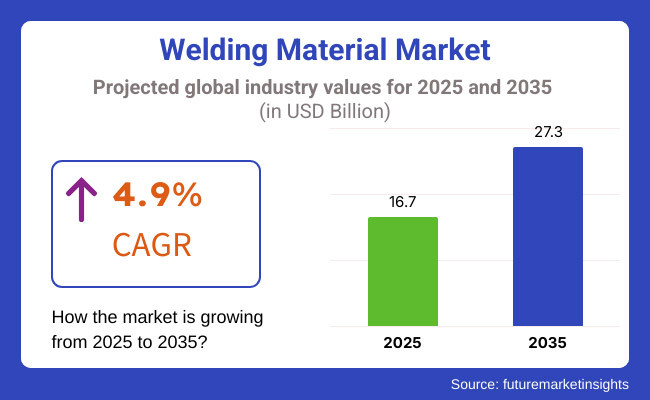

The global welding materials market is expected to witness significant growth which helps to growing from USD 16.7 billion in 2025 to USD 27.3 billion in 2035, at a steady CAGR of 4.9%. The growth is primarily due to the increasing industrialization, infrastructure development, and adoption of automated welding technologies in different industries. Advanced welding materials and equipment are witnessing increased demand from the automotive, aerospace, oil & gas, shipbuilding, energy, and construction industries.

The precision, effectiveness, and sustainability of welding applications are being enhanced by innovations in this field, including robotic welding, laser welding, and ultrasonic welding. Additionally, the market is changing due to the move towards high-performance and more environmentally friendly welding products. The advancements in filler and flux materials as well as better shielding gases are propelling the sector.

On a regional basis, Asia-Pacific leads the market, heavily influenced by rapid urbanization and an expanding manufacturing sector in China, India, and Japan, among others. Steady demand in North America and Europe is pocketed in the regions mainly because of the growing sophistication in aerospace & automotive industries.

As industries continue to move toward automation and smart manufacturing, the welding materials market is likely to experience consistent growth and present lucrative opportunities for major market members. New trends like AI welding systems and sustainable welding solutions will keep evolving the landscape of industry.

Explore FMI!

Book a free demo

Between 2020 and 2024, in developing countries, the market for welding materials grew due to rising infrastructure development and industrialization. The transportation and construction industries played a key role in this demand since welding is crucial in these industries. Advances in technology, including the use of automated welding operations, improved efficiency and accuracy, further driving market growth.

Conversely, the decade between 2025 and 2035 is expected to see increased emphasis on the use of sustainable and environmentally friendly welding solutions. The producers are likely to aim at producing materials that minimize environmental footprint, in line with worldwide sustainability objectives.

There is also expected to be an integration of sophisticated technologies, such as robotics and artificial intelligence, which will transform welding processes, providing enhanced performance and efficiency. This change occurs as a reaction to the changing market needs as well as advancing technologies.

| Key Drivers | Key Restraints |

|---|---|

| Industrial growth acceleration | Fluctuating raw material prices |

| Technological advancements | Stringent regulations and certifications |

| Infrastructure development surge | Availability of skilled welders |

| Automation integration | Environmental impact concerns |

Impact of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Industrial growth acceleration | High |

| Technological advancements | High |

| Infrastructure development surge | High |

| Automation integration | Medium |

Impact of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| Fluctuating raw material prices | High |

| Stringent regulations and certifications | Medium |

| Availability of skilled welders | High |

| Environmental impact concerns | Medium |

The welding materials market between 2025 and 2035 will remain dynamic in all segments, propelled by industrial development, technology innovations, and sustainability movements. Electrode and filler compounds will lead the market as high-performance welding products become the focal point for industries. Companies will create sophisticated alloys and coated electrodes to improve welding durability and effectiveness.

Flux-cored wires will play a critical role in precision applications in which fluxes and wires will be in vogue as the welding industry develops automation. Gases, such as shielding and fuel gases, will see increased demand as cleaner, more efficient methods of welding gain popularity in the industry. Due to its affordability and versatility, arc welding will remain the most widely used.

