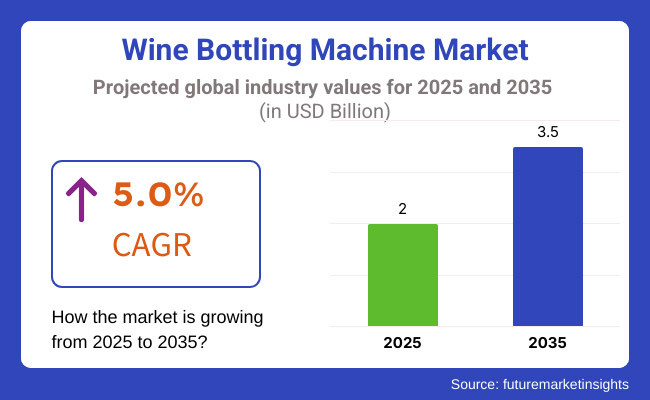

The global wine bottling machine market is estimated to account for USD 2.0 billion in 2025. It is anticipated to grow at a CAGR of 5.0% during the assessment period and reach a value of USD 3.5 billion by 2035.

Industry Outlook

From 2025 to 2035, the wine bottling machine market is projected to grow steadily at a CAGR of approximately 5%, with driving factors from technological innovation, growing automation, and expanding global consumption of wine. The implementation of intelligent bottling technologies such as IoT-based machines and AI-based quality control systems will improve productivity and reduce wastage.

Sustainability trends will also compel manufacturers to create energy-efficient and green bottling solutions, lowering carbon footprints. The growth of online wine retail and direct-to-consumer channels will also propel demand for small, home-compatible products.

In addition, the growing markets in Asia-Pacific and Latin America will emerge as primary drivers of growth because of increasing disposable income and changing consumer behavior in favor of premium and craft wines. Overall, innovation and automation will characterize the market landscape, ensuring consistent growth over the decade ahead.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to pandemic-related disruptions in 2020 to 2021 but recovery afterward, with rising wine production. | Steady and sustained growth, driven by increasing automation and demand for premium wines. |

| Basic automation and semi-automated bottling machines were widely used. | Advanced automation with AI, IoT, and robotics for precision bottling and quality control. |

| Recovery of the wine industry post-COVID, increasing consumer demand, and the expansion of online wine sales. | Increasing global wine consumption, increasing home bottling trends, and smart bottling innovations. |

| Limited focus on sustainability; plastic components and traditional bottling techniques were still common. | Strong emphasis on sustainability, with eco-friendly materials, reduced carbon footprints, and recyclable packaging. |

| Growth in demand for organic and natural wines, but home bottling remained niche. | Increased adoption of compact and home-friendly bottling machines for personalized winemaking. |

| Stricter regulations on preservatives and labeling requirements, but minimal changes in bottling techniques. | More stringent sustainability regulations and standardization of automated bottling processes. |

| Moderate investment in R&D, mainly by large manufacturers. | Heavy investments in R&D, especially in smart bottling technology and shelf-life enhancement. |

| Growth concentrated in traditional wine-producing regions like Europe and North America. | Stronger growth in emerging markets like Asia-Pacific and Latin America due to increasing wine consumption. |

| Supply chain disruptions due to COVID-19 and geopolitical instability impacted production and exports. | More resilient supply chains, with localized production and automation-driven efficiency improvements. |

High demand for sustainability and environment-friendly culture As more consumers search for customized and home-based bottling of wines, the need for small and straightforward bottling machines is rising. Small-scale wine manufacturers and wine aficionados are using the machines to tailor tastes, play with blends, and manage bottling procedures. House wine bottling fun and ease are about to boom, particularly where a developing culture of wine is being experienced.

The shift to green operations and sustainability is reorganizing the sector. The clients are requesting machinery that lessens wastage, employs recyclable materials, and saves energy. Others are going for recycling of glass bottles and reducing packaging as means of lessening impressions on the planet. As awareness for sustainability increases, the manufacturers of bottling machines are integrating green technology and low-carbon into their machines in response to customers' demands.

Premiumization and craft wine culture is one of the other dominant trends. Consumers are searching for better quality, small-batch, and handcrafted wines and are therefore turning to wineries and independent small producers that are investing in next-generation bottling technology. Automated bottling machines with oxygen-controlled technology, high-precision filling technology, and preservation options for guaranteeing quality are now being preferred by boutique wineries and luxury wine consumers.

Consumer habits are being transformed by digitalization and intelligent technology. Real-time tracked, smartphone app-controlled, AI-optimized productivity IoT-connected bottling machines are already in the pipeline. Commercial manufacturers as well as wine aficionados are moving towards data-driven bottling solutions to ensure consistency and extend the shelf life of their products.

Direct-to-consumer (DTC) wine consumption is on the rise, driving the need for versatile and expandable bottling machines. With sales of wine online exploding, wineries and small, independent producers need to fill orders for personalized and subscription-based customers efficiently at small scales. Demand for modular, automated, and space-saving bottling machines is hence increasing.

Based on product type, the market is divided into vacuum filling machines and enolmatic vacuum filler. Vacuum fill machines are utilized more in the wine bottling sector than Enolmatic vacuum fillers because they are more scalable, efficient, and capable of processing large volumes of production.

They are often utilized by wineries and commercial bottlers due to their precise filling with little oxidation, which is critical for maintaining wine quality. Vacuum filling machines work by producing a vacuum within the bottle so that wine will pass through freely without too much turbulence, hence flavor and aroma preservation. Their versatility to hold bottles of various sizes and speed capabilities make them suitable for the production of medium to large volumes.

By operation mode, the market can be segmented as semi-automated and automated. Automatic machines are not as frequent as automatic wine bottling machines, particularly in commercial wineries and major production houses. Higher efficiency, consistency, and speed are offered by automated bottling machines, and therefore they are well suited for fulfilling the rising worldwide demand for wine.

The machines execute a number of processes, including bottle sterilizing, filling, corking, labeling, and packaging, with minimal human involvement. Their ability to process thousands of bottles within an hour cuts labor costs, reduces contamination, and ensures uniformity in quality, which is why they are the winery and mass production's preferred equipment.

On the basis of application, the market is categorized into commercial purpose, beverage industry purpose, and others. Commercial-use wine bottle machines are applied more widely than beverage industry-use machines, primarily because they are designed specifically to meet the special requirements of wine bottling, such as control of oxygen, precise filling, and compatibility of corks.

Big and small wineries both place top priority on commercial wine bottling machines to ensure quality consistency, extended shelf life, and efficient production. These machines accommodate different bottle sizes, handle sensitive glass bottles with care, and often include vacuum or gravity filling mechanisms to preserve the wine's integrity.

The USA wine bottling machine market will expand further due to the strong foundation of wineries, increasing wine consumption, and continuous technological advancement. Digitalization and automation will be a key driver of increasing efficiency, with wineries settling for AI-based bottling lines, smart monitoring systems, and eco-friendly packaging solutions.

Direct-to-consumer consumer sales and online wine distribution will increasingly create demand for flexible and scalable bottling equipment. Low-energy, recyclable, and carbon emission saving will also be a product of sustainability efforts.

Home winemaking and craft wine making will define the United Kingdom wine bottling machines market. Customers are opting more for small and convenient personal usage bottling machines, whereas tiny wineries and start-ups opt for semi-automatic and versatile bottling machines so that they can balance cost and manufacturing.

As ecological concerns become even more important, the market would move towards environment-friendly material, returnable glass bottle systems, and energy-conserving bottling systems. Growing boutique winery and online wine store businesses also will offer an opportunity to modernize bottling technology.

Being the world's most advanced wine manufacturer, France will take the lead in adopting innovations in automated bottling solutions with a focus on keeping it green and maintaining quality. Conventional wineries are embracing oxygen-controlled filling technology, nitrogen-flush bottling technology, and robotic automation to increase the shelf life of wine and streamline operations.

The growing demand for biodynamic and organic wines is driving the evolution of waste-minimizing, low-impact bottling technology. Export wineries are also putting money into high-speed, AI-driven bottling machines to keep up with the growing global demand for French premium wines.

The Italian wine bottling machine market will be spurred by growing export markets, premium wine demand, and technology adoption in bottling. Wineries are adopting precision-filling machines, vacuum bottle technologies, and computerized control systems to secure the integrity of their wines and enhance efficiency.

Growth in organic and sustainable practices in wine making is spurring the adoption of recyclable packages, light-glass bottles, and green bottling lines. Boutique winemakers are also investing in semi-automatic bottling solutions to meet growing demand for small-batch, hand-made wines.

China's growth in its wine industry and domestic consumption will propel solid demand for highly automated, AI-enabled wine bottle machines. Wineries are adopting high-speed production lines, precise bottling systems, and smart quality-control technologies to maximize efficiency and keep up with increased consumer demands.

Increasing e-commerce and direct-to-consumer wine sales is encouraging wineries to opt for flexible on-demand bottling systems. Wineries will also keep emphasizing sustainability, with lower-energy bottling technology, lower-waste packs, and new-generation bottle re-use systems, to stay in line with international green standards.

The Australian wine bottling machines market will further evolve with increasing premium wine production and overseas export markets. Wineries are adopting automated bottling lines with better quality control systems, vacuum-filling technology, and AI-enhanced efficiency upgrades to offset international pressures.

Sustainability will be the highlight, with more focus on energy-efficient bottling operations, biodegradable packaging, and bottle reuse. With boutique wineries gaining popularity, there will be a requirement for customized and small-batch bottling solutions that will allow producers to maintain quality, flexibility, and affordability.

The market for wine bottling machines is comparatively concentrated, with global giants and local players collectively determining competition. Leading players focus on technological innovation, automation, and sustainability for optimum efficiency and quality output. Strong brands are in command owing to good distribution channels and sophisticated bottling solutions optimized for large wineries and commercial producers.

Local and specialty producers lead the market's growth by offering economical, flexible bottling options to boutique producers and home winemakers. The compact, semi-automatic machines allow them to compete in specialty markets. The growing number of craft wineries and boutique producers is creating demand for variable, small-capacity bottling machines worldwide.

Merger, acquisition, and strategic alliances characterize competition in the market as companies ramp up production capability and enhance knowledge technology. Investment in intelligent bottling equipment, AI-fueled automation, and environment-friendly packaging propels industry metamorphosis. International producers focus on customized solutions for different forms of wines in order to capture market growth across mature and upcoming wine-producing nations.

Major Developments

As per FMI analysis, the market for wine bottling machines is highly competitive with regional and international players offering innovative bottling solutions. Large companies focus on automation, precise filling, and sustainability to offer solutions to wineries of all sizes. Old-established brands dominate the market because of technical expertise, global distribution, and long-term partnerships with beverage companies and winemakers.

Local manufacturers compete by offering low-cost and flexible bottling machines intended for small wineries, craft producers, and home winemakers. Their ability to supply customized, space-efficient, and user-friendly equipment allows them to dominate niche market niches. Expansion of boutique wineries and independent wine producers continues to offer opportunities for new entrants and specialized machine developers.

Industry stakeholders focus on innovation, investing in AI-driven automation, robotic filling systems, and smart monitoring technologies. Companies also focus on oxygen-free bottling, nitrogen flushing, and high-tech sealing processes to enhance wine preservation and shelf life. Competition becomes more intense as sustainability is the key driver, pushing companies to develop eco-friendly and low-energy solutions.

Merger and acquisitions, and strategic partnerships define the competitive environment and enable manufacturers to increase product offerings, penetrate new geographies, and solidify supply chains. Large players acquire local players to grow their portfolios, while startups bring with them innovative bottling technologies. The worldwide demand for premium and organic wines pushes forward the use of high-tech bottling systems.

Online shopping platforms and direct-to-consumer wine distribution patterns reconfigure competition, with wineries looking for on-demand bottling capabilities. Industry leaders offer scalable and modular machines, offering the flexibility to adapt to changing production needs. As the sector aligns itself to digitalization, firms offering connected automation, cloud-based analysis, and remote monitoring features attain the upper hand in the dynamic marketplace.

The market is anticipated to reach USD 2.0 billion in 2025.

The market is predicted to reach a size of USD 3.5 billion by 2035.

Technology Co., Ltd., Qingzhou Tongda Packaging Machinery Co., Ltd, and others.

With respect to product type, the market is classified into vacuum filling machines and enolmatic vacuum filler.

In terms of mode of operation, the market is segmented into semi-automated and automated.

In terms of application, the market is divided into commercial purpose, beverage industry purpose, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.