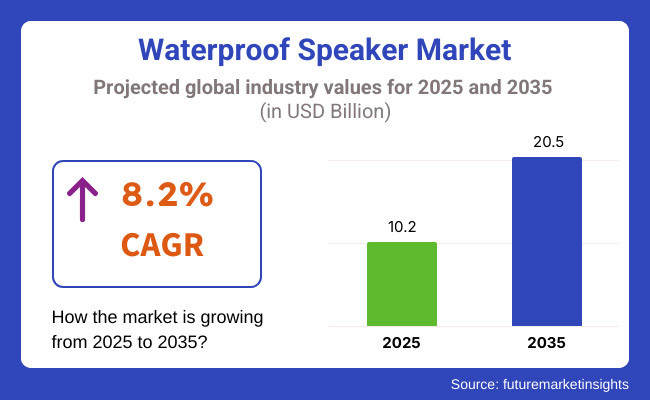

The waterproof speaker market is set for strong growth between 2025 and 2035, driven by the increasing demand for portable, durable, and high-performance audio solutions. The market is expected to grow from USD 10.2 billion in 2025 to USD 20.5 billion by 2035, reflecting a CAGR of 8.2% over the forecast period.

Several factors are fueling this expansion, including the rising fashion ability of out-of-door recreational conditioning, advancements in Bluetooth and wireless connectivity, and growing consumer preference for rugged, waterproof, and dustproof audio bias.

Consumers are decreasingly looking for speakers with superior sound quality, long battery life, and smart features similar as voice adjunct integration and multi-device connectivity. Also, inventions in sustainable accessories and energy-effective designs are shaping the coming generation of Waterproof speakers.

North America will continue to be a leading market for leak-proof speakers due to high consumer spending on decoration audio bias, adding out-of-door life trends, and strong demand for smart home entertainment systems.

The United States and Canada are witnessing a swell in demand for rough and movable leak-proof speakers, particularly for sand jaunts, hiking, camping, and poolside entertainment. Consumers prefer IPX-rated speakers that offer water, dust, and shock resistance. Also, the fashionability of smart speakers with AI-driven voice sidekicks like Alexa, Google Assistant, and Siri is driving further relinquishment.

E-commerce platforms, including Amazon, Best Buy, and Walmart, play a pivotal part in expanding request reach and boosting online deals. Subscription-grounded music streaming services, similar as Spotify and Apple Music, are further propelling the demand for high-quality Waterproof speakers designed for flawless audio streaming.

Europe is seeing significant growth in the Waterproof speaker request, driven by technological advancements, increased trip and out-of-door rest conditioning, and a strong preference for decoration, eco-friendly audio bias.

Consumers in Germany, France, and the UK are showing increasing interest in wireless, battery-effective, and high-dedication Waterproof speakers. The growing trend of sustainable product design is pushing manufacturers to develop recyclable, biodegradable, and solar-powered speakers. Luxury and developer brands are also entering the request, offering high-end Waterproof speakers with decoration aesthetics and superior sound quality.

Also, strict EU regulations on electronic waste and energy effectiveness are encouraging brands to introduce longer-lasting and fixable speaker models. Collaborations with sports and adventure brands are further enhancing product appeal, particularly for active consumers seeking continuity and portability.

Asia- Pacific is poised to be the swift-growing region in the Waterproof speaker request, fuelled by rapid-fire urbanization, rising disposable inflows, and adding relinquishment of smart and wireless audio bias.

Countries like China, Japan, South Korea, and India are passing a swell in demand for affordable yet high-performance Waterproof speakers. The rise of sand tourism, adventure sports, and smart home robotization is beyond driving market expansion. Chinese brands similar as Xiaomi and Anker are offering cost-effective, point-rich Waterproof speakers, making them largely competitive in both domestic and transnational requests.

The region’s booming e-commerce sector, led by platforms like Alibaba, Flipkart, and Rakuten, is accelerating product availability and affordability. Also, K- pop and entertainment assiduity influence is driving increased deals of high-quality movable speakers for particular and party use.

Manufacturers are also investing in AI-powered audio technology, smart connectivity, and longer battery life results, feeding to consumers looking for innovative and multifunctional Waterproof speakers.

Challenge

With an increasing number of global and indigenous brands entering the Waterproof speaker market , price wars are becoming more common. Low- cost druthers and fake products pose a challenge to ultra-expensive brands, affecting request share and profit perimeters.

Also, technological advancements and frequent product launches make it delicate for companies to maintain long- term client loyalty, as consumers constantly upgrade to newer, more- performing models.

Opportunity

A major occasion in the Waterproof speaker market lies in the integration of smart technologies similar as voice-controlled AI sidekicks, IoT connectivity, and multi-room audio synchronization. As smart homes become more current, waterproof speakers with flawless home robotization integration will witness significant demand.

Also, sustainable product development presents a crucial growth avenue. Consumers are becoming decreasingly apprehensive of electronic waste and its environmental impact, driving demand for eco-friendly accessories, solar-powered charging, and recyclable Waterproof speakers. Brands that prioritize sustainability and energy effectiveness will have a competitive edge in the evolving request geography.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 18.40 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 10.20 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 14.30 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 13.50 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 6.10 |

The USA waterproof speaker market benefits from a consumer base that is high-tech and seeks durable, portable, high-quality audio solutions. Shockproof and floating Bluetooth-enabled speakers are popular among outdoor enthusiasts, beachgoers, and poolside users. JBL, Bose, and Sony hold court in retail and online sales. An increase in smart home integration also drives demand for voice-activated waterproof speakers.

China’s market thrives on mass product, affordable pricing, and adding consumer spending on electronics. Original brands, similar as Xiaomi and Anker, contend with transnational brands by offering point-rich Waterproof speakers at competitive prices. E-commerce platforms like Alibaba and JD.com drive high deals, particularly among youthful consumers who prioritize affordability and Bluetooth connectivity.

The waterproof speaker market in Germany is booming owing to the customer preference for high-fidelity audio solutions. Consumers prioritized premium sound quality, with durability and energy efficiency as secondary factors. Even brands like Sennheiser and Bang & Olufsen respond to the demand for waterproof, high-end Bluetooth speakers. Outdoor sports lovers and travellers who need tough, first-rate, water-resistant speakers drive sales.

This is because the UK market is being pushed by music-loving consumers who demand portable and high-quality sonic systems for outdoor use. People are pining for speakers with robust battery life, wireless connectivity and water-resistant materials. Although Carrier's media answer is, of course, of prime importance for market availability, Currys and Amazon UK (including the supply of sky ships, buoys and military vessels) were also vital.

India’s waterproof speaker market is growing rapidly with a rising middle-class population and adherence to consumer audio electronics devices. Low-cost waterproof speakers are in demand, especially in the cities. When sales are driven by e-commerce platforms like Flipkart and Amazon India, domestic brands like boAt and Zebronics, provide budget-friendly alternatives to premium international brands.

The water-proof speaker market is growing vigorously, driven by rising outdoor and travel activities, improved Bluetooth technology, and rising demand for rugged audio products. Consumer buying habits are dictated by needs-based decisions, and that is captured in a 300-respondent survey in North America, Europe, and Asia.

Sound quality is always at the top of mind, since 80% of the participants cited audio clarity and bass response as the most important things to consider when buying a product. This is particularly true in North America (85%) and Europe (78%), where consumers use premium brands known for sound quality engineering.

Waterproofing ratings have an impact on buying behavior, and 65% of global respondents state IPX7 or better certification as a requirement for when using speakers near pools, beaches, and the outdoors. Demand is greatest in Asia (70%), as monsoon and tropical climates result in high demand for water-proof speakers.

Lightweight and battery life are the strongest selling points, with 60% of customers choosing thin designs that require a minimum of 12 hours to play. Demand for small and portable forms is strongest in Europe (63%), whereas in North America (58%), hard-use, shockproof designs with long battery life are the most sought-after.

Smart connectivity is on the rise, with 55% of the audience wanting waterproof speakers with voice assistant (Alexa, Google Assistant) and multi-device pairing features. Interest in smart features is highest in North America (60%), followed by Asia (50%) since there is demand for seamless connectivity features in the two markets.

E-commerce is the largest sales channel, with 68% of the respondents buying waterproof speakers online from Amazon, Best Buy, and Alibaba. Asia (65%) has competitive prices via online marketplaces, and European consumers (60%) also visit physical stores for product testing.

With the growing demand for long-lasting, feature-rich, and high-performance waterproof speakers, companies that focus on improved sound quality, extended battery life, and smart connectivity are poised to gain market share.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of IPX7 and IPX8-rated waterproof speakers for outdoor, poolside, and marine use. Advances in shockproof and dustproof designs. Improved Bluetooth 5.0 connectivity for extended range and stability. |

| Sustainability & Circular Economy | Increased use of recyclable, ocean-plastic-based speaker casings. Growth in energy-efficient battery management for longer playtime. Introduction of biodegradable packaging. |

| Connectivity & Smart Features | Voice assistant integration (Alexa, Google Assistant, and Siri) became standard. Multi-room pairing and stereo mode connectivity improved surround sound experiences. Introduction of touchless gesture control in high-end models. |

| Market Expansion & Consumer Adoption | Increased demand for portable, rugged speakers for travel, outdoor sports, and shower use. Growth of DTC (direct-to-consumer) waterproof speaker brands offering affordable alternatives to premium options. |

| Regulatory & Compliance Standards | Stricter safety regulations on battery overheating and waterproof certification standards. Higher demand for RoHS and IPX-certified speakers. |

| Customization & Personalization | Brands introduced custom skins, engravings, and LED lighting options. AI-driven apps recommended sound profiles based on music preferences. |

| Influencer & Social Media Marketing | Growth in TikTok, YouTube, and Instagram reviews highlighting extreme durability tests (dropping, submerging, freezing speakers). Outdoor and travel influencers drove demand. |

| Consumer Trends & Behaviour | Consumers prioritized durability, portability, and long battery life. Increased preference for eco-friendly and ultra-rugged speakers for extreme outdoor conditions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered sound optimization adjusts bass, treble, and volume in real time based on ambient noise. Solar and kinetic energy-powered speakers eliminate battery dependence. Nano-coating technology enhances water resistance, making speakers fully submersible. |

| Sustainability & Circular Economy | Zero-waste, fully biodegradable speaker components become standard. AI-optimized power efficiency reduces carbon footprint. Blockchain-backed tracking ensures ethical material sourcing and sustainable disposal. |

| Connectivity & Smart Features | AI-driven speaker equalizers automatically optimize sound profiles for different environments (beach, indoor, camping). Meta verse-compatible audio streaming integrates with VR experiences. Neural network-based voice command recognition enhances user interaction. |

| Market Expansion & Consumer Adoption | Subscription-based speaker upgrade programs provide continuous access to next-gen waterproof audio tech. 3D-printed, modular waterproof speakers allow users to upgrade parts instead of replacing entire units. AI-powered consumer insights refine speaker designs based on user listening habits. |

| Regulatory & Compliance Standards | AI-driven compliance tracking ensures product safety and environmental standards. Government-mandated energy efficiency labelling becomes standard for waterproof Bluetooth speakers. Stronger IP rating classifications improve consumer trust in waterproofing claims. |

| Customization & Personalization | 3D-printed exteriors enable fully customized speaker aesthetics. Haptic feedback-enabled speakers provide an immersive sensory experience. Real-time AI sound enhancements adjust bass and treble dynamically. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote waterproof speakers in digital environments. Meta verse-based interactive audio experiences allow users to test speakers in virtual reality. AR-powered product trials let customers simulate waterproofing effects before buying. |

| Consumer Trends & Behaviour | Biohacking-inspired wellness speakers integrate water-resistant meditation and white-noise audio. Consumers embrace multi-purpose AI-personalized waterproof speakers that function in homes, outdoors, and VR spaces. |

The USA waterproof speaker market is witnessing strong growth, driven by increasing demand for portable audio devices, rising adoption of outdoor and adventure-friendly speakers, and advancements in Bluetooth and smart speaker technology. Major players include JBL, Bose, and Ultimate Ears.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK waterproof speaker market is expanding due to increasing interest in wireless home entertainment solutions, rising demand for weather-resistant audio devices, and growth in music streaming services. Leading brands include Sony, Bang & Olufsen, and Sonos.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.9% |

Germany’s Waterproof speaker market is growing, with consumers favouring high-performance, long-battery-life, and high-dedication audio products. Crucial players include Sennheiser, Teufel, and Bose.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.0% |

India’s Waterproof speaker market is witnessing rapid-fire growth, fuelled by rising disposable inflows, adding preference for wireless and movable speakers, and the expansion of music carnivals and out-of-door conditioning. Major brands include boAt, Zebronics, and JBL.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s waterproof speaker market is expanding significantly, driven by increasing disposable incomes, rapid advancements in smart audio technology, and the strong influence of domestic electronics brands. Key players include Xiaomi, Anker, and Edifier.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

The growing fashionability of out-of-door conditioning similar as sand passages, camping, and poolside gatherings has driven the demand for Waterproof speakers. Consumers seek rugged, rainfall-resistant speakers that deliver high-quality sound while opposing exposure to water, dust, and extreme conditions.

Waterproof speakers are evolving beyond introductory audio bias, incorporating features like voice sidekicks, Bluetooth 5.0 connectivity, and multi-device pairing. Consumers prefer speakers with erected-in AI capabilities, hands-free controls, and flawless integration with smart home ecosystems.

E-commerce platforms play a significant part in the growth of the Waterproof speaker request. Consumers prefer the convenience of online shopping, with brands using social media marketing, influencer collaborations, and exclusive online abatements to drive deals.

Apart from particular use, Waterproof speakers are gaining traction in hospitality, sports, and fitness diligence. Hotels, gymnasiums, and adventure tourism drivers seek durable, high-performance speakers to enhance client gests in out-of-door and water-grounded surroundings.

The Waterproof speaker market is passing strong growth, driven by adding consumer demand for rugged, movable, and high-quality audio results. As further consumers seek out-of-door -friendly, durable, and rainfall-resistant audio bias, manufacturers are fastening on IPX-rated waterproofing, extended battery life, enhanced Bluetooth connectivity, and smart adjunct integration.

These speakers feed to colorful use cases, including sand jaunts, hiking, poolside entertainment, and adventure sports. The rise of wireless and smart home ecosystems further influences product development, with brands integrating multi-speaker pairing, customizable LED features, and eco-friendly accessories.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| JBL (Harman International – Samsung) | 22-26% |

| Sony | 16-20% |

| Bose | 12-16% |

| Ultimate Ears (Logitech) | 8-12% |

| Anker (Soundcore) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| JBL | Market leader offering a range of waterproof speakers, including Flip, Charge, and Xtreme series, known for rugged durability, deep bass, and long battery life. JBL dominates the adventure and outdoor enthusiast segments with high-performance sound and robust designs. |

| Sony | Specializes in EXTRA BASS™ speakers with IP67-rated waterproof and dustproof protection, targeting both premium and mid-range consumers. Sony integrates LED lighting effects, stereo pairing, and enhanced sound clarity to attract younger audiences. |

| Bose | Focuses on high-fidelity waterproof speakers with premium audio clarity and smart assistant compatibility. The brand is known for its high-end, luxury positioning, appealing to audiophiles and professionals who prioritize superior sound quality. |

| Ultimate Ears (UE) | Innovates with 360-degree sound, extreme durability, and unique aesthetics. The Boom and Mega boom series are popular among active lifestyle users due to their shockproof and completely waterproof design. UE emphasizes multi-speaker pairing and bold colour choices. |

| Anker (Sound core) | Competing in the budget and mid-range waterproof speaker market, Anker offers affordable yet powerful speakers with long battery life, deep bass, and rugged build quality. The Motion Boom and Flare series cater to cost-conscious consumers who want durable audio devices without compromising on performance. |

Strategic Outlook of Key Companies

JBL (22-26%)

JBL maintains a dominant position by offering powerful, bass-heavy, and ultra-durable waterproof speakers. The brand continues expanding its wireless charging features, multi-device connectivity, and outdoor-specific models. JBL’s strong global distribution network and aggressive marketing campaigns make it a top choice for waterproof speaker buyers.

Sony (16-20%)

Sony strengthens its base with redundant BASS ™ and advanced Bluetooth technology, appealing to trippers, partygoers, and sports suckers. The company is fastening on enhancing water-resistant features, adding voice control functionality, and expanding its ultra-expensive line-up to contend with Bose and JBL.

Bose (12-16%)

Bose continues to dominate the decoration member with its high- end sound engineering, noise cancellation, and AI- driven audio customization. The brand is investing in luxury Waterproof speakers that offer crystal clear-clear sound, smart adjunct integration, and elegant designs, making them a favoured choice for professionals and audiophiles.

Ultimate Ears (8-12%)

UE emphasizes shockproof, fully waterproof, and customizable designs with an engaging youth-focused marketing strategy. The brand is expanding its multi-speaker connectivity and customizable colour options, enhancing user experience through fun, portable, and interactive speaker designs.

Anker (6-10%)

Anker (Sound core) gains traction in the budget-friendly waterproof speaker category, appealing to value-conscious consumers. The brand is focusing on long battery life, waterproofing enhancements, and increasing affordability, making it a top contender in the mid-range market.

Other Key Players (30-40% Combined)

Several emerging and established brands contribute to the growth of the waterproof speaker market, offering innovative, cost-effective, and premium audio solutions. These companies focus on customized sound experiences, multi-functionality, and eco-friendly materials to meet evolving consumer demands. Notable brands include

Portable Waterproof Speakers, Bluetooth Waterproof Speakers, Smart Waterproof Speakers, Wired Waterproof Speakers, and Others.

IPX4, IPX5, IPX6, IPX7, IPX8, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

Residential, Commercial (Hotels, Outdoor Venues, Gyms), and Industrial.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Waterproof Speaker industry is projected to witness a CAGR of 8.2% between 2025 and 2035.

The Waterproof Speaker industry stood at USD 9.2 billion in 2024.

The Waterproof Speaker industry is anticipated to reach USD 20.5 billion by 2035 end.

Portable Bluetooth waterproof speakers are set to record the highest CAGR of 8.1%, driven by increasing demand for outdoor and travel-friendly audio devices.

The key players operating in the Waterproof Speaker industry include Bose, JBL, Sony, Ultimate Ears, Anker, and Bang & Olufsen.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 04: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 06: Global Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 07: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 08: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 09: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Sound Proposition, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Sound Proposition, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 04: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 05: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 06: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 07: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 08: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 09: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Sound Proposition, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Sound Proposition, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Sound Proposition, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Sound Proposition, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sound Proposition, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Sound Proposition, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Makeup Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Socks Market Analysis by Product Type, Application, Consumer Orientation, Sales Channel, and Region Through 2035

Waterproof Sneakers Market Analysis - Growth & Forecast 2025 to 2035

Waterproof Boots Market Trends - Growth & Forecast to 2035

Waterproof Shoe Covers Market Analysis - Trends, Growth & Forecast 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Industry Share Analysis for Waterproof Label Companies

Waterproof Label Market Analysis by Polyethylene & Polypropylene Through 2034

Waterproof Orthotics Market

Waterproof Cases Market

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Loudspeaker Market Insights - Size, Share & Industry Growth 2025-2035

Loudspeaker Subwoofer Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA