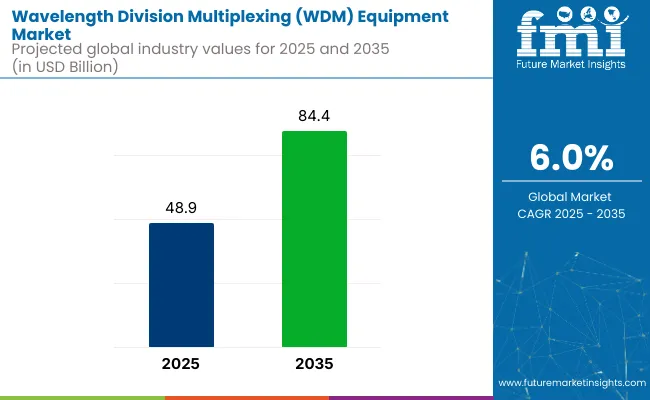

The global wavelength division multiplexing (WDM) equipment market is valued at USD 48.9 billion in 2025 and is expected to reach USD 84.4 billion by 2035, reflecting a CAGR of 6.0%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 48.9 billion |

| Projected value (2035) | USD 84.4 billion |

| CAGR (2025 to 2035) | 6.0% |

Growth is being driven by rising data traffic fueled by expanding cloud computing, rapid 5G deployments, and the increasing adoption of AI-driven applications. Additionally, significant investments in high-speed data transmission infrastructure and optical network upgrades across major economies are expected to support market expansion over the forecast period.

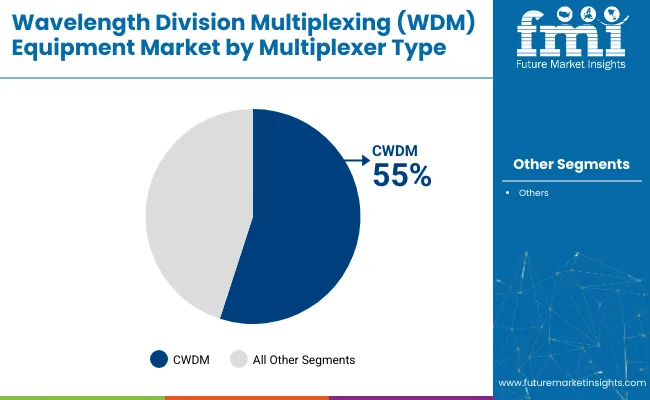

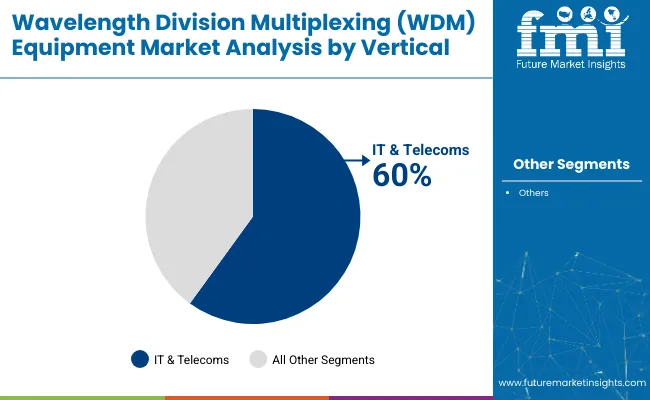

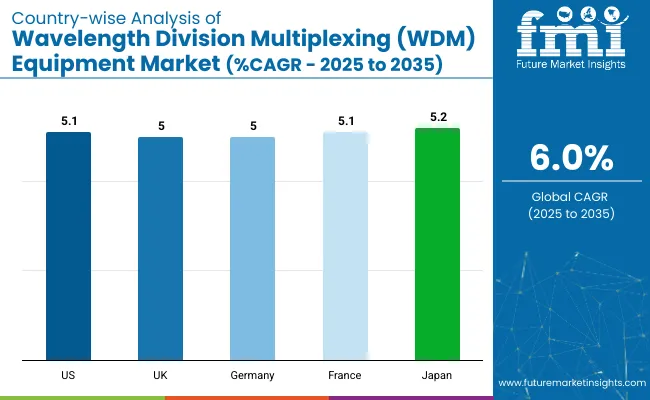

North America is projected to hold the largest market share by 2035 due to significant investments in data center expansions and advanced optical technologies, especially with the USA growing at a robust CAGR of 5.1%. Meanwhile, Japan and France closely follow this rapid growth with CAGRs of 5.2% and 5.1% respectively. Within multiplexer types, CWDM is expected to account for 55% of the market share. The IT and telecom vertical will continue leading the end-use market with 60% of the market share.

The wavelength division multiplexing (WDM) equipment market holds a significant share across its parent markets. In the optical networking equipment market, it accounts for approximately 35-40%, as WDM is essential for maximizing fiber bandwidth. Within the fiber optic communication market, its share is around 25-30%, due to its widespread use in long-haul and metro networks.

It represents about 20% of the telecommunications equipment market, supporting high-capacity data transfer. In data center networking, WDM equipment contributes 15-18%, driven by cloud scalability demands. Overall, WDM technology is a cornerstone of high-speed, scalable, and efficient data transmission across modern network infrastructures.

Looking ahead, the market is expected to be driven by innovations in silicon photonics, terabit-scale WDM solutions, and quantum-secured technologies to address increasing cybersecurity concerns. Partnerships between telecom operators, cloud providers, and technology vendors are anticipated to intensify as companies seek to integrate software-defined optical networks (SDON) for greater scalability and flexibility.

Furthermore, sustainability trends, including the use of energy-efficient and recyclable components, are likely to remain central to future product development and market differentiation. Investments in AI-driven wavelength optimization and automated network management are also expected to accelerate to enhance operational efficiency and reduce latency.

The wavelength division multiplexing (WDM) equipment market is segmented into multiplexer type, vertical and region. By multiplexer type, it is segmented into coarse wavelength division multiplexers (CWDM) and dense wavelength division multiplexers (DWDM).

By vertical, it includes IT & telecoms, healthcare, manufacturing, financial services, and others (including education, retail, logistics), and by region, it covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

The CWDM segment is anticipated to continue holding a dominant share of approximately 55% through 2035. Its growth is being driven by the increasing demand for cost-effective and scalable optical networking solutions in urban and regional networks. The segment’s appeal is underpinned by its simpler design and lower implementation costs compared to DWDM systems, enabling broadband service providers and data centers to expand capacity efficiently, especially in price-sensitive emerging markets.

The IT & telecoms vertical is projected to account for nearly 60% of the market share by 2035. Growth is being driven by surging demand for high-speed data transmission to support cloud computing, AI applications, and 5G rollout. Telecom operators and data centers continue to upgrade optical infrastructure to accommodate the exponential increase in data traffic while ensuring low latency and scalable network performance.

Recent Trends in the Wavelength Division Multiplexing (WDM) Equipment Market

Challenges in the Wavelength Division Multiplexing (WDM) Equipment Market

The USA leads the WDM equipment market with robust growth driven by hyperscale data centers, 5G rollout, and strong telecom investments. China follows closely, fueled by aggressive network expansion, urban connectivity projects, and government-backed digital infrastructure initiatives.

Germany and Japan show steady growth, driven by industrial automation, 5G adoption, and enterprise demand for high-speed networks. The UK maintains moderate growth due to cloud service expansion and smart city initiatives. Overall, North America and East Asia dominate WDM adoption due to technological maturity and digital transformation investments, while European countries follow with strong momentum in enterprise and broadband infrastructure upgrades.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The WDM equipment market in the USA is projected to grow at a CAGR of 5.1% from 2025 to 2035. Growth is being driven by extensive investments in hyperscale data centers, cloud computing infrastructure expansion, and widespread 5G deployments. Strong technological advancements, coupled with a focus on software-defined networks, continue to position the country as a leader in high-capacity optical networking solutions across the telecom and IT sectors.

The WDM equipment sales in the UK are estimated to grow at a CAGR of 5.0% between 2025 and 2035. Expansion is supported by government initiatives like the National Infrastructure Strategy and the UK Gigabit Program that promote digital infrastructure upgrades. Demand is further enhanced by rapid urbanization, smart city initiatives, and the country’s commitment to sustainable and energy-efficient optical networks.

The WDM equipment demand in Germany is expected to grow at a CAGR of 5.0% from 2025 to 2035. This is driven by the rapid roll-out of 5G networks and Industry 4.0 initiatives demanding low-latency, high-capacity optical networks. Significant government investments in digital infrastructure, particularly in rural and industrial areas, continue to support market expansion and advanced network deployments.

The WDM equipment market in France is projected to expand at a CAGR of 5.1% between 2025 and 2035. Growth is driven by a strong government focus on digital transformation and fibre-optic broadband expansion, particularly under EU green initiatives. Rising demand for scalable, high-speed optical networks to support AI, cloud computing, and 5G is further fueling market demand in the country.

The WDM equipment industry in Japan is anticipated to grow at a CAGR of 5.2% from 2025 to 2035. Growth is supported by the country’s mature telecom infrastructure, strong focus on technological innovation, and increasing investments in AI and smart city applications. The market benefits from the demand for compact, cost-efficient, and high-performance WDM systems across dense urban networks.

The WDM equipment market is moderately consolidated, with a few global leaders accounting for a significant share of revenues. Companies such as Huawei Technologies, Ciena Corporation, Nokia, Infinera, and Cisco Systems dominate based on their technological leadership in coherent optics, photonic services, and software-defined optical networking solutions. These firms focus on continuous innovation to enhance bandwidth capacities, reduce latency, and integrate WDM systems into software-defined and automated network architectures.

Company strategies revolve around competitive pricing for emerging markets, partnerships with telecom operators and data centers, and expanding R&D in silicon photonics and terabit-scale systems. Firms like Huawei and ZTE leverage competitive pricing and government-backed projects to expand in Asia and Africa, while Ciena and Nokia invest in advanced 400G/800G solutions to cater to North American and European hyperscale data center deployments. Cisco Systems is prioritizing SDN integration and cloud-ready WDM solutions, whereas Infinera focuses on subsea and long-haul transmission system innovations.

Recent Wavelength Division Multiplexing Equipment Industry News

In February 2025, Juniper Networks partnered with Turkcell to pilot IPoDWDM over 248 km between their data centers.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.9 billion |

| Projected Market Size (2035) | USD 84.4 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Multiplexer Type | Coarse Wavelength Division Multiplexer (CWDM), Dense Wavelength Division Multiplexer (DWDM) |

| By Vertical | IT & Telecoms, Healthcare, Manufacturing, Financial Services, Others (including education, retail, logistics) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Australia, India, Brazil |

| Key Players | ADTRAN, Inc., Aliathon Technology Ltd, Ciena Corporation, Cisco Systems, Fujitsu Ltd., Huawei Technologies, Infinera , Nokia, ZTE Corporation, ALCATEL-LUCENT, ADVA Optical Networking, FiberHome Networks, Juniper Networks |

| Additional Attributes | Dollar sales by value, market share analysis by segment, region-wise and country-wise analysis |

It is bifurcated into coarse wavelength division multiplexer (CWDM), dense wavelength division multiplexer (DWDM).

It is segmented into IT & telecoms, healthcare, manufacturing, financial services, and other.

The industry is studied across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 48.9 billion in 2025.

The market is forecasted to reach USD 84.4 billion by 2035, reflecting a CAGR of 6.0%.

The coarse wavelength division multiplexer (CWDM) segment is expected to lead with a 55% market share in 2025.

The IT & Telecoms segment is expected to hold nearly 60% of the market share by 2035.

Japan is anticipated to be the fastest-growing market with a CAGR of 5.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Garage Equipment Market Growth – Trends & Forecast 2024-2034

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA