The waterproof label market expands exponentially as companies require robust, water-resistant labeling solutions for harsh environments. Companies combine cutting-edge printing technologies, tamper-evident adhesives, and sustainable materials to improve label performance. Food & beverage, pharmaceuticals, and logistics are the key industries driving adoption to guarantee product durability and regulatory compliance.

Companies innovate using UV-resistant inks, high-speed digital printing, and intelligent labels with integrated QR codes and RFID tracing. The market evolves to more sustainable, economical, and high-performance waterproof labels to support stringent industry regulation and sustainability drives.

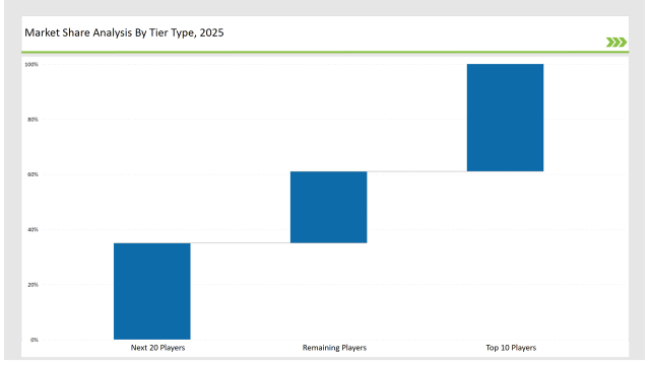

Tier 1 players like Avery Dennison, CCL Industries, and UPM Raflatac dominate the market with 39% share because of their innovations in weatherproof adhesives, security labels, and international distribution channels.

Level 2 players such as 3M, Lintec Corporation, and Tesa SE hold 35% of the market share with their emphasis on high-performance materials, thermal transfer labels, and custom-printed waterproof solutions in logistics, healthcare, and industrial uses.

Tier 3 is comprised of niche players offering environmentally friendly waterproof labels, regional manufacturing, and industry-specific adhesives with the remaining 26% share of the market.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Avery Dennison, CCL Industries, UPM Raflatac) | 20% |

| Rest of Top 5 (3M, Lintec Corporation) | 11% |

| Next 5 of Top 10 (Tesa SE, Brady Corporation, Fuji Seal, Schreiner Group, Inland Packaging) | 8% |

The waterproof label industry serves multiple sectors where durability, readability, and compliance are essential. Companies integrate advanced adhesives, synthetic label materials, and high-resolution printing technologies to meet industry demands. They enhance resistance to extreme temperatures and chemicals, ensuring label integrity. Manufacturers also develop sustainable materials to reduce environmental impact.

Manufacturers improve waterproof label solutions with advanced adhesives, anti-fade coatings, and smart tracking capabilities. Companies incorporate encrypted QR codes and tamper-evident technology to prevent counterfeiting and unauthorized label replacement. They also enhance label flexibility to withstand extreme conditions and optimize material composition for extended durability.

Automation, durability, and sustainability redefine the waterproof label market. Companies leverage advanced coatings, AI-driven quality control, and IoT-enabled tracking to optimize label longevity and supply chain visibility. Businesses enhance security by integrating blockchain-backed authentication labels and tamper-resistant adhesives. Manufacturers develop solvent-resistant coatings, expand encrypted label verification, and integrate predictive analytics to improve supply chain efficiency. They enhance production speed by adopting digital printing techniques and smart label manufacturing. Industry leaders implement real-time defect detection using AI to minimize errors. Companies also optimize supply chain transparency through cloud-based data management solutions.

Year-on-Year Leaders

Technology providers should prioritize high-performance materials, automation, and sustainable solutions to meet evolving industry needs. Partnering with major sectors like logistics, pharmaceuticals, and food packaging will drive adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Avery Dennison, CCL Industries, UPM Raflatac |

| Tier 2 | 3M, Lintec Corporation, Tesa SE |

| Tier 3 | Brady Corporation, Fuji Seal, Schreiner Group, Inland Packaging |

Leading manufacturers integrate AI-powered monitoring, high-durability coatings, and smart tracking solutions into waterproof labels. Companies advance tamper-resistant and encrypted label technologies to enhance security and regulatory compliance. They implement automated quality checks to ensure label durability and performance. Manufacturers also enhance label adhesive strength to withstand extreme environmental conditions.

| Manufacturer | Latest Developments |

|---|---|

| Avery Dennison | Launched recyclable waterproof labels in March 2024. |

| CCL Industries | Developed UV-resistant, high-security barcode labels in April 2024. |

| UPM Raflatac | Strengthened solvent-proof adhesives in May 2024. |

| 3M | Introduced industrial-grade waterproof labels in June 2024. |

| Lintec Corporation | Expanded tamper-proof security labels in July 2024. |

| Tesa SE | Released smart tracking labels with NFC technology in August 2024. |

| Brady Corporation | Innovated RFID-integrated tracking labels in September 2024. |

Manufacturers drive the waterproof label market forward by investing in eco-friendly materials, high-performance adhesives, and AI-driven quality control. Companies integrate blockchain-backed label verification and predictive analytics to optimize product authentication and prevent counterfeiting. Industry leaders develop solvent-resistant coatings and enhance UV-protection for long-lasting label performance.

Companies continue investing in AI-quality checking, blockchain authentication, and smart labelling technologies. Businesses design performance-oriented, bio-based materials and super-resistant print innovations for improved product longevity. Businesses expand predictive analysis and IoT-enabled tracking to simplify the efficacy of supply chains. Participants introduce innovations through temperature-proof tapes, machine learning configurations to detect faults, and live supply chain monitoring technologies. Companies enhance customization capabilities to meet industry-specific needs and extend sustainability efforts by using recyclable label materials. Leading companies also concentrate on the development of next-generation ink formulas to enhance durability and clarity.

Leading players include Avery Dennison, CCL Industries, UPM Raflatac, 3M, Lintec Corporation, and Tesa SE.

The top 3 players collectively hold 20% of the global market.

The market has medium concentration, with the top players holding 39% of the industry share.

Sustainability, AI-driven analytics, smart tracking technology, and high-performance adhesives drive innovation in waterproof labeling solutions.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.