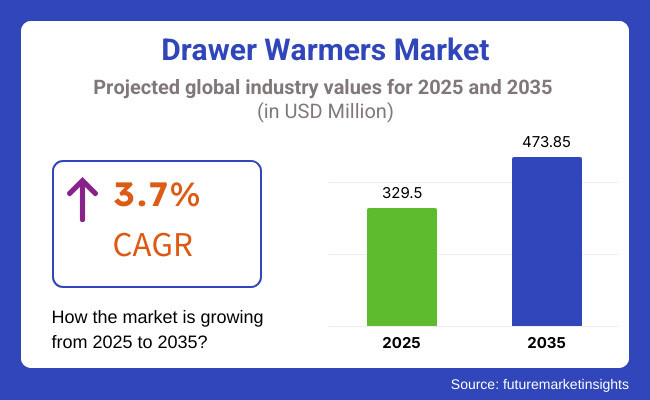

The worldwide drawer warmers industry is expected to maintain its steady growth pattern on the back of developments in automation, IoT technology, and growing focus on food safety and hygiene. The industry is anticipated to reach a valuation of USD 329.5 million by 2025 and by 2035, is expected to reach around USD 473.85 million, growing at a CAGR of 3.7%.

As per industry trends, food service facilities are giving greater importance to food safety and sanitation, which is driving the demand for simple-to-clean and sanitize drawer warmers. These machines ensure food quality while minimizing contamination risks, and hence they are a must for commercial kitchens with high food preparation levels.

The drawer warmers industry witnessed a stable growth in 2024 driven by the rising interest in food safety, operation efficiency, and sustainability in commercial kitchens. One of the major factors surging the sales for models with improved sanitation properties like antimicrobial layering, smooth interior, and easy-to-clean trays.

In the coming years, the industry is poised to expand steadily with the rising emphasis on kitchen management systems backed by AI, sustainable materials in manufacturing, and modular designs that allow customization.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual growth with mounting adoption in foodservice kitchens. | Ongoing growth with emphasis on automation and AI-based efficiency. |

| Growing food safety issues, energy efficiency, and health code compliance. | Sustainability, IoT integration, and AI-based kitchen management. |

| Slow penetration of smart controls and IoT-compatible drawer warmers. | Mass adoption of AI, IoT, and predictive maintenance systems. |

| Greater emphasis on easy cleanability, antimicrobial finishes, and health regulation compliance. | Sophisticated self-cleaning technologies and materials with improved antimicrobial properties. |

| Adoption of energy-saving features, but limited in scope. | Industry-wide movement towards energy-efficient and environmentally friendly drawer warmers. |

| Substantial demand in North America and Europe; developing adoption in Asia-Pacific. | Rapid growth in Asia-Pacific and Latin America as a result of growing food service industries. |

| Pre-engineered models with limited options for customization. | Modular and highly customizable designs to accommodate varied culinary requirements. |

| First steps towards sustainable materials and energy-efficient products. | Strong focus on environmentally friendly manufacturing and lower carbon footprint. |

| Aids high initial cost and unawareness in emerging countries. | Competition from other food warming technologies and regulatory reforms. |

| Regulatory driven growth as well as advancement in technology. | Industry growth due to innovation, automation, and greater uptake in developing countries. |

The drawer warmers industry comes under the segment of the commercial food service equipment sector, which is a part of the overall hospitality and food service industry. The drawer warmers sector is impacted by restaurant chain trends, catering operations, hotels, cloud kitchens, and institutional food service trends.

As it rely on commercial kitchens, macroeconomic conditions including consumer expenditure, inflation, supply chain stability, and technological developments are crucial to shape the growth landscape. The industry for drawer warmers establish a strong connection with global economic trends, the performance for the hospitality sector, levels of disposable income, and growing rate of urbanization.

As economic recovery replaces pandemic-related interruptions, consumer demand for restaurant dining and food delivery is thriving the industry expansion. However, economic concerns including inflation, surging energy prices, and supply chain issues have affected production and pricing.

