The steady growth of activated tape water is closely related to increasing demand for eco-friendly, secure, and tamper-evident packaging solutions. Manufacturers focus on automation, sustainability, and material innovation to enhance performance while reducing operational costs. The e-commerce boom, security-related package concerns, and an increasing need for saving shipping cost also contribute to the growth of the market.

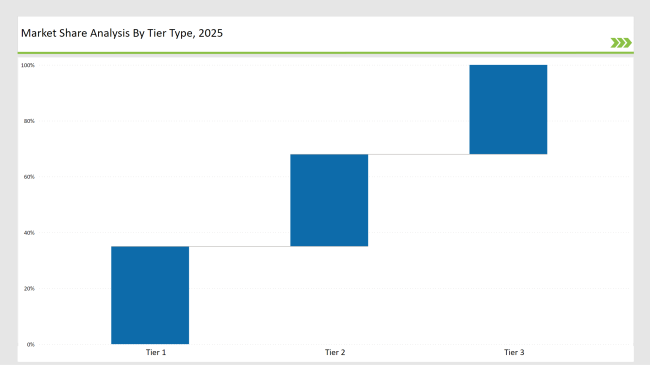

Tier 1: Leaders: The leaders of the market include Intertape Polymer Group, Better Packages, and 3M. They own about 35% of the market share. Advanced automation, a strong distribution network around the globe, and R&D investment support their continued market leadership.

Tier 2: Companies including Uline, Marsh Tapers, and Phoenix Tapers account for 33% of the market. They serve mid-sized businesses by offering high-performance, customizable water activated tape dispensers designed for various industries.

Tier 3: Regional and niche manufacturers specializing in industrial, e-commerce, and logistics applications represent the remaining 32% of the market. These players focus on cost-effective solutions, innovative dispenser designs, and localized distribution networks.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Intertape Polymer Group, Better Packages, 3M) | 18% |

| Rest of Top 5 (Uline, Marsh Tapers) | 10% |

| Next 5 of Top 10 (Phoenix Tapers, Cyklop, Paper Mart, Start International, IPG) | 7% |

The water activated tape dispensers market serves multiple industries by providing secure, efficient, and environmentally friendly packaging solutions that enhance shipping efficiency and reduce material waste.

Manufacturers focus on automation, material efficiency, and sustainability by integrating smart dispensing technologies and durable tape application methods.

Manufacturers are investing in automation, material innovation, and AI-driven quality control to fulfill the evolving demands of the industries. Key players are focusing on sustainability, higher operational efficiency, and improved security features to outshine the markets. Machine learning algorithms are further optimizing tape dispensing speed and accuracy. Furthermore, companies have started using blockchain technology for advanced supply chain security and transparency.

Year-on-Year Leaders

Technology providers should enhance automation, sustainability, and customization in water activated tape dispenser manufacturing. Partnering with material suppliers will drive cost efficiency and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Intertape Polymer Group, Better Packages, 3M |

| Tier 2 | Uline, Marsh Tapers |

| Tier 3 | Phoenix Tapers, Cyklop, Paper Mart, Start International, IPG |

Manufacturers expand production capacity, integrate sustainable materials, and enhance automation features to meet industry demands. They are also implementing predictive analytics to optimize inventory management and improve supply chain efficiency.

| Manufacturer | Latest Developments |

|---|---|

| Intertape Polymer Group | March 2024: Launched fully automated water activated tape dispensers. |

| Better Packages | August 2023: Developed high-speed tape dispensers with energy efficiency. |

| 3M | May 2024: Introduced ergonomic and sustainable dispenser designs. |

| Uline | November 2023: Expanded industrial-grade tape dispenser offerings. |

| Marsh Tapers | February 2024: Enhanced affordability with entry-level automated dispensers. |

| Phoenix Tapers | April 2024: Developed smart dispensers with real-time tape tracking. |

| Cyklop | June 2024: Launched heavy-duty dispensers for logistics applications. |

The water activated tape dispensers market remains competitive, with companies prioritizing automation, sustainability, and enhanced security features to maintain their positions.

Manufacturers will drive growth by adopting smart packaging technologies, investing in sustainable materials, and optimizing production efficiency. The increasing demand in e-commerce, logistics, and industrial sectors will further accelerate market expansion.

Additionally, advancements in AI-driven automation are enhancing precision and reducing operational costs. The introduction of IoT-enabled tape dispensers is improving real-time tracking and efficiency in high-volume packaging environments.

Leading players include Intertape Polymer Group, Better Packages, 3M, Uline, and Marsh Tapers.

The top 3 collectively control 18% of the global market.

Medium concentration, with top players holding 35%.

Sustainability, automation, material advancements, and enhanced security features.

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Flexible Thin Film Market Trends - Growth & Forecast 2025 to 2035

Injection Bottles Market Analysis – Size, Demand & Forecast 2025 to 2035

Hydrogel Market Demand & Technological Advances 2025-2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.