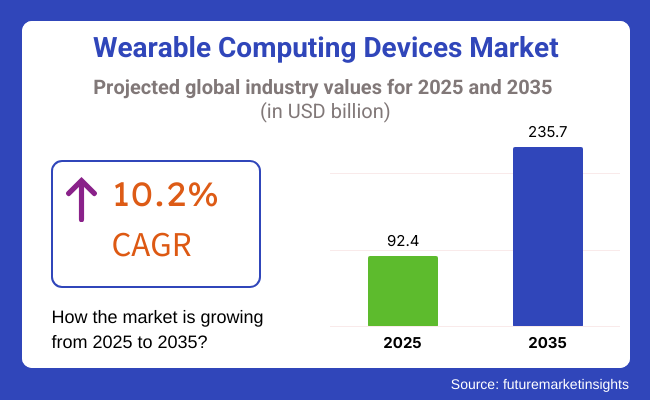

The wearable computing devices market will reach USD 92.4 billion by 2025 and also show a high CAGR of 10.2% of USD 235.7 billion by 2035. This extension is due to the emergence of artificial intelligence (AI), the proliferation of the Internet of Things (IoT) applications, and the miniaturization of sensors and processors. With wearables increasingly integrated into our daily lives, their applications in healthcare, fitness, entertainment, and commerce are all on the rise, driving demand in the industry.

Wearable computing devices encompass a wide range of products, including smartwatches, augmented reality (AR) and virtual reality (VR) headsets, smart glasses, fitness trackers, and medical devices, among others. And with the advent of AI-based features, biometric authentication, real-time health tracking, and cloud-connected analytics, these devices have become even more powerful and enabled to enhance the user experience. This is possible because of the advancements in digital ecosystems that has made wearable technology support productivity, entertainment and healthcare results.

Some of the key underlying factors driving the industry's growth include the constant technological advancements in IoT and AI, which are rendering wearables more intelligent and customized. Machine learning and technology-integrated healthcare monitoring devices, such as AI-powered watches, are increasingly applicable on a large scale.

In addition to this, wearable technology is providing AR and VR solutions for remote work, training, and immersive experiences to enhance productivity in the workplace. The adoption of fitness and medical wearables has contributed to the increase in health and wellness consciousness among consumers.

Despite the industry's aggressive growth, there are a few obstacles that hinder the full adoption of these devices. As devices become interconnected, they raise concerns about the security and privacy of sensitive information about people. Customers who want an affordable and efficient solution have high development expenses and short battery lives as major deterrents to mass adoption. Interoperability between brands and platforms has also been an issue, as consumers want seamless integration between devices and into ecosystems.

Every day, technology advances to help shape the future of these devices and their industry. Improved technologies in flexible displays, ultra-low-power processors, and advanced haptics are enhancing user experience and enabling exciting new use cases. Investment in 5G, connectivity, edge computing, and wearable AI integration was driven by the continued development of equipment functionality toward the end of the device's life, as well as greater process and real-time data processing capabilities.

Industry consolidation around consumer electronics companies, health professionals, and technology firms' strategic affiliations are driving convergence in the industry and enabling further expansion and growth. Wearables equipped with technology will penetrate and transform industries such as healthcare, fitness, and enterprise solutions in a radical way, driving long-term growth and industry expansion.

In the case of wearable computing devices, smartwatches are expected to become the largest segment, with a 63% share of the industry by 2025. Smartwatches have gained popularity due to their multifunctionality, which includes health tracking, communication options, and smart notifications.

Brands like Apple, Samsung, and Garmin are adding more AI-powered health monitoring features like ECG tracking, blood oxygen measurement, and stress detection among their Industry leaders. Apple’s watch OS evolution, most notably with FDA-approved ECG and fall detection features, has solidified smartwatches’ position in the healthcare spectrum, resulting in an ecosystem that promotes both fitness and medical attention.

At the same time, head-mounted displays (HMDs) are expected to capture a 37% share of the market due to the technological advancements in AR (Augmented Reality) and VR (Virtual Reality). Key players, including Meta (Oculus), Microsoft (HoloLens), and Sony (PlayStation VR), are transforming immersive experiences across various fields, from gaming to enterprise training and remote collaboration.

In healthcare, AR-powered HMDs are already augmenting surgeries and enhancing medical training, both made possible by Vuzix and Magic Leap, creating a future of hands-free, smart visualization (via eyes and ears) for surgeons and healthcare professionals.

The rise of hands-free computing, better virtual experiences, and workplace productivity applications is driving the development of HMDs beyond gaming and entertainment and into sectors like education, manufacturing, and defense. Wearable devices are dynamic technologies that encompass AI, 5G, and edge computing, which will enhance the performance of these personal devices, enabling watches and HMDs (Head-Mounted Devices) to reshape how users engage in healthcare, fitness, and enterprise applications.

The fitness and wellness category is expected to claim the largest share of the industry, accounting for a 58% share of revenue by 2025. The growth of this segment can be attributed to the growing adoption of smartwatches and fitness bands for real-time health tracking, activity monitoring, and personalized coaching.

Brands such as Fitbit and WHOOP have gained traction as classics, but now these companies are leveraging AI-based analytics to provide insights into sleep cycles, stress levels, and athletic ability. The addition of blood oxygen sensors, heart rate variability tracking, and recovery insights has added fuel to the fire of consumer interest in wearable fitness tech.

The medical and healthcare segment is expected to account for 42% of the industry, driven by the increasing adoption of remote patient monitoring, digital therapeutics, and advanced chronic disease management solutions. Wearables are playing a critical role in healthcare (with FDA-approved devices from Abbott, Biotronik, and Dexcom allowing continuous glucose monitoring [CGM], ECG tracking, and real-time arrhythmia detection).

Wearable biosensors are in particularly high demand for applications in postoperative care, elderly monitoring, and telehealth solutions, replacing the need for patient hospitalization while healthcare providers shift their focus toward the rapid detection of diseases, followed by individualized treatment programs.

With the increasing integration of AI, 5G, and IoT into wearable devices, it is anticipated that fitness and medical applications will converge more rapidly. Rather than relegating devices that were initially conceived as mere exercise companions to the bin, many makers are reimagining them as clinical-grade health tools.

Recent advancements in sensor technology, artificial intelligence, and IoT connectivity are strong drivers of the industry. In consumer electronics, the availability of smartwatches and AR glasses in the mass industry depends on the growing demand of individuals for easy connection and tailored user experiences.

The healthcare industry is practically utilizing wearable devices for the jobs like remote patient monitoring, early disease detection, and real-time health analytics, thus, demanding data security and accuracy code. Industrial sectors include the adoption of AR headsets and smart gloves, with the aim of improving efficiency and safety in the workplace.

The sports and fitness field focuses on performance tracking, biometric analysis, and AI-driven insights, ultimately leading to the request for advanced sensor accuracy. In the field of defence and security, devices like body-worn cameras and smart helmets take the lead in communication, thus, the troops share a common operational picture. The industry is the driving force of developments in flexible electronics, energy-efficient processors, and AI-powered analytics, and these factors are battery life and durability among the key purchasing factors.

| Company | Contract Value (USD Million) |

|---|---|

| Oura Health | Approximately USD 200 - USD 250 |

| Meta Platforms and EssilorLuxottica | Approximately USD 500 - USD 700 |

| Samsung Electronics | Approximately USD 300 - USD 400 |

Smart product launches and business partnerships significantly increased the wearable computing device industry in 2024 and early 2025. The funding round, valued at USD 200 million, enabled Oura Health to develop the fourth-generation Oura Ring, which added health monitoring functions and strengthened its industry positioning. The rugged AI-sparked Ray-Ban smart glasses from Meta Platforms and EssilorLuxottica is a move away from the concept of the phone to one of wearables, mixing tech with what we do every day.

The launch of the Galaxy Ring by electronics giant Samsung, which will come equipped with state-of-the-art health-tracking technology, is a prime example of a company expanding its wearable product offerings. This is a testament to the growing competition and dynamism in the industry, as manufacturers continually strive to push the boundaries of what these devices can do to address evolving consumer demands.

From 2020 to 2024, the industry experienced rapid growth, driven by increasing demands for smart wearables, health monitoring, and innovations in sensor technology. Consumer electronics, healthcare, and business solutions are transformed with the use of smartwatches, fitness trackers, AR glasses, and medical wearables. Regulatory bodies, FDA and EMA, released guidelines for medical wearables so as to guarantee safety and interoperability. Consumers have adopted AI-powered health metrics, including heart rate, SpO2, and ECG monitoring, for preventive purposes.

Small sensors, biometric authentication, and AI-powered insights improved real-time health monitoring and gesture-based input. 5G and edge computing deployment accelerated data transfer, making low-latency applications a reality. Data privacy, battery life, and cybersecurity concerns existed, prompting the development of blockchain-based data security and AI-optimized battery management solutions.

Between 2025 and 2035, the industry is expected to be revolutionized by AI-powered biometric wearables, neurotechnology-based interfaces, and intelligent textiles. Brain-computer interfaces and artificial intelligence-based emotion recognition will enable brainwave-controlled smart glasses and enhance cognitive performance. Smart fabrics with nano-sensors and adaptive materials will allow real-time health monitoring and posture adjustment. AI-based predictive health analytics will allow personalized care and remote monitoring.

Voice AI assistants and augmented reality smart glasses will transform business productivity and real-time decision-making. Blockchain identities and quantum encryption will secure data created from wearables, rendering them more private. Automated production, biodegradable electronics, and energy harvesting through self-powering will drive the development of sustainable and economical wearable solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Standardized safety guidelines for wearable medical devices and data privacy regulations emerged. | AI-driven regulatory compliance, decentralized data ownership policies, and blockchain-powered security frameworks will govern the development of wearable computing. |

| Wearables that include AI analytics, biometric monitoring, and 5G connectivity. | Brain-computer interfaces, quantum-powered security wearables, and biosensors through smart textiles will transform the industry. |

| Smartwatches, fitness trackers, and AR/VR headsets found common applications in fitness, gaming, and enterprise segments. | Wearables that utilize neurotechnology, emotion-sensing devices powered by AI, and adaptive smart textiles will increase industry uses. |

| Enterprises, healthcare professionals, and consumers used wearable AI assistants and real-time health monitoring devices. | AI-powered cognitive augmentation wearables, neural interfaces, and intelligent, bio-responsive clothing will drive the next big adoption wave. |

| Minaturized wearables companies, low-power sensor companies, and cloud-integrated analytics companies. | Self-sustaining wearables, biodegradable smart clothing, and electronic recycling through the circular economy will drive higher sustainability. |

| AI-optimized health monitoring, real-time fitness tracking, and optimized wearable utility through personalized insights will drive wearables to their highest utility. | Quantum-boosted predictive analytics, emotion-sensitive AI, and neurotechnology-enabled data interpretation will be the new user experience. |

| Supply chain disruption and uncontrolled manufacturing cost prevented industry scalability. | AI-optimized manufacture of wearables, decentralized manufacture, and advanced sensor fabrication will increase industry accessibility. |

The growth of this industry is stimulated by technologies such as AI, IoT, and health monitoring, among others. However, production costs remain high, and the complexity of integrating them with the existing ecosystem runs the financial risk. To remain competitive and make a profit in the long run, companies should concentrate on cost-effective production, formulate partnerships, and offer scalable solutions. The production and pricing of goods are really affected by several factors like the rising material costs, the semiconductor chips, and also the dependency on special components.

The geopolitical trade barriers and price instability of raw materials also contribute to industry instability. Thus, businesses should seek alternative suppliers, explore new materials, and develop risk management strategies to ensure the stability of their production and supply.< In the past, risks such as data privacy and cybersecurity predominated as wireless devices gained the intelligence to collect sensitive information from users. Consumer confidence can be negatively impacted by issues such as unauthorized access, hacking, and data breaches.

Such dangerous problems could have been mitigated by robust encryption, periodic updates of the software, and being compliant with the global data protection regulations that are the main focus on user data protection and credibility. In addition to these factors, the risk of a product being outdated by innovation is also influenced by the rapid rate of technological advancement and changing consumer preferences. Companies must place a greater emphasis on research and development, as well as modular designs and frequent software updates, in order to keep up with industry dynamics and thus, ensure long-term acceptance of wearables.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 6.2% |

| France | 6.1% |

| Germany | 6.3% |

| Italy | 6% |

| South Korea | 6.7% |

| Japan | 6.4% |

| China | 6.8% |

| Australia | 6% |

| New Zealand | 5.9% |

2025 to 2035 CAGR will be 6.5%. The industry in the United States is experiencing significant growth, driven by substantial consumer demand for augmented reality devices, fitness trackers, and smartwatches. The strongest growth driver is the adoption of AI-based features and health monitoring features. The healthcare sector in the United States is adopting wearables for remote monitoring and chronic disease management, fueling the industry. Firms like Apple, Fitbit, and Garmin are continuing to innovate and improve biometric monitoring and connectivity capabilities.

5G and IoT connectivity growth propels increased adoption to ensure easy sharing of live information. Gaming and entertainment companies also utilize AR and VR-capable wearables to enhance interactive experiences. Wearable payments and the growing adoption of enterprise wearables in the defense and logistics sectors further solidify industry direction. Promoting R&D spending and tech partnerships among technology firms and healthcare institutions further drives growth.

The 6.2% CAGR is expected to be achieved from 2025 to 2035. Wearable computers in the UK are driven by a growing population with health-oriented inclinations and government support through digital healthcare products. The National Health Service (NHS) is incorporating wearables into patient management and preventive services at an increasing pace. Fitbug and MyZone are among the companies that drive the industry forward with innovative fitness and health-monitoring features.

Growth is also being spurred by increasing demand for smart glasses and AR-powered devices for retail, logistics, and training purposes. Enhancements in AI-powered biometric monitoring and IoT-powered wearables are also fostering product launches. The fitness segment is also a major growth driver, wherein consumers prefer the use of smartwatches and fitness bands for tracking activities. The expansion of telemedicine and the increasing adoption of wearables in personal health management are also fueling industry growth.

2025 to 2035 CAGR is forecasted at 6.1%. The French industry is expected to grow with increasing investment in digital healthcare and consumer electronics. Connected glasses, medical wearables, and smartwatches are in high demand as consumers increasingly prioritize convenience and health monitoring. Industry leaders like Withings drive innovation in the industry.

The country's focus on luxury and fashion is influencing the growth of high-fashion, luxury wearables. AR wearables find applications in retail and tourism businesses. France's focus on data protection and cybersecurity is shaping wearable technology trends toward strict regulation enforcement. The push towards sustainability and sustainable wear material is on the rise, too.

2025 to 2035 CAGR is predicted to be 6.3%. The German industry is supported by its strong engineering capabilities and advanced healthcare infrastructure. Industry leaders like Zeiss and Bosch are developing advanced AR glasses and sensor-enabled wearables for industrial and medical applications. Workplace safety tracking and productivity enhancement wearables are also propelling growth.

The automotive industry is embracing wearable technology to connect and protect the vehicle along with the driver. Precision engineering and quality manufacturing in Germany enable the manufacturing of advanced and durable wearables. Increasing government initiatives towards digitalization and IoT integration further boost industry potential. Smart textiles and energy-efficient wearables are also gaining momentum in Germany's innovation ecosystem.

2025 to 2035 CAGR is expected to be 6.0%. The Italian wearables industry is driven by Italy's leadership in the global fashion and design sectors. Luxury brands are entering the wearables segment, blending design with functionality. Demand for premium smartwatches and designer sports watches is driving it substantially.

The medical sector is incorporating wearables with medical-grade quality for the management of the elderly and chronic diseases. Digitalization investment in Italy and smart city initiatives drive IoT-based wearables. Entertainment and tourism industries are also exploring wearable AR technologies to enhance the tourist experience. As sustainability becomes increasingly important, Italian companies are considering the use of green materials in wearable devices.

2025 to 2035 CAGR stands at 6.7%. South Korea's wearables industry for computing devices is on fire, thanks to the nation's significant lead in display and semiconductor technology. Samsung and LG are driving the development of flexible, foldable, and AI-based wearables. Government efforts towards 6 G-enabled smart devices are also driving innovation.

The convergence of AR and VR wearables is driving adoption in education, health care, and gaming. The transition towards more widely adopted smart home automation wearables and biometric-based payment wearables also rises. South Korea's fast innovation dynamics, along with early interest in cutting-edge technology, provide a strong base for future expansion.

The projected CAGR is 6.4% from 2025 to 2035. Its technological dominance in miniaturization, robotics, and AI drives Japan's industry. Its producers, like Sony and Panasonic, dominate in innovation with wearables such as smart glasses, fitness bands, and biometric wearables. Japan's aging population is a key driver for health-monitoring wearables.

Wearable entertainment and gaming devices are also gaining momentum, spearheaded by Japan's gaming culture. Wearables in the workplace also enhance the working process and employee safety. With advancements always taking place in sensor technology, wearables innovation is still led by Japan.

2025 to 2035 CAGR is estimated at 6.8%. China is the global leader in wearables, with industry leaders such as Huawei, Xiaomi, and Oppo at the forefront of the industry. The country's robust manufacturing ecosystem and the fast adoption of AI and 5G-enabled wearables are major drivers.

The health and fitness sector is experiencing strong demand for wearables with advanced biometric tracking. The expansion of e-commerce and direct-to-consumer business is also fueling increased industry penetration. Smart garments and industrial use cases driven by AR are also revolutionizing the industry landscape.

The CAGR between 2025 and 2035 is expected to be 6.0%. The Australian industry is expanding with the increase in the adoption of wearables in healthcare, sports, and fitness. Corporate entities like Catapult Sports are in charge of monitoring athlete performance. Health monitoring devices and smartwatch sales are increasing.

Growth in telemedicine and remote patient monitoring technologies is fueling adoption in healthcare. Safety applications in wearables are also increasing continuously. Australia's wellness-oriented emphasis and interest in outdoor activities in that country puts that marketplace firmly within reach of wearables marketed for fitness.

New Zealand's industry is expanding due to the functionality demonstrated by consumers in tracking health and fitness. There is an increasing demand for medical wearables to facilitate remote health monitoring. A 5.9% CAGR is projected from 2025 to 2035.

The country boasts a robust startup community that is driving innovation in wearable technology. Wearable adoption across the agriculture and outdoor segments is also on the rise for monitoring productivity.

Advancements in technology have presented a more efficient way to build wearable and wearable computing devices, which is the trend that consumers are following. Advancements in biometric sensors, AI-powered analytics, and extended battery life lead to an improved user experience and functionality, fueling the industry.

The industry is led by global technology giants and specialized wearable makers, including Apple, Samsung Electronics, and Google (Alphabet Inc.). They harness AI-enhanced health information, connectivity to an intelligent ecosystem, and the forefront of biometric monitoring to boost their edge. Furthermore, some new entrants and niche frontrunners are concentrating their efforts on unique offerings, such as sports analytics, AR smart glasses, and long-lasting batteries.

The industry is expected to be supported by several factors, including the growing accuracy of sensors, AI-based health monitoring, and increased adoption of AR-based wearables. Inter-device compatibility, enhanced health tracking features, and intuitive user interfaces are among the key growth factors driving this industry, according to the companies.

Pricing, trends in smartwatch operating systems, and the increasing importance of regulatory approvals for medical-grade health tracking all impact the competitive landscape. With this growth, brands must focus on ecosystem integration, data security, and AI-powered personalization to foster user adoption and drive industry expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Apple Inc. | 25-30% |

| Samsung Electronics | 15-20% |

| Google (Alphabet Inc.) | 10-15% |

| Garmin Ltd. | 7-11% |

| Huawei Technologies Co., Ltd. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Apple Inc. | Leads in smartwatches with the Apple Watch series, featuring ECG, SpO2, and deep iOS integration. |

| Samsung Electronics | Develops the Galaxy Watch series with biometric sensing technology, sleep monitoring, and fitness tracking capabilities. |

| Google (Alphabet Inc.) | Owns Fitbit and Pixel Watch, focusing on AI-driven health insights and wearable-integrated ecosystems. |

| Garmin Ltd. | Specializes in GPS-enabled smartwatches for athletes and outdoor enthusiasts, offering rugged durability. |

| Huawei Technologies Co., Ltd. | Produces HarmonyOS-powered smartwatches emphasizing battery life and sports analytics. |

Key Company Insights

Apple Inc. (25-30%)

Apple is the leader in wearables, with the Apple Watch offering class-leading health-tracking features, including ECG, heart rate detection, and fall detection. The top user experience has deep integration with the iOS ecosystem, which includes AI-powered analytics of the brand.

Samsung Electronics (15-20%)

On Android, Samsung offers its Galaxy Watch range, which features blood pressure monitoring, body composition tracking, and a revamped Wear OS.

Google (10-15% of the portfolio as of now) (Alphabet Inc.)

This means that in areas such as Fitbit and Pixel Watch, where Google is well-established, its products will be heavily driven by AI to generate data points that inform health metrics and provide fitness tracking services, as well as cloud-based wellness services.

Garmin Ltd. (7-11%)

Garmin focuses on professional athletes and adventurers, creating rugged, GPS-enabled smartwatches with long-lasting battery life and sport-specific tracking.

Huawei Technologies Co., Ltd (5-9%)

Touted feature-packed smartwatches like fitness trackers for less dollars are offered by Huawei, as well as advanced sensors and multi-day battery life through HarmonyOS.

Other Key Players (30-40% combined)

By product type, the industry covers smartwatches, head mounted displays, smart clothing, ear worn, fitness trackers, body worn camera, exoskeleton, and other.

By application, the industry includes fitness and wellness, medical and healthcare, infotainment, industrial and defense, and other.

By region, the industry covers North America, Latin America, Europe, South Asia, East Asia, Middle East & Africa (MEA), and Oceania.

The industry is projected to witness a CAGR of 10.2% between 2025 and 2035.

The industry will reach USD 92.4 billion in 2025.

The industry is anticipated to reach USD 235.7 billion by 2035 end.

North America is expected to record the highest CAGR, driven by advancements in smart wearables and increasing health-conscious consumers.

Apple Inc., Samsung Electronics, Google (Alphabet Inc.), Garmin Ltd., Huawei Technologies Co., Ltd., Fitbit (Google-owned), Xiaomi Corporation, Sony Corporation, and Oura Health Ltd. are the key players in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Beauty Market Size, Growth, and Forecast for 2025 to 2035

Wearable Medical Robots Market - Trends & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Fitness Technology Market Insights - Trends & Forecast 2025 to 2035

Wearable Medical Devices Market Growth – Trends & Forecast 2024-2034

Wearable Sleep Tracker Market Trends – Growth & Forecast 2024-2034

Wearable Sensor Market Growth – Trends & Forecast 2024-2034

Wearable Glucometers Market

Wearable Thermometers Market

Wearable Sensors Market

Wearable Sensors For Animal Health Management Market

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA