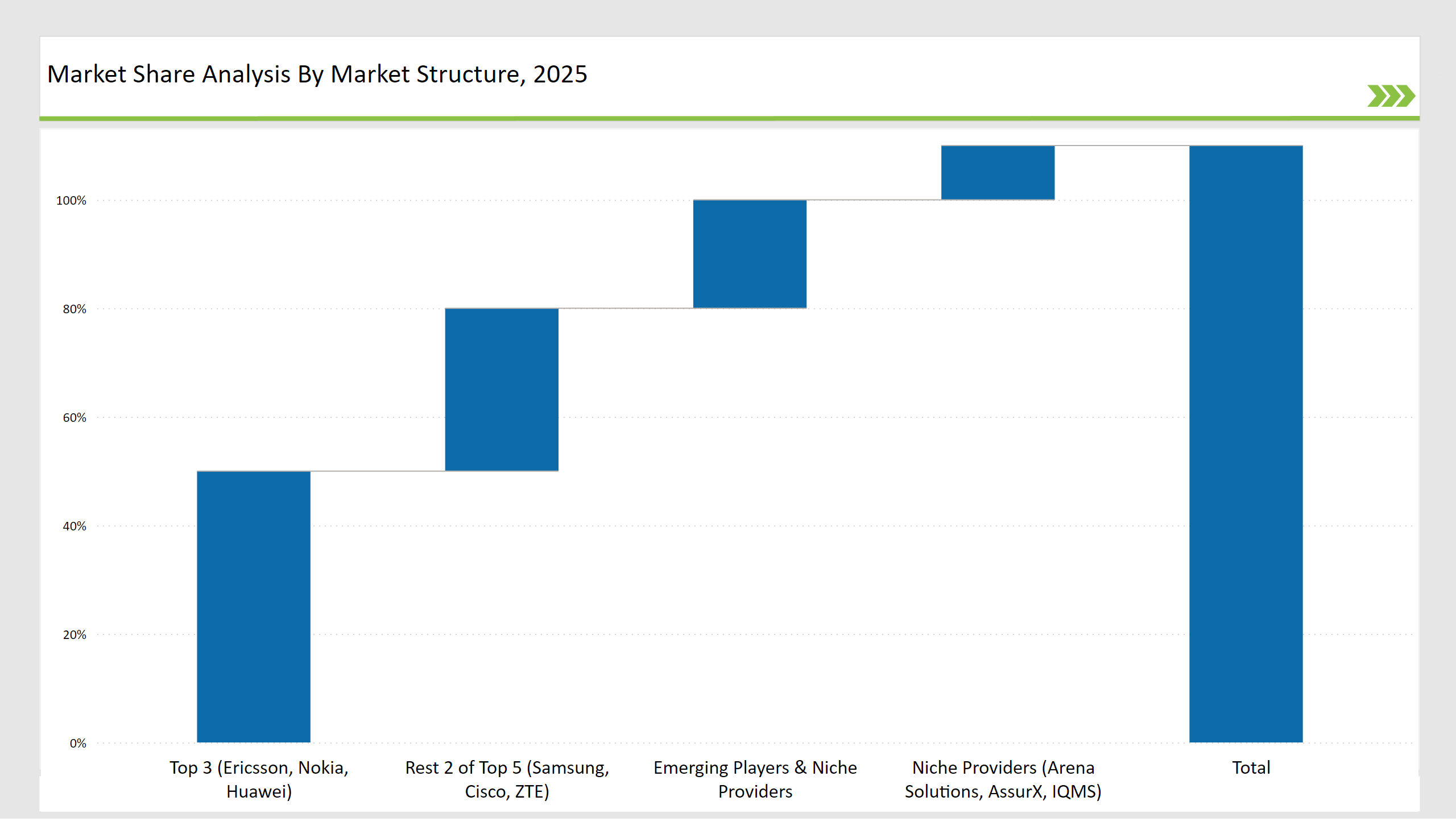

The Voice Over LTE (VOLTE) And Voice Over Wi-Fi industry will explode, as top telecom operators switch from traditional voice services to high-definition voice over LTE networks. There are three prominent players of VoLTE: Ericsson, Nokia, and Huawei, who currently hold 50% market share in the world market due to strong network infrastructure and innovation in LTE technology.

Regional players like Samsung Networks, Cisco, and ZTE hold 30% share. Emergent and niche providers are another 20%. Integration of VoLTE with 5G and cloud-based communication solutions is fast-tracking adoption; the market will grow at a 14.2% CAGR to USD 12.5 billion by 2035.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 12.5 billion |

| CAGR (2025 to 2035) | 14.2% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Ericsson, Nokia, Huawei) | 50% |

| Rest 2 of Top 5 (Samsung, Cisco, ZTE) | 30% |

| Emerging Players & Niche Providers | 20% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

The VoLTE Service Platform segment leads the market with a 40% share, driven by increasing demand for HD voice services and seamless voice and data integration. Ericsson and Nokia dominate this segment with cloud-native, AI-powered VoLTE solutions that enhance network efficiency and voice quality.

VoLTE brings reductions in operational costs for operators, allows enhancement of customer experience, and helps in the 5G transition. As networks advance, VoLTE solutions are increasingly implemented by businesses to ensure cost-effective yet reliable communications..

The telecommunication sector takes the lead position with 45% market share due to considerable investment in VoLTE deployment by the firms such as AT&T, Verizon, and Vodafone. These firms upgraded voice quality and reduced latency with support for advanced features like Voice over Wi-Fi (VoWiFi), and rich communication services (RCS).

Telecommunications operators have moved toward integrating VoLTE with other network capabilities as 5G comes into play, improving the voice-quality field. As competition advances, advanced VoLTE solutions have high demand.

Ericsson

Ericsson also expanded its cloud-native VoLTE offerings to guarantee seamless 5G integration and superior voice quality. The solution reduces latency, enhances voice continuity across 4G and 5G networks, and ensures improved user experience for both consumers and enterprises.

Nokia

Nokia unveiled AI-driven VoLTE analytics to aid telecom operators improve call efficiency and decongest their networks. Machine learning algorithms enable real-time detection and resolution of call quality issues to optimize network performance.

Huawei

Huawei enhanced VoLTE security by providing end-to-end encryption for enterprise voice communications. This new security framework ensures compliance with strict data protection regulations and protects sensitive business communications.

Cisco

Cisco enhanced VoLTE infrastructure with cloud-based scalability, allowing global operators to optimize their communication services. Its cloud-native architecture enables telecom providers to deploy and manage VoLTE services flexibly, lowering operational costs and improving service reliability.

ZTE

ZTE expanded VoLTE deployment in emerging markets, helping operators get rid of 2G and 3G networks. This thus accelerates the digital transformation process in emerging markets, providing expanded access to high-definition voice services and network efficiency.

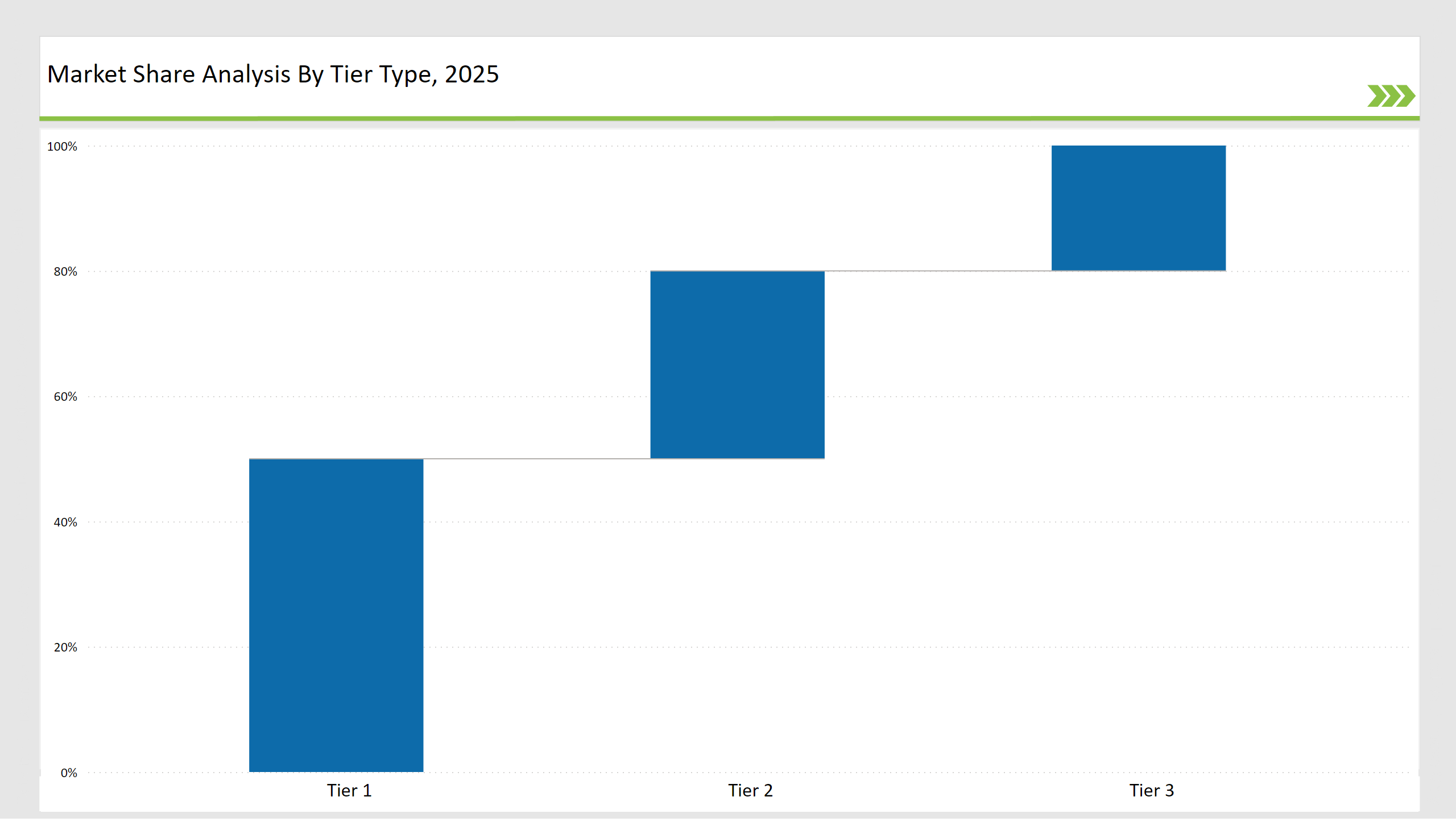

| Tier | Tier 1 |

|---|---|

| Vendors | Ericsson, Nokia, Huawei |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Cisco, Samsung Networks, ZTE |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | Ribbon Communications, Mavenir, Metaswitch |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| Ericsson | Advances cloud-native VoLTE solutions and AI-driven call analytics. |

| Nokia | Strengthens 5G and VoLTE integration for superior call quality. |

| Huawei | Enhances VoLTE security and encryption. |

| Cisco | Develops cloud-based VoLTE scalability solutions. |

| ZTE | Expands VoLTE deployment in emerging markets. |

| Samsung | Innovates in VoLTE for 5G devices and seamless voice continuity. |

| Qualcomm | Enhances VoLTE chipset efficiency for better power consumption and connectivity. |

| Mavenir | Offers fully virtualized and cloud-native VoLTE core solutions. |

| Ribbon Communications | Optimizes VoLTE call routing and network performance with AI-driven insights. |

| Metaswitch (Microsoft) | Develops software-based VoLTE solutions for flexible and scalable deployment. |

Telecom operators should work with vendors and enhance voice quality through AI algorithms, thus improving the superior VoLTE experience. VoLTE, with 5G and AI-driven analytics, means businesses can route calls more efficiently and decrease congestion on the network. Cloud-based VoLTE platforms will make seamless communication possible for consumers, as well as enterprises, while automation lowers operating expenses with superior scalability.

The opportunities for telecom operators to upgrade from legacy networks to LTE and 5G are huge in emerging markets. Vendors must tailor VoLTE solutions to regional network requirements and optimize performance for diverse infrastructures. Collaborations with regulatory agencies and telecom carriers will ensure smooth VoLTE deployment and compliance with industry standards.

As demand for unified communications grows, VoLTE vendors should integrate advanced features like VoWiFi, real-time AI-driven call analytics, and blockchain-backed security. Strengthening interoperability between VoLTE and next-generation network architectures will sustain market growth and technological advancement.

Leading vendors Ericsson, Nokia, and Huawei hold 50% of the market.

Regional players Samsung Networks, Cisco, and ZTE hold 30% of the market.

Emerging players and niche providers hold 20% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.