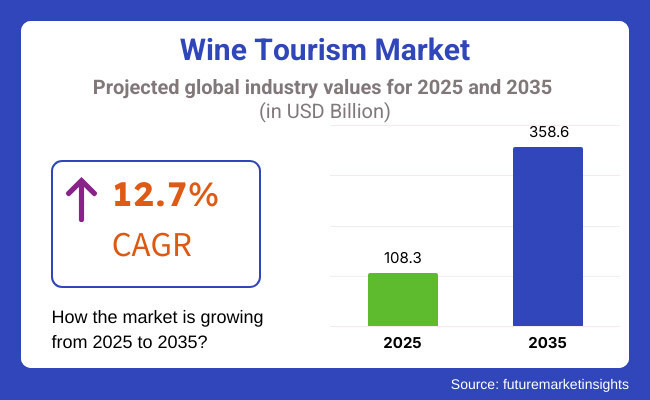

The wine tourism market is forecast to expand significantly from USD 108.3 billion in 2025 to USD 358.6 billion by 2035. A CAGR of 12.7% is expected during this period. The growth is driven by the rising demand for wine tasting, vineyard visits, and curated food pairings. Both wine connoisseurs and casual tourists are increasingly drawn to these experiential offerings, fueling market expansion.

Experiential and cultural travel trends have played a key role in supporting the wine tourism market. Investments have been made by local wineries and tourism authorities to improve infrastructure and visitor engagement. These enhancements have created more immersive, authentic experiences that appeal to a wider audience. Wine festivals, guided tours, and vineyard events have become more frequent and diverse.

Sustainability has become a central theme within wine tourism. Eco-conscious travelers increasingly seek out vineyards practicing organic farming, water conservation, and biodiversity preservation. As a result, eco-friendly tours and sustainable wine production have gained prominence. This has added an attractive dimension to wine tourism, aligning with global environmental awareness.

Authoritative industry reports have reinforced the significance of wine tourism. The UN World Tourism Organization’s Global Wine Tourism Report 2025 highlights wine tourism’s role in sustainable development, rural economic diversification, job creation, and preservation of cultural heritage. Similarly, the Annual Global Wine Tourism Report 2025 by the Wine Industry Advisor confirms wine tourism as a dynamic and profitable market segment, while stressing the need for data-driven policy and business planning.

Key geographic regions such as Europe, North America, and Australia continue to dominate the market due to their established wine industries and well-developed tourism sectors. Meanwhile, emerging wine-producing countries in Asia-Pacific and South America have begun attracting more visitors. These regions are investing in wine tourism infrastructure and marketing to capitalize on growing interest.

The integration of wine tourism with local gastronomy, cultural festivals, and heritage sites is being emphasized. This holistic approach helps attract a broader range of tourists and enhances the overall appeal. Additionally, technological innovations such as digital booking platforms, virtual vineyard tours, and augmented reality experiences have increased accessibility and engagement.

The wine tourism market is expected to witness robust growth through 2035. The focus on authentic experiences, cultural immersion, and sustainability will continue to attract diverse tourist segments worldwide. Ongoing investment in infrastructure and innovative offerings is likely to further boost the market’s expansion.

Winery visits and the 30-40 age group together account for more than 65% of the wine tourism market revenue in 2025.Winery visits lead with a 38.7% market share, while the 30-40 demographic contributes 26.8%, driven by experiential preferences and digital engagement.

In 2025, winery visits and tastings are projected to hold a dominant 38.7% share of the global wine tourism market. This growth is driven by tourists seeking immersive and educational experiences. Wineries such as Robert Mondavi in Napa Valley and Château Pichon Baron in Bordeaux attract thousands annually through curated activities like guided vineyard tours, barrel tastings, and food pairing dinners. These offerings enhance customer interaction while enabling on-site purchases of wine, memberships, and exclusive vintages.

Events like grape harvest festivals and winemaker dinners stimulate off-season demand. Hunter Valley seasonal wine-food festivals in Australia illustrate this trend. Additionally, virtual tastings hosted on platforms like Cellar Pass broaden the revenue base, reaching global customers. Consumers can taste and purchase directly, regardless of location.

The blend of physical and digital experiences strengthens loyalty and brand engagement. With an increase in direct-to-consumer sales, repeat visits, and global participation, winery visits are set to remain a core revenue generator in the evolving wine tourism landscape, particularly as preferences shift toward authentic, local, and curated experiences.

The 30-40 age group is expected to contribute 26.8% of the total wine tourism market revenue in 2025. This demographic has high disposable income and a strong inclination toward experiential travel. Wineries such as Ram’s Gate in Sonoma and Bodega Garzón in Uruguay appeal directly to their lifestyle preferences, offering customized tastings, vineyard cycling tours, and interactive wine-blending workshops. Modern tasting lounges and aesthetically appealing vineyard setups attract social media-driven visitors looking for unique experiences.

This age group frequently engages with digital booking platforms like Vivino and Wine Paths, making it easier for them to plan and share experiences. Wineries promote events such as sunset tastings and vineyard concerts through Instagram and similar channels, ensuring high visibility and participation. Moreover, subscription-based models-like those from Black Stallion Winery-build long-term customer loyalty through curated wine deliveries.

These platforms also offer early access to special vintages, maintaining recurring revenue. By targeting this age group’s digital behavior, preference for quality, and engagement with lifestyle branding, wine tourism operators can ensure sustained contribution from this customer segment across physical and online channels.

A major transformation is being observed in the wine tourism industry. Experiences rooted in culture, sustainability, and personalization are being prioritized. Digital integration is being accelerated across booking, promotion, and customer engagement. Market players are being guided by shifts in traveler expectations. Greater emphasis is being placed on authenticity, wellness, and local community engagement.

Driving forces in experiential innovation and demand personalization

Wine regions are being rediscovered by travelers seeking authenticity. Sustainable farm practices are being promoted by estate owners. Local food pairings are being featured in curated tastings. Personalized experiences are being offered by boutique vineyards. Visitor data is being used to tailor activities.

Heritage stories are being embedded in tour content. Interest in slow travel is being observed. Immersive vineyard walks are being requested more often. Booking platforms are being optimized for mobile use. Group experiences are being restructured around exclusivity. Tasting formats are being diversified to cater to health-conscious visitors. Emotional connections to regions are being strengthened through storytelling.

Opportunities emerging through digital adoption and regional branding

Digital tools are being adopted to streamline visitor experiences. Virtual tours and online bookings are being used more widely. Social media storytelling is being harnessed to attract international travelers. Regional identity is being built through collaborations with local artisans. Destination marketing is being personalized for different visitor segments. Scenic wine routes are being mapped digitally for ease of access. Wine festivals are being repackaged with wellness components.

Loyalty is being cultivated through branded merchandise and take-home kits. New revenue streams are being explored through hybrid online-offline experiences. Influencer partnerships are being utilized for global visibility. Community inclusion is being emphasized in every visitor interaction. Local employment is being supported through tourism infrastructure investments.

Challenges in service consistency and environmental balance

Inconsistent service standards are being flagged by returning visitors. Training programs are being requested across hospitality teams. Climate uncertainty is being noted as a threat to seasonal planning. Waste management practices are being scrutinized by regulators. Visitor impact on rural ecosystems is being monitored more closely. Local traditions are being diluted when large volumes are not managed well. Language barriers are being reported in non-English speaking regions. Pricing transparency is being questioned in luxury vineyard packages.

Route overcrowding is being documented during peak harvest periods. Visitor expectations are being misaligned with actual winery capacities. Wine education levels are being found insufficient among new guides. Experience quality is being affected by staff shortages in high-demand seasons.

Threat landscape shaped by imitation and poor differentiation

Generic experiences are being rejected by returning guests. Market saturation is being observed in popular wine destinations. Copy-paste itineraries are being criticized in online reviews. Wine offerings without regional storytelling are being undervalued. Repeat visitation is being hampered by lack of novelty. Heritage wines are being under-promoted in favor of mainstream labels. Differentiation is being weakened when branding is inconsistent. Traveler reviews are being ignored in experience redesign.

Competing wine regions are being chosen due to better digital presence. Niche wine varietals are being overlooked by larger operators. Cultural context is being removed when international formats are copied. Experience loyalty is being lost when expectations are not matched.

The wine tourism market is being shaped by rising interest in vineyard-based experiences, luxury travel, and regional branding. India is growing the fastest, while the United States continues to lead with high-end offerings. China, South Korea, and Australia-New Zealand are advancing through destination marketing, youth appeal, and eco-tourism initiatives.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

| China | 5.4% |

| South Korea | 5.2% |

| United States | 5.1% |

| Australia-New Zealand | 4.9% |

Indian wine tourism market is being expanded by domestic tourism, lifestyle changes, and luxury travel demand. A CAGR of 5.7% is being projected from 2025 to 2035. Regions such as Nasik and Karnataka are being promoted through events like SulaFest and wine-tasting programs. Vineyard resorts are being developed with wellness, hospitality, and cultural experiences. Support is being provided through state incentives and tourism campaigns. A growing middle class is being drawn to weekend retreats and wine trails.

Social media is being used for branding and bookings. Agri-tourism is being supported by policies, leading to improved infrastructure and investor confidence. Indian wineries are being integrated into culinary travel circuits. Experiential travel is being aligned with local wine culture. Regional travel agencies are promoting vineyard circuits. Interest is being generated among young travelers and urban professionals. India is being positioned as a rising star in experiential wine tourism globally.

In China, wine tourism market is being elevated by luxury destination branding and infrastructure investments. A 5.4% CAGR has been projected. Regions like Ningxia, Shandong, and Yunnan are being developed as premium vineyard zones. Upscale wine resorts and grape harvest festivals are being hosted. High-income consumers are being targeted through curated wine tastings and vineyard tours. Support is being provided by local governments through cultural tourism grants.

Online booking platforms are being adopted to streamline travel. Domestic wine brands are being promoted through destination storytelling. Emphasis is being placed on sustainability, digital engagement, and culinary fusion. Vineyard tourism is being supported by rising wine consumption among urban youth. Mobile apps, WeChat campaigns, and influencer promotions are being used. Interest is also being created for international visitors through export-focused wine tourism programs. China is being aligned with premium wine travel by promoting both product quality and scenic appeal.

South Korean wine tourism market is being supported by youth demand, pop culture ties, and rural revitalization policies. A 5.2% CAGR is being estimated. Domestic vineyards in Gyeonggi, Gangwon, and Jeolla are being upgraded to host aesthetic events, beauty-themed retreats, and wellness wine tastings. Interest is being driven by social media trends and the desire for Instagram-worthy experiences. Local governments are promoting agri-tourism and vineyard heritage through regional campaigns.

Seasonal festivals are being designed for domestic travelers. Young tourists are being encouraged to explore vineyards through themed travel packages. Fusion experiences, including music, spa, and local food, are being created. Wine education workshops and DIY bottling experiences are being introduced. Support is being given to local wineries to improve product quality. Cultural immersion is being fused with vineyard tourism. South Korea is being recognized for its creative wine experiences and compact regional tourism models.

The United States wine tourism market is being led by structured experiences, luxury services, and eco-tourism alignment. A 5.1% CAGR is being projected. Iconic wine regions like Napa Valley and Sonoma are being promoted globally. Luxury lodgings, private vineyard tastings, and helicopter tours are being offered. Farm-to-glass experiences and culinary pairings are supporting the market. Tourism boards are collaborating with vineyards to market sustainable and heritage wine routes.

Eco-certifications are being highlighted for responsible travel. Virtual tastings and wine events are being held online. Bookings are being made easier through integrated digital platforms. Local producers are targeting wellness tourism through vineyard yoga and nature trails. Heritage wine estates are being branded as cultural destinations. Wine festivals and regional food tours are being promoted together. The United States is being maintained as a benchmark for immersive wine travel and high-value vineyard tourism.

The Australia-New Zealand wine tourism market is being shaped by eco-tourism models, scenic vineyard routes, and clean-label wine practices. A 4.9% CAGR has been projected. Areas like Barossa Valley, Hunter Valley, and Marlborough are being developed with eco-lodges, helicopter tastings, and wildlife-linked wine trails. Domestic travelers are being engaged through sustainability storytelling. International tourists are being targeted through regional culinary experiences and biodiversity tours.

Indigenous heritage is being integrated into vineyard experiences. Government funding is being allocated to improve local infrastructure. Wine festivals are being hosted to showcase regional flavors. Support is being provided to winemakers using organic methods. Cross-sector partnerships are being promoted between tourism and agriculture. Wine and food pairings are being designed around environmental themes. Australia and New Zealand are being positioned as leaders in low-impact, nature-inspired wine tourism, blending natural landscapes with world-class wine travel.

