The Wireless Fire Detection Systems Market is valued at USD 1.62 billion in 2025. As per FMI's analysis, the wireless fire detection will grow at a CAGR of 7.6% and reach USD 3.1 billion by 2035. Growing utilization of wireless fire detection systems can be explained in terms of stringent safety standards, IoT and sensor technology advancements, and surging demand for smart building technology. Commercial, residential, industrial, and healthcare sectors are leading notable contributions toward fueling industry growth.

In 2024, the sector for wireless fire detection systems witnessed stable growth fueled by rising uptake in commercial and industrial applications. Governments around the globe enforced stricter fire safety codes, compelling companies to invest in sophisticated, wireless fire detection systems. In North America, stricter building codes led to a surge in retrofitting efforts, particularly for older infrastructure.

North America and Europe continue to be dominant players in the sector, given rigid safety standards and technological advancements in regional sectors, while Asia-Pacific is expected to emerge as a lucrative segments in line with the development of urbanization and infrastructure. Major industry contributors are concentrating on product innovations, the infusion of AI-powered monitoring systems, and strategic partnerships to enhance their market position.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.62 billion |

| Industry Size (2035F) | USD 3.1 billion |

| CAGR (2025 to 2035) | 7.6% |

Explore FMI!

Book a free demo

The wireless fire detection systems landscape is propelling on account of extensive implementation of fire safety regulations and for propelling fire detection technology using smart buildings with patterns of slow-built-up fire.

Even outside of this shift towards innovation in safety these systems with improved agility and scalability open themselves up to additional benefits throughout commercial, industrial, and residential sectors. Given the relative ease to install and cost saving benefits compared to conventional wired fire detection systems will only continue to render pioneers for conventional wired fire detection systems mute to the transition.

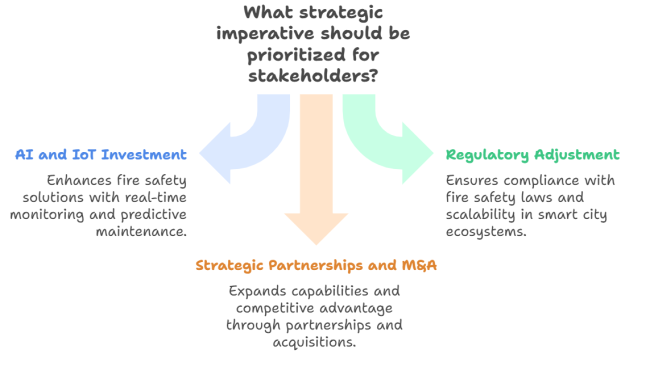

AI and IoT Integration Investment

Executives must invest in AI-driven fire detection systems and IoT-based connectivity to improve the reliability and precision of wireless fire safety solutions. These technologies will provide real-time monitoring, predictive maintenance, and proactive alerts, keeping up with increasing demand for smart, connected solutions in both. These technologies will drive real-time monitoring, predictive maintenance and proactive alerts, sustainably meeting the increased demand for smart, connected solutions in both commercial and residential sectors.

Adjusting to Regulations and the Changing Sector

Stay updated on regulatory changes and smart building trends, particularly in countries that have strict fire safety laws. Executives must confirm that their products can scale within smart city ecosystems, presenting themselves and their brands as primary selections for new developments along with retrofits.

Strategic Partnerships and M&A

Look for partnerships to enable synergies between the business capabilities of smart building tech integrated sensors (that the company does not have) and take an added step to broaden the scope. Also, take a look at M&A possibilities with smaller innovators to enhance R&D capacity, broaden product portfolios and acquire a competitive advantage in emerging sectors with a focus on the Asia-Pacific (APAC) region.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions (Semiconductor shortages, geopolitical tensions) | Probability: High - Impact: High |

| Regulatory Compliance Changes | Probability: Medium - Impact: High |

| Technological Obsolescence & Integration Challenges | Probability: Medium - Impact: Medium |

| Priority | Immediate Action |

|---|---|

| Innovate in AI and IoT Integration | Run feasibility studies on integrating AI-driven analytics and IoT connectivity in wireless fire detection systems. |

| Strengthen Regulatory Compliance | Initiate a review of current product offerings to ensure alignment with emerging fire safety regulations and standards. |

| Expand Strategic Partnerships | Launch a pilot program with key channel partners to enhance distribution networks and integrate wireless solutions into smart buildings. |

To stay ahead, companies must have fast-paced nature of advancements in the wireless fire detection systems, executives need to emphasize and speed up the incorporation of Artificial Intelligence (AI) and Internet of Things (IoT) technologies into their systems.

Such a strategy will allow for real-time monitoring, predictive maintenance, and the ability to easily integrate into smart building ecosystems, rapidly establishing it as the industry standard. It is also essential to comply with the new global fire safety regulations coming into play, getting products in order and ready for heavily regulated sectors, including North America and Europe.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

71% of USA stakeholders determined advanced wireless fire detection systems to be "worth the investment" whereas 38% in Japan still rely on traditional wired systems.

Consensus:

Plastic/Polymer-based Materials: Selected by 65% of global stakeholders due to lightweight designs and cost-effectiveness, particularly for residential applications.

Variance:

Shared Challenges:

88% cited rising component costs (IoT sensors, advanced detection modules) as a main issue.

Regional Differences:

Manufacturers:

Distributors:

End-Users (Commercial/Residential):

Alignment:

74% of global manufacturers plan to invest in AI and IoT integration for smarter fire detection systems.

Divergence:

Conclusion: Variance vs. Consensus

High Consensus:

Global stakeholders agree on the importance of fire safety compliance, durability, and cost control

Key Variances:

Strategic Insight:

A regionalized approach is essential-smart technologies and AI in the USA, cost-effective solutions in Japan/South Korea, and sustainability-focused products in Western Europe are key to segment penetration.

| Country | Policies, Regulations, and Mandatory Certifications Impacting the Industry |

|---|---|

| United States | Regulations: Stringent fire safety standards enforced at federal and state levels, including requirements for smoke detection systems in residential and commercial buildings. |

| Western Europe | Regulations: The EU Fire Safety Directive (2017/2392) mandates the installation of fire detection systems in all commercial buildings. Certifications: CE marking is required for all fire detection systems sold within the EU, ensuring products meet EU health, safety, and environmental requirements. |

| Japan | Regulations: Japan’s Fire Service Act mandates fire detection systems in certain buildings, especially in densely populated areas. There are also requirements for wireless fire detection systems in high-rise buildings in urban centers. |

| South Korea | Regulations: South Korea requires compliance with Fire Safety and Prevention Act, which enforces fire detection systems in public, commercial, and high-rise buildings. Certifications: Like Japan, South Korea requires fire detection products to meet KCs (Korean Certifications), a mandatory certification system ensuring the safety and effectiveness of fire safety products. |

| China | Regulations: China’s Code for Fire Protection Design of Buildings (GB50016-2014) mandates fire safety measures in residential and commercial buildings. |

| India | Regulations: India’s National Building Code (NBC) and Fire and Life Safety Code outline the need for fire safety systems, including fire alarms, in various types of buildings. There is increasing adoption of fire detection systems in smart cities. |

| Australia | Regulations: Australia has a series of state-based fire safety regulations, such as AS 1670, which requires specific fire alarm systems to be installed in various commercial and industrial buildings. |

The USA. wireless fire detection landscape accounts for 18% of the global wireless fire detection systems, with a projected CAGR of 8.2% from 2025 to 2035, slightly ahead of the global average, owing to the expanded, tech-variable structure of the country and the standards of fire safety ensured by regulations in the course of the last three decades.

The USA smart building sector growing interest in IoT and AI technologies for predictive maintenance has made the need for wireless fire detection systems integrated with IoT and AI-driven solutions increasingly important. Fire detection products must comply with mandatory standards such as UL (Underwriters Laboratories) certification and NFPA (National Fire Protection Association).

From 2025 to 2035, the UK wireless fire detection systems landscape is expected to grow at a CAGR of 7.4%. This growth will be propelled by the country’s expanding smart city projects as well as more stringent fire safety laws in both residential and commercial structures.

Recently, smart homes and workplaces in the UK are trending toward the growth of IoT-based fire detection systems that combine real-time monitoring with predictive fire safety features. Further, following the Grenfell Tower fire, the Building Safety Bill, which is expected to become law in the coming years, focuses even more on fire safety measures in high-rise residential buildings. With features like easy installation and seamless integration with existing systems, wireless fire detection systems are leading the way.

The segment is projected to grow at a compound annual growth rate (CAGR) of 7.2%. This growth is mostly a consequence of improvements in building technologies and strengthening regulations for fire safety. France has forceful fire safety standards, with the requirement to go through the French Fire Safety Code and for things on the sector to have CE certification, etc.

Building and renovation projects are becoming more and more demanding of smart fire safety solutions that can run with IoT devices to ensure quick detection and monitoring. France also has specific sustainable and green building standards that drive demand for energy-efficient, wireless systems. The EU Fire Safety Directive also ensures that the country follows best practices in fire safety that can lead to higher segment adoption of wireless fire detection systems.

The segment for wireless fire detection systems in Germany is expected to thrive through 2035, registering a worthy 8.0% CAGR between 2025 and 2035 and emerging as one of the strongest-performing regions in the European wireless fire detection systems. The country has a robust regulatory framework that governs fire safety protocols, including fire detection systems in public buildings and high-rise buildings.

Germany, in particular, has one of the most mature smart building sectors in Europe, with significant momentum toward integrating wireless IoT devices into fire detection systems. Ongoing digitalization across sectors and industries in the country, especially the construction sector, is accelerating the adoption of AI-based fire safety solutions.

The wireless fire detection systems market in Italy is predicted to predicted to grow at a CAGR of 6.8% from 2025 to 2035. The Italian landscape is expected to grow constantly due to the regulatory framework established on building safety across the country and constant investments in smart infrastructure.

The Italian Fire Prevention Code mandates that buildings implement fire detection and prevention systems, which has spurred demand for more reliable and easy-to-install wireless systems. Smart city solutions, where fire detection systems are integrated into other smart building technologies, are also being increasingly adopted in Italian cities. Given the country’s decades-long tradition of preservation, particularly of heritage buildings, retrofitting traditional systems in them can prove tough for wireless systems to install.

The wireless fire detection systems in South Korea are predicted to grow with a CAGR of 7.0% from 2025 to 2035. Demand for smart fire detection systems, especially in high-rise buildings and commercial facilities, has surged due to the country's focus on technological innovation and urbanization.

With the efforts for safety regulation by the South Korean government, the fire prevention law had been made strict, and the installation of fire detection systems has been made compulsory in a wide range of sectors. In particular, as a part of smart cities initiatives, such as in the case of Seoul, there is a growing demand for the integration of fire equipment, such as wireless fire detection, into buildings which already have other smart technologies. Businesses and homeowners are more interested in IoT enabled solutions to increase the safety of buildings.

Japan Wireless Fire Detection systems landscape is predicted to grow at a CAGR of 6.5% from 2025 until 2035. Despite being a mature sector, the roll-out of wireless systems in this sector has been slow, and that compares with other advanced economies, partly due to conservative segment dynamics. The country’s growing urbanization and high-density life in cities like Tokyo will spur a demand for more efficient fire safety solutions, he added.

Wired fire detection systems are favoured in Japan due to their increased reliability and lower installation cost, as stipulated by the Fire Service Act for construction types with fire detection systems. Nonetheless, the sector for wireless systems is projected to demonstrate steady growth due to the increasing affordability and acceptance of IoT and AI technologies.

The wireless fire detection systems market in Australia and New Zealand is expected to grow at a CAGR of 6.9% from 2025. The growth of advanced fire safety technologies in these countries can be attributed to regulatory requirements and a strong emphasis on sustainable building designs.

Fire safety regulations are stringent in Australia at the state and federal levels, the National Construction Code (NCC) requiring fire detection systems in both high-rise and commercial buildings. Likewise smoke alarms and fire detection systems have to be installed in residential and commercial buildings under Building Act 2004 in New Zealand. With the upward trend of smart cities and green buildings in both regions, wireless fire detection system will witness an increase in adoption.

The China wireless fire detection systems market is expected to grow at a CAGR of 7.5% from 2025 to 2035. Since it's the world's largest populated country and one of the world's leading manufacturing bases, China's urbanization and construction spree continues to drive the demand for sophisticated fire detection systems. The fire protection designs of buildings and local standards mandate strict fire safety practices for both residential and commercial properties, driving the demand for wireless fire detection systems. Smart cities initiatives and the Belt and Road Initiative also have driven urban infrastructure expansion, which is opening up new demand for IoT-based fire alarm systems integrated with larger smart building solutions.

In wireless fire detection systems, sensors play a pivotal role as they diligently detect and measure diverse environmental parameters to identify potential fire hazards, in turn, attaining a CAGR of 7.4% during the forecast period of 2025 to 2035. The wireless fire detection systems industry is segmented into product type as: The basic components are sensors and detectors responsible for the detection of the fire hazard such as smoke, heat or gases. Call points allow individuals to activate alarms manually in case of an emergency. Fire alarm panels and modules are the processing centers of the system, which receive inputs from detectors and trigger alarms or emergency protocols accordingly.

The global wireless fire detection systems market has an installation CAGR of 7.6% in 2025. The segment is divided into new installation and retrofit installation types. New installations are tailored for new construction or major remodeling, intended for smooth integration of the latest fire detection technology.

Retrofit installations cater to older buildings, offering a solution to modernize existing infrastructure with contemporary wireless fire detection systems. Because so many existing buildings require better fire safety features, retrofit options are common. These types are crucial in enabling a greater reach for wireless fire detection solutions in different types and ages of buildings.

As per the FMI analysis, the hybrid systems sub-segment is likely to emerge as the top system type in the market at a CAGR of 7.5% from 2025 to 2035. Wireless systems utilize only wireless communication for interconnecting various components like detectors, alarms, and control panels, providing more flexibility and more straightforward installation. Hybrid systems incorporate both wired and wireless technologies, offering a more dynamic solution for large or complicated buildings where an all-wireless solution may not be viable. These systems are gaining footholds in mixed environments with new and legacy infrastructure.

As per the FMI analysis, the application type attaining a CAGR of 7.4% growth rate from 2025 to 2035. Wireless fire detection systems find application in a range of uses, both indoors and outdoors applications. Indoor uses include residential, commercial, and industrial premises, where fire detection is important for protecting the occupants and property.

Outdoor uses, like open-air venues or big industrial complexes, need fire detection systems capable of monitoring greater areas and various environmental conditions. Both indoor and outdoor uses are enhanced by wireless systems' capability to integrate easily with other building management systems, enhancing general safety and emergency response times.

As per the FMI analysis, the vertical in the sector at a CAGR of 7.4% growth rate from 2025 to 2035. The wireless fire detection systems serves various verticals, such as residential, commercial, government, and industrial. In the residential sector, the increasing fire safety awareness and the growing number of smart homes have made fire detection systems more popular. Both the commercial and government sectors require systems with high reliability to meet regulatory compliance and for the safety of workers and the public. Industries that are involved in dealing with flammable materials or hazardous environments must implement proven fire detection solutions and Fire Fighting System Manufacturer in the manufacturing sector.

Leading players in the wireless fire detection systems market are actively engaging in strategies such as pricing, innovation, mergers & acquisitions, partnerships, geographical expansions and collaborations. These players are using advancements in technology to provide new solutions that can scan with higher accuracy and in real-time, establishing themselves as frontrunners for smart safety solutions.

These companies are also focusing on strategic partnerships and expansion in addition to innovation and competitive pricing. To expand their reach and enhance their product offerings, many are forging partnerships with regional distributors, technology companies, and system integrators to make their products more widely available.

Key Developments

Major Industry Moves

Regulatory & Segment Shifts

Emerging Competition

The demand for wireless fire detection systems is fueled by growing emphasis on safety regulations, smart building trends, and the convenience and affordability of wireless solutions. Technological developments, including IoT integration and real-time monitoring, also play a major role in driving the demand.

Wireless fire detection systems are flexible and easy to install, with no need for extensive wiring. In contrast, conventional wired systems require extensive wiring and are less flexible.

Wireless installations make residents' lives more convenient, they are simple to install and can be reconfigured or expanded according to requirements.

Wireless fire detection solutions are being used more and more in different sectors, such as residential, commercial buildings, government buildings, and industrial.

Issues involve high initial investment, compatibility with installed building management systems, and ensuring proper maintenance and periodic updates to guarantee peak performance.

Sensors/Detectors, Call Points, Fire Alarm Panels and Modules, and Input/ Output Modules

New Installation and Retrofit Installation

Wireless Systems and Hybrid Systems

Indoor and Outdoor

Residential, Commercial, Government, and Manufacturing

North America, Latin America, Europe, Asia Pacific, and Middle East and Africa

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.