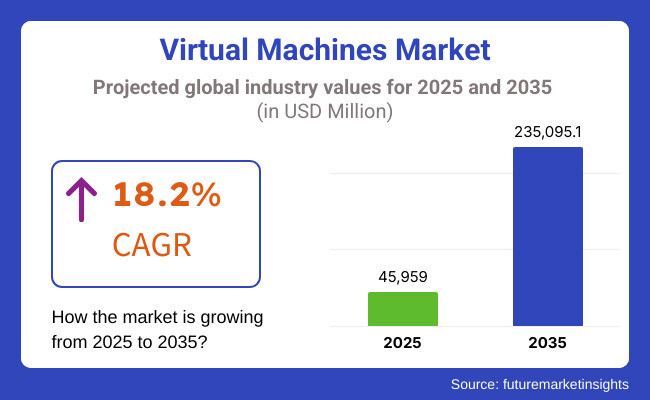

The global Virtual Machines market is projected to grow significantly, from USD 45,959.0 Million in 2025 to USD 235,095.1 Million by 2035 an it is reflecting a strong CAGR of 18.2%.

The risk management is becoming particularly important for organizations that handle virtual machines (VMs) from third-party vendors. Process/Application VMs or System VMs are not even sufficient for organizations to comply with security measures. This is a geography for industries like BFSI, healthcare, IT & telecom, etc. that requires comprehensive VM security from rogues to escape data breaches, unauthorized access, and operational disruptions.

As developing regulatory structures such as GDPR in Europe and CCPA in California take effect, organizations need to ensure that their VM deployments satisfy stringent data security and protection mandates. Third-party risk assessment of VM provider; Automated compliance tools are imperative for SMEs & Large Enterprises to monitor, evaluate and mitigate risk(s), and ease regulatory adherence.

Businesses are going digital, the first step in this process is the Cloud and cloud based virtual machines due to scalability, cost cuts, increase in operational efficiency. This increasing reliance on third-party cloud and IT service providers creates a demand for state-of-the-art risk management solutions that safeguard VM-based infrastructures and thwart compliance violations or security loopholes.

It has become increasingly important to continuously monitor and assess risk in real time due to the increasing occurrence of cyber threats aimed at virtual environments. Third-party risk management tools to Identify vulnerabilities in the outsourced virtual machine services. The VM, whether it is a third-party service or an externally engaged service in their system, and be able to detect whether malware, unauthorized access, data leaks, etc. are being introduced from the external service into the organization to command one or more systems or application systems.

The North American VM market is majorly driven by significant regulatory requirements around cybersecurity, presence of major VM solution providers, and high cloud adoption rates. At the same time, the growing digital economies and regulators in countries like India and Australia are increasingly driving demand for secure VM solutions. This global scale demand needs risk management solutions for the virtual machine environment.

Explore FMI!

Book a free demo

| Company | IBM and HashiCorp |

|---|---|

| Contract/Development Details | IBM agreed to acquire HashiCorp, a major player in cloud and IT infrastructure automation, for USD 6.4 billion in cash, aiming to bolster its cloud infrastructure capabilities. |

| Date | December 2024 |

| Contract Value (USD Million) | 6,400 |

| Renewal Period | Not applicable |

Rising adoption of cloud-based virtual machines for scalability and cost efficiency

Businesses are now adopting cloud-based virtual machines (VMs) for better scalability and driving cost efficiency. This change enables businesses to scale computing power up or down based on their requirements, without the need for large up-front investments in physical hardware.

When companies experience peaks in their operations, they can easily and quickly add more VMs to ensure they keep performing at their best, and then turn them off when the peak period is over and they no longer need them. This flexibility enhances operational efficiency while delivering substantial cost savings by moving away from capital expenditures to more predictable operational expenses.

For example, in the public sector, initiatives such as the USA Federal Government's "Cloud Smart" strategy highlights cloud adoption as a key priority, resulting in a focus on security, procurement, and workforce readiness to modernize IT infrastructures.

Growth in digital transformation initiatives driving VM adoption

Digital transformation initiatives have accelerated across industries, leading to an increase in the adoption of virtual machines. However, as organizations continue to modernize their operations, improve customer experiences, and stay competitive, their future relies on the integration of digital technologies.

In this paper, we present the underlying principles of virtualization as an approach to transform physical cement into a software infrastructure and discuss the role of virtual machines in supporting a variety of application and services deployments without being tied to specific physical hardware implementations.

For the public sector, the COVID-19 pandemic served as a catalyst, driving government agencies to adopt cloud solutions at an accelerated pace to continue delivering services while supporting changing public needs. The boom of digital initiatives highlights the increasingly prominent role of the OVM in providing the necessary infrastructure to enable innovation, agility, and resilience in an ever more digitized world.

Rising focus on cybersecurity and risk management in VM environments

With the increasing presence of virtual machine environments, so too comes an intensifying focus on cybersecurity and risk management practices to protect these infrastructures. Virtualization itself (the VM's ability to run on one physical host) raises different security concerns. That is why strong security protocols must be established to safeguard against unauthorized access and data breaches, as there are risks like VM sprawl, malware infiltration, and hypervisor attacks.

Machine learning algorithms for IoT security-these approaches focus on the use of machine learning algorithms to create effective detection systems for IoT attacks. Secure VM environments - there is an ongoing exploration of automated Interaction models, supported by machine learning algorithms, that can help improve the proactive defense of VM environments by predicting the likely attacks on such a setup. VMs are subjected to safety systems that secure not only the VMs but also the hardware and the hypervisor.

High initial setup complexity for configuring and managing VM environments

The process of setting up initial deployment of virtual machines (VMs) is a complicated and time-consuming process that takes a lot of planning and technical expertise. Organizations need to be well versed with how to set hypervisors, allocate compute resources, and set network connectivity, etc., which requires a deep understanding of virtualization technologies.

When trying to integrate VMs into existing IT infrastructure, the challenge further multiplies; virtualized and non-virtualized environments may not work well together. Factors such as choosing what should be stored, using random access memory (RAM) versus read-only memory (ROM) or processing power for optimal functioning all need to be fine-tuned, as poor choices can lead to crashes or inefficient use.

Moreover, the enterprises running more than one VM must also handle dependencies and interactions occurring between virtual instances. And then there are security configurations, firewalls, and access controls. Orchestration tools and management platforms are necessary for large-scale VM deployments, too, but they must be set up and monitored continuously. Additionally, organizations are required to invest either in skilled personnel, or leverage third-party expertise, which adds more complexity to the overall process.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments imposed cloud data localization requirements. |

| Cloud-Native Virtualization | Increased adoption of containerized virtual environments. |

| Hybrid & Multi-Cloud Growth | Enterprises embraced hybrid cloud models for scalability. |

| Cybersecurity & Data Protection | Demand for enhanced virtual machine security led to encrypted environments. |

| Market Growth Drivers | Surge in remote work and SaaS adoption drove VM demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Decentralized AI governance ensures compliance with global cloud computing laws. |

| Cloud-Native Virtualization | AI-powered virtualization minimizes resource overhead and enhances efficiency. |

| Hybrid & Multi-Cloud Growth | Autonomous cloud platforms optimize workload distribution in real time. |

| Cybersecurity & Data Protection | Quantum-secure encryption ensures data protection against next-gen cyber threats. |

| Market Growth Drivers | AI-optimized virtual infrastructure enables cost-effective, autonomous computing environments. |

Based on the concentration of vendors, VM market can be defined as moderately high to highly concentrated, where Tier- 1 vendors have strong market power owing to their multiple sources, massive portfolio of services, and the number of patrons served. They remain dominant, because they are in continuous innovation mode and can provide integrated solutions that meet the complex requirements of large enterprises.

By capitalizing on specialized knowledge, establishing partnerships, and developing customer-driven solutions, tier 2 vendors remain a competitive force. They frequently vie with one another by providing niche functionalities, attractive pricing models, or enhanced customer service.

Smaller Tier 3 vendors help make up for that market diversity through niche targets, open-source options or emerging technologies. It enables them to react swiftly to changing market trends and customer demands.

The section highlights the CAGRs of countries experiencing growth in the Virtual Machines market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 25.7% |

| China | 24.2% |

| Germany | 19.8% |

| Japan | 22.5% |

| United States | 21.8% |

Under government-led initiatives, the development of digital infrastructure has been quickly made in China, which promoting cloud-based virtual machine (VM) in the industry. Considering policies, including the "New Infrastructure" plan and the "14th Five-Year Plan" on cloud computing, artificial intelligence, data centers, and other data-driven industries, businesses and public institutions are rapidly hosted on VM-based cloud environments.

The government has required state-owned enterprises (SOEs) and government agencies to modernize their systems by adopting cloud; as part of this modernization, virtual machines are being deployed to improve performance and reduce costs. Moreover, the launch of China’s "East Data, West Computing" project plays a significant role in balancing computing power distribution, which leads to a huge increase for VM requirements in data centers located in western provinces.

To start, China, in its”3-Cloud” policy announced over 70% of public sector IT workloads must be migrated to domestic cloud environments by 2025. As a result, when state-backed clouds began enhancing their VM offerings this drove up competition and innovation. China is anticipated to see substantial growth at a CAGR 24.2% from 2025 to 2035 in the Virtual Machines market.

The growing digitization backed by the government and cost-effectiveness and flexibility has led to an increase in adoption of open-source virtual machine platforms around the SMEs in India. One of the most prominent benefits of the "Digital India" program has been the proliferation of cloud-based technologies, which have encouraged organizations to engage with open-source virtualization for affordable computing.

With the growing demand for IT services, e-commerce, and fintech companies are propagating out to strategy (SMEs) tend to gravitate toward the migration of their existing on-premise infrastructure to VM-based cloud environments to be able to scale as per their consumer demand without an extensive capital investment. There has been a trend towards open-source platforms like KVM and Proxmox due to the desire for lower licensing costs and more customization.

To facilitate this transition, Indian government has introduced programs such as the “National Cloud Initiative”, which provides cloud credits and incentives to startups and SMEs. India's Virtual Machines market is growing at a CAGR of 25.7% during the forecast period.

HPC strives for distributed and vector processing, and the USA is ahead of the world in this direction. And, with government-backed research initiatives and collaborations with private tech giants, the USA is zeroing in on next-generation VMs optimized for AI workloads, quantum computing, and large-scale simulations.

APIs and VM-based environments capable of supporting this extreme computation power are fueled by programs like the Department of Energy’s Exascale Computing Project. Also, Federal investments in AI research and cloud computing infrastructure have increased industries, such as healthcare, defense, and financial services to adopt high-performance VMs.

In a federal news release posted last week, the USA has earmarked USD 1.2 billion to support AI-focused high-performance computing (HPC) research, a sizable fraction of this support aimed at provisioning virtual machine (VM) infrastructure as a cloud service. As a result of this funding VM deployments for compute applications is up 30%.

The National Science Foundation (NSF) also has taken steps to facilitate the deployment of AI-ready VMs at research institutes, paving the way for the next generation of computing (efficient and scalable). USA is anticipated to see substantial growth in the Virtual Machines market significantly holds dominant share of 72.3% in 2025.

The section provides detailed insights into key segments of the Virtual Machines market. Among these, Process/Application Virtual Machines is growing quickly and making prominent advancements. The IT & Telecom hold dominant share.

The Process/Application Virtual Machine (VM) market is growing at a rapid pace because of a rise in software virtualization in cloud computing, software development and enterprise applications. These virtual machines (VMs) enable applications to operate in isolated environments, allowing compatibility across various operating systems and hardware architectures.

Application VMs also benefitted from the emergence of containerization technologies, such as Docker and Kubernetes, which provided lightweight application runtime environments that did not require full OS virtualization. Moreover, the application VMs are also being utilized by enterprises for better and more efficient deployment, testing as well as scaling of cloud-based applications at a lesser infrastructure cost, thus ensuring higher flexibility.

Some of these initiatives point towards an expanding role for the USA government in the development of cloud-native technologies, with continued investments in software virtualization. Using Federal Cloud Computing Strategy, USD 800 Million has recently been allocated to assist government agencies be more proactive in the adoption of containerized applications and virtualized environments. Process/Application Virtual Machines grows at a substantial CAGR of 14.9% from 2025 to 2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Process/Application Virtual Machines (Type) | 20.3% |

The Virtual Machines (VM) market report comprises segments by (small, medium, and large enterprises) organizations. The increasing use of network resources through virtual machines (VMs) by telecom operators help to reduce hardware dependency and to improve service level delivery.

Bigger names like cloud service providers and IT enterprises use Virtual Machines for things like facilitating remote working, building scalable infrastructure and enhanced data security. With technologies such as AI and 5G, adoption of VMs has been driven further in telecom networks.

Government across the globe are investing on telecom infrastructure upgrades that indirectly are boosting the demand for virtual machines. In India, the Department of Telecommunications has set aside USD 1.5 billion for the development of 5G infrastructure, including investments in cloud-based network virtualization. IT & Telecom are projected to dominate the Virtual Machines market, capturing a substantial share of 36.4% in 2025.

| Segment | Value Share (2025) |

|---|---|

| IT & Telecom (Industry) | 36.4% |

The market for virtual machines is the most competitive market that exists in recent times, due to the increase in cloud adoption and digital transformation. Vendors compete in performance, scalability, security and integration with cloud and on-premise environments.

Competing with High-Cost Open-source and Proprietary Solutions Pricing and features differentiation play a crucial role in offering a competitive And an ever-changing competitive landscape is being shaped by ongoing advancements in virtualization, containerization, and AI-based management technologies.

Industry Update

The Global Virtual Machines industry is projected to witness CAGR of 18.2% between 2025 and 2035.

The Global Virtual Machines industry stood at USD 45,959.0 million in 2025.

The Global Virtual Machines industry is anticipated to reach USD 235,095.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 23.8% in the assessment period.

The key players operating in the Global Virtual Machines Industry VMware, Microsoft, Amazon Web Services (AWS), Google Cloud, Oracle, Red Hat, Citrix Systems, IBM, Nutanix, Huawei.

In terms of Type, the segment is divided into Process/Application Virtual Machines and System Virtual Machines.

In terms of Enterprise Size, the segment is segregated into SMEs and Large Enterprises.

In terms of industry, the segment is segregated into BFSI, IT & Telecom, Retail, Healthcare, Manufacturing, Government and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.