The Vital Signs Monitoring Devices Market is expected to witness substantial growth from 2025 to 2035, driven by rising demand for real-time health monitoring, increasing prevalence of chronic diseases, and advancements in wearable health technologies. These devices play a crucial role in tracking essential physiological parameters such as heart rate, blood pressure, respiratory rate, and body temperature, which are vital for early disease detection and management.

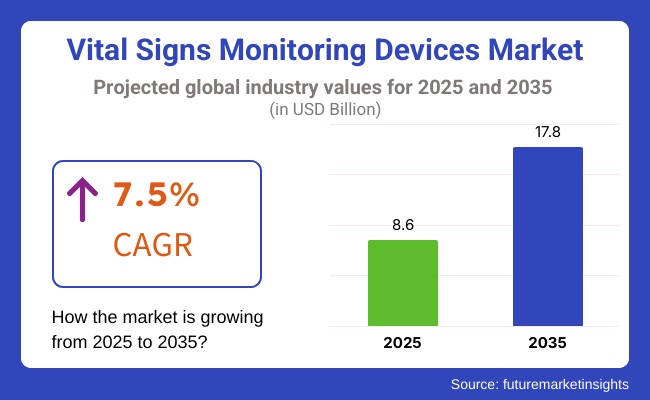

The market is estimated to be worth USD 8.6 Billion in 2025 and is projected to reach USD 17.8 Billion by 2035, expanding at a CAGR of 7.5% during the forecast period. The rising geriatric population, growing adoption of remote patient monitoring solutions, and integration of artificial intelligence (AI) in healthcare devices are major factors driving market expansion.

The increasing use of wireless and portable monitoring devices has enhanced the accessibility of vital signs monitoring, particularly in home healthcare settings and ambulatory care. The demand for telemedicine and digital health platforms is further supporting the adoption of smart, cloud-based, and AI-integrated monitoring systems that provide real-time insights and predictive analytics for healthcare providers.

With ongoing developments in biosensors, wearable monitoring patches, and IoT-enabled health tracking, the market for non-invasive and continuous vital signs monitoring solutions is expected to create significant growth opportunities over the next decade. (IoT) devices will constantly be updated and new services will be introduced.

Explore FMI!

Book a free demo

The major framework for the vital signs monitoring devices market is likely to be North America, due to high healthcare spending, technological advancements, and a significant presence of crucial market players. Receivership has been a problem area for sales growth in the United States and Canada, surrounded by increasing demand for wearable health devices from both the consumer and health-care professional sectors seeking continuous and non-invasive monitoring options.

The growing prevalence of cardiovascular diseases, diabetes, and hypertension across the region have driven the demand for remote patient monitoring systems which are now an integral part of personalized healthcare and chronic disease management. Furthermore, the emergence of government initiatives promoting digital healthcare revolution in addition to reimbursement policies for telehealth services are also accelerators encouraging the adoption of smart monitoring solutions.

North America is also pioneering research and development in AI-based diagnostic tools, with several companies incorporating machine learning algorithms and predictive analytics into wearable health devices. The growth of this market in the region can be attributed to the advanced infrastructure, increase in healthcare expenditure, and increase in consumer's focus on availing preventive healthcare services.

Europe accounts for the largest market share owing to the well-established healthcare systems, growing geriatric population, and pathogenetic burden of chronic diseases in the nations such as Germany, UK, and France. Increasing adoption of digital healthcare solutions in hospitals and homecare environments are enhancing the demand for advanced vital signs monitoring technologies.

The European Union regulatory emphasis on patient safety and standardization of medical devices was a driving factor for certified high-accuracy monitoring systems. Dynamic and diverse, the continued expansion of telemedicine, remote diagnostics and AI-powered health tracking programs are also changing the service delivery models across the healthcare landscape throughout the region.

As self-health monitoring and wearable technology becomes more prevalent, smartwatches, biosensors, and wireless monitoring patches are in demand. Through the implementation of government-backed digital health policies, market expansion is supported as innovation in portable and connected monitoring devices takes place.

Asia-Pacific is set to be the fastest-growing region in the vital signs monitoring devices market, due to surging urbanization, expanding healthcare needs, and rising adoption of digital health technologies. There is increasing concurrent investment in healthcare by countries like China, India, Japan, and South Korea further catalysing consumer interest in proactive health monitoring.

The growing prevalence of chronic diseases and the expanding availability of telemedicine and mobile health applications are driving the need for affordable and scalable monitoring solutions. The increasing prevalence of smartphone use and wearable health monitoring devices in urban communities is also transforming the healthcare of the region.

These are some of the key drivers for growth such as China’s leadership in AI-based healthcare innovations & India’s developing market for affordable monitoring solutions. In addition, integration of monitoring platforms that are based on cloud in hospital systems as well as development of AI-driven diagnose algorithms are anticipated to stimulate adoption rate in the region.

Challenges

Opportunities

AI-powered wearable monitors, remote diagnostic tools, and contactless health sensors were able to win fast-tracked approvals from regulatory bodies including the USA Food and Drug Administration (FDA), European Medicines Agency (EMA), and International Organization for Standardization (ISO) to address surging demand for accurate, real-time tracking of vitals.

The worldwide shift to digital healthcare also drove the demand for IoT-enabled smartwatches, ongoing blood pressure trackers, wireless ECG patches, and mobile-based diagnostic applications. Cloud connectivity and real-time data sharing, combined with the AI driven predictive analytics enabled physicians to identify early signs of cardiovascular, respiratory and metabolic conditions to prevent life threatening complications.

Ultra-low-power biosensors, miniaturized health monitoring chips, and smart textiles capable of tracking vital signs in the background without interaction with the user were made possible. Wearable sensors (photo plethysmography (PPG) and electrocardiography (ECG) mounted on a device) became essential to track cardiac health for real time data of arrhythmia and pulse monitoring.

By seamlessly connecting 5G and AI-based analytics platforms, continuous remote patient monitoring was implemented, allowing for early disease detection and personalized treatment recommendations and transforming healthcare from reactive treatment to proactive prevention. And touchless infrared thermometers, smart blood pressure cuffs and digital pulse oximeters saw clinical and home use take off.

Challenges remained, however, including high device costs, data privacy issues and regulatory complications, despite rapid advances. With connected health devices becoming more prevalent, and cybersecurity risks increased, manufacturers had to comply with HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) standards. In our study, we found that the concerns over the device accuracy, the calibration of sensors, and the lack of interoperability limited the widespread deployment of these devices in some geographical areas.

But by moving towards job saving, AI enabled, consumer accessible monitoring devices manufacturers began to make these devices available in more market segments, catering to high-income and developing healthcare sectors.

By 2025 to 2035 Healthcare IoT has witnessed major transformation in vital sign monitoring devices datamining using AI driven health analytics, continuous real time monitoring and integration of smart neural interfaces. The future will witness the advent of wear and wearable multi-sensor health patches for constant comprehensive patient tracking, AI-assisted predictive diagnostics with real-time alerts, and non-invasive bio sensing platforms.

Rather than being a simple cuff, probe, or electrode, implantable and skin-integrated biosensors will enable continuous and real-time, nonuser-driven health monitoring. Wearable devices using AI-enhanced nano-sensors integrated into smart textiles or used in skin patches or disposable and biodegradable implants will regulate blood pressure, glucose levels, hydration, and metabolic health with precision.

Block chain-backed electronic health records (EHRs) will enable secure and tamper-proof data sharing through its decentralized framework, which will improve patient-doctor interaction as well as healthcare decision-making.

The next evolutionary phase of our traditional AI-assisted vital signs interpretation with help the doctor to build a tailored and super early symptom prediction systems that help to predict cardiac arrest, stenosis, respiratory failure and metabolic imbalances months ahead of clinical symptoms.

Quantum-enhanced AI, for example, will enable planetary-scale processing of extremely large datasets, ultimately delivering real-time, accurate and predictive insights into a patient’s health - giving clinicians the ability to make speedier and more accurate diagnoses. To further this goal, advancements with 5G and edge computing will facilitate seamless connectivity between connected wearable devices, onsite AI diagnostic hubs, and cloud-based healthcare platforms, thereby minimizing response times for urgent clinical interventions.

Health monitoring will enter a new frontier with cognitive monitoring, stress analytics, and emotional health sensors in addition to the existing areas of chronic disease management. Combined with AI-powered illusions of neuro feedback devices, which use the power of feedback to alter brain activity and believe that they can adjust neurotransmitter levels, smart EEG-integrated wearables, and mood-sensing biosensors will provide insights into mental health conditions in real time, such as depression, anxiety, and neurodegenerative illness.

More advanced self-powered, biodegradable, and battery-free medical devices that charge using solar energy will also come into practice, thereby removing the need to replace batteries and creating environmentally friendly medical technology.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments sped up approvals of wearable ECGs, continuous blood pressure monitors and smart pulse oximeters, to enable remote patient care. |

| Technological Advancements | Devices integrated 5G, AI, and IoT, enabling real-time remote tracking of heart rate, oxygen levels, and body temperature. |

| Industry Applications | Hospitals, home healthcare, and telemedicine platforms relied on connected health devices for vital signs tracking and early disease detection. |

| Adoption of Smart Equipment | Wearable ECGs, smart blood pressure cuffs, and AI-driven thermometers gained widespread adoption. |

| Sustainability & Energy Efficiency | Battery-powered monitoring devices improved with longer battery life and energy-efficient sensors. |

| Data Analytics & Predictive Maintenance | AI-assisted real-time monitoring platforms and cloud-based diagnostics enhanced patient care and disease prediction. |

| Production & Supply Chain Dynamics | The pandemic increased demand for remote patient monitoring devices, but supply chain disruptions affected semiconductor and sensor availability. |

| Market Growth Drivers | Growth was fuelled by telehealth expansion, aging populations, and the need for continuous health tracking. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered self-diagnostic health devices, block chain-secured patient data laws, and cybersecurity regulations will redefine compliance in connected healthcare. |

| Technological Advancements | AI-powered nano-sensors, implantable vital sign trackers, and neural-integrated wearables will redefine personalized health monitoring. |

| Industry Applications | Expansion into cognitive function monitoring, AI-powered stress tracking, and real-time emotional health diagnostics will reshape the industry. |

| Adoption of Smart Equipment | Multi-sensor biometric wearables, AI-powered skin patches, and real-time hydration tracking will enable continuous, automated health monitoring. |

| Sustainability & Energy Efficiency | Self-powered, biodegradable, and solar-charged medical devices will drive sustainability in vital signs monitoring. |

| Data Analytics & Predictive Maintenance | Quantum-enhanced AI health forecasting, edge computing-powered vitals tracking, and AI-driven self-diagnosis will revolutionize healthcare. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized health manufacturing, and automated medical device production will improve global access to monitoring technology. |

| Market Growth Drivers | Neural-integrated health monitoring, AI-powered emotional health analytics, and real-time, automated diagnostic platforms will shape future healthcare monitoring. |

In North America, the United States Vital Signs Monitoring Devices Market is growing exponentially with the upsurge in chronic diseases, growth of remote patient monitoring (RPM) as well as development in wearable health technologies. The growing geriatric population and the growing adoption of telehealth solutions has been triggering the demand for blood pressure monitors, pulse oximeters, ECG devices and temperature monitors.

The market is mainly driven by rising prevalence of cardiovascular diseases (CVDs) and hypertension. About 48% of USA adults suffer from hypertension, according to the CDC, so timely home-based BP monitors and wearable ECG devices are key.

The other primary reason is the increased use of remote patient monitoring (RPM) programs. Hence why Medicare has expanded their reimbursement policies about home monitoring with the kind of patient with chronic diseases and they will pay less to monitor their vital signs.

The rise in use of AI, and IoT, in wearable health devices is also contributing to market growth. Smart watches tracking ECG, SpO₂, and real time vitals are also being increasingly popularized by companies like Apple, Fitbit, and Garmin to promote consumer wellness and clinical settings.

Moreover, with the rising adoption of hospital-at-home programs, the demand for vital signs monitoring kits in home healthcare settings (particularly those involving post-operative care and chronic disease management) is increasing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.3% |

With the increasing prevalence of chronic diseases and preventive healthcare initiatives, the demand for wearable monitoring devices is on the rise in Countries like United Kingdom and supported by the government to proliferate digital health solution in the UK. The NHS has been leading the development of the adoption of vital signs monitoring into primary care and home health care programmes.

The growing aging population in the United Kingdom is one of the major reasons which have catered towards the increasing need for home-based blood pressure monitors, ECG Devices, and pulse oximeters as 18% of their population is over than 65 years.

Another major factor is the rise of telemedicine and home care services. The UK government has invested more than £250 million in digital health initiatives, from patient remote monitoring to AI diagnostics.

Additionally, increasing use of wearable health technology is contributing to the market growth. Both healthcare providers and consumers are utilizing AI-driven smartwatches and wireless BP monitors to detect early signs of hypertension and heart disease.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

The Prevalent Market For Vital Signs Monitoring Devices Vital Signs Monitoring Devices Market In European Union The market is being driven by the governments in the European region focusing on investments related to the digital health along with a growing geriatric population and the ever-increasing demand for remote health monitoring within the patient population als. The EU’s eHealth Initiative and Digital Health Strategy will drive the expansion of telehealth and connected monitoring devices.

Germany, France, and Italy are among the leading countries in the integration of AI-based diagnostic tools and vital signs monitoring solutions in hospital settings. As the EU’s geriatric population is set to rise to 150 million by 2050, demand for home-basing health monitoring is increasing.

The growing effort to prevent cardiovascular diseases (CVDs), which contribute to more than 45% of total deaths in continent Europe is fuelling the demand for wearable ECG monitors, digital BP monitors, and pulse oximeters.

Moreover, the growing focus on smart hospital programs is one of the major factors of continuous vital signs monitoring market revenue, as it provides an additional patient safety layer along with an early detection of a disease in ICU and general hospital wards.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.0% |

Japan Vital Signs Monitoring Devices Market Overview Japan Vital Signs Monitoring Devices Market is expected to 642.70 million by 2025 with a 93% CAGR during the forecast period. Japan is home to one of the oldest populations in the world, where more than 28% of its citizens are aged 65 or above, thus driving the need for continuous health monitoring solutions.

Japan government is investing heavily in the area of digital health, issuing billions in research grants for wearble ECG monitors, smart BP monitors, and AI powered Health tracking-devices for remote monitoring of patients.

Another major driver is the increasing adoption of AI and robotics in healthcare. Imagine the breakthrough in blood pressure monitoring, pulse oximeters, or smart health wearables led by Japanese companies like Omron, Fujitsu, and Sony.

Japan’s 5G-enabled smart healthcare infrastructure service is another major sector to improve real-time remote patient monitoring, where patients’ vital signs and other units of their health can now be accurately and continuously tracked during home-based and elderly living arrangements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

The South Korea vital signs monitoring devices market has very few market players that have invested to develop sophisticated technologies for real-time monitoring of vital signs such as heart rate monitoring, blood pressure monitoring and cardiac output monitoring. The South Korean government's investment in smart healthcare technologies is creating opportunities for innovation in AI-driven remote monitoring devices.

Growing incidences of chronic diseases, including hypertension and diabetes are increasing the uptake of portable ECG monitors, smart BP monitors and digital pulse oximeters. The Ministry of Health and Welfare in South Korea has rolled out programs to augment telemedicine and AI-driven diagnosis solutions with real-time patient monitoring systems.

The widespread rollout of 5G networks is facilitating real-time communication of monitor data from wearable health devices to cloud-based health monitoring platforms, driving telemedicine and home health care initiatives forward.

Also, Samsung, LG, and Meditronics Korea - among others - are leading South Korea’s solid medtech industry, which is another driver behind ongoing breakthroughs in wearable health monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

The mid acuity monitors segment in the vital signs monitoring devices market which are under monitors segment and automated blood pressure monitors segment under blood pressure measurement devices together lead the market due to the growing emphasis on accurate, real-time patient monitoring by healthcare givers for chronic diseases, emergency care delivery, and telehealth working. Such devices are key for early disease detection, hospital triage, post-operative monitoring and home healthcare, leading to better patient outcomes, reduced hospital readmissions and enhanced clinical decision-making.

The mid acuity monitors segment is one of the important segments of the vital signs monitoring devices market that provides continuous measurement of heart rate, blood pressure, respiratory rate, oxygen saturation (SpO₂), and temperature in hospitals, step-down units, and ER. Mid acuity monitors are designed for a different level of care than high acuity monitors that are used on critically ill patients in intensive care units (ICUs) and low acuity monitors that are typically used while patients are in with a doctor for a routine check-up.

The growth of step down care units and intermediate care facilities has spurred demand for mid acuity monitors, regardless of the state of hospitalization, as hospitals demand cost-effective yet complete monitoring solutions for patients in recovery from surgery, recently released from the ICU, and moderately compromised patients. Connected these monitors transmit real time data including alerts to notify doctors of abnormal vitals by sending them through the hospital electronic health record (EHR) system thus providing proactive management of patients and timely medical intervention.

Mid acuity monitors are also extensively used in the emergency and trauma care sector as these devices help assess patients' stability before being admitted to the ICU or discharged to general care wards by medical professionals like paramedics, emergency physicians, triage teams, and so on. Portable versions of these monitors are used in ambulances, urgent care clinics and field hospitals to assess patients quickly and precisely in emergency settings.

There has also been increased adoption of mid acuity monitors in home healthcare and telemedicine, where remote monitoring solutions are sought for patients with chronic diseases, elderly patients, and post-operative patients to monitor vital signs away from traditional healthcare setups. Smart mid acuity monitors featuring AI-driven analytics, Bluetooth connectivity, and cloud-based data sharing allow physicians to monitor a patient’s progress in real-time, modify their treatment plans remotely, and minimize hospital visits.

Mid acuity monitors have found greater adoption, but they struggle with things like cost, data privacy risk, and complexity of integration for existing hospital infrastructure. Technology advancements including AI-enabled predictive analytics, wearable sensor technology and wireless patient monitoring networks are helping drive device accuracy, interoperability and access, ensuring continued market expansion.

Intended Usage Segment Growth: Blood pressure monitors Automated have been adopted throughout the market, most notably, in the prevention of hypertension, cardiovascular disease, and telehealth services as ever more patients and practitioners look for device solutions which make monitoring blood pressure outside of the bloodstream, easy, convenient, and clinically accurate. Automated blood pressure monitors deliver digital readings with very little input from their users, as opposed to manual sphygmomanometers that require the operator to inflate the cuff and listen for Korotkoff sounds.

Increasing prevalence of hypertension and cardiovascular disease has led to a surge in demand for automated blood pressure monitors, as millions of patients need to monitor blood pressure on a daily basis to manage high blood pressure, identify early signs of cardiovascular complications, and to ensure medication adherence. More physicians have become advocates of home-based blood pressure monitoring (HBPM) devices, which allow patients to regularly monitor their readings, identify periods of elevation, and transmit real-time data to their physicians.

Additionally, the increasing aging population and rising awareness regarding preventive healthcare have also encouraged the growth of the automated blood pressure monitor market as elderly people need repetitive monitoring for hypertension, orthostatic hypotension, and postural blood pressure variations. The introduction of portable, wrist-worn, and wearable blood pressure monitors has also improved patient compliance and accessibility.

Automated blood pressure monitoring has also gained traction in hospitals, outpatient clinics, and long-term care facilities, where they provide rapid, non-invasive assessments of patients during routine check-ups, pre-surgical evaluations and post-operative recovery. Clara’s digital blood pressure monitors connected to HIS and AI-driven insights enable clinicians to spot trends, catch at-risk patients early, and tailor therapies.

Few of the automated blood pressure monitors available in the market today are approved by the FDA in the USA, however, they pose challenges such as variations from accuracy, device calibration, and over-reliance on self-measured BP without having a professional BP monitoring. On the other hand, the development of AI-enabled blood pressure trends analytics, cuff-less BP measurement technology and smart health integration with fitness wearables are enhancing the measurement precision, usability, and long-term monitoring stability which will stimulate the market growth over the period.

Standalone and portable mount types form the two major categories of the market, as the healthcare providers, home care patients and emergency responders seek mobile, compact, easy-to-use devices for continuous and point-of-care vital signs monitoring.

No hands-free monitoring devices are standard issue in hospitals, urgent care centres, and physician offices, because they provide real-time, thorough vital sign analysis in a structured healthcare setting. Whatever their location, these monitors provide continuous monitoring of blood pressure, heart rate, respiratory rate, oxygen saturation, and temperature.

Standalone monitors when integrated with hospital electronic medical records (EMRs) and artificial intelligence-based clinical decision support systems (CDSS) have increased patient safety, workflow efficiency, and reduced diagnostic errors. These devices assist clinicians in identifying signs of deteriorating patients, managing high-risk patients, and automating vital sign documentation.

Standalone monitors are also increasingly adopted in surgical and ICUs environments, where healthcare professionals need real-time, highly accurate vital sign monitoring to help ensure stability of patients during and post-procedure. They enable rapid intervention and improved clinical outcomes by providing immediate alerts for abnormal readings.

Standalone monitoring devices come with their own merits, but they are limited by their high installation cost, lack of portability, and dependence on centralized hospital infrastructure. But improvements in touch-screen displays, AI-assisted predictive analytics and real-time data sharing are boosting usability, functionality and clinician efficiency and keeping market demand alive.

Portable monitoring devices have witnessed widespread use in home healthcare, ambulatory monitoring, and emergency medical services (EMS) as patients and healthcare providers demand lightweight, mobile, and easy-to-use devices for off-the-shelf health monitoring. Portable devices are dissimilar from standalone monitors as it enables patients to check their vital parameters regularly from home or on the go, promoting continuous health monitoring and decreasing reliance on hospitals.

The growth of telehealth and remote patient monitoring programs has driven demand for portable monitoring devices, as physicians come to rely on wireless, cloud-connected sensors to monitor patients’ vital signs in real time. These devices facilitate virtual consultations and enable remote chronic disease management and post-operative recovery monitoring, all of which help to mitigate hospital admissions and reduce costs for health systems.

Portable monitoring devices not only benefit hospital and clinical providers, but also emergency responders and field healthcare providers by providing paramedics with lightweight, battery power monitors to complete pre-hospital evaluations, trauma response, and disaster relief efforts.

And yet, despite their rapid adoption, portable monitors face challenges including connectivity issues, battery life limitations, and data privacy concerns. The market for portable vital signs monitoring devices is witnessing continuous growth globally, which is driven by emerging innovations in AI based diagnostics, integration of wearable sensors, real time cloud based monitoring improving device accuracy, security and level of patient engagement in the treatment of disease.

The market for vital signs monitoring devices is expected to grow considerably in response to a growing demand for remote patient monitoring, early disease detection, and AI-integrated health diagnostics. Wearable health trackers, wireless connectivity between devices, and AI-powered predictive analytics for enhanced monitoring, hospital optimization, and at-home care have become the focal areas for companies. First is the global leader which mostly consists of general and specialized manufacturers of blood pressure monitors, ECG models, and pulse oximetry systems that are compatible with multi-parameter monitoring systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 12-17% |

| GE Healthcare | 10-14% |

| Philips Healthcare (Koninklijke Philips N.V.) | 9-13% |

| Omron Healthcare, Inc. | 7-11% |

| Masimo Corporation | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Develops wearable and implantable ECG monitors, multi-parameter patient monitoring systems, and AI-driven predictive health analytics. |

| GE Healthcare | Specializes in hospital-grade vital signs monitors, wireless patient monitoring solutions, and real-time clinical decision support systems. |

| Philips Healthcare | Produces multi-parameter bedside monitors, wearable biosensors, and remote patient monitoring platforms for ICUs and home healthcare. |

| Omron Healthcare, Inc. | Offers AI-powered blood pressure monitors, pulse oximeters, and ECG wearable devices focused on hypertension and heart health management. |

| Masimo Corporation | Leads in advanced pulse oximetry, remote monitoring sensors, and wireless vital signs tracking for hospital and home care applications. |

Key Company Insights

Medtronic plc (12-17%)

Vital signs monitoring devices are primarily provided by Medtronic, which crafted smart multi-parameter monitoring systems integrating AI-powered analytics and remote health tracking. The company specializes in cardiac health monitoring and hospital-to-home management of patients.

GE Healthcare (10-14%)

As listed under GE Health Care, GE Healthcare focuses on real-time hospital monitoring solutions and offers technologies such as wireless vital signs, automatic patient data input, and the likes. Its emphasis on early disease detection and predictive analytics in a holistic manner enhances its competitive differentiation.

Philips Healthcare (9-13%)

Philips offers both wearables and bedside monitoring for health tracking-ideal for continued care in ICU and home settings. The company adds features for IoT-enabled patient monitoring and AI-driven diagnostics into its catalog of products.

Omron Healthcare, Inc. (7-11%)

Omron has long been a leader in home-based vital signs monitoring with its AI-enhanced blood pressure monitors, ECG wearables, and oxygen saturation meters. The firm is also building a broad ecosystem for managing hypertension and heart disease.

Masimo Corporation (5-9%)

About Masimo Masimo is a medical technology company that develops innovative non-invasive monitoring technologies including the use of advanced pulse oximetry, pulse CO-Oximetry, and other non-invasive monitoring systems to measure vital signs in hospitals and in the most remote ecosystems. Despite predictions of doom, the company is thriving with its cloud-based data integration and real-time alerts for patients.

Other Important Players (45-55% Combined)

Manufacturers developing AI-enabled health monitoring, miniaturized bio sensing, and high-precision multi-parameter monitoring systems. These include:

In USD 2025, the total market size for Vital Signs Monitoring Devices Market was USD 8.6 Billion.

USD 17.8 Billion is expected to be the value of the Vital Signs Monitoring Devices Market by 2035.

The growing importance of preventive healthcare, the increasing number of elderly people, the increasing prevalence of cardiovascular and respiratory diseases along with technological advancements in the field of telemedicine and remote monitoring of patients are likely to drive the demand for vital signs monitoring devices.

Countries leading the development of Vital Signs Monitoring Devices Market are USA, UK, Europe Union, Japan and South Korea.

Mid Acuity Monitors and Automated Blood Pressure Monitors to Lead Market share during forecast period.

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Bleeding Control Tablets Market Analysis - Growth, Applications & Outlook 2025 to 2035

Burn Matrix Devices Market Insights - Size, Share & Industry Growth 2025 to 2035

Chlorhexidine Gluconate Dressing Market Outlook - Size, Share & Innovations 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.