The North America vertical turbine pump market is anticipated to be valued at USD 542.83 million in 2025. It is expected to grow at a CAGR of 4.2% during the forecast period and reach a value of USD 819.11 million in 2035.

In 2024, steady growth in the North America vertical turbine pump market was brought on by increasing municipal water projects and expanding industrial applications. Infrastructure rehabilitation projects in the United States drove demand for wastewater treatment and flood control systems.

Agricultural irrigation systems were buoyed by the growing development of water-efficient solutions spurred on by widespread drought concerns. Technological developments such as high-efficiency pump designs and smart monitoring systems contributed to increased operational efficiency.

Looking ahead to 2025 and beyond, growth will not lie low since governments will focus on sustainable water management and invest in upgrading their infrastructure. Increasing investments will aid the long-term demand and sustainability of energy-efficient pumping solutions and smart water networks.

Growth in industrial water reuse projects and cooling water systems will further contribute to adoption. By 2035, the industry is expected to grow massively to USD 819.11 million owing to continuous infrastructure investments and a stream of innovation that are likely to shape the competitive landscape.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 542.83 Million |

| Projected Industry Size in 2035 | USD 819.11 Million |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

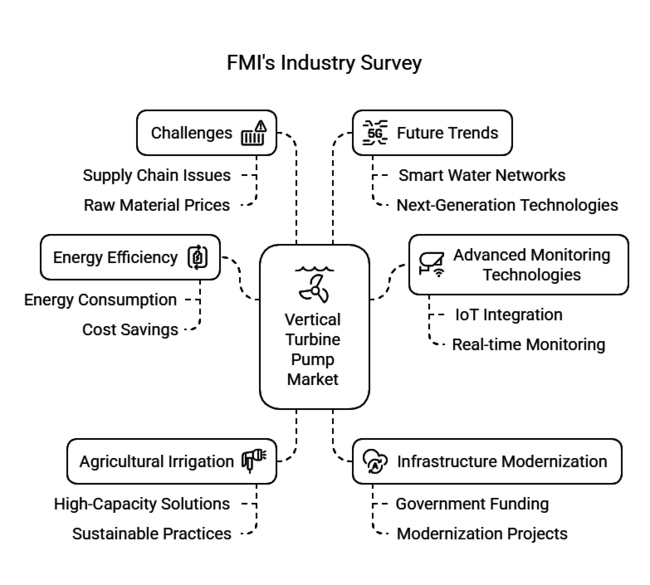

FMI had organized a wide-reaching survey study with important stakeholders like manufacturers, distributors, and end users, that would help the FMIs understand the North America vertical turbine pump market broadly. These findings that inform the survey reveal a lot about energy efficiency and specific advanced monitoring technologies, which have been cited by over 60 percent of the survey sample as critical parameters affecting their purchasing decisions.

Municipalities are also showing a preference for trends that bring the industrial user to pumps with optimization in hydraulic performance and IoT-enabled performance tracking, aiming at reducing expenses and improving resource management of water for operations.

More increases in the demand for vertical turbine pumps were also exposed from the survey results which focused mainly on agricultural irrigation in areas that are less endowed with water. More than 55 percent of stakeholders in the farming industry pinpointed demand for high-capacity, stationed solutions as the ones assuring reliable water location while needing less energy.

Respondents mentioned that changing water availability and regulatory forces are making farmers and irrigation agencies tilt towards more efficient and sustainably engineered pumping systems.

Another identified driver for the top growth was infrastructure modernization, where more than 70% of respondents claimed that government-led initiatives were very crucial in affecting expansion. Increased funding for wastewater treatment, flood control, and industrial water recycling is accelerating the adoption of pumps. Yet it is supply chain and volatile raw material prices that present challenges for many stakeholders leading them to search for alternate sourcing routes and localized manufacturing.

The respondents also looked forward to continuous investments in smart water networks and AI-based pump diagnostics, which are to guarantee the efficiency and reduced downtime of the entire system in the future. The changing environment is expected to change the competitive arena, especially with the transition into electrification and hybrid-powered systems, leading to increased focus by manufacturers on R&D into next-generation vertical turbine pump technologies.

Government regulations and policies play a crucial role in shaping the North America vertical turbine pump market. Strict environmental standards, energy efficiency mandates, and industry certifications influence product adoption, while infrastructure investments and water management laws drive industry growth across the United States, Canada, and Mexico.

| Countries | Regulations & Mandatory Certifications |

|---|---|

| United States | - EPA Clean Water Act (CWA): Mandates efficient water management, driving demand for energy-efficient pumps in wastewater treatment. - Department of Energy (DOE) Efficiency Standards: Requires compliance with minimum energy performance for pumps. - NSF/ANSI 61 Certification: Mandatory for pumps used in potable water systems. - Buy American Act & Infrastructure Investment and Jobs Act: Encourages domestic sourcing for government-funded water projects. |

| Canada | - Canadian Environmental Protection Act (CEPA): Regulates industrial water discharge, increasing demand for advanced pump filtration systems. - Energy Efficiency Regulations (Natural Resources Canada): Sets minimum performance requirements for industrial pumps. - CSA B64.1 Standard: Applies to pumps used in cross-connection control and backflow prevention. - Municipal and Agricultural Water Use Permits: Water-efficient solutions that influence pump selection are required. |

| Mexico | - Norma Oficial Mexicana (NOM-001-SEMARNAT-2021): Imposes stricter water discharge limits, boosting the adoption of high-efficiency pumps. - NOM-ENER-001: Defines energy efficiency standards for industrial water pumps. - CONAGUA Regulations: Govern water extraction permits for agricultural and industrial users, encouraging the adoption of sustainable pumping solutions. - FTA Compliance (with USMCA): Allows manufacturers to benefit from tariff exemptions if sourcing follows regional content rules. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| From 2020 to 2024, moderate industry growth was fueled by infrastructure upgrades, industrial expansion, and agricultural modernization. | Growth is expected to accelerate due to smart water management, energy-efficient solutions, and increased government investments in sustainable infrastructure. |

| Water scarcity concerns heavily influenced demand, pushing the adoption of municipal water treatment and irrigation. | Water conservation policies and advancements in pump efficiency will further drive adoption, particularly in the agriculture and municipal sectors. |

| Mining and industrial applications remained strong, with pumps playing a crucial role in dewatering and material processing. | The industrial segment is expected to grow, driven by rising energy efficiency mandates and stricter environmental regulations. |

| The pandemic caused supply chain disruptions, leading to delays in manufacturing and project implementation. | Manufacturers will focus on localized production and diversified sourcing strategies to mitigate supply chain risks. |

| The 500 to 2000 m head type and stainless steel pumps dominated due to their versatility and corrosion resistance. | Smart pump technology, IoT-enabled monitoring, and automation will reshape industry dynamics, improving efficiency and reducing operational costs. |

The 500 to 2000 m head type dominates the industry due to its versatility across municipal, industrial, and agricultural applications. Furthermore, this range provides an excellent balance between high capacity and cost: it is used widely and pocket-friendly. Industry practitioners prefer it over others because of its use for pumping needs as well as infrastructure development projects.

They can equally perform high-pressure transportation of water, which is best for bulk distribution and hydropower generation. These pumps use energy while being operatively efficient; they consume less power, yet work effectively, making them so popular. Industries, that are willing to consider long-term delivery and efficiency stability, also keep investing in the segment, thereby giving it a solid position in the vertical turbine pump market.

Stainless steel pumps top the market as far as corrosion and durability are concerned. Such pumps service the demands of industries that handle harsh chemicals, as well as pressure applications, thus giving them one of the most reliable use cases. The applications of these pumps are extensive, ranging from water treatment to oil & gas and industrial processes, rendering them the prime choice for long-term operational effectiveness, along with reduced maintenance needs.

The material's resistance to high temperatures and mechanical / stress render it applicable in some very demanding applications. Besides, they do not use extra resources for cleaning and maintenance - two of the biggest culprits that contaminate the process - creating a value proposition in today's mission-critical industries globally.

The multi-stage vertical turbine pump segment is well-established in the industry because it can create higher pressure levels with efficiency. Municipal water supply, power generation, and firefighting industries prefer these pumps because they are more energy-efficient and versatile. They can meet complicated fluid movement needs, making them a critical part of large-scale operations.

The multi-stage pump's modular construction enables customization according to precise pressure requirements, which makes it suitable for deep well applications. Their efficiency in operation, coupled with lower energy usage, guarantees cost-effectiveness. This category keeps growing as industries focus on performance and sustainability.

The 1500 to 4000 Hp power range category becomes the top option for industrial and municipal use. The pumps achieve a balance between efficiency and power, thus fitting well in water supply, mine drainage, and flood control operations. Their ability to transfer large volumes of fluids with maximum efficiency raises their demand across industries.

This range is ideal for mega-scale infrastructure development, providing uninterrupted water supply and high-pressure output. Their strength and capacity to function under harsh conditions make them a necessity for heavy-duty use. With industries looking for dependable and affordable solutions, this power category continues to be a leading market segment.

The agriculture segment leads demand due to the growing need for efficient irrigation solutions. Expanding farmland and sustainable water management practices drive the adoption of vertical turbine pumps in this sector. Their efficiency, flexibility, and longevity make them a perfect option for sustaining high-level agricultural productivity and solving water distribution issues.

These pumps provide a consistent water supply, which increases crop production while minimizing water loss. Their capability to perform under changing field conditions makes them a must-have for contemporary farming practices. With climate change affecting water supply, the need for efficient, energy-saving irrigation systems keeps this market growing.

The North America vertical turbine pump market has seen notable developments in 2024, driven by increasing demand from sectors such as agriculture, oil & gas, water treatment, and industrial applications. Key players like Flowserve Corporation, Xylem Inc., Sulzer Ltd., Grundfos, and ITT Inc. have been actively pursuing strategies to strengthen their positions, innovate product offerings, and expand their customer base.

In 2024, Flowserve Corporation maintained its leadership in the North American vertical turbine pump sector with a 25% share and revenue of USD 300 million. The company has focused on expanding its product portfolio with energy-efficient and smart pump solutions, catering to the growing demand for sustainable technologies.

Flowserve has also invested in digitalization, integrating IoT-enabled monitoring systems into its pumps to enhance performance and reduce downtime. In March 2024, Flowserve announced a strategic partnership with a major water utility company to supply advanced vertical turbine pumps for large-scale municipal water projects, as reported by Pump Industry Magazine.

Xylem Inc. holds a 22% share and revenue of USD 264 million in 2024. The company has prioritized innovation, launching a new line of vertical turbine pumps with enhanced durability and corrosion resistance for harsh industrial environments.

Xylem has also expanded its service network across North America, offering predictive maintenance and repair services to improve customer satisfaction. In February 2024, Xylem acquired a regional pump manufacturer specializing in custom vertical turbine pumps, as confirmed by WaterWorld. This acquisition has strengthened Xylem’s capabilities in serving niche applications.

Sulzer Ltd., with an 18% share and revenue of USD 216 million, has been actively pursuing growth in North America. In 2024, Sulzer introduced a new series of vertical turbine pumps designed for high-efficiency performance in agricultural irrigation systems. The company has also focused on sustainability, incorporating recyclable materials into its pump designs. Sulzer’s strategic emphasis on innovation and environmental responsibility has helped it secure contracts with major agricultural and industrial clients.

Grundfos, a global leader in pump solutions, holds a 15% share and revenue of USD 180 million in 2024. The company has launched a new range of vertical turbine pumps equipped with advanced variable frequency drives (VFDs) to optimize energy consumption.

Grundfos has also expanded its presence in the oil & gas sector, providing customized pumping solutions for offshore and onshore applications. In April 2024, Grundfos partnered with a leading energy company to deploy vertical turbine pumps in a large-scale water injection project, as reported by the Oil & Gas Journal.

ITT Inc., with a 12% share and revenue of USD 144 million, has been focusing on innovation and customer-centric strategies in 2024. The company introduced a new line of vertical turbine pumps with modular designs, allowing for easier installation and maintenance.

ITT has also invested in digital tools to provide real-time performance monitoring and diagnostics for its pumps. In January 2024, ITT announced a collaboration with a major industrial manufacturer to develop specialized vertical turbine pumps for chemical processing applications, as confirmed by Chemical Engineering.

The North American vertical turbine pump industry in 2024 has also witnessed increased consolidation and strategic partnerships. For instance, in March 2024, Flowserve Corporation entered into a joint venture with a technology firm to develop AI-driven pump optimization solutions, as reported by Industrial Equipment News. Similarly, Xylem Inc. has been actively collaborating with research institutions to advance pump efficiency and sustainability.

Economic growth, infrastructure investments, and regulatory policies shape the North America vertical turbine pump market. Government spending on water conservation, energy-efficient technologies, and sustainable urban development is a major driver of demand. Industrial expansion and rising agricultural activities further support growth, as efficient water management remains a priority for both sectors.

The USA and Canada emphasize clean energy initiatives and stricter environmental regulations, encouraging the adoption of high-efficiency pumps. Meanwhile, Mexico's growing industrial sector and water scarcity issues drive demand for advanced fluid handling solutions. Investments in smart water infrastructure and automated irrigation systems will further support long-term expansion.

Supply chain challenges, raw material price volatility, and skilled labor shortages pose risks, but technological advancements in pump automation and predictive maintenance are mitigating these concerns. The integration of IoT and AI in pump monitoring enhances efficiency, reducing downtime and operational costs. As North America prioritizes sustainable resource management and industrial modernization, the vertical turbine pump industry is expected to witness steady growth in the coming decade.

Expansion into Smart Water Management Solutions

The increasing focus on smart water infrastructure presents a key growth opportunity. Stakeholders should invest in IoT-enabled vertical turbine pumps with real-time performance monitoring and predictive maintenance capabilities. Developing AI-integrated pump systems that optimize energy consumption and detect faults early can enhance industry penetration, especially in the municipal and industrial sectors.

Strengthening Presence in Agriculture Through Sustainable Irrigation

With the rising adoption of precision agriculture, manufacturers should develop high-efficiency pumps tailored for automated irrigation systems. Partnering with agritech firms and government-backed irrigation projects can boost sales. Customizing solutions to meet variable flow rates and regional soil conditions will help gain traction in water-stressed regions.

Capitalizing on Energy Efficiency Regulations

As governments tighten energy consumption laws, companies should focus on high-efficiency, low-power pumps to align with regulatory requirements. Developing variable-speed turbine pumps that adjust performance based on demand can attract buyers from power generation, oil & gas, and industrial processing sectors, where energy costs are a major concern.

Rising demand for efficient water management, industrial expansion, and infrastructure development is driving industry growth. Adoption is increasing also due to energy efficiency regulations and advancements in smart pump technology.

These pumps are widely used in municipal water treatment, agriculture, mining, power generation, and oil & gas industries. Their ability to handle high-pressure fluid movement makes them essential for large-scale operations.

The integration of IoT, AI-driven monitoring systems, and variable-speed motors is enhancing pump efficiency and reducing maintenance costs. These innovations help optimize performance, energy consumption, and predictive maintenance.

Stricter energy efficiency mandates, water conservation policies, and industrial sustainability standards are encouraging the use of high-performance, low-energy consumption pumps across various sectors.

Key challenges include raw material price fluctuations, supply chain disruptions, and the need for skilled labor. To overcome these, manufacturers are focusing on localized production, supplier diversification, and automation in manufacturing processes.

By head, the sector is segmented into up to 500 m, 500 - 2000 m, and 2000 m & above.

In terms of material type, the industry is segmented into ductile iron pump, stainless steel pump, bronze, and cast iron.

By stages, the sector is segmented into single-stage and multi-stage.

In terms of power rating, the industry is segmented into low power (up to 1500 Hp), medium power (1500 to 4000 Hp), and high power (4000 Hp & above).

By end-use, the sector is segmented into residential, commercial, agriculture, industrial, municipal, and firefighting.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.