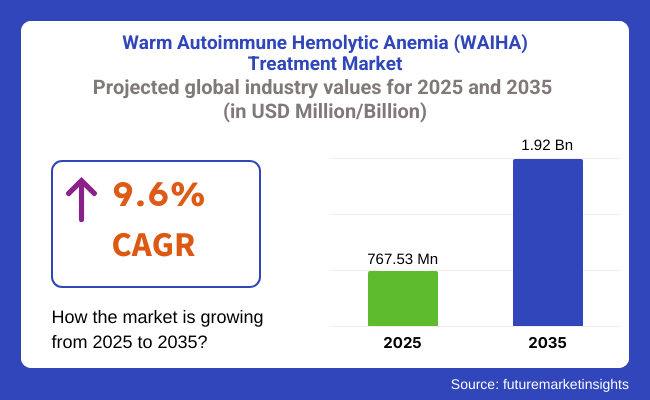

The warm autoimmune hemolytic anemia (WAIHA) treatment sector is valued at USD 767.53 million in 2025. As per FMI's analysis, the warm autoimmune hemolytic anemia (WAIHA) treatment industry will grow at a CAGR of 9.6% and reach USD 1.92 billion by 2035.

The world's warm autoimmune hemolytic anemia (WAIHA) treatment sector is growing enormously, fueled by growing awareness, improving treatment options, and the expanding prevalence of autoimmune diseases.

In 2024, the industry for treating warm autoimmune hemolyti canemia (WAIHA) saw significant developments. In March, HUTCHMED Limited launched the registration process of a Phase II/III clinical trial in China for sovleplenib, an oral spleen tyrosine kinase (Syk) inhibitor, in adult WAIHA patients.

By July, a survey of USA hematologists identified a strong unmet need for efficacious WAIHA treatments, with many clinicians showing interest in pipeline drugs such as Johnson & Johnson's nipocalimab and Novartis' ianalumab.

Today, North America leads the sector because it has a strong healthcare infrastructure and a well-informed patient population. Emerging economies in Asia-Pacific are expected to grow quickly next. The competitive landscape is marked by big drug companies spending money on research and development to bring out new therapies that work better and are safer.

The Warm Autoimmune HemolyticAnemia (WAIHA) treatment segment is expected to see significant growth due to rising disease awareness, improved targeted therapies, and expanding healthcare spending.

Drug manufacturers that are creating new therapies, including monoclonal antibodies and Syk inhibitors with patients and healthcare professionals also enjoying improved choices. Widespread use may be hindered by expensive treatments and limited access, however, especially in developing countries.

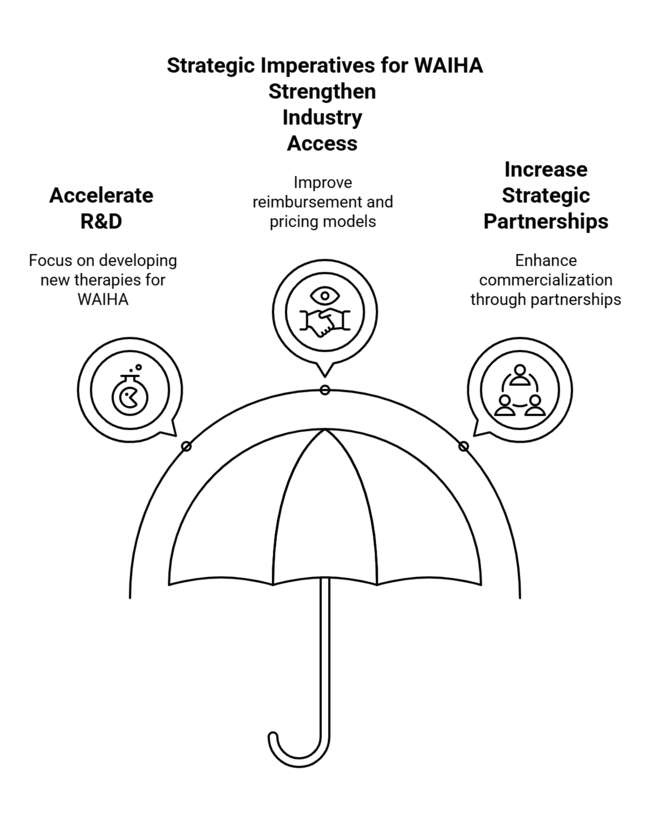

Accelerate R&D for New WAIHA Therapies

Invest in the commercial development of targeted therapies, including Syk inhibitors and monoclonal antibodies, to meet the large unmet need and receive regulatory benefits such as Fast Track and Orphan Drug designations.

Strengthen Industry Access & Affordability Strategies

Align with the healthcare payers and policymakers to ensure improved reimbursement models, increase patient assistance programs, and adopt tiered pricing models to enhance global accessibility.

Increase Strategic Partnerships & Distribution Channels

Strengthen partnerships with biotech companies, specialty pharmacies, and local distributors to drive commercialization, leverage supply chain efficiencies, and capture growth in emerging sectors.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays & Approval Uncertainty | Medium Probability-High Impact |

| High Treatment Costs Limiting Adoption | High Probability-High Impact |

| Competitive Landscape & Industry Saturation | Medium Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Monitor Key Drug Approvals & Trial Outcomes | Track regulatory decisions on nipocalimab, sovleplenib, and ianalumab to assess sector entry timelines. |

| Expand Industry Access & Reimbursement Plans | Engage with payers and policymakers to secure favorable pricing and reimbursement strategies. |

| Strengthen Strategic Partnerships | Initiate collaborations with biotech firms and specialty distributors to enhance industry reach. |

The management must prioritize R&D spending in targeted therapies to focus on the growing WAIHA treatment sector and match the FDA's fast-track development opportunities with pipeline drugs. Our next step should be toward forming strategic alliances with biotech firms with rare disease expertise.

There also needs to be a focus on optimising segment access-showing payers how to think about reimbursement.

With competition from therapeutics from other leading organizations, differentiation will increasingly come down to better efficacy, safety profiles, and long-term data that demonstrates continued positive effects of treatment.

Regional Variance

High Variance

Divergent ROI Perspectives

69% of North American payers found high-cost biologics justified by long-term benefits, while 41% in Japan still relied on generic immunosuppressants due to lower costs.

Consensus

Monoclonal Antibodies: Chosen by 62% due to efficacy and reduced relapse rates.

Regional Differences

Shared Challenges

85% cited rising drug costs (biologics up 25%, immunosuppressants up 15%) as a primary barrier.

Regional Differences

Manufacturers

Payers & Distributors

Alignment

Regional Divergence

High Consensus: Segment access, affordability, and innovation in biologics remain top priorities worldwide.

Key Variances

Strategic Insight: A one-size-fits-all approach will not work-regional adaptation is crucial, with premium biologics dominating North America, biosimilars gaining ground in Europe, and hybrid cost-saving models shaping Asian sectors.

| Country/Region | Policy & Regulatory Impact |

|---|---|

| United States |

|

| Western Europe |

|

| Japan |

|

| South Korea |

|

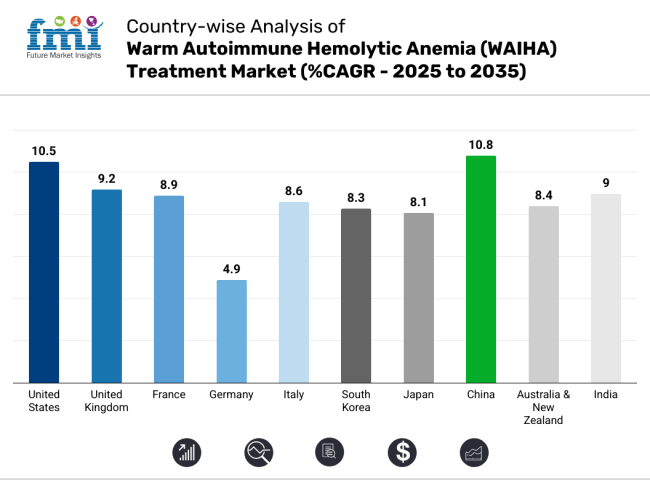

The USA WAIHA treatment sector is dominant and is projected to grow at a CAGR of 10.5% between 2025 and 2035 due to various factors, such as the widespread adoption of biologics, substantial R&D investment, and favorable orphan drug policies. The FDA's Fast Track and Orphan Drug Designation programs have sped up the approval of new medicines like FcRn and Syk inhibitors. The expansion of healthcare providers and increased awareness among professionals are driving market growthand coverage offered by Medicare & private payers.

Rising drug prices and new rules for negotiating prices set by the Inflation Reduction Act (IRA) could make manufacturers raise their prices. Moreover, the concentration of leading biotech companies and research institutes promotes ongoing innovation, sustaining a solid move in the sector. The USA has by far the biggest sector for WAIHA treatment in the world.

Between 2025 and 2035, the sector for WAIHA treatment in the UK will grow at a compound annual growth rate (CAGR) of 9.2%. This is mostly because of the NICE guidelines that praise biologics and other new therapies. Although cost-effectiveness evaluations occasionally limit access to high-cost biologics, the United Kingdom National Health Service (NHS) offers strong reimbursement support.

The introduction of new high-cost drugs may be delayed through the NICE process, which prevents non-clinically viable and non-cost-effective drugs from entering the sector. The UK government’s increased focus on rare diseases has led to more emphasis on clinical trials and new drug development, which has been an advantage in making WAIHA treatments available.

Brexit-related changes to regulations have also caused the way drugs are approved in the UK to change, with the need for separate approvals by the Medicines and Healthcare Products Regulatory Agency (MHRA). Despite potential delays in drug launches, growth is sustained by a strong rare disease foundation and rising healthcare spending.

The current revenue industry for WAIHA treatment is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2035. The widespread use of economic evaluations for the efficacy and pricing of WAIHA treatments in France means that the payer (the French National Authority for Health, HAS) directly determines whether a drug is reimbursed, effectively limiting the reimbursement of high-priced drugs.

Nevertheless, France is one of the EU leaders in terms of orphan drug approvals, partly due to early access programs (Autorisation Temporaired'Utilisation-ATU), which give patients access to innovative therapies ahead of full approval. Moreover, the presence of various biotech companies working on monoclonal antibodies and immunosuppressants, along with government and private sector investment in research on rare diseases, propels the sector forward.

The fastest growth of treatments from 2025 to 2035 are in Europe, and Germany is projected to be the fastest-growing industry for WAIHA treatments, with a compound annual growth rate in Germany from 2025 to 2035 will stand at 4.9%. The German healthcare system has a strong reimbursement structure, and biologics are widely used. This makes it an appealing area for WAIHA treatment providers.

Even though Germany is one of the first places in Europe to use new treatments, the Federal Joint Committee (G-BA) and the Institute for Quality and Efficiency in Healthcare (IQWiG) do thorough reviews of them before they are used.

Germany is committed to personalized medicine, has a strong biopharmaceutical R&D ecosystem, and spends a lot on healthcare, which is helping the WAIHA treatment industry grow. Germany also has a well-established patient registration system for rare diseases that has been around for a long time. This helps with early diagnosis, which makes treatment more effective.

The Italian WAIHA treatment sector will grow at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2035. This is mainly due to government programs that reimburse patients and more patients becoming aware of the treatment. Patients in Italy's National Health Service (SSN) can get orphan drugs for free, but the Italian Medicines Agency's (AIFA) reviews can take a long time, so patients may not be able to get them right away.

Even so, Italy has one of the highest adoption rates for new rare disease treatments in Europe, supported by a robust healthcare infrastructure and hospitals. Forecasts predict that the nation's focus on immunotherapy and biosimilars will also propel the sector. However, newer, more expensive biologics will not be used as much because of tight budgets for public healthcare and tough price negotiations.

The South Korean WAIHA treatment sector is projected to grow by double digits, registering a CAGR of 8.3% during the forecast 2025-35 period, as government-backed biosimilars and hospital infusion centers help patients access the treatment. The Ministry of Food and Drug Safety (MFDS) requires extensive local clinical trials for biologic products as well, which has delayed approvals of foreign drugs. Such a policy accounts for effectiveness and safety but does impair possible rapid segment entry by multinational pharmaceutical companies.

The South Korean government’s aggressive pursuit of pharmaceutical innovation and the country’s government tax incentives for R&D investment have spurred domestic biotech companies and companies to create low-cost alternative routes, working mainly on biosimilars.

The National Health Insurance Service (NHIS) imposes stringent price controls, restricting reimbursement of high-priced biologic therapies, further driving the need for lower-cost biosimilars. Rising prevalence of autoimmune disorders among patients and increasing expansion of specialty hospital networks are other factors supporting the industry growth in recent times.

The WAIHA treatment sector in Japan is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035. This is because of a cautious approach to using biologics, strict price controls, and a high number of autoimmune diseases in older people. The National Health Insurance (NHI) system conducts biannual price negotiations, resulting in frequent price reductions of premium high-cost biologic therapies, making such high-cost therapy sector less attractive for manufacturers.

This approach has delayed the adoption of newer biologics and has been particularly familiar among cost-conscious healthcare providers. Japan's Sakigake fast-track approval system, established to help patients reach new therapies faster, offers a glimmer of hope to developers of novel therapies for WAIHA. Japan is also getting more and more elderly, which makes people more likely to get autoimmune diseases.

The WAIHA treatment sector in China is one of the fastest-growing in the world. It is expected to grow at a rate of 10.8% per year from 2025 to 2035. This is because more people are getting autoimmune diseases, more people can afford health care, and more money is being spent on biologics and new therapies. China has enhanced and streamlined the approval process for new drugs, attracting foreign pharmaceutical companies to advance innovative therapies.

Additionally, the Chinese government has prioritized the development of rare disease treatment, implementing expanded reimbursement policies under the National Reimbursement Drug List (NRDL), which now includes more high-cost biologics.

Price controls and negotiations with insurers continue to challenge the profitability of premium biologics to make money, forcing companies to run very aggressive pricing campaigns. This is because China's biopharmaceutical industry is growing very quickly. There are still some problems that could happen, such as differences in access to healthcare based on location, worries about protecting intellectual property, and inconsistent rules.

The WAIHA treatment sector in Australia and New Zealand is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035. This is because of strong research infrastructure, government-backed reimbursement programs, and easy access to biologics for medicine. In Australia, the Pharmaceutical Benefits Scheme (PBS) aids in affordability, but the lengthy approval timelines for new biologics and pricing pressures continue to pose challenges for pharmaceutical companies.

Similarly, New Zealand's PHARMAC program strictly regulates drug costs, frequently postponing the release of expensive therapies until they demonstrate their cost-effectiveness. Importantly, despite these obstacles, the strong clinical trial environment in Australia, complemented by growing investments in immunotherapy research, means WAIHA drug developers can find a receptive growth.

In New Zealand, too, more people are being diagnosed with autoimmune diseases, which means more people need effective treatment. This trend is also helping to overcome pricing barriers, as specialty care centers proliferate and access to private insurance improves, contributing to increased patient adoption of biologics.

The India WAIHA treatment sector is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2025 to 2035. More people are learning about autoimmune diseases, healthcare infrastructure is getting better, and biosimilars are being used more and more. The Indian government has already made a lot of policies about rare diseases, such as the National Policy for Rare Diseases (NPRD), which says that patients who need expensive treatments will get financial help.

The emergence of domestic biopharma firms and growing government investments in healthcare R&D are likely responsible for this improved drug access and affordability. Global pharmaceutical companies want to get into India's sector because of its strong clinical trial framework and growing network of hospitals. Even though there are problems like regulatory delays, reimbursement issues, and low rates of diagnosing rare diseases, the government should do more to support better digital health adoption, telemedicine services, and patient registries.

The WAIHA treatment market is expected to grow at a CAGR of 9.7% from 2025 to 2035, driven by advancements in drug classes.Various treatment options for WAIHA are available, making periodic updates around evolutionary changes to treatment important. With the help of kinase inhibitors and monoclonal antibodies, the way autoimmune hemolysis is treated is about to change. Next-generation therapies are becoming more popular, because of higher success rates in clinical trials and more regulatory approvals.

This means that a lot more people with severe or refractory WAIHA can get treatment. Still, price pressures, problems with reimbursement, and differences in how regulations work in different areas have made it hard for some drug classes to break into new sectors. Putting more money into developing biologic drugs and biosimilar versions of them is changing the competitive landscape of the segment even more.

The WAIHA treatment landscape is registering a CAGR of 9.8% in the forecast period 2025 to 2035 in distribution channel. The WAIHA treatment landscape is evolving swiftly in the realm of changing healthcare infrastructure and patient preferences. Hospital pharmacies focus on the infusion business, which is where biologics and many other therapies are given. And nothing leverages that potential better than digital pharmacy changing the game for accessibility, adapted to the nuances of the locality.

People with long-term conditions that need ongoing treatment can get oral therapies from retail pharmacies, which makes things easier for them. With increasing availability of WAIHA medication, reimbursement policies, as well as supply chain efficiencies, are emerging as key drivers determining availability of these products.

Over the years, leading pharmaceutical companies have aggressively competed in the WAIHA treatment sector through product pricing strategies, innovation, strategic partnerships, and industry expansion initiatives. Biologic therapies are very expensive, companies are using tiered pricing models and expanded reimbursement programs to make them easier for more people to get.

Innovation continues to be a primary competitive edge, with brands pouring resources into next-generation therapies (e.g., next-gen BTK inhibitors and PI3K inhibitors, bispecific monoclonal antibodies with better efficacy and safety profiles). Clinical trials are increasingly being conducted in low- and middle-income countries, expanding beyond traditional research hubs. Since many trials in these areas are assessing novel combination strategies, this may enhance treatment outcomes when implemented.

Market Share Analysis

Key Developments

It is segmented into Fostamatinib, Sutimlimab, Parsaclisib, Rilzabrutinib, and Isatuximab

It is segmented into Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies

It is segmented intoNorth America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa

Growth is primarily driven by the rising prevalence of autoimmune disorders, new developments in biologic therapies, and enhanced diagnostic capabilities.

These include corticosteroids, immunosuppressants, monoclonal antibodies, BTK inhibitors, and promising small-molecule agents.

New drugs, like complement and kinase inhibitors, work better, cause fewer side effects, and have higher remission rates than traditional treatments.

These include high cost, reimbursement issues, regulatory approval, and the introduction of advanced therapies in developing regions.

The companies need to put money into global clinical trials, patient assistance programs, and biosimilars. They also need to work with health care providers to make sure that everyone has access.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Warm Cap Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Warm Syrup & Topping Dispensers Market – Enhanced Serving Solutions 2025 to 2035

Swarm Computing Market Size and Share Forecast Outlook 2025 to 2035

Shawarma Grill Machine Market Size and Share Forecast Outlook 2025 to 2035

Gel Warmers Market Size and Share Forecast Outlook 2025 to 2035

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Food Warmer Machines Market

Semen Warmer Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Strip Warmers Market - Precision Heating for Commercial Kitchens 2025 to 2035

Drawer Warmers Market - Size, Share and Forecast 2025 to 2035

Countertop Warmers & Display Cases Market – Food Presentation & Preservation 2025 to 2035

I.V. Fluid Warmer Market

Mobile Food Warmer Market Size and Share Forecast Outlook 2025 to 2035

The Blood Fluid Warming System Market is segmented by product type, application, and end user from 2025 to 2035

Baby Bottle Warmers Market

Nacho Cheese Warmers Market – Hot & Fresh Cheese Dispensing 2025 to 2035

Catering Food Warmers Market Analysis by Product Type, End Use, Sales Channel, and Region Forecast Through 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA