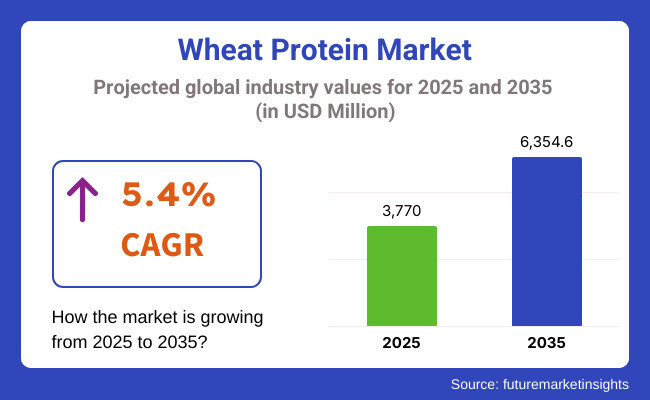

The global wheat protein market is estimated to be worth USD 3,770 million by 2025 and is projected to reach a value of USD 6,354.6 million by 2035, reflecting a CAGR of 5.4% over the assessment period 2025 to 2035.

The market for wheat protein is increasingly being recognized for its critical role in addressing consumer demand for plant-based, functional, and clean-label ingredients across the food and personal care industries. Industry experts have observed that the shift toward health-conscious dietary patterns, coupled with heightened environmental and ethical awareness, has accelerated the adoption of plant-derived proteins.

Among these, wheat protein-particularly in its isolated and hydrolyzed forms-is being positioned as a versatile and value-driven solution. It has been extensively evaluated for its superior amino acid composition, functional properties like elasticity and water-binding capacity, and compatibility with meat alternatives, protein bars, and bakery formulations.

The market's progression is being shaped by a convergence of evolving consumer behavior, advanced food processing capabilities, and scientific validation of wheat protein’s nutritional and technical benefits. Manufacturers and formulators have increasingly opted for wheat protein isolate due to its concentrated protein profile, which enhances nutritional value while improving texture and stability in processed foods.

Technical teams within the industry have also endorsed the use of hydrolyzed wheat protein in personal care products, citing strong evidence of its moisturizing and film-forming properties-attributes highly sought after in clean beauty formulations. These applications are being reinforced by regulatory approvals across the EU, North America, and other developed markets, lending further credibility to its safety and efficacy.

Research professionals and food technologists have noted that the market’s growth is also attributed to strategic R&D and innovation pipelines aimed at delivering wheat protein-based products that meet diverse application requirements-from allergen-free claims to enhanced digestibility.

With heightened scrutiny around sustainability and ingredient transparency, brands have responded by adopting traceability mechanisms and cleaner processing methods, enhancing both consumer trust and product differentiation. Notably, regional clusters in North America and Europe continue to lead the market in terms of product innovation, consumption volume, and investment in sustainable ingredient technologies.

As the wheat protein market evolves, it is expected that future growth will be anchored not only in core food and beverage applications, but also in the expanding functional cosmetics and personal care space. Market participants that align their sourcing, processing, and marketing strategies with verified scientific data, clean-label commitments, and regional regulatory expectations are anticipated to secure competitive advantage over the coming decade.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global wheat protein market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.3% |

| H2 (2024 to 2034) | 4.9% |

| H1 (2025 to 2035) | 5.4% |

| H2 (2025 to 2035) | 6.0% |

The above table presents the expected CAGR for the global wheat protein demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 4.3%, followed by a slightly higher growth rate of 4.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 5.4% in the first half and remain relatively moderate at 6.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 12 BPS while in the second half (H2 2025), the market witnessed an increase of 31 BPS.

Wheat protein isolate accounted for the largest share of the global wheat protein market in 2025, with the segment projected to expand at a CAGR of approximately 5.9% through 2035. This dominance is underpinned by its superior concentration and multifunctionality in plant-based and protein-enhanced applications.

Positioned at the intersection of clean-label demand and nutritional enhancement, wheat protein isolate continues to be favored for its robust functionality-ranging from textural reinforcement to water retention and thermal stability.

These attributes have made it indispensable in sectors seeking animal protein alternatives or gluten-reinforcement mechanisms, especially in bakery, snack, and alternative meat categories. Formulators have increasingly selected isolates over less refined protein sources due to their consistent behavior under varying processing conditions and ability to support label simplification. Furthermore, its use aligns with allergen-conscious and non-soy positioning, offering a strategic advantage in North American and European markets.

As regulatory scrutiny and consumer expectation around ingredient transparency intensify, isolates processed through enzymatic or mechanical means-without solvents-are being prioritized. R&D pipelines are now focused on optimizing isolate functionality for emerging use cases such as high-protein beverages and clinical nutrition.

Over the next decade, companies that invest in improving yield, solubility, and sustainable sourcing of wheat protein isolate are expected to lead premium-positioned growth within the broader plant protein ecosystem.

Hydrolyzed wheat protein is projected to grow at a CAGR of 6.1% from 2025 to 2035, outpacing the overall wheat protein market average. Though currently a smaller segment by volume, its multifunctional appeal in both food and personal care is driving accelerated adoption.

This segment has increasingly been leveraged for its film-forming, moisturizing, and digestibility-enhancing characteristics-qualities validated through both empirical testing and sustained industry use. In personal care, its low molecular weight allows for deeper skin and hair penetration, positioning it as a sought-after ingredient in clean-label beauty products that target hydration and repair without synthetic additives. In parallel, food technologists are exploring its potential in specialized nutrition formats, especially for populations requiring improved protein assimilation or reduced allergenic load.

The functional versatility of hydrolyzed wheat protein is also being viewed as a strategic solution for hybrid product formats that bridge wellness and indulgence-such as fortified bakery items and dermonutrition supplements.

With regulatory frameworks in North America, the EU, and select APAC markets increasingly recognizing its safety and efficacy, hydrolyzed wheat protein is gaining credibility across application domains. Manufacturers that capitalize on traceable sourcing and gentle hydrolysis techniques are likely to lead in positioning this segment as a premium, science-backed ingredient for next-generation clean formulations.

Functional Foods and Nutraceuticals

The realization of consumers about health and wellness has skyrocketed the need for functional foods that not only provide basic nutrition but also additional health benefits. Wheat protein has become the essential component because of its effect on satiety, recovery of the muscle, and the provision of amino acids.

In search of fast and healthy meals, wheat protein is included in new health-oriented goods like protein bars, meal replacements, and fortified snacks. The promotion of the consumption of wheat protein gained more popularity through the dietary supplements and functional beverages where it becomes a powerful source of proteins from plants for the health-conscious individuals who want to enhance their well-being.

Innovative Meat Alternatives

The increasing popularity of plant-based foods has resulted in the development of meat substitutes through the use of textured wheat protein near to none. Wheat protein has become an important ingredient by manufacturers creating meat alternatives that closely replicate the characteristics of traditional meat such as taste, texture, and mouthfeel, thus bringing in more flexitarians and vegetarians to their products.

There has been a recent development in the protein alternative market which includes diverse types of products like wheat protein burgers, sausages, and meatballs due to this innovation. The opportunity for the non-meat product market to thrive and explore the textured wheat protein is referred to as the creativity in the food and beverage sector.

Personal Care and Cosmetics Growth

Additionally, beyond the food industry, the field of cosmetics and personal care products is experiencing substantial growth with the use of wheat protein. Featuring its natural moisturizing and film-forming properties, this ingredient is very appealing to hair and skin care manufacturers. Applying wheat protein can provide texture and performance improvements through the addition of hydration and a barrier element of moisture protection for hair and skin.

The incorporation of wheat protein with the demand for natural ingredients is a result of consumers placing an increased priority on clean and efficient beauty. This trend is extending the market of wheat protein beyond the traditional food applications as brands are pursuing innovation and consequently differentiating their offerings in the highly competitive personal care market.

Tier 1 Companies: This tier comprises industry leaders with annual revenues exceeding USD 20 million, collectively holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacities and extensive product portfolios, which include various forms of wheat protein such as wheat gluten, wheat protein isolate, and textured wheat protein.

Tier 1 players are distinguished by their advanced manufacturing capabilities, robust supply chains, and a broad geographical presence, allowing them to cater to diverse consumer needs across multiple regions. Their strong consumer base and established brand reputation further solidify their market leadership.

Prominent companies in this tier include Cargill, Archer Daniels Midland Company (ADM), Kerry Group, and Tate & Lyle, all of which leverage their expertise to drive innovation and maintain competitive advantages in the wheat protein sector.

Tier 2 Companies: Tier 2 consists of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a significant presence in specific regions and play a crucial role in influencing local markets. While they may not possess the extensive global reach of Tier 1 companies, they are characterized by strong consumer insights and localized product offerings.

These players often focus on niche markets and have developed good technology to ensure regulatory compliance. Notable companies in this tier include MGP Ingredients, Emsland Group, and Roquette Frères, which are known for their specialized products and regional expertise.

Tier 3 Companies: The third tier encompasses a majority of small-scale companies with revenues below USD 5 million. These businesses primarily operate within local markets, catering to niche demands and specific consumer preferences. Tier 3 companies are often characterized by limited geographical reach and a focus on fulfilling localized marketplace needs.

This segment is generally considered unorganized, lacking the extensive structure and formalization seen in higher-tier competitors. However, these small players can be agile and responsive to local trends, allowing them to carve out unique market positions.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 953.2 million |

| Germany | USD 635.5 million |

| China | USD 444.8 million |

| India | USD 317.7 million |

| Japan | USD 127.1 million |

Has there been any notable transformation in the state of gluten, particularly among the consumers who do not have gluten-calibrated bodies? During the time gluten was on the negative side of the health equation many people thought that gluten was the main culprit for certain health problems and the like, but now it seems, many people are aware of the meager nutritional value of wheat protein.

Wheat protein is rich in essential amino acids and therefore acts as an important contributor to the protein content in the diet. This lifted the veil of ignorance about wheat protein and brought to light the fact that wheat protein is one of the main food components in many products such as baked goods, snacks, and meat alternatives. The direct outcome is an increase in the wheat protein market as consumers view it as a beneficial health asset and the wheat protein types are inserted in products throughout the whole sector.

Germany's massive plant-based revolution is the reason for the increasing wheat protein demand and its success as a leader in the European plant-based food market. The number of vegetarians and vegans, who are mainly driven by their concerns about health, environment, and ethics, is on the rise.

Textured wheat protein is a popular component of meat alternatives due to its ability to give a filling mouthfeel and nutritious value that is attractive to people who are interested in a more sustainable protein diet. This change shows that attitudes to eating are being reshaped while a market for innovative, plant-based products grows among consumers who want to do right by the environment and themselves through their buying choices.

The strong fitness culture that is booming in India is heavily affecting the young people's health food choices, who are mostly inclined to make them as healthy as possible. Products with a good amount of protein/energy boost are on the wave of increase besides creating muscle recovery and health benefits headings as more and more people are doing fitness.

People in India are consuming more wheat-protein foods including protein products, bars, and health foods made with this ingredient as it has appeared in the fitness food sector where healthy people and athletes go in search of easy-to-carry and nourishing options. This trend goes hand in hand with the overall transition to more conscious lifestyle choices where consumers start getting aware of and prioritize the benefits of protein consumption in fitness and health preservation.

This segment is further categorized into Wheat Gluten, Wheat Protein Isolate, Hydrolysed Wheat Protein, and Textured Wheat Protein.

This segment is further categorized into Dry and Liquid.

This segment is further categorized into Animal Feed, Bakery & Confectionary, Nutrition Supplements, Dairy Products, Cosmetics and Personal Care, and Other Applications.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Wheat Protein industry is estimated at a value of USD 3,770 million in 2025.

Sales of Wheat Protein increased at 4.9% CAGR between 2020 and 2024.

Archer Daniels Midland Company, Cargill, Inc., Agridient B.V., MGP Ingredients Inc., Manildra Group are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 26% over the forecast period.

North America holds 36% share of the global demand space for Wheat Protein.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 32: Europe Market Volume (MT) Forecast by Form, 2017 to 2033

Table 33: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: Asia Pacific excluding Japan Market Volume (MT) Forecast by Country, 2017 to 2033

Table 35: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: Asia Pacific excluding Japan Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 37: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 38: Asia Pacific excluding Japan Market Volume (MT) Forecast by Application, 2017 to 2033

Table 39: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 40: Asia Pacific excluding Japan Market Volume (MT) Forecast by Form, 2017 to 2033

Table 41: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Japan Market Volume (MT) Forecast by Country, 2017 to 2033

Table 43: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: Japan Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: Japan Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 46: Japan Market Volume (MT) Forecast by Application, 2017 to 2033

Table 47: Japan Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 48: Japan Market Volume (MT) Forecast by Form, 2017 to 2033

Table 49: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Middle East and Africa Market Volume (MT) Forecast by Country, 2017 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 54: Middle East and Africa Market Volume (MT) Forecast by Application, 2017 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 56: Middle East and Africa Market Volume (MT) Forecast by Form, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 18: Global Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 42: North America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific excluding Japan Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific excluding Japan Market Value (US$ Million) by Form, 2023 to 2033

Figure 100: Asia Pacific excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: Asia Pacific excluding Japan Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 103: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 106: Asia Pacific excluding Japan Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 107: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 110: Asia Pacific excluding Japan Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 111: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 114: Asia Pacific excluding Japan Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 115: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: Asia Pacific excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific excluding Japan Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific excluding Japan Market Attractiveness by Form, 2023 to 2033

Figure 120: Asia Pacific excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 121: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Japan Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Japan Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Japan Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 127: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 130: Japan Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 131: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: Japan Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 134: Japan Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Japan Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 138: Japan Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 139: Japan Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: Japan Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 142: Japan Market Attractiveness by Application, 2023 to 2033

Figure 143: Japan Market Attractiveness by Form, 2023 to 2033

Figure 144: Japan Market Attractiveness by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Middle East and Africa Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 151: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 154: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 158: Middle East and Africa Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 159: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 162: Middle East and Africa Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 163: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 164: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 165: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 167: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 168: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrolysed Wheat Protein Market Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA