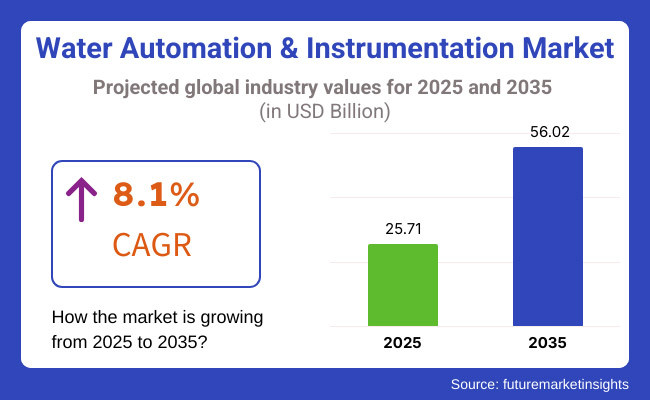

The global water automation & instrumentation market is expected to experience a considerable expansion due to rising demand for efficient water management systems and stringent environmental regulations. Estimated at USD 25.71 billion in 2025 and by the end of forecast period it will reach USD 56.02 billion with a CAGR of 8.1% from 2025 to 2035 this industry is set to grow steadily.

Urbanization, industrial development, and rising water scarcity are key drivers behind this growth. Automation solutions are crucial at a time when water quality needs to be monitored in real time, treatment processes have to be optimized, and operational efficiency must be improved. Moreover, IoT, AI, and cloud-based monitoring systems are anticipated to drive innovation in this field.

The rise in government and private investments in smart water management further speeds up the growth of the market. The booming demand for sustainable and cost-effective solutions for water treatment is pushing industries and municipalities to automate their water treatment plants by deploying modern instrumentation technologies, which is expected to create significant opportunities for growth over the forecast period.

Explore FMI!

Book a free demo

From 2020 to 2024, there have been rapid developments in the water automation and instrumentation market. Industries started adopting IoT technologies for water management systems, allowing for real-time monitoring and data-driven decision-making.

For example, smart sensors featuring Wi-Fi connectivity, higher accuracy, and latest innovations are creating opportunities for market players. Cloud-based solutions were also adopted during this period and enabled remote access and centralized control of the water treatment process. Focus on automation to ensure operational efficiency and reduce manual intervention.

During 2025 to 2035, the industry will be in even more flux. AI and machine learning-driven predictive maintenance and process optimization in water systems. Advanced water management technologies will be integrated into smart city initiatives, enhancing the urban development sustainably. Moreover, the emphasis will be on developing technologies for water that are energy-efficient and sustainable that can solve the problem of water scarcity and the environmental problem of the world. Together these innovations will fuel the next growth wave in the water automation and instrumentation market.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for smart water management systems. | Capital-intensive with high operating costs. |

| Innovatice technologies of AI, IoT, and cloud-based applications. | Data governance and cyber security risks in automated systems. |

| Urban smart and industrial automation. | Infrastructure woes in the developing parts of the world. |

| Advances in real-time monitoring technologies. | Issues regarding interoperability with legacy systems. |

| Reduction of water wastage and making us energy efficient in water conservation and sustainable water solutions. | Barriers in diverse global markets due to regulations. |

Impact Assessment of Key Dynamics

| Key Drivers | Impact Level |

|---|---|

| Growing demand for smart water management systems | High |

| Merging technologies of AI, IoT, and cloud-based applications | High |

| Regulation on conservation of water by government | High |

| Urban smart and industrial automation | Medium |

| Growing fears about water shortages | High |

| Advances in real-time monitoring technologies | Medium |

| Reduction of water wastage and energy efficiency in sustainable water solutions | High |

| Key Restraints | Impact Level |

|---|---|

| Capital intensive with high operating costs | High |

| Data governance and cyber security risks in automated systems | Medium |

| Infrastructure woes in the developing parts of the world | High |

| Reluctance of traditional operators to evolve | Medium |

| Issues regarding interoperability with legacy systems | Low |

| Barriers in diverse global markets due to regulations | Medium |

In water automation and treatment, the treatment of water is the most lucrative process for solution providers, as it demands advanced technologies like filtration, chemical dosing, reverse osmosis, and UV purification to meet stringent quality standards, creating recurring revenue through equipment sales, maintenance contracts, and upgrades driven by regulatory compliance, industrial demand for pure water, and the growing need to address contaminants in municipal and commercial systems.

In industrial automation and control, SCADA (Supervisory Control and Data Acquisition) systems are the most widely used and lucrative for solution providers, as they are critical for real-time monitoring, data acquisition, and control across industries like energy, water treatment, manufacturing, and infrastructure.

Their demand stems from scalability, integration with IoT/cloud platforms, and the need for modernization in aging systems, driving revenue through software licenses, customization, cybersecurity upgrades, and long-term maintenance contracts. While DCS (Distributed Control Systems) and MES (Manufacturing Execution Systems) are highly lucrative in process industries (e.g., oil and gas, pharmaceuticals), SCADA’s broader applicability, recurring service opportunities, and alignment with smart infrastructure trends make it the dominant choice for sustained profitability and market reach.

In water automation and instrumentation, electromagnetic flow meters are the most widely used and lucrative for solution providers, as they are critical for accurately measuring water flow in pipelines, treatment processes, and distribution networks without moving parts, ensuring minimal maintenance and high reliability.

Their demand is driven by strict regulatory compliance, billing accuracy in utilities, and integration with SCADA/DCS systems. Pressure transmitters and control valves follow closely, given their universal role in maintaining system pressure, preventing leaks, and optimizing pump operations.

However, electromagnetic flow meters dominate profitability due to their recurring replacement needs, calibration services, and adoption in smart water networks. Emerging technologies like leakage detection systems are gaining traction due to water scarcity concerns, but established devices like flow meters remain the revenue backbone for instrumentation providers.

Reaching USD 6.9 billion by 2025 sales are likely to grow at a brisk pace in the USA. Utilities have started investing in modern systems such as the SCADA system and IoT-enabled sensors in order to increase operational efficiency and regulatory compliance.

While data integration of AI and ML to enable predictive maintenance and real-time monitoring is in its infancy, such improvements have reduced the cost of operations while improving the quality of service. United States being a frontier for the adoption of latest water technology due to federal programs encouraging the adoption smart water management systems is also aiding growth of the market.

Recent years have seen steady growth in the water automation and instrumentation market for Canada, as municipalities and industries alike focus on sustainable water management practices. With so much surface and groundwater available to the country, proper monitoring and distribution systems must be in place to prevent wastage and grow regions in need.

Widespread investments in advanced metering infrastructure and real-time data analytics automation technologies are improving water treatment and distribution network efficiency. Add to that government policies encouraging conservation and infrastructure development, and the stage is set in Canada for advanced solutions to lay the groundwork for water resource management within the country.

The UK Water Automation and Instrumentation market is expected to observe strong growth due to the stringent regulatory framework and need to preserve the ecosystems. Water companies implement smart automation solutions to meet the demands of an ageing infrastructure and ever-tightening quality requirements.

The inseparable association of IoT gears and AI-based analytics empowers the organizations to monitor and do predictive maintenance in real-time dashboards, thus reducing cost and enhancing service delivery. Government initiatives to promote smart water networks and leakage reduction in the sectors are additionally driving the adoption of new technologies.

In France, the market is driven by a strong focus on environmental protection and resource efficiency, and the water automation and instrumentation market is growing strongly. In reaction to that, the French government has taken a proactive stance on water conservation, which in turn has led to broader investments in modernizing water infrastructure.

Advanced control systems and automation technologies will enable these utilities to optimize the treatment and distribution of water, Savorelli said, Smart metering, along with the availability of real-time data management tools, is ushering in greater transparency and fiduciary responsibility among private service providers, which aligns with France's ambition to expand the use of new technology in the field of sustainable water management.

The market for water automation and instrumentation in Germany is characterized by technological innovation and a focus on sustainability. There is a requirement for automation systems and instrumentation in a large number in the industrial sector in the country, making the water management solutions in the region difficult.

Asian countries are adopting Industry 4.0 methods such as IoT and AI to utilize and treat water more efficiently. The market will receive extra thrust from government laws promoting environmental conservancy and resource efficiency, which makes Germany a hub for advanced water management technologies.

High urbanization and industrial development in South Korea are pushing the water automation and instrumentation market. Intelligent Water Management Systems as Part of Smart City Initiatives The efficiency and reliability of the water supply and wastewater treatment rely on the availability of advanced automation technologies purchased by the utilities.

In addition, South Korea's focus on sustainable development, economic growth, and energy efficiency aligns with these measures in terms of technological alignment, implementation, and timely information to make better operational decisions.

Technological innovation and infrastructure resilience are pushing the automation and instrumentation market for water in Japan. Natural disasters and an ageing population are among the challenges highlighting the need for efficient and reliable water management systems. However, the increasing use of automation technologies, such as remote monitoring and control systems, is enabling a smarter and more resilient water infrastructure.

In addition, supportive government policies for smart infrastructure development along with environmental sustainability are elevating the market for water management practices in Japan.

China's water automation and instrumentation market is expected to be driven by the rapid growth of industrialization and urbanization in the country over the next few years. USD 100 billion is being earmarked by China to address water scarcity and pollution issued by the Chinese government is driving significant water infrastructure modernization investments.

Modern automation systems and real-time monitoring technologies are transforming the water treatment and distribution process to be less energy-intensive and more efficient. Policies emphasizing smart city progression and preservation of the environment are propelling the adoption of innovative water management solutions across the nation.

The water automation and instrumentation market in India is growing in the country, on the other hand, as the nation focuses on the issues of water scarcity and distributing inadequacies. The adoption of automation technologies is aided by government programs to develop water infrastructure and smart cities. Utilities are adopting new advanced, automated metering systems and real-time monitoring tools to help them better manage water.

| Past Trends (2020 to 2024) | Future Projections (2025 to 2035) |

|---|---|

| Overview of the Industry 4.0 Market: Industry 4.0 is characterized by the rapid adoption of IoT, AI, and cloud-based technologies. | Self-regulating treatment plants powered by AI will optimize operations. |

| With the use of smart sensors, real-time monitoring and automation were possible. | Intelligent water networks will adapt the distribution to demand. |

| Governments imposed tighter water conservation measures. | Tougher policies will hasten energy-efficient water solutions. |

| Water wastage was reduced by AI-Powered predictive analytics. | Big Data, automation and cloud computing will improve measurement accuracy. |

| High capital costs and infrastructure constraints slowed adoption. | Financial losses will be significantly reduced with strengthened leak detection and predictive maintenance. |

| Industries upgraded the infrastructure to comply with regulations. | Desalination and wastewater recycling will allow automation to ensure water security. |

| Clarifying brand definitions and context of use drove demand for better segmentation. | Automation will play a key role in ensuring the sustainability of global water resources. |

The water automation & instrumentation market is consolidated, with 90% of the market share held by Tier 1 players. The market concentration means that a small number of large competing companies influence market development, technological development, and prices. This results in market-leading positions, as these companies can deliver and support a comprehensive range of products and solutions across various end-user applications globally.

Some of the leaders in the domain are ABB Group, Siemens AG, Schneider Electric SE, Rockwell Automation Inc., General Electric, etc. Siemens AG, for example, incorporated advanced data analytics and Internet of Things (IoT) technologies into its digital water solutions portfolio and is committed to developing equipment that optimizes and makes more sustainable water management systems.

Similarly, ABB Group in 2023 recently released new automation products that help improve energy efficiency and operational reliability in the water treatment market. Both these actions demonstrate the commitment of key players in stimulating innovation and adapting to the evolving needs of the water automation & instrumentation market.

While some established corporations dominate the water automation and instrumentation market, emerging startups are making game-changing strides through innovative solutions. Hydrific, for example, makes a sensor called Droplet you can install to monitor your water usage in real time to help detect leaks and save on bills.

In parallel, CIWI is developing electrochemical water treatment technologies that reduce the reliance on the traditional chemicals that are currently used to disinfect water, thus fostering more sustainable water management practices. Noteworthy are the examples of these startups that illustrate the dynamic changes in the industry.

Automation improves efficiency, minimizes water waste, and allows real-time monitoring for optimal resource management.

Advanced water treatment, distribution, and monitoring systems are transforming the industry using AI, IoT, SCADA, PLCs, and smart sensors.

Industries, municipalities, agriculture, and households benefit from better water quality at lower costs, making water use more efficient and affordable.

High initial costs, cyber security risks, and integration with existing systems are some significant barriers to widespread adoption.

It is segmented into Collection of Water, Treatment of Water, Distribution of Water (Dead End System, Radial System, Grid System, Ring System & Method of Water Distribution)

It is segmented into Distributed Control System-DCS, Supervisory Control and Data Acquisition-SCADA, Programmable Logic Controller-PLC, Human Machine Interface-HMI, Manufacturing Execution-MES, Identity & Access Management-IAM, Laboratory Information Management System-LIMS

it is fragmented into Pressure Transmitter, Level Transmitter (Hydrostatic Operating Principle, Ultrasonic Operating Principle, Capacitive Operation & Guided Wave Radar), Electromagnetic Flow Meters, Sludge Density Measurement, Gas and Liquid Analyzer, Leakage Detection Systems, Control Valves, High and Low AC Drives and Others.

it is segmented into Drinking Water, Household Water - Other than Drinking Water, Commercial Water, Industrial Water, Agriculture and Others.

it is fragmented into North America, Latin America, Europe, Asia Pacific and Middle East & Africa

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.