The global Veterinary Video Endoscopy Industry is valued at USD 314.6 million in 2025. It is projected to grow at a CAGR of 8.7% and reach USD 739.2 million by 2035. From 2025 to 2035, the industry is expected to show consistent, strong growth, continuing technological advancements, and awareness of minimally invasive veterinary treatments.

Flexible and rigid endoscopy demand developed as small-and-large-and-small-animal practices searched for increased diagnostic accuracy with faster recovery times. Endoscopy services will also be included in the hospitals and specialty clinics, using high-definition imaging and robotic-assisted modalities.

The new paradigm for veterinary endoscopy will be diagnosis combined with AI and machine-learning technology, along with automatic anomaly detection and advanced real-time visualization.

Endoscopy procedures will become easier to access and less risky when individuals will be able to undergo procedures using capsule and wireless endoscopes. Adoption will be stimulated further by increasing veterinary services and pet insurance penetration.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 314.6 million |

| Industry Value (2035F) | USD 739.2 million |

| CAGR (2025 to 2035) | 8.7% |

Explore FMI!

Book a free demo

The veterinary endoscopy industry is anticipated in steady growth with increasing acceptance of minimally invasive procedures and technological advances in the field of imaging. Major beneficiary stakeholders will include veterinary hospitals, specialized clinics, and manufacturers also involved in the development of high-definition and AI-assisted endoscopy solutions, thus threatening older diagnostic modalities.

Emerging industries, with special emphasis on Asia-Pacific, offer good prospects for growth owing to rising pet ownership there and developing infrastructure in veterinary services, thus supporting long-term demand.

In the year 2025, the veterinary video endoscopy of the gastrointestinal tract contributed to more than 46% of the market revenue. The veterinary video endoscopy industry is on an upward growth trajectory as more sophisticated diagnostic and surgical solutions are being demanded. Veterinary video endoscopy equipment is the mainstay of this industry, with manufacturers focusing on the improvement of image resolution, flexibility and ergonomics in its use.

Accessories and consumables such as biopsy forceps, insufflation needles, and cleaning brushes are assuming steady demand, propelled by increasing procedure volumes. Continued technological advancement and cheaper solutions will propel the industry forward as endoscopic procedures become routine.

Integrating cloud-based PACs and assisted CA imaging is going to revolutionize the diagnostic accuracy for veterinarians to detect patients' conditions sooner and make more informed treatment decisions.

The rigid endoscopes segment held the largest market share in 2025, with a revenue share of over 45%. The evolution is shown in veterinary video endoscopy products which consist of different types of endoscopes to meet diverse diagnostic as well as surgical needs. Flexible endoscopes lead industry, mainly because of their multispecialty application in gastrointestinal, respiratory and urinary examinations.

Rigid endoscopes are limited to orthopedic and laparoscopic use as their imaging is superior in terms of clarity and precision. Capsule endoscopy is in very premature stages but gaining momentum because of being non-invasive in diagnosing small intestinal complaints.

Robot-assisted endoscopes shall change the entire paradigm of surgery in the small animal by delivering more precision and control with minimally invasive procedures.

Another endoscopy-related offering that is slightly expected to complement procedure outcomes is hybrid endoscopy, flexible with rigid features. As technological advances push toward making procedures better and smarter, the industry strives for flexibility, better image quality, and incorporating artificial intelligence-automated diagnostics.

Product innovation and cost-effectiveness will fuel the trend towards higher penetration during the forecast period, broadening the access to quality veterinary care.

Veterinary video endoscopy is increasing in demand in various categories of animals due to the higher degree of awareness of minimally invasive procedures. Endoscopy systems for large animals such as horses and cattle will need to be tailored for efficient diagnosis of gastrointestinal and respiratory disorders.

Small animals such as dogs and cats account for a sizable section of the industry, where pet owners are seeking accurate diagnostic methods that are less invasive. Companion animals continue driving the acceptance of endoscopy, propelled by increasing pet healthcare expenditure and the rising incidence of chronic conditions.

Meanwhile, livestock animals are drawing some attention, as farmers and vets recognize the advantages of early disease detection in herd health and productivity.

Other animals, such as exotic species and zoo animals, have a small but growing industry as conservation mandates and the specialized veterinary care sector continue to expand. In the next decade, easing cost and access issues will bolster applications of endoscopic technologies across all categories of animals.

The veterinary video endoscopy industry is mainly driven by the two key applications, that is diagnostics and surgical/interventional. In terms of application, diagnostic procedures accounted for more than 73% of the total demand for veterinary video endoscopy in 2025.

Anatomical view in real time affords early detection of diseases and thus interventions and treatments via endoscopy are preferred and well accepted in the use of diagnostics as it consumes most of the industry. The latest developments in imaging technologies with high-definition and AI-assisted visualization have a further refining role on diagnostic accuracy.

Surgical or interventional applications are on a slow but steady upward trend as minimally invasive procedures are favored as an alternative to traditional surgery. The push toward precision medicine and personalized treatment plans will continue to enhance the position of endoscopy in veterinary healthcare.

In the next decade, robotic and 3D imaging capabilities will support the advancement of both diagnostics and interventional procedures, so as to improve outcomes for patients and create a new benchmark in veterinary medicine.

Veterinary video endoscopy encompasses a wide range of procedures tailored to specific diagnostic and surgical needs. Gastroduodenoscopy and colonoscopy are widely used for gastrointestinal disorders, allowing for biopsy collection and therapeutic interventions.

Bronchoscopy and tracheoscopy are essential for diagnosing respiratory conditions, especially in small animals and equines. Male urethro cystoscopy is gaining traction for detecting urinary tract issues, while laparoscopy and thoracoscopy are becoming standard procedures for minimally invasive surgeries.

Otoscopy and rhinoscopy are crucial for evaluating ear and nasal conditions, improving early diagnosis of infections and tumors. Arthroscopy is increasingly utilized for joint evaluations and minimally invasive orthopedic surgeries.

Other endoscopic procedures, including hysteroscopy and cystoscopy, are expanding veterinary capabilities, enhancing treatment precision. As veterinarians gain access to more advanced equipment and training, the adoption of specialized endoscopic procedures will continue to grow, improving the overall standard of care across species.

The veterinary video endoscopy industry is segmented by key end-users, including veterinary clinics, hospitals, academic institutes, and other facilities. Veterinary clinics are seeing an increasing adoption of portable and compact endoscopic devices, making diagnostics more accessible in general practice. Veterinary hospitals, particularly specialty and referral centers, are investing in high-end endoscopic systems to perform complex diagnostic and surgical procedures.

Academic institutes play a vital role in advancing veterinary endoscopy, offering specialized training programs and contributing to research and innovation in the field. Other end-users, including research laboratories and mobile veterinary services, are expanding their use of endoscopy for both diagnostic and interventional applications.

Over the forecast period, increased funding, advancements in training, and improved affordability will drive endoscopy adoption across all end-user segments. This expansion will ensure that more veterinarians, regardless of practice size or location, can leverage cutting-edge technology to enhance patient care and treatment outcomes.

Invest in AI-Driven and Robotics-Assisted Endoscopy

Stakeholders should allocate resources toward AI-powered imaging and robotic-assisted endoscopy solutions to enhance diagnostic precision and procedural efficiency. Investing in automated anomaly detection, real-time visualization enhancements, and machine-learning-based decision support will differentiate sector leaders and drive adoption among veterinary specialists.

Expand Market Penetration in Emerging Regions

With rising pet ownership and increasing veterinary infrastructure in Asia-Pacific and Latin America, aligning business strategies with these growth industries is essential. Companies should focus on affordable, portable endoscopy solutions, local partnerships, and training programs to drive adoption and establish a strong presence in these regions.

Strengthen Distribution and R&D Collaborations

Strategic partnerships with veterinary hospitals, academic institutions, and endoscope manufacturers can accelerate product innovation and sector penetration. Investing in OEM collaborations, joint R&D efforts for advanced imaging solutions, and expanding aftermarket service networks will enhance customer retention and ensure sustainable growth.

| Risk | Probability - Impact |

|---|---|

| High Cost of Advanced Endoscopic Systems | High - Medium |

| Regulatory and Compliance Challenges | Medium - High |

| Slow Adoption in Price-Sensitive Markets | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Expand AI-Powered Endoscopy Solutions | Develop AI-driven diagnostic enhancements and partner with research institutions |

| Optimize Cost Structure for Emerging Markets | Assess pricing models and introduce flexible financing for clinics |

| Enhance Distribution and Aftermarket Services | Launch training programs and strengthen OEM service partnerships |

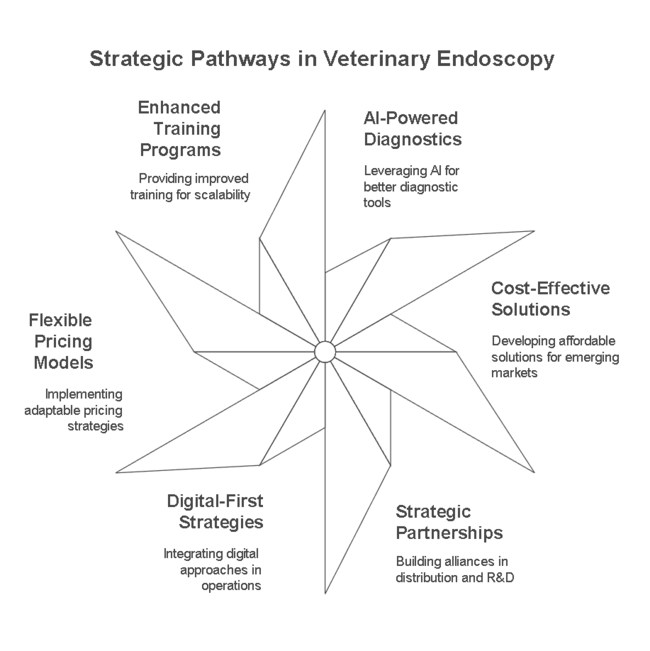

The veterinary video endoscopy sector is at a turning point, with AI, robotics, and affordability driving the next wave of adoption. To stay competitive, companies must double down on AI-powered diagnostics, expand cost-effective solutions for emerging regions, and deepen strategic partnerships in distribution and R&D.

Executives should prioritize investments in high-growth areas, ensuring product pipelines align with evolving sector demands. The roadmap must integrate digital-first strategies, flexible pricing models, and enhanced training programs to scale efficiently. Now is the time to leverage innovation, optimize global sector entry, and position for long-term leadership in veterinary endoscopy.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across veterinary device manufacturers, distributors, veterinary hospitals, and specialty clinics in the US, Western Europe, China, and India)

Increasing Adoption of Minimally Invasive Procedures:

79% of global stakeholders identified the shift toward minimally invasive diagnostic and surgical solutions as a top priority, with demand for high-definition imaging and AI-assisted diagnostics driving adoption.

Cost Efficiency and ROI on Equipment Investments:

74% of respondents cited cost efficiency and long-term ROI as key factors influencing purchasing decisions, especially in small and mid-sized veterinary clinics.

Regional Variance:

High Variance in Adoption Rates:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Veterinary Hospitals & Clinics):

Alignment:

Divergence:

High Consensus:

Key Variances:

Strategic Insight:

| Country/Region | Policies, Regulations & Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) regulates veterinary medical devices, including endoscopes, under the Federal Food, Drug, and Cosmetic Act (FFDCA). While presector approval is not required for most veterinary devices, manufacturers must comply with Good Manufacturing Practices (GMP) under 21 CFR Part 820. The USDA (United States Department of Agriculture) also sets guidelines for veterinary procedures in animal healthcare. |

| European Union | The EU Medical Device Regulation (MDR 2017/745) does not directly cover veterinary devices, but veterinary endoscopes must meet CE Marking standards for quality and safety. The EU Veterinary Health Strategy 2025 emphasizes minimally invasive procedures, encouraging adoption of advanced veterinary imaging. Stricter RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives also impact device manufacturing. |

| China | The National Medical Products Administration (NMPA) oversees veterinary medical devices, requiring manufacturers to obtain Class I or II device registration depending on risk level. The China Compulsory Certification (CCC) mark is mandatory for imported medical equipment. The government is promoting affordable veterinary care policies, leading to a rise in local manufacturing. |

| India | The Central Drugs Standard Control Organization (CDSCO) does not classify veterinary endoscopes as regulated medical devices, but imported products must meet BIS (Bureau of Indian Standards) quality norms. The Animal Welfare Board of India (AWBI) encourages minimally invasive procedures, but regulation enforcement remains inconsistent. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) mandates that veterinary endoscopes comply with Japan Industrial Standards (JIS) and must be registered under the Veterinary Drug and Medical Device Act. Importers need approval from the Ministry of Agriculture, Forestry, and Fisheries (MAFF). |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates veterinary medical devices, requiring KGMP (Korean Good Manufacturing Practice) certification for manufacturers. The Animal Protection Act encourages modern diagnostic techniques, driving endoscopy adoption in veterinary hospitals. |

| Australia | The Therapeutic Goods Administration (TGA) does not classify veterinary endoscopes as medical devices, but compliance with ISO 13485 (Medical Device Quality Management System) is preferred for imports. The Australian Pesticides and Veterinary Medicines Authority (APVMA) oversees veterinary product safety. |

| Company | Market Share (%) |

|---|---|

| Karl Storz SE & Co. KG | 24.5% |

| Olympus Corporation | 19.8% |

| Hillrom (now part of Baxter International) | 14.2% |

| Steris PLC | 10.7% |

| Fujifilm Holdings Corporation | 8.9% |

| Hoya Corporation (Pentax Medical) | 6.5% |

| Smith & Nephew PLC | 5.1% |

| Others (Regional and Emerging Players) | 10.3% |

From 2025 to 2035, the USA veterinary video endoscopy sector is expected to grow at a CAGR of 9.2%, exceeding the global average due to high pet adoption rates, increased veterinary healthcare spending, and advancements in endoscopic technology.

The country has a well-developed veterinary infrastructure, with a high concentration of specialty clinics and animal hospitals adopting minimally invasive diagnostic procedures.

The rise in pet insurance coverage and increasing awareness among pet owners regarding early disease detection are further driving sector growth. Leading companies, including Karl Storz and Olympus, have strong distribution networks in the country.

Regulatory frameworks such as FDA guidelines for veterinary devices and USDA initiatives supporting modern veterinary practices continue to shape the sector. Additionally, an increasing number of veterinary training programs focusing on endoscopic procedures is enhancing sector penetration.

Between 2025 and 2035, the UK veterinary video endoscopy sector is projected to expand at a CAGR of 8.5%, driven by stringent animal welfare regulations and growing demand for minimally invasive diagnostic tools.

The UK has a high pet ownership rate, and companion animal care is a priority, supported by the National Health Service (NHS) initiatives for veterinary care. The British Veterinary Association (BVA) has been advocating for the widespread adoption of advanced diagnostic techniques, leading to increased investment in endoscopic technology.

Additionally, corporate veterinary groups, such as CVS Group and IVC Evidensia, are expanding their services, integrating advanced imaging solutions. The demand for flexible and capsule endoscopes is rising, particularly for gastrointestinal and respiratory diagnostics in small animals.

From 2025 to 2035, France’s veterinary video endoscopy sector is anticipated to grow at a CAGR of 8.3%, benefiting from government-backed veterinary health initiatives and a strong emphasis on preventive care. France has one of the highest rates of pet ownership in Europe, with a growing number of veterinary hospitals adopting cutting-edge diagnostic tools.

The French Veterinary Association has introduced new guidelines encouraging the use of non-invasive diagnostic techniques, fueling endoscope adoption. Additionally, the rise of pet insurance schemes covering advanced diagnostics has made veterinary video endoscopy more accessible. The sector is also seeing increasing demand for robotic-assisted endoscopy for precision surgeries in equine and companion animals.

During 2025 to 2035, Germany’s veterinary video endoscopy sector is expected to grow at a CAGR of 8.9%, supported by the country’s leadership in medical technology and strict animal welfare laws.

Germany has one of the most advanced veterinary healthcare infrastructures in Europe, with a strong presence of domestic manufacturers developing high-quality endoscopic solutions. The demand for minimally invasive procedures is particularly strong in the livestock sector, as the country has stringent regulations regarding animal health and disease prevention.

Veterinary hospitals and clinics are increasingly investing in rigid and robot-assisted endoscopy solutions for advanced surgical applications. The presence of major medical technology firms, such as Karl Storz and Hoya Corporation, further enhances sector growth.

Between 2025 and 2035, the veterinary video endoscopy sector in Italy is projected to grow at a CAGR of 8.1%, driven by increased investments in veterinary infrastructure and rising pet ownership. The Italian government has been promoting animal welfare programs, leading to the adoption of modern veterinary diagnostic tools.

The demand for veterinary endoscopy is particularly strong in the companion animal segment, as pet owners are increasingly willing to invest in high-quality healthcare. Additionally, academic institutions and veterinary research centers are adopting endoscopic technologies for training and experimental procedures. The growing number of specialty veterinary clinics offering laparoscopic and bronchoscopy procedures is also contributing to sector expansion.

From 2025 to 2035, New Zealand’s veterinary video endoscopy industry is expected to grow at a CAGR of 8.4%, driven by the country’s strong focus on livestock health and biosecurity. With a significant portion of the economy dependent on the dairy and meat industry, veterinary healthcare services play a crucial role in disease prevention and animal welfare.

The government has been actively promoting advanced diagnostic techniques for herd management, leading to increased adoption of veterinary endoscopy. In the companion animal sector, rising pet ownership and improved access to specialized veterinary care are further fueling industry demand. The integration of digital imaging and AI-assisted endoscopy is also gaining traction among veterinary practitioners.

During 2025 to 2035, South Korea’s veterinary video endoscopy industry is expected to grow at a CAGR of 8.6%, driven by increasing urbanization and rising pet ownership. The country has one of the fastest-growing pet care industries in Asia, with a significant shift towards advanced veterinary diagnostics.

The South Korean government has implemented new veterinary healthcare standards, encouraging the adoption of minimally invasive technologies. Academic institutions and research hospitals are investing in AI-powered endoscopy solutions to improve diagnostic accuracy.

Additionally, the industry is witnessing strong demand for compact and portable endoscopic systems, particularly in urban veterinary clinics where space constraints are a challenge.

From 2025 to 2035, Japan’s veterinary video endoscopy industry is anticipated to grow at a CAGR of 7.9%, slightly below the global average due to the country’s slower adoption of new veterinary technologies. However, Japan remains a key industry for advanced medical imaging solutions, with a strong presence of domestic manufacturers such as Olympus and Fujifilm.

The demand for veterinary endoscopy is primarily driven by the aging pet population, as pet owners seek advanced diagnostic solutions for chronic conditions. The Japanese Veterinary Medical Association is promoting the use of endoscopy in specialized veterinary procedures, particularly in gastroenterology and respiratory diagnostics. Despite cost concerns, the industry is gradually shifting towards digital and AI-enhanced endoscopic solutions.

Between 2025 and 2035, China’s veterinary video endoscopy industry is expected to grow at a CAGR of 9.5%, making it one of the fastest-growing industries globally. The country is experiencing a rapid increase in pet ownership, coupled with significant investments in veterinary healthcare infrastructure.

The Chinese government has been promoting the modernization of veterinary services, leading to increased adoption of advanced diagnostic technologies. Domestic manufacturers are expanding their presence in the endoscopy segment, offering cost-effective solutions that compete with international brands.

Additionally, the livestock industry is increasingly adopting endoscopic procedures for disease management and productivity improvement. The rise of veterinary super-clinics in urban centers is also contributing to industry expansion.

From 2025 to 2035, Australia’s veterinary video endoscopy industry is projected to grow at a CAGR of 8.7%, in line with the global average. The country has a strong veterinary healthcare system, with a high demand for advanced diagnostic tools.

Government initiatives promoting animal welfare and disease prevention are driving the adoption of endoscopic technologies. The livestock sector, particularly the cattle and sheep industries, is seeing increased use of endoscopic procedures for disease monitoring.

In the companion animal segment, pet insurance coverage and a growing preference for minimally invasive procedures are fueling industry growth. The presence of leading veterinary groups, such as Green cross Vets, is also contributing to industry development.

The rising demand for minimally invasive procedures, increasing pet ownership, advancements in imaging technology, and growing awareness about animal healthcare are major contributors to industry expansion.

Diagnostic applications are projected to witness significant adoption due to the increasing need for early disease detection and precise imaging, which enhances veterinary care outcomes.

Innovations such as AI-powered imaging, robotic-assisted procedures, and capsule-based visualization systems are improving diagnostic accuracy, reducing procedure time, and enhancing overall efficiency.

High equipment costs, a shortage of skilled professionals, and regulatory compliance requirements may pose hurdles to widespread adoption, particularly in developing regions.

North America and Europe are experiencing rapid development due to advanced veterinary infrastructure, while Asia-Pacific is emerging as a lucrative region due to increasing pet ownership and investments in animal healthcare.

Veterinary Video Endoscopy Equipment, Veterinary Video Endoscopy Accessories or Consumables, Veterinary Video Endoscopy PACs, Other Solutions

Flexible Endoscopes, Rigid Endoscopes, Capsule Endoscopes, Robot-assisted Endoscopes, Other Products

Big Animals, Small Animals, Companion Animals, Livestock Animals, Other Animals

Diagnostic Applications, Surgical or Interventional Applications

Gastroduodenoscopy, Colonoscopy, Bronchoscopy, Male Urethrocystoscopy, Tracheoscopy, Laparoscopy, Otoscopy, Rhinoscopy, Thoracoscopy, Arthroscopy, Other Procedures

Veterinary Clinics, Veterinary Hospitals, Academic Institutes, Other End-users

North America, Latin America, Europe, East Asia, South Asia and Pacific, Middle East and Africa (MEA)

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.