The wireless flow sensors market is anticipated to be valued at USD 3.54 billion in 2025. It is expected to grow at a CAGR of 25% during the forecast period and reach a value of USD 32.97 billion in 2035.

The wireless flow sensors market witnessed increased adoption across water and wastewater management, industrial automation, and power generation in 2024. Regulatory compliance was an important driver, with utilities using wireless solutions with high accuracy for flow measurement and for remote monitoring.

India saw a high growth due to rapid industrialization, especially in process automation and energy management. Advancements in low-power, high-accuracy sensors improved operational efficiency, and strategic alliances were established with key players who increased investments in R&D.

Looking forward to 2025 and beyond, the trajectory of the industry is a stable growth one. Growing demand for predictive maintenance and data-driven decision-making will drive faster adoption across manufacturing and energy sectors. With advanced wireless protocols and extended battery lives, sensors will seamlessly blend with the already existent IoT ecosystems.

And expansion in emerging industries, especially Asia-Pacific, will be a growth catalyst. prescript: smart infrastructure and Industry 4.0 applications will drive a value of the USD 32.97 billion by 2035.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 3.54 Billion |

| Projected Industry Size in 2035 | USD 32.97 Billion |

| CAGR (2025 to 2035) | 25% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=500 stakeholders evenly distributed across manufacturers, industrial end users, system integrators, and technology providers in North America, Europe, China, India, and Southeast Asia

Regional Variance

High Variance

Convergent & Divergent ROI Perspectives

72% of North American stakeholders considered predictive maintenance investments worthwhile, while only 31% in Southeast Asia found AI-driven solutions cost-effective.

Shared Challenges

Regional Differences

Alignment

76% of global manufacturers plan to invest in AI-powered analytics and machine learning integration for enhanced sensor capabilities.

Divergence

High Consensus

Regulatory compliance, cost efficiency, and scalability remain global priorities.

Key Variances

Strategic Insight

A one-size-fits-all approach is not viable. Manufacturers must tailor solutions based on regional demands, whether it be high-accuracy sensors in the West or cost-efficient models in Asia.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The Environmental Protection Agency (EPA) mandates accurate flow monitoring in industries such as water treatment and oil & gas. The National Institute of Standards and Technology (NIST) requires compliance with precision measurement standards. The FCC (Federal Communications Commission) regulates wireless communication frequencies used in industrial sensors. |

| European Union | The EU Water Framework Directive (2000/60/EC) enforces strict water monitoring, increasing demand for real-time flow sensors. The CE Marking is mandatory for electronic equipment, ensuring compliance with health, safety, and environmental protection standards. The RoHS (Restriction of Hazardous Substances Directive) limits hazardous materials in sensor manufacturing. |

| China | The Ministry of Ecology and Environment (MEE) mandates industrial water discharge monitoring, increasing demand for flow sensors in wastewater management. The CCC (China Compulsory Certification) is required for all electronic products, including wireless sensors, before industry entry. The MIIT (Ministry of Industry and Information Technology) regulates wireless spectrum usage. |

| India | The Central Pollution Control Board (CPCB) enforces real-time effluent monitoring, driving wireless flow sensor adoption. The Bureau of Indian Standards (BIS) certification is mandatory for electronic measurement instruments. The Telecom Regulatory Authority of India (TRAI) controls frequency allocation for wireless communication devices. |

| Japan | The Japan Industrial Standards (JIS) set quality and safety benchmarks for industrial equipment, including sensors. The Ministry of Internal Affairs and Communications (MIC) regulates wireless spectrum and ensures compliance with radio frequency laws. |

| Southeast Asia (Singapore, Malaysia, Indonesia) | Governments are pushing for smart water management and industrial automation, requiring real-time data monitoring solutions. Singapore’s Infocomm Media Development Authority (IMDA) oversees wireless communication regulations, while Malaysia’s SIRIM certification is mandatory for electronic instruments. Indonesia enforces local content requirements (TKDN) for imported industrial equipment. |

| South Korea | The Korea Communications Commission (KCC) regulates wireless sensor networks and ensures compliance with frequency use laws. The Korean Agency for Technology and Standards (KATS) mandates safety and performance standards for industrial sensors. The Ministry of Environment (MOE) enforces water pollution monitoring, increasing demand for advanced sensing solutions in environmental applications. |

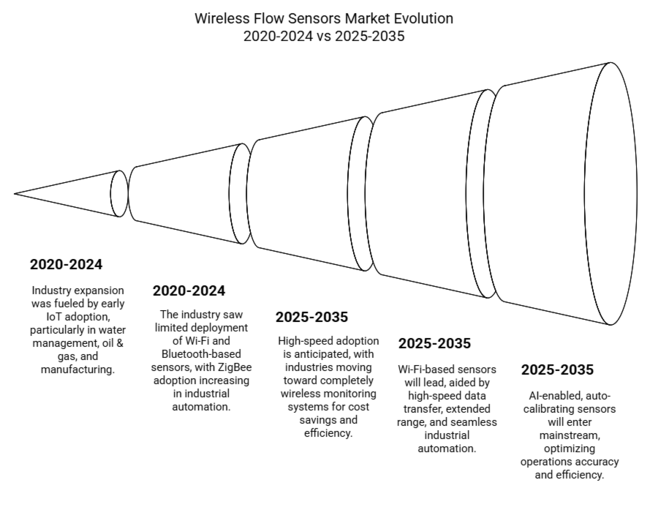

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry expansion was fueled by early IoT adoption, particularly in water management, oil & gas, and manufacturing. | Industry growth will be driven by the pervasiveness of IIoT integration, 5G networks, and smart cities. |

| Adoption was moderate, with industries testing wireless solutions but continuing to use wired alternatives. | High-speed adoption is anticipated, with industries moving toward completely wireless monitoring systems for cost savings and efficiency. |

| Government regulations required minimal real-time monitoring, but compliance standards were still in the process of evolving. | More stringent regulations will increase the demand for sophisticated wireless sensors based on predictive analytics using AI and real-time data transmission. |

| The industry saw limited deployment of Wi-Fi and Bluetooth-based sensors, with ZigBee adoption increasing in industrial automation. | Wi-Fi-based sensors will lead, aided by high-speed data transfer, extended range, and seamless industrial automation. |

| Demand was found in developed economies such as the USA, UK, Germany, and Japan. | Growth will be strongest in emerging economies like China and India, based on industrial automation and infrastructure growth. |

| Investment in R&D was on miniaturizing sensors and enhancing battery efficiency. | AI-enabled, auto-calibrating sensors will enter mainstream, optimizing operations accuracy and efficiency. |

Wireless sensors can be categorized depending on the communication technology employed, into Wi-Fi, ZigBee, NB-IoT, LoRaWAN, and others. Wi-Fi is the most widely employed technology in the wireless flow sensors market and will continue to increase with a compilation average growth rate of 24.4% (2025 to 2035). Industrial automation, energy management, and municipal water systems are just some of the verticals that reap its advantages in high-speed data transmission as well as extended-range connectivity.

Wi-Fi-enabled sensors are implemented by utility companies for real-time flow tracking that minimizes manual inspections and allows for remote diagnostics. These sensors improve operational efficiency, predictive maintenance, and system reliability in oil & gas, chemical, and manufacturing sectors by identifying leaks, pressure drops, and inefficiencies. With the expansion of smart cities and Industry 4.0, demand for Wi-Fi-integrated sensors will continue rising as industries prioritize automation, cost reduction, and sustainability.

Water & wastewater management is the largest application, anticipated to grow at a 24.1% CAGR (2025 to 2035). These sensors enable real time monitoring, leak detection, and pressure control in municipal water systems, industrial wastewater plants, and irrigation networks. They are critical to minimizing operating expenses, avoiding damage to facilities and assets, and meeting stringent environmental requirements.

They underpin wastewater treatment plants for accurate effluent discharge monitoring and achieving set water quality standards. As smart water management programs gain momentum, governments encourage sustainable use of resources, thus driving wide-scale adoption of effective water distribution, proactive maintenance, and better decision-making.

The USA wireless flow sensors market is set to expand at a 22.5% CAGR between 2025 and 2035, driven by the growing adoption of Industrial IoT (IIoT) solutions across water management, oil & gas, and manufacturing.

The Environmental Protection Agency (EPA) has placed the strongest ever demands on industrial real-time monitoring of water discharge, resulting in private and municipal water utilities needing more sophisticated sensors. Moreover, the frequency allocation as described operates within the requirements of the Federal Communications Commission (FCC) for wireless devices in the industrial context.

