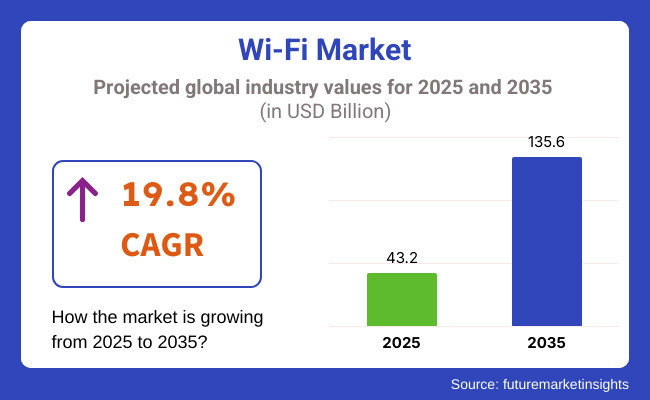

The Wi-Fi market will reach phenomenal revenues of USD 43.2 billion by 2025 while growing to USD 135.6 billion by the end of 2035. This points towards a healthy 19.8% CAGR through the forecast period. Increasing demand for wireless high-speed connectivity, growing construction of smart cities, and rising need for enterprise and home networks play a crucial role in the market growth.

As digital transformation is revolutionizing one industry after another, the technology is also evolving to meet the bandwidth, latency, and security requirements of next-generation applications and connected devices. The technology has matured into a fundamental layer of digital infrastructure that connects ever‐increasing numbers of internet of things (IoT) devices, cloud services, and real‐time communications solutions.

From Wi-Fi 6 to Wi-Fi 7, new standards of networking are laid in place, making the network more used without letting up and dealing with betterment in congestion and overall performance. Enterprises, public sector organizations, and homes are widely adopting mesh networking technology, AI-driven optimization of networks, and cloud-controlled Service to provide boundary-less connectivity.

With the rise of intelligent technologies, the technology is quickly becoming an indispensable enabler of connected environments that increase productivity and fuel new waves of innovation in automation, smart homes and digital workplaces. Driving the Growth of the Industry: Moreover, the demand is significantly driven by rising dependence on wireless connectivity for business operations, remote working, and recreational activities.

The infrastructure is being built by deploying fiber-optic and 5G networks with full-coverage connectivity solutions. Apart from that, government initiatives for digital inclusion and smart city programs are also driving the wider adoption of it. This is accelerating global investments of organizations in next-gen management solutions to enhance network performance, optimize bandwidth utilization, and boost cyber security through AI and automation.

It’s Now a Growing Urban and Countryside Connectivity. However, the market is rising, creating a number of growing pains. The high cost of the infrastructure required to upgrade networks to support Wi-Fi 6 and Wi-Fi 7 capabilities could also limit deployments to small and medium businesses. Security reasons - including unauthentic access, cyber-attacks, and third-party data privacy - act as critical barriers.

The PwC report recommended technology solutions such as intelligent spectrum management to avoid network congestion and bandwidth spikes in highly populated urban areas (city centers and stadiums) and thereby avoid outdated frequency. In addition, other regulations (related to the allocation of wireless spectrum) can influence the speed of deploying it in certain markets. Electronics businesses are experiencing the demand for intelligent solutions that assist with enhancing connectivity and minimizing downtime, especially in high-use settings.

And it is turning to cloud-managed technology solutions to help the company manage its networks remotely and bolster its security. Promising ultra-high-speed connectivity to areas such as healthcare, manufacturing, and smart cities, the anticipated arrival of Wi-Fi 7 this year will most likely revolutionize wireless communications for a second time. Even as dependency on digital ecosystems is at an all-time high across the world, the Industry will witness an extremely high degree of innovation to afford quick, secure, and uninterrupted wireless networking for the next decade.

The industry is skyrocketing, primarily due to increased connectivity demands, digital enterprise transfer, and the IoT ecosystem. Wi-Fi 6 and Wi-Fi 6E drivers are used by both enterprises and industries at full throttle for cutting the speed and latency and augmenting the device capacity.

Thus, high-density population areas can work without disturbances. Healthcare organizations prioritize high-reliability secure networks for their work remotely on patient monitoring, telehealth, and digital records management. For example, look at the retailers and hospitality businesses that have moved concentrating on the smooth guest experiences, security in public Wi-Fi, and analytics-driven insights in their list of priorities.

Coupled with that, the industrial applications have brought in solutions that work hand in glove with IoT and AI-based automation to cause invoice and monitoring in real time. Growing requirements for networks with low overhead, enhanced safety measures, and economical scalability keep setting the agenda, where mesh networking and cloud-based Wi-Fi management are emerging as the most advantageous technologies for superior performance and connectivity.

| Company | Contract Value (USD Million) |

|---|---|

| Cisco Systems | Approximately USD 120 - USD 130 |

| Aruba Networks (HPE) | Approximately USD 90 - USD 100 |

| Qualcomm Technologies | Approximately USD 80 - USD 90 |

| NETGEAR Inc. | Approximately USD 70 - USD 80 |

Between 2020 to 2024, the Industry experienced strong growth driven by remote work development, smart home consumer demand, and IoT connectivity. Wi-Fi 6 and 6E deployment boosted network capacity, reduced latency, and improved connectivity in crowded spaces.

Big data and AI made networks optimized in real-time to make it more reliable and faster. Networks based on the cloud provided central monitoring and management of numerous networks. Mesh network systems became popular for greater coverage and elimination of dead spots. Overcrowding, security risks, and incompatibility with legacy devices were the drawbacks.

Between 2025 and 2035, AI-based, self-optimizing networks will dynamically assign bandwidth and channels according to current user demand and external conditions. Wi-Fi 7 and subsequent versions will be deployed, providing multi-gigabit speeds, ultra-low latency, and higher capacity for devices.

Quantum encryption will provide a boost in security inside the network against malicious cyberattacks. Edge AI will allow the optimization of the network at the local level, with improved connectivity and reduced interference. Blockchain-authenticated networks will provide device security and user anonymity. Energy-efficient gear will minimize energy consumption, aligning with sustainability goals. Intelligent networks will enable end-to-end connectivity across smart cities, autonomous transport, and industrial environments, turning it into a high-speed, secure, and responsive system.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments increased spectrum allocations (e.g., 6 GHz band) for Wi-Fi 6/6E to lower congestion and enhance performance. | AI-based spectrum management and dynamic frequency allocation maximize real-time traffic capacity for smooth connectivity in high-density urban and industrial IoT use cases. |

| Consumers and businesses migrated to Wi-Fi 6/6E to enjoy higher speeds, lower latency, and better multi-device connectivity. | Self-optimizing Wi-Fi 7 networks based on AI with multi-link operation (MLO) allow ultra-low latency applications like AR/VR, autonomous systems, and metaverse experiences. |

| Artificial intelligence-based Wi-Fi analytics improved network performance with congestion forecasts, channel optimization, and self-diagnostics. | AI-native Wi-Fi networks detect usage patterns, fix connectivity errors, and provide in-real-time security interventions against cyber threats. |

| Metropolitan areas deployed public Wi-Fi networks to improve connectivity, optimize transport systems, and facilitate smart infrastructure. | Self-repairing AI-based Wi-Fi mesh networks provide fast, secure urban connectivity for smart city applications, real-time traffic control, and AI-based emergency response. |

| Wi-Fi 6 has been used by industries to support smart manufacturing, connected health, and logistics for efficiency and automation. | Ultra-reliable, AI-driven Wi-Fi 7 industrial networks facilitate real-time control of robots, AI-driven supply chain optimization, and low-latency edge computing for predictive maintenance. |

| Remote work and hybrid offices put further pressure on high-performance, secure enterprise and home Wi-Fi solutions. | AI-driven, context-aware Wi-Fi networks dynamically switch bandwidth, prioritize enterprise app latency, and enable more advanced security for improved remote collaboration. |

| Telecom operators launched Wi-Fi and 5G hybrid networks to improve indoor coverage and offload mobile traffic. | Seamless AI-based Wi-Fi-7-to-6G handovers provide unbroken ultra-high-speed connectivity, enabling real-time applications such as autonomous mobility, immersive AR/VR, and holographic communication. |

| Growing cybersecurity threats resulted in greater use of WPA3 encryption, AI-driven intrusion detection, and cloud-managed Wi-Fi security. | AI-born, zero-trust Wi-Fi architectures blend quantum-secure encryption, real-time anomaly detection, and decentralized authentication to deliver enterprise-level security. |

| Power-efficient Wi-Fi chips and adaptive power management reduced power consumption in enterprise and consumer deployments. | AI-tuned, self-sustaining Wi-Fi networks employ energy-harvesting technologies, minimizing carbon footprints and facilitating sustainable smart city and industrial IoT deployment. |

| Wi-Fi motion sensing-capable applications in the smart home, elderly care, and security surveillance. | Non-intrusive health monitoring, AI-optimized smart building control, and gesture-based device control for future human-machine interaction, enabled by AI-driven Wi-Fi sensing technologies. |

The Industry is subject to several risks, particularly cybersecurity threats. As more and more devices are connected (IoT, smart homes, enterprises), the hacking, data breaches, and unauthorized access risks have become more and more crucial. Businesses are required to adopt the latest technologies such as strong encryption, firewalls, and network monitoring to counter these awful vulnerabilities.

Regulatory compliance is a serious issue. Governments all over the world, on the one hand, impose spectrum regulations, data privacy laws, and security standards (GDPR, FCC, TRAI, etc.). Companies that do not comply with those would-be fines, loss of operational time, and consumers’ distrust which negatively affects their profitability.

The continuous introduction of newer technology, for instance, Wi-Fi 6 and Wi-Fi 7, causes older devices and infrastructure to be redundant. As a result, the firms have to regularly replace hardware and software which results in the above situation and thus increasing capital expenditure (CAPEX) and maintenance costs.

Network congestion and performance issues in densely populated urban areas are another issue facing risk. The presence of numerous consumers in public areas like airports, stadiums, and corporate offices cause the signal interference with the system which leads to speed drops, and poor user experience, respectively, affecting service providers' reputation.

World economies being low or wars might also be reasons for the deficiencies in the chain of supply for hardware components such routers, chips, and antennas. Chip shortages and factory disruptions may occur, which can negatively affect the hardware manufacturing segment by raising costs, delaying supplies, and causing losses.

The hardware segment serves as the mainstream in the Industry, including routers, access points, wireless controllers, network interface cards, and range extenders. Wi-Fi 6 and Wi-Fi 6E adoption is picking up speed with the need for dynamic businesses and mentors to deliver faster speeds, lower latency, and better network efficiency. The need for high-performance hardware is being driven by smart homes, enterprises, and industrial IoT applications.

Companies such as Cisco, Aruba (Hewlett Packard Enterprise), and TP-Link are contributing significantly to innovation by developing next-generation hardware to enable connectivity without disruptions. Moreover, the growing number of smart city initiatives and public networks in regions such as the Asia Pacific and North America is increasingly contributing to market growth. With hybrid work environments coming into play, enterprises are also rolling out enterprise-grade to give employees secure and fast access to help them collaborate from home.

By avoiding manual workarounds and failures that result in downtime, the solutions segment is changing the way organizations are managing and securing their networks as organizations turn to subscription-based cloud WaaS offerings that provide real-time information about the network, cybersecurity, and network management from anywhere in the world. Wi-Fi network optimization is being transformed by AI-based solutions that can analyze traffic patterns, predict network congestion, and automate troubleshooting.

One such example is Juniper Networks’ Mist AI, which empowers enterprises to manage their network proactively, causing a decrease in downtime and improved performance. In addition, enterprise-grade threats from the cyber domain, with its foundation embedded in network security, are forcing enterprises to invest in upgraded network security systems that provide protection against botnets, cyberattacks, and data breaches.

The high-density technology segment is imperative for places where multiple users/devices need to connect at the same time. High-density technology enables seamless low-latency connectivity in stadiums, airports, universities, and shopping malls. As more and more IoT devices, smart surveillance systems, and cloud applications are adopted in these environments, the need for powerful, high-capacity networks have grown exponentially.

So along, SoFi Stadium in Los Angeles deployed a high-density Wi-Fi 6E solution that allows tens of thousands of spectators to watch and use digital service without congesting the network. Several airports, such as Changi Airport in Singapore, are implementing AI-powered network optimization solutions to accommodate constantly changing traffic loads and maintain quick, seamless connectivity for passengers.: And as public spaces get increasingly digital, the huge demand for high-density technology networks will only increase.

Enterprise-class is designed for secure, high-performance wireless connectivity across corporate office spaces, manufacturing plants, healthcare facilities, and financial services businesses. Enterprises are deploying AI-powered, cloud-managed technology solutions to deliver seamless connectivity, real-time analytics, and automated troubleshooting.

Enterprise-grade technology is available from firms such as Cisco and Aruba (Hewlett Packard Enterprise), which improve the security of the network, bandwidth management, and remote accessibility. For example, Siemens’ smart manufacturing plants use enterprise-class technology to connect robotic automation systems, real-time monitoring tools, and IoT-enabled equipment, enhancing productivity and decreasing operational downtime.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 8.7% |

| France | 8.5% |

| Germany | 8.9% |

| Italy | 8.3% |

| South Korea | 9.2% |

| Japan | 9.3% |

| China | 10.5% |

| Australia | 8.9% |

| New Zealand | 8.4% |

The USA Industry will rise at a 9.8% CAGR from 2025 to 2035. The growth of the market is driven by demand for high-speed internet, large-scale adoption of Wi-Fi 6 and 6E technologies, and government funding towards upgrading private and public networks. Companies are installing cloud-based management solutions and spending on state-of-the-art cybersecurity solutions to improve wireless communication. The increase in smart homes, industrial uses of IoT, and end-to-end connectivity solutions in urban areas is also fueling market expansion even more.

Expanding smart city initiatives and installations of smart digital infrastructure are some of the leading factors driving the adoption of the industry. Organizations and academies are embracing wireless capacity expansion in order to allow hybrid work and digital learning. Expansion of e-Commerce and digital transactions are driving secure and rapid network requirements. Ongoing investments in AI-enabled network automation and IoT-powered wireless solutions will get the market highly energetic in the following two years.

The UK Industry is likely to observe a growth of 8.7% CAGR in 2025 to 2035. Rising digitalization in industries, high roll-out of public networks, and increasing demand for secure business connectivity are driving the market growth. Wi-Fi 6 and 6E adoption is improving wireless performance, especially in smart homes, corporate offices, and hospitals. The nation's initiatives to increase rural connectivity and broadband coverage are driving installations of networks.

Retail and financial companies are using Wi-Fi to drive customer experience with seamless digital payments and intelligent store connectivity. Adoption of AI-driven network management solutions is maximizing performance, minimizing latency, and boosting security. With organizations and government agencies focusing on data security and GDPR compliance, the demand for high-performance and encrypted solutions is growing day by day.

France's Industry will grow at an 8.5% CAGR during the period 2025 to 2035 with greater investment in broadband growth, increasing needs for wireless high-speed solutions, and firm government support for digital transformation. The heavy deployment of smart homes and industrial automation has encouraged the use of Wi-Fi 6 and AI-based networking solutions. Organizations are embracing secure and high-performance wireless networks for hybrid working practices and IoT implementations.

Urban public infrastructure and transport hotspots are enhancing connectivity and fueling market growth. Retail, healthcare, and financial sectors are deploying enhanced security solutions to enable safe online transactions and digital services. Increased emphasis on the convergence of 5G technology and networks will further fuel market growth in the coming years.

Germany's Industry will grow at a CAGR of 8.9% between 2025 and 2035. Cybersecurity, high-speed enterprise networking, and digital infrastructure are some of the key drivers in Germany's market growth. Wi-Fi 6 is gaining traction with companies rapidly for Industry 4.0 and smart manufacturing. Companies are using cloud-managed technology to enhance operational efficiency and data security.

Public and private entities are deploying GDPR-compliant wireless solutions to safeguard consumer information. Expansion in the adoption of AI-based technology optimization in business and smart cities is enhancing network performance. Rising demand for encrypted and high-performance technology in healthcare, retail, and public services will drive market growth in the next few years.

Italy's Industry will be growing at a CAGR of 8.3% over the 2025 to 2035 forecast period. Increasing deployments of Wi-Fi networks in public infrastructure, smart homes, and industrial automation are driving demand. Wi-Fi 6 technology adoption is improving enterprise, schools', and hospitals' connectivity. Government expenditure in broadband penetration and digital inclusion initiatives is also driving growth.

It is being used by businesses to enhance customer engagement, enhance e-commerce capabilities, and expand secure distant working technology. Public networking in transportation hubs and urban centers is increasing connectivity and ease of access. With more business sectors becoming adopters of AI network management solutions, networks will become even more optimized and secure and build long-term growth.

South Korea's Industry is anticipated to register a CAGR of 9.2% from 2025 to 2035. The nation's dominance in 5G and next-generation networking technologies is driving the uptake of Wi-Fi 6 and cloud-managed solutions at a quicker rate. Enterprises are implementing quick, secure networks for smart manufacturing, retail, and finance. Government focus on digitalization and public growth is also driving market demand.

Growing adoption of AI-based network optimization by business and government organizations is enhancing wireless performance. Convergence with autonomous transportation networks and intelligent city infrastructure is increasing seamless connectivity. As industries make secure and efficient wireless communication their first priority, next-generation solutions of technology continue to see growing demand.

Japan's Industry is predicted to post a CAGR of 9.3% during 2025 to 2035. Growth is fueled by Japan's advancement in 5G-Wi-Fi integration, AI-managed networks, and intelligent infrastructure building. Cloud-based services are being implemented by enterprises and governments for increased efficiency and security.

Demand for low-latency, high-speed internet for smart cities, autonomous vehicles, and industrial automation is increasing. Country leadership in miniaturized networking hardware and wireless solutions IoT-ready is also driving adoption. With the country still emphasizing secure and seamless connectivity, the Industry will continue to see robust growth.

China's Industry is also expected to grow at a CAGR of 10.5% between 2025 to 2035. Strong levels of development in broadband infrastructure, government-backed digital initiatives, and rising demand for high-speed data are fueling market growth. Extensive usage of internet in smart homes, industrial IoT, and financial services is also fueling demand.

Funding for nationwide coverage and strengthening cybersecurity from governments is driving adoption. Growth in e-commerce, online transactions, and online banking is driving the need for safe and performance-packed networks. Applications of AI-powered network management products will become more and more significant in driving efficiency and security going forward.

Australia's Industry is predicted to register an 8.9% CAGR from 2025 to 2035. Demand is fueled by fiber-optic wireless networks, 5G-Wi-Fi convergence, and AI-powered network management. Government and business organizations are adopting solutions for increased connectivity, security, and automation.

The New Zealand Industry is expected to expand at a CAGR of 8.4% over the forecast period 2025 to 2035. Public network deployments are on the rise, broadband penetration is growing, and there is a growing demand for high-speed wireless solutions that drive the market. Secure, scalable networks are being deployed more among organizations and public authorities to enhance communication and digital services.

The Industry is growing at an accelerated pace due to high demand for high-speed connections, IoT integration, and cloud applications. It is the low-latency, high-capacity, and secure nature of the wireless solutions that have endeared Wi-Fi 6, Wi-Fi 6E, and emerging Wi-Fi 7 technologies to businesses and consumers alike.

Top players such as Cisco Systems, Broadcom, Qualcomm, Netgear, and TP-Link Technologies, with their enterprise networking solutions, AI-based network management, and next-generation security protocols, still dominate the arena. Middle-tier and startup companies focus on mesh networking, cloud-managed technology, and software-defined wireless solutions targeting small and medium enterprises and the smart home market.

Market evolution is mainly influenced by factors such as the 5G convergence, AI-based traffic optimization, and enhanced WPA3 security standards. Investments in edge computing, IoT-based networking solutions, and cloud-managed technology are being made to augment performance and scalability.

Some of the strategic-changing factors include enterprise digital transformation, infrastructure development for public technology, and regulation standards for frequency spectrum allocation. Vendors will earn their stature in due course by selling scalable solutions with high performances, having security as the operational backbone, and edging out others as the global demand for connectivity surges.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cisco Systems | 20-25% |

| Broadcom Inc. | 15-20% |

| Qualcomm Technologies | 10-15% |

| Netgear Inc. | 8-12% |

| TP-Link Technologies | 5-10% |

| Other Companies (combined) | 35-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cisco Systems | Enterprise-grade networking solutions with AI-driven network optimization. |

| Broadcom Inc. | Advanced chipsets and connectivity solutions for next-gen wireless networking. |

| Qualcomm Technologies | High-performance Wi-Fi 6 and Wi-Fi 6E solutions for smart homes and enterprises. |

| Netgear Inc. | Consumer and business Wi-Fi routers, mesh networking systems, and security enhancements. |

| TP-Link Technologies | Cost-effective networking devices, mesh routers, and smart home solutions. |

Key Company Insights

Cisco Systems (20-25%)

Cisco dominates the space with its enterprise-level networking solutions, AI-optimized optimization tools, and cloud-managed network management services.

Broadcom Inc. (15-20%)

Broadcom offers top-of-the-line chipsets and connectivity solutions, enabling next generation wireless communication technologies.

Qualcomm Technologies (10-15%)

Qualcomm is engaged in the production of high-speed, power-sipping Wi-Fi 6 and Wi-Fi 6E chipsets for consumer and enterprise use cases.

Netgear Inc. (8-12%)

Netgear provides state-of-the-art networking solutions for both consumers and businesses, including mesh systems and secure cloud-based connectivity services.

TP-Link Technologies (5-10%)

TP-Link offers competitively priced and scalable solutions to the smart home user as well as small businesses through its robust networking hardware.

Other Key Players (35-40% Combined)

These companies contribute to ongoing advancements in technology by integrating AI-powered automation, cloud-based network management, and enhanced security protocols. The increasing adoption of high-speed, low-latency solutions, IoT connectivity, and smart home applications continues to shape the competitive landscape of the Industry.

By component, the industry is segmented into hardware, solutions, and services, with solutions holding the largest share due to increasing adoption of advanced networking and connectivity technologies.

By density, the market includes hi-density and enterprise-class solutions, with enterprise-class being widely used for its scalability and high-performance capabilities.

By location type, the market is divided into indoor and outdoor solutions, with indoor deployments leading due to their extensive use in offices, retail stores, and healthcare facilities.

By organization size, the market caters to large enterprises and SMEs, with large enterprises dominating due to their higher investment in advanced networking infrastructure.

By vertical, the market serves education, healthcare and life sciences, transportation and logistics, retail and e-commerce, government, manufacturing, hospitality, and others, with healthcare and life sciences leading due to the growing need for reliable and secure connectivity in medical facilities.

By region the industry spans North America Asia Pacific, Europe, Middle East & Africa & Latin America.

The industry is projected to witness a CAGR of 19.8% between 2025 and 2035.

The industry is expected to reach USD 43.2 billion in 2025.

The industry is anticipated to reach USD 135.6 billion by 2035 end.

North America is set to record the highest CAGR during the assessment period, driven by the rapid expansion of smart home technologies, increasing deployment of Wi-Fi 6 and Wi-Fi 7, and growing demand for high-speed wireless connectivity in enterprises and public infrastructure.

The key players operating in the industry include Cisco Systems Inc., Huawei Technologies Co., Ltd., Qualcomm Technologies Inc., Aruba Networks (Hewlett Packard Enterprise), Broadcom Inc., Netgear Inc., and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Density, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Location Type , 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Density, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 25: Global Market Attractiveness by Component, 2023 to 2033

Figure 26: Global Market Attractiveness by Density, 2023 to 2033

Figure 27: Global Market Attractiveness by Location Type , 2023 to 2033

Figure 28: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 29: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Density, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 55: North America Market Attractiveness by Component, 2023 to 2033

Figure 56: North America Market Attractiveness by Density, 2023 to 2033

Figure 57: North America Market Attractiveness by Location Type , 2023 to 2033

Figure 58: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 59: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Density, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Density, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Location Type , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Density, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Density, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Location Type , 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Density, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Density, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Location Type , 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Density, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Density, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Location Type , 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Organization Size, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Density, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Density, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Location Type , 2023 to 2033

Figure 208: East Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Density, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Location Type , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Density, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Density, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Density, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Location Type , 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Location Type , 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Location Type , 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Density, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Location Type , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Organization Size, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

WiFi Alarm System Market Size and Share Forecast Outlook 2025 to 2035

WiFi Extenders Market Size and Share Forecast Outlook 2025 to 2035

WiFi as a Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA