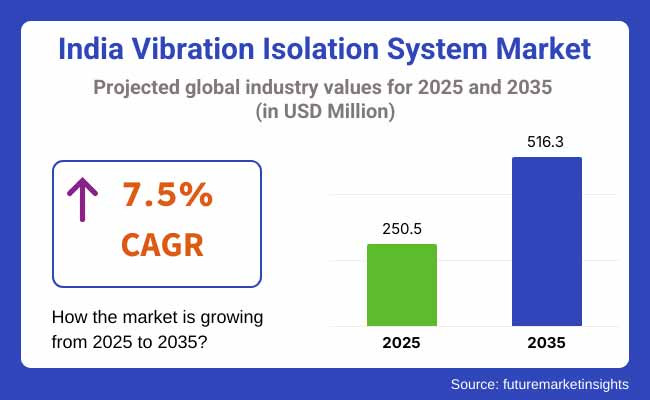

Vibration Isolation System industry Analysis in India is poised for robust growth over the forecast period from 2025 to 2035. The market is projected to grow from an estimated USD 250.5 million in 2025 to USD 516.3 million by 2035, reflecting a strong compound annual growth rate (CAGR) of 7.5%.

This growth is primarily driven by rising demand across key sectors such as automotive, aerospace, manufacturing, infrastructure, and renewable energy. Urban infrastructure projects, including smart city initiatives, are particularly fueling demand for advanced vibration isolation solutions that reduce noise and structural vibrations in construction and transportation industries.

Technological advancements are accelerating market expansion, with smart materials and active isolation systems gaining traction. Leading players are focusing on integrating AI-driven predictive maintenance tools, enhancing system reliability and operational efficiency while minimizing downtime.

The use of IoT-enabled monitoring and self-adaptive isolation technologies is improving performance and lifespan, especially in applications such as electric vehicles (EVs), where noise, vibration, and harshness (NVH) control is critical. Competition in the Indian market is intensifying as global and local players innovate and expand their footprints. ContiTech AG enhanced its elastomeric isolator offerings in 2024 to serve heavy industry applications, while Lord Corporation introduced smart vibration control solutions with real-time monitoring in 2023.

HUTCHINSON’s focus on eco-friendly, lightweight materials aligns with sustainability goals, and ACE Stoßdämpfer GmbH expanded regional support services in India to improve customer responsiveness. Fabreeka and RMS Corporation are leading with IoT-integrated vibration monitoring platforms and AI-based predictive maintenance, respectively, optimizing equipment uptime in manufacturing and energy sectors.

Eaton and Trelleborg AB are pioneering self-adaptive and hybrid isolation technologies, advancing capabilities for infrastructure and seismic applications. Local firms like Lisega India and Gerb Vibration Control Systems are strengthening manufacturing and product portfolios to meet growing domestic demand.

Meanwhile, Dynemech Systems and VIBZORB are targeting aerospace and automotive EV segments with specialized noise and vibration dampening solutions. VibraSystems Inc. focuses on lightweight isolation mounts suited for compact electronics and industrial equipment.

The passive vibration isolators product type and the automotive sector application are the key growth drivers in the India vibration isolation system market. Passive isolators dominate due to their effectiveness and cost-efficiency, while the automotive industry's rapid expansion fuels strong demand for vibration control solutions. Emerging technologies such as smart materials and AI-enabled systems are poised to accelerate market growth.

Passive vibration isolators are forecasted to hold a commanding volume share of approximately 71.5% in 2025 in the India vibration isolation system market. Their simple design, reliability, and cost-effectiveness have made them the preferred choice across diverse industrial sectors. These isolators are widely deployed in manufacturing plants, HVAC systems, and heavy machinery to reduce noise and mechanical vibration, thus enhancing equipment lifespan and worker safety.

Companies such as Lord Corporation and Vibro-Acoustic Solutions offer advanced passive isolation solutions tailored to Indian industrial requirements. The surge in industrial automation and expanding urban infrastructure projects further support the demand for passive vibration isolation systems. Additionally, growing regulatory emphasis on noise and vibration control continues to reinforce the dominance of passive isolators, which effectively meet compliance standards without significant complexity or cost.

The automotive sector is expected to capture about 34% of the market share in 2025, driven by rapid growth in vehicle production and increasing consumer demand for comfort and safety. Vibration isolation systems are critical in minimizing noise, vibration, and harshness (NVH) in passenger vehicles and commercial trucks.

This reduces driver fatigue, improves ride quality, and protects vehicle components from wear. Leading automotive manufacturers in India, such as Tata Motors and Mahindra & Mahindra, increasingly integrate advanced vibration isolation technologies into their vehicle platforms.

Furthermore, the adoption of electric vehicles (EVs), which require specialized vibration control solutions due to battery pack sensitivities, is expected to accelerate market expansion. Technological innovations, including AI-enabled predictive maintenance and smart materials, are further enhancing vibration management, making the automotive sector a primary growth segment in India’s vibration isolation system market.

Regional Variation

Regional Insights

Regional Breakdown

Regional Trends

Manufacturers

Distributors

End-Users

Regional Strategies

Key Variances

| Region | Government Regulations & Mandatory Certifications |

|---|---|

| North India |

|

| South India |

|

| North-East India |

|

| West India |

|

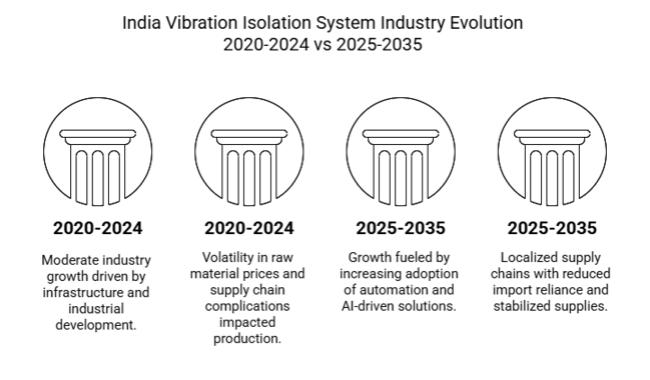

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate industry growth driven by infrastructure and industrial development. | Growth fuelled by increasing adoption of automation and AI-driven solutions. |

| There is a high reliance on conventional vibration isolation materials like rubber and steel. | There is an increasing demand for hybrid materials like polymer composites and intelligent isolators. |

| Government regulation focused primarily on noise and the environment. | Stricter enforcement of vibration control regulations across sectors. |

| Volatility in raw material prices and supply chain complications impacted production. | There are localized supply chains with reduced import reliance and stabilized supplies. |

| There is a limited application of IoT and predictive maintenance in vibration isolation systems. | Extensive application of IoT-connected monitoring and AI-powered predictive analysis. |

| Metro rail, construction, and automotive sectors drove growth. | Significant growth has occurred in aerospace, defence, renewable energy, and high-tech manufacturing. |

| Mature global players define the industry. | There has been an increased industry presence of domestic players and start-ups. |

Macroeconomic factors such as industrial growth, infrastructure development, regulatory policies, and technological advancement have a significant impact on the vibration isolation systems industry. The government-backed pace of urbanization and industry-focused efforts (e.g., Make in India, Smart Cities Mission) is expected to significantly boost the industry for vibration isolation solutions.

Increasing investments in high-tech manufacturing, metro rail projects, and renewable energy sectors provide industry opportunities, propelling the growth of advanced isolation technologies. Moreover, stabilization of global supply chains, rising FDI, and local manufacturing incentives are assisting.

Increasing implementation of the Industry 4.0 concept in predictive maintenance as well as incorporation of IoT and AI are facilitating new revenue streams, making the industry more innovation-driven. Nevertheless, short-term profitability could face headwinds from challenges like raw material price volatility, regulatory compliance expenses, and import restrictions. Strong demand for energy-efficient, sustainable, and high-performance vibration isolation solutions across industries is anticipated to support long-term growth.

Key players in the industry for vibration isolation systems compete on the basis of pricing, technological developments, mergers and acquisitions, partnerships, and geographic expansion. Key players emphasize cost-effective manufacturing while providing premium, high-performance solutions for sophisticated industries. The emergence of smart isolators, IoT-enabled monitoring, and AI-driven predictive maintenance is a key differentiator here.

Growth strategies involve M&A activities, joint ventures, and R&D investments to improve product portfolios. Sustainability is a consideration as well, with companies creating green, recyclable isolation materials to adhere to higher environmental standards and carve out a competitive advantage.

Larsen & Toubro (L&T)

Industry: ~25-30%

L&T: ENA, a leader in the Indian marketplace, utilizes its extensive engineering know-how and diversified product offerings to deliver advanced vibration isolation solutions across sectors such as construction, protection, and heavy devices.

Tata Projects

Industry Share: ~20–25%

Tata Projects is already a noteworthy player in the vibration isolation domain, with expertise in both infrastructure and industrial projects. A industry position solidified with cutting-edge technologies and strategic partnerships.

HAL (Hindustan Aeronautics Limited)

Industry Share: ~15-20%

HAL designs and manufactures vibration isolation systems for aerospace and defence applications. With a strong focus on precision, it remains a key player in the industry due to its aerospace engineering expertise and government-backed projects.

Parker Hannifin India

Industry Share: ~10-15%

A subsidiary of the global Parker Hannifin Corporation, the organization provides high-performance vibration isolation products for industrial and automotive industries, leveraging its global R&D capabilities.

Vibro Acoustics India

Industry Share: ~5-10%

Specializing in customized vibration isolation solutions for the automotive and manufacturing sector, Vibro Acoustics India, through its philosophy of innovation and customer-centricity, has been gaining traction as a niche player.

RUBBER MILLS (India)

Industry Size: ~5-10%

Specializing in rubber products. For vibration isolation rubbers, Rubber Mills is well known all around. The rubber-based vibration isolation products serve various far-reaching industries in construction, transportation, and machinery where long service life and low cost of ownership are vital.

Since 2024, L&T has expanded its vibrating isolation systems division for use in the defence and aerospace sectors. Chawla, who was encouraged to pursue industrial partnerships through emerging startups, then went on to land a multi-million-dollar contract with the Indian Ministry of Defence for the supply of state-of-the-art vibration isolation solutions for military aircraft and naval vessels, an impressive feat for a fledgling startup. This move comes as part of India’s efforts toward self-reliance in defence manufacturing under the “Make in India” initiative.

In Q1 of 2024, Tata Projects entered into a strategic alliance with Siemens India to build next-generation vibration isolation systems for smart city and urban infrastructure projects. In addition, this partnership will bring IoT-enabled solutions to vibration control systems in large infrastructure projects to allow for real-time monitoring and maintenance.

Hindustan Aeronautics Limited (HAL) showcased its homemade vibration isolation for fighter jets and helicopters in mid-2024. The breakthrough, a result of HAL’s continued R&D efforts, will lead to a reduction in maintenance expenses and improve the operational efficiency of India’s defence aircraft fleet.

In 2024, Parker Hannifin India commissioned a new state-of-the-art manufacturing facility in Pune for the manufacture of vibration isolation systems for automotive and industrial applications. In addition to the state-of-the-art technology, it also has an AI production line to boost the company’s production capacity by 30%.

In 2024, Vibro Acoustics India diversified its product offerings with the launch of vibration isolation solutions for wind turbines and solar panel installations. The move aligns with India's growing focus on renewable energy and strengthens the company's position in this emerging industry segment.

RUBBER MILLS introduced a new line of green vibration isolation products made from recycled rubber in 2024. The move is a pilot for the company's wider sustainability program, which will work to reduce its environmental impact in response to the growing demand for green technology in transport and construction.

Key challenges and opportunities include expansion in high-precision industries such as aerospace, defence, and semiconductor manufacturing within the vibration isolation industry. Stakeholders should concentrate on areas such as metro rail expansions, smart city projects, renewable energy infrastructure, and tunneling, where vibration control is crucial. Localize production to reduce reliance on other nations.

To meet the requirements of Industry 4.0, manufacturers should adopt the AI-based predictive maintenance solutions. Developing new materials using polymer composites and smart isolators can enhance product sustainability and durability. New revenue streams will be unlocked through partnerships with construction companies and original equipment manufacturers (OEMs).

This goes beyond regional focus, which is heavy on customization, like focusing on solutions for needs like seismic-resistant products in Northeast India or automated vibration control for tech hubs in South India. The regulatory compliance should not be ignored, as its adaptability to BIS, ISO 10816, and CPCB norms paves the way for traditional industry sustainability. In price-sensitive segments, too, leasing models, for instance, can galvanize higher adoption among cost-conscious buyers.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 250.5 million |

| Projected Market Size (2035) | USD 516.3 million |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Type Segments Analyzed (Segment 1) | Passive Vibration Isolators (Springs, Mechanical Dampers, Elastomeric Isolators, Air Isolators, Compact Pneumatic Isolators, Others), Active Vibration Isolators (Active Damping Systems, Electromagnetic & Piezoelectric), Semi-Active Dampers |

| End Use Segments Analyzed (Segment 2) | Automotive, Aerospace, Defence, Research & Development, Manufacturing (General Engineering, Heavy Engineering, Precision Engineering), Electronics (Consumer & Medical), Building & Construction, Others |

| Regional Segments (Segment 3) | North India, South India, North East India, West India |

| Key Players influencing the Market | ContiTech AG, Lord Corporation, HUTCHINSON, ACE Stoßdämpfer GmbH, Fabreeka, Eaton, Lisega India Pvt. Ltd., Trelleborg AB, Gerb Vibration Control Systems Pvt. Ltd., RMS Corporation, Dynemech Systems, VIBZORB, VibraSystems Inc. |

| Additional Attributes | Dollar sales by product type and end use, Adoption trends across automotive and manufacturing sectors, Impact of automation and infrastructure development, Technological advancements in active and semi-active isolators, Regional market growth drivers |

The industry is segmented into passive vibration isolators (springs, dampers (mechanical), elastomeric isolators, air isolators, compact pneumatic isolators and others), active vibration isolators (active damping system, electromagnetic & piezoelectric) and semi-active dampers

It is fragmented into automotive, aerospace, defence, research & development, manufacturing (general engineering, heavy engineering & precision engineering), electronics (consumer & medical), building & construction and others

The industry is segmented into North India, South India, North East India and West India

Table 01: Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 02: Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 03: Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 04: Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 05: Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 06: Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 07: Size Value (US$ million) and Volume ('000 Units) Analysis and Forecast By Region, 2018 to 2033

Table 08: North Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 09: North Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 10: North Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 11: North Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 12: North Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 13: North Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 14: South Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 15: South Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 16: South Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 17: South Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 18: South Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 19: South Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 20: North East Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 21: North East Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 22: North East Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 23: North East Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 24: North East Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 25: North East Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 26: West Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 27: West Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 28: West Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 29: West Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Type

Table 30: West Volume (Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 31: West Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Figure 01: Historical Volume (Units), 2018 to 2022

Figure 02: Volume (Units) Forecast, 2023 to 2033

Figure 03: Historical Value (US$ million), 2018 to 2022

Figure 04:India Vibration Isolation System Value (US$ million) Forecast, 2023 to 2033

Figure 05: Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Share and BPS Analysis By Type - 2023 to 2033

Figure 07: Y-o-Y Growth By Type , 2023 to 2033

Figure 08: Attractiveness Analysis By Type , 2023 to 2033

Figure 09: India Incremental $ Opportunity By Type, 2023 to 2033

Figure 10: Share and BPS Analysis by End-use - 2023 to 2033

Figure 11: Y-o-Y Growth by End-use , 2023 to 2033

Figure 12: Attractiveness Analysis by End-use , 2023 to 2033

Figure 13: India Incremental $ Opportunity By End-use , 2023 to 2033

Figure 14: Share and BPS Analysis By Region, 2023 to 2033

Figure 15: Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 16: Attractiveness Analysis By Region, 2023 to 2033

Figure 17: Incremental $ Opportunity By Region, 2023 to 2033

Figure 18: North Share and BPS Analysis By Type - 2023 to 2033

Figure 19: North Y-o-Y Growth By Type , 2023 to 2033

Figure 20: North Attractiveness Analysis By Type , 2023 to 2033

Figure 21: North Share and BPS Analysis by End-use - 2023 to 2033

Figure 22: North Y-o-Y Growth by End-use , 2023 to 2033

Figure 23: North Attractiveness Analysis by End-use , 2023 to 2033

Figure 24: South Share and BPS Analysis By Type - 2023 to 2033

Figure 25: South Y-o-Y Growth By Type , 2023 to 2033

Figure 26: South Attractiveness Analysis By Type , 2023 to 2033

Figure 27: South Share and BPS Analysis by End-use - 2023 to 2033

Figure 28: South Y-o-Y Growth by End-use , 2023 to 2033

Figure 29: South Attractiveness Analysis by End-use , 2023 to 2033

Figure 30: North East Share and BPS Analysis By Type - 2023 to 2033

Figure 31: North East Y-o-Y Growth By Type , 2023 to 2033

Figure 32: North East Attractiveness Analysis By Type , 2023 to 2033

Figure 33: North East Share and BPS Analysis by End-use - 2023 to 2033

Figure 34: North East Y-o-Y Growth by End-use , 2023 to 2033

Figure 35: North East Attractiveness Analysis by End-use , 2023 to 2033

Figure 36: West Share and BPS Analysis By Type - 2023 to 2033

Figure 37: West Y-o-Y Growth By Type , 2023 to 2033

Figure 38: West Attractiveness Analysis By Type , 2023 to 2033

Figure 39: West Share and BPS Analysis by End-use - 2023 to 2033

Figure 40: West Y-o-Y Growth by End-use , 2023 to 2033

Figure 41: West Attractiveness Analysis by End-use , 2023 to 2033

Vibration isolation helps protect machines, improving accuracy and reducing noise levels.

Aerospace, automotive, construction, semiconductor, and renewable energy industries.

IoT and AI-driven monitoring enable real-time diagnostics and predictive maintenance.

Customizability, material quality, load capacity, and automation integration

Yes, firms are working on sustainable, energy-efficient insulation materials.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA