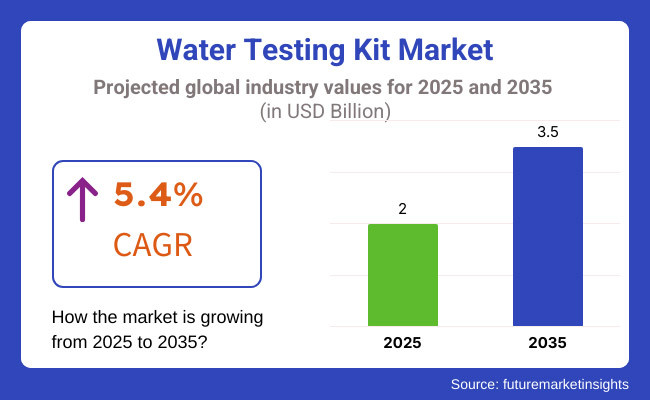

The global water testing kit industry is projected to grow significantly over the next decade. According to Future Market Insights, it is expected to surge from USD 2 billion in 2025 to USD 3.5 billion by 2035, translating to a robust 5.4% CAGR over 2025 to 2035.

The year 2024 witnessed several pivotal developments in the water testing kit sector. Heightened awareness of water safety propelled demand, as multiple events underscored the importance of monitoring water quality.

For instance, regulators introduced stricter limits on contaminants - the USA EPA issued its first-ever enforceable standards for PFAS “forever chemicals” in drinking water in early 2024, and the EU began implementing its recast Drinking Water Directive with tighter heavy metal and micro-pollutant thresholds. These regulatory moves prompted municipalities and industries to ramp up testing efforts.

Public health incidents and infrastructure challenges also kept water quality in the news. Aging water pipelines and sporadic contamination scares (e.g. localized boil-water advisories and post-flood pollution concerns) led communities to proactively test their water, boosting sales of kits for home use.

On the corporate front, companies responded to market needs with new product improvements - many kits in 2024 featured faster detection times and digital integration (smartphone apps and cloud connectivity), making water testing more user-friendly and data-driven.

The competitive landscape saw consolidation and partnerships: although no mega-mergers occurred exclusively in 2024, a few strategic acquisitions and alliances (particularly in digital water monitoring) indicated companies’ intent to offer end-to-end water quality solutions.

Overall, 2024 can be characterized by stricter regulations, greater consumer involvement, and technological enhancements, all contributing to a more vigilant water testing environment.

Moving into 2025 and the longer-term, these trends are expected to strengthen. Regulatory momentum will continue - more governments are likely to enforce stringent water quality standards (for example, additional countries setting lower allowable limits for contaminants like lead, nitrates, and PFAS). This will expand the market for compliance-related testing in both municipal water systems and private wells.

Technological innovation is poised to play a larger role: we anticipate broader adoption of smart testing kits that sync with apps for real-time analysis, portable digital sensors with higher sensitivity, and even AI-based tools to interpret results.

Key market drivers such as urbanization and industrial growth (especially in Asia-Pacific) mean demand for kits in emerging economies will climb, as these regions invest in safer water for growing populations.

Meanwhile, in mature markets (North America, Europe), replacement and upgrade cycles - e.g. utilities replacing old lab equipment with portable kits for fieldwork, or households shifting from basic strips to more advanced kits - will sustain growth.

Explore FMI!

Book a free demo

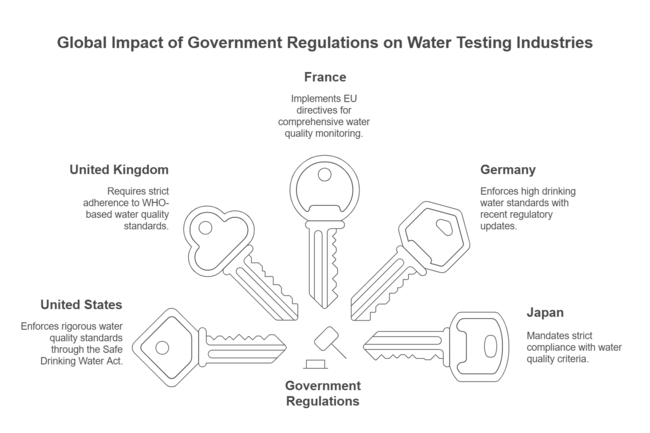

Regulatory policies are a key driving force in the water testing kit industry, as they set the standards for water quality that necessitate frequent testing. Below is a summary of notable regulations by country and how they influence the water testing kits market:

Safe Drinking Water Act (SDWA) - Federal law empowering EPA to set enforceable water quality standards. Utilities must routinely test drinking water for ~90 contaminants and report results

Recent updates include the Lead and Copper Rule revisions (tightening lead limits) and 2024 PFAS regulations, which are driving increased testing for those substances. Overall, SDWA mandates rigorous monitoring schedules, boosting demand for compliant testing kits in municipal and private systems.

Water Supply (Water Quality) Regulations (enforced by the Drinking Water Inspectorate, DWI) - UK. law (mirroring EU directives) requires water companies to meet strict WHO-based standards. Daily samples of drinking water are tested by the DWI’s independent labs.

Regulation 31 ensures any treatment chemical or material in contact with water is approved so as not to leach contaminants. These rules ensure continuous testing; water utilities and accredited labs heavily rely on test kits for parameters like bacteria, chemicals, and trace metals to maintain compliance.

Code de la Santé Publique & EU Directive 98/83/EC - France implements the EU Drinking Water Directive via national legislation (e.g. Décret 2001-1220 and successors). This sets parametric limits for microbes and chemicals in tap water. Regular monitoring of public water supplies is compulsory; utilities take samples at set frequencies (multiple times per year for major networks) and report to health authorities.

France’s regulations also emphasize risk management and transparency, requiring consumer notification if any standard is breached. These policies drive a consistent market for testing kits (especially for chlorine, bacteria, pesticides, nitrates) among water suppliers.

Drinking Water Ordinance (Trinkwasserverordnung) - A comprehensive regulation enforcing high drinking water standards. It was revised in June 2023 to introduce risk-based monitoring and stricter limits for contaminants like lead, chromium, and arsenic. Water providers must conduct regular testing for a wide array of microbiological and chemical parameters (with 99%+ compliance historically

Any exceedance triggers immediate investigation and corrective action. This ordinance ensures that laboratories and water utilities continuously invest in accurate test kits for regulatory compliance, including new requirements (e.g., testing for emerging pollutants such as certain PFAS compounds added in the latest update).

Legislative Decree 31/2001 - Italy transposed the EU Drinking Water Directive into national law via this decree. It sets strict quality standards for potable water (microbial, chemical, and indicator parameters) and assigns local health units to oversee testing. Water suppliers must regularly sample water at both treatment plants and distribution endpoints.

Italy’s regulations have recently been updated to align with the EU’s 2020 directive revisions, meaning tighter controls on contaminants like bisphenol-A and PFAS in coming years. The consistent enforcement by regional water authorities ensures ongoing demand for test kits, especially in monitoring rural aqueducts and aging distribution systems common in parts of Italy.

Drinking Water Management Act & Water Supply Act - South Korea maintains standards largely based on WHO guidelines. Public water systems are required to monitor dozens of water quality parameters at specified intervals. For example, residual chlorine, bacteria, and heavy metals are tested regularly in municipal supplies.

High-profile incidents (such as a 2020 case of insect larvae found in tap water reservoirs) have led to even stricter inspection protocols by the Ministry of Environment. Regulations also cover water purifiers and building storage tanks, mandating periodic testing. These legal requirements push municipalities and even building owners to utilize certified test kits to ensure compliance and reassure the public.

Water Supply Act Standards - Japan’s Waterworks Act mandates that tap water must meet 51 specified quality criteria through regular inspections.

Water utilities perform daily checks (for chlorine residual) and frequent lab tests for a range of contaminants (from E. coli to arsenic) across distribution systems. The standards are very stringent (e.g., zero tolerance for coliform bacteria), and any deviation requires immediate corrective measures. Japan’s enforcement of these standards is rigorous, resulting in over 99.9% compliance nationally.

This regulatory framework ensures continuous use of high-precision water testing kits by utilities. In addition, recent moves to address pollutants like PFAS have authorities evaluating new testing methods, potentially expanding kit usage for those parameters.

National Drinking Water Standard (GB 5749-2022) - China updated its drinking water standard in 2022 (effective April 2023) to unify urban and rural water quality requirements. It specifies limits for 97 indices, including microbial, chemical, and physical parameters. Notably, it tightened permissible levels for nitrate, turbidity, organics (permanganate index), and added new indicators (such as some PFAS).

Regular monitoring is mandatory: water treatment plants must conduct daily tests for key indicators and comprehensive analyses periodically, reporting to the National Health Commission. Enforcement is strict in cities and increasingly in townships, driving demand for a wide range of testing kits - from basic chlorine/pH kits at rural facilities to advanced multi-parameter kits in urban water companies.

Australian Drinking Water Guidelines (ADWG) - Australia’s approach is guideline-based (non-enforceable at federal level) but widely adopted by state health regulations. The ADWG, developed by the NHMRC, sets limits for microbiological, chemical, and radiological characteristics of water. Utilities regularly test against these guideline values.

In practice, state authorities require large water suppliers to perform continuous monitoring (e.g., chlorine, turbidity) and periodic testing for metals, pesticides, etc. Additionally, given Australia’s climate, recycled water and rainwater usage is common - there are guidelines and rules for testing those sources as well. The result is a robust testing regimen; water utilities and private operators (like mine sites, remote communities) use a variety of kits to ensure water meets safety guidelines.

Drinking Water Standards for New Zealand (DWSNZ) - Legally enforced under the Water Services Act 2021 and overseen by the new regulator Taumata Arowai. After a major contamination incident in 2016, NZ overhauled its regulations: now all drinking water suppliers (including small rural schemes) must monitor water quality regularly.

The DWSNZ specify sampling frequency based on population served and set strict maximum allowable values for contaminants. Parameters like E. coli are tested at least weekly in most supplies, and chemical checks (nitrates, metals) are done quarterly to annually. Compliance is mandatory; failure can lead to supply shutdowns.

This regulatory landscape has markedly increased demand for reliable test kits in New Zealand, especially for small communities that previously did minimal testing and now must regularly check their water to stay within the law.

The water testing kit market is highly fragmented, with numerous players contributing to the global supply. No single company dominates the entire market; instead, a mix of multinational corporations and specialized regional firms make up the competitive landscape. A deep dive into market share reveals the following:

M&A Activity: In 2024, the water testing kit sector experienced targeted mergers and acquisitions, though on a modest scale (relative to some other water industry segments). One notable deal was AquaPhoenix Scientific’s acquisition of TankScan in December 2024, a move that combined traditional water testing kit expertise with IoT-based remote monitoring capabilities.

AquaPhoenix (a USA. manufacturer of water testing kits and solutions) purchased TankScan - a provider of wireless tank level monitoring technology - to expand into smart monitoring of water storage and distribution systems.

This acquisition highlights a trend of kit companies integrating digital monitoring tools, enabling them to offer clients a more comprehensive water management solution (kits for on-spot testing plus sensors for continuous data). Another strategic acquisition influencing the space was EQT Group’s buyout of AMCS Group (an Irish firm specializing in waste & water management software) for USD1.4 billion in early 2024

While not a direct acquisition of a test kit manufacturer, this deal underscores investor interest in water quality technologies. It signaled the growing value of digital water platforms and could indirectly affect kit companies - as large investors assemble end-to-end water solution portfolios, smaller kit makers might become acquisition targets to complement digital offerings.

Corporate Restructuring: 2024 also saw spin-offs and refocusing by conglomerates that have water testing lines. A prominent example was DuPont’s decision to spin off its water business (announced in the first half of 2024) as a separate entity

DuPont’s water division deals with filtration and treatment, but the spin-off reflects a broader trend of large companies streamlining to focus on core strengths, much like Danaher’s 2023 spin-out of Veralto (which included Hach’s water quality business)

While Danaher’s spin-off occurred in late 2023, its effects carried into 2024 - Veralto began operating independently, potentially freeing it to pursue more targeted acquisitions in the water testing arena in 2024 and beyond.

These restructurings are significant because they suggest that major players are positioning themselves for growth in water-related analytics, possibly by acquiring niche kit innovators or forging partnerships post spin-off. Industry analysts in 2024 viewed these moves as groundwork for an anticipated uptick in focused M&A activity in the testing and analysis segment of the water industry.

Partnerships and Collaborations: Partnerships were another key theme in 2024, as companies and government bodies collaborated to address water quality challenges. A standout example is the public-private partnership in Colorado, USA, where the state’s Department of Public Health & Environment partnered with Cyclopure Inc. in a pilot program to test private well water for PFAS contamination

Within testing kits, many moves were “bolt-on” acquisitions - larger corporations acquiring small innovative companies - or strategic collaborations rather than blockbuster mergers. The net effect in 2024 was a gradual concentration of capabilities: multi-national firms expanded their portfolios (organically or via acquisitions), and specialists linked up with complementary partners.

This sets the stage for a more integrated industry, where hardware (test kits), software (data management), and service (consulting/testing services) are increasingly entwined. Stakeholders expect that the groundwork laid in 2024 will lead to further M&A and partnership announcements in 2025 as companies digest these changes and pursue the next opportunities.

The United States represents one of the largest and most advanced markets for water testing kits. The Safe Drinking Water Act requires regular testing by public water systems, creating a baseline continuous need for kits and lab supplies.

Recent regulatory moves - such as the EPA’s proposal of enforceable limits on PFAS in 2024 and ongoing enforcement of the revised Lead and Copper Rule - have intensified testing activity. Utilities across the USA.

are ramping up monitoring efforts to comply with these stricter standards (e.g. more frequent lead testing in schools and daycares, new PFAS monitoring programs), directly boosting kit purchases for parameters like lead, PFAS, and disinfection byproducts. The USA. market is characterized by a mix of institutional and consumer segments.

On the institutional side, thousands of municipal water utilities, commercial labs, and industrial facilities purchase kits and instruments to meet regulatory and operational needs. Many small rural water systems rely on field test kits for periodic checks due to limited lab access.

The industrial sector (power plants, food/beverage, pharmaceuticals) is another significant segment - these industries must test boiler water, manufacturing effluent, etc., and often use portable kits for quick onsite readings to complement lab analysis. On the consumer side, there’s a growing trend of homeowners testing their well or tap water.

High-profile incidents like the Flint, Michigan lead crisis and more recent concerns (e.g., trace contaminants in city supplies) have led to greater consumer vigilance. Sales of do-it-yourself water test kits in retail and online channels have risen, as families seek to independently verify the safety of their drinking water.

The USA. market is seeing technological adoption and consolidation. Digital test kits and smartphone apps are quite popular - for example, many pool owners have shifted to app-enabled testing as tech-savvy consumers embrace convenience.

Also, the concept of “smart home” water monitoring is emerging, wherein a digital test device might be part of home water systems; USA. consumers are early adopters of such innovations.

Future Market Insights projects the USA. water testing kit market to grow at about 6.1% CAGR from 2025 to 2035, slightly above the global average.

This growth is underpinned by continued regulatory stringency (the EPA is expected to add or tighten standards for contaminants, requiring more testing), infrastructure investment (federal funding for replacing lead service lines and upgrading water systems includes components for water quality monitoring), and climate change impacts (droughts and flooding can compromise water quality, prompting more testing in affected regions).

Within the USA., demand is nationwide but particularly high in regions with known water quality challenges - for instance, the Midwest for agricultural runoff (nitrates), the Southwest for arsenic and uranium in groundwater, and older Northeastern cities for lead and corrosion issues.

States like California, with very stringent water regulations (sometimes stricter than EPA’s), drive significant testing volume - California’s Title 22 water code mandates extensive testing, benefiting kit suppliers.

The USA. market hosts major global players (Hach/Danaher, Thermo Fisher, LaMotte, etc.) and numerous domestic brands for different niches (e.g., industrial kits vs. home kits). The presence of an educated customer base and the litigious nature of water safety (liability concerns push companies and municipalities to test more) mean quality and reliability are paramount - USA.

buyers often prefer well-established brands and EPA-approved test methods. As a result, innovation is quickly adopted but must be validated; for instance, new PFAS test kits are gaining interest, but many utilities still rely on EPA-approved lab methods until field kits prove themselves.

The USA. will likely continue to be a market leader in adoption of new testing technologies and a bellwether for industry trends. With ample funding and a robust regulatory framework, the USA. water testing kit market is expected to steadily expand, focusing on ensuring drinking water safety, monitoring aging infrastructure, and addressing emerging contaminants.

The United Kingdom has a well-developed water testing regime, anchored by strict regulatory oversight and a mature infrastructure. In the UK (England, Wales, Scotland, Northern Ireland), water quality is tightly regulated; the Drinking Water Inspectorate (DWI) and devolved agencies enforce standards equivalent to or exceeding EU levels.

This means that water companies must perform daily testing of water supplies for a host of microbiological and chemical parameters.

Consequently, the UK market for water testing kits is largely driven by the needs of these regional water utilities (such as Thames Water, Severn Trent, etc.) and accredited laboratories servicing them. The majority of testing is laboratory-based (utilities operate sophisticated labs), but there is still substantial use of field kits for operational monitoring and emergency checks.

For example, water company field teams use portable kits to test chlorine residuals and turbidity in the distribution network on-site, ensuring real-time compliance. UK water companies also maintain emergency testing kits for incidents (like pipe bursts or contamination events) to quickly assess water safety on the spot.

This institutional demand ensures a continuous base market for high-quality test kits - typically those that align with BS EN standard methods or are approved by the DWI.

Beyond the utilities, environmental monitoring and industrial compliance form another segment. The Environment Agency conducts river and groundwater quality monitoring; while much is lab analysis, field test kits (for parameters like pH, dissolved oxygen, ammonia) are used for quick screening during site inspections.

Industries such as food processing, pharmaceuticals, and power plants in the UK must monitor their wastewater and process water - they often employ on-site kits for daily checks to avoid breaches of discharge consents.

Consumer and Niche Use: Historically, British consumers did not commonly test tap water at home (due to high trust in public water supply). However, there’s a niche consumer market growing for lead testing kits in older homes (given some legacy lead plumbing) and for private well owners (mostly rural estates not on mains supply).

Additionally, the UK has a sizeable pool and spa market (both public pools and home spas), which drives demand for pool water test kits (for chlorine, pH, etc.). Brands like Palintest (a UK company) and Lovibond are well-known in this space. Growth Factors: The UK market is relatively mature, so growth is modest - driven by upgrades and replacements rather than new demand surges.

Future Market Insights identifies the UK as one of the top five countries driving demand, thanks to its stringent standards, but the CAGR here is likely around the global averageUK water companies have been investing in online sensors for some parameters (like turbidity or chlorine) - while those are not “kits”, it influences the kit market by setting higher expectations for real-time data.

In turn, kit manufacturers are offering more digital solutions to UK clients, such as Bluetooth-enabled portable photometers that upload results to central databases. Another factor is brexit - the UK has retained EU-equivalent regulations and even seeks to strengthen some aspects (for example, considering national limits on PFAS ahead of some EU timelines), so testing requirements remain high.

Also, Scotland and Wales often implement additional monitoring for raw water sources to protect their abundant catchments, contributing to kit usage in environmental contexts. The UK benefits from domestic manufacturers (like Palintest/Halma, a significant player globally) and hosts European operations of others (Hach has a UK presence, for instance).

The market values quality and compliance - kits that are certified or come from trusted suppliers are preferred by institutions.

The UK will continue to demand a wide array of test kits, from basic chlorine/pH pool testers to advanced multi-parameter field kits for utilities. Growth will be steady, tied closely to regulatory evolutions (e.g., potential upcoming rules on microplastics or tighter pesticide limits could spur new kit adoption).

Overall, the UK’s combination of regulatory rigor, environmental consciousness, and technical capability ensures it remains a robust market for water testing solutions, albeit with incremental growth.

France has a comprehensive framework for water quality management, making water testing an essential ongoing activity. France’s drinking water is monitored under strict rules derived from EU directives, enforced by regional health agencies (Agences Régionales de Santé, ARS).

All community water systems must regularly test water at the source and various points in the distribution network. This entails frequent sampling sent to certified laboratories for analysis. As a result, much of the market in France revolves around these labs and the consumables they use (reagents, culture media, etc.), as well as some field testing by technicians.

For instance, field workers use portable kits to do quick checks of chlorine levels on-site daily at water treatment plants and storage reservoirs, as an operational safeguard before lab confirmation.

France’s geography (with many small rural communes historically managing water) means a lot of small water systems. In recent years, consolidation of water services has occurred, but there remain thousands of small facilities - these often rely on simpler test kits for routine monitoring because setting up full labs isn’t economical.

Thus, demand exists for user-friendly kits that local operators can use to check parameters like residual disinfectant, basic microbial indicators (like coliform presence/absence kits), and nitrates (particularly in agricultural regions like Brittany where nitrate pollution is a concern).

France’s significant industrial base (chemicals, pharmaceuticals, agrifood) must adhere to water discharge regulations, which drives testing in factories and independent test service companies. Industrial sites often maintain their own testing kits for process water (e.g., cooling tower water test kits for legionella, boiler water hardness kits).

The environmental agencies and river basin authorities conduct surface water monitoring - here portable water testing kits might be used for field screening of parameters such as pH, conductivity, and sometimes for educational river programs (France has active water awareness programs that use kits in schools or community science).

Recent regulatory changes in France - like lowering limits for pesticides and emerging compounds - push laboratories to upgrade capabilities, but they also spur interest in on-site test kits for early detection. For example, French water agencies have been trialing rapid algal toxin test kits in response to algal bloom issues in certain rivers/lakes used for drinking water.

Another driver is the national focus on eliminating lead piping: as France works to replace old pipes, there’s been widespread testing for lead at consumer taps, including the use of field test kits by some investigative teams to map out lead contamination.

French consumers generally trust public water (bottled water consumption is high in France but often for taste preferences). However, there is a niche market for home testing kits - typically for those on private wells (in rural areas or holiday homes) and those curious about hardness or wanting to check if their filter systems work.

The DIY market isn’t as large as in the USA., but exists through pharmacies or online stores offering kits to test for things like nitrates (especially in farming communities concerned about well water).

The French market is relatively stable with moderate growth. It’s heavily compliance-driven; as EU directives evolve (the recast Drinking Water Directive mandates new parameters like some PFAS by 2026), French entities will need to incorporate these tests - potentially boosting sales of specialized kits or instruments.

There’s also a push in France for innovative solutions via its “Tech for Water” initiatives, meaning French startups (like those developing sensor-based kits) could stimulate the market. French water companies (e.g., Veolia, Suez) are global players and often pilot new testing technologies at home before abroad - this bodes well for early adoption of cutting-edge kits in France.

In summary, France’s water testing kit demand is anchored by regulatory compliance for public water and industry, with steady, incremental growth expected as standards tighten and technology advances (but radical shifts in demand are not anticipated unless driven by a major new regulation or public health issue).

Germany is known for its rigorous water quality standards and engineering prowess, which extends to the water testing domain. Germany’s Drinking Water Ordinance (Trinkwasserverordnung) is very strict, ensuring that potable water nationwide is of excellent quality

Apart from drinking water suppliers, industrial water testing is significant. Germany’s large industrial sector (automotive, chemical, manufacturing) must comply with strict wastewater discharge permits (Überwachungsverordnung).

Industrial facilities commonly use kits to monitor their effluents continuously - for example, quick tests for pH, cyanide, or metals in wastewater as on-site pre-screening before lab analysis. Cooling and boiler water testing in factories and power plants is another niche - German industry often uses drop test kits (for hardness, silica, etc.) to maintain their systems and prevent scaling/corrosion.

Environmental awareness is high in Germany; citizen science and hobbyist testing are somewhat popular. For example, there are educational water test kits sold for school experiments and for environmental groups checking local streams (measuring things like nitrate from farm runoff).

Additionally, private well owners (not a huge population in Germany, as most are on public supply) in rural areas do sometimes use basic kits to check their water, although many prefer sending samples to labs for absolute assurance.

German companies (like Merck KGaA’s MilliporeSigma, Lovibond, and MACHEREY-NAGEL for test strips) are key suppliers domestically and internationally. They keep innovation high. International brands (Hach, Palintest, etc.) also operate in Germany, but often highlight German certifications of their kits to gain trust.

The market expects compliance with DIN (German Institute for Standardization) methods from any kit. Outlook: Germany will remain a leading market focused on precision and comprehensive testing.

Future demand might get a bump from initiatives such as monitoring microplastics (German researchers are active in developing microplastic detection methods - kits for these could eventually emerge). In essence, Germany’s commitment to water quality ensures a stable, technically advanced market for test kits, with growth tied to incremental tightening of standards and technological enhancements.

Italy presents an interesting mix of advanced water management in the north and infrastructure challenges in parts of the south, impacting its water testing needs. Italy follows EU drinking water directives strictly (Decreto Legislativo 31/2001), which mandates regular testing of public water supplies for a wide range of parameters.

In practice, testing frequency and resources can vary. Northern Italy, with larger utility companies (often multi-utility firms managing water, power, etc.), operates modern labs and employs both lab tests and field kits to ensure compliance.

For example, a utility in Lombardy or Veneto might use online analyzers for continuous monitoring but still dispatch technicians with portable kits to verify chlorine levels at remote ends of the distribution network or during pipeline works.

In contrast, southern Italy and the islands sometimes face water quality challenges (aging pipes, intermittent supply in some rural areas, higher natural occurrence of certain contaminants like boron or chlorides). Utilities there and local health authorities rely on water testing kits especially during emergencies - e.g., if a water tanker is supplying a village, kits are used to test the tanker water for chlorine and bacteria before distribution.

Private Wells & Rural Use: Italy has many rural communities and farms that use private wells or springs. While these are supposed to be monitored, enforcement can be lax. In recent years, awareness has grown about ensuring potability of these sources, leading to increased use of test kits by individuals and local authorities.

A farmer in Tuscany might use a basic kit to check nitrates in his well (given fertilizer run-off concerns), or a small agriturismo lodging might periodically test its own water supply to reassure guests. Companies have targeted this niche with simple Italian-language test kits for hardness, nitrates, and microbial presence.

Italy’s huge tourism industry also drives water testing needs - for instance, countless hotels, resorts, and public pools require daily testing of pool and spa water (for chlorine, pH). Therefore, pool testing kits are in strong demand, particularly along coastal areas and tourist regions (Amalfi, Sicily, Rimini, etc.). Italian pool maintenance companies frequently use drop test kits or electronic testers to keep water safe for swimmers.

Italy’s industrial heartland in the north (Piedmont, Lombardy, Emilia-Romagna) has many manufacturing plants which must monitor wastewater. Many of these industries utilize kits for quick checks - for example, dairy processing plants using kits to measure wastewater nutrient levels before discharge, or textile factories testing for dye content compliance.

Enforcement by regional environmental protection agencies (ARPA) pushes industries to be vigilant, sustaining demand for test supplies in the private sector.

Regulatory compliance is the top driver - Italy will implement the new EU directive provisions (like testing for Legionella in building water or stricter PFAS limits, especially relevant in areas like Veneto with PFAS groundwater contamination issues). Such requirements will increase testing volume.

Another factor is water scarcity and quality issues: recurring droughts in Italy have led to more reliance on alternative water sources and re-use, all of which need careful quality monitoring (for example, re-used treated wastewater for irrigation in Puglia - farmers and authorities test this water for safety).

South Korea combines advanced urban water systems with a growing public interest in health, shaping its water testing market. Municipal Water and Regulation: South Korea’s cities are served by modern water treatment plants, and water quality is regulated by the Ministry of Environment under the Water Supply & Waterworks Act.

Utilities conduct regular testing of tap water at treatment plants and within distribution (e.g., weekly microbiological tests, continuous chlorine monitoring). As a result, the institutional demand for test kits comes from these water utilities and associated labs.

They use high-end equipment for compliance testing, but also maintain portable kits for field checks. For example, after the 2020 incident where insect larvae were found in Incheon’s filtering basins, waterworks across the country increased on-site inspection frequency - operators armed with kits to test for chlorine residual and check for any anomaly in water quality at various points. This underscores how any scare or regulatory notice can spur immediate kit usage.

A unique aspect in Korea is the prevalence of large building water tanks (many high-rise apartments store water). Regulations mandate periodic testing of these building water tanks. Facilities management companies often use simple test kits to periodically ensure the tank water has adequate chlorine and no obvious contamination, in between more formal lab tests.

This is a niche driving sales of easy-to-use test strips and basic portable kits in the urban setting (essentially making sure building tap water remains safe from tank to faucet).

Korean consumers have one of the highest rates of using home water purifiers. With that comes an interest in verifying purifier performance - some households and certainly purifier maintenance services use test kits to measure parameters like residual chlorine, TDS (total dissolved solids), or hardness pre- and post-filter.

The typical Korean consumer is tech-savvy, so digital pen testers (for TDS, etc.) and test strips for chlorine or microbes are selling to those who want reassurance that their filter is working or their tap is safe. Also, after events like the Incheon water scare, sales of home test kits jumped as people wanted to double-check their water.

South Korea’s heavy industries (semiconductors, electronics, petrochemicals) require ultra-pure water for processes and treat their wastewater to high standards. Companies like Samsung and LG have stringent internal water quality protocols - they use advanced instruments primarily, but some on-site kits are used for quick monitoring in factories (for example, checking ultra-pure water resistivity or cooling water pH daily).

Meanwhile, environmental NGOs and community groups, while smaller than in some countries, have been increasing water quality advocacy. Some citizen science projects involve testing local streams or groundwater for pollutants (especially in areas near industrial complexes).

The government too has pushed for more groundwater monitoring after past incidents of contamination; this has led to local officials occasionally using portable test kits to screen wells for things like nitrate or organic solvents before deeper analysis.

South Korea’s market growth for test kits is moderate but steady, driven by public health priorities and technology adoption. One growing segment is smart water monitoring - Korea invests in smart city initiatives, and water quality is part of that.

We see pilot programs using sensor networks; complementary to that, kit providers partner with municipalities to offer integrated solutions (like a kit that logs results into an IoT platform). Regulatory updates like lowering allowable disinfection byproducts or pushing for lead pipe replacements (Korea has been working to eliminate remaining lead pipes) result in heightened testing requirements - spurring kit demand for those specific parameters.

The COVID-19 pandemic also indirectly increased interest in water and sanitation monitoring in facilities (though virus testing in water is lab-based, it raised general awareness of environmental hygiene).

Outlook: South Korea’s focus on innovation and health suggests the water testing kit market will gradually incorporate more advanced and digital solutions. There’s likely to be an uptick in high-tech kits (like digital multi-test kits) as Korean consumers and industries tend to favor cutting-edge gadgets.

Additionally, with climate change impacting water (heavy rains causing runoff, etc.), authorities may broaden surveillance of drinking water sources - portable kits will be a tool in rapid assessments during such events. In summary, South Korea’s water testing market is driven by rigorous utility management, building water safety practices, and tech-oriented consumers, yielding a stable demand that evolves with technology and regulatory standards.

Japan has an exceptionally high standard for water quality and a long history of water management, which shapes its testing market. Tap water in Japan is monitored under the Waterworks Act, which specifies 51 quality criteria that water suppliers must meet

Large municipal utilities (e.g., Tokyo, Osaka) run sophisticated labs that continuously test for everything from bacteria to trace chemicals. This means the primary testing workload is handled by automated systems and lab technicians. However, field testing kits are still vital for certain tasks.

Water treatment plant operators use portable kits to do quick operational tests - for example, measuring chlorine residual, pH, and turbidity at various process stages or in distribution when investigating a customer complaint.

Japan’s water companies often equip field staff with compact test kits for residual chlorine and simple microbial presence tests to rapidly check any section of the network if an issue is suspected (like a pipe break or backflow event).

A noteworthy aspect of Japan’s water testing demand comes from its focus on disaster preparedness. Given Japan’s susceptibility to earthquakes and tsunamis, portable water testing kits are stockpiled as part of emergency response gear.

In the aftermath of a disaster, water lines may be damaged and contamination possible - relief teams use kits to test drinking water at shelters and affected communities for safety (parameters like coliform bacteria, chlorine level, etc.). This means agencies and local governments maintain reserves of easy-to-use kits (including bacteriological test packs and basic chemical strips) that can be deployed quickly when needed.

Japan’s advanced industries (electronics, automotive) require high-purity water and meticulous wastewater treatment. Industrial facilities utilize continuous monitoring instruments but also rely on quick test kits for daily checks (for instance, testing ultra-pure water for silica with specialized kits, or ensuring factory wastewater neutralization through pH test strips before discharge).

Environmental monitoring of Japan’s many water bodies (rivers, lakes) by the Ministry of the Environment and volunteers often involves kits - e.g., kits to measure phosphate or DO (dissolved oxygen) in rivers for education and screening. There is a cultural emphasis on education; school science curricula sometimes involve testing local water, supporting a small market for educational test kits.

Generally, Japanese consumers trust their tap water’s safety (and indeed it consistently ranks as high quality). Thus, widespread home testing isn’t common. However, some consumers do check for taste-affecting elements. For example, aquarium hobbyists and tea connoisseurs might use hardness or chlorine test kits to ensure their water meets desired qualities.

Also, in areas with older buildings, a few might test for residual chlorine or copper from pipes. Bottled water and filter usage is significant for taste preferences, but that hasn’t translated into a huge DIY testing trend as it has in some countries.

Growth in Japan’s market is relatively flat, as systems are mature and population is stable or declining. The market spikes slightly when new concerns arise - for instance, the 2011 Fukushima nuclear incident led to increased water testing for radiological contaminants (though largely lab-based, some consumer interest in radiation test kits briefly appeared).

Another example is recent global focus on PFAS; Japan is starting to monitor these (“forever chemicals”) in water sources, which could create future demand for PFAS test kits as awareness grows. Innovation: Japanese firms are active in water tech innovation - e.g., HORIBA’s compact water quality meters are used globally. Japan embraces high-tech solutions, so we see interest in digital multi-parameter kits with inbuilt quality control.

Japan will remain a high-quality, steady market. Institutional purchases dominate (utilities and industries ensuring compliance). If any area sees growth, it might be automation and integration - Japanese utilities may invest in newer portable devices that link to their information systems for traceability.

Overall, with near-universal access to excellent tap water, the focus in Japan is on maintaining that quality and being ready for emergencies, which will keep demand for reliable testing kits (especially portable, accurate ones) consistently present.

China is a vast and fast-growing market for water testing, driven by its scale and ongoing water pollution challenges. Urban Water Supply: China’s major cities have been modernizing water treatment and distribution, but ensuring consistent quality remains a priority. Municipal water utilities in big cities (Beijing, Shanghai, Guangzhou, etc.) conduct extensive testing - they have large water quality labs and online monitoring equipment.

However, given the size of distribution networks, they also rely on numerous field test kits for spot-checks and rapid response. Chinese utilities commonly use portable chlorine testers, turbidity meters, and microbial test kits to regularly patrol far-reaching pipeline networks. With the implementation of the new national standard GB 5749-2022, which added stricter limits and more parameters, urban utilities have been expanding their testing regimes

A significant portion of China’s population in smaller towns and rural villages still lacks advanced water treatment. The government’s drive to improve rural drinking water has included distributing simple testing kits to local centers.

County-level water stations use kits to test village well water for basic safety (testing for bacteria, nitrates, etc.) periodically. Some NGOs and government programs have trained villagers to use easy colorimetric kits to monitor their water, fostering a large decentralized user base. This means demand for affordable, easy-to-use kits (e.g., test strips or color disc kits with pictogram instructions) is strong in China’s countryside.

China’s rapid industrialization led to pollution of many rivers and lakes. The central and provincial governments have put in place extensive monitoring to restore water quality (e.g., the “Water Ten Plan”). Environmental agencies conduct thousands of tests nationwide on surface and groundwater.

While sophisticated instruments are used, field teams use portable kits for quick screening - for example, checking if a factory outflow is suspiciously high in COD or ammonia on-site using a kit before further investigation.

The sheer number of small factories and discharge points in China means portable test kits are invaluable for inspectors to do on-the-spot assessments. One example: inspectors might carry kits to test for pH and chemical oxygen demand (COD) in wastewater when visiting industrial parks; if a reading is off, they then collect samples for detailed lab analysis.

Many Chinese industries themselves have internal testing to avoid fines. Factories use water testing kits to self-monitor their effluent and process water. The growth of sectors like electronics, pharmaceuticals, and food processing (which need ultra-clean water and have strict effluent limits) has increased demand for advanced test kits in industrial labs and on factory floors.

China is anticipated to be one of the fastest-growing markets for water testing kits, with FMI projecting around 6.3% CAGR (2024 to 2034). Factors include: continuing urbanization (new water systems in expanding cities), heavy infrastructure spending on water treatment (every new plant comes with testing needs), tightening regulations on pollutants (for instance, the government setting lower limits for heavy metals and enforcing checks, which leads even small utilities to purchase kits), and rising public awareness.

Chinese consumers are increasingly conscious of water quality - there’s a burgeoning market for home water test kits especially among middle-class households who use filters or have concerns about old apartment plumbing. Sales of TDS meters and basic test strip kits on e-commerce platforms have been climbing, reflecting more people testing their drinking or aquarium water at home.

China’s sheer scale ensures that all segments - municipal, rural, industrial, consumer - drive enormous demand for test kits. Local Chinese manufacturers have grown rapidly to supply low-cost kits domestically, but there’s also appetite for high-quality imported kits especially in critical applications (foreign brands are often used by top-tier labs or for parameters where accuracy is paramount).

Going forward, as China aims for its “Beautiful China” environmental goals, monitoring will intensify, benefitting the testing market. We can expect continued robust growth, with China possibly becoming the largest single-country market for water testing kits in volume.

Challenges remain (like ensuring kit quality control and proper training in their use across so many users), but investment in water quality is unwavering. In summary, China’s water testing kit market is large and growing - fueled by regulatory pressure to clean up water sources, massive infrastructure projects, and increasing public engagement in water safety.

Australia and New Zealand have smaller populations but strong emphasis on water quality, leading to a focused demand for test kits in specific areas.

The country’s vast geography and climate extremes influence its water testing needs. Urban centers like Sydney and Melbourne have modern water systems with rigorous testing mostly handled by automated plants and labs (similar to other developed nations). However, remote and regional communities often rely on boreholes, rainwater tanks, or small treatment plants, where on-site testing kits are essential.

State health departments in Australia provide guidance and sometimes test kits to owners of rainwater tanks (common in rural homes) to check for contaminants like E. coli. The mining industry - a big water user - also drives kit usage: mine sites in the Outback use portable kits to monitor groundwater quality, mine runoff, and treatment efficacy (testing for pH, heavy metals, etc., in the field due to distance from labs).

Agriculture in Australia’s inland areas leads to testing for salinity and nutrients in water; farm extension services often supply farmers with simple test kits to manage irrigation water quality.

A significant segment in Australia is recreational water testing. Given the outdoor lifestyle, swimming pools are ubiquitous - over 10% of Australian households have a pool. This translates to a steady demand for pool water test kits (for chlorine, pH, stabilizer levels). Pool owners and professional pool service technicians alike use quick test kits or electronic testers frequently (at least weekly in summer).

Additionally, Australia’s beach culture includes many public swimming baths and saltwater pools, which are regularly tested by councils using kits. The concern for algal blooms in some areas (like the Murray-Darling basin) has led to kits being used to monitor blue-green algae levels in water bodies for public safety.

NZ has generally high-quality source water but faced a wake-up call with the Havelock North incident where untreated groundwater contaminated with bacteria caused illness. This led to a regulatory overhaul: the new Water Services Act requires even the smallest water suppliers to regularly test water.

Many small rural schemes and marae (Māori community centers) that previously did minimal testing are now required to do so, spurring demand for simple compliance kits (e.g., portable turbidity meters, chlorometers, and presence/absence bacteriological kits) so they can self-monitor between official lab tests.

New Zealand’s terrain means many communities have their own bores or springs; local operators use kits as an early warning for any contamination (for example, checking for E. coli with compartment bag tests or similar field kits after heavy rains).

The new regulator Taumata Arowai also encourages a “source to tap” monitoring approach, which likely increases usage of field test kits for source water checks (like turbidity and UV transmissivity for plants using UV disinfection).

In NZ, private wells and roof rainwater systems are also common in rural living - public health units sometimes distribute free test kits for E. coli to encourage residents to test their tank water, especially after long dry spells or if contamination is suspected. Pool ownership is smaller in NZ than Australia due to climate, but there are many thermal spas and public pools which require frequent testing.

Both countries have mature water industries, so growth in test kit demand is modest. In Australia, growth areas include water recycling schemes (as cities like Perth and Brisbane expand reuse of treated wastewater for irrigation or even indirect potable use, they impose strict testing needs, benefiting kit suppliers for parameters like nutrients, chloramine, etc.) and Indigenous and remote community water supplies (government programs delivering testing resources there).

New Zealand’s new regulatory regime is a direct growth driver - many small suppliers that previously did no on-site testing are now entering the market as first-time kit buyers.

Overall, Australia and New Zealand will maintain a solid baseline demand for water testing kits. The focus is on ensuring safe drinking water in remote/rural settings, maintaining recreational water quality, and monitoring environmental waters.

Both countries are also quite environmentally conscious, so emerging issues (like PFAS at defense sites in Australia, or looking at freshwater health in NZ) may prompt targeted increases in testing in those domains.

While not large markets by absolute size, ANZ customers generally prefer high-quality, reliable kits and are willing to adopt new technologies (for example, Australian pool owners quickly embraced smartphone apps for reading test strips). Thus, suppliers often introduce or pilot new water testing products in ANZ to showcase their effectiveness in a demanding user base.

FMI has segmented the market into Product Type, Test Type, Water Type, End User, and Region.

Leading vs. Fastest-growing (Product): Portable kits are clearly the leading segment by market value (driven by institutional purchases). In terms of fastest-growing, one could argue test strip kits are growing fastest in user base because of increasing retail penetration and emerging market uptake.

However, in pure revenue CAGR, all three segments grow roughly in line with the overall market with test strips possibly slightly higher if more consumers start testing water at home. That said, if a new technology within portable kits (like digital testers) drastically drops in price, the portable segment could accelerate further.

At present, expect portable kits to continue leading revenue, and test strips to perhaps have the edge in growth rate due to volume expansion.

Potable water testing is clearly the leading segment by market share and will continue to be, due to the critical need for safe drinking water everywhere. The fastest-growing segment by water type is likely sewage effluent (wastewater) because of the global push to improve sanitation infrastructure and enforce environmental regulations.

Many developing nations are investing heavily in wastewater treatment (which historically lagged drinking water investments), so the testing related to that will surge. Swimming pool testing is significant but grows more slowly (saturated in some markets).

Marine and pond segments are niche; marine might grow with increased marine environmental efforts but remain small, pond grows with aquaculture but also remains comparatively small. Cooling/boiler water is steady with industrial activity.

The global water testing kit industry is about USD 1.9 billion in 2024, and it’s growing at roughly 5.4% per year. This means the market value is expected to approximately double by the mid-2030s, reaching over USD 3.3 billion by 2034 if current trends continue.

Portable water testing kits are the most widely used by value - these are comprehensive kits (often with digital meters or multi-parameter capabilities) and they command the largest share of revenue (over half of the market). For quick checks, test strip kits are very common in terms of number of users (like pool owners and home users) because they are easy and affordable, though each sale is smaller.

Key companies include Danaher’s Hach, Thermo Fisher Scientific, Merck KGaA (Sigma-Aldrich), LaMotte, Hanna Instruments, and Taylor Technologies, among others. These firms have a global presence and offer a wide range of kits. Additionally, specialized companies like Palintest (Halma), Lovibond (Tintometer), and Aquagenx are well-known in specific niches or regions. (See the list of key companies above for more details on major manufacturers.)

The United States, China, Germany, India, and the UK are currently driving the highest demand. The USA and Germany have strict water quality regulations and extensive testing regimes, leading to significant market demand. China and India, due to their large populations and increasing focus on water safety, are rapidly growing markets. The UK also has a robust testing framework. Other countries with active markets include Japan, France, and Australia, thanks to strong regulatory compliance and public awareness.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Leukocyte Adhesion Deficiency Management Market - Innovations & Treatment Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.