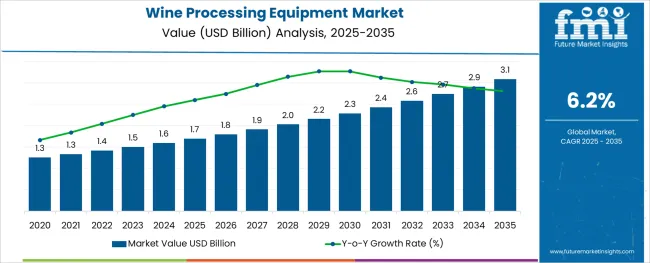

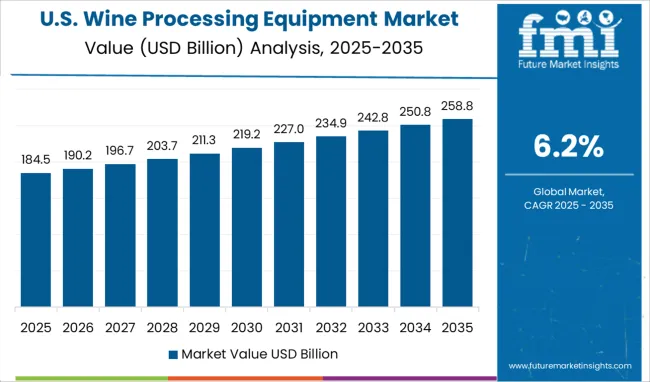

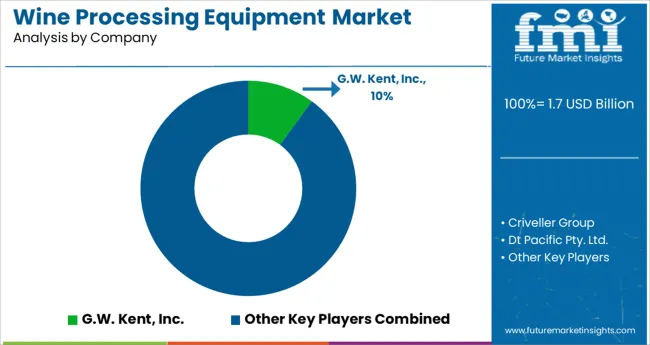

The Wine Processing Equipment Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The wine processing equipment market is experiencing steady growth, driven by rising global wine consumption, modernization of wineries, and the pursuit of efficiency and quality in production processes. Growing consumer demand for premium wines and increasing investments by wineries in advanced production technology have propelled the adoption of specialized equipment.

The market is further supported by regulatory emphasis on hygienic processing and sustainability in manufacturing. Future growth is expected to be sustained by the expansion of vineyards in emerging markets, adoption of automation to reduce operational costs, and innovations in material and energy efficient designs.

The focus on improving yield, maintaining consistent product quality, and reducing waste is paving the path for further technological adoption and market penetration.

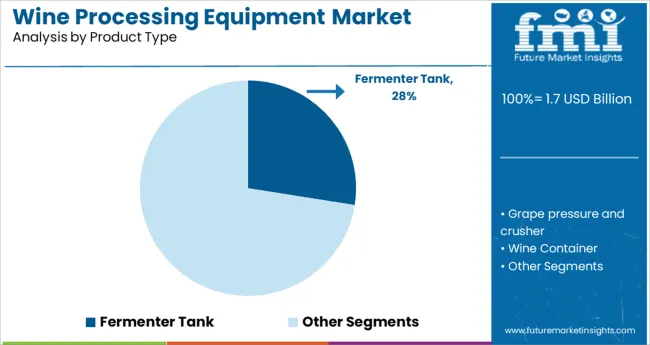

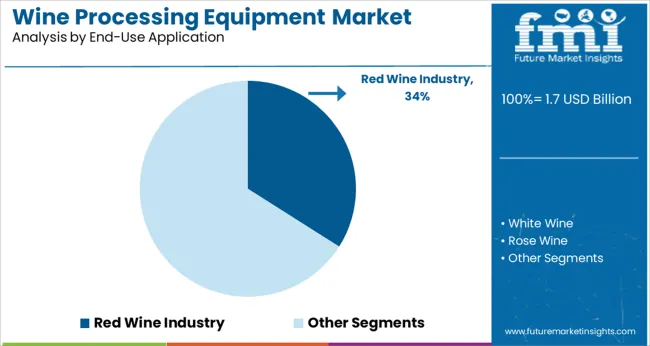

The market is segmented by Product Type and End-Use Application and region. By Product Type, the market is divided into Fermenter Tank, Grape pressure and crusher, Wine Container, Wine Tank, Wine Temperature Control, and Wine Filtration. In terms of End-Use Application, the market is classified into Red Wine Industry, White Wine, Rose Wine, Sparkling Wine, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type the fermenter tank segment is projected to hold 27.5% of the total market revenue in 2025 positioning it as the leading product type. This dominance has been driven by its central role in the winemaking process as it enables controlled fermentation ensuring consistency and quality of output.

The ability of fermenter tanks to offer precise temperature regulation hygiene and scalability has been instrumental in their widespread adoption. Observations from the industry show that wineries are increasingly upgrading to advanced stainless steel and automated fermenters to improve process efficiency and meet stringent quality standards.

Additionally the longevity and lower maintenance requirements of modern fermenter tanks have contributed to their preference over traditional alternatives reinforcing their leadership within the product landscape.

Segmented by end use application the red wine industry segment is anticipated to capture 34.0% of the market revenue in 2025 securing its position as the largest application segment. This leadership has been reinforced by the enduring global popularity of red wines and the greater complexity involved in their production which necessitates specialized and robust equipment.

The longer aging periods and higher demand for precise temperature and oxygen control in red wine production have driven investment in advanced processing technologies. Furthermore the premiumization trend in red wine has led producers to adopt equipment that enhances quality and efficiency while supporting larger batch sizes.

The resilience of red wine demand even in changing consumer markets and its significant share in the overall wine industry have further solidified the prominence of this segment in driving equipment sales and innovation.

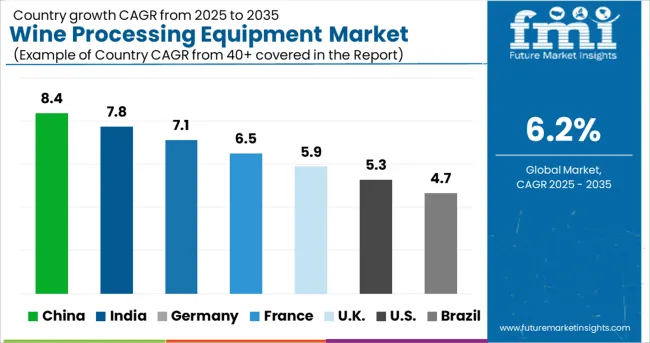

The global wine processing market is expected to grow at a steady CAGR of 6.2% between 2025 and 2035 in comparison to the 5.4% CAGR registered during the historical period from 2020 to 2025.

Rising consumption of wine, an increasing number of bars & lounges, and the growing popularity of premium wines are some of the key factors driving the worldwide wine processing equipment industry.

In recent years, demand for both white and red wine has skyrocketed as a result of the availability of a wide range of wine products, increasing penetration of social media, and growing awareness about the health benefits of consuming wine. The global wine processing equipment market is projected to benefit from this.

Similarly, increasing search for new wine products with innovative flavors, advancements in wine processing technology, and a rise in the export of wine are expected to aid in the expansion of the wine processing equipment during the projection period.

A number of influential factors have been identified that are expected to spur growth in the global wine processing equipment market during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence wine processing equipment sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Increase in Export of Wine Generating Demand in the USA Wine Processing Equipment Market

According to FMI, the USA wine equipment market is currently valued at USD 3 Billion and it is expected to grow steadily at a CAGR of 5% during the next ten years. Growth in the USA wine processing equipment market is driven by rising production and consumption of wine due to its health benefits, increasing the number of wineries, and advancements in wine processing technologies.

The wine industry in the USA is thriving and experienced a massive 16.8% uptick in wine sales in the year 2024. Similarly, the increasing export of wine is playing a key role in facilitating the growth of the wine-processing equipment market.

According to the National Association of American Wineries, total US wine exports reached USD 1.3 billion in value in 2020 and this number is expected to further surge during the next few decades. Driven by this demand for wine processing equipment across the USA is expected to rise at a steady pace.

Penetration of online wine shopping platforms, growing consumer inclination towards purchasing wine products through online mode, and rapid expansion of the white wine industry due to the culture of gifting white wine as a gift are expected to bolster sales of wine processing equipment in the USA during the next ten years.

Rising Consumption of Wine Boosting Market in the UK

As per FMI, the UK wine processing equipment market is valued at USD 125 Million and it holds around 22% of the market share in the Europe wine processing equipment market. This can be attributed to the rising consumption and export of wine, lax government regulations, and increasing sales through digital platforms.

Although beer is the most popular alcoholic drink in the UK wine has a strong following. The per capita wine consumption was 15.5 bottles for the year 2024 in the UK With it being easier to order online from mobile, wine sales will continue to rise which in turn will push the demand for wine processing equipment.

High Consumption of Red Wine Due to Its Multiple Health Benefits Pushing Demand in the Market

Based on end-use application, the red wine segment holds the largest share of the global wine processing equipment market and it is expected to grow at a CAGR of 6.2% from 2025 to 2035. This can be attributed to the rising production and consumption of red wine across the world due to its various health benefits.

Red wine has several health benefits, including lowering blood sugar levels, weight loss, and lessening the effects of colds and congestion. Furthermore, because red wine is regarded as the strongest wine on the market, it is the most popular among corporations and millennials. As a result, major winemakers are experimenting with diverse flavors in red wine. This will help accentuate sales of wine processing equipment.

On the other hand, emerging trends reveal that the sparkling wine segment is likely to grow at a higher CAGR over the next ten years, owing to the rising awareness among consumers about the potential health benefits of sparkling wine due to the presence of various antioxidants and nutrients.

The global wine processing equipment market has become highly competitive due to the presence of a large number of regional and domestic players. To capitalize on the emerging opportunities and solidify their position, leading wine processing equipment manufacturers are adopting strategies such as new product launches, mergers, acquisitions, partnerships, and collaborations. For instance,

As the global demand for wine continues to rise, various companies are jumping into the wine processing equipment business to grab this opportunity. As a result, the number of start-ups has increased significantly during the last few years. One such start-up company is Oeuf De Beaune.

Founded in 2020 by Virginie Fournier and Marc Nomblot, the France Based Oeuf de Beaune company specializes in handcrafted concrete tanks. The company uses only spring water, clay-based cement, Loire sand, and Burgundy gravel to manufacture its innovative tanks.

For fermenting and maturing wines, Oeuf de Beaune’s concrete egg tanks provide a natural insulator for stabilizing the temperature gradually. These tanks are suitable for all types of wines.

Similarly, founded in 2020 WINEGRID is focused on developing innovative technological solutions for process digitalization in the wine industry. The company has become quite popular among wine manufacturing industries for its products like WINEGRID Systems.

Based on IoT, WINGRID Systems, in addition to contributing to increased productivity and efficiency, allow a reduction of costs in processes and are an important support in oenological decision-making.

The company recently launched e-volum, a new solution to monitor wine storage. The solution helps to keep track of the wine stock in general and in each tank.

in 2020 JUCLAS USA was started in the USA with the aim to provide winemakers in North America with the same top-quality products and equipment know-how the company is known for.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| Value-based CAGR (2025 to 2035) | 6.2% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Application, Region |

| Key Companies Profiled | Criveller Group; Dt Pacific Pty. Ltd.; G.W. Kent, Inc.; Love Brewing Limited; Northern Brewer; Paul Mueller Company, Inc.; Grapeworks Pty Ltd.; Vitikit Ltd; Arsilac; Brive Tonneliers; Bucher Vaslin; Tec Inox; Themas; PMH Vinicole; Cazaux Rotorflex; Cave De Bissey; Cadalpe Srl; ENOTEC |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global wine processing equipment market is estimated to be valued at USD 1.7 billion in 2025.

It is projected to reach USD 3.1 billion by 2035.

The market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types are fermenter tank, grape pressure and crusher, wine container, wine tank, wine temperature control and wine filtration.

red wine industry segment is expected to dominate with a 34.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Destemmer Market - Growth & Demand 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Wine Crusher Market Growth - Winemaking Equipment & Industry Trends 2025 to 2035

Wine Subscription Market Analysis by Subscription Model, Wine Type, Price Tier, and Subscription Frequency and Region through 2035

Wine Cooler Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA