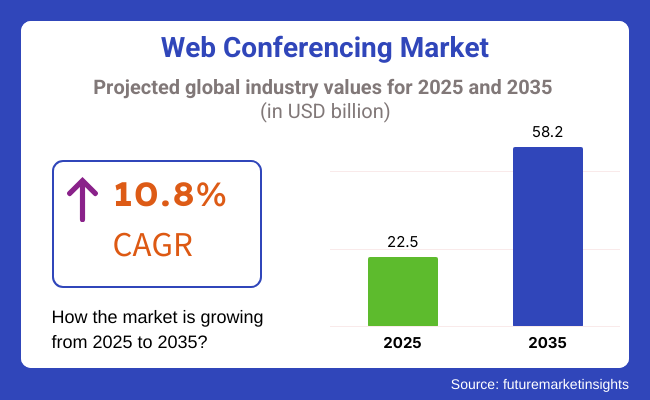

The web conferencing market is likely to grow to a valuation of USD 22.5 billion in 2025 to grow to USD 58.2 billion by 2035, growing at a CAGR of 10.8% in the forecasted period. Growth is driven by increasing demand for remote working tools, along with the integration of new AI-enabled virtual assistants and deepening enterprise-level adoption of video conferencing products.

Because schools, government agencies and institutions are moving towards digital collaboration, increasing numbers of people are starting to use these tools as a way to help keep communication fluid, and companies running as smoothly as possible.

Some products included in these solutions are video conferencing, virtual meeting software and webinars. These technologies enable organizations to conduct remote meetings, training, and events while increasing connectivity and productivity. Incorporating AI-based collaboration tools, improved security features and real-time language translation abilities, has led the sector to evolve quickly, and making these more effective and accessible worldwide.

The growing demand for flexible workspaces and remote collaboration is one of the primary drivers of industry growth. The increasing demand for AI-based virtual assistants that manage meetings, schedule appointments, and take notes. To further drive engagement, enterprises are investing in high-end video conferencing solutions that allow for high-definition video, noise cancellation, and interaction. The growth of the industry is also a result of cloud-based platforms, which have helped companies scale operations without incurring significant infrastructure costs.

Though it has a strong growth trajectory, the industry is faced with several challenges. Security and data privacy challenges continue to be uppermost, particularly for organizations who process sensitive information. Concerns for cyber threats, including hacking and unauthorized access, have fueled hefty investment in robust encryption and multi-factor authentication.

Furthermore, limited bandwidth and connectivity issues can interrupt virtual meetings, particularly in regions with underdeveloped web infrastructure. The expense of these high-end conferencing solutions can also deter small firms from adopting them.

Technological advancements continue to shape the future of the industry 5G-based conferencing is set to minimize the latency and enhance the video quality, and will provide new technologies to integrate and transform user experience. Scalability is becoming as easy as signing up for an AWS account.

Apart from this, real-time analysis, active AR/VR conference calling, hybrid collaboration environments are modernizing the sector. The evolution of the industry is further predicted to be made faster by increased investments in cybersecurity, competitive cooperation between technological companies, and raised emphasis on AI-based automations leading to long-term growth and innovation over the decade ahead.

The industry is on the brink of massive growth, powered by hybrid work models, remote collaboration, and the infusion of AI. In 2025, Solutions will lead the industry with ownership of 68% of the industry share, with enterprises continuing to adopt cloud-based platforms such as Zoom, Microsoft Teams, and Cisco Webex. AI-infused features like automated transcription, seamless translation, and advanced security are fueling the widespread adoption.

Virtual meetings, which will be more than physical ones according to Gartner, the demand for collaboration for AI tools and will soar 75 % of all meetings will be virtualized by 2025 On the other hand, systems integration, training, and managed support services will drive the services share to 32% of the industry share. Thus, enterprises are spending a lot on IT consulting and optimizing their infrastructure to ensure smooth virtual communication. At the same time, companies such as Adobe, LogMeIn, and Avaya are solidifying their service portfolios to help business customers with digital transformation initiatives.

This growing reliance on remote workforce solutions is generating demand for security compliance services and advanced IT assistance. The industry will continue to accelerate, and organizations will implement virtual-first business models. The combination of 5G and edge computing will accelerate new types of digital collaboration, increasing productivity and engagement across sectors with the help of AI-driven automation. The initiating global enterprise transition to using scalable, secure, and immersive delivery technologies is expected to support continuing long-term growth across the industry.

By deployment, the industry is segmented into Hosted Web Conference and Software-as-a-Conference (SaaC) models; both of these models are being driven by the increasing demand for flexible, scalable, and secure virtual collaboration solutions, leading to industry expansion. As businesses seek cloud-based platforms designed to facilitate and enhance remote communiqués, Hosted Web Conference solutions will be commended for 56% of the industry share on 2025.

Adopted by leading providers like Zoom, Cisco Webex, and Google Meet, enterprise-level security, AI-enabled automation, and collaboration tools that facilitate real-time conversation make them the perfect solution for enterprises transitioning to a hybrid workplace environment. Moving towards subscription-based and pay-as-you-go models is fuelling the growth of this segment.

Conversely, Software-as-a-Conference (SaaC) will command 44% of industry share, as companies pursue customizable, on-premise, or hybrid tools offering enhanced control over data security and compliance. Microsoft Teams, BlueJeans, and Adobe Connect are targeting enterprises that need custom integrations, end-to-end encryption, and industry-specific compliance (such as HIPAA for healthcare and FINRA for finance).

The increasing demand for AI-powered analytics, immersive virtual events, and real-time content collaboration further drives this segment. As organizations continue to prioritize scalability and security with an increasing focus on AI-based enhancements, both deployment models will be crucial in the advancement of the industry. The integration of various technologies like 5G, edge computing, and virtual reality (VR) is likely to evolve and push innovation in a way that leads to even more engaging and effective remote collaboration.

The industry is at rapid growth, which is primarily due to the fast-growing demand for remote collaboration, e-learning, and virtual events. In business environments, organizations emphasize the delivery of better video, seamless integration with productivity tools, and strong security features to enable global collaboration.

The educational sector looks for appealing interfaces and low-cost solutions to be able to organize virtual learning in a better way. Some healthcare applications deal with HIPAA-compliant platforms for telemedicine, remote consultations and patient engagement.

Security and scalability are two main requirements of government agencies in establishing platforms for large virtual meetings and confidential dialogues. In contrast, small businesses search for simple, affordable, and compatible solutions that work with existing workflows. The industry expands towards such products that are more immersive and intelligent due to the popularity of features that are powered by AI such as real-time transcription, language translation, and automated meeting summaries.

| Company | Contract Value (USD million) |

|---|---|

| Zoom Video Communications and U.S. Federal Government | Approximately USD 500 - USD 700 |

| Microsoft Teams and Global Financial Institution | Approximately USD 300 - USD 500 |

| Cisco Webex and International Healthcare Organization | Approximately USD 200 - USD 400 |

2024 growth and first quarter 2025 growth were designated as boosted opportunities powered by large deals and strategic partnerships. And there is a growing realization in the public sector, too. The collaboration of the USA Federal Government and Zoom Video Communications (ZVM) reminds that basic public sector work increasingly depends on safe virtual collaboration platforms.

Making hard decisions about Microsoft Teams rollout deep within their organizational structure (where behemoths have lazy communications which require immense uprooting) with a firm strategy to drive organizational productivity in the future structure of technology remote work economy.

The introduction of virtual conferencing technology is here to stay, with Cisco Webex being adopted by a global healthcare organization, which is yet another sign in a sea of new signs of how healthcare organizations are recognizing the need to embrace the rapid technological advancements to improve patient care and streamline operations. Such measures are indicative of a broader trend across industries that is prompting companies to fine-tune their investment in the right levels of premium technology while keeping pace with evolving business requirements and enabling rapid connectivity avenues.

From 2020 and 2024, the industry grew at an exponential pace as organizations, institutions, and healthcare organizations adopted remote communication platforms. Remote working and digitalization drove demand for video conferencing, webinars, and virtual collaboration solutions.

FCC and European Commission imposed regulations to further improve data security and users' privacy.AI-powered functionalities like voice assistants, speech recognition, and live captions enhanced accessibility and productivity. AR/VR was used for immersive events and training by content creators, and cloud infrastructure enabled scalability and high availability to manage massive virtual meetings. The threats included user fatigue, bandwidth constraint, and cyber-attacks, which posed demands for innovations in smart bandwidth management, background blur, and noise suppression to enhance user experience.

As per this, virtual communication will be revolutionized between 2025 and 2035 through the utilization of holography, quantum encryption, and AI. AR collaboration and holographic telepresence will offer spatial audio and 3D video calls with interactive whiteboards. AI virtual assistants will track who is present or absent, will automatically take minutes, and will even provide proposals for action items.

Brain-computer interfaces (BCIs) will provide thought-to-text voice and gesture command.Quantum computing will provide ultra-high-security, real-time encryption for secure communication. Blockchain-based, decentralized platforms will enable more data security and transparency. Carbon-free data centers and AI-driven energy consumption will lower the carbon footprint of web-conferencing.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulators released privacy and security law for these systems. | Quantum-safe encryption, decentralized conferencing infrastructure, and AI-compliance will shape regulation. |

| AI-powered transcription, noise suppression, and instant translation improved communications. | Holographic conventions, BCI integration, and quantum-encrypted video conferencing will transform virtual meetings. |

| Virtual meetings and online training were the new norm with business, health, and educational sectors. | Real-time cognitive feedback, interactive virtual collaboration, and AI-powered sentiment analysis will shape market uses. |

| Webcams, microphones, and cloud conferencing tools were used by companies. | Holographic projectors, AI-facilitated meeting assistants, and neural wearables will be driving conferencing of the next generation. |

| Cloud-based conferencing software maximized resource utilization. | AI-based power-efficient conferencing platforms, environmentally friendly hardware, and carbon-zero virtual events will increase sustainability. |

| AI-based meeting analytics, real-time engagement monitoring, and action items done by automation maximized productivity. | Predictive analytics based on quantum, real-time monitoring of behavior, and affective AI will transform user engagement. |

| Innovations in cloud infrastructure made conferencing scalable. | Data centers optimized with artificial intelligence, communication networks made based on blockchain, and eco-friendly hardware production will maximize scalability. |

| Remote work trends, digitalization, and hybrid work patterns drove industry growth. | AI-powered automation, virtual collaboration in an immersive environment. |

The industry is experiencing a surge of growth due to the soaring demands for remote work, virtual collaboration, and digital transformation. But cyber threats, such as hacking, data breaches, and unauthorized access, are some of the notable risks to the businesses. Full encryption, multifactor identification, and more frequent updates of security protocols are the crucial means to securing not only the data but also the user privacy. The industry landscape is becoming more competitive with many players offering nearly the same solutions. The price cuts and the feature set saturated can impact the profit margins.

To be a step ahead of competitors, businesses should use AI advancements on the top feature platform; have a user-friendly experience and well-matched integrations with enterprise software to lure and hold customers in all the competing industry. Reliability and downtime are some of the risky components, as the time of downtime or poor connectivity likes to cause damage to the brand value and customer trust. Organizations should invest money in robust cloud infrastructure, additional servers, and improved network optimization to minimize latency and provide zero service downtime to their global customers.

The rapidly evolving technology landscape and varying consumer preferences may render certain platforms obsolete. Constant evolution, AI-driven automation, and adaptive business models need to be employed for the businesses to thrive. The industry requires high levels of security, operational resiliency, and ongoing technological advancements to counterbalance risks and remain competitive.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 7% |

| France | 6.8% |

| Germany | 7.1% |

| Italy | 6.7% |

| South Korea | 7.3% |

| Japan | 6.9% |

| China | 7.5% |

| Australia | 6.6% |

| New Zealand | 6.4% |

The industry in the USA is likely to record a CAGR of 7.2% through 2035. The USA industry is expanding rapidly with the widespread adoption of remote work, business collaboration software, and AI-powered virtual meeting software. Industry dominators such as Zoom, Microsoft Teams, and Cisco Webex continue to hold sway in the industry and come up with innovative solutions for easy digital communications.

Organizations are investing heavily in secure the industry software to facilitate hybrid work models, ensuring employee productivity and real-time collaboration. AI-powered features like auto-transcriptions, intelligent summaries, and virtual backgrounds are also enhancing the end-user experience.

The USA federal government and healthcare institutions are also driving the growth of the industry, using the industry for telemedicine and e-government public services. The educational sector has also embraced digital learning tools, further fueling demand.

Technological innovations in 5G networking and cloud communications are shaping the industry, with low latency and high-definition video on the cards. Immersive virtual reality (VR) conferencing startups are in vogue, providing new dimensions to virtual collaboration. As a force behind cybersecurity issues, U.S. firms are making investments in end-to-end encryption and artificial intelligence (AI) fraud detection to secure digital communications.

The industry in the UK is likely to be a CAGR of 7% during the forecast period. The industry in the UK is thriving with increased hybrid work cultures, digitally facilitated transformation programs by governments, and increased usage of cloud-based collaboration tools. Organizations across different industries are adopting AI-driven video conferencing to boost operational efficiency and engagement.

The availability of top players like BT Group, Zoom, and Microsoft is driving the industry with constant innovation in connectivity and security features. Cloud offerings are still dominating, as organizations prefer to build on low-budget solutions for the management of employees and remote conversations.

The professional and financial consultancy services sectors are also opting for web conferencing software to manage customer engagement and automate processes. The education sector too is investing heavily in e-learning software, and telehealth apps are being utilized by healthcare workers to communicate with patients.

UK's priorities regarding GDPR compliance and data security laws are driving companies to design very secure the industry solutions. Simultaneous language interpretation based on AI is also set to occupy a dominant position in global business-to-business communication. The competitive industry is seeing increasingly localized start-ups focused on secure and encrypted the industry solutions.

France is likely to account for a CAGR of 6.8% during the forecast period. France's industry is expanding due to the country's emphasis on digital transformation, data protection as a high priority, and cloud-based collaboration tools being used more frequently. Global businesses as well as small and medium-sized enterprises are implementing AI-based video conferencing software to fuel operations and support remote employees.

Leading French businesses such as Orange Business Services and OVHcloud are industry leaders in providing secure, elastic conferencing solutions for various sectors. Flexible work demand has stimulated investments in virtual collaboration software with businesses looking for high-definition video and real-time collaboration features.

French government legislation promoting digital security has encouraged companies to switch over to GDPR-compliant the industry software. The education sector is another strong catalyst for the trend, as online educational sites and universities deploy virtual classroom technology.

France's dynamic startup environment is also producing innovative AI-based software that provides improved user experience through real-time analytics and automation. With increasing 5G networks, enterprises are leveraging augmented connectivity to facilitate improved virtual collaboration, which facilitates seamless cross-border interactions.

The industry in Germany is likely to record a CAGR of 7.1% through 2035. Germany's industry is also expanding slowly with the assistance of its robust manufacturing sector, government efforts towards digitalization, and adoption of AI-driven collaboration platforms by emerging. Germany's businesses such as Deutsche Telekom and TeamViewer are the first to lead with the innovation of innovative corporate and institutional conference solutions.

Demand for enterprise-level conferencing software is also on the rise because the country gives high priority to safe, GDPR-compliant communication technology. Artificial intelligence-based transcription services and language translation are becoming trends, allowing multinational business operations.

Germany's industrial sector is leveraging them for cross-border business collaboration as well as off-site equipment diagnostics. The healthcare industry is also adopting telemedicine solutions, further driving business expansion. Additional extension of the 5G network is delivering high-definition-quality video and solid connectivity. Germany's pro-regulatory climate guarantees that it is a fitting industry for technologically savvy providers of secure online communications. It is creating a good investment environment for secure conferencing solutions through the integration of AI capability.

The industry in Italy is set to record a CAGR of 6.7% through 2035. The market is growing with increasing digital uptake, government support for smart workplace solutions, and development of cloud-based communication technology. The solutions are being adopted by organizations from diverse industries to enable remote working and enhance productivity.

Italian tech firms, such as TIM (Telecom Italia), are investing in AI-powered video conferencing solutions to enable virtual collaboration and data security. As hybrid working patterns become more fashionable, companies desire cost-effective as well as scalable digital communication infrastructure.

Italy's education sector has also seen heavy uptake of e-learning whereby web conferencing is being increasingly used for remote learning by educational institutions and universities. Virtual meetings are also being utilized by the hospitality and tourism industries to business and customer relations.

Artificial intelligence-based abilities like real-time language translation and meeting notes by automated processes are becoming the norm for multinational enterprises. The nation's investment in fiber-optic networks and 5G facilities continues to develop video conferencing capabilities to allow secure and stable connections.

China is likely to record a CAGR of 7.5% through 2035. The industry of China is expanding robustly with the country's aggressive digitalization drive, increasing business utilization of cloud-based collaboration tools, and dominance by home-grown technology giants like Tencent, Alibaba, and Huawei.

Virtual meeting solutions based on AI are being increasingly demanded, particularly in manufacturing, education, and finance. The efforts of the government to facilitate development of digital infrastructure and extensive deployment of 5G technology are accelerating the growth of the industry even further.

China's stringent cybersecurity laws are forcing firms to develop highly secure, localized conferencing solutions. The e-learning sector is one of the most critical drivers of growth, with web-based training websites and schools increasingly utilizing virtual classroom technology.

Large firms are investing in AI-driven real-time translation and transcription capabilities to facilitate business communication between geographically dispersed linguistic regions. As more people work remotely, China's businesses are emphasizing high-definition video and data security in conferencing platforms.

Australia is projected to record a CAGR of 6.6% through 2035. The industry in Australia is growing steadily due to the widespread adoption of hybrid work models, advancements in cloud-based communication technologies, and the need for efficient remote collaboration solutions. Telstra and other leading Australian players are investing in scalable and secure video conferencing solutions for business and government use. The emergence of AI-based automation in video conferencing is improving productivity and user experience.

The education and healthcare industries are at the forefront of driving demand for expansion, with virtual classrooms being rolled out into universities and telemedicine services being taken up by healthcare professionals. Greater fiber-optic network coverage and 5G technology are boosting video conferencing ability, with high-quality virtual meetings now on the cards. Companies are also investing in AI-driven security capabilities to provide immunity to cyber-attacks and to data protection regulations.

The industry is likely to record a CAGR of 6.4% through 2035. New Zealand's industry is expanding as organizations and government bodies embrace online collaboration tools to increase productivity. The growth is spurred by greater reliance on hybrid work models, cloud-based communication tools, and AI-powered virtual meetings. Telecommunications giants Spark and Vodafone are building fiber-optic internet infrastructure, which allows for seamless video conferencing.

The education sector is one of the key drivers as schools and colleges are using the technology for remote learning. Telemedicine is also being used in the healthcare sector to provide more care to the patients. Even though the country is strengthening data privacy legislation, organizations are giving importance to encrypted and secure conferencing tools. Startups are also introducing AI-powered features such as live captions, automatic meeting minutes, and intelligent scheduling software to make virtual collaboration a more convenient affair.

The market in South Korea is likely to record a CAGR of 7.3% during the forecast period. South Korea's industry is expanding fast with the growth in 5G technology deployment on a grand scale, AI-driven virtual meeting solutions, and government-backed digitalization initiatives. Industry leaders among South Korea's top technology companies like Samsung and LG are heavily investing in state-of-the-art technology that involves HD video as well as live AI-based transcription.

Companies in various industries, such as education, entertainment, and corporate, are adopting immersive VR-based conferencing platforms for better interaction. Government attention to next-generation communication technologies is also driving industry growth, with virtual assistants powered by AI and meeting automation being developed by startups. South Korea's robust cybersecurity framework is defining highly secure and encrypted conference platform needs, securing information and maintaining regulatory compliance.

Japan is likely to record a CAGR of 6.9% through 2035. Japanese industry is expanding with increased digital workplace solution adoption, remotely managed government-supported work policies, and AI-driven virtual collaboration technologies. Japanese giants among which are Sony and NTT Communications, which are developing high-definition video conferencing solutions supported by innovative features like real-time translation and AI-based automation.

The country's focus on intelligent office solutions and cloud communications technology is driving industry growth further. The industry is being embraced by Japan's manufacturing and education industries for seamless knowledge sharing and business efficiency. The advent of 5G connectivity also enhances video quality and lowers latency, enabling simple virtual communication. Businesses are also concentrating on data security as well as adherence to Japan's evolving cybersecurity regulations to guarantee web conferencing solution trust.

Growing demand for remote collaboration, virtual meetings, and hybrid work solutions is propelling the growth of the industry. Implementations of AI-powered meeting assistant technology, enhanced security technologies, and high-quality video streaming technologies to enhance user experience and reliability are driving the industry growth.

Its leaders are the big global technology companies and specialized software suppliers, such as Zoom Video Communications, Microsoft (Teams), and Cisco (Webex). These companies use cloud-based conferencing and real-time collaboration tools as well as virtual event hosting capabilities to support their competitive strategy. In addition, niche players and emerging innovators have the opportunity to distinguish themselves through cost-effective, industry-specific solutions and AI-powered automation features.

Improved video quality, AI-powered features, end-to-end encryption for security, and integrations with productivity suites are among the key factors influencing the evolution of the industry. To satisfy businesses, schools and universities, and event organizers craving this kind of future, companies are constantly investing in scalability, real-time engagement tools, and hybrid event solutions.

Pricing, feature differentiation, and enterprise security requirements shape the competitive landscape. Companies need to prioritize user experience, data privacy, compliance, and integration with larger ecosystem players to drive adoption and capture industry share over time to maintain that growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zoom Video Communications | 30-35% |

| Microsoft (Teams) | 20-25% |

| Cisco (Webex) | 10-15% |

| Google (Meet) | 7-12% |

| GoTo (LogMeIn) | 5-9% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zoom Video Communications | Dominates with cloud-based HD video conferencing, webinar hosting, and AI-driven meeting tools. |

| Microsoft (Teams) | Offers deep integration with Office 365, enterprise collaboration tools, and AI-enhanced meeting transcriptions. |

| Cisco (Webex) | Focuses on enterprise-grade security, AI-powered noise cancellation, and virtual event hosting. |

| Google (Meet) | Provides seamless integration with Google Workspace, adaptive streaming technology, and real-time captions. |

| GoTo (LogMeIn) | Focuses on conferencing tools for small businesses with flexible pricing, plus remote access tools through one app. |

Key Company Insights

Zoom Video Communications (30-35%)

With its comfort-friendly interface, HD attributes, and AI-powered tools such as auto-captioning and virtual backgrounds, Zoom reins the industry. The company is still developing and adding features for real-time collaboration and even webinars.

Microsoft (Teams) (20-25%)

Microsoft Teams: Another heavyweight in enterprise collaboration, Microsoft Teams goes deep into Office 365 integration for seamless document sharing and interaction. Features such as AI-backed meeting transcripts and security capabilities bolster its offering.

Cisco (Webex) (10-15%)

Cisco Webex offers enterprise-class security, AI-integrated noise cancellation, and tailored virtual event hosting to larger companies.

Google (Meet) (7-12%)

Google Meet is providing a simple interface with cool streaming technology and real-time captions as well as its unique end-to-end encryption for this business and education video conferencing software.

GoTo (LogMeIn) (5-9%)

GoTo is great for SMBs with budget-friendly, robust hosted web conferencing with remote work tools and per-but offerings.

Other Major Players (15-25% Combined)

By component, the industry covers solutions and services.

By development, the industry includes hosted web conference, software-as-a-conference, on-premises web conference, and managed web conferencing.

By end-use, the industry spans banking and financial services, education, pharmaceutical/healthcare, manufacturing, media & entertainment, it and telecommunications, government, and others.

By region, the industry covers North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

The industry is projected to witness a CAGR of 10.8% between 2025 and 2035.

The industry will stand at USD 22.5 billion in 2025.

The industry is anticipated to reach USD 58.2 billion by 2035 end.

North America is expected to record the highest CAGR, driven by increasing remote work adoption and advancements in cloud-based communication solutions.

Zoom Video Communications, Microsoft (Teams), Cisco (Webex), Google (Meet), GoTo (LogMeIn), BlueJeans by Verizon, RingCentral Video, Adobe Connect, Zoho Meeting, and BigBlueButton are the key players in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 19: Global Market Attractiveness by End Use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 39: North America Market Attractiveness by End Use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Deployment, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Deployment, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Website Builder Tool Market Size and Share Forecast Outlook 2025 to 2035

Web Scraping Software Market Size and Share Forecast Outlook 2025 to 2035

Web Real-Time Communication (WebRTC) Solution Market Analysis - Size, Share, and Forecast 2025 to 2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

Web3 Messaging Tools Market Report - Growth & Forecast 2025 to 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Web Content Management Market Insights – Growth & Forecast through 2034

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Web Based e-Detailing Market

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Corporate Web Security Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Web Scraping Market Analysis - Growth & Forecast 2025 to 2035

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

LDPE & LLDPE Sealant Web Films Market Insights and Trends 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Audio Conferencing Services Market Outlook 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA