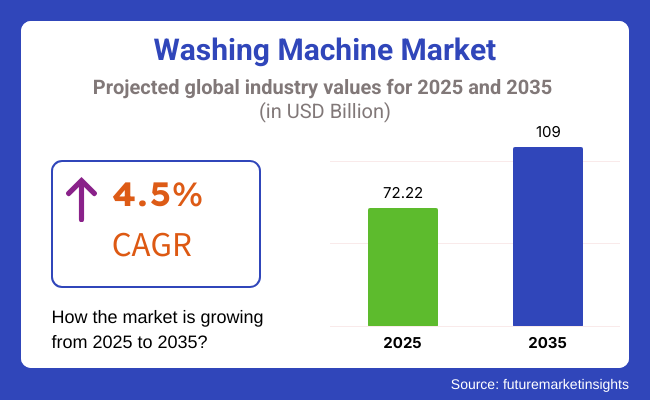

It is projected that the washing machine market will keep on staying on a positive path of development, considering that the total sales will reach a height of USD 72.22 billion in the year 2025 and an additional growth to USD 109 billion by 2035. The progress is calculated with a compound annual growth rate (CAGR) of 4.5% during the estimated time frame.

The household sector is the largest contributor by a significant margin with over 60% of market demand because of urbanization and increased disposable incomes.

The rising focus on sustainability and innovation in technology are also the forces boosting the market. In cities, especially in the context of intelligent houses, there is a rise in the need for more advanced washing machine solutions as the customers are looking for devices that bring comfort, effectiveness, and connection with the home network.

Emphasis on environmental and energy-efficiency consumption is shifting the manufacturers into developing less resource-consuming machines that cater to the eco-conscious users.

The washing machines that are produced today are being embedded with technologies and new age features like IoT which are compatible for smart homes, cloud-based AI and robotic technologies that have laundry optimization and automation as key features in modern washing machines that correlate with attached home automation demand.

The regular retailing routes have been changed massively with the expansion of internet sales direct-to-consumer channels where shoppers visit their favorite sites check out the AI clothes fitting, reviews on the products, and make a decision about the purchase. The partnership of digital and physical retail is widely used in a hybrid approach to delivering superior customer interaction and accessibility.

Personalization is one big trend that has emerged with the companies that manufacture washing machines focusing on high-tech, customizable ones that meet consumer-specific needs. The target audience is the rich people who like to have the ability to use features like DIY cycle personalization for water-saving and the use of block chain technology for not only verifying authenticity but reselling the goods.

The move towards sustainability has been achieved through recycling and closed-loop modes manufacturing, as well as energy-efficient technologies seen through the environmental issues addressed and the changing consumer needs.

Along with the transition through digital transformation, brands have found a way to utilize the existing technological advances of artificial intelligence, machine learning, and smart things to substitute the outdated and tedious operations and replace them with effective and user-friendly ones.

Explore FMI!

Book a free demo

From 2020 to 2024, the market for washing machines saw consistent growth, fueled by urbanization, increasing disposable incomes, and growing demand for energy-efficient appliances. Smart washing machines with IoT-based features, app-based functions, and AI-powered wash cycles became increasingly popular, especially in developed markets. Buyers chose to buy models with water-saving and low-energy consumption technologies.

The reason behind this buying trend was increased environmental consciousness and government policies mandating appliance efficiency. Emerging economies experienced higher penetration of front-load and fully automatic washing machines, driven by rising living standards and expanding middle-class consumer bases.

Between 2025 and 2035, the market might see automation. Laundry might become AI-based, and focus would be to develop eco-friendly solutions. New-generation washing machines might have self-cleaning technology, fabric recognition sensors, and the machines might even have a system to use the detergent in the most efficient way. Waterless and ultrasonic cleaning technology can come into the market, and this would be a cause of less usage of resources.

Circular economy policies will compel producers to use recyclable materials and modular designs to achieve longer product life. Additionally, growth in smart home ecosystems will integrate washing machines into home automation, which will make consumers more convenient and energy-efficient.

| 2020 to 2024 Trends | 2025 to 2035 Projected Trends |

|---|---|

| Gradual recovery post-COVID, with steady growth driven by urbanization and e-commerce. | Sustainability initiatives, AI-enabled automation, and the expanding global middle class provide opportunities for faster growth of businesses. |

| Increased adoption of front-load and smart machines. | AI-integrated smart machines that operate using voice commands and have water efficiency features are now being adopted widely. |

| Growing demand for energy-efficient models due to environmental awareness. | The gradual mix of everyday life with the start of use of fully sustainable, biodegradable, and modular machines. |

| Digital marketing, influencer reviews, and AR-enabled product demonstrations gain traction. | Web3, blockchain-based product authentication, and AI that generate customer recommendations are the main trends. |

| E-commerce and DTC (direct-to-consumer) sales rise significantly. | Mixture of two models does exist, where traditional in-store shopping interacts with modern digital twin simulations. |

| Strong market growth in Asia-Pacific, North America, and Europe. | Asia-Pacific region is the forerunner, while India, Southeast Asia, and Africa see the most rapid uptake. |

| Smart home integration begins with Wi-Fi-enabled machine. | Ecosystem of IoT with independently operating detergent refillers and maintenance-of-predictors is the new standard. |

| Increased focus on price-sensitive consumers due to inflation and supply chain disruptions. | The most advanced and ultra-modern smart machines boost the business through the introduction of technology-based features. |

| Demand for second-hand and refurbished machine grows. | A circular economy is being developed with the introduction of subscription-based and modular upgraded machines. |

| Limited customization options beyond color and basic settings. | AI provides hyper-personalization possibilities by allowing users to set washing programs, water consumption, and smart diagnostics. |

The washing machine market is experiencing several risk factors on a global scale. Supply chain disruptions - including pandemic-driven lockdowns and logistic bottlenecks - have caused shortages of components, production slowdowns and increased costs. Fluctuations in the price of raw materials (especially steel and plastics and electronic parts) are pressuring manufacturer margins and compelling price adjustments.

As technology evolves quickly and consumers demand packable, power-sipping intelligent gadgets, companies need to innovate incessantly, or black-labeled devices at risk of being declared obsolete. Moreover, the global governments are tightening energy efficiency and environmental laws for appliances, making manufacturers invest in design and technologies that are compliant.

To counter these risks, washing machine makers are strengthening their sourcing and production strategies. A lot of manufacturers are diversifying suppliers and materials to buffer against supply shocks and cost spikes. They are also deploying automation and advanced manufacturing to increase efficiency and reduce dependence on volatile labor or supply inputs.

Iterative product innovation is essential: firms are evolving new models leveraging alternative materials and more intelligent, sustainable features to comply with regulations and satisfy consumer preferences. Manufacturers are gaining a competitive edge and sustaining growth by optimizing supply chains, investing in technology, and innovating design.

Raw Material Cost Analysis and Volatility

| Raw Material | Cost Volatility |

|---|---|

| Steel (structural frames, drums) | High |

| Plastics (ABS, polypropylene casings) | Medium |

| Aluminum (panels, fittings) | Medium |

| Electronic Components (chips, circuit boards) | High |

| Rubber (hoses, gaskets) | Low |

| Motors (electric drive units) | Medium |

In the washing machine, the glass door segment is expected to achieve rollout because of its aesthetic design, strength, and luxury appeal. Scratched, transparent and modern glass door washing machines are increasingly welcomed by consumers. from opulent appearance to more powerful, better performing devices.

The key trends fueling the growth of this market are the high demand for high-end home appliances, increasing disposable income and rapid urbanization. As durable and visually appealing appliances have become a priority for consumers, machines with glass doors are gaining in popularity, which is key to expanding the market.

Some of the washing machine segments have stable growth, with above-mentioned factors including low-cost, lightweight and user-friendly maintenance contributing to the segment. Because of their robustness, low price point, and basic design, sheet door washing machines will attract buyers who want decent dependability without the premium price.

The growth in this segment is driven by increased demand in price-sensitive markets and in areas that host a significant number of washing machines. Function-over-sizzle consumers are drawn to the aptly named sheet door machines for their rugged, easy-to-clean composition. Moreover, manufacturers are launching sheet door models with value-added materials and novel features to enhance their competitiveness, which is contributing to sustained growth across this category segment.

In fact, top load continues to be the segment that sells the most amount of washing machines, thanks to its low cost, ease of use and shorter wash cycles. These systems are quite common for people in regions with good water availability as the water user can load the unit without unsightly containers and without the backache during the wash routine.

Top-load washing machines are in fact gaining more preference in emerging/rural markets due to their low price and efficiency opening peaks of a potential customer. Smart technology and energy efficiency will allow high efficiency top-load machines to remain competitive and enter new markets.

Features such as advanced wash technologies, water saving capabilities, and energy efficiency are creating a spike in demand across the front load segment of the washing machine market. These machines have a softer washing action, higher load capacity as well as better performance on a wider range of fabrics, which make them popular with customers.

Front-loading washing machines have become especially popular in developed markets and metropolitan areas where high-performance appliances and water conservation are priorities. Its more contemporary design and quieter performance also appeal to customers seeking higher-end appliances.

Such recent advancements as smart controls, allergen-removing features and higher energy ratings have bolstered the value proposition of front-load models while also garnering an increasing share of the space which has solidified front-load machines as an important part of the sales mix across both developed and developing economies.

Global Washing Machine Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

| UK | 8.8% |

| Germany | 3% |

| Japan | 8.4% |

| India | 9% |

The USA According to the high consumer demand for the green and smart appliances, the USA washing machine market is positively affected. The front-load machines available are predominantly from Whirlpool, GE, and LG brands. The usual consumer thinks of models that are high capacity and AI and IoT interactivity as inclusion of delusions as the preferable features. Furthermore, the manufacturers are adopting ecologically-friendly inventions that are in response to the pressure of the regulations related to the sustainability.

Growth Factors in The USA

| Growth Factors | Details |

|---|---|

| Technological Advancements | Integration of smart technologies, such as IoT-enabled features, enhancing user convenience and energy efficiency. |

| Consumer Demand for Energy Efficiency | Growing awareness and preference for energy-efficient appliances to reduce utility costs and environmental impact. |

| Replacement and Renovation Trends | High rate of appliance replacement and home renovation activities boosting market demand. |

The space problems prevalent in the UK homes have given rise to the popularity of the integrated and compact machines. Innovative water-saving and energy-efficient technologies are the major demand drivers for Bosch, Samsung, and Hotpoint who are emphasizing the product.

The ability to be operated remotely via smart connectivity and making low noise during operation are the two main requirements from the consumers. The designs of the products and the preferences of consumers are a lot of times determined by the policies of the government concerning environmental sustainability.

Growth Factors in The UK

| Growth Factors | Details |

|---|---|

| Urbanization and Housing Development | Rapid urbanization leading to increased housing projects, thereby elevating the demand for household appliances. |

| Consumer Shift Towards Convenience | Busy lifestyles prompting consumers to invest in fully automatic and smart washing machines. |

| Energy Efficiency Regulations | Stringent energy efficiency standards encouraging the adoption of modern, compliant appliances. |

Germany, known for the premium appliance manufacturer, has the washing machine market that places a high value on durability, efficiency, and the latest technology. Miele and Bosch dominate the scene with high-performance, energy-saving models. Buyers prefer to see features like automatic detergent dosing and heat pump technology that helps the environment. The request for WiFi enabled and smart machines which is on rise echoes Germany’s core principle of sustainability and innovation.

Growth Factors in Germany

| Growth Factors | Details |

|---|---|

| Emphasis on Sustainability | High consumer preference for energy-efficient and eco-friendly washing machines. |

| Technological Innovation | Manufacturers focusing on advanced features like smart connectivity and water-saving technologies. |

| Strong Manufacturing Base | Presence of leading appliance manufacturers contributing to market growth and innovation. |

The Japanese market targets compact, top-load washing machines predominantly because of limited living spaces. Local brands like Panasonic, Sharp, and Hitachi lead in offering energy-efficient, space-saving, and quick-wash models. Advance technology, AI sensors, and automatic detergent dispensing are features that are on demand.

Growth Factors in Japan

| Growth Factors | Details |

|---|---|

| Compact Living Spaces | Demand for space-saving and efficient washing machines suitable for smaller homes. |

| Technological Prowess | Integration of advanced features such as AI and IoT in appliances to cater to tech-savvy consumers. |

| Aging Population | Development of user-friendly machines with features catering to the elderly demographic. |

India's washing machine market has been booming as people's income rises and urbanization accelerates. Semi-automatic models are common for low-budget carters, while fully automated ones are gaining popularity in urban areas. Brands like LG, Samsung, and Whirlpool are the main suppliers. Energy efficiency mainly, but also the reasonable price, plus the excellent after-sales service are the factors that weigh in when buying. There is a significant rural demand for quality, cost-effective, and low-water use models

Growth Factors in India

| Growth Factors | Details |

|---|---|

| Rising Disposable Income | Increasing middle-class income levels leading to higher adoption of household appliances. |

| Urbanization | Rapid urban growth resulting in greater demand for modern conveniences, including washing machines. |

| E-commerce Expansion | Online retail platforms making appliances more accessible to a broader audience. |

The washing machine niche is largely controlled by Tier 1 companies, which wield their brand power, innovation, and supply chain management as a tool against competitors. Advanced fabric care, smart technology, and energy efficiency are some areas where these companies set industry standards through their investments. Global manufacturing and extensive distribution have led to cost advantages and the continuous availability of products globally.

The competitive edge has been enhanced by strategic acquisition, and partnerships that integrate cutting, state-of-the-art technologies before the others. The company's strength, price premiums, and after-sales services are reinforcing customer loyalty. The leadership of these companies is maintained through setting the standards of the industry, and influencing the regulations, which makes it difficult for smaller firms to challenge.

The washing machine market across the globe is intensely crowded with top players, including whirlpool corporation, LG electronics, Samsung electronics, Haier, Bosch, Panasonic, and Electrolux. Major competition areas for these companies include technology, energy efficiency, pricing, and design innovation. For instance, an example of such competition between LG and Samsung is the innovation of smart and AI-enabled washing machines. Both incorporate Wi-Fi connectivity and voice control features in their products.

An example would be Haier and Bosch, emphasizing energy-efficient models along with the usage of eco-friendly washing technologies. While Whirlpool and Electrolux separate themselves from the rest with their premium and large-capacity machines directed at high-end consumers. The competition also includes brands that have a stronghold in regional markets like Godrej and IFB in India or Midea in China, which can leverage the massive local demand at prices lower than their international peers.

These companies have deepened their growth strategies through joining aggressive investments in R&D and customer-centric strategic partnerships besides sustaining domestic market penetration initiatives. Samsung and LG are rapidly diversifying their smart appliance ecosystems with advanced AI-based washing features in their new products. Haier has undertaken acquisitions like the one of GE Appliances, to build a global competitive position.

The company spends on innovation and sustains new models which consume less water and energy. Bosch and Electrolux focus on markets within Europe regarding premium products. Here, the initial advanced front-load sets focus on noise reduction and eco-friendly characteristics. Furthermore, the emerging players from China and India are disrupting the market with low-priced models, thereby presenting affordability as a key battleground.

Key company insights

Whirlpool Corporation

Expanded its global footprint through mergers and acquisitions, including the absorption of Maytag and a joint venture with Arçelik A.Ş. in Europe.

Haier Group Corporation

Strengthened its position by acquiring international brands such as Candy and GE Appliances and thus broadening its product range and global reach.

LG Electronics Inc.

Aiming to move ahead with consumer demands, the designs of the new smart energy-saving washing machines give great focus on innovation.

Samsung Electronics Co., Ltd.

Invested in smart home technology, integrating IoT capabilities into their washing machines to enhance user experience.

BSH Hausgeräte GmbH

While pursuing sustainability and energy efficiency in its product range, it has grown its international presence through strategic acquisitions and joint ventures.

Key Developments

The worldwide washing machine market is being transformed by smart technology, energy efficiency, and automation. Leading brands turn their efforts to AI-based machines that wither power usage, and better fabric care. Sustainability is an additional aspect that is outlined with green movements taken in product designs and environmental synergetics.

In recent events, the promotional items integrated with the concept of smart homes that users can control machines remotely via mobile phones and voice assistants. Companies are also unleashing their high-tech hygiene features such as steam cleaning and antibacterial wash cycles directed to consumers concerned about health. The market persists in its renewal by presenting products with superior performance and user-friendly combinations.

In 2025, the market is estimated to reach USD 72.22 billion.

By 2035, the market is forecasted to reach USD 109 billion.

LG Electronics, Whirlpool Corporation, Samsung Electronics, Haier Group, Bosch, Electrolux, Panasonic Corporation, Midea Group, and Hitachi Appliances are some important key market players.

The CAGR rate is forecasted to reach 4.5% in the forecasted period.

By type this industry is segmented into glass door and sheet door.

By product the market is segmented into top load and front load machines.

By technology the washing machine market is segmented into automatic and semi-automatic tech.

By capacity the market is segmented into below 8 kg and above 8 kg washing machines.

By distribution channel the market is segmented into offline and online modes.

By application the industry segmented into residential and commercial ways.

By region the market spans over seven regions those are North America, Latin America, Europe, South Asia, East Asia, Oceania, The Middle East and Africa (MEA).

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Sexual Enhancement Supplements Market Analysis – Trends & Forecast 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Luxury Fine Jewellery Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.