California, Texas and New York in the United States are deploying smart city projects that are being outfitted with sensors for leak detection and water conservation. Another big user is oil & gas, using sensors to check pipelines remotely, reduce leakages or improve efficiency. The National Institute of Standards and Technology (NIST) requires precise flow measurement, hence calibration-compliant sensors are a requirement.

Government incentives for energy-efficient production in the Inflation Reduction Act (IRA) also promote the use of low-power sensors. Honeywell and Emerson Electric are leading companies in the USA, and they are investing in AI-enabled sensors to improve predictive analytics to continue fueling industry expansion.

The UK is poised to expand at a 21.8% CAGR from 2025 to 2035, fueled by smart infrastructure projects and stringent green building regulations. The UK Environment Agency mandates real-time monitoring of water and air pollution, compelling industries to adopt sensors for compliance. Additionally, the UK’s Net Zero Strategy promotes low-energy IoT solutions, boosting demand for energy-efficient sensors in HVAC systems and smart buildings.

The water and wastewater management sector is a key driver, with UK water regulator Ofwat mandating continuous monitoring of industrial water use. Wireless sensors are also gaining traction in the renewable energy industry, particularly in hydropower and offshore wind farms, where real-time flow measurement is critical for operational efficiency.

The UK government’s Industrial Decarbonisation Strategy incentivizes AI-based monitoring systems, increasing demand for sensors. Leading manufacturers are leveraging 5G connectivity to enhance performance and improve data transmission rates. With ongoing investments in smart cities and automation, the UK is emerging as a lucrative hub for adoption across multiple industries.

France is forecast to grow at a 21.5% CAGR from 2025 to 2035, driven by strict environmental regulations and the government’s commitment to industrial automation. The French Energy Transition Law mandates reduced energy consumption in industrial sectors, encouraging the use of low-power wireless sensors for monitoring energy efficiency.

The water and wastewater industry is a major end-user, with France’s Agence de l’Eau requires industries to implement real-time flow monitoring. The Grenelle II Act enforces stricter air quality and emissions monitoring, leading to increased demand for wireless sensors in HVAC and industrial ventilation systems.

France is also investing heavily in smart grid and renewable energy projects, where sensors are crucial for optimizing energy flow and consumption. The automotive and aerospace industries, key contributors to the French economy, are integrating sensors into production lines to enhance automation and predictive maintenance. With government-backed digital transformation initiatives, leading companies such as Schneider Electric and Suez are investing in IoT-driven technologies, ensuring long-term growth.

Germany is expected to experience a rise of 22.0% in terms of CAGR from 2025 to 2035 owing to increased adoption of Industry 4.0 and rigorous environmental regulations. Real-time monitoring of industrial effluent discharge is mandated by the Federal Water Act (WHG), resulting in the installation and widespread application of sensors in water treatment plants.

The manufacturing sector, especially automotive and chemical industries, is the main end-user of sensors for process improvement. Demand also generated by the National Hydrogen Strategy of Germany is correlated with the measurement of hydrogen flow for monitoring fuel cell efficiency in transportation and electricity generation.

In Germany, the wireless communication standard is regulated by the Federal Network Agency (BNetzA), ensuring proper integration with IoT-enabled flow sensors. Moreover, Germany's Climate Protection Act sets forth targets for carbon neutrality, which drive industries to use low-energy wireless sensors for sustainable operations. Major German companies, such as Siemens and Endress+Hauser, are investing in AI-driven, self-calibrating flow sensors, thereby reaffirming Germany's leadership in industrial automation.

Smart water management and industrial automation policies set by the government will see Italy grow at a 20.8% CAGR from 2025 to 2035. As part of the Italian National Water Plan, real-time flow monitoring in water utilities will hasten the adoption of wireless sensors in wastewater treatment plants.

Another driving force is tighter industrial water discharge monitoring enforced by the National Institute for Environmental Protection and Research (ISPRA) to deploy sensors across industries. Of these, many are IoT-enabled flow sensors integrated into production processes to enhance efficiency in Italy's automotive as well as manufacturing sectors.

The other growing sectors are HVAC and building automation; apart from that, the Italian Green Building Code stipulates the monitoring of VOCs (volatile organic compounds). As regards weighty policies such as Italy's National Energy and Climate Plan (NECP), the country promotes low energy wireless sensors to ensure sustainable operations in industries.

Italy is also investing into renewable energy and smart grids, and in this context, real-time sensors can be understood as having a crucial role in optimizing energy usage. Leading Italian firms such as ABB and SEKO are applying AI in sensor technologies, while their applications will, in turn, utilize the 5G network for improved measurement and data transmission. The result is a growth rate that promises decent figures for the Italian industry thanks to government incentives toward automation.

In South Korea, high diversification due to smart factories and automated industrial processes is expected to grow at a CAGR of 21.0%, between 2025 and 2035. The Korean Smart Manufacturing Initiative supports the adoption of wireless sensors for predictive maintenance and process optimization. Real-time monitoring of industrial emissions is required by the Ministry of Environment (MOE), which is contributing to the growth of the sensors in air and water quality monitoring.

While the IoT adoption accelerates within the key sectors of South Korea, like automotive and semiconductors, and, further, production lines are incorporated with smart IoT-enabled sensors for precise fluid measurement, packaging, and quality assurance, thus adding value to final products. Enforcing stricter municipal water management, the Korea Water Resources Corporation (K-water) multiplies its adoption in water treatment plants.

Sensors are critical to the efficiency of hydropower and unplugged solar energy, which means that smart infrastructure and renewable energy projects are supported by the Korean New Deal. AI-assisted sensors can improve automation, and companies like Samsung and LG Innotek are at the forefront of this new technology. Moreover, South Korea is a primary industrial Internet of Things (IoT) hub, as a result of government incentives and 5G deployment, which is driving strong growth in the industry across the region.

Japan has predicted a growth of 19.5% from 2025 to 2035 that can be attributed to high-precision industrial automation as well as strict calibration standards. Japan Industrial Standards (JIS) require stringent flow sensor precision, leading to extensive use in the pharmaceutical, semiconductor, and automotive sectors. With real-time flow monitoring requirement in urban water distribution enforced by the Japan Water Works Association (JWWA), demand for wireless solution is on the rise.

In the electronics and precision machinery sectors in Japan, IoT-based sensors are being incorporated to improve their manufacturing efficiencies and product quality control. Government initiatives under the Society 5.0 framework are encouraging the use of smart sensors in infrastructure as well as transportation systems, thus driving the growth of this industry.

Japan’s Green Growth Strategy also promotes the use of low-energy wireless sensors in renewable energy facilities, such as hydrogen fuel cells and wind energy systems. Prominent Japanese companies like Yokogawa Electric and Azbil Corporation are committing to AI-integrated sensors, improving analytical abilities with real-time data results. Japan’s industry is well-equipped for steady growth due to automation and government-backed strategies.

China's wireless flow sensors market is forecast to register a 23.0% CAGR between 2025 and 2035, the highest in the world, due to government-backed industrial automation and smart manufacturing campaigns. The Made in China 2025 policy advances the use of IoT, rendering sensors crucial in manufacturing, water management, and energy industries. The Ministry of Ecology and Environment (MEE) requires real-time monitoring of industrial emissions, boosting the use of sensors in industries.

Along with the build-out of hydropower and smart grids in China, millions of sensors are being used to optimize energy efficiency. The NDRC's more stringent water conservation legislation is driving further use of sensors in farming and municipal water consumption. Sensor technology is being adopted in the automobile and semiconductor industries as well to boost production efficiency and for quality inspection.

China's AI and 5G developments are also improving sensor precision and real-time data analysis. Leading Chinese firms like Huawei and Hikvision are developing next-gen sensors integrated with machine learning algorithms. With continued investments in automation and environmental regulations, China remains the most lucrative region for sensor adoption.

As of 2024, the wireless flow sensors market has seen remarkable growth due to a surge in demand for IoT-based solutions, industrial automation, and smart water management systems. The industry is expected to grow from USD 3.54 billion in 2025 to USD 32.97 billion by 2035, with a strong CAGR of 25%.

Industry leaders like Emerson Electric Co., Siemens AG, Honeywell International Inc., ABB Ltd., and Yokogawa Electric Corporation have been intensely developing their products and increasing geographic reach to grab new opportunities. These companies have emphasized innovation, strategic alliances, and sustainability as a means of responding to shifting industry needs for oil and gas, water and wastewater, and manufacturing.

Emerson Electric Co. has an estimated 28% share in the industry, retaining its top spot through relentless innovation and strategic investments. In 2024, Emerson unveiled an advanced series of oil & gas wireless sensors that boast impressive battery longevity as well as high-quality data accuracy.

The companies also launched a collaboration with a utility giant, American Water, to deploy sensors for real-time water monitoring and leak detection. According to a press release on Emerson's site, this partnership is meant to improve water conservation and dose efficiency of operations over urban water infrastructure.

Siemens AG, with a 22% share, has concentrated on incorporating cutting-edge technologies into its sensor products. Siemens launched a new series of IoT-enabled sensors for smart manufacturing applications in 2024. These sensors include predictive maintenance features, allowing real-time monitoring and minimizing downtime in industrial processes.

Siemens has also bought Cascade Technologies, a smaller company with expertise in wireless communication protocols, according to Automation World. Through this buy, Siemens' capabilities to provide transparent connectivity and interoperability for industrial IoT solutions have been boosted.

Honeywell International Inc., holding approximately 18% of the industry share, has prioritized innovation and sustainability in 2024. The company launched a new series of energy-efficient sensors, targeting the HVAC and building automation sectors. Honeywell also unveiled a partnership with Sidewalk Labs, one of the smart city leaders, to utilize sensors for the monitoring of urban infrastructure. The collaboration is said to improve resource management and sustainability in smart cities, as reported by Smart Cities World.

ABB Ltd. has a 15% share of the industry and has focused on expanding its footprint in the water and wastewater management industry. ABB Has introduced a new series of wireless sensors resistant to a harsher and more chemical environment for industrial zone applications in 2024.

The company also teamed up with Xylem Inc., a global water technology company, to co-create integrated solutions for water treatment plants, as published by Water Technology Online. The partnership seeks to enhance operating efficiency and decrease energy usage in water management systems.

Yokogawa Electric Corporation has a 10% share and has focused on technological innovation and strategic partnerships. The firm introduced a new line of ultra-low power-consuming sensors, aimed at remote and off-grid applications.

Yokogawa also made an announcement of collaboration with NextEra Energy, one of the largest renewable energy firms, in the installation of sensors on wind and solar power installations, as reported by Renewable Energy World. The joint venture focuses on maximizing energy yields and lowering upkeep expenses in renewable energy plants.

Even more, a key industry in 2024 is a pronounced focus on innovation, sustainability, and strategic collaboration. The leading players in the industry are banking on sophisticated technologies such as IoT, AI, and predictive analytics, to provide smarter as well as more efficient solutions.

There has been tremendous growth and uptake of sensors for smart city projects, industrial automation, and renewable energy systems. With the increasing need for real-time monitoring and optimization of resources, businesses have a strong position to seize new opportunities and shape the future of the industry.

Sensors are used to measure and monitor the flow rate of liquids and gases in various industries, including water management, oil & gas, power generation, and manufacturing. They enable real-time data transmission, leak detection, pressure regulation, and predictive maintenance, improving operational efficiency and reducing downtime.

Wi-Fi-enabled flow sensors use wireless technology to transmit real-time flow data to remote monitoring systems. They measure fluid flow rates using technologies like ultrasonic, magnetic, or thermal mass flow, sending data via Wi-Fi for analysis and predictive maintenance. This minimizes manual inspections and allows for immediate issue detection and resolution.

Industries such as water and wastewater management, oil & gas, chemical processing, power generation, and manufacturing benefit the most. These devices enhance efficiency, safety, and regulatory compliance by providing accurate and continuous monitoring of critical processes, reducing environmental impact and operational costs.

Key factors include fluid type, pressure range, temperature, required accuracy, data transmission range, and compatibility with existing systems. Consider the device’s power consumption, environmental conditions, and regulatory compliance requirements to ensure optimal performance and reliability.

Industry 4.0 promotes automation, data analytics, and smart technologies in industrial processes. Sensors play a crucial role by providing real-time data for automated systems, enabling predictive maintenance, reducing operational costs, and improving process optimization. This integration enhances efficiency and decision-making across industries.

By technology, the industry is segmented into Wi-Fi, Bluetooth, ZigBee, WLAN, and others.

In terms of application, the sector is segmented into Water & Waste Water Management, Chemicals & Petrochemicals, Power Generation, and others.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.