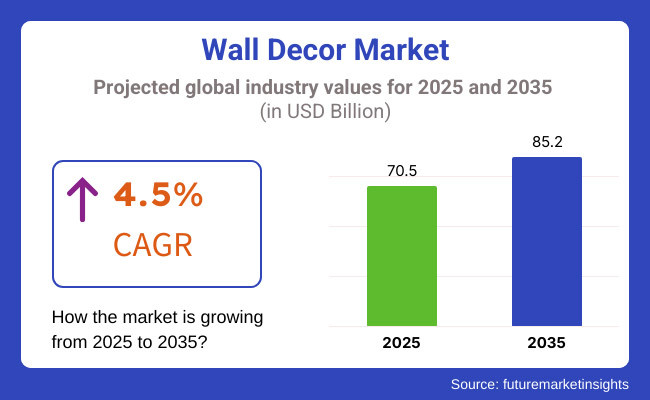

The global wall decor market is poised for significant expansion between 2025 and 2035, driven by evolving interior design trends, increasing disposable incomes, and a growing preference for personalized and aesthetically pleasing living spaces. The market is projected to grow from USD 70.5 billion in 2025 to USD 85.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The rise of urbanization, the influence of social media on home aesthetics, and the adding demand for eco-friendly and customizable wall décor results are crucial factors propelling request growth. Consumers are embracing colourful forms of wall décor, including oils, showpieces, wallpapers, wall stickers, 3D panels, and framed art, to enhance the air of both domestic and marketable spaces. also, advancements in digital printing and sustainable accessories are shaping the elaboration of the assiduity, enabling brands to offer unique, high- quality, and environmentally responsible products.

Explore FMI!

Book a free demo

North America remains a dominant player in the wall décor request, driven by strong consumer demand for high-end, developer, and substantiated home décor results. The adding fashion ability of home addition systems, combined with the influence of digital platforms and social media, has significantly impacted purchasing gets . Consumers are turning to online commerce that offers virtual visualization tools, allowing them to customize wall décor before purchase.

Also, the growing trend of minimalistic yet elegant innards has fueled demand for decoration artworks, framed prints, and ornamental panels. The region is also witnessing increased relinquishment of smart and interactive wall décor, similar as LED art panels and voice-controlled digital frames, enhancing the appeal of tech- integrated home spaces.

Europe is witnessing steady growth in the wall décor request due to the region’s strong preference for cultural and culturally inspired décor pieces. The emphasis on sustainability is a crucial motorist, with consumers concluding for eco-friendly wall décor made from recycled and natural accoutrements. European interior design trends frequently blend classic fineness with ultramodern aesthetics, leading to increased demand for hand- drafted, artisanal wall art, and nature- inspired prints.

The request is also seeing a rise in demand for wall coverings that integrate smart features, similar as aural panels and tone-drawing wallpapers. Also, with civic exist in fastening on compact yet swish living spaces, multifunctional and modular wall décor results remain gaining fashion ability across major metropolises.

Asia-Pacific is anticipated to witness the fastest growth in the wall décor request, supported by rapid-fire urbanization, rising disposable inflows, and a swell in homeownership. The adding influence of social media and home makeover trends has significantly impacted consumer preferences, leading to heightened demand for affordable yet swish wall décor results.

Countries like China and India are witnessing a shift towards bold, contemporary designs that reflect particular aesthetics and artistic influences. Also, the region’s growing middle class is driving demand for decoration wall décor, including luxury wallpapers, penmanship-inspired prints, and ultramodern digital art. Smart home integration is also fueling interest in tech-driven wall décor, similar as digital display art and interactive protuberance walls.

Also, the booming e-commerce sector is making wall décor more accessible, with online retailers offering customized and do-it-yourself ( DIY) décor options acclimatized to individual tastes.

Challenges

The wall décor request faces violent competition, with multitudinous original and transnational brands offering a wide range of products at varying price points. The high vacuity of low- cost, mass- produced décor particulars makes it challenging for decoration and niche brands to separate themselves. Also, price perceptivity among consumers, especially in arising requests, limits the relinquishment of high- end wall décor results.

With the presence of fake and reproduction products in the request, maintaining brand authenticity and consumer trust remains a significant challenge. Companies must concentrate on unique designs, superior quality, and strong branding to stand out in the crowded business.

Opportunities

The growing demand for substantiated and digitally customizable wall décor presents an economic occasion for request players. Consumers are decreasingly looking for unique, made-to-order designs that reflect their individual tastes and personalities. With advancements in stoked reality ( AR) and virtual reality( VR), brands can now offer interactive gests , allowing guests to fantasize décor in their spaces before taking.

Also, the rise of sustainable and eco-conscious décor results, including biodegradable wallpapers, upcycled art, and immorally sourced accoutrements, is creating new growth avenues. Companies that integrate digital invention, sustainability, and personalization into their product immolations will gain a competitive edge in the evolving request geography.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 22.30 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 10.40 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 18.20 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 16.90 |

| Country | France |

|---|---|

| Population (millions) | 65.8 |

| Estimated Per Capita Spending (USD) | 17.50 |

The USA dominates the global wall scenery request, driven by the growing trend of home personalization and interior design invention. Consumers prefer framed art, oil prints, wall- mounted puppets, and peel- and- stick wallpapers to produce aesthetically pleasing spaces.

E-commerce titans like Wayfair, Amazon, and Home Depot grease online purchases, while decoration retailers like West Elm and Crockery Barn cater to high- end consumers. The adding fashion ability of DIY home scenery, fueled by platforms like Pinterest and Instagram, further propels demand.

China's wall scenery request is expanding due to rising disposable income, urbanization, and an adding number of homeowners investing in home aesthetics. The request sees strong demand for ultramodern and minimalist scenery rudiments, including digital wall art and 3D wall panels. E-commerce platforms like Taobao and JD.com enable flawless access to a wide variety of designs. Also, original manufacturers concentrate on affordable, customizable options to feed to different consumer parts.

Germany's wall scenery request benefits from a strong preference for sustainable and high- quality scenery products. Consumers favor handcrafted rustic wall art, quaint prints, and eco-friendly wallpaper. European brands emphasize continuity and dateless aesthetics, making ultra-expensive brands like IKEA, H&M Home, and Made.com popular choices. The DIY home enhancement trend also drives demand for wall- mounted shelves and ornamental panels.

The UK request sees high demand for contemporary and abstract wall scenery, with framed art and bespoke wallpaper being particularly popular. Consumers prioritize customization, with online platforms offering individualized oil prints and tempera services. Retailers like Dunelm, John Lewis, and IKEA dominate the request, while independent artists and Etsy merchandisers gain traction among niche buyers.

France's request thrives on a blend of classic and ultramodern design rudiments, emphasizing luxury and cultural expression. High- end consumers prefer developer wall art, hand- painted showpieces, and elegant tapestries. Parisian influence plays a crucial part in shaping scenery trends, with brands like Roche Bobois and Maisons du Monde setting the standard. The emphasis on curated, sophisticated aesthetics makes France a significant player in the decoration wall scenery request.

The market for wall decor is growing steadily due to rising consumer demand for home decoration, urbanization, and home re modeling trends. Industry experts and a survey of 250 consumers give insights on the market-defining trends.

Canvas prints and framed art lead the way in consumer choice, with 61% of the respondents preferring paintings, prints, and artistic wall decor to decorate living areas. Abstract and modern styles are especially favored, as they mirror current design trends.

Personalization options and online shopping drive sales, with 67% of consumers opting to purchase wall decor from online sites due to variety, value for money, and convenience. Tailored wall decor in the form of customized photo frames, murals, and nameplates is gaining popularity among young consumers.

Current trends are sustainable, handmade decor because 54% of consumers seek environmentally friendly material like reclaimed wood, bamboo, and handmade textile items. Locally designed and handcrafted items also make it to the wishlist, benefiting smaller businesses and responsible sourcing.

Peel-and-stick wall decals and wallpapers are on the rise, with 57% of the respondents viewing them as an affordable, removable option for renters and homeowners who wish to update interiors without long-term obligation. Geometric patterns, botanical prints, and bold patterns are the most favored.

Smart and interactive wall decor technologies are catching on, with 48% of shoppers interested in LED-lit frames, digital art screens, and sound-activated panels that bring a technological twist to home design.

With ecommerce revolution, eco-friendly design trends, and social media playing an increasingly prominent role in home décor, the wall décor market is poised for continued expansion, meeting both aesthetic needs and functional design solutions.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Rise of smart LED wall panels, digital art frames, and 3D wall murals. Augmented reality (AR) apps allowed users to preview wall decor before purchase. |

| Sustainability & Circular Economy | Increased use of eco-friendly materials, such as recycled wood, bamboo, and biodegradable wallpapers. Brands focused on non-toxic paints and adhesives. |

| Connectivity & Smart Features | Wi-Fi-enabled digital art frames allowed users to rotate artworks. Voice-controlled LED wall panels integrated with smart home systems. |

| Market Expansion & Consumer Adoption | Growth in DIY wall decor solutions and customizable wallpaper prints. E-commerce platforms saw a surge in direct-to-consumer (DTC) sales. |

| Regulatory & Compliance Standards | Stricter chemical safety regulations for wallpapers and paints. Increased adoption of certified sustainable decor materials. |

| Customization & Personalization | Brands offered custom photo prints, personalized murals, and tailored design solutions. AR technology allowed consumers to visualize wall decor before purchasing. |

| Influencer & Social Media Marketing | Interior designers and home decor influencers promoted DIY decor trends and sustainable designs. Social media platforms like Instagram and Pinterest fueled viral decor aesthetics. |

| Consumer Trends & Behaviour | Consumers prioritized affordability, easy installation, and sustainable materials. Demand for multi-functional and space-saving decor increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven personalized wall art generates designs based on user preferences. Holographic and interactive wall displays redefine home and office decor. Sustainable 3D-printed wall art gains popularity. |

| Sustainability & Circular Economy | Zero-waste wall decor solutions using biodegradable and plant-based materials. Blockchain-enabled transparency for sourcing sustainable decor items. Energy-efficient digital art displays reduce environmental impact. |

| Connectivity & Smart Features | AI-generated dynamic art walls adjust decor based on mood and time of day. NFT-based wall decor allows users to display exclusive digital collectibles. Meta verse integration enables virtual interior decor customization. |

| Market Expansion & Consumer Adoption | Emerging markets drive demand for affordable, smart wall decor solutions. AI-powered shopping assistants recommend personalized decor based on consumer behaviour. |

| Regulatory & Compliance Standards | Global standardization of eco-friendly materials in wall decor manufacturing. AI-driven compliance tracking ensures ethical sourcing of raw materials. |

| Customization & Personalization | AI-powered wall decor customization enables real-time adjustments in color, texture, and style. 3D-printed personalized art pieces provide ultra-customized solutions. |

| Influencer & Social Media Marketing | AI-driven virtual influencers curate home decor inspirations. Meta verse-based virtual home decor showrooms allow users to visualize and purchase wall decor in immersive environments. |

| Consumer Trends & Behaviour | Biohacking-inspired decor integrates mood-enhancing smart lighting into wall designs. Consumers shift towards interactive and AI-powered decor solutions. |

The USA wall scenery request is witnessing strong growth, driven by adding home addition conditioning, rising demand for substantiated innards, and the growing influence of social media-inspired scenery trends. Major players include The Home Depot, Wayfair, and West Elm.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The UK wall scenery request is expanding due to adding demand for ultramodern and minimalist innards, rising home enhancement investments, and the growth of independent art and design brands. Leading companies include Dunelm, Graham & Brown, and Made.com.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.7% |

Germany’s wall scenery request is growing, with consumers favoring high-quality, sustainable, and design-acquainted scenery results. crucial players include Ikea, Höffner, and Kare Design.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.8% |

India’s wall scenery request is witnessing rapid-fire growth, fueled by rising urbanization, adding disposable inflows, and a growing preference for home aesthetics inspired by artistic and traditional art. Major brands include Pepperfry, Urban Ladder, and Home Centre.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s wall scenery request is expanding significantly, driven by adding disposable inflows, rapid-fire urbanization, and the growing trend of digitally published and smart home-integrated wall art. Crucial players include Oppein, Redstar Macalline, and IKEA China.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

The growing emphasis on home aesthetics and interior design customization is driving demand for wall scenery products. Consumers decreasingly seek unique and individualized scenery rudiments, similar as wall art, showpieces, and symbols, to enhance their living spaces. Social media influence and home enhancement trends showcased on platforms like Instagram and Pinterest farther energy the demand for trendy and swish wall scenery results.

Framed artworks, bills, and oil prints are witnessing a swell in fashionability due to their affordability and capability to round colorful interior styles. Consumers are drawn to statement pieces featuring abstract art, nature-inspired themes, and pop culture references. Online commerce offering customizable prints and digital art downloads give an accessible way for consumers to epitomize their wall scenery according to their tastes and preferences.

The expansion of online retail and direct-to-consumer brands has significantly told the wall scenery request. E-commerce platforms enable consumers to explore a vast selection of wall scenery particulars, compare prices, and access unique, hand wrought pieces from independent artists. Subscription- grounded art services and virtual design consultations further enhance the shopping experience, making high- quality wall scenery more accessible to a global followership.

The adding mindfulness of environmental sustainability is shaping the wall scenery assiduity, with consumers preferring eco-friendly and immorally sourced accessories. Brands are introducing wall scenery products made from recycled wood, biodegradable fabrics, and non-toxic maquillages. Sustainable product processes, coupled with ethical sourcing practices, are gaining fashion ability as consumers come more conscious of the environmental impact of their scenery choices.

The wall scenery request is driven by rising home addition trends, personalization, and digital printing advancements. Consumers are decreasingly seeking customized wall art, eco-friendly scenery, and smart scenery results like LED- LED-integrated or interactive digital wall panels. Online retail platforms and social media influence are crucial factors shaping buying opinions, with brands using AI- grounded design recommendations and virtual room visualization tools to enhance client engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| IKEA | 12-16% |

| Home Depot | 10-14% |

| Lowe’s | 8-12% |

| Wayfair | 7-11% |

| Williams-Sonoma (West Elm, Pottery Barn) | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| IKEA | Offers affordable, Scandinavian-style wall decor including framed prints, canvas art, and wall organizers. Strong in sustainability with eco-friendly materials. |

| Home Depot | Specializes in DIY wall decor solutions, wallpapers, murals, and 3D panels. Focuses on home improvement and renovation trends. |

| Lowe’s | Provides a mix of wall art, mirrors, shelving, and customizable decorative panels. Expanding online retail presence. |

| Wayfair | Dominates in e-commerce for wall decor, offering a vast range of styles, from modern to rustic. Uses AI-powered personalized recommendations. |

| Williams-Sonoma (West Elm, Pottery Barn) | Focuses on premium, artisanal, and handcrafted wall decor, including limited-edition artwork and sustainable collections. |

Strategic Outlook of Key Companies

IKEA (12-16%)

Leading with affordable, stylish, and sustainable decor options, IKEA is expanding its eco-conscious product lines and digital home visualization tools.

Home Depot (10-14%)

A strong player in DIY and home renovation decor, Home Depot is enhancing smart decor options with LED-integrated wall panels and interactive murals.

Lowe’s (8-12%)

Gaining traction with customized and high-quality wall decor solutions, Lowe’s is investing in e-commerce and AR-powered virtual design tools.

Wayfair (7-11%)

A dominant force in online retail for home decor, Wayfair is leveraging data-driven personalization, influencer marketing, and digital design tools.

Williams-Sonoma (6-10%)

Positioning as a luxury and handcrafted decor brand, Williams-Sonoma’s brands like West Elm and Pottery Barn focus on high-end, unique pieces.

Other Key Players (40-50% Combined)

The Wall Decor industry is projected to witness a CAGR of 4.5% between 2025 and 2035.

The Wall Decor industry stood at USD 68.4 billion in 2024.

The Wall Decor industry is anticipated to reach USD 85.2 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 7.1% in the assessment period.

The key players operating in the Wall Decor industry include IKEA, Bed Bath & Beyond, The Home Depot, Wayfair, Ashley Furniture Industries, and Williams-Sonoma, Inc.

Wall Art, Wallpapers & Wall Coverings, Wall Stickers & Decals, Clocks, Mirrors, and Others.

Wood, Metal, Plastic, Fabric, Glass, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.