems, Wi-Fi-based Asset tracking has the potential to save costs related to misplaced equipment and manual asset tracking for multi-specialty and large-scale hospital networks. The transition to intelligent hospitals is likely to hasten the use of Wi-Fi, helping hospitals to manage seamlessly while enhancing patient care.

The wireless healthcare asset management market is expanding rapidly as hospitals and healthcare providers increasingly adopt digital solutions to improve asset tracking, enhance patient safety, and optimize operational efficiency. The shift toward AI-powered real-time location systems (RTLS), cloud-based inventory management, and IoT-enabled medical asset tracking is driving significant market growth. These innovations help healthcare facilities reduce operational costs, improve resource utilization, and streamline workflow automation.

Leading companies such as Stanley Healthcare, CenTrak, and GE Healthcare dominate the market by offering comprehensive tracking and monitoring solutions tailored to the healthcare sector. Their focus on AI-driven predictive maintenance, RFID-based asset visibility, and secure data integration positions them as key industry leaders. These firms continue to invest in cutting-edge technology, regulatory compliance, and interoperability with hospital IT systems to strengthen their market presence.

Emerging players are gaining traction by developing niche solutions such as AI-powered patient monitoring, real-time emergency response tracking, and advanced data analytics for predictive asset maintenance. Sustainability and cybersecurity concerns are shaping innovation, with companies prioritizing energy-efficient tracking solutions and encrypted data management.

As digital transformation accelerates, competition will be defined by advancements in automation, seamless system integration, and enhanced decision-making capabilities in healthcare asset management.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stanley Healthcare | 20-25% |

| CenTrak | 15-20% |

| GE Healthcare | 12-17% |

| Zebra Technologies | 8-12% |

| AeroScout (Securitas) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stanley Healthcare | Develops AI-powered RTLS, real-time asset tracking, and patient safety monitoring systems. |

| CenTrak | Provides cloud-based healthcare asset tracking, RFID-enabled location solutions, and workflow automation. |

| GE Healthcare | Specializes in IoT-based medical equipment tracking, predictive maintenance, and hospital efficiency solutions. |

| Zebra Technologies | Focuses on barcode and RFID-based asset tracking, real-time inventory monitoring, and smart healthcare solutions. |

| AeroScout (Securitas) | Offers wireless asset tracking, patient and staff location monitoring, and emergency response solutions. |

Key Company Insights

Stanley Healthcare (20-25%)

Stanley Healthcare leads the wireless healthcare asset management market by providing AI-driven RTLS solutions, patient safety tracking, and real-time asset management systems.

CenTrak (15-20%)

CenTrak enhances healthcare efficiency with cloud-based asset tracking, RFID location solutions, and AI-powered workflow automation.

GE Healthcare (12-17%)

GE Healthcare optimizes hospital operations with IoT-based medical asset tracking, predictive maintenance, and integrated inventory management.

Zebra Technologies (8-12%)

Zebra Technologies specializes in RFID-based tracking, barcode scanning, and real-time medical equipment monitoring to improve healthcare logistics.

AeroScout (Securitas) (5-9%)

AeroScout (Securitas) offers wireless healthcare tracking solutions, real-time staff and patient location monitoring, and emergency response systems.

Other Key Players (20-30% Combined)

The industry is projected to reach USD 52.06 billion in 2025.

The industry is expected to grow to USD 155.4 billion by 2035.

Some key players include Stanley Healthcare, CenTrak, GE Healthcare, Zebra Technologies, and others.

South Korea, driven by advancements in healthcare technology, digital asset tracking, and increased hospital automation, is expected to record the highest CAGR of 10.4% during the forecast period.

By region, the market is segmented into North America (USA, Canada), Latin America (Mexico, Brazil), Western Europe (Germany, Italy, France, UK, Spain), and Eastern Europe (Poland, Russia), Asia Pacific (China, India, ASEAN, Australia & New Zealand), Japan, and the Middle East & Africa (GCC, South Africa, North Africa).

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.