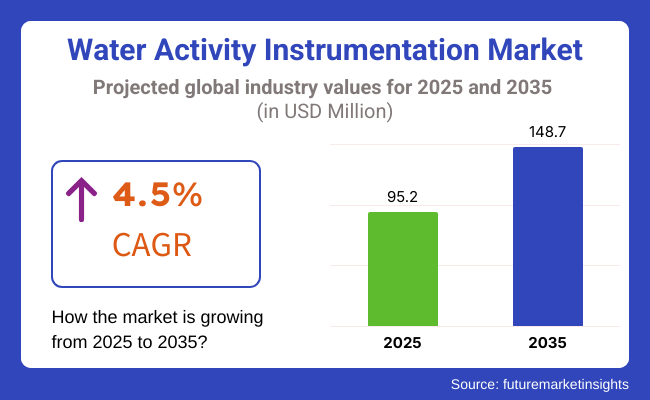

The growth of the water activity instrumentation market, which is envisaged to increase to USD 148.7 million by 2035 from USD 95.2 million in 2025, with a consistent CAGR of 4.5% is indicative of its potentiality. Factors that support this trend are the rising regulatory requirements for food safety, the pharmaceutical industry, and material science research, along with stability testing.

Every industry, including food and beverage, pharmaceuticals, and cosmetics, finds that water activity measurement is an important aspect regarding the product quality, stability time, and shelf life achieved. As the companies ensure that they produce more ''right first time products '' and at the same time completely adhere to the very stringent and tough global regulations, there is a rise in the requirement of the highly sophisticated water activity instruments.

Utilization of these devices by the manufacturers enables them to keep high standards, avoid spoilage, and enhance productivity which makes them a necessity in the quality control procedures. The market nowadays has advanced technological water activity meters that are characterized by a user-friendly interface, portability, and cost-effectiveness.

With the availability of small and cost-effective versions, they are becoming indispensable for ensuring quality in remote production sites where measurement of water activity is facilitated across various industries. Advances in technology have been key in the water activity instrumentation through the promotion of automation, real-time monitoring, and sensor accuracy development.

Those firms which are channelling funds in research and development aimed at maximizing the operational effectiveness and making the devices more pocket-friendly will undoubtedly acquire a competitive edge in the market. The demand for accurate water activity measurement device will surge on the backdrop of stringent regulations and industries emphasizing product quality.

Consequently, the market will continue to grow at a steady pace in the following years, thus water activity instrumentation being an essential part of the modern quality control and safety measures.

Explore FMI!

Book a free demo

Between 2020 and 2024, the water activity instrumentation market grew at a steady rate, as there was a high demand in food, pharmaceuticals, cosmetics, and agriculture. Advanced analyzers became essential for ensuring product stability, microbial control, and regulatory compliance, with the food industry prioritizing humidity control for extended shelf life. The pharmaceutical sector also played a key role, and it required accurate moisture measurement for drug formulations.

Some new technologies like tunable diode laser spectroscopy and IoT-integrated water activity meters enabled measurements with a high accuracy, speed, and automation. But there are a few challenges, such as the instruments being very costly, and also the calliberation is quite tough. Because of this, there is a lack of standardization.

Between 2025 and 2035, next-gen analytics powered by AI, nanotechnology-enabled sensors, and next-generation spectroscopy will revolutionize the measurement of water activity. With non-contact and high-speed sensors, one can test moisture status in real time to maximize quality control. Predictive models with AI and IoT will improve efficiency and automation.

Data tracking with blockchain will enhance traceability and ensure regulatory compliance. Also, microfluidic lab-on-a-chip analyzers and laser spectroscopy will drive moisture analysis in pharmaceuticals and food processing, enhancing accuracy and production efficiency.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Complying with standards set by the FDA, EFSA, and WHO in the fields of food, pharmaceutical, and cosmetics. | Blockchain-protected regulatory data, AI-based compliance automation, and decentralized quality control. |

| Capacitive sensors, TDLS, and IoT-integrated analyzers. | Nano-based sensors, mid-infrared spectroscopy, and AI-powered predictive analytics. |

| For the assessment of food safety, pharmaceutical ingredients, cosmetic ingredients, and agrochemical ingredients. | Used in biotechnology, precision farming, and nanomedicine. |

| Portable water activity meters for cloud-connected manufacturing quality assurance. | Industry 4.0-based smart factories integrated with AI-assisted real-time remote monitoring systems. |

| Energy-efficient instruments with low sample volume requirements. | Self-powering, biodegradable biosensors, and Predictive maintenance AI for enhanced lifespan of instruments. |

| IoT-based data logging, cloud analytics, and automated trend detection. | Forecasting humidity with AI, real-time adjustments to the production line, and traceability with blockchain. |

| Market challenges have included the high costs of instruments and standardization issues. | AI-optimized supply chain monitoring, decentralized manufacturing, and real-time calibration feedback. |

| Growth factors include regulatory pressure, rising food safety concerns, and pharmaceutical stability requirements. | AI-supported automation, Industry 4.0 integration, and precision nanotechnology for further expansion into moisture analysis. |

Technology, accuracy, application, and target industries determine the pricing strategy for the water activity instrumentation market. Water activity meters designed for high precision (e.g., in pharmaceuticals, food safety, and research laboratories) have premium priced equipment because they are equipped with advanced sensors, are more automated, and must meet stringent regulatory standards.

In the mid-range food and industrial applications, you get a cost-performance trade off. Entry-level devices primarily used in agriculture and small-scale production are sold through penetration pricing to attract budget-conscious buyers. Manufacturers usually have a tiered pricing model with basic, advanced and premium versions, targeting different customers. Another model that we are seeing is subscription-based pricing where companies are offering their services as a cloud-based data logging and calibration of hardware.

There are many risks in water activity instrumentation market. Variations in the pricing of raw materials and components - specifically, sensitive sensors and electronic components - may also add to production costs. Supply chain disruptions, such as semiconductor shortages or precision manufacturing delays, may impact product availability.

Regulatory compliance is another big consideration; certain industries such as pharmaceuticals and food production have extensive and complex validation and calibration requirements that can often be costly and complex. Additionally, rivals providing affordable alternatives and state-of-the-art technology demand continual innovation. However, affordability with high accuracy, durability, and compliance need to find a balance for the sustainability of the market in the long term.

Pricing Strategy in the Water Activity Instrumentation Industry

| Metrics | Pricing Level |

|---|---|

| High-precision instruments (pharmaceuticals, research labs) | High |

| Industrial-grade instruments (food safety, manufacturing) | Medium |

| Entry-level instruments (agriculture, small-scale production) | Low |

| Cloud-based data logging and calibration services | Medium |

| Subscription-based pricing models | Medium |

Handheld water activity meters are small, portable, quick response on-site measurement systems, making them extremely helpful in the food processing, agricultural and pharmaceutical industries. They are easy to use, cost-effective, and suitable for on-site real-time water activity detection, product quality assurance, and stability in field use.

They are portable and can be used by manufacturers to measure moisture in raw materials or finished products on the production floor or in storage. The demand for portable and effective quality control instruments is propelling the growth of handheld water activity instrumentation.

Benchtop Water Activity Meters Stationary systems for laboratory and industrial applications, utilizing higher precision and advanced capabilities. These are utilized in research facility, quality assurance centres and manufacturing units where accuracy and detailed analysis are important. Benchtop devices facilitate formulation development and help to ensure product safety and regulatory compliance.

Applications encompass food & beverage production, pharmaceutical testing, and cosmetic stability testing. Benchtop water activity meters are increasingly being adopted, making use of advances in automation, data integration, and IoT-enabled monitoring to provide reliable and repeatable results.

Water activity instrumentation have an end-user base significantly represented by the food and beverage industry. Humidity control is a crucial factor for upholding product quality, prolonging shelf life, and inhibiting microbial proliferation. Water activity meters have increasingly been adopted across food manufacturing plants worldwide thanks to strict regulatory requirements from bodies such as the FDA, EFSA and GFSI.

Food manufacturers use these tools to achieve precise moisture levels in products like baked goods, dairy, snacks, and confectionery, maintaining uniform quality and texture while also avoiding spoilage. Increasing consumer preference for clean-label and preservative-free products also contributes to the driving need for sophisticated water activity instrumentation.

Real-time monitoring is possible as IOT-empowered sensors are used with AI powered analytics which enables predictive quality control so that production losses are save to enhance food safety.

Dew point based meters of very high precision are specifically useful to monitor water activity in lyophilized drugs, powder based capsules, and powdered antibiotics. With the increasing demand for personalized medicines, biologics and advanced drug delivery systems also comes a need for rigorous moisture control.

AI-based analytics facilitate automation in pharmaceutical manufacturing, allowing constant real-time monitoring for improving the production quality while also minimizing the risk. As innovation in this field expands and regulatory requirements tighten, the large-scale utilization of advanced water activity instrumentation in this industry is likely to proliferate.

North America dominates the market for water activity instrumentation due to severe food safety standards, advanced pharma production, and strong R&D spending. The USA and Canada are the key contributors, and they report good demand from the food industry and biotech industries. Availability of leading-line manufacturers and technological advances in accuracy instrumentation also fuel the growth of the market. Food safety and drug quality control initiatives from governments are propelling market adoption in the region.

Europe is a stronghold region, with Germany, the UK, and France leading pharmaceuticals and food production. The requirements for drug stability testing and food safety across the EU drive demand for water activity equipment. Market also benefits from advancing automatic test technology and additional funding in research lab facilities. Demand is further driven by rising interest in natural preservatives and clean-label foods, where better analysis of water activity is required for product integrity.

Asia-Pacific is anticipated to register the fastest growth, driven by increasing industrialization, expanding food and pharmaceutical sectors, and growing regulatory enforcement. China, India, Japan, and South Korea are major contributors, with heightened demand from food exporters, generic drug manufacturers, and research institutes.

The increasing adoption of automated lab tests, in association with higher government spending on food and drug quality testing, is driving the growth of the market in the space. Additionally, new emerging players focusing on intelligent water activity solution offerings are altering the competitive space.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| European Union | 4.9% |

| Japan | 5% |

| South Korea | 5.3% |

The USA is expanding due to strict food safety practices, enhanced need for pharmaceutical quality control, and technological advancement in sensor technology. The Food and Drug Administration (FDA) exercises strict control on water activity of packaged foods, which propels the adoption of advanced equipment to comply.

In the pharmaceutical, food, and research industries, high-resolution water activity meters are increasingly being employed to establish product stability and prevent microbial proliferation. Greater application of digital sensors and AI-powered monitoring systems enables real-time data collection as well as predictive maintenance.

Greater application of handheld and automated water activity analyzers ensures quality assessment is possible in decentralized sites such as food processing plants and grain stores silos. Industry giants such as Mettler Toledo, AQUALAB, and Rotronic remain committed to introducing high-performance equipment in order to respond to evolving industry needs.

Growth Factors in The USA

| Key Factors | Details |

|---|---|

| Strong Food & Beverage Industry | High demand for water activity measurement in food preservation and safety. |

| Advanced Pharmaceutical Sector | Stringent regulations drive the adoption of precise water activity instruments. |

| Technological Innovations | Growth in smart sensors and IoT-enabled water activity devices. |

| Regulatory Compliance Needs | FDA and USDA guidelines encourage companies to invest in accurate testing equipment. |

The UK is growing due to increasing regulatory attention on food safety, increasing demand for pharmaceutical stability testing, and improvements in measuring technology. The UK Food Standards Agency (FSA) demands stringent monitoring of water activity in processed foods, which encourages manufacturers to invest in precision devices.

The pharmaceutical manufacturers use advanced water activity meters for stabilizing drug formulations and ascertaining Good Manufacturing Practices (GMP). In addition, AI-powered analytics and remote monitoring help enhance the efficiency of food safety and pharmaceutical applications.

Growing demand for portable, easy-to-use water activity equipment in research and quality control labs is fueling market expansion. Major suppliers keep introducing new products, incorporating IoT-based connectivity for real-time data access and compliance tracking.

Growth Factors in The UK

| Key Factors | Details |

|---|---|

| Rising Demand in Food Manufacturing | High focus on food quality and shelf-life enhancement. |

| Growth in Cosmetic Industry | Increasing use of water activity measurement in skincare and cosmetic formulations. |

| Strict Safety Regulations | Compliance with EU and local standards for product quality control. |

| Expansion in Research & Academia | Growing use of water activity instruments in scientific studies and product development. |

The European Union is expanding due to strict regulatory frameworks, increasing demand for food and pharmaceutical quality assurance, and rising investments in automation. The European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) implement stringent laws for consumer products regarding water activity levels.

Germany, France, and Italy are frontrunners in the adoption of high-precision water activity meters for food processing, biotechnology, and pharmaceuticals. The smart sensors married at the altar with the cloud-compliant monitoring platforms for sources of fruitful assessment and compliance along with risk evaluation.

Technology disrupters have also introduced non-destructive water activity testing and lab-on-chip innovations and much more available across the board to increase speed and accuracy of measurement for diverse industries beyond food and beverage applications, into the wider market growth.

Growth Factors in the European Union

| Key Factors | Details |

|---|---|

| Stringent Quality Control Norms | EU food safety laws drive the adoption of precise water activity analyzers. |

| Diverse Industrial Applications | Usage in pharmaceuticals, chemicals, and agriculture. |

| High Investment in R&D | European companies invest in advanced water activity monitoring technologies. |

| Sustainable Packaging Initiatives | Need to optimize moisture levels in biodegradable and eco-friendly packaging. |

Japan is growing because of rising food safety concerns, increasing pharmaceutical research, and government initiatives for quality control. The Japanese Ministry of Health, Labour and Welfare is enforcing stringent standards of water activity in packaged foods and pharmaceuticals, thereby propelling the increased demand for advanced instruments.

Water activity meters with high precision are being increasingly adopted by pharmaceutical companies to improve drug formulation and storage stability. Not only the emergence of increasingly powerful AI diagnostics but also automated quality assurance solutions further energizes market growth. Also, the demand for portable and rapid water activity analysers is on the rise in the food production and research sectors to ensure real-time quality control in decentralized areas.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Cutting-Edge Technology Development | Japan leads in miniaturized and high-precision water activity instruments. |

| High Standards in Food Processing | Strict regulations for packaged and processed food safety. |

| Expanding Biotechnology Sector | Increased application of water activity measurement in lab research. |

| Focus on Automation & AI | Rising adoption of AI-integrated water activity devices for industrial use. |

Government expenditure on food safety measures and research into pharmaceuticals, along with the digital health transformation, continues to place this nation at the foot of rapid emergence alongside South Korea. The Ministry of Food and Drug Safety (MFDS) has formulated stringent regulations on water activity, which means there will be a rising demand for these precision measurement technologies.

South Korean companies invest heavily in AI-driven water activity monitoring systems, enhancing predictive analytics and automated compliance tracking. The country’s cutting edge pharmaceutical and biotechnology sectors further fuel demand for advanced instrumentation in drug development and storage applications.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Booming Semiconductor Industry | Demand for precise humidity and moisture control in electronics manufacturing. |

| Growing Pharmaceutical Sector | High investments in drug formulation and stability testing. |

| Increasing Processed Food Consumption | Rising urbanization fuels demand for moisture-controlled packaging. |

| E-commerce Growth in Lab Equipment | Online sales of precision instruments make water activity devices more accessible. |

The equipment related to measuring water activity is experiencing a boom with the increased need for precise moisture control in fields such as food safety, pharmaceuticals, and material science. Companies are working on high-accuracy sensors since they are portable, analyzer, and automatic water activity meters, which will enhance the quality control and shelf-life improvement of the product and research purposes.

The market involves worldwide leaders and specialist instrument manufacturers leading technological advancement in the dew point, capacitance, and resistive sensor-based measuring systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| METER Group | 15-20% |

| Aqualab (Decagon Devices) | 12-16% |

| Rotronic AG | 10-14% |

| Novasina AG | 8-12% |

| Kett Electric Laboratory | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| METER Group | Develops high-precision water activity meters, integrating AI-based predictive analytics for food and pharma industries. |

| Aqualab (Decagon Devices) | Specializes in portable and benchtop water activity instruments, emphasizing rapid testing for regulatory compliance. |

| Rotronic AG | Manufactures laboratory-grade and industrial water activity analyzers with advanced temperature control. |

| Novasina AG | Focuses on highly sensitive water activity sensors for pharmaceuticals, cosmetics, and food preservation. |

| Kett Electric Laboratory | Produces compact and user-friendly water activity meters with a focus on food and agricultural applications. |

Key Company Insights

METER Group (15-20%)

METER Group has the highest share in the water activity instrumentation market, and it provides state-of-the-art devices for AI-driven data analytics. This company specializes in fast-response sensors and cloud-based data management systems for live monitoring.

Aqualab Decagon Devices (12-16%)

Aqualab primarily offers very precise and user-friendly water activity instruments for food safety, pharmaceutical research, and materials science. These products have very quick analysis speeds and even include some regulatory compliance assistance.

Rotronic AG (10-14%)

Rotronic AG uses extremely accurate water activity analyzers in development with advanced temperature stabilization and humidity control. The company has lab-based instrumentation to serve the food, pharmaceutical, and packaging industries.

Novasina AG (8-12%)

Novasina develops measurement systems for very sensitive water activities in pharmaceuticals, biotechnology, and food applications. Precision and stability in sensor technology have gained high emphasis with the company.

Kett Electric Laboratory (5-9%)

Kett Electric Laboratory adopts production measures that will produce cost-effective portable water activity meters well suitable for usage in food safety, agriculture, and some industrial applications. The company also prioritizes other areas such as usability and accessibility in its devices.

Yet another manufacturer makes its contribution in the development of next-generation water activity measurement solutions, high-precision sensors, and AI-integrated analysis tools.

The market is projected to witness a CAGR of 4.5% between 2025 and 2035.

The industry stood at USD 95.2 million in 2025.

The industry is anticipated to reach USD 148.7 million by 2035 end.

North America is expected to record the highest CAGR, driven by growing demand in the food, pharmaceutical, and cosmetics industries.

The key players operating in the industry include Freund Corporation, Rotronic AG, Neu-tec Group Inc., Meter Group, Novasina AG, Biobase Group, Labtron Equipment Ltd, Steroglass Srl, and others.

Based on type, the market is segmented into handheld and benchtop.

According to distribution channel, the market is categorized into offline sales and online sales.

Based on end use, the market is segmented into industrial manufacturing, food industry, pharmaceutical & cosmetics industry, tobacco industry, and seed storage.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Gauss Meter Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth – Trends & Forecast 2025 to 2035

Trace Oxygen Analyzer Market Growth – Trends & Forecast 2025 to 2035

Soil Field Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Heat Stress Monitor Market Analysis by Product, Application, Offering, Life Form, Technology, Sensor Type, and Region Forecast Through 2035

ADAS Calibration Equipment Market Analysis by Vehicle Type, End User, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.