The wind turbine gear oils market size is anticipated to be worth USD 511.1 million in 2025. The industry is likely to reach USD 986.8 million in 2035, at a CAGR of 6.8% during the forecast period. In 2024, the wind turbine gear oils industry remained robust, with sustained growth driven by combined driving factors of escalating wind power installations and augmented demand for optimized lubrication products. The year marked a drift towards synthetic gear oils as they offered better oxidation stability and higher lifespans that minimized maintenance downtime.

Regulatory urgency to reduce environmental footprint resulted in greater use of biodegradable and low-toxicity lubricants. The Asia-Pacific, especially China and India, witnessed a sharp growth in demand on account of aggressive renewable energy policies and growing wind farm installations. Europe, in turn, concentrated on offshore wind farms, raising the demand for high-performance lubricants that are capable of resisting extreme marine conditions.

The industry will grow significantly through 2035. This Growth in the industry will be driven by continued tech advancement, such AI- and IoT-enabled predictive maintenance solutions that optimize lubrication cycles. Initiatives for sustainability and government programs with incentives for using renewable power will further augment demand. However, supply chain inefficiency and uncertainty of raw material pricing can potentially pose some challenges.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 511.1 million |

| Industry Size (2035F) | USD 986.8 million |

| CAGR | 6.8% |

Future Market Insights (FMI) engaged in a comprehensive survey with the most important stakeholders in the Wind Turbine Gear Oils industry to determine industry trends, challenges, and prospects. It was a survey comprising wind farm operators, turbine producers, lubricant providers, and regulatory institutions to gather a balanced view of the industry's direction.

About 78% of respondents said that the transition to synthetic and bio-based lubricants is gaining momentum due to longer oil-drain intervals and improved performance under harsh conditions. More than 65% of turbine operators also pointed to growing dependence on predictive maintenance technologies, combining IoT and AI to fine-tune lubrication schedules and minimize downtime.

One of the major findings of the survey was increasing supply chain volatility. More than 60% of lubricant suppliers indicated challenges in procuring high-quality base oils because of geopolitical risks and volatile raw material prices. This notwithstanding, players in the industry are optimistic,and 72% anticipate stable demand growth as worldwide wind power capacity increases.

Regulatory compliance was a major point stressed by stakeholders, especially in Europe and North America, where manufacturers are being compelled to come up with low-toxicity and biodegradable lubricants due to strict environmental regulations.

Looking forward, the survey said China and the Asia-Pacific are to lead the industry growth, with more than 80% of respondents citing the two regions as target expansion industries for fast-growing wind farm installations. Moreover, European and American offshore wind developments are opening new avenues with tailor-made lubricants formulated for corrosive marine environments being popular. Still, pressures around cost continue to pose an issue, as a staggering almost half of those interviewed cited prices as a likely inhibitory factor against premium synthetic oils uptake.

| Country/Region | Regulations & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| Germany |

|

| France |

|

| Italy |

|

| Australia-NZ |

|

| China |

|

| South Korea |

|

| Japan |

|

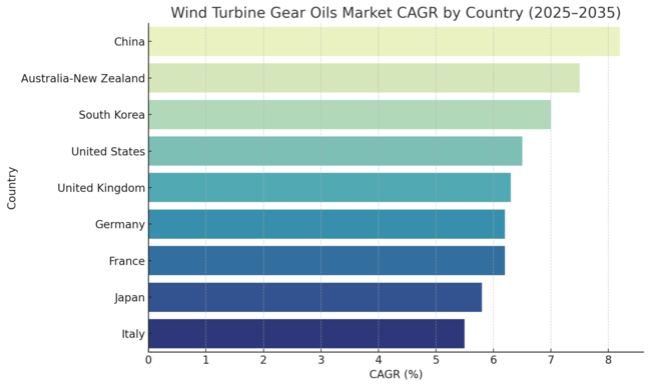

The USA wind turbine gear oils industry is driven by the strong government support for wind energy, including incentives from the Inflation Reduction Act of 2022 (IRA) and the continued availability of the Investment Tax Credit (ITC), which is expected to drive steady growth in the USindustry. The growing demand for synthetic and biodegradable lubricants is being driven by the expansion of offshore wind along the East and West Coasts. The USA wind turbine gear oils industry size is expected to reach USD 547.7 million by 2035, growing at a CAGR of 6.5% from 2025 to 2035.

Key trends are the EPA's push for environmentally acceptable lubricants (EALs) and predictive maintenance advancement. However, issues around supply chain disruptions and rising raw material costs continue to be a challenge in the industry.

FMI opines that the United States wind turbine gear oils sales will grow at nearly 6.5% CAGR through 2025 to 2035.

The UK Offshore Wind Sector Deal target of 50 GW by 2030 will surge the demand for high-performance lubricants. Regulatory bodies such as EU REACH and BS ISO 61400-4 apply strict sustainability standards, he explains. The wind turbine gear oils industry in the country will grow at a CAGR of 6.3% over the next decade. While wind operators are embracing AI-powered lubrication monitoring, challenges include high prices and supply limitations. Industry growth will be driven by expansion in offshore wind power in the North Sea.

FMI opines that the United Kingdom wind turbine gear oils sales will grow at nearly 6.3% CAGR through 2025 to 2035.

The wind turbine gear oils industry of Germany is anticipated to expand at a value CAGR of 6.2% over the forecast period from 2025 to 2035. Germany's Renewable Energy Sources Act (EEG) is increasing the demand for synthetic lubricants for wind turbines. Quality compliance is maintained as per regulations like DIN 51517 and ISO 12925-1. Predictive maintenance investments are on the rise, but rising raw material prices and supply chain challenges loom. The North Sea and Baltic Seaoffshore windfarms will provide longer-term growth.

FMI opines that the Germany wind turbine gear oils sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The global demand for French wind turbine gear oil is forecasted to expand at a 6.2% value CAGR between 2025 and 2035. Supported by EU Ecolabel certification, the use of low-toxicity and biodegradable lubricants is being promoted through France’s Energy Transition Law. Growth driver: offshore wind due to the expansion of offshore wind in Normandy and Brittany. Despite these concerns, sensor-based lubrication monitoring is gaining traction, even as compliance costs and oil price fluctuations are on the rise.

FMI opines that the France wind turbine gear oils sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The wind turbine gear oils industry in Italy is expected to grow at the CAGR of 5.5% during the period of 2025 to 2035. Italy is growing more slowly because of bureaucratic holdups in approving wind projects. But the demand for high-performance synthetic oils is driven by growing compliance with EU lubricant directives and an emergence of UNI EN ISO certifications. Offshore projects in Sicily and Sardinia will sustain growth, though high costs and limited demand for advanced lubricants present challenges.

FMI opines that the Italy wind turbine gear oils sales will grow at nearly 5.5% CAGR through 2025 to 2035.

With a CAGR of 8.2%, China’s wind turbine gear oils industry is anticipated to be the fastest-growing industry globally. Global growth is also eclipsed by China, where the rapid expansion of wind farms under the China Renewable Energy Law drives national growth. GB lubricant standards and CCC certification required by the government. Offshore wind is surging along the eastern seaboard, generating demand for corrosion-resistant lubricants, but supply chain disruptions and cost pressures remain.

FMI opines that the China wind turbine gear oils sales will grow at nearly 8.2% CAGR through 2025 to 2035.

The South Korea wind turbine gear oil industry will grow at a 7.0% CAGR. Demand for lubricants is being driven by South Korea’s Green Energy Policy and offshore wind development. Operators are moving towards synthetic and biodegradable oils in compliance with Korean Industry Standards (KS M 2131). But base oils being highly import dependent creates challenges.

FMI opines that the South Korea wind turbine gear oils sales will grow at nearly 7.0% CAGR through 2025 to 2035.

Japan'sindustry is expected to account for a 5.8% CAGR, which is lower than the worldwide average. Japan’s move to wind power is sluggish, but offshore developments and government tax breaks aid moderate gains. Lubricants must meet certain automotive lubricant specificationsthat are governed by Japanese Industrial Standards (JIS) K 2219, under the Japan Ministry of Economy, Trade, and Industry (METI) regulations. Import dependency and high costs are still obstacles.

FMI opines that the Japan wind turbine gear oils sales will grow at nearly 5.8% CAGR through 2025 to 2035.

The outlook for the wind turbine gear oils industry in Australia and New Zealand is projected to grow with a 7.5% CAGR. Growth is propelled by Australia's Renewable Energy Target, or RET, and offshore wind expansion. Predictive Maintenance Adoption and ISO 6743-4 Certification for Lubricants is increasing. However, supply chains are affected by logistical problems at far-flung wind farms.

FMI opines that the Australia-NZ wind turbine gear oils sales will grow at nearly 7.5% CAGR through 2025 to 2035.

The water treatment chemicals market is segmented by type into coagulants & flocculants, corrosion inhibitors, scale inhibitors, biocides & disinfectants, chelating agents, anti-foaming agents, pH adjusters and stabilizers, and others. By end use, the market serves power generation, oil & gas, mining, chemical, food & beverage, and other industries. Regionally, the market spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa (MEA).

From 2025 to 2035, Synthetic gear oil is likely to dominate the wind turbine gear oils industry due to its excellent performance in extreme conditions. Wind turbines, especially those in offshore conditions, use lubricants that must resist high loads, thermal cycles and oxidation. They are also moving to environmentally friendly lubricants, with an increasing number of biodegradable synthetic formulations. But high costs may dampen widespread adoption, particularly in cost-sensitive industries, where some operators might still favor mineral-based gear oils.

Mineral gear oil will support firm demand for wind, particularly in older turbines and cost-sensitive areas. Most existing onshore wind farms are using mineral-based lubricants owing to their low prices and their use in current turbine systems. Although synthetic alternatives yield improved performance, mineral gear oils suffice for moderate climatic conditions.

Commonly named after their respective mineral oil, expect breakthrough developments to improve the properties of your typical mineral oil formulations with extravagant additives to enhance longevity and efficiency. But the industry share of mineral oils is likely to come down gradually due to increasing focus on lower maintenance and sustainability by the operators.

Sustainability, being a significant focus for manufacturers, ensures a slow-burn adoption of other gear oil formulations,such as semi-synthetic and bio-based products. Ecosystem-friendly lubricants (EALs) have been developing new bio-based formulations due to government and regulatory pressures from around the world. While these alternatives are likely to be effective for offshore and ecologically sensitive wind farms.

The growth of large-scale installations across the globe will result in continuous demand for gear oils in onshore wind farms. Operators favour long-lived lubricants that minimize maintenance frequency and thereby guarantee continuous power generation. To support the growth of onshore wind farms in more extreme environments, there will be an increasing demand for high-performance gear oils to withstand different temperature and humidity conditions.

Cost efficiency will continue to be one of the important factors contributing to the growth of gear oil, and a mixture of synthetic and mineral gear oils will cater to various industry segments. Furthermore, the rise of predictive maintenance technologies will drive the need for smart lubricants that improve the efficiency of turbines.

Various governments have set ambitious targets for wind energy, which will result in an exponential increase of demand for gear oil in offshore wind farms. Offshore turbines are subjected to extremely challenging environments, and that means that they need synthetic lubricants that can resist corrosion, oxidation and extreme pressure conditions.

Operators are investing more and more in long-life gear oils, as they reduce maintenance visits that are more expensive and riskier in offshore sites. The need for biodegradable lubricant products and eco-friendly formulations is driving lubricant selection, prompted as well by regulatory frameworks. As floating offshore wind technology continues to develop, gear oil formulations must evolve to face the demands of deep-sea installations.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth, driven by increasing wind energy installations worldwide. Government incentives and renewable energy policies accelerated demand for wind turbine lubricants. However, supply chain disruptions due to COVID-19 affected production and distribution. | The industry will witness stronger growth fueled by aggressive wind energy expansion targets. Offshore wind projects will drive demand for high-performance synthetic and biodegradable gear oils, with advanced formulations gaining traction. |

| Synthetic gear oils gained popularity due to their superior efficiency, but cost concerns limited their adoption in some regions. Many onshore wind farms continued using mineral-based lubricants due to affordability. | Synthetic lubricants will dominate as operators prioritize longer drain intervals and predictive maintenance. Bio-based and environmentally friendly alternatives will see higher adoption due to stricter regulations. |

| Emerging economies, particularly China and India, saw a surge in wind farm installations, increasing lubricant demand. Europe led in offshore wind expansion, while the USA ramped up investments in renewable energy. | China will continue to dominate wind energy expansion, followed by the USA and Europe. Offshore wind will be a key focus in regions like the North Sea, the USA East Coast, and Asia-Pacific. |

| Technological advancements in wind turbines required improved lubricant formulations, but the widespread adoption of predictive maintenance solutions was still in the early stages. | AI-driven lubrication monitoring and predictive maintenance systems will become standard, optimizing lubricant use and extending turbine lifespan. |

| Environmental regulations started shaping lubricant choices with the initial adoption of environmentally acceptable lubricants (EALs). However, compliance costs and limited awareness have slowed adoption in some industrie s. | Governments will enforce stricter sustainability regulations, pushing widespread adoption of biodegradable and low-toxicity gear oils. Certification requirements will become more stringent, influencing purchasing decisions. |

| The industry faced challenges from fluctuating crude oil prices, affecting raw material costs. Supply chain bottlenecks further impacted production and availability. | Supply chain resilience will improve as manufacturers diversify sourcing strategies. However, rising raw material prices and geopolitical tensions may create occasional cost pressures. |

| Onshore wind remained the dominant application, with offshore wind still in its growth phase. Offshore projects required specialized lubricants, but adoption was gradual. | Offshore wind will experience rapid expansion, increasing demand for high-performance, corrosion-resistant lubricants. Onshore wind will remain significant but grow at a slower pace. |

Macro-economic View

The wind turbine gear oils industry falls under the industry lubricants and supports renewable energy. It is interlinked with renewable sources, wind energy, industry, power generation and specialty chemicals. It is significant in the global energy transition and is influenced by policies, environmental regulations, and wind power technology.

The industry is primarily governed by increasing investments in renewable energy infrastructure due to global initiatives toward carbon neutrality and net-zero emissions. Countries are adding wind power, both land and sea, to cut reliance on fossil fuels. This growth directly increases the demand for high-performance lubricants that improve the efficiency and longevity of wind turbine elements. Being petroleum-derived and used in gear lubricants, industry growth is influenced by the ups and downs in crude oil prices.

The industry also deals with cost pressures from global supply chain disruptions, geopolitical instability and inflation. Increasing raw material prices and stringent environmental policies are prompting manufacturers to manufacture biodegradable and synthetic lubricants, corresponding to international sustainability targets. Moreover, innovations in predictive maintenance and AI-based monitoring are changing lubricant utilization trends, delivering higher efficiency and lower operating costs to wind farm operators.

Top-tier companies in the wind turbine gear oils industry are competing based on price strategy, product innovation, strategic alliance, and geographic expansion. Whereas some players target cost-effective products to reach price-sensitive industries, others target high-performance synthetic lubricants with extended drain intervals and better efficiency. Players are also spending on R&D to come up with biodegradable and environmentally acceptable lubricants (EALs) that comply with the stringent sustainability requirements.

Growth tactics focus on international expansion and partnerships with wind turbine original equipment manufacturers and renewable energy companies. Industry leaders are entering into long-term supply contracts with wind farm owners to tie up firm demand. Some are buying regional lubricant producers to gain a presence, while others are improving predictive maintenance capabilities through AI-based lubrication monitoring. As offshore wind energy continues to grow rapidly, firms are coming up with specialized lubricants that have greater corrosion, oxidation, and weather resistance, providing long-term competitiveness.

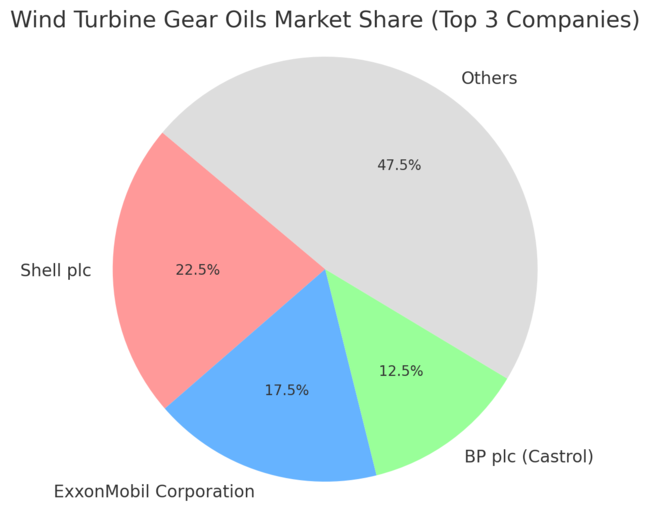

The global wind turbine gear oils market is dominated by key players such as Shell plc, holding an estimated market share of 20-25% owing to its advanced lubricant solutions and strong global presence, followed by ExxonMobil Corporation with 15-20% share driven by its high-performance gear oils and innovation in renewables. BP plc, through its Castrol brand, commands around 10-15% of the market with a focus on specialized, sustainable lubricants.

Total Energies SE holds 10-12% market share, known for high-quality and eco-friendly gear oils, while Fuchs Petrolub SE captures 8-10% with its strong wind energy lubricant portfolio. Chevron Corporation maintains a 5-8% share as it expands its footprint in the sector. The remaining 15-20% is split among other players like Kluber Lubrication, Petro-Canada Lubricants, and various regional suppliers, who add diversity to the market despite holding smaller individual shares.

The wind turbine gear oils market is witnessing notable consolidation and strategic repositioning through mergers and acquisitions. In early 2024, Shell significantly bolstered its leadership in the renewable lubricants segment by acquiring Castrol's wind turbine lubricants business, consolidating technical expertise and expanding its market share.

Similarly, ExxonMobil reinforced its wind energy portfolio by acquiring a specialized synthetic lubricants manufacturer, enabling it to cater more precisely to the performance demands of modern turbines. TotalEnergies, aiming to enhance its position in industrial lubrication for renewables, completed a merger with a European industrial lubricants firm, allowing for greater penetration into the continent’s growing wind sector.

Strategic partnerships are also shaping the competitive landscape as companies seek innovation and application-based testing. Chevron has entered into a collaboration with a major wind turbine OEM to co-develop advanced gear oils tailored for the increasing torque and scale of offshore turbines, signaling a move toward highly customized formulations.

Valvoline, on the other hand, announced a partnership with a prominent wind farm operator to test and fine-tune gear oil formulations under real-world turbine conditions, improving performance validation. Meanwhile, Fuchs Petrolub launched a joint research initiative with a materials science institute to pioneer bio-based gear oils, aligning with broader sustainability trends in wind energy operations.

To meet escalating global demand, particularly from emerging markets, several companies are expanding operational capacity and product portfolios. Klüber Lubrication has scaled up its synthetic gear oil production in Asia, anticipating rising installations in the region. Mobil Industrial introduced a new line of gear oils engineered for the challenges of offshore wind, marking a targeted product expansion. Additionally, SINOPEC is increasing its European footprint by establishing new distribution channels for its wind turbine lubricant range, signaling its intent to compete more aggressively in the global market.

Synthetic gear oil, mineral gear oil and others

On-shore and off-shore

North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East and Africa

Growing wind energy adoption and the need for efficient, long-lasting lubricants.

Synthetic oils dominate due to superior durability and performance.

Stricter environmental laws push for biodegradable and low-toxicity oils.

Raw material costs, supply chain disruptions, and offshore maintenance issues.

AI-driven monitoring and advanced additives enhance performance and longevity.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Litre) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wind Vane Wiring Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Wind Speed Alarm Market

Window Rain Guards Market

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Forging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Pitch and Yaw Drive Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Automation Market Insights - Growth & Forecast through 2035

Wind Turbine Composite Material Market Size 2024-2034

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Wind Turbine Shaft Market

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA