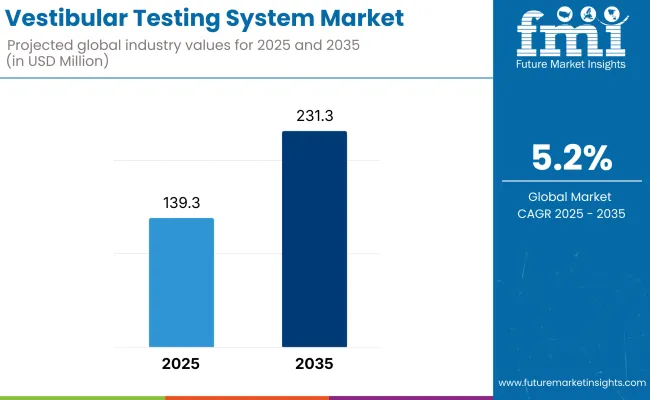

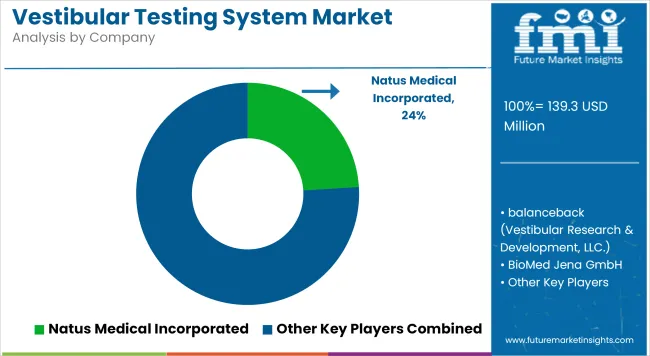

The Vestibular Testing System Market is anticipated to be valued at USD 139.3 million in 2025 and is expected to reach USD 231.3 million by 2035, registering a CAGR of 5.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 139.3 million |

| Industry Value (2035F) | USD 231.3 million |

| CAGR (2025 to 2035) | 5.2% |

This market witnessing significant growth driven by the increasing prevalence of balance disorders and advancements in diagnostic technologies. These systems are essential for diagnosing conditions like vertigo, dizziness, and imbalance, which are becoming more common due to aging populations and lifestyle changes. The market is characterized by the adoption of non-invasive, accurate diagnostic tools such as Videonystagmography (VNG) and Computerized Dynamic Posturography (CDP).

Healthcare providers are increasingly investing in these technologies to enhance patient care and diagnostic accuracy. The integration of artificial intelligence and machine learning into vestibular testing systems is also contributing to market growth by enabling more precise and efficient diagnostics.

Furthermore, the expansion of healthcare infrastructure in emerging economies and increased awareness of vestibular disorders are creating new opportunities for market players. Overall, the market is poised for continued growth, supported by technological innovations and a growing demand for effective diagnostic solutions.

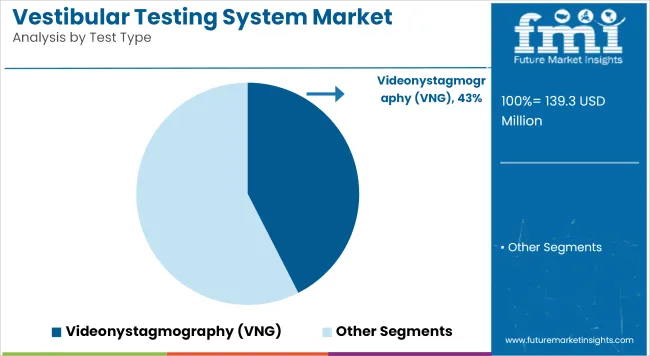

A revenue share of 42.5% in 2025 has been secured by the Videonystagmography (VNG) segment in the Vestibular Testing System Market. The growth of this segment has been largely driven by its non-invasive nature and high diagnostic accuracy in assessing vestibular and ocular motor functions.

The demand for VNG systems has been reinforced by clinicians’ preference for eye-tracking methodologies that deliver real-time responses to stimuli, improving diagnostic certainty in vertigo, dizziness, and balance-related disorders. Its dominance has also been attributed to its broad compatibility with various test protocols, faster setup, and ease of use in both hospital and ambulatory care settings.

VNG’s ability to quantify and document eye movements with video-based goggles has enhanced clinical decision-making. Increased training access and awareness among audiologists and neurologists have enabled its rapid adoption.

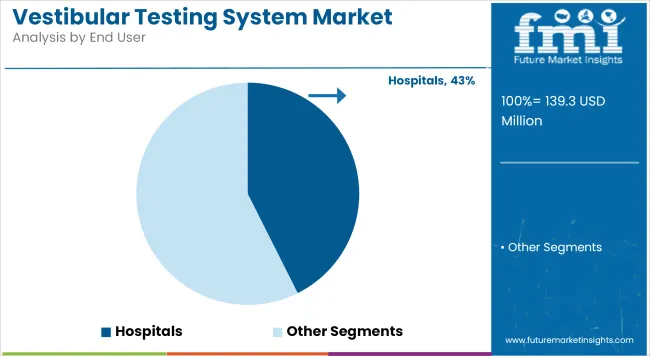

Hospitals were identified as the leading end user in 2025, accounting for 42.6% of the revenue share in the global Vestibular Testing System Market. This dominance has been supported by hospitals’ ability to invest in high-end diagnostic equipment and integrate vestibular testing with broader neurology and ENT departments.

The availability of specialized personnel and established diagnostic workflows has enhanced clinical throughput and optimized the utilization of vestibular technologies. Hospitals have served as the primary centers for early diagnosis and management of balance disorders, often coordinating with rehabilitation services.

Their role in medical education and research has further supported early adoption of cutting-edge technologies, such as AI-based VNG and rotary chair systems. Additionally, the reimbursement infrastructure in developed regions has favored hospital-based diagnostic care, reinforcing patient volumes and technology upgrades.

Cross-functional expertise and a higher footfall of geriatric patients have made hospitals pivotal in shaping the growth trajectory of the Vestibular Testing System Market. This concentration of diagnostic resources within hospitals is expected to continue driving their leading position.

Diagnostic Variability, Limited Access, and Cost Barriers Hindering Widespread Adoption of Vestibular Testing Systems

Although there has been progress made on the technical fronts of vestibular testing systems, there exist key pain points within the market of vestibular testing systems that currently exist, being born on complexity of operation and inequity of access.

Most kinds of vestibular tests such as caloric tests, VNG, and rotary chair tests involve personnel with specific training and dedicated lab equipment restricting their adoption to cities or tertiary-level care. Further, interpretation of responses to eye movement is subjective and any tests stepping dependency is patient-based which tends to offer site-based inconsistency of diagnosis.

The repeated high capital cost involved with state-of-the-art testing equipment discourages mid-sized clinics and outpatient facilities, particularly in cost-conscious markets. Every provider also must contend with restricted access to international standardization of vestibular protocols, leading to fractured models of care that limit the capacity of the market to scale appropriately and hinder technology transfer between nations or providers.

Expanding Horizons with AI Diagnostics, Remote Monitoring, and Multisensory Integration

The vestibular testing system market is undergoing transformative times, shaped by digital innovation that creates new avenues for access, precision, and functionality. Sophisticated eye tracking by artificial intelligence (AI) and machine-learning-based pattern recognition broaden the diagnostic excellence of VNG and vHIT systems, reducing user bias and speeding up interpretation in community primary care practice.

The advent of battery-operated vestibular assessment kits that are recharged from a tablet computer or smart phone is opening the door to rural and community clinic deployment, especially for fall-risk screening in the geriatric population.

The integration of vestibular testing and virtual reality (VR) rehabilitation platforms gives rise to dual-purpose equipment that tests and treats balance dysfunctions in one workflow, which improves attractiveness in neurology and sports medicine.

In addition, since wearable vestibular monitors for real-time dizziness monitoring are being developed, diagnostics will eventually transition away from episodic testing to real-time monitoring. As telehealth integration gains wider reach, these advances are building the cornerstone for scalable vestibular testing that is poised to drive growth in the developed and developing world.

Market Outlook

The United States vestibular testing system market is growing at a rapid pace, owing to the rising incidence of vestibular diseases such as balance related diseases, motion sickness and bicharotherapeutic. Increasing propensity of the elderly population towards these health issues, is another aspect driving the market.

Technological innovations, such as artificial intelligence (AI) and machine learning (ML) systems incorporated into diagnostic tools for vestibular disorders, are significantly improving the accuracy and efficiency of assessments. The growing number of top multinational medical device companies and a strong healthcare infrastructure help these systems find widespread commercial adoption.

Market Growth Factors

Market Forecast

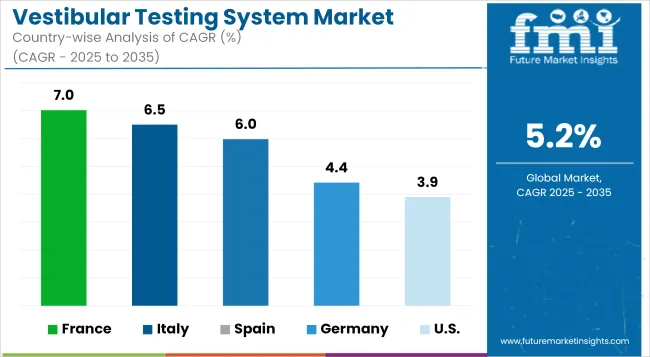

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

Market Outlook

The increasing awareness regarding vestibular testing in the country as well as the developing healthcare infrastructure is positively impacting the India vestibular testing system market. The aging population poses a potential large patient pool for vestibular diagnostics. Additionally, government programs to improve healthcare access and affordability are contributing to more robust market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.6% |

Market Outlook

The vestibular testing system market in Germany benefits from a robust healthcare system and a strong focus on research and development. The country has an elderly population, leading to various disorders of balance. Revolutionary diagnostic technologies are being developed through collaborations between academic institutions and medical device companies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.3% |

Market Outlook

China vestibular testing market is experiencing high growth with rising healthcare investment and increasing prevalence of balance disorders. The government has made a commitment to improving healthcare infrastructure and access across the nation, which is a major driver of adoption for these advanced diagnostic technologies. The global market is dominated by vestibular health awareness, which is another driving factor for market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

Market Outlook

Brazil is the most lucrative market for vestibular testing systems due to the growing prevalence of balance disorders, coupled with rising medical technology advancements. Healthcare access is also hindered by economic barriers, but national health policies attempt to enhance local diagnostic services. Innovative diagnostic tools is aiding to enhance patient care as well as the growth of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 3.9% |

The vestibular testing system market is growing rapidly due to increasing awareness of balance disorders, rising geriatric populations, and advances in diagnostic technologies. These systems are essential in identifying vestibular dysfunctions linked to conditions like vertigo, Ménière’s disease, vestibular neuritis, and post-concussion syndrome.

Demand is being driven by hospitals, ENT clinics, and audiology labs seeking comprehensive and efficient diagnostic tools. The market is characterized by a mix of established diagnostic equipment manufacturers and innovators in video head impulse testing (vHIT), rotary chair systems, and caloric irrigation systems.

Recent Developments:

Videonystagmography (VNG), Vestibular-evoked myogenic potential (VEMP), Rotary chair, Computerized Dynamic Posturography and Others

Hospitals, Diagnostic Centers and Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for vestibular testing system market was USD 139.3 million in 2025.

The vestibular testing system market is expected to reach USD 231.3 million in 2035.

Growing utilization of vestibular testing in post-COVID neurorehabilitation programs is accelerating system adoption across rehabilitation centers.

The top key players that drives the development of vestibular testing system market are Interacoustics A/S, GN Otometrics, Neuro Kinetics, Inc., Micromedical Technologies, and Difra Instrumentation

Videonystagmography (VNG) is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Market Share Distribution Among Leak Testing Machine Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA