A water softener, also known as a softening system, treats the water, primarily hard water, to make it soft with minerals like sodium or potassium salts which are exchanged for calcium and magnesium. Hardness - A recurring headache hard water problems, caused by excessive calcium and magnesium in the water, is indeed an old problem for several places.

Hard water causes scaling in pipes and appliances and lowers the effectiveness of water heaters, among other things, also impacting laundry quality. The widespread adoption of water softeners to mitigate these problems presents a significant growth prospect for manufacturers.

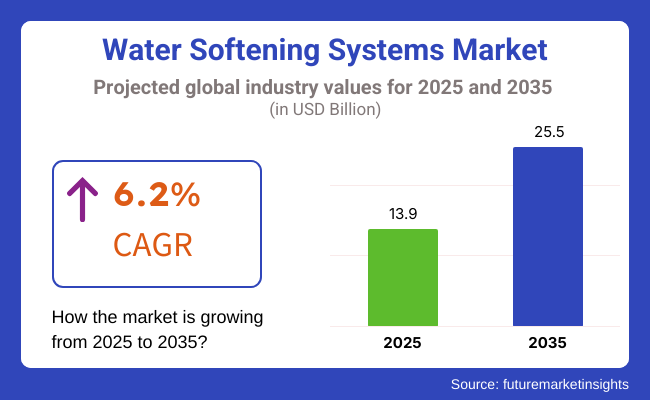

Water softeners systems market is segmented by system type into ion exchange power system, magnetic water softener systems, reverse osmosis system, and others. It is projected to reach USD 25.5 Billion by 2035, with a CAGR of 6.2% during the forecast period. This growth is primarily driven by increasing urbanization and rapid industrialization, leading to a demand for reliable, quality supplies of water for domestic as well as industrial applications.

Salt-free systems, magnetic softeners and electronic descales are some of the new innovations in the field of water softening technologies gaining popularity. In addition to scaling down, these technologies also require less maintenance than traditional systems. Moreover, regulatory frameworks that facilitate water efficiency and environmental sustainability are encouraging households and businesses to invest in advanced water treatment solutions, which is further enabling the market growth.

Explore FMI!

Book a free demo

The North America water softener systems market- by Application - Household, Commercial, and Industrial systems Key players in North America water softener system market water softener system rheem water softener systems eco water systems llc kinetic water softeners culligan water softeners ecosofts (company share currently rating at 12%) a leading market for water softening systems is in North America, due to the prevalence of hard water and high water consumption levels combined with a growing understanding of the advantages of soft water.

In the United States, for instance, hard water is available in areas like the Midwest and the Southwest. This led to a high demand for residential and commercial water softeners. With water quality, maintenance costs, and the longevity of plumbing and appliances at stake, many municipalities and homeowners are embracing advanced water softening technologies.

The emphasis on water conservation and sustainable water management in Canada has also favored the market growth. Demand-initiated regeneration systems, which help reduce water and salt consumption while providing effective performance, are emerging as the advanced solutions of choice owing to the increasing demand for energy-efficient and eco-friendly softeners.

Another significant market for water softening systems is Europe, especially in the countries where the problem of hard water is prevalent. Germany, Italy and the United Kingdom are prime examples. For example, in the UK, water hardening occurs in over 60% of households which promotes the addition of water softeners in both residential and commercial places. In Germany, fields like automotive manufacturing, food and beverage processing and pharmaceutical are intensive users of these systems to establish consistent water quality and protect critical machinery from scaling.

The rise of high-performance water softeners has also been boosted by strict European Union regulations on water use and advocate for sustainability. Implementation of water waste reduction methods and energy efficiency initiatives in several EU member states promoted the development and dissemination of water softening solutions that not only stress economic efficiency but also environmental issues.

The Asia-Pacific region is expected to witness the highest growth in the water softening system market due to rapid urban development, rising population, and greater industrial activity. In urban households and industrial facilities, countries including China, India, and Japan are seeing an increase in demand for clean, soft water. For instance, in China, the government has been paying more attention to the improvement of water infrastructure and quality, which has enabled many residential communities and industrial parks to set up water softening systems.

India’s growing middle class and urban population have also helped fuel the market. The same applies in the majority of places where hard water is a big problem for households, leading many to both invest in water softeners to make their drinking water better as well as prolong the life of their appliances. Additionally, with the immense focus on water-saving technologies and the maturity of the industrial base in Japan, the demand for water softening systems as per the defined quality as well as efficiency standards is constant across the country.

Challenge

Significant Installation Expenditures and Complex Maintenance Necessities

The complexities of installation, maintenance, and customization for various water hardness levels can hinder market growth. The process of softening water needs advanced filtration technologies and special ion exchange resins to remove calcium, magnesium, and other minerals. However, the installation cost and recurrent maintenance issues are improving enough to discourage small scale residential and business users.

If systems are not appropriately maintained, scaling, and efficiency issues can lead to a rising operational cost as well. Manufacturers need to come up with affordable, modular water softening solutions that provide automated monitoring and self-cleaning functions to overcome these challenges and develop long-term dependable and efficient solutions.

Opportunity

Growing Need for Sustainable and Intelligent Water Treatment Systems

This is anticipated to provide numerous opportunities for the Water Softening Systems Market as demand continues to rise around the globe for water conservation and lesser build-up of scale in pipelines & appliances. Demand for energy-efficient and sustainable water treatment processes that work towards improving water quality while minimizing the environmental impact is on the rise. Adoption is increasing for smart water softening technologies that can provide the likes of real-time water quality monitoring, automatic regeneration cycles, and salt-efficient softeners.

Moreover, government efforts to encourage sustainable water management, along with the increasing adoption of environmentally-friendly and salt-free softening solutions, is escalating the market growth. Firms leveraging intelligent connectivity, sustainable purification materials, and automated controls will emerge as the clear leaders in this emerging marketplace.

From 2020 to 2024, the Water Softening Systems Market maintains stable growth, driven by awareness of hard water problems and their effects on applications in homes and industries. There was a rapid growth of demand for water softening residential systems, especially in cities and capital markets where water hardness levels were above average. The commercial and industrial sectors also expanded usage of more advanced softening technologies to avoid silting of piping and to improve equipment longevity.

Yet high system costs and consumer resistance to traditional salt-based softeners constrained market growth. In response, companies developed hybrid and salt-free options, increased energy-efficient, and added features for remote monitoring for better performance and user-friendliness.

2025 to 2035 Market will see significant progress on AI-based water quality management and analysis, automation, and sustainable softening technologies. Moving toward more environmentally-friendly water softening technologies like, template-assisted crystallization (TAC) and electromagnetic water treatment will spur up innovation. Smart water treatment systems with cloud-based analytics and predictive maintenance will dominate in water softening application.

In addition, as industries increasingly focus on sustainability, new water softening systems will utilize recyclable filtration media and energy-efficient ion-exchange technologies to minimize environmental impact. In the next couple of years, the market will likely be led by the companies which are into intelligent automation, solutions based on the principles of the circular economy and customized water treatment technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter water quality regulations and salt bans on softeners in some areas |

| Technological Advancements | Salt-based softeners and hybrid filtration systems grow |

| Industry Adoption | Increased demand in residential, commercial, and industrial sectors |

| Supply Chain and Sourcing | Dependence on high-quality ion-exchange resins and filtration components |

| Market Competition | Presence of traditional water treatment manufacturers and regional players |

| Market Growth Drivers | Rising concerns over hard water effects on plumbing and appliances |

| Sustainability and Energy Efficiency | Initial development of low-energy softening systems |

| Integration of Smart Monitoring | Limited adoption of IoT-enabled water softeners |

| Advancements in Filtration Materials | Standard ion-exchange resins and polymer-based softeners |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of governmental incentives promoting sustainable and softeners that produce salt-free water |

| Technological Advancements | AI-powered automation, on-the-spot water quality monitoring, and sustainable softening technologies. |

| Industry Adoption | Expansion into smart cities, large-scale desalination projects, and zero-liquid discharge (ZLD) applications. |

| Supply Chain and Sourcing | Shift towards bio-based, reusable softening media and localized production to enhance supply chain stability. |

| Market Competition | Entry of start-ups offering AI-integrated, modular, and sustainable water softening systems. |

| Market Growth Drivers | Increased focus on water conservation, circular economy principles, and energy-efficient treatment methods. |

| Sustainability and Energy Efficiency | Full-scale adoption of non-salt-based softening solutions and advanced nanotechnology filtration. |

| Integration of Smart Monitoring | AI-powered water management systems with remote diagnostics and cloud-based performance tracking. |

| Advancements in Filtration Materials | Breakthroughs in graphene-based and mineral-free filtration materials for enhanced efficiency. |

United States water softening systems market is expected to grow at a steady rate owing to the presence of high-water hardness degree, rising awareness regarding water treatment systems, and strong demand from residential and commercial sectors. Parts of the Midwest and Southwest, including states like Texas, Arizona and California, contain some of the hardest water found in the country, leading to widespread adoption of water softening systems.

Commercial entities such as hospitality, healthcare, and food service industries are also large-scale consumers of water softeners to prevent scale build up on appliances and improve their efficiencies. Also, the market is growing due to the increased adoption of smart, salt-free and green water softening technologies.

The USA water softening systems market is anticipated to grow at a steady pace attributed to increased consumer inclination towards IoT-enabled and high-efficiency water softeners.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The UK Water Softening Systems Market is driven by high water hardness levels, growing adoption in residential and commercial buildings, and government regulations promoting water-efficient appliances. Some of the hardest water in Europe is found in the UK’s south and east, covering the hotspots of London, Kent and Essex, resulting in high demand for home and business water softeners.

The hospitality industry comprises another important end-use application, where hotels and restaurants leverage water softeners to enhance energy efficiency and minimize maintenance expenses. Furthermore, increasing emphasis on sustainable water treatment solutions is increasing adoption of salt-free and magnetic water softening technologies.

One of the major factors driving the growth of the UK water softening systems market is greater investment in water-efficient infrastructure and consumers becoming more aware of water quality issues.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

In the European Union, the market for water softening systems is steadily growing as demand for potable water increases and stricter water quality regulations are implemented, with the key drivers being increased urbanization and a trend toward sustainable water treatment solutions. Germany, France, and Italy has moderate hardness to hard water ranges, which necessitate the presence of efficient water softening systems across residential, commercial, and industrial applications.

The EU’s demands for sustainable water treatment and reduced sodium discharge will also drive growth in ion-exchange resins, template-assisted crystallization (TAC, and electromagnetic water softeners. Moreover, the increasing uptake rate of smart water management technologies is driving market growth.

In addition, due to increasing awareness about hard water issues and growing demand for high efficient water softening system the EU water softening systems market is anticipated to grow at a stable rate over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The market for Japanese water softening systems will be propelled by the increasing demand for high-quality water among residential, healthcare, and industrial end users. Though Japan is a bit soft on comparison level of water with Western countries, certain regions including Tokyo and Osaka own closely characterized moderate water hardness, which is a significant contributor to localized requirement of water softeners in Japan.

Trending high-efficiency water softening and purification technologies in industrial sector, particularly in electronics, semiconductor manufacturing and pharmaceutical production is consequently contributing to the set to rise ultra-pure water demand. In addition, the municipal areas in Japan treat water, as modern, compact and automated softening systems are in demand.

Owing to ongoing innovations in the field of water treatment technology and increasing demand for high-purity water solutions in Japan, the Japanese water softening systems market is likely to jump up progressively.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea water softening systems market is mainly driven by growing urbanization and industrialization across households and commercial establishments. South Korea’s dense urban areas filled with apartment and commercial buildings are driving demand for central water softening systems.

Key consumers are in the hospitality and food service industries, with businesses looking to improve appliance longevity and water quality for cooking and beverage preparation. Moreover, the burgeoning smart home sector in South Korea is driving the demand for IoT-enabled water softening systems providing remote monitoring.

The South Korean water softening systems market is projected to thrive, owing to continued investments towards smart water infrastructure and growing awareness of water quality among consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Commercial & industrial water treatment industries have adopted advanced water purification which is expected to increase residential sector upgrading systems will increase demand in the "Water Softening systems" market. This makes them an essential piece across households, hotels, manufacturing units, and food & beverage processing plants, as these high performance water softeners play an incredibly important role in increasing water efficiency, optimizing energy consumption and effective maintenance cost.

Electric water softeners are now one of the most commonly used water treatment systems, delivered automatic operation, accurate and effective ion exchange, and better hardness removal performance. Unlike conventional manual softeners, electric systems employ programmable logic controls, sensors, and automatic regeneration cycles to maximize water softening with minimal user input.

Growing demand for electric water softeners in urban residential and commercial infrastructures, owing to their capacity to deliver constant quality of treatment and automated control systems, has propelled high efficiency softening systems adoption, where home owners and companies prefer reliable water treatment with minimal maintenance systems. According to studies, water softeners that run on electricity extend the life of water-based appliances by up to 40%, leading to better cost-effectiveness and energy efficiency as well.

Growth of Wi-Fi-enabled smart electric water softeners with mobile app-based real-time monitoring strengthened market demand, ensuring greater penetration of smart electric water softeners in developed homes and commercial buildings.

The incorporation of dual-tank electric softeners provides soft water around the clock without interruption for regeneration, further improving adoption for higher demand applications like hotels, laundries, and health care providers.