The wine tourism market has been shaped by rising demand for experiential luxury and cultural travel. Tier 1 operators like Delaire Graff Estate, MaisonRémy Martin, and the Napa Valley Wine Train have delivered premium hospitality. Focus has remained on heritage branding, fine dining, and immersive tastings.

These firms have combined wine with art, history, and high-end lodging. Tier 2 suppliers such as BKWine Tours, Gourmet Touring, and ViñaMatetic have created niche value through personalized travel experiences. Educational tours and sustainability-focused offerings have been promoted to appeal to independent and eco-conscious tourists.

Tier 3 players like Villa Melnik and CVNE have relied on regional promotion and community-based tourism. Investment in cellar tours, local varietals, and storytelling has helped differentiate offerings. Barriers to entry have included brand recognition, infrastructure costs, and seasonal travel risks. The market has remained fragmented but increasingly structured around luxury, authenticity, and sustainability as core themes.

Recent Wine Tourism Industry News

In 2023, MaisonRémy Martin marked its 300th anniversary by reopening its historic house in Cognac, France. New visitor experiences such as the Opulence Masterclass and Cocktail Masterclass were introduced. These formats have allowed guests to explore XO cognac pairings and mixology using Rémy Martin spirits.

In the same year, ViñaMatetic in Chile received the Global Best Of Wine Tourism award. Recognition was given by the Great Wine Capitals network for its excellence in biodynamic and sustainable tourism practices.

As of 2025, BKWine Tours has continued offering curated wine experiences in Europe and beyond. Destinations have included France, Spain, Portugal, Argentina, and South Africa. However, no formal announcement has confirmed new tour additions in Georgia or Slovenia.

These updates reflect the industry’s growing focus on authenticity, sustainability, and high-value wine travel offerings-backed by verified activities from globally recognized wine tourism leaders.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 108.3 billion |

| Projected Market Size (2035) | USD 358.6 billion |

| CAGR (2025 to 2035) | 12.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tourists for volume |

| Types Analyzed (Activity Type) | Winery Visits and Tasting, Wine Trails, Wine Festivals and Events, Wine Education and Workshops, Other Activities |

| Age Groups Analyzed | Less than 20 years, 20-30 years, 30-40 years, 40-50 years, Over 50 years |

| Demography Analyzed | Men, Women |

| Tourism Types Analyzed | Domestic Tourists, International Tourists |

| Tour Types Analyzed | Individual, Group |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia and Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, France, Germany, Italy, Spain, China, Japan, India, Australia, South Africa, Argentina, Chile, New Zealand |

| Key Players influencing the Wine Tourism Market | BKWine Tours, Gourmet Touring, González Byass, Villa Melnik Winery, Vergelegen Estate, Compañía Vinícola del Norte de España (CVNE), Viña Matetic, Napa Valley Wine Train, Delaire Graff Estate, Maison Rémy Martin |

| Additional Attributes | Luxury and experiential travel trends drive premium wine tours, European regions dominate cross-border wine trails, millennial and Gen Z travelers boost social-media-based promotion, international tourists contribute high per capita spend, digital platforms improve booking access and personalized itineraries. |

By activity type, the market is categorized into Winery Visits and Tasting, Wine Trails, Wine Festivals and Events, Wine Education and Workshops, and Other Activities.

By age group, the market is categorized into Less than 20 years, 20-30 years, 30-40 years, 40-50 years, and Over 50 years.

By demography, the market is categorized into Men and Women.

By tourism type, the market is categorized into Domestic Tourists and International Tourists.

By tour type, the market is categorized into Individual and Group.

By region, the market is geographically segmented into North America, Eastern Europe, Western Europe, East Asia, South Asia and Pacific, Latin America, and Middle East and Africa.

The global Wine Tourism Market is projected to reach USD 108.3 billion by 2025.

The market is expected to expand substantially, reaching approximately USD 358.6 billion by 2035.

Key companies include BKWine Tours, Gourmet Touring, González Byass, Villa Melnik Winery, Vergelegen Estate, Compañía Vinícola del Norte de España (CVNE), Viña Matetic, Napa Valley Wine Train, Delaire Graff Estate, and Maison Rémy Martin.

Rising interest in experiential travel, increasing global wine consumption, and the integration of culinary and cultural experiences are key growth drivers.

Europe, especially France, Spain, and Italy, remains the dominant region, while South Africa, Chile, and the USA continue to gain international appeal.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA