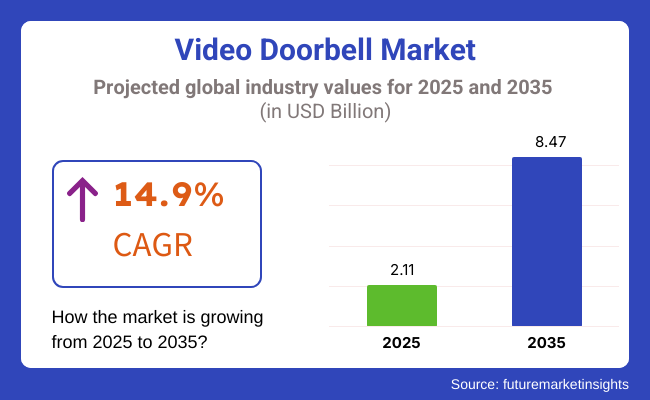

The video doorbell market is estimated at around USD 2.11 billion in 2025 and USD 8.47 billion by 2035. The CAGR is anticipated to be around 14.9% through 2035. Increasing concerns regarding home security and prevention from burglary are shifting the consumer base towards smart surveillance devices. At the same time, the implementation of artificial intelligence (AI) and cloud storage services enhances the efficiency and reliability of these systems.

Another key driver is the increasing adoption of smart home ecosystems. Homeowners are increasingly pouring money into smart appliances that can be controlled remotely from a smartphone or by voice. Innovative wireless technologies, like Wi-Fi 6 and 5G, are improving video doorbell performance.

Better and more reliable internet connections facilitate uninterrupted live streaming and swifter response times. This contributes to user experience. Reduction in hardware costs and the growing rivalry among manufacturers have rendered these devices more attainable for a broader consumer market.

IT professionals with experience operating out of North America and Europe currently dominate the market with high levels of consumer awareness and remarkable adoption of smart home technologies. Nevertheless, the fastest growth is expected in the Asia-Pacific, especially China and India, owing to high rates of urbanization, higher disposable incomes, and greater internet penetration.

With technological innovations in tow, it seems that the focus of manufacturers these days is on enhancing the security and battery life of the devices along with Artificial Intelligence driven features in the ever-growing video doorbell market. With the market poised for continued growth, video doorbells are now a mainstay of residential security solutions around the world.

Explore FMI!

Book a free demo

Sales of video doorbells are booming, spurred by both technological innovation and growing fears about home security. AI-powered facial recognition, motion detection, and package monitoring are intended to improve the user experience as well as home & office security.

Smart home compatibility is another big trend, as consumers look for devices that plug into such ecosystems as Amazon Alexa, Google Home, and Apple HomeKit without a hassle. Additionally, consumer cloud storage and subscription-based services provide homeowners with the opportunity to not only store but also review footage remotely.

End-user segment purchasing trends vary. Ease of installation, price, and integration with home comfort systems are important to residential users. Most popular features: wireless, battery-powered, HD video quality, night vision, and two-way audio. Privacy and data security are also huge factors, and buyers are choosing models with encrypted storage.

For multi-family housing and apartment residents, as well as property managers, video doorbells with multi-user access are important, as are centralized management solutions. Smart access control, visitor logs, and remote monitoring capabilities are important purchase determinants in this segment.

It is one of the best surveillance cameras for small businesses, office spaces, and such commercial establishments, where you will need advanced security features like multi-camera integration, real-time alerts, and AI-based analytics. This group of end-users needs durability, weather resistance, and the ability to store for a longer time. With the changes in consumer preferences, manufacturers are always innovating, bringing better security, AI capabilities, and ubiquitous connectivity to serve different end-user segments.

Between 2020 and 2024, the video doorbell market experienced rapid growth due to the increasing demand for home security, smart home integration, and remote monitoring. Shoppers demanded AI-driven motion detection, two-way talk, and cloud storage for improved security.

Industry leaders like Ring (Amazon), Arlo, Nest (Google), and Eufy launched battery-powered, wireless, and AI-driven video doorbells with enhanced facial recognition and package detection. The transition to subscription-based cloud storage and compatibility with smart home platforms increased adoption. Concerns over data privacy, cybersecurity threats, and high subscription fees were still hurdles for mass adoption.

Between 2025 and 2035, autonomous security powered by AI, edge computing, and ultra-wideband (UWB) connectivity will define future growth. AI-driven predictive analytics will provide real-time threat detection and adaptive security management, lowering false alarms.

Edge video processing will enhance privacy by minimizing cloud reliance, providing local storage, and providing fast response times. UWB technology will provide accurate person tracking and easy integration with autonomous home security systems. Solar-powered, energy-efficient video doorbells will be available to sustainable smart homes. Video doorbells in 2035 will be AI-powered, self-learning security centers fully integrated into smart settings.

Comparative Market Shift Analysis from 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Smart security demand, AI-powered motion detection, and remote monitoring demand. | AI-driven autonomous security, edge video processing, and ultra-wideband connectivity. |

| AI-driven facial recognition, cloud storage, and smart home integration. | Predictive risk assessment, in-edge data processing, and renewable solar-powered doorbells. |

| Privacy issues, cyber threats, and dependence on cloud-based services. | Optimization of AI to detect threats in real-time, enhancing local security of data, and growing use of sustainable power consumption. |

| Adoption in home security, online store package tracking, and rental real estate. | Intelligent, automated security hubs based on AI-driven, self-healing security frameworks for complete self-sustained smart home security systems. |

| Domestic security, home automation, and property control. | Next-generation smart cities, AI-based security networks, and networked IoT -based access control. |

Consumers have privacy concerns due to hacking, data breaches, and unauthorized access to video feeds. Reliability challenges like network problems, software glitches, or hardware faults can also affect the user experience, as do legal risks if cameras record public areas or the homes of nearby residents without their permission. Manufacturers, too, should arbitrate cybersecurity threats as weak encryption or data hacking can get them into liability trouble.

There can be operational risks based on supply chain issues such as component shortages or price fluctuations, and regulatory pressures like compliance with GDPR or CCPA can bring in operational challenges as well. Retailers and distributors face market risks due to the change in consumer preferences/ fast pace of technological change, due to which stocks can become obsolete. Any sale of defective or insecure products also creates reputational risks and potential legal disputes.

Video footage serves very much the same purpose, which means that law enforcement and governments need to balance public security with privacy concerns when they request access to videos in the first place.

Without responsible usage and consideration of ethical aspects, data storage, and adherence to legal and evolution of legal frameworks, it can lead to misuse of data which can lead to public backlash. As the video doorbell market expands, stakeholders need to take proactive steps to mitigate these risks and protect security, maintain compliance, and foster consumer trust.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 11.5% |

| UK | 10.2% |

| France | 9.8% |

| Germany | 10% |

| Italy | 8.7% |

| South Korea | 12.1% |

| Japan | 11.3% |

| China | 13.5% |

| Australia | 9.5% |

| New Zealand | 8.9% |

The USA will experience a massive growth rate, driven by the growing acceptance of home automation solutions and rising consumer consciousness regarding home security. The strong presence of IoT devices and well-established key market players in the region drive the growth of the market.

The incorporation of cloud storage and artificial intelligence in security systems is taking place. The growing instances of home burglary and parcel theft continuously drive demand for doorbells with video features. The presence of established online platforms promotes extensive reach and dissemination, further driving industry growth.

The UK market shows consistent growth from growing investment in home automation and smart security. Government initiatives towards adopting smart homes, along with positive consumer trends, also form a significant part of growth. Increased demand for subscription-based cloud storage solutions and voice assistant integration with video doorbells is pushing demand.

Also, insurance companies providing discounts for smart security installation are prompting residents to purchase the same. Product availability increases through the competitive marketplace with international players as well as domestic players.

Increased security worries and advancements in smart home structures are pushing the demand for video doorbells in France. Growing demand from urban residents for smart home security systems supports the growth.

Encouragement from the presence of strict regulations on home security standards also drives the installation of intelligent security technologies. Wireless and AI-based doorbells are highly sought after by French consumers for ease in monitoring homes. Smart home installations offered with government incentives also drive demand.

The nation's robust technology infrastructure supports Germany's growth and focuses on innovation in security technology. The high incidence of IoT-based home security devices is a major growth driver.

Privacy and data security are of prime importance to German consumers, and therefore, there is a higher demand for locally stored and encrypted video solutions. The leadership of large home automation players drives growth. Rising disposable income and urbanization trends also drive the trend towards intelligent security devices.

Italy is growing at a slower rate as consumers learn more about smart security solutions. The rate of adoption is average, owing to economic uncertainty; however, the trend towards home automation and digitization is propelling industry penetration. Urban markets are more in demand due to security issues and increasing urban house crime. Increasing momentum in European smart home initiatives also gives direction to the industry.

South Korea has a well-established smart home industry. Top electronics companies' presence and enormous 5G infrastructure facilitate rapid growth. Consumers require AI-based, high-definition doorbells with smart home platform compatibility. The phenomenon of smart apartments, where security is embedded at the building level, drives adoption. Furthermore, more penetration of e-commerce channels provides security solutions for easy reach by technology-forward consumers.

Market expansion is driven by the aging population in Japan and the rising need for home remote monitoring technology. Facial recognition-supported doorbells with artificially intelligent support and two-way models reap high demand.

The high demand for energy-efficient, compact devices complements Japan's inclination towards technology with less spatial consumption. In addition, high safety levels and government incentives encouraging intelligent security technology ease expansion. The presence of local electronic giants also adds to product development and supply.

China leads in the production of video doorbells, driven by increasing disposable income, adoption of smart home technology, and urbanization. Domestic tech industry giants with affordable AI-based security products drive growth. Increasing security needs coupled with the policy to promote smart city development at the governmental level drive demand. Moreover, increasingly middle-class consumers are actively investing in home automation.

Australia continues to grow steadily with the support of increasing demand for do-it-yourself home security. Consumers are looking for easy-to-use, wireless products with remote access through mobile apps. Rising rates of property crime influence demand for video monitoring on sites. Adoption by the real estate sector of incorporating smart security features in new residential projects also supports sales expansion. Broader e-commerce platforms increase product availability and price competition.

One of the continuously rising trends in New Zealand is the use of video doorbells, triggered by increasing concerns about home security and burglary prevention. The industry is driven by growing demand for cloud storage products and AI-based monitoring. Home automation technology is increasingly being included in New Zealand's housing market, thus creating further demand.

The nation's work-from-home trends and growing home-based time have also contributed to heightened interest in home security, which is the foundation of video doorbell uptake. Furthermore, rising connectivity infrastructure investments make it easier to link smart devices with home environments.

In 2025, wireless models are expected to be the dominant segment and will account for approximately 78% of the share; on the other hand, wired doorbells will hold around 22% of the value share.

Wireless video doorbells are convenient for smart homes and can be remotely operated. Innovative powerhouses like Ring (Amazon), Arlo, Google Nest, and Eufy continue to provide advancements such as motion-sensing with Artificial Intelligence, cloud storage, and two-way communication.

Demand for wireless video doorbells further stems from the rapid adoption of smart home ecosystems along with advancements in 5G and Wi-Fi 6 connectivity. Battery-powered models are popular for flexibility with regard to household locations and are, therefore, usually found in both urban and suburban homes.

Wired doorbells account for 22% of the share. The doorbells work on continuous power supply and are good for consumers who have issues with battery life. Wired doorbells are found in commercial buildings, apartment complexes, and homes where a high priority is given to the reliability of power and networks.

There has been a rise in household security concerns coupled with new developments in facial recognition, AI alerts, and cloud solutions, leading the way for a very promising future for the video doorbell segment, especially concerning wireless, as consumers start choosing better, smarter, easier solutions for security measures.

The residential segment will dominate in 2025, with more than 85% of the industry share. It is projected that the non-residential segment will account for 15% of the share.

A major reason for the dominance of the residential sector is the increasing adoption of smart home security applications. Homeowners are interested in improved security access from remote locations and real-time monitoring, which has led to the most common adoption of smart video doorbells in modern homes.

The top brands include Ring (Amazon), Google Nest, Arlo, and Eufy, introducing innovative enhancements like AI-powered motion detection, cloud storage, and integration with voice-controlled devices like Alexa and Google Assistant. Wireless installations also assist the home environment, and the addition of two-way communication and night vision are features that can further help boost the segment.

The non-residential segment, defined almost entirely by offices, commercial buildings, and industrial facilities, accounts for 15% of the total market. Controlled access, management of visitors, and surveillance of property for security are just some of the many uses for which businesses and property managers use such systems.

Brands like Hikvision, Dahua, and Ring for Business mark commercial use in offering enterprise-grade security solutions for tailoring commercial requirements. This sector demand is influenced mainly by automating buildings with smart technologies, having corporate security protocols in place, and the need for real-time monitoring of retail stores, warehouses, and offices.

The residential segment is still going to contribute greater shares in the future. In contrast, the non-residential sector is also anticipating further upsurge due to corporations' increasing investment in security. Urbanization, smart cities, and IoT continue to build a strong base.

There has been a growth in the industry as consumers require smarter security systems for homes. New leading firms are pioneering the way, each with its purpose to drive growth.

Ring, Amazon's subsidiary brand, is the leading brand today because it provides a whole array of video doorbell products with high-definition output, motion detection, and straightforward integration into Amazon's Alexa smart system. The integration offers consumers a smooth and convenient-to-use smart home system.

Google's Nest business has also leaped forward with its Nest Hello video doorbell, emphasizing features of the future such as facial recognition and continuous video recording. Leveraging Google's AI capabilities, Google Nest offers intelligent alerts and personalized notifications, enhancing user interaction and security.

Arlo Technologies heads the pack for excellence in making excellent, wire-free video doorbells that are also packed with elite features like 4K video and intelligent motion detection. Excellence in producing such top-class products is what excites customers looking for the best-quality security technology.

Anker Innovations' Eufy Security has been popularizing feature-packed but affordable doorbells. Smart home platform support and local storage are features of Eufy cameras.

ADT Inc., a home security business for decades, entered the doorbell space when it introduced smart doorbell cameras into its packaged security plans. That's wonderful for customers who need professionally monitored systems and the latest smart home features.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ring (Amazon) | 8.5% |

| Google Nest | 5% |

| Arlo Technologies | 3% |

| Eufy Security (Anker) | 2.5% |

| ADT Inc. | 1.5% |

| Other Companies | 79.5% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ring (Amazon) | High-definition doorbells with Alexa integration. |

| Google Nest | AI-powered doorbells featuring facial recognition technology. |

| Arlo Technologies | Wire-free doorbells offering 4K video resolution. |

| Eufy Security (Anker) | Affordable doorbells with local storage and smart home compatibility. |

| ADT Inc. | Integrated doorbell cameras within professional security systems. |

Key Company Insights

Ring (Amazon) (8.5%)

Ring continues to lead the industry by expanding its product lineup and enhancing integration with Amazon's ecosystem, solidifying its position in the smart home security sector.

Google Nest (5.0%)

Google Nest leverages AI advancements to offer intelligent features like facial recognition, providing users with personalized and proactive security notifications.

Arlo Technologies (3.0%)

Arlo focuses on delivering high-quality, wire-free doorbells with superior video resolution, catering to consumers seeking premium security solutions.

Eufy Security (Anker) (2.5%)

Eufy appeals to budget-conscious consumers by offering feature-rich doorbells with local storage options and broad smart home compatibility.

ADT Inc. (1.5%)

ADT integrates the doorbells into its professional security services, attracting customers interested in comprehensive, monitored home security solutions.

Other Key Players (79.5% Combined)

The video doorbell market is expected to be around USD 2.11 billion in 2025.

The video doorbell industry is anticipated to record a CAGR of 14.9% through 2035.

The industry is likely to register a valuation of USD 8.47 billion by 2035.

Residential sector is the key end user in the industry.

Wireless models remain key product type in the industry.

The segmentation is into Wired and Wireless.

The segmentation is into Residential and Non-Residential.

The segment is into online/e-commerce and physical stores.

The segmentation is into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.