The VOC sensors and monitors Industry is valued at USD 204.0 million in 2025. According to FMI's analysis, the VOC sensors and monitors industry will grow at a CAGR of 7.6% and reach USD 431.3 million by 2035.

In 2024, the industry witnessed notable advancements in both technology and regulatory frameworks. Growing awareness of air quality and the need for safe indoor environments drove demand for these sensors in industrial processes, including manufacturing and chemical plants.

Several leading players introduced smaller, cost-effective, and more accurate sensors that attracted small and medium-sized enterprises (SMEs) focusing on adhering to environmental standards.

Furthermore, regulatory pressure in Europe and North America encouraged businesses to adopt air monitoring solutions. This is particularly prominent in sectors such as automotive and healthcare, where VOCs significantly impact product quality and public health. In addition, governments enacted stricter environmental regulations, driving the adoption of VOC monitors in commercial and residential buildings.

Looking ahead to 2025 and beyond, the industry is expected to continue expanding, driven by advances in smart sensing technologies and integration with the Internet of Things (IoT). The growing focus on sustainability and environmental health, particularly in emerging economies, will likely further boost the demand for these sensors across various industries.

Market value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | 204.0 million |

| Industry Value (2035F) | 431.3 million |

| CAGR (2025 to 2035) | 7.6% |

Explore FMI!

Book a free demo

This industry is poised for steady growth, driven by increasing regulatory pressure and rising awareness of air quality’s impact on health and safety. Key drivers include technological advancements, such as IoT integration and miniaturization of sensors, which will lower costs and improve accessibility.

Industries like manufacturing, automotive, and healthcare will benefit from these innovations, while companies failing to adopt these solutions may face regulatory challenges and operational inefficiencies.

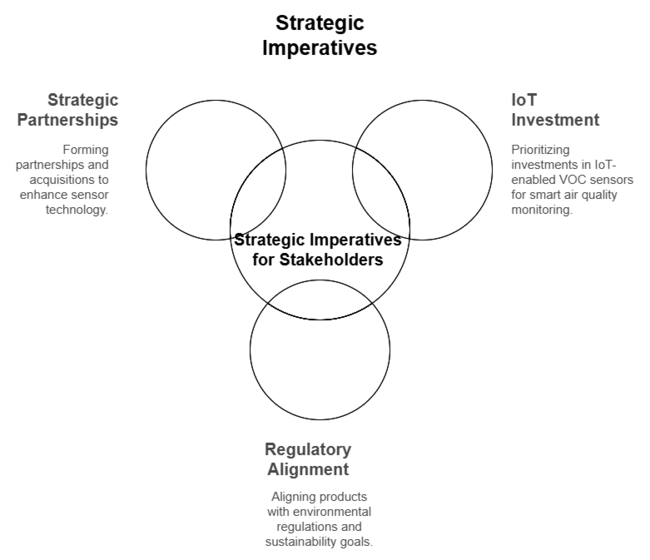

Invest in IoT-Enabled VOC Sensors and Monitors

Executives should prioritize investment in Internet of Things (IoT)-enabled VOC Sensors and Monitors Market to capitalize on the growing demand for connected, smart air quality monitoring systems. By integrating sensors with cloud-based platforms, companies can offer real-time data analytics, positioning themselves as leaders in the evolving industry.

Align with Regulatory Standards and Sustainability Goals

To stay competitive, executives should align product offerings with evolving environmental regulations and sustainability trends. This includes ensuring products meet compliance standards across different regions and integrating energy-efficient and eco-friendly solutions to address both regulatory and consumer preferences.

Explore Strategic Partnerships and Acquisitions

Executives should consider forming partnerships with technology providers and research institutions to advance sensor technology, or pursue acquisitions of smaller innovative players. This will expand R&D capabilities, accelerate industry entry, and enable companies to build a comprehensive product portfolio to meet diverse industry needs.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays or Changes | Medium Probability, High Impact |

| Technological Obsolescence | Medium Probability, Medium Impact |

| Supply Chain Disruptions | High Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| IoT Integration | Run feasibility on IoT-enabled VOC sensor integration with cloud-based platforms. |

| Regulatory Compliance | Initiate review of upcoming regional regulations on VOC emissions and align product offerings. |

| Supply Chain Resilience | Launch a pilot program to diversify suppliers for critical sensor components to avoid disruptions. |

To stay ahead, companies must prioritize the integration of IoT-enabled VOC Sensors and Monitors and ensure their offerings are aligned with evolving environmental regulations. By investing in smart, connected technologies, they can differentiate themselves in the competitive landscape and position for long-term growth. Immediate focus should be on expanding R&D capabilities, establishing regulatory compliance frameworks, and securing a more resilient supply chain.

These actions will not only help meet industry demand but also enable companies to lead in sustainability and innovation, turning potential risks into strategic advantages. Adjusting the roadmap now will ensure they are prepared to capitalize on emerging opportunities while staying compliant and technologically advanced.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, end-users, and regulatory bodies in the US, Western Europe, Japan, and South Korea)

Regional Variance:

Convergent and Divergent Perspectives on ROI:

| Country | Government Regulations & Policies |

|---|---|

| The USA | Strict state-level VOC emission regulations, particularly in California (e.g., California Air Resources Board standards). Mandatory compliance for industrial applications. |

| UK | VOC monitoring is required under EU-based regulations (post-Brexit, UK follows similar policies), with emphasis on air quality monitoring in industrial sectors. Certifications like ISO 9001 required. |

| France | Strong focus on reducing industrial VOC emissions, with regulations like the French Environmental Code. Certifications such as CE marking required for VOC-related devices. |

| Germany | Compliance with the EU’s Industrial Emissions Directive, which mandates VOC monitoring in certain industries. CE marking and conformity to EU standards are required for VOC sensor manufacturers. |

| Italy | VOC monitoring is governed by EU directives for air quality and industrial emissions. CE marking is mandatory for VOC sensor products. |

| South Korea | VOC regulations under the Korean Ministry of Environment. Strong focus on compliance in industrial sectors, with mandatory certifications like KCs for product safety. |

| Japan | VOC regulations under the Japanese Air Pollution Control Law, with a focus on industrial emissions. Certifications like JIS (Japanese Industrial Standards) required for these sensors. |

| China | Stringent VOC emission control policies under the Chinese Environmental Protection Law. Manufacturers must comply with China Compulsory Certification (CCC) for VOC monitoring equipment. |

| Australia-NZ | VOC sensor standards regulated by the National Environment Protection Council in Australia. Both CE and Australian certifications required for industrial use, with strict compliance needed. |

The VOC sensors and monitors industry is categorized into fixed and portable devices. The monitor’s segment is projected to grow with a CAGR of 7.5% from 2025 to 2035. Fixed VOC sensors dominate the industry, particularly in industrial applications such as petrochemical plants, manufacturing, and oil & gas, where continuous air quality monitoring is crucial for compliance and safety.

Technologies like photoionization detectors (PID) and infrared sensors are commonly used due to their high accuracy in detecting VOCs at low concentrations. On the other hand, portable sensors are gaining traction because of their flexibility and ease of use in applications such as construction, mining, and environmental testing, where personal safety is a priority. The rise of IoT-enabled and miniaturized portable sensors further accelerates their adoption across various industries.

These are used in various applications, including industrial monitoring, environmental monitoring, and indoor air quality management. The air purification and monitoring segment is expected to grow with a CAGR of 7.4% from 2025 to 2035. Industrial monitoring is the largest segment, with sectors such as petrochemical, manufacturing, and oil & gas relying on these sensors for emission control and compliance with regulations.

However, environmental monitoring, particularly in urban air quality management and smart city initiatives, is projected to experience significant growth. With increasing urbanization, there is a growing demand for real-time air quality monitoring systems to track VOC emissions. Indoor air quality monitoring is also expanding rapidly due to rising awareness of health risks associated with VOC exposure in indoor environments like offices, schools, and homes.

US is estimated to grow at a rate of 7.9% CAGR for years 2025 to 2035, due to its solid industrial base and the presence of a stringent regulatory framework. The US reported some of the strongest environmental regulations in the world, specifically at the state level (for instance, California), which in turn spurs demand for these sensors across petrochemicals, manufacturing, and agriculture industries.

Increasing penetration of smart technologies, including IoT-enabled sensors, will continue to drive the industry growth. As a result, there is a growing demand within the industry for available solutions such as real-time VOC monitoring to meet requirements regarding emission limits. Growing demand due to the drive towards sustainability and the rise of awareness of air quality problems in urban regions will also encourage demand.

The UK is estimated to have a CAGR of 7.4% over the examined period, driven by changing environmental regulations and a growing emphasis on sustainability. In particular, the UK’s stance on air quality, especially in industrial sectors, is unlikely to soften as the net-zero emissions target for 2050 is pursued. Government initiatives and the need for air quality monitoring in urban and industrial areas are key drivers for growth.

Ongoing development of integrated sensors in smart city projects and growing emphasis on carbon footprint reduction across manufacturing industry will drive overall growth in UK industry.

France is expected to be 7.5% CAGR, supported by strong environmental policies and industrial regulations. France’s alignment with the EU’s Green Deal and stricter industrial emissions norms drive the adoption of VOC monitoring systems across industries such as chemicals, automotive, and energy. As manufacturers in France push toward more sustainable production methods, the demand for advanced VOC sensors will rise.

Additionally, growing investments in smart technologies and IoT integration for real-time emissions monitoring will be key growth drivers for these sensors and monitoring systems in France over the next decade.

Germany is accounted at 7.7% CAGR during 2025 to 2035. Germany, being the largest industrial hub in Europe, is driven by strict EU regulations and industrial emissions reduction, propelling a strong demand for these sensors in the region. Germany remains at the forefront of automation as well as green technology; hence, potential for advanced VOC monitoring systems in various sectors such as chemicals, automotive, energy, is expected to be in place.

Germany's focus on sustainability, highlighted by its carbon-neutral goal for 2045, drives additional demand for emissions monitoring systems. Continuous investment in industrial intelligent solutions is expected to drive the industry growth of VOCs sensors, since these sensors are primarily used in large-scale industrial production plants automated or green factories.

Italy is forecast to be at 7.3% CAGR from 2025 to 2035. Need to combat air pollution in Italy and adherence with EU-wide environmental compliance are expected to create demand for VOC monitoring systems in automotive, chemicals, and manufacturing among others. The adoption of these sensors in the industrial segment as well as smart city projects is expected to grow with the increased adoption of digital technologies in manufacturing and the increasing use of IoT for environmental monitoring.

South Korea is forecasted at 7.5% CAGR. South Korea’s stringent environmental regulations, particularly in industrial hubs like Seoul and Ulsan, drive demand for VOC monitoring systems in the automotive, petrochemical, and semiconductor industries. The government's push for a carbon-neutral society by 2050 is a significant factor in increasing the adoption of the sensors, especially for compliance purposes. Additionally, South Korea’s growing interest in smart city infrastructure and IoT-based environmental solutions will further drive the industry. The rise of green technologies will support demand for advanced monitoring systems.

Japan is expected to be grow at the CAGR of 7.3%. Japan’s strong regulatory environment, particularly concerning industrial emissions and air quality, positions it as a key industry for these sensors. The country’s industrial sectors, including automotive, electronics, and chemicals, are under increasing pressure to meet emission standards, which drives demand for advanced monitoring solutions.

While Japan has been slower to adopt IoT-enabled systems compared to other regions, its focus on sustainability and technological innovation will boost the use of the sensors. As Japan moves toward carbon neutrality by 2050, these sensor adoption is expected to grow significantly.

China is projected at CAGR of 7.8%. China’s rapid industrialization and commitment to addressing air pollution are major drivers of this sensor industry. The Chinese government’s stringent regulations to curb VOC emissions, particularly in manufacturing and petrochemical sectors, make sensors a critical tool for compliance. Additionally, China’s push for greener technologies, including smart city initiatives and IoT adoption, will further accelerate the demand for VOC monitoring systems. As the country aims for carbon neutrality by 2060, these sensors will play a crucial role in environmental monitoring and emissions control.

Australia-NZ is projected to be 7.4% CAGR for 2025 to 2035. In both Australia and New Zealand, the sensors industry is growing due to increased government attention on air quality and sustainability. Australia’s regulatory policies are becoming stricter regarding industrial emissions, which will drive the demand for VOC monitoring systems, especially in mining, agriculture, and manufacturing industries.

Additionally, New Zealand’s focus on maintaining its clean and green image while pursuing environmental sustainability will push for better emissions monitoring solutions. Both countries are increasingly adopting IoT and smart technologies, which will further boost this industry.

As for developments in these sensors and monitors industry in 2024, several key advancements have occurred. In early 2024, Figaro Engineering Inc. launched a new series of these sensors targeted at industrial applications, designed to provide more accurate detection of volatile organic compounds in environments like chemical plants and factories. These sensors are expected to enhance safety and help meet regulatory compliance standards. Meanwhile, Honeywell expanded its air quality monitoring portfolio with new sensors aimed at commercial and residential buildings.

These solutions feature real-time monitoring capabilities, helping facility managers ensure better indoor air quality. In a notable strategic move, Sensirion, a Swiss leader in environmental sensors, acquired a tech startup specializing in innovative VOC sensing technologies in February 2024. This acquisition is intended to strengthen Sensirion's position in the smart building and environmental monitoring industries.

Additionally, the demand for indoor air quality (IAQ) monitoring has surged in North America and Europe, driven by growing concerns about health risks from VOC exposure in enclosed spaces. Companies like Aeroqual and TSI Incorporated are capitalizing on this trend by ramping up production and enhancing their VOC sensor technologies.

Honeywell

Estimated Share: ~20-25%

A global leader in industrial and smart building VOC monitoring, leveraging advanced IoT integration and AI-driven analytics for air quality management.

ION Science

Estimated Share: ~15-20%

Specializes in photoionization detection (PID) sensors, dominating environmental and occupational safety applications with high-accuracy solutions.

ams AG (now part of Renesas)

Estimated Share: ~10-15%

Focuses on miniaturized VOC sensors for consumer electronics and automotive air quality systems, benefiting from Renesas’ semiconductor expertise.

Alphasense

Estimated Share: ~10%

A key OEM supplier of electrochemical and MOS VOC sensors, widely used in industrial safety and portable gas detectors.

Figaro Engineering

Estimated Share: ~8-10%

Known for metal-oxide semiconductor (MOS) sensors, particularly in residential and automotive air quality monitoring.

Aeroqual

Estimated Share: ~5-8%

Specializes in portable and fixed VOC monitors for environmental agencies, with strong adoption in regulatory compliance applications.

Nissha FIS, Inc.

Estimated Share: ~5%

Develops flexible VOC sensors for wearable devices and smart home applications, emphasizing compact and low-power designs.

Winsen

Estimated Share: ~5%

A growing Chinese player, expanding in industrial and smart home VOC sensors, supported by cost-effective MEMS-based solutions.

Extech (FLIR Systems)

Estimated Share: ~3-5%

Provides handheld VOC monitors for occupational safety and industrial hygiene, with a niche in rugged, user-friendly designs.

Membrapor

Estimated Share: ~2-3%

Focuses on high-precision VOC sensors for medical and laboratory applications, with a reputation for accuracy and reliability.

The VOC Sensors and Monitors Market is driven by increasing regulations, environmental concerns, and the need for emissions control and air quality monitoring.

VOC Sensors and Monitors Market are used across industries like petrochemical, oil & gas, manufacturing, environmental monitoring, construction, and indoor air management

The main manufacturers include Figaro Engineering Inc., Honeywell International Inc., Sensirion AG, Aeroqual Ltd., TSI Incorporated, RKI Instruments, Inc., Alphasense Ltd., City Technology Ltd., Amphenol Advanced Sensors, Oakton Instruments, ABB Ltd.

The industry is expected to be valued at USD 431.3 million by 2035.

The future of VOC Sensors and Monitors Market includes the rise of IoT-enabled devices, increased automation, lower costs, and more advanced monitoring capabilities.

The industry is bifurcated divided into sensors and monitors.

It is segmented into industrial process monitoring, environmental monitoring, air purification and monitoring, and leak detection.

The market is studied across North America, Europe, Asia Pacific, The Middle East and Africa, and Latin America.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.