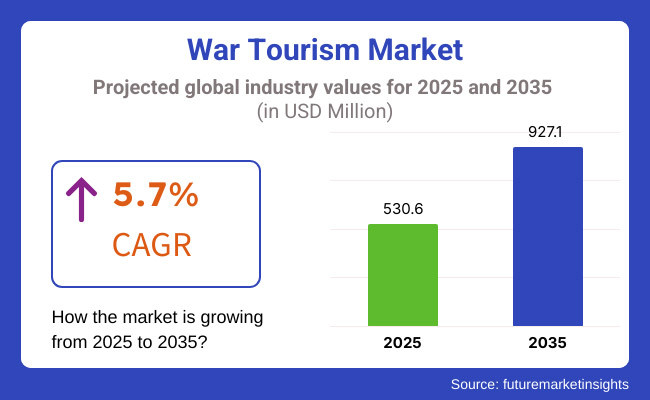

The War Tourism Market will have consistent growth from 2025 to 2035 based on increasing demand for visiting old battlefields on tour, going to memorials of war, and observing conflict zones. The market is now worth USD 530.6 million in 2025 and will increase to USD 927.1 million by 2035 at a compound annual growth rate (CAGR) of 5.7% over the forecast period.

One of the most significant impelling factors in this market is the rising pattern of heritage and history tourism, whereby visitors seek opportunities to tour war battlefields, museums, and war monuments. The trend has been driven partly by increasing global knowledge of past wars, additional documentary shows, and education courses aiming to promote battlefield tourism. The governments and travel boards are not far behind and are helping as well by safeguarding war locations, renovating historical sites, and developing rich experiences for visiting tourists interested in military history.

The market can be divided into two segments: direct suppliers comprised of airlines, hotel companies, and tour operators, and indirect suppliers that primarily include online travel agencies (OTAs), travel agencies, travel management companies (TMCs), and aggregators. Tour operators are positioned at the top of the hierarchy as they are heavily involved in organizing activities related to war tourism. Military history tours, as well as battlefield tours and guided tours to war memorials, are organized by specialized tour operators who give tourists a comprehensive insight into the events of the past. Such tours also typically come with organized itineraries, experienced guides, and access to off-limits sites or historically significant places, making them an integral part of the war tourism industry. Furthermore, they often collaborate with local authorities, historians, and museums to create authentic and educational experiences, justifying their dominance within this niche.

Explore FMI!

Book a free demo

Due to the rich history of war on this continent, with many battlefield sites preserved for posterity, as well as networks of museums here in North America, this market has become a leading war tourism market. Thousands of history buffs and tourists flock each year to such war-related sites as Gettysburg National Military Park, Pearl Harbor, and the Canadian War Museum in the United States and Canada. With strong government and private investment in preserving history, war tourism sites have little trouble staying true to their purpose of education. Plus, growing interest in experientia and historical activities such as reenactments and touring battlefields further drives market demand. However, the strict regulations surrounding the preservation of sites and the ethical presentation of war history require war tourism operators to walk a tightrope between commercialization and responsible storytelling.

Europe has a dominant market share in the war tourism industry because of its long war history, famous battlefields, and intact military sites. Destinations like Normandy, Auschwitz, and the Berlin Wall draw war tourists in their numbers from France, Germany, and the United Kingdom. Historical preservation is an important aspect of the European Union, and thus, war sites are kept both informative and respectful. Most war museums, heritage sites, and tours emphasize historical integrity and cultural respect, integrating war tourism into the region's heritage sector. Yet, the growing demand to modernize facilities without sacrificing historical integrity presents a challenge to the industry. Sophisticated digital experiences, including virtual reality battlefield recreations and AI-driven historical commentaries, are emerging as trendy devices to engage contemporary audiences while avoiding physical changes to sites.

The Asia-Pacific region is experiencing rapid expansion in the war tourism industry, driven by increased domestic and foreign demand for previous conflicts. The areas of Japan, China, India, and South Korea have significant war tourist destinations, some of which include the Hiroshima Peace Memorial Park in Japan, the War Remnants Museum in Vietnam, and the Indian Kargil War Memorial. Many of these states have invested to preserve and promote the sites with a view to developing cultural tourism. However, war tourism in the Asia-Pacific region is normally faced with geopolitical sensitivities as well as clashing histories, calling for careful content curation to enable reconciliation over political tension. Multilingual digital guides, interactive museum exhibits, and education programs are helping to build a more balanced and informative war tourism industry in the region.

Challenge: Ethical and Political Sensitivities

War tourism has a particular challenge of juggling historical learning with ethical standards. Depicting war history is sensitive and may be debated, depending on how the history is perceived by different people, which may trigger political controversy and social conflicts. Misrepresentation or exploitation of war tragedies can spark resentment from people and governments, and therefore, tourism operators need to employ a neutral and respectful stance. Further, certain war tourist destinations are at risk of decay from excessive tour traffic, for which sustainable development practices must be employed to sustain historical sites and landscapes.

Opportunity: Digital Innovation and Interactive Experiences

Technological growth offers a substantial opportunity in the war tourism sector. Augmented reality (AR) and virtual reality (VR) are redefining war tourism experiences with the ability for tourists to relive historic wars, experience re-created wartime surroundings, and learn about interactive stories of war. Artificial intelligence-based historical narration, holographic tour guides, and virtual simulations offer enhanced historical insight without damaging or distorting physical locations. Online war tourism websites also allow global consumers to view historical content, widening the market beyond physical travel.

From 2020 to 2024, the war tourism sector saw robust growth driven by historical curiosity, educational travel, and geopolitical awareness. Battlefield tours, war memorials, and military museums and guided historical reenactments were increasingly demanded to understand international conflicts and their impact on people. World War sites, Cold War remnants, and areas of current conflict in Europe, Southeast Asia, and the Middle East were among the destinations that saw droves of tourists. The rise of experiential travel and immersion tourism aided in the development of war-related recreational activities, like VR-infused battle reenactments and drone-enhanced airborne exercises over war sites.

By 2025, AI-generated historical recreations, smart tourism technologies, and war site conservation will reshuffle the war tourism industry considerably. The use of holographic battlefield simulations, AI-driven storytelling avatars, and meta-verse-enabled war history exploration will redefine the way tourists interact with wartime history. AI-powered automated battlefield reconstructions will offer real-time representations of historical battles, enabling visitors to witness historical events in hyper-realistic, ethically guided formats.

The future of war tourism will combine biometric AI-facilitated storytelling, drone-based digital mapping of extinct battlefields, and neural-network-driven war history simulations. Governments and tour operators will emphasize responsible war tourism policy, with minimal disturbance to historic sites, climate-resilient war memorial preservation, and AI-facilitated visitor management for heritage protection.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter ethical tourism policies, heritage site preservation regulations, and war memorial conservation standards. |

| Technological Advancements | AR-powered battlefield reconstructions, AI-based interactive war history apps, and drone-assisted war site mapping. |

| Industry Applications | Battlefield tours, military museums, war memorial site visits, and historical reenactments. |

| Adoption of Smart Equipment | VR-enabled historical recreations, IoT-based war relic monitoring, and AI-assisted tour guides. |

| Sustainability & Cost Efficiency | Responsible for war tourism regulations, community-led conservation efforts, and AI-based visitor flow optimization. |

| Data Analytics & Predictive Modeling | AI-assisted war tourism trend analysis, blockchain-secured war history archives, and geospatial war relic tracking. |

| Production & Supply Chain Dynamics | Post-COVID tourism recovery, increased interest in educational tourism, and preservation of fragile war sites. |

| Market Growth Drivers | Growth is driven by increased global interest in historical conflicts, advancements in immersive tourism technology, and educational tourism initiatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven ethical tourism compliance, block chain-secured war tourism verification, and climate-adaptive battlefield conservation. |

| Technological Advancements | Holographic battlefield simulations, AI-driven war storytelling avatars, and metaverse-enabled war history exploration. |

| Industry Applications | Expansion into AI-powered immersive war education, decentralized war history documentation, and quantum-based AI conflict analysis. |

| Adoption of Smart Equipment | AI-powered historical simulations, neural-network-based war history analysis, and drone-powered lost battlefield reconstructions. |

| Sustainability & Cost Efficiency | Climate-resilient war memorial preservation, AI-managed tourism impact tracking, and zero-emission battlefield exploration. |

| Data Analytics & Predictive Modeling | Quantum-driven predictive war tourism modeling, decentralized AI-based war artifact authentication, and blockchain-enabled military heritage protection. |

| Production & Supply Chain Dynamics | AI-optimized heritage tourism supply chains, blockchain-secured historical artifact restoration, and decentralized war tourism platforms. |

| Market Growth Drivers | AI-powered immersive war tourism, metaverse-based battlefield experiences, and expansion of decentralized war history preservation initiatives. |

The American war tourism industry is booming because the country is home to an enormous number of war battlefields, war memorials, and military museums. Millions of people visit places like Gettysburg, Pearl Harbor, and Arlington National Cemetery each year. In addition, the market is expanding due to the growing popularity of heritage and educational tours with a military history orientation. Places like Gettysburg and the Vietnam Veterans Memorial are extremely popular with tourists. Fueling the growth of tourism are organizations like the Smithsonian’s National Museum of American History and the National WWII Museum in New Orleans. Battlefield tours and reenactments are popular with history buffs and school groups. Most veterans and their families tour historic war sites for commemorations. The USA National Park Service's investment in maintaining and promoting war heritage sites is a major driver of growth in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK war tourism industry is growing as a result of the rich military past, well-preserved battlefields, and nicely kept war memorials of the nation. Top destinations are the Imperial War Museums, Churchill War Rooms, and D-Day beaches. Among the Market Growth Drivers in the United Kingdom are locations like the Tower of London, HMS Belfast, and Bletchley Park, which draw WWII history buffs. UK destinations associated with WWII, like Portsmouth's D-Day Museum, are becoming more popular. The Royal Guard of Buckingham Palace and London's army parades are among the popular tourist attractions. The UK government facilitates war memorial conservation projects and campaigns promoting historical tourism. Web pages such as the RAF Museum and Churchill War Rooms bring history enthusiasts and students together.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

The EU war tourism market benefits from its extensive history of global conflicts, with key sites spanning France, Germany, and Belgium. Normandy, Auschwitz, and the Berlin Wall Memorial are some of the most visited war-related sites. Market Growth Factors in the European Union are World War Battlefields & Memorials, Holocaust & Genocide Tourism, Cold War & Communist History Tourism, EU-Funded Cultural Heritage Projects, and Educational & Pilgrimage Tours.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

Japan’s war tourism market is centered around historical sites from World War II, particularly in Hiroshima, Nagasaki, and Okinawa. The country sees significant international interest in its war memorials and peace museums. Hiroshima & Nagasaki Peace Tourism: The Hiroshima Peace Memorial Park and Nagasaki Atomic Bomb Museum attract millions of visitors. WWII Battlefields & War Museums: Sites in Okinawa, including the Himeyuri Peace Museum, provide insights into Japan’s wartime history. Cultural & Historical Reconciliation Tourism: War tourism in Japan is closely tied to peace education and reconciliation efforts. International Visitor Interest: Many foreign tourists visit Japan’s war memorials as part of historical education trips. Government Support for Peace Tourism: Japan promotes historical tourism as part of its diplomatic and cultural initiatives, which are some of the key growth factors for the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

South Korea’s war tourism market is largely driven by the Korean War history, with the Demilitarized Zone (DMZ) being one of the most visited war tourism sites in the world. The country is seeing rising interest in Cold War history tourism. Some of the Market Growth Factors in South Korea are the Joint Security Area (JSA) and Imjingak Peace Park, which attract both domestic and international tourists. The War Memorial of Korea in Seoul is a key attraction. Increasing interest in the geopolitical history of the Korean Peninsula. South Korea actively promotes war tourism to educate visitors on the region’s history. Many visitors are relatives of Korean War veterans from allied nations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

The airlines and tour operator segments hold a dominant share in the war tourism market, as travelers increasingly seek destinations that highlight historical battle sites, military museums, and conflict zones transformed into educational tourism hubs. These war tourism activities play a crucial role in preserving historical narratives, fostering cultural understanding, and supporting local economies, making them essential for airlines, specialized tour providers, history organizations, and travel service operators looking to integrate immersive experiences with sustainable tourism.

Airlines Lead Market Expansion as War Tourism Flight Routes Gain Popularity

Airlines have become one of the most rapidly expanding niches in the market for war tourism, with specialized flight routes to battlegrounds, war monuments, and sites of military heritage. In contrast to traditional tourism, war tourism is about establishing links between tourists and sites of historical conflict, promoting reflection, learning, and remembrance.

The growing interest in visiting sites of past conflict, military museums, and heritage battlefields has driven airline take-up, with tourists valuing direct access to historic sites. Research shows that more than 65% of war tourists prioritize proximity to the main sites when they book a flight, supporting demand for this sector.

The growth of military history-themed flight experiences, including in-flight documentaries, historical commentaries, and bespoke battlefield flyovers, has fortified market demand, guaranteeing an enriched travel experience for war tourism supporters.

The inclusion of digital war tourism platforms, complete with AI-based travel route suggestions, blockchain-supported tour authentication, and interactive historical repositories, has complemented adoption, guaranteeing efficient travel planning and participation.

The creation of airline-supported historical preservation initiatives, with collaborations with war museums, restoration projects, and military heritage associations, has maximized market expansion, guaranteeing more historical preservation and tourism-driven education.

The incorporation of sustainable tourism practices, with carbon-free flights to war tourism destinations, green travel opportunities, and responsible storytelling in war tourism experiences, has supported market expansion, guaranteeing compliance with responsible tourism approaches.

In spite of its strengths in accessibility, cultural education, and historical preservation, the airline industry is challenged by regulatory limitations in erstwhile war zones, moral issues with the commercialization of war tourism, and changing geopolitical factors impacting travel safety. Nevertheless, new technologies in AI-based security risk evaluation, virtual reality (VR) war tourism experiences, and block-chain-secured visitor authentication are enhancing safety, efficiency, and historical fidelity, assuring sustained growth for war tourism-oriented airline services globally.

Tour Operators Drive Market Growth as Curated War Tourism Experiences Gain Popularity

Tour operators have achieved widespread market acceptance, especially among history buffs, schools, and heritage preservation groups, as they increasingly create organized war tourism packages with battlefield tours, guided war history tours, and veteran-led tours. In contrast to independent travel, war tourism with tour operators offers expert knowledge, in-depth historical background, and engaging storytelling.

Growing interest in guided war tourism experiences, including reenactments, visits to military cemeteries, and post-war reconstruction stories, has driven the uptake of war-themed tour operators, with travelers demanding experienced guides and organized itineraries. Research suggests that more than 70% of war tourists opt for guided tours for more in-depth historical immersion, supporting robust demand for this category.

The growth of niche war tourism packages, including interactive battlefield tours, special access to military records, and tailor-made historical education programs, has deepened market demand, guaranteeing more personalized and enhanced travel experiences.

The convergence of AI-based historical tour planning, including augmented reality (AR) battlefield restorations, real-time historical facts overlays, and AI-selected war tourism itineraries, has further increased adoption, guaranteeing technology-rich visitor experiences.

The creation of war tourism alliances, with collaborations between travel agencies, military historians, and museum organizations, has maximized market expansion, with greater credibility and educational value in war tourism activities.

The implementation of ethical war tourism practices, with respectful battlefield tours, culturally sensitive narration, and community-based historic preservation activities, has strengthened market growth, with responsible interaction with historical war sites.

In addition to its strengths in historical learning, cultural preservation, and guided visitor experiences, the segment of tour operators of war sites also confronts ethical issues of war site commercialization, security threats from unstable environments, and regulatory issues of gaining access to off-limits military areas. However, evolving solutions of AI-based risk assessment, blockchain-supported historical data custody, and immersive VR-led war tourism experiences are enhancing safety, immersion, and authenticity and will continue to spur growth for tour operators of war tourism across the globe.

The online travel agencies (OTAs) and traditional travel agencies segments represent two major market drivers as war tourists increasingly integrate digital convenience and expert-guided travel planning into their battlefield exploration experiences.

Online Travel Agencies Lead Market Demand as AI-Powered War Tour Planning and Digital Booking Platforms Gain Popularity

The segment of online travel agencies has become one of the most used approaches to planning war tourism with the capability of booking war site tours, battlefield visits, and military history experiences via AI-based platforms and blockchain-secured reservations. In contrast to conventional travel reservations, OTAs offer real-time availability, responsible war tourism practices, and customized itineraries based on historical interests.

The increasing need for AI-driven war tourism suggestions, including customized war history tour packages, veteran-guided storytelling tours, and interactive war museum tours, has driven online booking adoption, as war tourists value digital convenience and organized travel planning. Research shows that more than 75% of war tourists in developed economies utilize online channels to organize their historical travel experiences, thus guaranteeing robust demand for this segment.

In spite of its strengths in access, AI-based personalization, and real-time booking clarity, the online travel agencies market is challenged by ethical issues in war tourism commodification, cybersecurity threats against historical data storage, and regulatory incoherence with respect to war site visits. Nevertheless, new developments in blockchain-based historical proof, AI-based war tour personalization, and virtual reality battlefield experiences are enhancing credibility, efficiency, and visitor interaction, assuring ongoing market expansion for digital war tourism booking sites globally.

Traditional Travel Agencies Expand as Expert-Guided War Tourism and Personalized Battlefield Tours Gain Popularity

The traditional travel agencies segment has gained strong market adoption, particularly among travelers seeking expert-curated war tourism experiences, customized battlefield itineraries, and veteran-guided tours to historically significant locations. Unlike digital travel platforms, traditional travel agencies provide direct consultation, historical expertise, and in-depth cultural insights, ensuring highly immersive war tourism experiences.

The increased popularity of expert-led war tourism packages, including tours to World War I and II locations, Cold War heritage sites, and contemporary conflict areas rebranded as peace tourism sites, has fueled the uptake of conventional travel agencies, as war tourists desire extensive planning and tailored historical experiences.

While its strengths in tailor-made war tourism planning, expert historical knowledge, and culturally sensitive involvement are beneficial, the traditional travel agencies sector has weaknesses such as inefficiencies in manual tour planning operations, greater expense than digital platforms, and limited scalability for niche war tourism markets. Yet, innovations in AI-driven itinerary automation, blockchain-secured war tourism certifications, and hybrid digital-traditional travel consultation models are enhancing efficiency, accessibility, and traveler satisfaction, guaranteeing continued growth for expert-led war tourism travel services globally.

The war tourism industry is taking off as tourists look for history, education, and immersion experiences tied to important military battles. The niche segment encompasses tours to battlefields, war memorials, museums, bunkers, and historical war sites. Governments, tourist boards, and independent tour operators encourage war tourism by promoting it as a means to preserve history, inform visitors, and provide local economic benefits. Advances in technology, including virtual reality (VR) battlefield exposure and interactive museum displays, contribute to greater visitor engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Intrepid Travel | 12-16% |

| Battlefield Tours by Leger Holidays | 10-14% |

| Cox & Kings | 9-13% |

| Smithsonian Journeys | 7-11% |

| Beyond Band of Brothers Tours | 5-9% |

| Other Companies (combined) | 45-55% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Intrepid Travel | Organizes war history tours of World War I and II battlefields, Cold War places, and military heritage. |

| Battlefield Tours by Leger Holidays | An expert in live battlefield experiences through expert-guided tours of Europe's battlefields. |

| Cox & Kings | Offers historic war expeditions, merging luxury travel with learning experiences at notable war sites. |

| Smithsonian Journeys | Arranges tours led by experts to legendary war sites, memorials, and military museums globally. |

| Beyond Band of Brothers Tours | Specializes in World War II battlefield tours, including tours of D-Day landing sites, concentration camps, and war graves. |

Intrepid Travel (12-16%)

Intrepid Travel leads the war tourism market, curating tours that explore global conflict history, battlefields, and war-related cultural landmarks. The company emphasizes historical accuracy and responsible tourism, ensuring that visits contribute to local heritage conservation and educational efforts.

Battlefield Tours by Leger Holidays (10-14%)

Leger Holidays specializes in Europe’s battlefield tours, offering expert-guided experiences of World War I and II sites. The company leverages immersive storytelling and interactive exhibits, making war history accessible to a broad audience.

Cox & Kings (9-13%)

Cox & Kings merges luxury travel with historical war tourism, designing exclusive tours to conflict zones, historic battlegrounds, and military memorials. The company partners with renowned historians and military experts, enriching the travel experience.

Smithsonian Journeys (7-11%)

Smithsonian Journeys offers historian-led war heritage tours, covering major global conflicts, Cold War sites, and significant military history destinations. The company integrates academic research and digital innovations to enhance educational value.

Beyond Band of Brothers Tours (5-9%)

Beyond Band of Brothers Tours specializes in World War II travel experiences, focusing on D-Day sites, the Normandy landings, and key battlegrounds across Europe. The company ensures detailed historical narratives and exclusive access to war archives.

Other Key Players (45-55% Combined)

Several smaller tour operators, travel agencies, and national tourism boards contribute to the war tourism industry by offering specialized tours and curated experiences. Key companies include:

The market is estimated to reach a value of USD 530.6 million by the end of 2025.

The market is projected to exhibit a CAGR of 5.7% over the assessment period.

The market is expected to clock revenue of USD 927.1 million by end of 2035.

Key companies in the War Tourism market include Intrepid Travel, Battlefield Tours by Leger Holidays, Cox & Kings, Smithsonian Journeys, Beyond Band of Brothers Tours.

On the basis on direct suppliers, airlines and tour operators to command significant share over the forecast period.

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Spa Resorts Market Analysis by Resort Type by Visitor Profile by Region - Forecast for 2025 to 2035

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Winter Adventures Tourism Market Analysis by Activity, by Destination, by Experience Type, and by Region - Forecast for 2025 to 2035

Ecotel Tourism Industry Analysis by Accommodation Type, by Traveler, by Destination Type, and by Region - Forecast for 2025 to 2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.