The trend towards energy-efficient and sustainable kitchen appliances is becoming rapidly critical, as businesses try to reduce operational costs and meet the environmental standards. Moreover, technological innovation, especially IoT and AI-based automation, will help improve efficiency and accelerate adoption.

On the basis of type, the industry is dominated by full size drawer segment, which is expected to hold a CAGR of 3.6% over the analysis period. Large-capacity warmers are commonly employed in commercial kitchens where bulk storage of food and effective heat retention are critical.

Restaurants, hotels, and catering units use full-size drawer warmers due to their capability to keep several food products at serving temperature with high food quality and hygiene. The growth in large-scale food production, especially in buffet restaurants and institutional food facilities, is likely to fuel demand.

Companies are emphasizing the inclusion of smart technology, including automated temperature control and IoT connectivity, to increase efficiency while minimizing energy consumption. The half-size drawer warmers industry is picking up pace because of its compact design and flexibility.

As small-scale food service operations and small commercial kitchens demand more, half-size drawer warmers provide a cost-effective way to keep food warm without taking up too much counter space. Their use is increasing in food trucks, cafes, and specialty restaurants where space efficiency is essential.

The countertop drawer warmers industry is likely to experience consistent demand, especially from quick-service restaurants, fast-food chains, and bakery stores. Due to their small size, they can be easily placed on countertops, making them suitable for companies that need quick and easy food warming solutions. With urbanization and busy lifestyles still shaping consumer eating patterns, the demand for effective countertop solutions will drive industry growth.

Based on the Application, the restaurants segment is expected to expand at rapid rate of 3.5% CAGR over the analysis period. Restaurants, especially quick-service and full-service restaurants, use drawer warmers to keep prepared food warm and fresh. As demand for effective kitchen operations continues to grow, the adoption of intelligent, energy-saving drawer warmers is gaining traction.

The growth of international restaurant chains and the emergence of cloud kitchens are also driving industry growth. Advances in technology, including remote temperature monitoring and AI-driven energy optimization, are likely to improve product efficiency and fuel further uptake.

The hotel segment remains a major contributor to industry growth. Luxury resorts, hotels, and high-volume catering facilities need drawer warmers to provide top-notch food service in banquet halls and room service. As the hospitality sector is emphasizing the improvement of guest experiences, the use of premium drawer warmers with upgraded features is growing.

The catering services segment is experiencing consistent growth due to the increasing demand for off-premise dining and large-scale event catering. Catering operations need high-capacity and reliable food warming solutions, and therefore drawer warmers are a crucial part of their operations.

The cafeterias and other food service institutions segment, including hospitals, schools, and corporate dining facilities, is seeing increasing demand. As institutional kitchens are preoccupied with efficiency and food safety, the take-up of drawer warmers within this segment should remain strong.

The United States industry of drawer warmer remains one of the leading sectors, boosted by a well-established food service segments and continuous developments in kitchen equipment. Demand is further fueled by the increasing numbers of quick-service restaurants (QSRs), casual dining chains, and institutional food services, like hospitals and corporate cafeterias.

Additionally, the rigid food safety regulations imposed by the USA Food and Drug Administration (FDA) and regulatory authorities, commercial kitchens are driving the sales of effective food warming solutions.

Sustainability and energy efficiency are emerging as the prime concerns for food service operators, creating a higher demand for Energy Star-rated drawer warmers that help in reducing operational expenses. Moreover, with the ongoing recovery of USA economy from inflationary pressures, investment in the hospitality sectors is poised to grow, further pushing the industry growth.

The UK drawer warmers industry is witnessing steady growth, led by the increasing demand for high-quality food service equipment among large restaurant chains as well as small independent restaurants. The industry is being driven by strict food safety regulations by the Food Standards Agency (FSA), which are prompting food service businesses to invest in technologically sophisticated drawer warmers that provide accurate temperature control and ease of sanitization.

The growth in food delivery platforms and dark kitchens is a key demand driver. With the UK food delivery industry continuing to flourish, numerous commercial kitchens are now using drawer warmers to keep food quality up to par before sending it off. Furthermore, the increased adoption of grab-and-go foods has led cafes and bakery chains to invest in efficient and space-saving warming equipment.

Energy efficiency is likewise a strong interest in the UK industry, as government schemes support the application of sustainable kitchen appliances. Use of smart technology for commercial kitchens is increasing, and operators seek to have their drawer warmers communicate with the more extensive kitchen control systems for further efficiency gains as well as decreasing energy expenditure.

France's flourishing culinary culture, from its ranging cafe' culture to upscale eateries, is one of the major drivers leading the drawer warmers industry. Further, with the growth in quick-service restaurants and boulangeries, there is increased demand for cost-effective and space-saving warming solutions.

Another key factor leading the industry is the government's continuous food safety and cleanliness. The guidelines imposed by the French Agency for Food, Environmental and Occupational Health & Safety (ANSES) necessitate commercial kitchens to cater to rigid sanitation polices. Innovative developments, such as IoT-driven appliances, are on the rise in France.

Numerous upscale restaurants and catering operations are embracing smart drawer warmers with sophisticated temperature control and automation capabilities. Sustainability efforts are also influencing buying decisions, with more companies choosing environmentally friendly and energy-efficient models.

The healthy food service sector and the rigorous regulatory framework make Germany a notable industry for drawer warmers. The country's extensive focus on food safety and energy efficient has led to the high usage of smart kitchen appliances.

Increased IoT and smart kitchen technology penetration is transforming the German industry. Institutional kitchens and restaurants are more and more turning to automated drawer warmers with remote monitoring and predictive maintenance, improving efficiency and reducing costs.

Sustainability is a key driver in Germany, and purchasing decisions are influenced by this factor. With strict energy efficiency regulations and incentives for using environmentally friendly appliances, energy-efficient drawer warmer demand is increasing. The majority of German food service establishments are shifting towards appliances that minimize power usage while keeping food at its optimal temperature.

South Korea's food service sector is growing strongly, spurred by a rise in fast food intake, café culture, and food delivery. Growing numbers of foreign fast-food chains and local restaurant brands are stimulating demand for effective drawer warmers that ensure food quality and safety.

South Korean commercial kitchens have high smart technology adoption, with numerous installations of IoT-capable drawer warmers which enable remote monitoring and accurate temperature control. South Korea's highly digitized food service industry is driving automation as the primary selling feature for emerging warming products.

The growing greening of consumerism is also influencing the industry. Numerous companies are spending money on energy-efficient and eco-friendly kitchen appliances to keep up with government regulations and company sustainability initiatives. Furthermore, with South Korean consumers focusing on food safety, commercial kitchens are finding it more popular to use drawer warmers that have improved sanitation features.

The need for drawer warmers in Japan is fueled by the country's advanced food services industry, mainly convenience stores, sushi chains, and fast foods. Food presentation and quality having great importance there, Japanese cafes and restaurants must maintain exact control of temperature; high-performance drawer warmers then are crucial in operating a commercial kitchen.

Implementation of technology as an integral aspect in commercial kitchens is a landmark in Japan. Most food service businesses are implementing smart kitchen solutions, such as drawer warmers with AI-driven temperature control systems. These technologies enable companies to maximize food storage conditions and overall efficiency.

Energy efficiency and minimal size are top priorities in Japan's industry, where space in commercial kitchens forces restaurants to desire small, multi-functional appliances. Restaurants and catering outlets favor small compact drawer warmers with high efficiency without taking up much space in kitchens.

As people become more aware of sustainability, the industry is also seeing a move towards green drawer warmers using energy-saving heating components. Regulatory policies in government supporting sustainable practice in food service are also boosting this trend.

The rapidly growing food-service industry of China is led by urbanization and rising middle-class prosperity. The growing recognition of chain restaurants, delivery services, and catering operations is creating a notable demand for quality warming solutions.

The use of automation and IoT-based kitchen management systems is becoming the new norm among big restaurant chains and cloud kitchens. China's strong emphasis on food safety regulations is also impacting industry trends.

The government has set strict standards for keeping business kitchens clean and hygienic, and companies are being forced to incorporate drawer warmers with better sanitation features. Moreover, with China's emphasis on sustainability, energy-efficient kitchen appliances are in huge demand. Companies are introducing green options that reduce electricity consumption and meet the country's carbon neutrality goal.

India’s food service sector is observing a robust growth, driven by the growth of quick-service restaurants, cloud kitchens, and catering operations. The heightened demand for convenient food and food delivery services is leading the sales for effective drawer warmers that ensure food freshness and quality.

With the technological integration in Indian commercial kitchens is growing, restaurants are investing in advances appliances to make operations more efficient. IoT-backed drawer warmers that offer remote temperature control and energy-saving capabilities are becoming widely popular, especially among large restaurant chains and institutional foodservice kitchens.

Food safety is emerging as an important issue in India, and regulatory bodies are imposing tighter standards of hygiene. This has given rise to higher demand for drawer warmers that meet safety requirements and have ease of cleaning and sanitization facilities. Sustainability is also on the rise in India's foodservice sector. As companies aim to save on energy bills and have a reduced footprint on the environment, there is a higher interest in energy-saving drawer warmers that support green kitchen operations.

Future Market Insights (FMI) recently conducted a survey among major stakeholders of the drawer warmers industry, such as manufacturers, restaurant owners, and catering service providers. The results showed that automation and energy efficiency are becoming the first priorities for purchasers.

Numerous businesses are displaying more interest in IoT-enabled drawer warmers with remote temperature monitoring capabilities, maintaining the freshness of food while saving on operational costs. Food hygiene and safety also became major issues, with business kitchens placing premium on easy cleaning designs.

All stakeholders stressed the need for antimicrobial paints and sophisticated heat controls to avoid contamination. Strict regulation, especially in Europe and North America, is compelling producers to come up with models compatible with health and safety standards.

The survey also reflected industry demand variations in different regions. North America and Europe are experiencing steady growth owing to quick-service restaurants and institutional food services, whereas Asia-Pacific sectors are growing at a rapid pace with the emergence of cloud kitchens and small commercial establishments. High-performance, compact drawer warmers are sought after in these sectors.

In general, the survey highlighted the move towards smart, sustainable, and long-lasting warming solutions. Companies are focusing on product innovation in response to changing consumer needs, thereby securing long-term industry development.

| Countries | Regulations Impacting the Market |

|---|---|

| United States | The USA Food and Drug Administration (FDA) strictly regulates food safety, mandating that drawer warmers in commercial kitchens meet sanitation standards. The Department of Energy (DOE) also regulates energy efficiency standards for commercial kitchen equipment, which affects product design. |

| United Kingdom | The Food Standards Agency (FSA) requires food safety and hygiene standards, such as storage and temperature control for warmers. The UK Minimum Energy Efficiency Standards (MEES) also impact the use of energy-efficient drawer warmers. |

| France | French food safety regulations are in line with European Union (EU) standards, mandating adherence to Hazard Analysis and Critical Control Points (HACCP) standards for food storage. Energy efficiency standards established by the French Agency for Ecological Transition (ADEME) also affect manufacturers. |

| Germany | The German Food Code (Lebensmittelgesetz) strictly regulates temperature control and hygiene standards for kitchen equipment in commercial establishments. The Energy Efficiency Act requires alignment with European energy efficiency standards, promoting the use of environmentally friendly drawer warmers. |

| China | The National Food Safety Standards (NFSS) prescribe standards on food storage and handling, which influence the design of drawer warmers. The government's energy-saving policies also compel manufacturers to create energy-efficient versions for the commercial industry. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates hygiene and safety levels for food storage equipment. The energy efficiency labeling program in South Korea also has an impact on the use of high-efficiency drawer warmers. |

| Japan | Commercial kitchen equipment is regulated by the Food Sanitation Act to maintain food safety and control contamination. The Top Runner Program in Japan determines energy efficiency standards, which prompts innovation in the technology of drawer warmers. |

| India | The Food Safety and Standards Authority of India (FSSAI) demands rigorous temperature control for commercial kitchen food storage. The Bureau of Energy Efficiency (BEE) is encouraging energy-efficient appliances to minimize power usage. |

The drawer warmers industry is expected to grow steadily because of rising demand from food service outlets, advancements in technology, and food safety regulations. Restaurants, hotels, and catering industries are increasingly emphasizing energy efficiency, intelligent automation, and hygiene regulations, giving manufacturers ample scope for innovation and expansion.

Cloud kitchen and takeaway culture growth also supports demand for safe food warming solutions, especially in developing economies. One of the largest opportunities for growth is the use of IoT-capable drawer warmers that provide remote temperature monitoring, automatic energy management, and predictive maintenance.

The integration of AI and machine learning can help make the operation more efficient, lowering energy costs and food waste. Customization and modular design also offer a significant opportunity, enabling companies to customize drawer warmers based on individual kitchen layouts and operational requirements.

In order to leverage industry trends, companies need to prioritize sustainability and meeting changing energy efficiency requirements and hygiene laws. Industry presence can also be boosted through expansion into high-growth sectors like Asia-Pacific, where commercial food services and urbanization are on the rise.

Strategic collaborations with hotel chains, restaurant chains, and catering operations can further enhance sector presence. Financing opportunities or leasing plans could entice small companies seeking to invest in premium equipment without overspending.

The industry of drawer warmers is moderately fragmented, with the presence of both well-established global players and regional producers vying for industry share. However, established brands lead with their cutting-edge technologies, energy-efficient products, and extensive distribution networks.

The industry is slowly consolidating on the back of mergers, acquisitions, and strategic alliances among major players seeking to extend their reach and drive product innovation. In 2024, the drawer warmer industry experienced major evolution via mergers, acquisitions, and collaborations propelled by demand for energy-efficient as well as intelligent technology solutions.

Alto-Shaam acquired an IoT-enabled kitchen appliances startup that augmented its offerings of smart drawer warmers. Hatco collaborated with a dominant foodservice chain to co-design energy-efficient variants, emphasizing sustainability. Wells Bloomfield formed a strategic partnership with a technology company to integrate AI-powered monitoring capabilities, enhancing operational effectiveness.

Potential newcomers to the sector for drawer warmers can benefit from innovation and intelligent technology like IoT capabilities to enable remote operation and energy conservation. Low price and affordable manufacturing can capture budget-conscious consumers. Niche target sectors like food trucks and cloud kitchens can benefit from tailor-made solutions for differentiation. Energy conservation and sustainability are important because products that are friendly to the environment are favored by regulatory-aware buyers.

Growing focus on food safety, hygiene, and energy efficiency in restaurants, hotels, and catering services.

IoT-enabled monitoring, automated temperature control, and energy-saving features are improving efficiency.

Restaurants, hotels, catering services, and cafeterias rely on them to maintain food quality.

High raw material costs, strict regulations, and the need for continuous innovation.

Yes, developed regions prefer energy-efficient models, while emerging areas focus on affordability.

Food Dehydrators Market Analysis by Type and End-Use Industry Through 2035

Brewery Equipment Market Analysis by Fermentation equipment, Brew house equipment, Carbonation and other Product Type Through 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Merchandizing Carts Market - Mobile Retail & Food Display 2025 to 2035

Heated Shelf Food Warmers Market - Efficient Hot Holding Solutions 2025 to 2035

Heat Lamps Market - Commercial Food Warming & Service Excellence 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.