Arc welding will remain the most widely used technology due to its affordability and versatility. Resistance welding will increase slowly with the automotive and aerospace industries embracing it for mass production and precision welding. Oxy-fuel welding will continue to be a crucial instrument for metalworking and repair, particularly in the building and infrastructure industries. Other cutting-edge technologies like laser and ultrasonic welding will continue to be used more frequently because of their accuracy and effectiveness in specialized applications.

Transportation will be in high demand for welding materials, with automotive and aircraft manufacturers using light and high-strength materials. The building construction industry will also depend on welding technologies for infrastructural growth and mega projects. Heavy industry, shipbuilding, mining, and energy will need strong and effective welding solutions to hold heavy machinery and infrastructure together. Other applications, like consumer goods production and electronics, will enjoy improvements in welding technology, allowing for high-quality and reliable assembly of products.

A growing market is expected for welding materials in USA market owing to automation, infrastructure, and manufacturing. The demand for welding materials will continue to be driven by construction and automotive sectors, with growing investments for both electric vehicles and sustainable infrastructure projects.

An additional contributor is the aerospace industry, as the demand for advanced welding technologies increases. The growing focus on eco-friendly welding solutions and stringent emissions regulations will compel manufacturers to develop innovative, low-impact welding materials. The USA market is set to grow at a stable CAGR between 2025 to 2035 contributing to a total USD 2.8 billion.

The Canadian welding materials market will witness a gradual external growth owing to its robust industrial sector and infrastructure projects. This will be a particularly strong driver for the oil and gas energy sector, which has been a key customer for advanced welding technology to date. Government-led housing and transportation infrastructure investment will also benefit the construction industry.

This will also mean growing use of robotic welding and green welding materials as Canada continues to gravitate towards sustainable manufacturing. Although the market will not grow at the same rate as in the USA or China, Canada will enjoy steady growth as industries adopt new welding technologies for improved efficiency and compliance with environmental regulations.

Post-Brexit industrial policies and investments in both manufacturing and infrastructure will be defining features of the United Kingdom welding materials market. The construction sector is expected to continue to be a significant growth area, with an emphasis on sustainable and energy-efficient buildings.

Aerospace and automotive industries will add to demand as growing adoption of advanced welding techniques such as laser and ultrasonic welding opens up new avenues for growth. You are trained on data until Oct 2023. The market is expected to reach USD 540 million by 2025, at a CAGR of around 5% during the forecast period. The growth is driven by technological advancements and investments in the industry.

Moderate growth is expected from France’s market for welding materials, with the country’s robust aerospace, automotive, and infrastructure industries driving activity. High-performance welding solutions will be in demand, supported by government initiatives to restructure transport networks and energy networks.

As the automotive industry moves toward electric and lightweight vehicles, advanced welding technologies will need adapted materials as well, ensuring significantly increased demand. As more focus is placed on decarbonization, companies will increasingly turn to green welding processes. Hastelloy gaskets, coatings, and filtration applications will demand innovative welding materials, driven by investments in automation and Industry 4.0 that will also change the market.

The strong industrial base of Germany and its global leadership in automotive and engineering sectors would enable prosperity for the welding materials market in Germany. The move to electric vehicle production will increase demand for high-precision welding technologies like laser and resistance welding.

We will also gain significantly from the construction sector as the country emphasizes sustainable urban development. This will include the move towards smart welding systems and automated solutions, which will help in reducing labor dependency and improving efficiency. 365 tonnes per annum by 2025 with USD 750 million in sales projected for 2025 to support Germany's leadership in the European welding market.

The demand for welding materials in South Korea will increase gradually, underpinned by the country's leadership in shipbuilding, electronics and car industries. The country’s push towards smart factories and automation will create demand for high-quality welding materials.

The automotive industry's transition to electric and hydrogen-powered vehicles will necessitate sophisticated welding solutions to facilitate endurance and efficiency. Shipbuilding activity continues to buoy demand, particularly for high-strength materials and precision welding techniques. The South Korean market will be valued at about USD 700 million by 2025, and investments in advanced welding technologies are growing fast.

