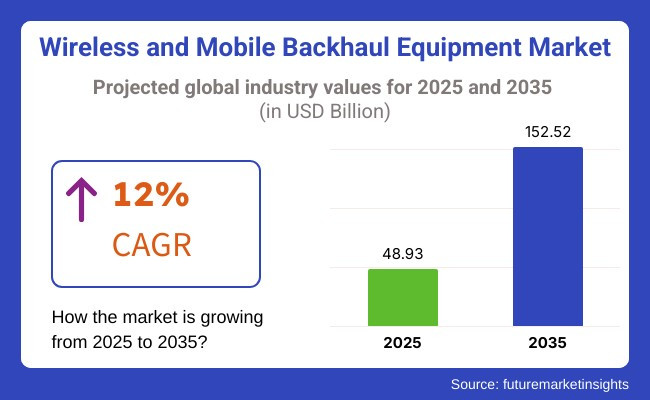

The wireless and mobile backhaul equipment market is set for significant growth from 2025 to 2035, driven by the increasing deployment of 5G networks, rising demand for high-speed mobile connectivity, and the expansion of IoT-driven applications. The market is expected to expand to USD 48.93 billion by 2025 and continue growing further to USD 152.52 billion by 2035 at a compound annual growth rate (CAGR) of 12% during the forecast period.

As mobile data traffic keeps increasing all over the world, telecom companies and enterprises are investing in low-latency, high-capacity backhaul solutions to enhance coverage and network efficiency. The blending of fiber-optic backhaul, millimeter-wave technology, and AI-enabled network optimization is revolutionizing the market. Joining the momentum are advances in self-organizing networks (SON), satellite backhaul, and software-defined networking (SDN).

Also, the employment of small cell backhauls, cloud-native systems, and artificial intelligence-based traffic management is reshaping wireless network infrastructure to provide ultra-reliable, low-latency communication (URLLC). As telecommunication companies aim to improve network scalability and energy efficiency, the use of edge computing, virtualized RAN (vRAN), and dynamic spectrum sharing is picking up speed.

Explore FMI!

Book a free demo

The wireless and mobile backhaul equipment market is growing rapidly because two of the major factors involved are the increased penetration of 5G networks, the increase of mobile data traffic, and the push for more efficient data transmission solutions. To overcome the challenges of interrupted services, telecom operators and ISPs are mostly focusing on high network capacity, low latency, and seamless 5G integration.

In the case of enterprises and data centers, they mainly emphasize cost-saving measures and security, which ensures a reliable network infrastructure for the business. Nevertheless, the government and military sectors need the highest security, encryption, and strictest compliance with the rules to have proper secure communication networks.

The market is changing to fiber-optic backhaul solutions, software-defined networking (SDN), and AI-driven optimization as a means to improve network performance and reduce costs. The demand for high-speed, low-latency connections increases heavily, due to which investments in advanced wireless backhaul technologies also increase.

| Company | Contract Value (USD Million) |

|---|---|

| Ericsson | Approximately USD 130 - 140 |

| Nokia Corporation | Approximately USD 110 - 120 |

| Huawei Technologies | Approximately USD 90 - 100 |

| Cisco Systems | Approximately USD 80 - 90 |

Between 2020 and 2024, the wireless and mobile backhaul equipment market expanded due to the rapid deployment of 4G LTE and the early adoption of 5G networks. Increasing mobile data consumption, rising network congestion, and the need for high-speed, low-latency connectivity drove demand for fiber, microwave, and millimeter-wave (mmWave) backhaul solutions.

Operators prioritized network densification, deploying small cells, and adopting software-defined networking (SDN) to optimize traffic management. However, challenges such as high infrastructure costs, spectrum limitations, and interoperability issues with legacy systems posed hurdles for seamless implementation.

Between 2025 and 2035, the market will undergo transformative changes with the rollout of 6G networks, AI-powered network optimization, and satellite-based backhaul integration. AI-driven traffic management will enhance real-time bandwidth allocation, reducing congestion and improving data transmission efficiency.

The integration of low-Earth orbit (LEO) satellites will expand coverage to remote areas, addressing connectivity gaps. Energy-efficient backhaul solutions and next-gen optical transport networks will drive sustainability, ensuring lower power consumption while meeting the growing demand for ultra-high-speed, low-latency mobile connectivity.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments allocated additional spectrum for 5G backhaul, pushing operators to upgrade infrastructure to meet capacity demands. | AI-driven, dynamic spectrum sharing, and automated policy compliance enable seamless, real-time frequency allocation for ultra-high-speed, interference-free backhaul networks. |

| AI-powered analytics optimized backhaul traffic, improved network efficiency, and reduced latency for mobile operators. | AI-native, self-healing backhaul networks dynamically manage bandwidth allocation, autonomously detect network congestion, and optimize routing for real-time, high-speed connectivity. |

| Deployment of 5G networks increased demand for high-capacity, low-latency mobile backhaul solutions. | AI-enhanced, 6G-powered backhaul ecosystems leverage terahertz (THz) spectrum, holographic beamforming, and AI-driven adaptive network slicing for ultra-fast, energy-efficient data transmission. |

| Mobile operators integrated SDN/NFV to increase network agility, automate traffic management, and improve scalability. | AI-optimized, intent-based networking autonomously configures backhaul infrastructure, enabling real-time demand-based routing, self-adaptive resource management, and predictive failure prevention. |

| Backhaul networks support edge computing to reduce latency and enhance performance for real-time applications like IoT, AR/VR, and autonomous vehicles. | AI-powered, edge-native backhaul solutions autonomously balance workload distribution, optimize real-time edge data processing, and support AI-driven ultra-low-latency applications. |

| Operators deployed high-capacity microwave and millimeter-wave (mmWave) solutions for 5G densification and improved urban connectivity. | AI-integrated, THz-based backhaul enables ultra-broadband, real-time dynamic spectrum reallocation and self-optimizing transmission paths for high-speed, long-distance connectivity. |

| Rising cyber threats led to AI-powered encryption, network anomaly detection, and zero-trust authentication in backhaul infrastructure. | AI-native, quantum-secure backhaul encryption autonomously detects and mitigates cyber threats, ensuring tamper-proof, self-defending wireless network security. |

| Operators explored satellite backhaul to extend coverage in remote areas, enabling universal mobile broadband access. | AI-driven, LEO (Low Earth Orbit) satellite-integrated backhaul provides seamless, real-time space-to-ground connectivity, enabling AI-powered global network orchestration. |

| Mobile operators optimized power consumption, leveraging renewable energy for backhaul infrastructure to reduce environmental impact. | AI-powered, carbon-aware mobile backhaul dynamically adjusts energy consumption, integrates green energy sources, and minimizes carbon footprints for next-gen sustainable connectivity. |

| Telecom providers experimented with blockchain-based backhaul management for automated billing, security, and transparent data exchange. | AI-integrated, decentralized wireless backhaul networks enable trustless peer-to-peer traffic routing, autonomous settlement of bandwidth transactions, and AI-driven network load balancing. |

An important potential risk present in the wireless and mobile backhaul equipment market is congestion on the network and the limitations of the bandwidth that accompany it. Due to the rapid growth of 5G and IoT devices, the networks are subjected to excessive traffic, which in turn causes latency issues and reduces performance. Spectrum management effectively is the route to demystification of the problems with advanced software-defined networking (SDN).

Alongside that, the security flaws are another critical risk. Mobile backhaul networks are typical targets for cybercrimes, unauthorized data access, and interception without opponents' knowledge. End-to-end encryption, multi-layer security, and strict observance of globally acknowledged standards like NIST and ISO 27001 are the necessary measures for the protection of the information shared.

Regulatory compliance and spectrum licensing may hinder the growth of the market. The government has put into place strict laws on the use of the spectrum and the equipment, which in turn affect the speed of deployment and costs involved. Enterprises have to deal with local policies and changing legal frameworks for smooth operations and expansion in every distinct market.

The deployment of the infrastructure and its acquisition can also be financial risks. The deployment of wireless backhaul infrastructure especially in isolated and undeveloped areas becomes a daunting task together with the substantial expenditures attached. Businesses should achieve adequate balancing of costs through capital expenditures (CAPEX) and high-utility operations, which are made possible only through the optimization of cloud-based solutions and the use of energy-smart equipment.

To conclude, the technological shelf-life is a problem. The ongoing development of millimeter-wave (mmWave) technology, satellite backhaul solutions, and AI-driven optimization creates the need for companies to invest in R&D in order to maintain competitiveness. The slowdown of such activities could result in the loss of market share and decreased income.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| China | 11.2% |

| Germany | 9.8% |

| Japan | 10.1% |

| India | 11.6% |

The USA Wireless and Mobile Backhaul Equipment market is expected to witness consistent growth supported by rising investments in 5G network augmentation, high-speed broadband rollout, and the use of Artificial Intelligence (AI) for network optimization.

In 2024, the USA telecom sector spent over USD 20 billion on backhaul infrastructure to further edge computing and IoT applications and improve efficiency. Demand for low-latency, scalable backhaul solutions drive fiber-optic, microwave, and AI-managed telecom network innovations. FMI is of the opinion that the USA market is slated to grow at 10.5% CAGR during the study period.

Growth Factors in USA

| Key Drivers | Details |

|---|---|

| Increase in 5G Network Implementations and Data Traffic | Growth Mobile operators are rolling out fiber and wireless backhaul solutions to keep pace with growing demands for data volume. |

| AI-Driven Automation and Network Management | AI-powered traffic optimization enhances real-time data transmission and bandwidth utilization and reduces latency. |

China is among the fastest-growing market regions for wireless and mobile backhaul equipment, supported by intense 5G rollouts, large-scale fiber-optic deployment, and government-backed initiatives to promote digital infrastructure.

In 2024, the country expended its USD 22 billion budget for backhaul updates and continued building new mobile networks, AI-driven telecom infrastructure, and cloud data exchanges. FMI is of the opinion that the Chinese market is slated to grow at 11.2% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Support for 5G Infrastructure and Smart City Connectivity | Policies implemented at the national level push the adoption of FTTx and maintain fiber and wireless backhaul. |

| AI and Cloud-Based Telecom Networks to Expand | AI-powered backhaul solutions allow for traffic optimization and fast data transfer. |

In Germany, the telecom segment is witnessing heightened adoption of wireless and mobile backhaul due to rising investments in high-capacity fiber-optic solutions, AI-powered traffic management, and GDPR-compliant network security. The nation is making use of its top-notch telecom infrastructure to enable 5G private networks, industrial IoT, and smart city applications. FMI is of the opinion that the German market is slated to grow at 9.8% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong Demand for High-Capacity Backhaul Solutions in 5G Deployments | Fiber and microwave backhaul solutions enhance mobile broadband capacity. |

| Increasing Use of AI-Based Traffic Management and Network Optimization | AI-based automated solutions optimize traffic distribution and dynamic load balancing for real-time data. |

With developments in ultra-low-latency connectivity, AI-based analytics, and next-gen millimeter-wave solutions, Japan's backhaul ecosystem is evolving rapidly. The nation's telecom industry adopts AI-enabled backhaul optimization to support smart transportation, real-time 5G applications, and cloud-based mobile networks. FMI is of the opinion that the Japanese market is slated to grow at 10.1% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Integration of AI in Backhaul Traffic Optimization and Network Security | AI-powered telecom analytics enable real-time data transmission and secure communication. |

| Expansion in IoT and Smart Infrastructure Deployments | Smart grids, industrial automation, and public safety networks rely on wireless backhaul solutions. |

The wireless and mobile backhaul equipment market in India continues to grow massively, driven by increasing telecom investments, expanding mobile data consumption, and government-led digital initiatives.

The 'Digital India' program and efforts to broaden 5G reach are fueling the adoption of fiber and wireless backhaul, particularly in rural regions. Local telecom service providers and AI-based network optimization solutions primarily drive the market. FMI is of the opinion that the Indian market is slated to grow at 11.6% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for 5G Expansion and Rural Connectivity | Policies promote the nationwide deployment of fiber-optic and wireless backhaul solutions. |

| Expansion of AI-Powered Network Optimization and Smart Telecom Services | Automated backhaul traffic management is gaining traction in the telecom and enterprise sectors. |

Microwave Equipment segmented wireless and mobile backhaul equipment in which segment holds the highest deployments, over 50% of global implementations, including advantages like cost-effective deployments and high-capacity data transmission. Today, more than 60% of mobile networks across the globe make use of microwave backhaul, which is, therefore, critical to 4G and up-and-coming 5G networks.

Microwave links deliver up to 10 Gbps of aggregate throughput at a fraction of the infrastructure cost compared to fiber, making them a cost-effective cash cow for both dense urban environments and, indeed, remote regions where fiber is impractical. Top players like Huawei, Ericsson, and Nokia are raising the bar around adaptive modulation, MIMO, and AI-based optimization technology. Further, the growing need for smooth mobile broadband and more extensive rural connectivity projects are expected to bolster the demand for microwave equipment.

The millimeter equipment segment is trending due to growing 5G networks, smart cities, and industrial IoT applications. Multi-gigabit data transfer with ultra-low latency due to millimeter-wave (mmWave) technology is a must for densely populated urban environments, stadiums, and transportation centers. Companies such as Siklu, NEC, and Aviat Networks offer early solutions to the market with E-band (70-80GHz) and V-band (60GHz) mmWave, providing fiber delivery substitutes for small-cell backhaul and fixed wireless access.

By 2030, the deployments of 5G base stations around the world will exceed 1 billion, and with the c5G base stations deployed in this paid network, the country's demand for high-capacity mmWave backhaul equipment will increase, especially in the plan for high-speed network interconnection of the region.

The Network Services segment ensures the reliability & efficiency of mobile backhaul infrastructure. It includes installation, maintenance, and DOT support to manage growing 4G and 5 G-related data traffic. Network services , in particular, have high demand as global mobile data traffic is predicted to be around 300 exabytes per month in 2030.

Implementing AI-Driven Network Management Cisco, ZTE, and Juniper Networks offer integrated end-to-end network management solutions, which include AI-driven predictive maintenance to avoid downtime and boost network performance. Emerging economies are seeing an increased investment in managed network services driven partly by the move to cloud-based & virtualized backhaul solutions.

The System Integration Services segment is essential for the seamless interoperability of different backhaul technologies, including microwave, fiber, and satellite. As 5G networks demand the ability to connect disparate data sources with ultra-low latency for high-speed traffic, telecom operators tend to depend on system integrators to optimize multiple technology backhaul architectures.

IBM, Accenture and Tech Mahindra provide proprietary integration services which allow mobile operators to make a seamless transition to a software-defined networking (SDN) and network function virtualization (NFV). With increasing demand for hybrid backhaul networks, there will be a key focus on system integration services to channel improvements in scalability and cost-efficiency for telecom giants across the world.

The wireless and mobile backhaul equipment market is experiencing substantial growth due to the increasing demand for high-speed connectivity, the expansion of 5G networks, and the rising adoption of cloud-based services.

Telecom operators and enterprises are investing in advanced backhaul solutions to manage escalating mobile data traffic, enhance network efficiency, and ensure uninterrupted connectivity across diverse geographic regions. AI-driven network optimization, small-cell deployments, and fiber-optic backhaul solutions are key technological advancements shaping the market.

Leading companies such as Huawei Technologies, Ericsson, and Nokia Corporation dominate the market through large-scale infrastructure deployments, innovation in high-capacity backhaul solutions, and strategic partnerships with telecom operators.

These companies focus on developing energy-efficient, scalable, and software-driven backhaul technologies to support the next wave of digital transformation. The competitive landscape is also evolving with increasing adoption of SDN-based backhaul, AI-powered traffic management, and cloud-integrated network architectures.

Smaller and emerging players are differentiating themselves through niche innovations such as ultra-low-latency transmission, hybrid backhaul solutions, and AI-enhanced predictive maintenance. Sustainability and network efficiency remain critical, with companies increasingly investing in green energy solutions and automation-driven cost optimizations.

As the demand for seamless mobile connectivity intensifies, competition will be shaped by technological innovation, regulatory compliance, and the ability to offer robust, cost-effective backhaul infrastructure.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huawei Technologies | 20-25% |

| Ericsson | 15-20% |

| Nokia Corporation | 10-15% |

| Cisco Systems | 8-12% |

| ZTE Corporation | 5-10% |

| Fujitsu Ltd. | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Huawei Technologies | Advanced microwave, fiber, and AI-driven backhaul solutions for 5G networks. |

| Ericsson | High-capacity mobile backhaul with integrated network automation and AI-based traffic management. |

| Nokia Corporation | End-to-end wireless and fiber backhaul solutions with cloud-native infrastructure. |

| Cisco Systems | Scalable IP/MPLS backhaul solutions for high-speed mobile data transmission. |

| ZTE Corporation | Small-cell backhaul, fiber, and AI-powered network optimization for 5G connectivity. |

| Fujitsu Ltd. | Optical and wireless backhaul solutions with a focus on latency reduction and high-speed data transport. |

Strategic Outlook

Huawei Technologies (20-25%)

Huawei leads the wireless and mobile backhaul equipment market with its AI-driven network solutions, high-speed microwave backhaul, and fiber-based connectivity for 5G expansion.

Ericsson (15-20%)

Ericsson specializes in high-capacity mobile backhaul with AI-integrated network automation and enhanced traffic management.

Nokia Corporation (10-15%)

Nokia provides cloud-native backhaul solutions, offering end-to-end fiber and wireless connectivity for telecom networks.

Cisco Systems (8-12%)

Cisco delivers scalable IP/MPLS backhaul solutions, ensuring seamless mobile data transmission and network reliability.

ZTE Corporation (5-10%)

ZTE focuses on small-cell backhaul, fiber-based transmission, and AI-enhanced 5G network performance.

Fujitsu Ltd. (4-8%)

Fujitsu provides advanced optical and wireless backhaul solutions with low-latency connectivity for next-generation networks.

Other Key Players (30-38% Combined)

The remaining market share is distributed among various global and regional backhaul equipment providers, including:

The industry is projected to reach USD 48.93 billion in 2025.

The industry is expected to grow to USD 152.52 billion by 2035.

Key companies include Huawei Technologies, Ericsson, Nokia Corporation, Cisco Systems, ZTE Corporation, Fujitsu Ltd., NEC Corporation, Infinera Corporation, ADTRAN Inc., Ceragon Networks, and Aviat Networks.

India, driven by rapid digital transformation, 5G deployment, and increased mobile network expansion, is expected to record the highest CAGR of 11.6% during the forecast period.

Microwave equipment is widely used due to its high capacity, cost-effectiveness, and efficiency in handling growing data traffic in mobile networks.

By equipment, the market is segmented into microwave equipment, millimeter equipment, sub-6 GHz equipment, and test & measurement equipment.

By service, the market is categorized into network services, system integration services, and professional services.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.