Moreover, the growing demand for automated salt level detection and predictive maintenance alerts due to their usage of AI-powered water usage analytics is helping in optimal ring the market growth leading to increased adoption of smart water softening solutions.

The implementation of electric water softeners in industrial processes, which offer precise regeneration of resin bed in large-scale water conditioning process, has further reinforced market expansion by ensuring better adherence to industrial water treatment standards.

Electric Water Softeners have benefits in Automation, Efficiency, and Smart Monitoring, but they are challenged with a higher initial cost, reliance on the power supply, maintenance of electronic components, etc. But advances in energy-efficient softening technologies, battery-backed systems, and AI-driven predictive maintenance is enhancing operational reliability, sustainability, and user convenience that will sustain growth in the electric water softening systems market.

The growing need for non-electric water softeners in rural homes and green structures characterized by high water conservation with minimal water waste has led to the widespread implementation of salt-free and compact softening methods that offer mechanical metering and non-electric water flow-based regeneration systems. Furthermore, users are seeking maintenance-free methods for water softening as they aim towards alternatives for old conventional electric softeners. According to other studies, non-electric water softeners can lead to savings of up to 30% on energy costs, providing benefits in terms of savings in the long run, as well as being environmentally friendly.

With the integration of hybrid non-electric water softeners, which analyse resin bed capacity and total flow rate for optimization before initiating a regeneration cycle, providing noticeably greater efficiency, applications of these systems in medium to large scale water treatment are expected to rise.

With the evolution of high-efficiency salt-less non-electric softeners which require no chemical regeneration for scale prevention through template-assisted crystallization (TAC) as well as chelation technology; the salt-less domestic softeners market has really taken off, as a result, greater adoption of this technology is expected across hard water prone locations across the country.

Zero-energy operation is a growing trend in the area of gravity-fed non-electric water softeners, with expanding access in low-infrastructure and remote locations thanks to self-cleaning resin media, further propelling market growth.

Non-electric water softeners, albeit advantageous with their cost-effectiveness, efficiency, and eco-friendliness, suffer from a few issues such as lesser control over regeneration cycles, limited viability in high-demand usage, and possible fluctuations in efficiency with different water flow situations. Leading innovations in water-saving resin technologies, AI-based flow monitoring and modular softener system designs are significantly enhancing flexibility, sustainable systems and system performance to ensure that non-electric water softening solutions will continue to flourish.

The two primary segments of the market are residential and industrial. As industries, households, and commercial establishments are increasingly installing advanced water softening systems in order to extend the life of appliances, enhance water quality, and attain regulatory compliance regarding industrial water use, these segments serve as major drivers for the market.

In residential applications, they continue to register as one of the maximum share tings of water softening systems, as efficiency and advanced softening solutions have begun to penetrate the homeowners market in order to avoid scaling in the plumbing system, does not increase energy use, and also improves the quality of the water for bathing and cleaning. By contrast, instead of manual descaling, automated water-softening offers long-lasting protection to water heaters, dishwashers, and washing machines while reducing maintenance costs and enhancing home water efficiency.

With high-energy ion exchange resins removing every drop of calcium and magnesium, the growing usage of salt-based residential water softeners will push the adoption of high-efficiency softening units, as these will safeguard appliances for years to come, so that householders understand the real cost savings. According to studies, water softening can save on soap and detergent use by 50% or more, making it an economical and environmentally-friendly solution for the household.

The growing segment of salt-free residential water softeners with template-assisted crystallization (TAC), which prevents scale build up through various means without a sodium by-product, is driving demand and is likely to see wider adoption in areas where water treatment laws restrict sodium discharge.

This has been complemented with the introduction of compact and under-sink residential softeners with space-efficient designs for apartments and condos, which by its nature is making residential adoption more accessible in urban homes with limited space.

The market has been further spurred in their growing adoption as smart residential water softeners are the next step in Wi-Fi-enabled control in real time and tracking of water quality in the home, allowing for automatic regeneration alerts and optimally timed filter changes in the water system.

With a growing preference for hybrid residential softener systems, which incorporate more utility by combining filtration and softening capabilities for multi-purpose water treatment, market penetrations in this sector have only strengthened, leveraging better fit to the dynamic nature of household water quality needs.

While residential water softening systems do come with appliance protection, cleaning efficiency, and reduced water-related maintenance, they also present challenges of upfront cost, salt replenishment, and sodium discharge. Nonetheless, new advancements in AI-powered softener management, salt-free scale inhibitor methods, and biodegradable regeneration alternatives are enhancing efficiency, sustainability, and availability in the market, further providing growth to household water softening systems.

Industrial applications particularly in power plants, manufacturing plants and food & beverage processing have witnessed solid market adoption as industries increasingly turn towards high capacity water softening solutions to mitigate the effects of scale in boilers, cooling systems, and production lines. Also known as industrial water softeners, these systems are designed for frequent use in constant supply, unlike residential units that may only improve a few gallons of water per day without an excessive scale of operation.

Emergence of high-capacity softening units, owing to the growing need for large-scale industrial softening systems with multi-tank configurations for continual water treatment, is anticipated to translate into demand for high-capacity softening units, particularly in activity-focused industries that stress on operational efficiency and durability of equipment. Moreover, the growth in the automated and chemical-free industrial softeners equipped with magnetic and electronic descaling technologies, augments market demand resulting in passing of rigorous laws in environmentally regulated industries.

This is further boosted owing to advancements of modular industrial softeners having scalable designs for an individualized water treatment procedure solution which has ensured better adaptation in diverse industrial applications.

While boasting great benefits for treatment of large quantities of water, equipment protection, and regulatory compliance, industrial water softeners can come with downsides such as high installation costs, heavy energy requirements, and periodic resin replacements. But, novel innovations in energy-efficient softening technologies, AI-assisted water usage optimization, and chemical-free scale prevention are ensuring that the sustainability, cost-effectiveness, and adaptability of solutions continue to grow and expand for industrial water softeners.

The global water softening systems market is witnessing a boost in demand for preventing scale buildup, improving water quality, and ensuring efficient water treatment processes across residential, commercial, and industrial end-user segments. Automation and Artificial Intelligence (AI) have become new technology pathways to address these issues, and companies are concentrating on smart water softeners, AI-based monitoring systems, and green ion exchange technologies to improve operational performance, sustainability, and water conservation.

This market comprises worldwide water treatment firms as well as dedicated softening system manufacturers, with each investing in technology to improve innovations including salt-free II water treatment methods, dual-tank techniques, and high capacity water treatment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Culligan International Company | 15-20% |

| A.O. Smith Corporation | 12-16% |

| EcoWater Systems LLC | 10-14% |

| Kinetico Incorporated | 8-12% |

| Pentair Plc | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Culligan International Company | Develops smart water softening systems with AI-powered water usage tracking and automated regeneration. |

| A.O. Smith Corporation | Specializes in salt-free, reverse osmosis (RO)-integrated, and hybrid water softening systems. |

| EcoWater Systems LLC | Manufactures residential and commercial water softeners with smart home connectivity and salt-efficient regeneration technology. |

| Kinetico Incorporated | Provides non-electric, dual-tank water softening systems with high-flow capabilities for industrial and residential applications. |

| Pentair Plc | Offers eco-friendly, programmable water softeners with water-saving technology and digital monitoring. |

Key Company Insights

Culligan International Company (15-20%)

Culligan dominates the water conditioning system solutions market with advanced water conditioning & purification systems that boast innovative smart water softener technology, integrated artificial intelligence technology, salt-saving regeneration, and other ultra-performance filtration systems.

A.O. Smith Corporation (12-16%)

A.O. Smith focuses on making compact, energy-efficient, and salt-free systems, which help to maximize performance while minimizing maintenance.

EcoWater Systems LLC (10-14%)

EcoWater creates (Wi-Fi-enabled) water softeners which allow for real-time monitoring with a focus on sustainability and efficiency.

Kinetico Incorporated (8-12%)

Kinetico offers non-electric, high-capacity and dual-tank softeners, where regular washing and maintenance takes place.

Pentair Plc (5-9%)

Their water softeners are designed to customize, and energy-efficient, pentair water softeners are smart home compatible technology and are eco-friendly regeneration systems.

Other Key Players (40-50% Combined)

Several water treatment and home appliance companies contribute to next-generation water softening technology, AI-driven water monitoring, and sustainable softening solutions. These include:

The overall market size for Water Softening Systems Market was USD 13.9 Billion in 2025.

The Water Softening Systems Market expected to reach USD 25.5 Billion in 2035.

The demand for water softening systems will be driven by factors such as increasing water hardness due to urbanization, industrial growth, and rising water consumption. Additionally, growing awareness about the adverse effects of hard water on appliances, skin, and hair will further fuel market growth.

The top 5 countries which drives the development of Water Softening Systems Market are USA, UK, Europe Union, Japan and South Korea.

Electric and Non-Electric Water Softeners Drive Market Growth to command significant share over the assessment period.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.