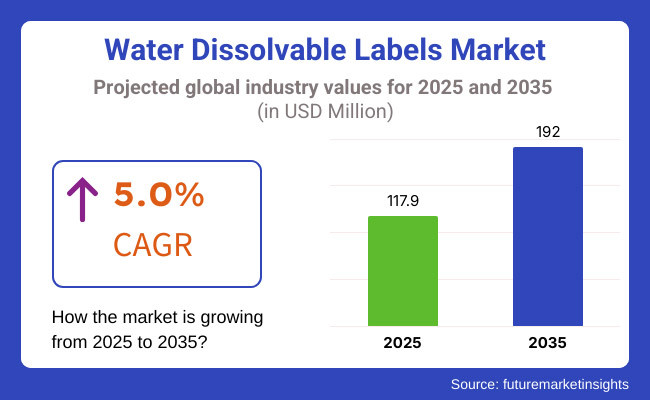

The water dissolvable labels market is anticipated to be valued at USD 117.9 million in 2025. It is expected to grow at a CAGR of 5.0% during the forecast period and reach a value of USD 192.0 million in 2035.

Water soluble labels are developing as a new and sustainable labeling technology in different industry sectors, such as food & beverage, pharmaceuticals, and logistics. Water-soluble labels dissolve completely in water, thus reducing wastage from containers for reuse or recycling.

The demand for an environmentally friendly substitute to adhesive labels will largely increase the market throughout the next decade. Regulatory bodies all over the globe are continuously making rules that support the use of biodegradable labeling solutions.

Market growth is also being influenced by growing consumer demand for easy-to-peel, residue-free labeling solutions for food packaging and product identification. Growing sustainable packaging initiatives and company commitments to reduce waste are further contributing to market growth.

New label film technologies, including better solubility and print longevity, are set to increase functionality across many industries. Furthermore, advancements in printing techniques are improving the aesthetic appeal and branding opportunities for businesses using water dissolvable labels.

Explore FMI!

Book a free demo

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Initial restrictions on non-recyclable labels. | Stricter global policies mandating biodegradable and water-soluble labeling adoption. |

| Development of basic water-soluble label films. | Expansion of high-performance, moisture-resistant, and eco-friendly label formulations. |

| Widely used in food & beverage and logistics. | Increased adoption in pharmaceuticals, industrial, and healthcare applications. |

| Dominated by major packaging and labeling brands. | Rise of sustainable labeling startups and collaborations with biotechnology firms. |

| Growth driven by sustainability and convenience. | Market expansion fueled by AI-optimized label designs and circular economy initiatives. |

| Early-stage transition to biodegradable label materials. | Large-scale adoption of carbon-neutral and fully compostable labeling. |

| Limited use of AI in material optimization. | AI-driven predictive modeling and automated manufacturing enhancements. |

| Focus on solubility and print durability improvements. | Development of multi-use, high-barrier, and temperature-resistant water-soluble labels. |

Shifts in the Water Dissolvable Labels Market from 2020 to 2024 and Future Trends 2025 to 2035

Between 2020 and 2024, the market witnessed steady growth due to rising consumer awareness, corporate sustainability commitments, and government regulations on plastic waste. However, challenges such as high production costs and material performance limitations remained key concerns for manufacturers.

Additionally, the market saw increased investments in research to improve solubility and print durability. Growing concerns over label contamination in recycling processes prompted regulatory bodies to encourage biodegradable alternatives. Furthermore, advancements in printing technology contributed to improved label clarity and dissolvability.

Moving forward, market expansion will be driven by innovations in biodegradable films, eco-friendly adhesives, and production efficiency. The integration of AI and automation in label design and manufacturing processes will further enhance market competitiveness.

Additionally, increasing demand for water dissolvable labeling solutions in logistics and healthcare applications will create new growth opportunities. Companies are also focusing on enhancing the shelf stability and moisture resistance of labels to meet industry-specific needs. The rise of customized labeling solutions tailored for niche markets is expected to gain momentum in the coming years.

Challenges

High Production Costs

The production of water dissolvable label films involves specialized materials and manufacturing processes, making them more expensive than conventional adhesive labels. These higher costs impact pricing strategies and adoption rates, particularly among cost-sensitive industries. Businesses must weigh the benefits of easy removability against the added expense of production and procurement.

Performance Limitations

Water dissolvable labels must maintain an optimal balance between solubility and durability to function effectively. In high-humidity environments, excessive moisture exposure can cause premature dissolution, reducing label readability and adhesion. Manufacturers are continually refining formulations to enhance performance while ensuring labels dissolve efficiently when exposed to water during cleaning or disposal.

Opportunities

Expansion into New Industries

Water dissolvable labels are gaining traction in pharmaceutical, laboratory, and industrial applications due to their convenience and eco-friendly properties. These labels help prevent residue buildup on containers and equipment, improving hygiene and compliance with industry standards. As businesses seek efficient labeling solutions, the demand for water-soluble options continues to grow.

Advancements in Biodegradable Label Technology

Ongoing research in high-performance, water-soluble materials is driving innovation in biodegradable label technology. Manufacturers are developing labels that dissolve quickly while maintaining durability during use. These advancements improve sustainability by reducing waste and minimizing environmental impact, making water dissolvable labels a preferred choice for industries prioritizing eco-friendly packaging solutions.

The industrial, pharmaceutical, and food & beverage industries are leading the market actively as companies look for residue-free, easy-to-remove, and environmentally friendly labeling options. The companies are increasing improvements of the adhesion, print stability, and controlled-delamination properties to cater to industry requirements.

In addition, the companies are focusing on the shelf-life extension of their labels through moisture-resistant and antimicrobial coatings. Also, the developments in biodegradable adhesive technology are further increasing the sustainability and efficiency of soluble labels for a wide range of applications.

Food and beverage packaging has been a major sector of this market, manufacturers are now opting for removable or biodegradable label materials. To lessen the probable early dissolution effect during cleaning, companies provide protection on the labels.

It should still be easily removed later. Furthermore, the addition of dissolvable barcodes for inventory tracking is also boosting product effectiveness. Companies are also conducting research into edible label options for novel use in food security and sustainability.

The pharmaceutical sector is adopting water dissolvable labels for precision labeling in medical packaging, prescription bottles, and drug tracking. Dissolvable label forms are tamper-evident and solvent-proof, and firms are investing in them to comply with regulatory requirements.

Furthermore, innovative pharmaceutical labeling solutions are being actively researched under bio-based adhesives. Moreover, the emerging different types of temperature-sensitive dissolvable labels enhance their applications in cold-chain pharmaceutical supply chain logistics.

Asia-Pacific is expected to dominate the market, driven by increasing urbanization, rising disposable incomes, and growing environmental consciousness.

Countries such as China, India, and Japan are key contributors, with strong demand for sustainable labeling solutions in food packaging, logistics, and healthcare sectors. Additionally, rapid industrialization and the expansion of the FMCG sector in the region are further accelerating market growth.

The region’s market growth is further supported by stringent government regulations on plastic waste, encouraging manufacturers to adopt water dissolvable alternatives. Additionally, advancements in biodegradable label technology are enhancing label performance, making them suitable for a wider range of applications.

The increasing presence of global packaging manufacturers in Asia-Pacific is also boosting local production capacities. Furthermore, research and development in water-soluble adhesives are expected to create new growth opportunities in the region.

North America remains a prominent market for water dissolvable labels due to strong demand from the food & beverage, pharmaceutical, and logistics industries. The United States and Canada are leading the region with technological advancements in biodegradable labels and sustainable packaging solutions. The growing preference for easy-to-remove labels among consumers and businesses is further boosting market demand.

The adoption of eco-friendly and dissolvable labeling materials is gaining traction, influenced by government regulations and corporate sustainability initiatives. Increasing investments in research and development for advanced label adhesive technology are further propelling market growth. Additionally, the rise in e-commerce and direct-to-consumer sales is driving demand for convenient, residue-free label solutions.

Many companies in North America are also focusing on improving the solubility and durability of labeling films to enhance product performance. Innovations in moisture-resistant, water-dissolvable labels are expected to further shape the market in the coming years.

Europe holds a significant share of the market, driven by strong regulatory frameworks supporting biodegradable and plastic-free packaging solutions. Leading economies such as Germany, France, and the UK are at the forefront of sustainable labeling innovations. The increasing investments in circular economy initiatives and eco-friendly packaging research are further strengthening the region's leadership in the market.

Stringent environmental policies promoting plastic reduction and compostable labeling materials are accelerating the shift toward water dissolvable labels. In addition, increasing consumer awareness and demand for green products are expected to contribute to long-term market growth.

The region is also witnessing an increasing number of collaborations between label manufacturers and FMCG brands to develop new water-dissolvable formulations. Furthermore, research institutions across Europe are investing in next-generation label films with improved solubility and print clarity. These advancements are expected to enhance the overall efficiency and adoption of these labels in various industries.

| Country | CAGR(2025 to 2035) |

|---|---|

| USA | 4.9% |

| UK | 4.5% |

| Japan | 4.3% |

| South Korea | 4.7% |

The USA dominates the market, driven by the growing demand for sustainable and easily removable labeling solutions in industries such as food & beverage, pharmaceuticals, and industrial packaging. The shift toward eco-friendly alternatives to conventional adhesive labels has encouraged manufacturers to develop innovative water-soluble labeling technologies.

Additionally, government regulations promoting sustainable packaging and waste reduction are pushing companies to adopt biodegradable and compostable label materials. Moreover, advancements in water-dissolvable adhesives are enhancing label durability while ensuring easy removal in various washing and cleaning processes.

Businesses are also exploring multi-layer dissolvable label solutions to improve information accessibility. Furthermore, the increasing demand for tamper-evident and residue-free labeling options is driving innovation in plant-based, water-dissolvable materials.

The UK is expanding as businesses emphasize sustainability and compliance with environmental regulations. The rising demand for biodegradable and waste-reducing labeling solutions has led to increased adoption across multiple industries. Government initiatives promoting the use of plastic-free packaging are further pushing companies to integrate water-dissolvable label materials.

Additionally, innovations in label coatings and thickness adjustments are making these materials more attractive for various applications. Companies are also exploring antimicrobial and moisture-resistant water-dissolvable labels to enhance product longevity. Furthermore, the rise of refillable and reusable packaging formats is increasing the adoption of dissolvable label solutions in the UK market.

Japan is growing steadily due to its high standards in packaging and its increasing focus on sustainable solutions. Companies are developing precision-engineered dissolvable labels for food, pharmaceuticals, and industrial applications. With strict regulations on reducing plastic waste, businesses are transitioning toward plant-based and biodegradable label materials.

Additionally, advancements in rapid-dissolution adhesives are driving demand in applications requiring seamless removal of labels. Businesses are also investing in automated labeling technologies to enhance precision and minimize material waste. Furthermore, the rise of compact and lightweight packaging solutions in Japan is fueling demand for water-dissolvable labels across various industries.

South Korea is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and sustainable labeling solutions has led manufacturers to develop enhanced water-dissolvable label films with improved adhesive strength and controlled dissolution rates. Government regulations promoting plastic-free and biodegradable packaging further support market expansion.

Additionally, businesses are integrating smart labeling technologies such as QR-code embedded dissolvable labels to improve product traceability and consumer engagement. The growing demand for clear, easy-to-remove labels in food and beverage packaging is further boosting adoption.

Moreover, research into temperature-sensitive dissolvable adhesives is helping businesses develop innovative labeling solutions tailored to specific industry requirements.

The industry for water-dissolvable labels is fragmented; many firms are competing among themselves to gain a firm foothold. One company does not occupy the whole space of business, which makes the whole competition framework a purely competitive one, where innovation differentiates companies from one another.

The focus of businesses is on cost-effective, high-performance label solutions appropriate for use in temporary, eco-friendly, and easily-removable identification for several applications in industries.

Leading companies in the industry focus on the development of advanced materials and manufacturing techniques that boost product performance. R&D investments contribute to the creation of water-soluble labels that meet durability during use.

By fine-tuning their adhesive properties along with compatibility with the ink, the manufacturers ensure that the labels can meet all the industrial-specific requirements and can be categorized under foodservice, healthcare, and packaging.

Sustainability is a major consideration for competition in this segment. The use of biodegradable materials and water-soluble adhesives would ensure compliance with environmental rules put in place by governments and the increasing consumer preference for greener options.

Manufacturers who manage to integrate sustainability with performance have the potential of getting a strategic advantage and will most likely be considered sources for industries that are looking for compliant, green labeling solutions of excellence and convenience.

Strategic partnerships and mergers are further reshaping the terrain of water dissolvable labels. It encompasses collaboration with suppliers, distributors, and technology providers to increase their footprint and reinforce production capabilities.

The linkages also allow companies to scale operations and enhance supply chain efficiency while developing an innovative class of labeling solutions catering to the rising demand for temporary and sustainable identification methods.

Intense competing nature, but all these advances are possible only by a spending budget of research, sustainability, and strategic alliances. By continuing to improve the formulations of products and increasing the distribution networks according to regulatory revised patterns, the key players have continued to push towards the advancement of the technology of water dissolvable labels.

Thus, constant innovations keep the companies within the competition and serve the growing demand for efficient and environment-friendly labeling solutions around the globe.

The water dissolvable labels market is growing due to increasing demand in food service, healthcare, logistics, and retail applications. Businesses in these industries require labels that provide clear identification while being easy to remove without leaving a residue. The need for efficient and sustainable labeling solutions is driving market expansion and product innovation.

Material advancements are enhancing label performance, with bio-based adhesives, moisture-resistant coatings, and improved print technologies addressing sustainability and durability concerns.

These innovations ensure high-quality printing while maintaining eco-friendly properties. As companies prioritize greener packaging solutions, the shift toward plastic-free and biodegradable labeling continues to gain momentum in various industries.

Technological improvements in automated label production and supply chain optimization are shaping market trends. Automation increases manufacturing efficiency, reducing costs and waste, while supply chain advancements enhance distribution and tracking. These developments help businesses streamline operations while ensuring that labeling solutions meet the growing demand for convenience and environmental responsibility.

Regulatory compliance and certifications are playing a significant role in market adoption. Companies are investing in research on enzymatic degradation of dissolvable adhesives to improve performance and minimize residue. As environmental regulations become stricter, businesses are focusing on certified eco-friendly labeling solutions to meet industry standards while maintaining product safety and sustainability.

The overall market size for the market was USD 117.9 million in 2025.

The market is expected to reach USD 192.0 million in 2035.

The market will be driven by increasing demand from food service, healthcare, and logistics industries. Sustainability trends, innovations in biodegradable adhesives, and improvements in label performance will further propel market expansion.

Key challenges include high production costs, limited durability in high-humidity environments, and regulatory approval complexities. However, advancements in nanotechnology and improved film formulations are addressing these issues.

By ink type, the market is bifurcated into water-based ink and solvent-based ink.

Based on the printing technology, the market is segmented into direct thermal printing, thermal transfer printing, laser printing, and flexography printing.

On the basis of end use, the market is categorized into food & beverage, pharmaceuticals, chemical, electrical & electronics, and shipping & logistics.

Region-wise, the market is studied across North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.