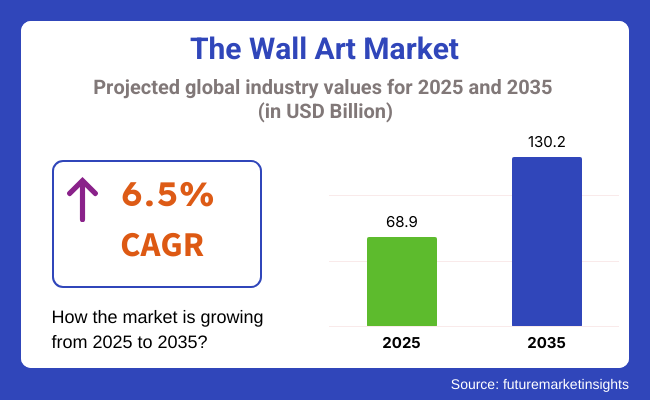

The wall art market size was USD 68.9 billion in 2025 and is expected to record a 6.5% CAGR from 2025 to 2035. The global wall art market is expected to reach USD 130.2 billion by 2035.

One of the key drivers for this expansion is the increasing emphasis on interior design, spurred by increasing disposable incomes, urban apartment living, and expanding consumer access to low-cost and personalized art through online channels. As consumer tastes move away from the conventional framed picture to more modern, newer, multimedia and personalized artworks, wall artwork is being revolutionized as both a style and lifestyle statement.

Canvas painting, metal wall artwork, digital prints, 3D installations and eco-friendly materials are some of the segments seeing growing traction. Greater home-based employment has also spurred the growth further, with people seeking to make home spaces more attractive and comfortable.

Digital transformation has been at the center of reshaping the landscape of wall artwork. Social media and online platforms have allowed individual artists to connect with global buyers directly, leading to a varied ecosystem of original and limited-edition artworks. Customization, AR-enabled visualizers, and virtual exhibitions now guide buying decisions, especially among digitally native consumers.

For commercial and hospitality firms, there is a growing demand for wall décor since companies aim to create brand and experiential spaces. Locally inspired and themed art continues to be integrated with offices, retail stores and hotels by interior designers and developers. It is particularly seen in boutique hotels and co-working spaces centered around ambiance and identity through visual narrative.

Europe and North America lead in revenue size, supported by an established interior décor industry and consumer interest in art-based home customization. The Asia-Pacific region will experience the most growth, driven by urbanization, the expansion of the middle class, and the growing interest in global design trends. Cross-border e-commerce, low-cost international shipping and digital curation will further support this growth over the next decade.

While wall art work is not directly associated with industries like healthcare or electronics, consumer purchases do display the same degree of personalization, sensory impact, and environmental consideration. Consumers in the residential and hospitality markets assess wall artwork on beauty balance factors, material, and cultural suitability, often selecting customized and sustainable products.

Demand growth is being driven by lifestyle changes, most notably the ascension of carefully curated and expressive interiors. Technology infusion-augmented reality previews, mobile personalization apps, blockchain-verified art are creating new expectations about user experience and authenticity, most particularly for high-end buyers. Cost sensitivity is quite moderate, with a dichotomy between mass-market décor and high-end collectible art.

With a growing emphasis on uniqueness and sustainability, mid-range to high-end products are in vogue. Regulation compliance in this sector is largely related to intellectual property, ethical procurement, and sustainable manufacturing practices.

The wall art industry, with its strong uptrend, carries substantial risks that would affect long-term performance. Fragmentation of the markets and sheer oversupply of low-end or generic products, specifically through mass e-commerce channels, is one of the primary concerns. There is a high potential to commoditize art and contain a demand for higher-value original art.

Another significant issue is intellectual property protection. With the rise of digital media and easy image duplication, artists and original designers face threats of duplication and abuse of their content. Authenticity protection and acquisition of copyright enforcement mechanisms are critical in maintaining artistic value and consumer trust.

Environmental concerns also present a growing pressure point. As sustainability ambitions are being taken forward into interior design, the use of non-recyclable materials, chemical-based ink, or unsustainable sources can alienate green-aware consumers. Brands must mitigate this risk by means of transparent supply chains and sustainable production practices, which are quickly becoming the competitive imperative in design-led markets.

Between 2020 and 2024, there was a sudden boom in sales with increasing demand for home decoration and personalization. Buyers wanted to introduce something personalized and expressive into their homes via artworks, and consequently, demand for various forms of wall artwork, including paintings, prints, and digital art, increased exponentially.

The increase in online business websites allowed easy access to numerous varieties of art genres and styles, allowing consumers to buy wall art according to their needs. Also, social networking sites played an important role in bringing upcoming artists and designs to the limelight, thus adding further growth.

During the forecast period 2025 to 2035, the industry will supposedly trend towards sustainability, technology integration, and personalization. Digital print innovation and augmented reality will presumably revolutionize the customer experience and wall art engagement.

Natural materials and green manufacturing techniques will presumably keep progressing as consumers are becoming more and more eco-conscious. Furthermore, customization features, including personalized prints and custom designs, should gain popularity, enabling customers to create their own unique pieces of art that suit their tastes and styles.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for home furnishings, online shopping growth, and the influence of social media | Sustainability, technology integration, and customization |

| Growth of online platforms for art and digital marketing | Advances in digital print, augmented reality, and design tools |

| Various styles of art, prints, and affordability | Nature-friendly materials, interactive experience, and customized design |

| Ease of accessing multiple works of art, ease of use, and affordability | Single, customized, and eco-friendly artworks |

| Limited information on emerging artists and trends | Combining newness with prices and maintaining ethical principles |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

| UK | 6.3% |

| France | 5.8% |

| Germany | 6.0% |

| Italy | 5.5% |

| South Korea | 6.7% |

| Japan | 5.9% |

| China | 8.2% |

| Australia-New Zealand | 6.1% |

The USA will grow at 7.1% CAGR throughout the study. Sustained consumer interest in home appearance, along with a well-developed e-commerce infrastructure, is fueling steady growth in both urban and suburban areas. High household disposable income and a strong tendency towards home customization are key drivers of demand for wall art.

There is an active involvement of both well-established brands and solo artists who provide a wide variety of styles and formats, such as canvas prints, murals, and digital art. Increased demand for digitally printed and personalized wall art is also supported by extensive use of social media platforms, which drive consumer tastes and interior design trends.

The increasing number of residential projects and home renovations, combined with rising purchases from commercial and hospitality segments, drives momentum to industry growth. Moreover, technological innovation in printing technology and eco-friendliness in materials are influencing consumer attitudes towards high-end offerings. Virtual art galleries and art-as-a-service platforms are also offering new routes to consumer interaction.

The UK would grow at a 6.3% CAGR over the study period. There is a shift due to increased consumer interest in contemporary interior aesthetics and greater emphasis on home decoration trends. Online retail activity coupled with platforms featuring curated and customized wall art collections has contributed majorly to accessibility and growth.

Urban areas, particularly, demonstrate a growing hunger for new and customized art installations that harmonize with environmentally friendly and region-specific designs. Stepped-up take-up rates for minimalist and Scandinavian-style interiors have opened doors for canvas and framed art modes, particularly within home and co-living markets. Demand from office spaces, hospitality properties, and shopping centers is also increasing prospects in the industry.

British designers and independent design houses are successfully targeting specialist consumer groups with the help of digital platforms. Focusing on reasonably priced art, capsule collections, and limited edition works pushes people to shop regularly and drives loyalty toward the brands.

As consumers tend to move in favor of environment-friendly and handcrafted home decoration pieces, the wall art segment is also set to gain from this shifting focus and environmentally sensitive consumer population.

France is anticipated to expand at 5.8% CAGR throughout the study. The nation's rich art heritage drives the growth, changing interior design styles, and growing demand for locally made and artist-driven wall art. The focus on heritage and authenticity in French homes provides a conducive setting for curated and handmade pieces of art. Urban consumers, particularly in cities such as Paris and Lyon, show an increased appetite for art that expresses individuality and sophistication of culture.

The rise of digital platforms featuring high-end collections of art, coupled with partnerships between galleries and conventional gallery setups, is working to close the gap between the artist and buyer. France's predisposition to sustainability and handcrafted work increases the demand for sustainable wall art products even more.

Besides that, hospitality and boutique hotel markets are increasingly incorporating artwork into design concepts, adding to segment growth. There is a growing demand for mixed media, vintage-style prints, and minimalist designs, fueled by consistent consumer expenditure in the lifestyle and decoration segments.

Germany will grow at 6.0% CAGR over the forecast period. Consumer taste in Germany is moving toward a clean design look, simple themes, and contemporary art forms well-matched with urban living spaces. There is a high sustainability consciousness that fuels the demand for green wall art printed with natural inks, recycled content, and ethically sourced materials.

Germany's robust industrial foundation and access to cutting-edge printing technologies underpin the creation and dissemination of custom and mass-personalized art products. The emergence of hybrid workspaces and home-office cultures has also heightened interest in interior spaces, stimulating sales of practical and visually attractive wall décor.

Expansion is underpinned by online channels and specialist stores that provide curated offerings. In urban areas like Berlin, Hamburg, and Munich, there is a mix of conventional art appreciation and digital design incorporation. Commercial buildings, such as offices, office spaces, and co-living buildings, are investing in themed paintings to create ambiance, further adding to steady demand over the forecast period.

Italy will grow at 5.5% CAGR over the study period. Though based on a rich artistic heritage, Italy is transforming to adopt modern and functional art forms that are compatible with contemporary lifestyles. An emerging segment of consumers is more interested in integrating traditional craftsmanship with minimalist and abstract styles. This fusion of heritage and modern appeal is seen in the forms of wall art that are gaining popularity in both residential and hospitality markets.

Urban cities like Milan and Rome are experiencing increased usage of luxury and limited-series items specifically designed for contemporary interiors. The demand also stems from tourism demand, as temporary rental properties and boutique hotels spend on looks alike.

Social media visibility and online marketplaces are increasing the availability of wall art for younger consumer groups looking for bespoke living spaces. The country's design-oriented culture and focus on artisanal techniques and sustainability result in a consistent, if more tempered, growth of the wall art category.

South Korea is forecasted to expand at 6.7% CAGR over the study period. A dynamic culture of design and the growing influence of social media-inspired home décor styles are driving demand for wall art in a diverse array of formats.

Young adults and urban working professionals are most attracted to contemporary, minimalist, and Korean pop-culture-influenced motifs. These tendencies are promoting the transition away from conventional artwork toward trend-conscious and highly personalized styles. The fast growth of e-retail websites and mobile shopping has made it easier for both international and local brands to reach further.

Incorporating augmented reality aspects into shopping apps enables customers to view wall decorations in actual spaces, making it easier to decide. South Korea is also being boosted by growing demand for individuality and self-expression, where consumers look for art that promotes individuality.

Corporate offices, cafés, and boutique hotels are driving demand for contemporary and thematic artwork. A strong focus on design innovation, coupled with a rapidly changing consumer market, makes South Korea a major growth industry.

Japan is expected to grow at 5.9% CAGR during the study period. The industry exhibits steady growth, driven by a cultural appreciation for aesthetics and a minimalist design philosophy. Consumers prioritize harmony and simplicity in home environments, which translates to demand for refined, nature-inspired, and calligraphy-based artwork. Japanese households typically opt for compact, elegant décor suited to smaller living spaces, creating opportunities for small-format and modular wall art.

Home design e-commerce websites have seen major traction, providing seasonal and curated collections that appeal to changing tastes. Demand from upscale hospitality sites and contemporary corporate environments is also driving growth.

Japanese artists and small boutique galleries are using online platforms to achieve exposure and connect with emerging customer bases. Increased interest in sustainable products and handmade goods is influencing future buying behavior. The industry is poised to change while maintaining a profound link with cultural and art traditions.

China is forecasted to register an 8.2% CAGR throughout the research period. Urbanization, rising disposable incomes, and expanding middle-class populations are some of the drivers boosting demand for residential and office interiors, such as wall décor. Young adults are adopting new interior trends and new forms of digital art, and there is an expanding desire for contemporary, customized, and trendy wall décor.

The prevalence of mobile-first commerce and online marketplace dominance has brought wall art within reach for regions beyond tier-1 cities. Influencer marketing, real-time selling, and home décor fashion endorsed on social media platforms have an important influence on consumer decisions.

Real estate developers and commercial property owners demand is also driving bulk acquisitions of artwork for staging and design upgrading. Technological investments, such as AI-aided design software and AR-enabled previews, are placing an extra layer of sophistication on the buying process.

The Australia-New Zealand region shall grow at a 6.1% CAGR over the study period. There have been increasing consumer interactions with personalized interior design and emerging demand for local art and nature-inspired themes. Demand for do-it-yourself home improvement products has gained impetus post-pandemic. It is increasing due to growing consumer demand for accessible and aesthetic art products in urban and suburban homes.

Online stores, solo art collectives, and curated home décor labels have grown distribution and product lines. In Australia, environmentally friendly purchasing behavior shapes material choice, with sustainably sourced wood, organic canvas, and non-toxic ink skewed demand.

In New Zealand, cultural symbols and indigenous art movements are increasingly part of design appeal, integrating heritage with modern aesthetics. Both nations enjoy strong internet penetration and digital design software, enabling consumers to browse, tailor, and visualize wall décor prior to buying. As lifestyle-oriented consumers seek convenient décor solutions, a stable growth trend is expected through residential and commercial use.

Residential type is the dominant sub-segment, currently accounting for an estimated 38-40% of the wall art market. Its popularity is largely due to its affordability, ease of installation, and design versatility. In residential settings, especially rental homes, wallpapers and peel-off stickers offer an accessible means of personalization.

Companies like A.S. Création Tapeten (Germany), Brewster Home Fashions (USA), and Asian Paints (India) are leading suppliers in this category. Recent advancements in eco-friendly, washable, and textured wallpapers are further fueling adoption. Based on current trends, this sub-segment is projected to grow at a CAGR of approximately 6.9% between 2025 and 2035, supported by both residential renovations and hospitality sector growth.

Hangings, including fabric tapestries, macramé, and cultural textiles, represent a smaller share, estimated at around 18-20% in 2024. Their appeal lies in their tactile quality and ability to convey artisanal or bohemian aesthetics, particularly among millennials and Gen Z consumers.

Brands such as Urban Outfitters and Anthropologie have popularized fabric-based hangings as part of their curated home décor lines. Although this segment grows more slowly than wallpapers, it still exhibits a healthy projected CAGR of 5.5% for 2025 to 2035. Growth is expected from niche design segments, particularly in North America and Europe, where boho and eclectic interior themes are trending.

Offline channels currently dominate with over 60% revenue share, primarily due to the tactile nature of wall artwork purchasing and the benefit of in-person visualization. Within this, specialty stores lead, contributing roughly 35-40% of total sales, offering curated selections and personalized advice.

Key players include IKEA, Home Goods, and regional interior boutiques. Hypermarkets like Walmart and Target also capture a substantial portion of the share, catering to cost-conscious consumers seeking off-the-shelf options. Offline retail is projected to maintain steady growth (CAGR ~4.8%) through 2035, particularly in emerging economies where e-commerce penetration remains moderate.

Online sales channels, while currently smaller in share (35-38%), are projected to grow at the fastest rate, with a CAGR exceeding 7.2% from 2025 to 2035. Consumers increasingly turn to platforms like Amazon, Wayfair, Etsy, and Redbubble for convenience, broader selection, and personalized creator-driven content they offer.

Direct-to-consumer brands such as Desenio and Minted have also gained traction, offering tailored digital previews and custom framing services. The rise in virtual staging tools and AR-enhanced shopping experiences is further propelling this sub-segment, particularly among digital-native consumers in urban regions.

The wall art market consists of digital-first platforms, curated marketplaces, and high-end design brands geared toward affluent urban and digitally engaged consumers. Art.com Inc. established a monopoly in the online distribution of art from Saatchi Art Limited and Society6 LLCs, creating bountiful customization and artist-led collections. Such companies spend a huge amount on user experience, AR for virtual positioning, and AI engines to distinguish from the throng of online retailing.

The cash-and-carry option, along with vertically integrated art processing and supply chains, allows bulk production against affordability and scaling in home decoration. Mid- to high-point offerings of limited-edition self-curated pieces cherished by interior designers and favored by the modern consumer looking for exclusivity go to Uprise Art LLC and Minted LLC.

Artsy Inc., 1stdibs.com Inc., and Art net Worldwide Corporation target luxury collector segments whereby authenticated and investment-quality wall arts are offered through gallery connects and auctions. Besides, they are throwing more into combining art commerce with provenance tracking through blockchain. Art space LLC withers away from the masses but is catching attention through museum collaborations with targeted niche editorial content.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Art.com Inc. | 16-19% |

| Saatchi Art Limited | 13-16% |

| Society6 LLC | 11-14% |

| VGL Group | 9-12% |

| Artsy Inc | 6-9% |

| Other Players | 32-38% |

| Company Name | Offerings & Activities |

|---|---|

| Art.com Inc. | Large-scale digital catalog, framing services, and virtual room preview features. |

| Saatchi Art Limited | Original art from emerging artists, global shipping, and AR-based visualization tools. |

| Society6 LLC | Artist-driven platform offering affordable prints, custom sizes, and décor products. |

| VGL Group | Scalable art manufacturing, affordable designs for home furnishing retailers. |

| Artsy Inc | High-end gallery listings, collector-focused tools, and auction integrations. |

Key Company Insights

Art.com Inc. (16-19%)

Leads the mass-industry segment through digital tools, vast inventory, and integrations with retail giants like Walmart and Amazon.

Saatchi Art Limited (13-16%)

Distinguishes itself with global artist reach, curatorial services, and robust digital tools supporting discovery and customization.

Society6 LLC (11-14%)

Captures millennial and Gen Z consumers through trend-forward art, artist royalties, and expansion into lifestyle goods.

VGL Group (9-12%)

Delivers value-driven art at scale with fast turnaround and large distribution partnerships, especially in home goods retail.

Artsy Inc. (6-9%)

Dominates in premium and investment-grade art markets, bridging galleries and collectors through an elegant online experience.

The segmentation is into wallpapers/stickers/wall coverings, hangings, frameworks, décor shelves, and others.

The segmentation is intooffline and online sales channels. Offline sales include hypermarkets and supermarkets, specialty stores, and others, while online sales cover e-commerce platforms.

The segmentation is intoresidential and commercial applications.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 68.9 billion in 2025.

The industry is predicted to reach a size of USD 130.2 billion by 2035.

Key companies include VGL Group, Art.com Inc., Uprise Art LLC, Saatchi Art Limited, Society6 LLC, Minted LLC, Artsy Inc., 1stdibs.com Inc., Artnet Worldwide Corporation, and Artspace LLC.

China, slated to grow at 8.2% CAGR during the forecast period, is poised for the fastest growth.

Wallpapers and peel-off stickers are being widely used.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ billion) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ billion) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ billion) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ billion) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ billion) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ billion) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ billion) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ billion) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ billion) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ billion) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ billion) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ billion) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ billion) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ billion) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ billion) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ billion) by Sales Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ billion) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ billion) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ billion) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Market Leaders & Share in the Wallets & Little Cases Industry

Market Share Distribution Among Wall Covering Product Manufacturers

Wall Covering Product Market Analysis – Growth & Trends 2024-2034

In-Wall Bottle Filling Station Market Size and Share Forecast Outlook 2025 to 2035

Firewall as a Service Market

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Multiwall Bags Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Mould Market

Thin Wall Glass Container Market

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA