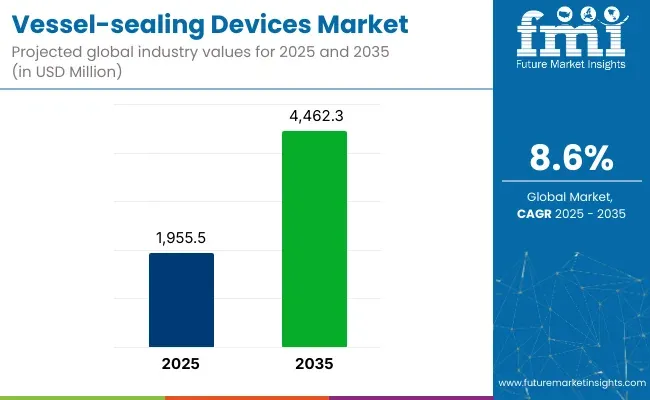

The global Vessel-sealing Devices Market is projected to be valued at USD 1,955.5 million in 2025 and is expected to reach USD 4,462.3 million by 2035, registering a CAGR of 8.6% during the forecast period, this growth is driven by the increasing demand for minimally invasive surgeries, advancements in energy-based sealing technologies, and the rising prevalence of chronic diseases necessitating surgical interventions.

Technological innovations, such as AI-enhanced surgical platforms and robotic-compatible sealing systems, are enhancing surgical precision and efficiency. Additionally, the expansion of healthcare infrastructure in emerging markets and the growing preference for outpatient surgical procedures are contributing to market expansion.

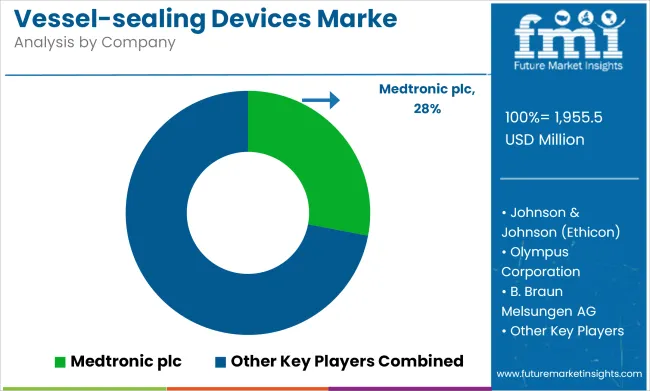

Prominent players in the vessel-sealing devices market include Medtronic plc, Olympus Corporation, B. Braun Melsungen AG, Ethicon USA, LLC and Erbe Elektromedizin GmbH. These companies are actively investing in research and development to introduce advanced vessel-sealing technologies that offer improved precision, safety, and efficiency.

In 2024, Olympus Corporation launched two new jaw designs in the POWERSEAL™ Sealer/Divider family of advanced bipolar surgical energy products: the POWERSEAL Straight Jaw, Double-action (SJDA) and the POWERSEAL Curved Jaw, Single-action (CJSA). “We are very excited to expand our advanced bipolar surgical energy portfolio with the addition of these two new POWERSEAL devices.

Meeting physician needs continues to be the primary driver of the product design and functionality,” said Phil Roy, Global Vice President and General Manager for Surgical Devices in the Therapeutic Solutions Division of Olympus Corporation. These innovations are expected to drive market growth by reducing operative times, minimizing complications, and improving patient recovery rates.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,955.5 million |

| Industry Value (2035F) | USD 4,462.3 million |

| CAGR (2025 to 2035) | 8.6% |

North America is witnessing rapid advancements in vessel-sealing technologies, driven by a strong emphasis on innovation and precision-based surgical interventions. The USA is at the forefront due to the high availability of robotic-assisted surgical systems, favourable reimbursement frameworks, and the widespread use of energy-based sealing devices in high-acuity procedures.

Hospitals and ambulatory surgical centres across the region are integrating AI-powered surgical tools into standard operating protocols. Increasing clinical trials and FDA approvals for next-gen vessel-sealing tools are also propelling the regional landscape. In Canada, government-backed healthcare reforms and rising surgical volumes are accelerating the adoption of these devices. Strong collaborations between med-tech companies and surgical institutes are further boosting R&D capabilities across North America.

Europe presents a robust ecosystem for the vessel-sealing devices market, supported by growing adoption of minimally invasive surgeries and sustained technological upgrades. Germany leads innovation in precision surgical equipment, with a growing number of clinical institutions embracing vessel-sealing systems as a standard for complex procedures.

The UK is actively investing in modernizing its public healthcare infrastructure, including equipping operating theatres with advanced energy-based sealing instruments. France and the Nordic countries are focusing on reducing hospitalization time, thereby increasing reliance on technologies that support quicker recovery vessel-sealing devices being a key enabler. Europe’s strong regulatory environment and support for med-tech research are fostering a culture of early technology adoption and clinical excellence in surgical care.

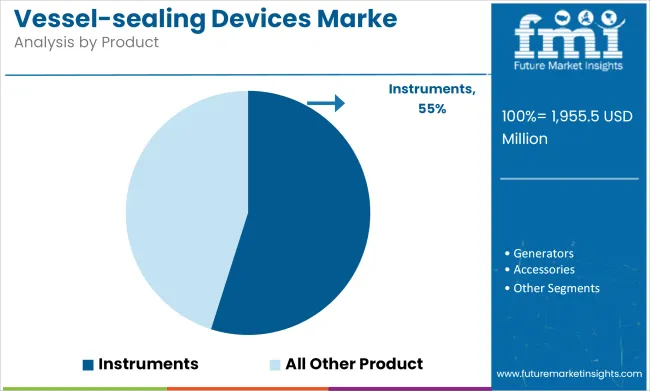

The instruments segment has been observed to lead the vessel-sealing devices market, contributing approximately 54.9% of revenue in 2025. This dominance has been driven by a rising demand for precision-based surgical tools that offer reliable sealing, cutting, and dissection.

Greater procedural efficiency and ergonomic designs have been prioritized by surgical teams, leading to increased adoption. Instruments have also been preferred due to their compatibility with both traditional and minimally invasive surgical platforms.

Continuous innovation by manufacturers has resulted in enhanced safety, reduced thermal spread, and faster vessel sealing. The use of single-use and procedure-specific instruments has been expanded in response to infection control protocols, further reinforcing this segment’s leading position in the market.

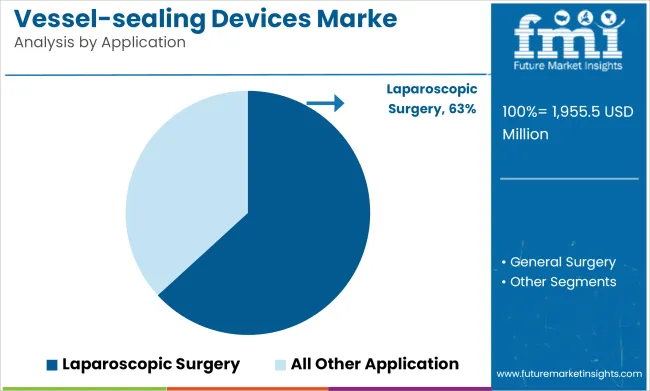

Laparoscopic surgery has been identified as the dominant application segment, capturing 63.2% of the vessel-sealing devices market in 2025. This growth has been supported by the increasing demand for minimally invasive procedures, which are associated with reduced recovery time and lower post-operative risks.

Vessel-sealing devices have been widely integrated into laparoscopic procedures for their precision and ability to minimize intraoperative bleeding. Greater adoption has also been facilitated by advancements in robotic-assisted and AI-integrated surgical systems. Healthcare facilities have emphasized outpatient and day-care surgeries, further accelerating this trend. Additionally, support from health authorities for laparoscopic infrastructure and surgeon training has contributed significantly to the segment’s continued expansion.

High Costs, Training Requirements, and Reusability

High capital and maintenance costs with advanced vessel-sealing devices, especially with ultrasonic or hybrid platforms. Reliance on multiple treatment sessions is contraindicated in resource-limited environments and adds a layer of safety and adoption concern due to the potential for thermal spread, limited established protocols for safe energy delivery, and risks associated with cyclical device use. Furthermore, disposables can also drive up procedural costs, which encourages institutions to explore reusable options.

Robotic Integration, Smart Energy Delivery, and Emerging Markets

The need for innovations such as robotic surgical arms integrated with these tools, real-time tissue feedback technologies, and small systems that make vessel sealing achievable in outpatient settings.

Automation is promoting efficiency, with the surge of AI-powered intraoperative monitoring, low-cost ultrasonic scalpel systems and hybrid platforms that allow for combined dissection and sealing in a single instrument. Long-term market growth will be fostered by emerging surgical markets allying with government energy platform talents.

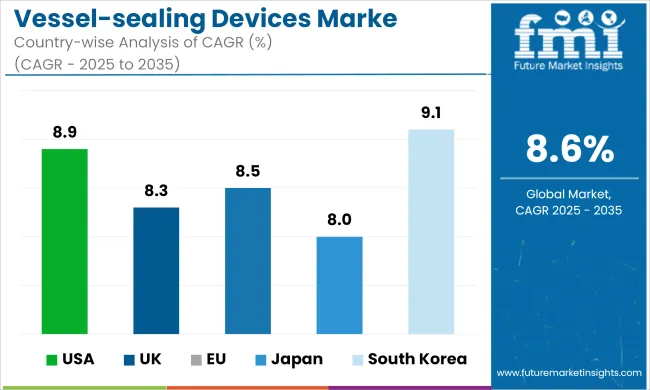

American market for vessel-sealing device (VSD) in medicine is burgeoning on enhanced numbers of minimally invasive and robotic-assisted surgeries, especially in the gynaecology, urology and general surgery. Hospitals & ambulatory surgical centers are investing in new generation, advanced bipolar & ultrasonic energy devices that enable faster sealing, lower thermal spread and shorter operative times.

The industry's growth is further fueled by encouraging reimbursement, adoption of electrosurgical platforms, and the integration of vessel-sealing instruments into robotic systems. Continuation of training programs and surgeons' preference for precision instruments is driving innovation in this segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.9% |

In UK, steady growth is witnessed in the vessel-sealing devices market, as NHS modernization programs fuel adoption of surgical tools based on energy. Colorectal, ENT, and bariatric procedures represent some of the fastest growing segments of the market, which are driven by vessel-sealing systems that reduce intraoperative blood loss and improve surgical results.

Med-tech procurement policies are promoting the use of more reusable and hybrid devices for both cost and environmental sustainability reasons. Further adoption is being stimulated in teaching hospitals and specialty clinics thanks to education in advanced laparoscopic techniques.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.3% |

High surgical procedure volumes, availability of experienced laparoscopic surgeons, and the consistent upgrading of your healthcare facility infrastructure contribute toward the EU vessel-sealing devices market growth in Germany, France, and Italy.

There is a growing demand for integrated energy devices combining cut, seal, and dissection in one tool. Manufacturers are being asked to improve ergonomic designs and device complexity, largely due to EU regulations on medical device safety and performance. Cross-border educational programs and surgical trainings have boosted the adoption of vessel-sealing systems in public and private surgical centers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.5% |

The outlook for Japan's vessel-sealing devices market is positive, driven by factors such as an ageing population, a high number of cancer surgeries, and innovation in precise surgical techniques. Here, Japanese surgeons prefer small and lightweight for easy access, resources with safe haemostasis and negligible collateral damage.

Vessel-sealing devices are increasingly being incorporated into sophisticated endoscopic and open surgeries in leading hospitals, most prominently in thoracic and gastroenterology (GI) surgeries. Both domestic and international manufacturers are working to enhance device durability, flexibility, and compatibility with next-generation electrosurgical units.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.0% |

South Korea vessel sealing devices market is growing at a significant rate, which is attributable to rising acceptance of minimally invasive procedures, a well-established hospital infrastructure and government support for surgical innovation. This is especially true in laparoscopic cholecystectomy, thyroidectomy, and gynaecologic surgeries.

Tie up with insurance companies: In partnership with global OEMs, local device manufacturers are working on developing affordable, high-performance vessel sealing systems, which will improve affordability and accessibility of devices. ATLAS AV, the digital surgery platform for vessel-sealing tools, now integrates with AI-powered energy modulation to increase the procedural efficiency and clinical safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.1% |

The vessel sealing devices market is expected to grow steadily owing to the increasing number of minimally invasive surgical procedures, rising number of electrosurgical and energy-based units, and demand for shorter operating times and reduced blood loss.

Vessel-sealing technologies are important interventions in laparoscopy, general surgery, gynaecology, urology, and oncology that enables haemostatic efficiency with minimal thermal spread, allowing for tissue type versatility and range of haemostatic approaches to suit targets. Important market components are technology advancements for bipolar energy platforms, robotic surgery integration and increasing access to an ambulatory surgical center.

The overall market size for the vessel-sealing devices market was USD 1,955.5 million in 2025.

The vessel-sealing devices market is expected to reach USD 4,462.3 million in 2035.

The demand for vessel-sealing devices will be driven by increasing number of minimally invasive and laparoscopic surgeries, rising prevalence of chronic diseases requiring surgical interventions, growing adoption of energy-based surgical technologies, and advancements in precision sealing and reusable instruments.

The top 5 countries driving the development of the vessel-sealing devices market are the USA, China, Germany, Japan, and India.

The laparoscopic surgery segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA