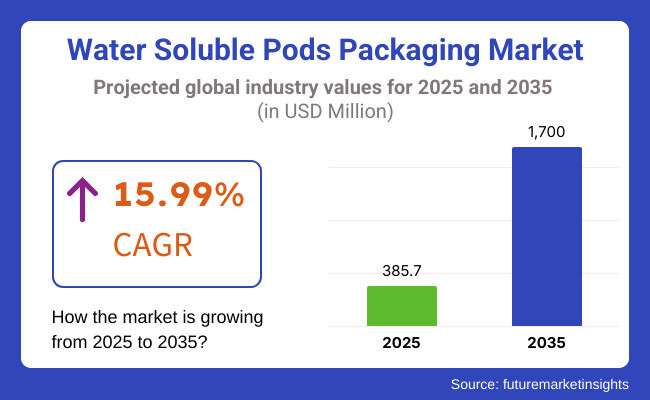

The water soluble pods packaging market is anticipated to reach USD 385.7 million in 2025. It is expected to grow at a CAGR of 15.99% during the forecast period and reach USD 1700 million in 2035.

Industry Outlook

Water soluble pods packaging is becoming increasingly popular as a new eco-friendly solution in many industries, such as household cleaning, personal care, and pharmaceuticals. The pods are made to dissolve in water, minimizing plastic waste and providing convenience for consumers. The growing demand for environmentally friendly substitutes for conventional plastic packaging will drive strong market growth in the coming decade.

The industry growth is also being fueled by growing consumer demand for pre-measured, mess-free solutions in cleaning and personal care categories. Growth in e-commerce and direct sales is driving expansion, with manufacturers focusing on sustainable and convenient packaging. Moreover, progressions in film technology, including better solubility and barrier characteristics, are anticipated to improve the functionality of water-soluble pods across industries.

Explore FMI!

Book a free demo

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Initial restrictions on single-use plastics. | Stricter global policies mandating biodegradable and water-soluble packaging adoption. |

| Development of basic water-soluble films. | Expansion of high-performance, moisture-resistant, and eco-friendly pod formulations. |

| Widely applied in domestic cleaning and personal hygiene. | Increasing use in pharmaceuticals, agriculture, and industrial applications. |

| Dominance of larger FMCG and cleaning brands. | Initiation of sustainable packaging start-ups in collaboration with biotech companies. |

| Sustainability and convenience-led growth. | Market growth driven by AI-optimized film structures and circular economy efforts. |

| Biodegradable pod materials in their formative transition. | Comprehensive use of entirely carbon-neutral and compostable packaging. |

| Minimal AI applications for material optimization. | Predictive modeling with AI supported by sophisticated automated manufacturing enhancement. |

| More attention is devoted to solubility and durability. | Design of multi-use, high-barrier, and temperature-resistant water-soluble films. |

Between 2020 and 2024, the water-soluble pods packaging industry experienced consistent growth with increasing consumer awareness, corporate sustainability initiatives, and government regulations on single-use plastics. However, high production costs and limitations of material performance have greatly bothered the manufacturers.

The market also witnessed high investments in research to enhance solubility and barrier properties. Growing concerns regarding microplastic pollution propelled regulatory agencies to advocate for biodegradability. In addition, advancements in formulation science helped with increased pod stability and dissolvability.

In the future, the landscape’s growth will be led by innovations in biodegradable film, green coating, and process efficiency. The implementation of AI and automation in package design and production processes will enhance market competitiveness as well.

Furthermore, the growing use of water-soluble products in industrial and agricultural applications will open up new avenues for growth. The development of improved shelf stability and robustness of pods to suit industry requirements is also a focus for companies. The growth of specialized packaging solutions designed for niche markets is expected to pick up pace in the years to come.

The poly vinyl alcohol (PVA) segment should lead the water soluble pods packaging market because it is biodegradable and water-soluble. With industries looking for environmentally friendly packaging, PVA is still the favorite material, particularly in detergents, agrochemicals, and food uses where contactless packaging is important as well as being environmentally friendly.

PVA's hydrophilic nature makes it ideal for coating toxic fertilizers in agriculture and storing condiments in food packaging. In addition, its FDA approval for food applications has encouraged its use in takeaway packaging. As innovation in PVA-based films and coatings rises, this segment is expected to witness rapid expansion.

Multi-chamber water pods will hold the highest proportion in the market for water-soluble pods packaging because of their high level of functionality and convenience. They dissolve in water, thus providing a hassle-free solution for products such as hand wash, detergent, and dish wash.

The category is soaring with rising demand from home-cleaning and personal care brands. Pre-measured and precise dosing reduce waste and are easier to use. With more consumers preferring eco-friendly, pre-packaged goods, multi-chamber pods will see huge market growth.

Detergents will dominate the market for water-soluble pods for packaging purposes because they produce less plastic waste and are more convenient for users. Growth in the environmental concerns aspect will drive more customers toward detergent pods, which dissolve entirely in water without a residue or disposed-of packaging.

Innovation in high-performance, plant-based detergent pods is also driving growth. Several brands are introducing digitally driven campaigns to increase awareness regarding the advantages of water-soluble detergent pods. The segment will grow further as consumers are moving towards sustainable, pre-measured laundry options.

31-60 micro meter thick water-soluble pods are anticipated to dominate the market as they offer the best combination of durability and solubility. This thickness will provide the pod with a solid form when in storage and during handling while dissolving readily in water.

With continuous innovation on dishes and laundry detergent pods, a need exists for customized thickness levels. Companies are making investments in better pod designs for moisture resistance while preserving dissolution effectiveness. Over the years, with the advancement of water-soluble film technology, steady growth is anticipated in this segment.

Challenges

High Production Costs

Production of water soluble films uses specialized materials and sophisticated manufacturing methods, which drive up costs relative to traditional plastic packaging. This increased cost affects pricing and prevents widespread use, especially among price-sensitive industries. Furthermore, increasing consumer need for environmentally friendly substitutes is stimulating investment in low-cost production innovations.

Performance Limitations

Water soluble pods need to have a perfect balance between solubility and durability to be effective. In humid conditions, too much exposure to moisture can weaken their integrity, causing them to dissolve prematurely. Manufacturers are working constantly to develop advanced formulations that provide better moisture resistance while ensuring quick solubility in target applications, enhancing the reliability of these packaging solutions.

Opportunities

Expansion into New Industries

Water soluble pods are finding increasing popularity in pharmaceutical and agro-based industries because of their convenience and environmentally friendly nature. They ensure correct dosing and reduce the waste of packs in drugs, and in agribusiness, they simplify pesticide and fertilizer application. These new applications are opening up new avenues for market growth.

Advancements in Biodegradable Film Technology

Constant research in water soluble material is optimizing the performance of biodegradable films. Improvements target solubility, strength, and environmental friendliness, increasing the versatility of these films in various industries. As sustainability laws continue to tighten, advancements in environmentally friendly film technology are likely to increase product applications and wider use.

Asia-Pacific is expected to dominate the water-soluble pods packaging market, driven by increasing urbanization, rising disposable incomes, and growing environmental consciousness. Regions such as China, India, and Japan are major contributors, with a high demand for sustainable personal care and household cleaning products. Rapid industrialization and growth of the FMCG sector in the region are also contributing to the acceleration of market growth.

The development of the region's market is also sustained by strict government regulations on plastic waste, which are prompting manufacturers to switch to water-soluble alternatives. Moreover, innovation in biodegradable film technology is improving pod performance, which is making them appropriate for a broader set of applications. The growing presence of international packaging manufacturers in Asia-Pacific is also driving local production capacities. In addition, R&D in water-soluble materials are likely to generate new growth prospects in the region.

North America is a leading market for water soluble pods packaging owing to high demand from the home care, personal care, and pharmaceutical sectors. The United States and Canada are spearheading the region with technology development in biodegradable films and eco-friendly packaging solutions. The increasing consumer trend for single-dose packaging is further accelerating the market demand.

The use of eco-friendly and biodegradable packaging materials is in vogue due to government rules and corporate efforts toward sustainability. Rising R&D investments for technology-driven film technologies are further enhancing market growth. Moreover, e-commerce and direct-to-consumer sales growth are also fuelling demand for handy, proportioned pod packaging.

Several companies in North America are also concentrating on optimizing the strength and solubility of packaging films to advance product performance. Developments in barrier coatings for water-soluble pods will also influence the market in the next few years.

Europe occupies a strong percentage of the market for water soluble pods packaging, bolstered by effective regulatory environments that favor biodegradable and plastic-free packaging technologies. Germany, France, and the UK, being the dominant economies, lead the charge on sustainable packaging development. The high investments in circular economy programs and green packaging studies are also contributing to the strengthening of Europe's dominance of the market.

Tight environmental regulations encouraging plastic reduction and compostable packaging materials are driving the transition toward water-soluble pods. Furthermore, growing consumer knowledge and demand for environmentally friendly products are likely to drive long-term market expansion.

The region is also seeing more and more partnerships between packaging producers and FMCG companies to create new water-soluble compositions. In addition, research centers in Europe are investing in future-generation water-soluble films with better solubility and barrier functionality. These improvements are likely to boost the general efficiency and usage of water-soluble pod packaging across different industries.

| Countries | CAGR |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| Japan | 4.6% |

| South Korea | 5.0% |

The USA dominates the market, driven by the increasing demand for convenient, eco-friendly, and single-use packaging solutions in industries such as household cleaning, personal care, and food & beverage. The shift toward sustainable alternatives to traditional plastic packaging has encouraged manufacturers to develop innovative water-soluble film technologies.

Additionally, government regulations on plastic waste reduction and sustainability initiatives are prompting companies to adopt biodegradable and compostable materials. Moreover, advancements in water-soluble polymer coatings are enhancing product durability and solubility, making them more suitable for diverse applications. Businesses are also exploring multi-compartment pod solutions to improve product efficiency. Furthermore, the increasing demand for non-toxic and chemical-free packaging options is driving innovation in plant-based water-soluble films.

As per FMI research, the UK is expanding as businesses emphasize sustainability and compliance with environmental regulations. The rising demand for biodegradable and waste-reducing packaging solutions has led to the increased adoption of water-soluble pods across various industries. Government initiatives promoting plastic-free alternatives are also pushing companies to integrate water-soluble and compostable films.

In addition, innovations in barrier coatings and film thickness adjustments are making these materials more attractive for global supply chains. Companies are also exploring odor-proof and antimicrobial water-soluble packaging solutions to enhance product shelf life. Furthermore, the rise of refillable and concentrated product formats is improving the adoption of pod-based packaging solutions in the UK market.

Japan is growing steadily due to its high-quality manufacturing sector and the increasing preference for sustainable materials. Companies are focusing on precision-engineered pod packaging for household and industrial cleaning, pharmaceuticals, and food applications. With strict regulations on plastic waste reduction, businesses are adopting plant-based and biodegradable water-soluble films.

Moreover, advancements in rapid-dissolution technologies are driving demand in applications where controlled solubility is essential. Businesses are also investing in automated production technologies to enhance precision and reduce waste. Furthermore, the rise of compact and space-saving packaging solutions in Japan is fueling demand for water-soluble pods in various consumer industries.

South Korea is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and sustainable packaging solutions has led manufacturers to develop enhanced water-soluble films with better tensile strength and controlled dissolution rates. Government regulations promoting plastic-free and biodegradable materials further support market expansion.

Moreover, businesses are integrating smart packaging solutions such as moisture-resistant water-soluble pods to improve usability and shelf life. The growing demand for convenience-driven and pre-measured pod packaging solutions is further boosting adoption. Additionally, research into temperature-sensitive solubility is helping businesses develop innovative packaging tailored to specific environmental conditions.

The water-soluble pods packaging industry remains moderately concentrated, with leading companies holding a dominant position. Established players leverage advanced manufacturing capabilities and strong distribution networks to maintain their influence. While competition exists, top firms drive industry trends by focusing on sustainability, product performance, and consumer convenience, effectively shaping the sector’s growth and innovation strategies.

Key companies prioritize innovation by investing in biodegradable materials and advanced water-soluble film technology. Their commitment to reducing plastic waste aligns with global environmental initiatives, strengthening their market presence. By continuously enhancing product formulations, they cater to consumer preferences for eco-friendly, pre-measured pods in cleaning, personal care, and industrial applications, reinforcing its competitive advantage.

Mid-sized firms contribute to the industry’s expansion by offering sustainable alternatives and cost-effective solutions. Their ability to balance affordability with performance attracts environmentally conscious consumers and businesses. These companies emphasize transparency in ingredient sourcing and packaging, helping them carve out a niche within the growing demand for ethical, sustainable, and efficient product solutions.

Smaller players and regional brands focus on specialized formulations that meet specific consumer needs. Their agility allows them to introduce innovative solutions, such as compostable pods and plant-based dissolvable films. By differentiating through sustainability and unique product features, they compete with larger firms while addressing niche markets that prioritize minimal waste and environmental responsibility.

Despite concentration among leading firms, the industry fosters continuous competition through technological advancements and regulatory compliance. Companies across all tiers invest in R&D to enhance product performance and eco-friendliness. This commitment to innovation ensures that water-soluble pods packaging remains a dynamic sector, evolving alongside sustainability trends and shifting consumer expectations.

The water soluble pods packaging market is growing due to increasing demand in household, industrial, and healthcare applications. These industries require efficient and sustainable packaging solutions that ensure controlled dissolvability and ease of use. The need for convenient, pre-measured dosing in cleaning and personal care products is driving market expansion and innovation.

Advancements in material formulations are enhancing product performance, with bio-based films, moisture-resistant coatings, and improved solubility technologies addressing sustainability concerns. These innovations ensure that water-soluble pods dissolve efficiently while maintaining protective properties during storage and handling. As companies prioritize eco-friendly alternatives, the shift toward plastic-free and biodegradable packaging continues to gain momentum.

Technological improvements in automated production and supply chain optimization are further shaping industry trends. Automation increases manufacturing efficiency, ensuring consistent quality and cost-effectiveness, while supply chain advancements enhance distribution and inventory management. These developments help businesses streamline operations while meeting the growing demand for sustainable and user-friendly packaging solutions.

Regulatory compliance and certifications are playing a crucial role in market adoption. Companies are investing in research on enzymatic degradation of water-soluble films to improve performance and minimize residue. As environmental regulations become stricter, businesses are focusing on certified eco-friendly packaging solutions to meet industry standards while maintaining product safety and sustainability.

The overall market size for the market was USD 385.7 million in 2025.

The market is expected to reach USD 1700 million in 2035.

The market will be driven by increasing demand from home care, personal care, and pharmaceutical industries. Sustainability trends, innovations in biodegradable films, and improvements in solubility performance will further propel market expansion.

The top 5 countries driving the development of the market are the USA, UK, Germany, Japan, and China.

The market is segmented by material type into poly vinyl alcohol.

Based on the product type, the market is segmented into single layer water pods, dual layer water pods, and multi chamber water pods.

Based on end use, the industry is categorized into detergents, hand wash, dish wash, and others.

Based on thickness type, the landscape is segmented into below 30 micro meter, 31-60 micro meter, and 61 micro meter thickness.

Region-wise, the market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.