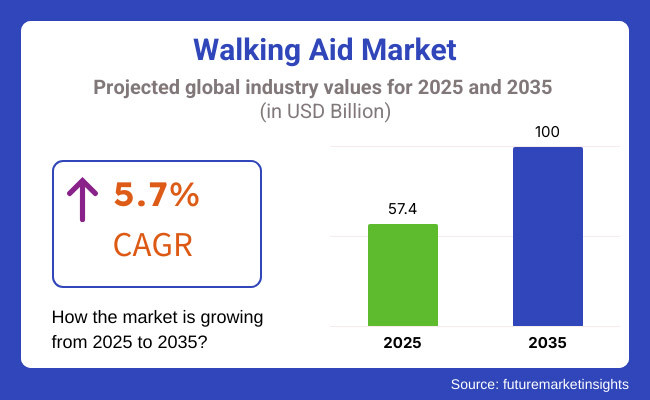

With an estimation for the global walking aid market to grow at a significant rate, indicating a healthy CAGR between the period of 2025 and 2035. Crutches, canes, walkers, and rollators are walking aids that enhance access and independence for persons with disabilities or age-related disabilities. Market growth is driven by an increasing focus on improving the quality of life for geriatric populations and patients recovering from injury or surgery.

Walks have been revolutionized by new technology: smart walking aids that utilize sensors, GPS tracking, and common human ergonomics. Additionally, government programs encouraging the use of assistive devices, positive reimbursement policies, and growing awareness of fall prevention are all contributing to the market's expansion.

However, the high cost of advanced mobility aids, the limited access to mechanical aids in developing regions, and the lack of acceptance associated with mobility aids may restrict market share. Nonetheless, the global market of walking aids will be worth USD 100 billion by the year 2035, at a CAGR of 5.7%.

Explore FMI!

Book a free demo

With a well-developed healthcare infrastructure, high market penetration of advanced mobility aids, and a rapidly aging population, North America is anticipated to lead the walking aid market. The rising incidence of arthritis, osteoporosis, and other musculoskeletal disorders is another factor contributing to the increasing demand. Market growth is also supported by government initiatives and insurance coverage for assistive devices.

The development of innovative mobility solutions by major industry players and research institutions will continue to accelerate the adoption of smart walking aids. Furthermore, increasing demand for personalized and ergonomically designed walking aids is driving manufacturers to come up with lightweight and adjustable walking aids that enhance comfort and functionality.

But costly tech walking aids can inhibit usage in low-income populations. In the region, the expansion of e-commerce platforms and direct-to-consumer sales models should improve accessibility and affordability-providing more growth opportunities.

Sustainable growth in Europe is expected to be spurred by an increasing geriatric population, favorable healthcare policies, and growing awareness of assistive mobility solutions. Germany, France, and the UK are among the countries investing in R&D of smart mobility aids. The European industry is experiencing a surge in demand for rollators and smart walking sticks that improve stability and monitoring abilities.

Moreover, market growth is being supplemented by robust public health programs that promote accessibility and fall prevention. Falling prices are being aided by an increase in government-funded subsidies for mobility aids in the region that makes them more affordable for elderly people.

On the downside, the strict reimbursement policy and the varying healthcare policies per European country may create some challenges in distributing and manufacturing the product. Walking aids to be used in Europe are influenced by specialty trends towards sustainability, with manufacturers increasingly sourcing eco-friendly materials and recyclable components in product creation.

The report segments the global mobility aid and transportation aid market into different regions, such as North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa (MEA). In countries like China, India, and Japan, assistive technology and rehabilitation services are increasing in the market. Rapid urbanization and increasing awareness regarding fall prevention are also driving the global fall prevention industry.

Growing healthcare coverage in developing economies is facilitating the purchase of mobility aids, particularly for those who are particularly low- to middle-better off in urban locations, enabling them to migrate with ease. However, market growth may be impeded owing to the affordability issue, lack of knowledge regarding mobility solutions, and limited access to advanced mobility aids in rural areas.

The increase in the number of e-commerce platforms is likely to enhance the accessibility of products all over the region. Moreover, owing to government initiatives and schemes for elderly care and disability inclusion in the region, the evolution of cost-effective and advanced mobility solutions by manufacturers has been facilitating the region's growth.

Challenges

One of the major contributors to restricting the growth of the global walking aid market is the high cost of technologically innovative mobility solutions, as a portion of the population, especially in underdeveloped areas and within low-income groups, would be unable to invest in high-tech walking devices. In addition, social stigma and attitudinal barriers to mobility aids may impede uptake rates, especially in the younger disabled population.

Regulatory complexity, coupled with divergence in reimbursement policy across countries, can pose significant challenges for manufacturers entering new markets. Counterfeit and substandard walking aids available in emerging markets can also undermine consumer confidence in the quality and safety of their products.

In addition, alternative solutions-like physical therapy, robotic exoskeletons, and non-invasive rehabilitation-could expand, making the market for commercial walking devices more limited. In addition, product innovation and differentiation are the result of the growing consumer requirements for ergonomic, lightweight, and technologically advanced solutions.

Opportunities

Increasing focus on innovative assistive technologies is giving rise to diverse growth opportunities for the market. Smart Walking Aids Introducing GPS-based tracking, information on fall detection, and AI-based movement analytics. In addition, rising health care spending and government aid programs are driving the market, which is designed to increase access for older and disabled individuals.

The channels through which products sell have transitioned to direct-to-consumer sales methods, and online retail platforms have provided accessibility to products and even helped engage consumers. Furthermore, collaborative projects between healthcare providers and assistive device manufacturers are supporting awareness-raising campaigns and increasing the uptake of walking aids.

Customization and personalization The evolution of a user-oriented business model is the third key opportunity that has been growing in assistive mobility devices, as the consumers are continually looking for individualized solutions that are generally tailored to their mobility needs. Using the latest improvements in 3D printing technology, 3D-printed walking aids are becoming personally customized to how you use them, making them more convenient and comfortable.

The walking aid market grew steadily from 2020 to 2024 due to factors such as the rise in the geriatric population, the increasing prevalence of mobility disorders, and growing awareness about assistive devices. The use of lightweight materials, ergonomic designs, and smart walking aids with sensors based on technological advancements improved the user experience and safety.

Moreover, the market growth was further augmented by government efforts to enhance accessibility and mobility for persons with disabilities. However, high costs and reimbursement barriers were limiting adoption.

From 2025 to 2035, the market for home healthcare services is expected to expand significantly. Walking aids enhanced by artificial intelligence (AI) and the Internet of Things (IoT) will be developed to improve how users interact with them. Authorities will enforce strict safety and quality standards across the industry.

There will also be a shift towards using eco-friendly materials in manufacturing due to growing environmental concerns. Increased investment in wearable devices that assist with mobility and in rehabilitation technologies will further drive industry transformation..

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety standards and accessibility regulations in assistive devices. |

| Technological Advancements | Development of lightweight, foldable, and ergonomic walking aids. |

| Consumer Demand | Increased adoption due to rising geriatric population and mobility impairments. |

| Market Growth Drivers | Aging population, rising chronic conditions, and government initiatives for disability support. |

| Sustainability | Limited focus on sustainable materials and energy-efficient production. |

| Supply Chain Dynamics | Dependence on key raw material suppliers and manufacturing constraints. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations focusing on product durability, eco-friendly materials, and safety standards. |

| Technological Advancements | Expansion of AI-powered and IoT-integrated smart walking aids for enhanced mobility. |

| Consumer Demand | Higher demand for customized, technologically advanced, and home-care-friendly walking aids. |

| Market Growth Drivers | Growth driven by smart rehabilitation technologies, home healthcare expansion, and AI integration. |

| Sustainability | Greater emphasis on eco-friendly materials, recyclable components, and sustainable manufacturing. |

| Supply Chain Dynamics | Strengthened supply chain resilience through localized production and diversified sourcing. |

Market Outlook

My mom started using a walker about 4 years ago, and there are more than 2 million walkers sold yearly in the USA alone, a figure that is growing rapidly with the aging of the population and the rising prevalence of mobility-related disorders like arthritis and Parkinson's. An estimated 24% of adults in the USA have arthritis, according to the Centers for Disease Control and Prevention (CDC), and a growing number of them are seeking mobility assistance devices.

From canes to crutches to walkers and rollators, the market has something for every type of patient. Technologies that enhance user convenience, such as foldable designs and lightweight materials, are both contributing to and segmenting the market. However, the high price of sophisticated walking aids and some populations' lack of knowledge about their options could hinder market expansion.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.4% |

Market Outlook

The walking aid market in Germany is driven by a well-established healthcare system and a large senior-based population. Often, patient mobility and rehabilitation are so well regarded among the population that walking aids are commonplace. New products like rollators with advanced braking systems and ergonomic designs are becoming more common.

Moreover, the market is growing owing to the presence of key manufacturers and supportive reimbursement policies. But high product costs and strict regulatory requirements could restrict the fast expansion of the market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.1% |

Market Outlook

With the aging population and increasing awareness of mobility assistance devices, the walking aid market in China is rapidly growing. As economies grow and healthcare infrastructures improve, more walking aids are available.

Manufacturers are producing affordable products locally, which has made walking aids within reach for a wider population. Regional discrepancies in healthcare amenities and a limited consciousness of those therapies in regional areas can act as an impediment to market penetration.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.2% |

Market Outlook

The India walking aids market is expected to grow significantly, owing to the increasing geriatric population and rising incidence of mobility-related ailments. The market is expanding as a result of government initiatives to improve healthcare affordability and accessibility.

To meet the diverse needs of consumers, a broad range of walking aids are available, ranging from extremely basic canes to highly advanced rollators. However, financial constraints in different regions, economic disparities, and low awareness in rural areas could pose obstacles to market expansion.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.7% |

Market Outlook

The Brazilian market for walking aids is growing, driven by an aging population and rising healthcare investments. The growing prevalence of chronic diseases that restrict mobility, most notably arthritis, is propelling walking aids market growth.

The market is anticipated to expand at a lucrative growth rate, owing to the provision of government healthcare programs, improved access to medical devices, and rising injections in developing regions. However, economic disparities and regional differences in healthcare infrastructure may pose challenges to uniform market growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.9% |

Rollators: Market Dominance with Improved Mobility Features Based on Mobility Aid Type: The walking aid segment is led by rollators because of their advanced features capable of providing stability, support, and ease of use for individuals who have mobility impairments. In contrast to a traditional walker, a rollator has wheels, braking, and sometimes a seat.

This makes it an ideal mobility aid for elderly patients and people recuperating from surgery or an injury. The aging of the population and the rise in the number of people with diseases like Parkinson's and arthritis are the main factors driving the demand for rollators. Additionally, their use in home care and rehabilitation facilities is being aided by ongoing advancements in lightweight materials, foldable designs, and smart health tracking technology.

Walkers & Gait Trainers: Shifting Focus on the Rehabilitation and Physical Therapy in Walkers and Gait Trainers-Biggest Segment of the Walking Aid Market Walkers and gait trainers are another major segment in the walking aids market, mainly used for people with severe disabilities, including those recovering from strokes, spinal injuries, and neuromuscular disorders.

By taking part in different physical therapy programs, many users can even learn to walk again with the additional support and improved stability that these devices provide. Technological developments like height-adjustable and shock-absorbing models are increasing the adaptability of walkers and gait trainers to meet the needs of various patients. The segment is further anticipated to be supplemented by the rising emphasis on rehabilitation services as well as the increasing number of available customized and pediatric gait trainers.

Automated Walking Aids: Revolutionizing Mobility with Smart Technology Transforming Mobility through Constructive Intelligence Automated walking aids are a new emerging market as robotics and AI improve mobility solutions. Additionally, AI-driven gait trainers, smart rollators, and robotic walkers are being developed to assist the severely disabled with their mobility in real-time, providing them with dynamic support and feedback.

Because they can react to shifting gait patterns and help with posture correction. These high-tech solutions are especially revolutionary for people with neurological conditions like multiple sclerosis and cerebral palsy. As IoT and machine learning are integrated and assistive technology is invested in.

Manual Walking Aids: Sustained Demand for Cost-Effective and Simple Mobility Solutions Due to their low cost, simplicity, and availability in terms of manual walking aids, manual walkers have a strong presence in the market. Canes, crutches, and standard walkers are still vital mobility aids for elderly people and people recovering from minor injuries or surgeries.

Manual walking aids are a constant in the home, clinical, and gym environments, thanks to their simplicity and robustness. This is also improving user comfort and safety with the availability of ergonomic and adjustable models. Just as expectations for automation are rising, they are also the most common and important parts of a walking assistance market.

The walking aid market is expected to witness steady growth, driven by the aging population, increasing prevalence of mobility impairments, and advancements in both manual and automated assistive technologies.

Demographic factors like the aging population, the sharp increase in the number of people with mobility-related disorders, and growing awareness of assistive devices are driving the walking aid market's growth. To increase user comfort and mobility, top vendors in the market are focusing on ergonomic designs, lightweight materials, and technological advancements. It is a very competitive market, where established healthcare companies and start-ups are aggressively pursuing innovative walking aid solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Invacare Corporation | 18-22% |

| Drive DeVilbiss Healthcare | 15-18% |

| Sunrise Medical | 12-15% |

| Medline Industries, LP | 8-10% |

| Other Companies (combined) | 35-47% |

| Company Name | Key Offerings/Activities |

|---|---|

| Invacare Corporation | Provides a wide range of mobility aids, including rollators, walkers, and canes. |

| Drive DeVilbiss Healthcare | Specializes in lightweight and ergonomic mobility assistance devices. |

| Sunrise Medical | Develops high-performance walking aids with advanced support and durability. |

| Medline Industries, LP | Offers cost-effective and hospital-grade mobility solutions for various needs. |

Key Company Insights

Invacare Corporation (18-22%)

Growth in the walking aid market is driven by demographic factors such as the growing aging population, rapid rise in the number of people suffering from mobility-related disorders, and increased awareness regarding assistive devices.

Leading vendors in the market are concentrating on technological innovations, lightweight materials, and ergonomic designs to improve user comfort and mobility. It is a very competitive market, where established healthcare companies and start-ups are aggressively pursuing innovative walking aid solutions.

Drive DeVilbiss Healthcare (15-18%)

Drive DeVilbiss Healthcare is known for its lightweight and highly adjustable mobility aids, catering to both home and institutional use. The company continuously invests in ergonomic and customizable solutions.

Sunrise Medical (12-15%)

Sunrise Medical offers advanced walking aids designed for comfort and performance. Its focus on user-centric innovations has strengthened its position in the market.

Medline Industries, LP (8-10%)

Medline provides a diverse portfolio of cost-effective walking aids, including standard walkers and rollators for hospitals and personal use. The company's strong distribution network enhances its market reach.

Other Key Players (35-47% Combined)

Several other companies contribute significantly to the walking aid market by offering specialized and cost-effective solutions. Notable players include:

As demand for walking aids continues to grow, companies are prioritizing innovation, regulatory compliance, and user-friendly designs to ensure mobility and independence for individuals with limited mobility.

The market is driven by an aging population, increasing prevalence of mobility disorders, advancements in smart walking aids, and supportive government initiatives for disability inclusion and healthcare accessibility.

North America is anticipated to lead due to its well-developed healthcare infrastructure, high adoption of advanced mobility aids, and government support for assistive technologies.

High costs of technologically advanced mobility aids, limited accessibility in developing regions, regulatory complexities, and social stigma associated with assistive devices are key challenges.

The integration of AI, IoT, and smart sensors in walking aids has improved safety, monitoring, and user experience. Innovations such as fall detection, GPS tracking, and ergonomic designs are enhancing mobility solutions.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.