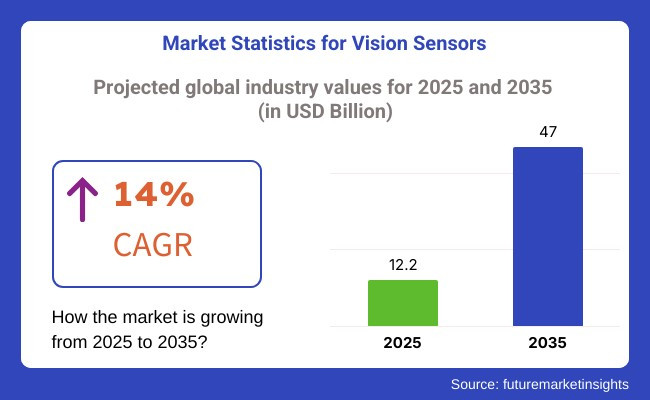

The global vision sensor industry has Millions of high-precision vision sensors will drive innovations in automotive assistance and automated driving systems. is projected to reach USD 12.2 billion by 2025 and expand at a 14.0% CAGR, reaching USD 47 billion. Rising demand in industrial automation and manufacturing is fueling market growth.

Vision sensors, known for innovation and adaptability in tough environments, are increasingly used in barcode scanning within retail and consumer goods. Advancements in electronics and automation technology further drive adoption, making vision sensors a key industry driver.

Explore FMI!

Book a free demo

From 2020 to 2025, vision sensors transformed industries. And businesses began using them constantly for quality control, making sure car parts, electronics and more were up to snuff. As a result vision sensors were not just another tool, they formed a critical part of increasing efficiency in manufacturing and accuracy.

From 2025 to 2035, visual sensors are expected to become even more sophisticated. With AI and machine learning in the game, they won’t merely observe; they’ll analyse, anticipate, even make decisions. Edge computing is going to accelerate these applications, reducing latencies and enhancing real-time applications such as the ones fuelling smart cities and autonomous vehicles.

GANs trained to predict how these processes “should” work are distributed across supply chains, replacing more rudimentary knowledge-based products and going far beyond factories into healthcare, consumer gadgets and environmental monitoring. The future is automated, intelligent and more connected than ever before.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for industrial automation | High initial investment costs |

| Advancements in AI and machine learning | Integration challenges with existing systems |

| Rising adoption in automotive and electronics | Limited awareness in small and medium enterprises |

| Increased use in quality control and inspection | Concerns over data security and privacy |

| Expansion into healthcare and consumer electronics | Dependency on stable internet and power supply |

| Growth of smart cities and IoT applications | Technical complexities in implementation |

Impact of Key Drivers

| Key Drivers | Impact |

|---|---|

| Growing demand for industrial automation | High |

| Advancements in AI and machine learning | High |

| Rising adoption in automotive and electronics | High |

| Increased use in quality control and inspection | High |

| Expansion into healthcare and consumer electronics | Medium |

| Growth of smart cities and IoT applications | Medium |

Impact of Restraints

| Key Restraints | Impact |

|---|---|

| High initial investment costs | High |

| Integration challenges with existing systems | Medium |

| Limited awareness in small and medium enterprises | Medium |

| Concerns over data security and privacy | Medium |

| Dependency on stable internet and power supply | Low |

| Technical complexities in implementation | Medium |

The demand for less-than-3D vision sensors will grow during the forecast period, driven by their widespread use in inspection and code-reading applications.

One-dimensional and two-dimensional vision sensors will dominate the market, as industries such as automotive, electronics, semiconductors, pharmaceuticals, and food packaging increasingly rely on them for inspection, measurement, barcode scanning, and object localization. Companies in Asia-Pacific, Europe, and North America will continue to adopt these sensors to enhance automation and quality control in manufacturing and logistics.

The vision sensor market for code reading will experience the fastest growth during the forecast period. Industries such as food and beverages, packaging, and logistics will increasingly rely on code reading for product identification and tracking.

One-dimensional and two-dimensional code readers, whether fixed or handheld, will play a key role in marking products and monitoring their movement along conveyor belts or during transportation. Rising demand from the automotive and food packaging sectors will further drive the adoption of vision sensors for code reading, contributing to overall market expansion.

The automotive industry will remain the largest user of vision sensors due to their growing role in inspection, identification, and localization. Manufacturers will rely on these sensors to inspect parts, detect faulty components, identify misalignment, and guide robotic arms in assembly processes.

The push for factory automation to reduce manufacturing time and inspection costs will further drive demand. North America, Asia-Pacific, and Europe will see significant adoption as automakers integrate vision sensors to enhance efficiency and precision in production.

The automotive, pharmaceutical, and food packaging industries in the Asia-Pacific region have grown rapidly in recent years. Rising disposable income and population shifts have increased demand for consumer goods, driving manufacturers to adopt automation to improve efficiency, reduce costs, and enhance product quality. As companies continue to integrate automated systems into production, the demand for vision sensors in these industries will keep rising throughout the forecast period.

The United States will continue to be an epicentre of innovation owing to booming automation, AI deployment, and growing use of industrial robotics in various sectors. The growing use of vision sensors in industries such as automotive manufacturing, healthcare diagnostics, and consumer electronics will drive demand.

High investment in smart factories and intelligent factories & Industry 4.0 is also likely to drive demand. The retail vertical will also play a role, as vision sensors improve self-checkout systems and inventory management. The USA government initiatives are in-sight of support for AI and automation, coupled with the major players are maximizing innovations in sensor, hence would drive the market position of the USA as the leader during the forecast period.

The market for vision sensor in Canada will see a consistent increase, driven by its expanding industrial automation and smart manufacturing sector. Demand will be driven by the country’s focus on AI-driven technologies and robotics in sectors such as automotive, aerospace, and healthcare.

As the companies pursue automation to improve efficiency, the penetration of vision sensors in logistics and warehousing will increase. The government’s investment in technology-driven infrastructure projects will accelerate adoption.

The Canadian agricultural industry will also incorporate vision sensors for the precision farming of crops, helping to monitor crops IP54 dust and water-proof housing for outdoor use. The growing number of research collaborations is likely to favour its prospects with emerging tech start-ups, thereby creating a propelling demand in the Canada market during the forecast period.

Vision sensor sales in the UK will also grow at a significant rate due to increasing automation in manufacturing and growth of smart factories. The strong automotive industry in country will propel the demand for vision sensors in quality inspection and driver assistance systems. The AI-enabled diagnostics and robotic surgeries will integrate the vision sensors in the healthcare.

More advanced barcode scanning and inventory management solutions will also be beneficial for retail and logistics sectors. And, with on-going investment in AI, IOT, and Industry 4.0 technologies, the UK will continue to be a key European market for vision sensors, especially to improve security and automate processes.

In France, vision sensor adoption is likely to take a leap driven by its focus for industrial automation, aerospace, and healthcare. The vision sensors, for the safety of vehicles and production line efficiency, will be integrated with the country’s strong automotive manufacturing base.

Advanced vision sensors are being adopted by aerospace companies for navigation, inspection, and surveillance. Sensory vision insights will be used to automate and optimize the supply chain in the retail and logistics industry. In addition, the healthcare sector will also contribute with visual sensors for medical imaging and surgical applications. With support from the government on AI and automation initiatives, the French market will also expand, solidifying the status of France as another player in the industry.

Germany’s strengths in industrial automation and smart manufacturing will drive substantial growth for the vision sensor market there. In robotics, automotive assembly and factory automation, the country's push for Industry 4.0 will create demand for high-precision vision sensors. The automotive sector will continue to integrate vision sensors in applications as autonomous driving, collision detection and quality control.

AI will help the healthcare industry with better medical imaging and diagnostics. Logistics and retail will follow suit with vision sensors for warehouse automation systems and smart checkout. They will stay as a European top performer in the vision sensor technology with the solid development and investment in R&D as well as the advanced industrial base.

Stronghold in consumer electronics, robotics, and smart manufacturing will spur the growth of South Korea’s vision sensor market in the coming years. The major tech companies of the country, as well, will keep on pushing the innovation envelope for the different applications of vision sensors across smartphones, smart TVs, and wearable electronic devices.

The automotive market will deliver vision sensors for driver assist and automated vehicle technologies. The health sector will harness sensory vision for diagnostic imaging, robotic-assisted surgeries. As the country is investing significantly in AI, IOT, and automation, the need for advanced vision sensor solutions will drive the growth of this market in South Korea, becoming one of the major markets in Asia during the forecast period.

Japan will continue to be a key market for vision sensors globally. During the course of the forecast period, vision sensor sales are likely to become a mainstream component of robotic systems and quality control in the country due to its strength in smart manufacturing. Tens of millions of these high-precision vision sensors will enable the automotive sector to keep innovating in driving assistance and automated driving systems.

Demand will also be boosted from healthcare applications like robotic surgeries and AI driven diagnostics. This is essential as Japan, which is making a big push toward AI and machine learning technologies, will bring about more advanced features for vision sensors and positions Japan to become a leader in automation through intelligent vision systems.

China's vision sensor industry will leverage from its blooming industrialization and automation and expected to grow exponentially. Demand across sectors will be fanned by the government's thrust on smart manufacturing and AI and IOT. The automotive industry will see the introduction of vision sensors for electric and autonomous vehicles, while the tech player will develop smart devices.

Sensory vision will be relied upon by the logistics and e-commerce sectors for warehouse automation and optimized delivery. Driven by significant private investments in R&D, coupled with strong electronics manufacturing capabilities, China is set to maintain its leading role in the vision sensor industry and will see continued market growth throughout the forecast period.

The Indian vision sensor market will witness rapid growth, driven by growing adoption of automation, AI, and industrial modernization. The increasing demand from the manufacturing industry for vision sensors to be used in quality control and robotics application will drive up demand.

E-commerce and logistics sectors will weave sensory vision into feeder systems for inventory tracking and automated sorting. Automotive driver assistance systems and safety applications will grow. Vision sensors will be used for diagnostics and telemedicine. The vision sensor market in India is therefore anticipated to witness strong growth over the next few years with government programs focused on AI and smart manufacturing further supporting widespread adoption.

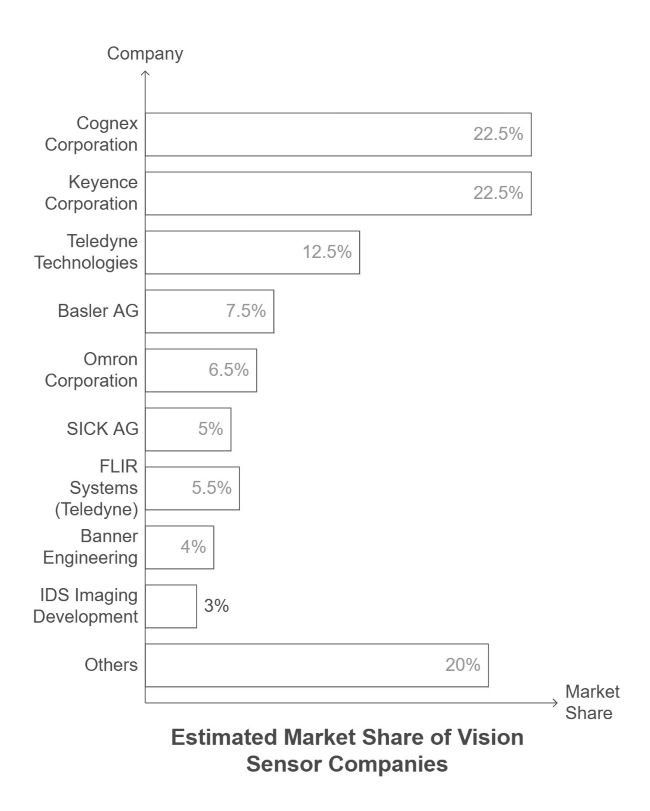

The vision sensor industry is highly consolidated, with Tier 1 players accounting for almost 90% of total market share. Leading players utilize strong R&D, distribution channels, and branding to establish a competitive advantage.

The big players are constantly innovating and combining AI, machine learning or even further automation into the vision sensor revolution addressing more and more the pains of adapting new systems into the manufacturing process as a whole, this has led to challenges for the smaller player to compete on such scale. Market remains consolidated among few global players due to heavy entry barriers, forecast capital investment and technological expertise required.

However, Tier 1 companies will face growing competition in terms of niche applications and pricing from emerging participants and regional manufacturers. New start-ups work wonders in industries like healthcare, automation in retail, and even developments in robotics, which means the potential to create new markets.

In this environment, strategic partnerships and mergers and acquisitions are frequent as larger companies seek to enhance their technology offerings and gain access to high-growth geographies. Although consolidation is breaking out, growing demand for customized vision sensor solutions is helping new entrants differentiate into specialized market segments, resulting in a wide and rapidly-adapting competitive landscape.

Vision sensor market buzzes as major players double down on innovation, acquisitions, and partnerships in 2024. In a bold move, Motorola Solutions acquired Silent Sentinel, a London-based firm that specializes in long-range camera technology.

The acquisition helps bolster Motorola’s security and surveillance business, and it adds state of the art vision sensors to its line-up. Siemens is also taking some action buying Inspekto, an AI-based machine vision provider. Now, Siemens is poised to transform automated quality inspection and empower digital manufacturing with this acquisition.

At the same time, start-ups are revolutionizing the industry, bringing new ideas that attract large investments. India Leads Hydrogen Cards for Plasma Propulsion for Artemis 2024 Lunar Mission India’s start up space-tech company Pixxel raised USD 24 million in Series B funding to pursue its hyperspectral imaging satellites popularizing high-resolution Earth imaging.

A Washington firm, Lumotive, also received a serious boost from a USD 45 million funding round to push forward its optical chips for 3D sensing. They want to exchange the bulky mechanical LiDAR for sleek, efficient optical technologies. The race is on, and one thing's for certain-both established players and nimble innovators are pushing boundaries in vision sensor technology like never before.

Growth is driven by the advancements in automation, increase demand in the manufacturing and retail industries, and AI-based quality inspection.

Vision sensors for automation and quality control make up a significant portion of industries such as manufacturing, automotive, electronics, healthcare, and retail.

The future belongs to innovators, disruptors, both large and small, but industry incumbents will need to change too. From start-ups embracing AI-powered vision systems, compact designs and cost-effective solutions, each one will challenge the old guard to innovate or die.

Challenges to large-scale adoption continue to be high cost, complexity of integration, and a need for skilled professionals.

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Industrial Coupling Market Growth - Trends & Forecast 2025 to 2035

Portable Metal Detectors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.