Japan based welding materials market is expected to witness strong growth on account of advanced manufacturing capabilities of end use industries and focus towards precision engineering. A key component of the country’s automotive sector will be a major driver, with the adoption of robotic welding systems deployed to increase efficiency.

As demand for high-performance materials surges in the aerospace and electronics sectors, these industries will also be aiding the growth of the market. In pursuit of sustainability, eco-friendly welding solutions will be developed in line with other sustainable manufacturing practices. The Japanese market will witness gradual growth with an estimated value of about USD 2.2 billion by 2025 owing to a robust technological base.

As per the report, China will retain its position as the largest global welding materials market as the country’s rapid industrialization and infrastructure construction process is instrumental to the growth. A major consumer of welding solutions will be the construction industry, where mega projects will be underpinning demand. Motor vehicles and shipbuilding will continue to be leading consumers, said, adding that China's deputies of the automotive industry taking on the production of electric vehicles also generated demand for precision welding technology.

The trend towards automation and smart manufacturing will only fuel further market growth. China's market is expected to remain the largest in the world within 2025 with a projected market value of around USD 3.0 billion registering slow CAGR and holding its dominance.

India welding materials market are expected to grow at a fast rate on account of rising investments in infrastructure, manufacturing, and energy sectors. Demand for welding materials across a variety of industries such as construction, automotive, and shipbuilding will receive a boost from the government’s push for “Make in India” initiatives.

In Market Growth Factors the Expansion of Railway Infrastructure & Development Projects Industries will demand higher efficiency and quality, further accelerating the adoption of automated and advanced welding techniques. The Indian market is projected to reach USD 1.5 billion by 2025, with a strong growth potential throughout the forecast period.

The welding material market is dominated by tier 1 players, who together control nearly 90% of the total market share. Leading businesses use their active international reach, cutting-edge product portfolios, and broad distribution networks to bolster their competitive position. There is a continuous market leading across industries, be it automotive, construction, aerospace, or shipbuilding, with their focus on innovation, automation, and high-performance welding materials.

Key Players in the Welding Material Market Due to their prominent presence and market share in 2024, Colfax Corporation, Illinois Tool Works Inc. (ITW), Lincoln Electric Holdings, Inc., and ESAB Corporation are some of the top contributors to this market. Elsewhere, Colfax Corporation's (CFX) ESAB subsidiary is expanding the company's reach and product presence in a number of industries.

Illinois Tool Works Inc. announced a focus on technological enhancement in welding equipment and specialty consumables, catering to industrial growth requirements. Lincoln Electric Holdings, Inc., entered the electric vehicle infrastructure development business with its Velion DC fast electric vehicle charging station, exemplifying its diversification efforts.

The inclusion of ESAB Corporation on Ukraine’s list of International Sponsors of War for continuing operations in Russia put a spotlight on geopolitical risks in the industry. Such developments highlight how the key players in the welding materials market are innovating, venturing into different sectors, and addressing changing global challenges to remain competitive.

The market is growing due to the rising industrialization, infrastructure growth, and use of automated welding technologies in industries such as automotive, aerospace, construction, and energy.

Asia-Pacific, but specifically China, Japan, and India, lead the market based on industrialization at a breakneck pace and infrastructure developments. Contributions also come from North America and Europe, based on technological advancements in automation and smart welding technologies.

The development of robotic and AI-based welding systems, the shift to environmentally friendly welding material, and the requirement for high-performance items to improve accuracy and efficiency are the main trends.

Some of the major challenges are unstable raw material prices, the requirement of skilled personnel, strict environmental regulations, and the high capital investment in automated welding systems.

The market is segmented into Electrode & Filler Materials, Fluxes & Wires, and Gases

Arc Welding, Resistance Welding, Oxy-fuel Welding, and Other Technologies

The segment includes Transportation, Building & Construction, Heavy Industry, and Other End Uses

The market is analyzed across North America, Latin America. Western Europe, Eastern Europe, South Asia and Pacific. East Asia, Middle East, and Africa

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.